false 0001718227 0001718227 2024-10-20 2024-10-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 20, 2024

CONSTRUCTION PARTNERS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38479 |

|

26-0758017 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

290 Healthwest Drive, Suite 2

Dothan, Alabama 36303

(Address of principal executive offices) (ZIP Code)

(334) 673-9763

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange

on which registered |

| Class A common stock, $0.001 par value |

|

ROAD |

|

The Nasdaq Stock Market LLC |

|

|

|

|

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. |

Entry into a Material Definitive Agreement. |

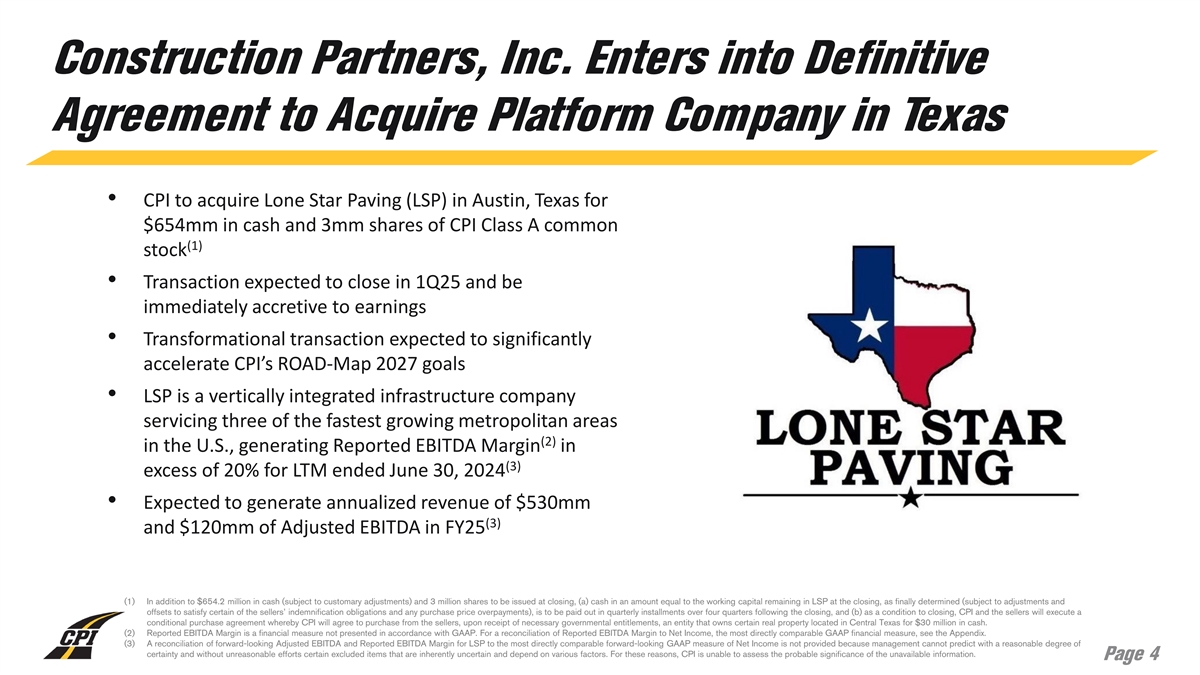

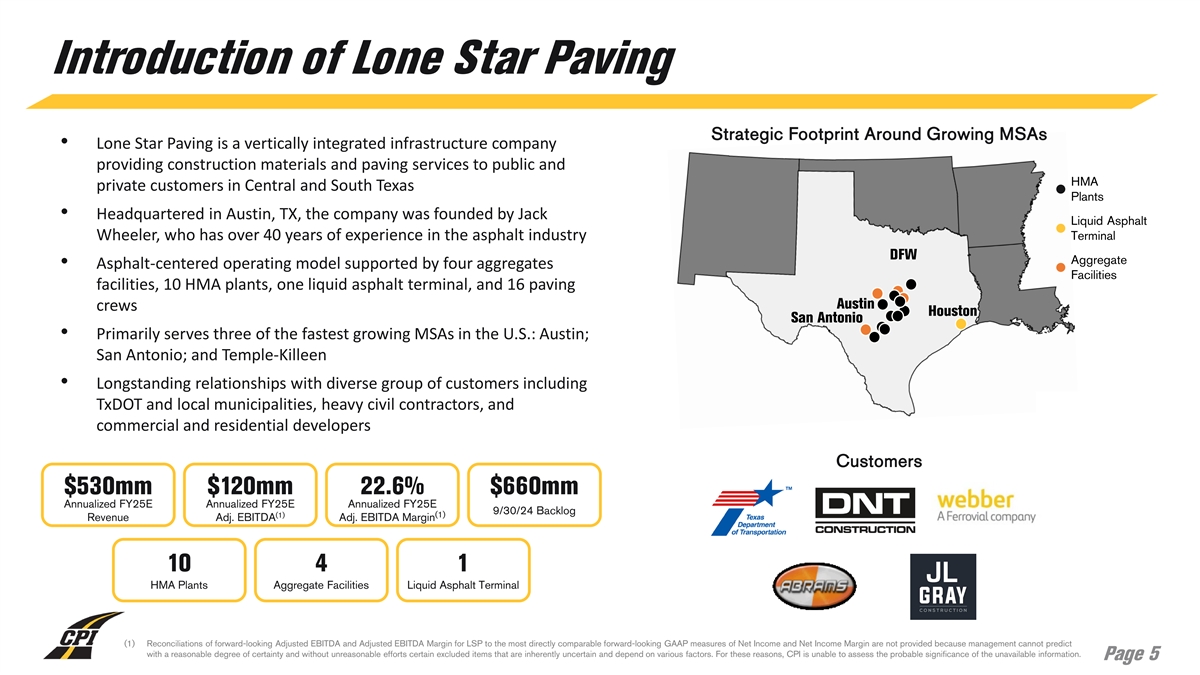

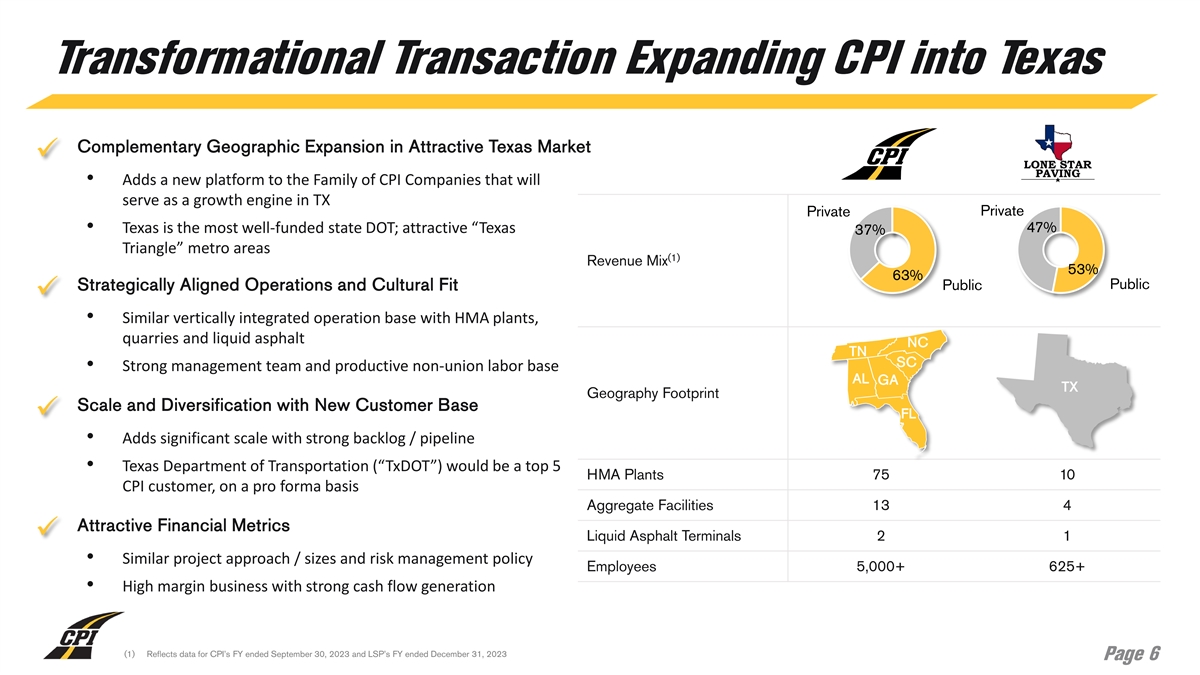

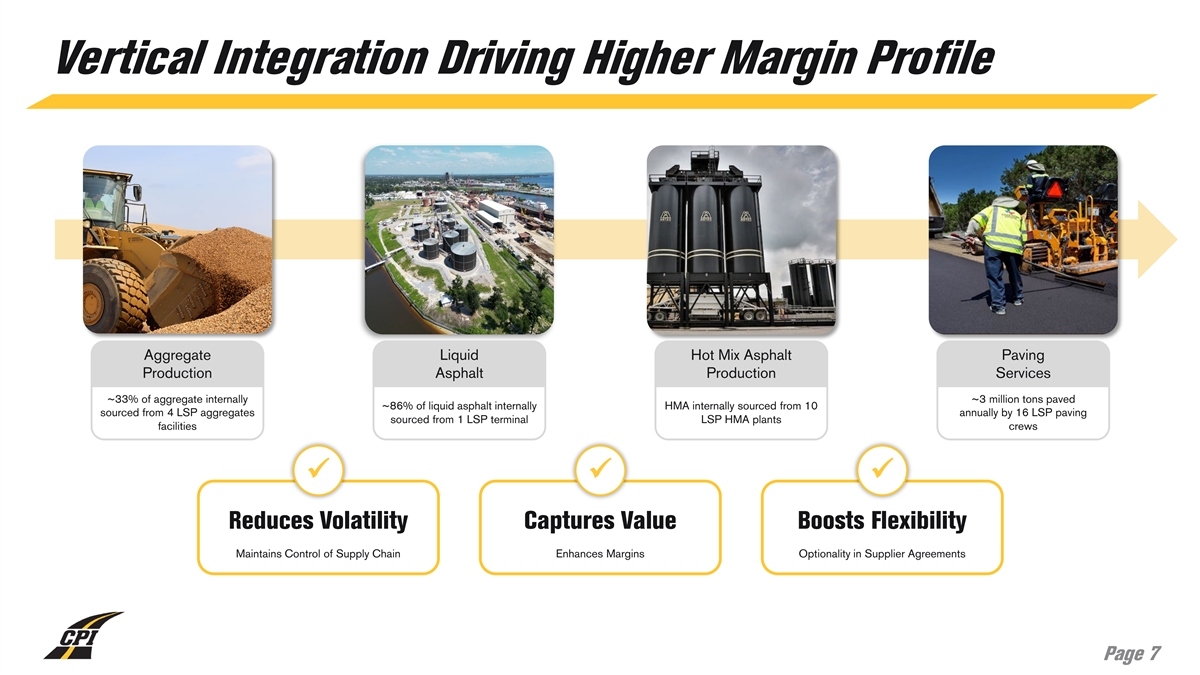

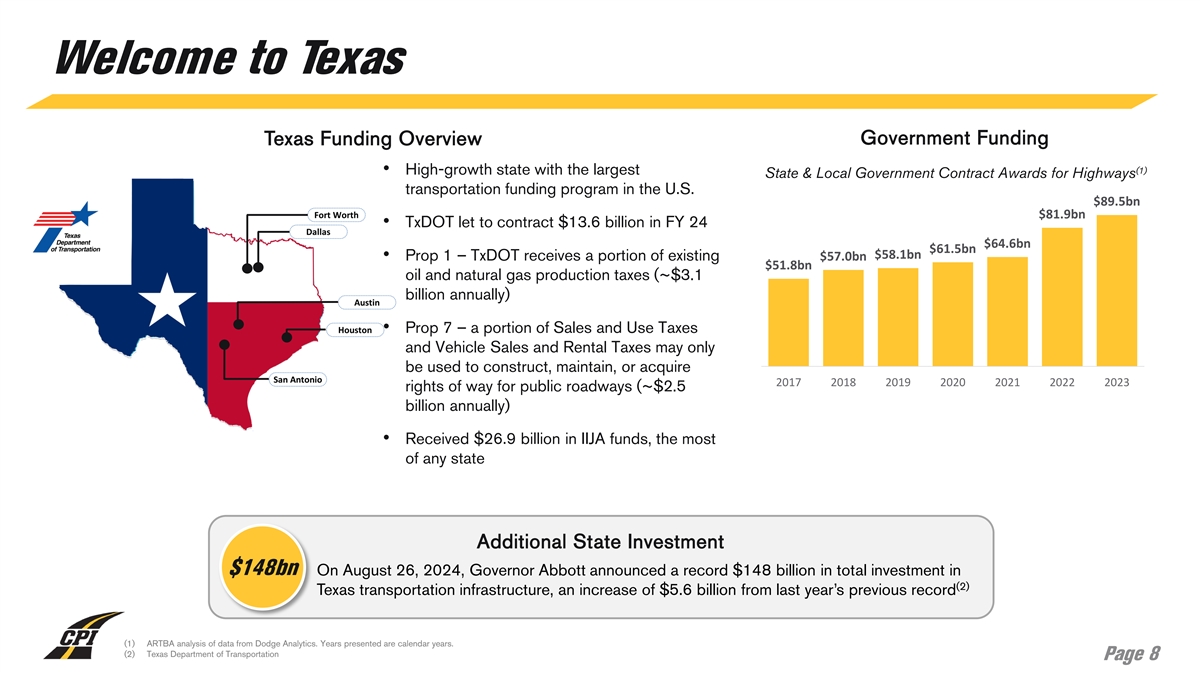

On October 20, 2024, Construction Partners, Inc., a Delaware corporation (the “Company”), entered into a Unit Purchase Agreement (the “Purchase Agreement”), by and among the Company, Asphalt Inc., LLC (doing business as Lone Star Paving), a Texas limited liability company (“Lone Star”), the individual sellers listed on the signature pages thereto (the “Sellers”) and John J. Wheeler, in his capacity as the Sellers’ representative thereunder. Pursuant to the Purchase Agreement, the Company agreed to purchase all of the issued and outstanding membership units of Lone Star from the Sellers (the “Acquisition”) for aggregate consideration consisting of (i) $654.2 million in cash (subject to customary purchase price adjustments) at the closing of the Acquisition (the “Closing,” and such cash payment, the “Cash Purchase Price”), (ii) 3.0 million shares (the “Closing CPI Shares”) of the Company’s Class A common stock, par value $0.001 per share (the “Class A Common Stock”) (subject to rounding for fractional shares), and (iii) cash in an amount equal to the working capital remaining in Lone Star at the Closing, as finally determined (subject to adjustments and offsets to satisfy certain of the Sellers’ indemnification obligations and any purchase price overpayments) to be paid out in quarterly installments over four quarters following the Closing, with the first payment due on the first business day after the expiration of the first full fiscal quarter following the Closing.

The Purchase Agreement contains customary representations and warranties of the parties. Additionally, the Purchase Agreement provides for customary covenants of the parties, relating to, among other things, (i) confidentiality, (ii) employee benefit matters, (iii) the conduct of Lone Star’s business during the period between the execution of the Purchase Agreement and the Closing and (iv) the efforts of the parties to cause the Acquisition to be completed, including obtaining any required governmental approval. The waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, has expired, and as a result, all regulatory approval conditions have been satisfied. The parties each have customary indemnification obligations and rights under the terms of the Purchase Agreement.

The Purchase Agreement provides that, during the period from the date of the execution of the Purchase Agreement until the Closing, the Sellers and Lone Star shall not (i) solicit from, or engage in negotiations with, third parties with respect to alternative acquisition proposals or (ii) provide non-public information to third parties in connection with alternative acquisition proposals.

The obligations of the Company, Lone Star and the Sellers to consummate the Acquisition are subject to the satisfaction or waiver of certain customary closing conditions, including (i) with respect to the Company’s obligation to consummate the Acquisition, the representations and warranties of Lone Star and the Sellers being true and correct (subject to certain materiality exceptions) and Lone Star and the Sellers having performed in all material respects their obligations under the Purchase Agreement, (ii) with respect to Lone Star and the Sellers’ obligations to consummate the Acquisition, the representations and warranties of the Company being true and correct (subject to certain materiality exceptions) and the Company having performed in all material respects their obligations under the Purchase Agreement, (iii) the absence of any order, law or proceeding prohibiting or restraining the consummation of the Acquisition, and (iv) there not having been any event or development that, individually or in the aggregate, has had, or would reasonably be expected to have, a material adverse effect on the other party since the date of the Purchase Agreement. In addition, as a condition to the Closing, the Company and the Sellers must execute a conditional purchase agreement whereby the Company will agree to purchase from the Sellers, upon the receipt of necessary governmental entitlements, an entity that owns certain real property located in Central Texas for aggregate consideration of $30.0 million.

The Purchase Agreement contemplates that, at the Closing, the Company and the Sellers will enter into lock-up agreements that will provide for, among other things, a lock-up on any transfer of the Closing CPI Shares issued to the Sellers, subject to certain exceptions, which lock-up will expire with respect to (i) 50% of the Closing CPI Shares on the six-month anniversary of the Closing and (ii) 50% of the Closing CPI Shares on the one-year anniversary of the Closing.

The Purchase Agreement may be terminated prior to the Closing under the following circumstances: (i) by the mutual written consent of the Company and Lone Star, (ii) subject to certain limited exceptions, by either the Company or Lone Star if the Closing has not occurred on or before December 31, 2024, (iii) by the Company in the event of a breach by the Sellers or Lone Star of any representation, warranty, covenant or other agreement contained in the Purchase Agreement that would result in a failure of applicable closing conditions if such breach was continuing as of the Closing, subject to certain customary cure rights set forth in the Purchase Agreement, (iv) by Lone Star in the event of a breach by the Company of any representation, warranty, covenant or other agreement contained in the Purchase Agreement that would result in a failure of applicable closing conditions if such breach was continuing as of the Closing, subject to certain customary cure rights set forth in the Purchase Agreement, and (v) by either the Company or Lone Star if the condition requiring the absence of any order, law or proceeding prohibiting or restraining the consummation of the Acquisition becomes incapable of satisfaction. Subject to certain exceptions, in the event that the Purchase Agreement is terminated by Lone Star as a result of a breach of any representation, warranty, covenant or other agreement set forth in the Purchase Agreement on the part of the Company, the Company will be required to pay Lone Star a termination fee of $9.0 million.

The Company expects to finance the Cash Purchase Price with the proceeds of debt financing. The Company has engaged BofA Securities, Inc. (“BofA Securities”) and PNC Capital Markets LLC (“PNCCM”) to, among other things, serve as joint lead arrangers and joint bookrunners in connection with (i) the arrangement and/or syndication of any financing undertaken in connection with the Acquisition, (ii) the arrangement of an amendment to the Company’s existing credit facility and the solicitation and receipt of requisite consents from the lenders under such facility and (iii) if applicable, any other financing for the purpose of refinancing all or a portion of the Bridge Loan Facility (as defined below).

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, a copy of which is attached as Exhibit 2.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated by reference herein.

The Purchase Agreement has been included with this Current Report to provide investors with information regarding its terms. It is not intended to provide any other factual information about the Company, the Sellers, Lone Star or their respective subsidiaries or affiliates. The representations, warranties and covenants contained in the Purchase Agreement were made solely for purposes of the Purchase Agreement and as of specific dates, were solely for the benefit of the parties to the Purchase Agreement, may be subject to limitations agreed upon by the parties to the Purchase Agreement, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Purchase Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the parties to the Purchase Agreement that differ from those applicable to investors. Investors are not third-party beneficiaries under the Purchase Agreement and should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or conditions of the parties thereto or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

| Item 2.02. |

Results of Operations and Financial Condition. |

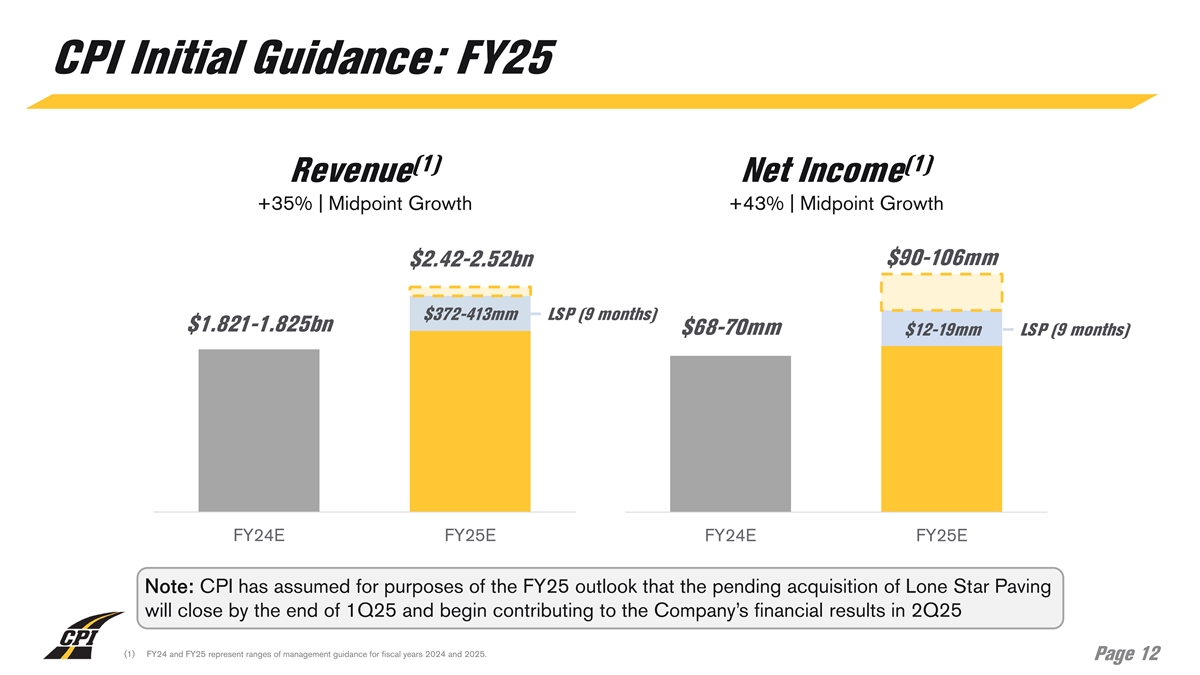

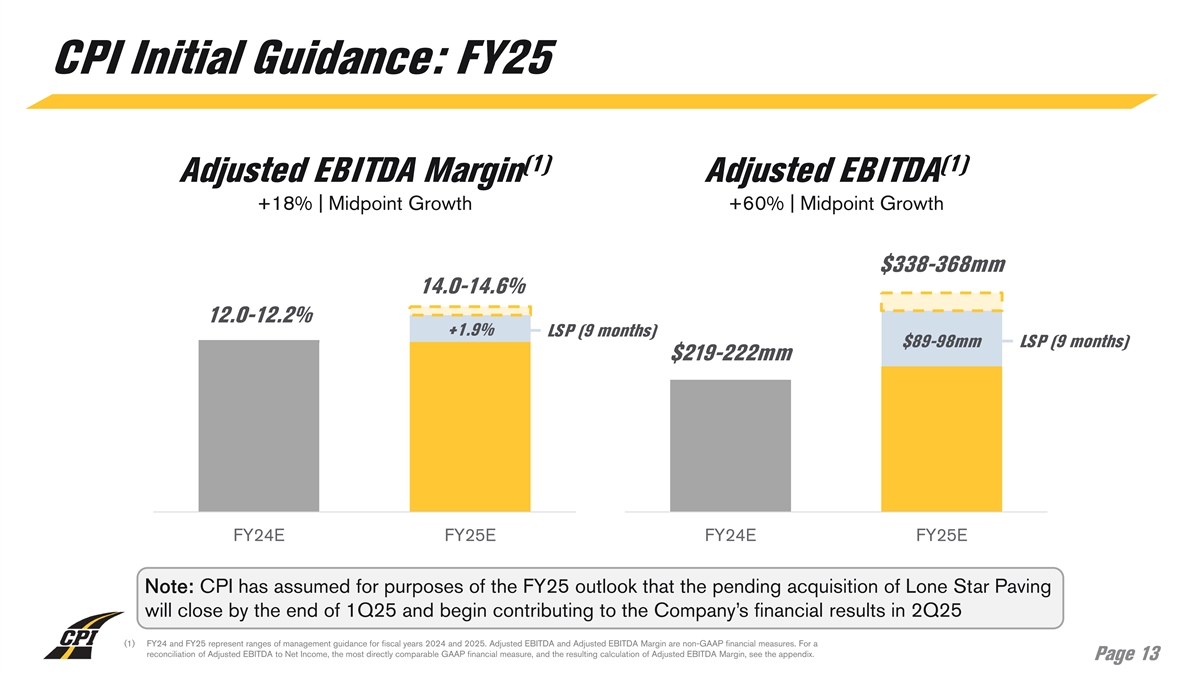

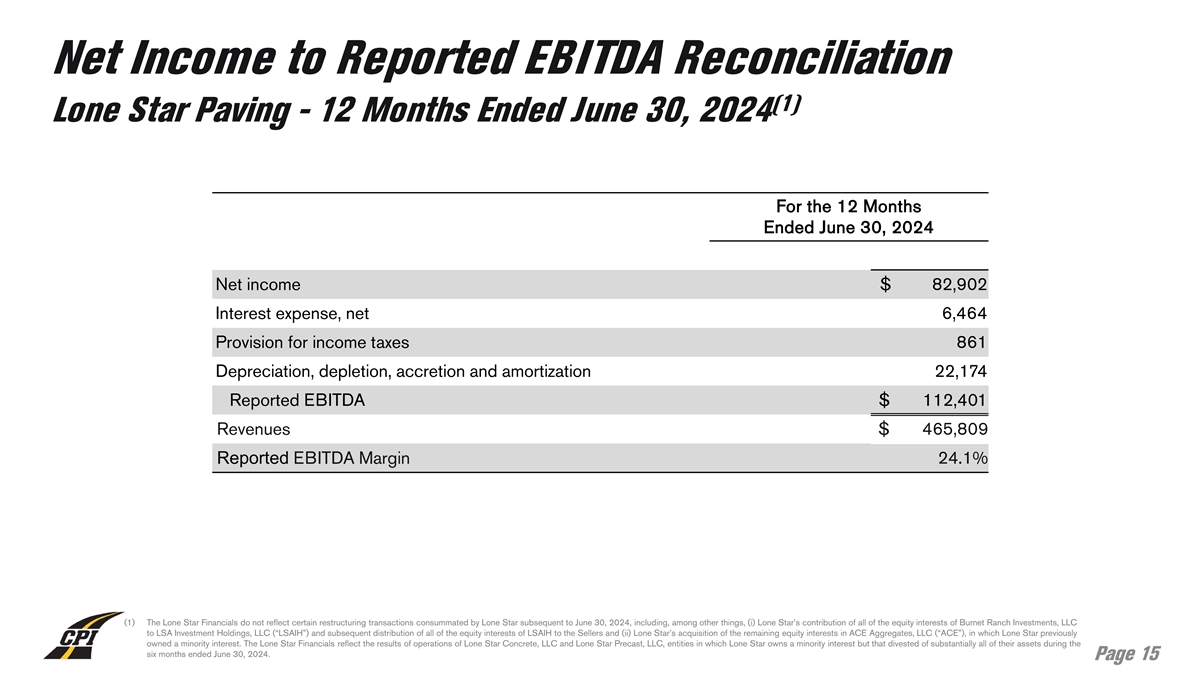

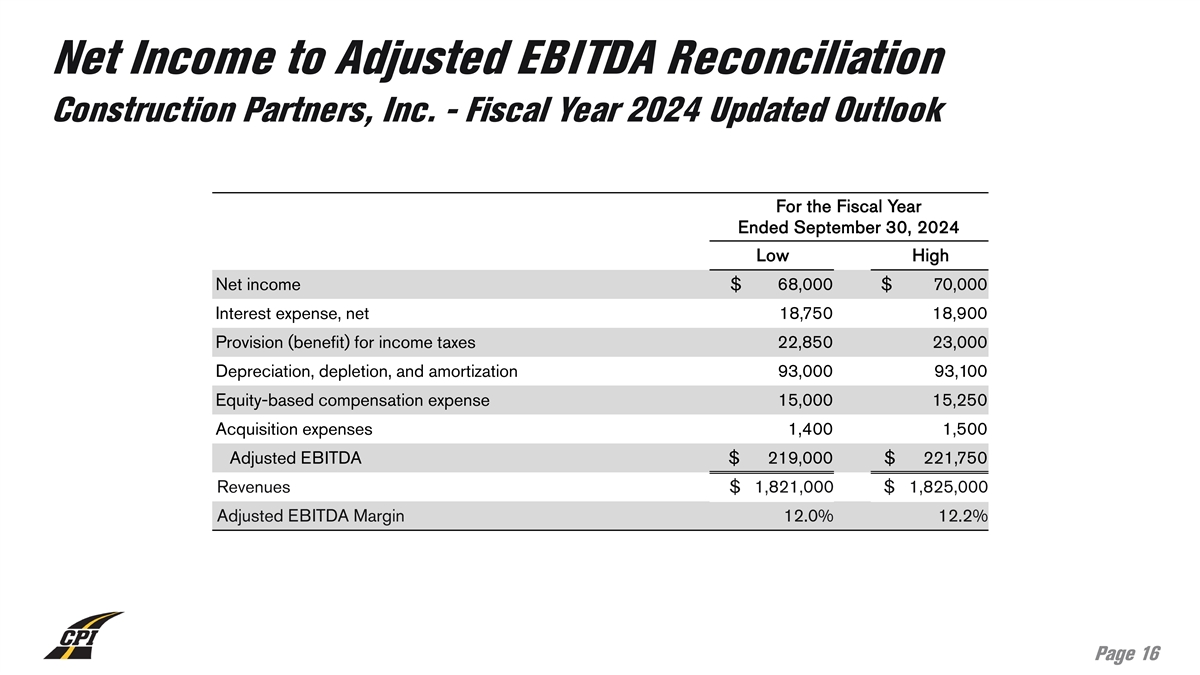

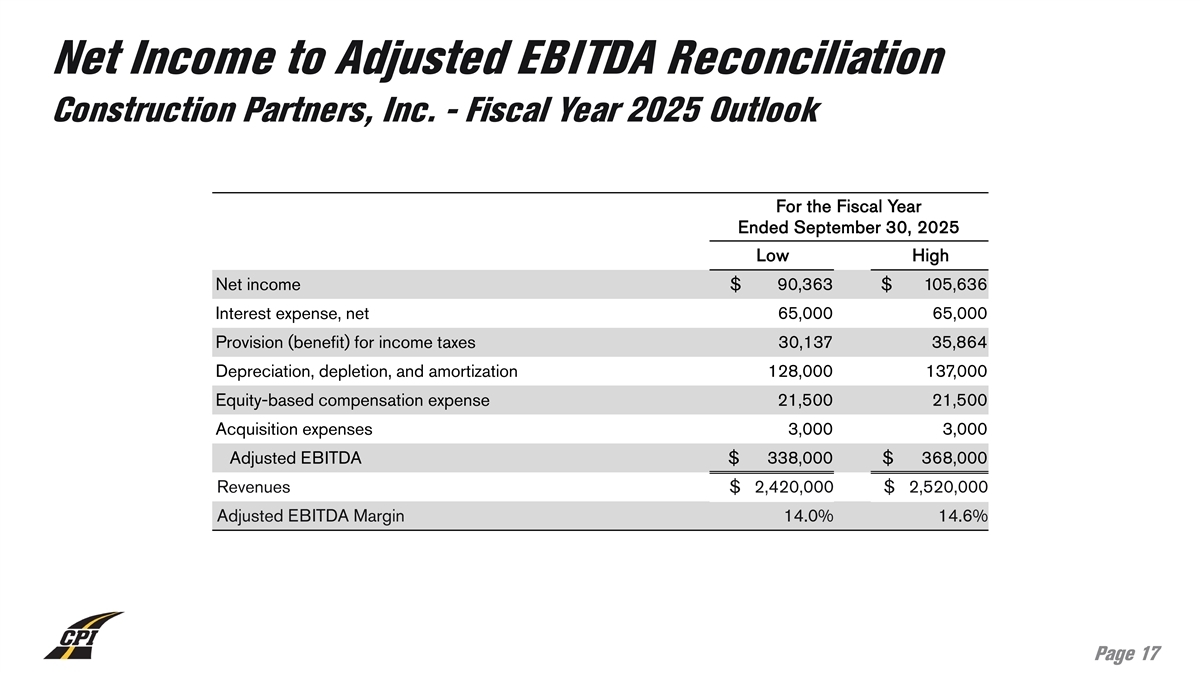

On October 21, 2024, the Company issued a press release announcing certain preliminary financial results for the fiscal year ended September 30, 2024, as well as a revised outlook for the fiscal year ended September 30, 2024 and a preliminary outlook for the fiscal year ending September 30, 2025. A copy of the press release is furnished as Exhibit 99.1 to this Current Report and is incorporated by reference herein.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act unless specifically identified therein as being incorporated therein by reference.

| Item 3.02. |

Unregistered Sales of Equity Securities. |

The information set forth under Item 1.01 regarding the Closing CPI Shares is incorporated by reference into this Item 3.02. Under the Purchase Agreement, the Company has agreed to issue the Closing CPI Shares to the Sellers at the Closing. The shares of Class A Common Stock comprising the Closing CPI Shares will be issued in reliance on the exemption from registration requirements of the Securities Act provided by Section 4(a)(2) thereof and Rule 506 of Regulation D promulgated thereunder.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

In connection with the Company’s entry into the Purchase Agreement, the compensation committee (the “Compensation Committee”) of the Board of Directors of the Company (the “Board”) approved one-time cash bonus payments (the “Transaction Bonuses”) to certain executive officers, key employees and advisors of the Company, including M. Brett Armstrong, the Company’s Senior Vice President, John L. Harper, the Company’s Senior Vice President, Gregory A. Hoffman, the Company’s Senior Vice President and Chief Financial Officer, and Fred J. (Jule) Smith, III, the Company’s President and Chief Executive Officer and a member of the Board. The Transaction Bonuses are subject to and payable following the Closing. In addition to the Transaction Bonuses, the Compensation Committee approved awards of (i) restricted shares of Class A Common Stock pursuant to the Construction Partners, Inc. 2018 Equity Incentive Plan and (ii) restricted shares of the Company’s Class B common stock, par value $0.001 per share (the “Class B Common Stock”), pursuant to the Construction Partners, Inc. 2024 Restricted Stock Plan to certain directors, executive officers, key employees and advisors of the Company, including Messrs. Armstrong, Fleming, Harper, Hoffman and Smith and Ned N. Fleming, III, the Executive Chairman of the Board (the “Market-Based Shares”). The Market-Based Shares will vest on the later of (x) the Closing and (y) the first date, if any, that the closing price of the Class A Common Stock on The Nasdaq Global Select Market equals or exceeds $88.00 per share, provided that (A) such date occurs on or before the fourth (4th) anniversary of the grant date and (B) the recipient is employed by, or providing services to, the Company on the vesting date. The following table sets forth the Transaction Bonus and Market-Based Shares awarded to each of Messrs. Armstrong, Fleming, Harper, Hoffman and Smith:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Market-Based Shares Awarded |

|

| Name |

|

Transaction

Bonus Amount |

|

|

Class A

Common Stock |

|

|

Class B

Common Stock |

|

| M. Brett Armstrong |

|

$ |

60,000 |

|

|

|

3,000 |

|

|

|

— |

|

| Ned N. Fleming, III |

|

|

— |

|

|

|

10,000 |

|

|

|

11,000 |

|

| John L. Harper |

|

$ |

60,000 |

|

|

|

3,000 |

|

|

|

— |

|

| Gregory A. Hoffman |

|

$ |

500,000 |

|

|

|

10,000 |

|

|

|

11,000 |

|

| Fred J. (Jule) Smith, III |

|

$ |

500,000 |

|

|

|

10,000 |

|

|

|

11,000 |

|

| Item 7.01. |

Regulation FD Disclosure. |

On October 21, 2024, the Company issued a press release announcing the entry into the Purchase Agreement. A copy of the press release is furnished as Exhibit 99.2 to this Current Report and is incorporated by reference herein.

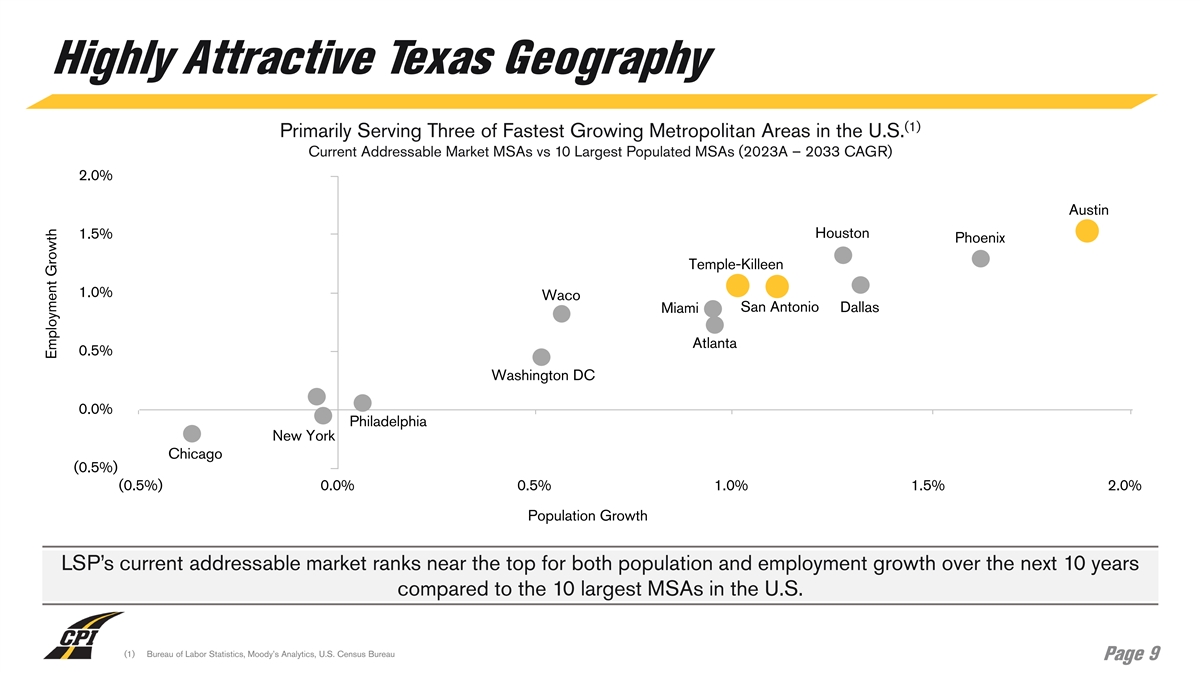

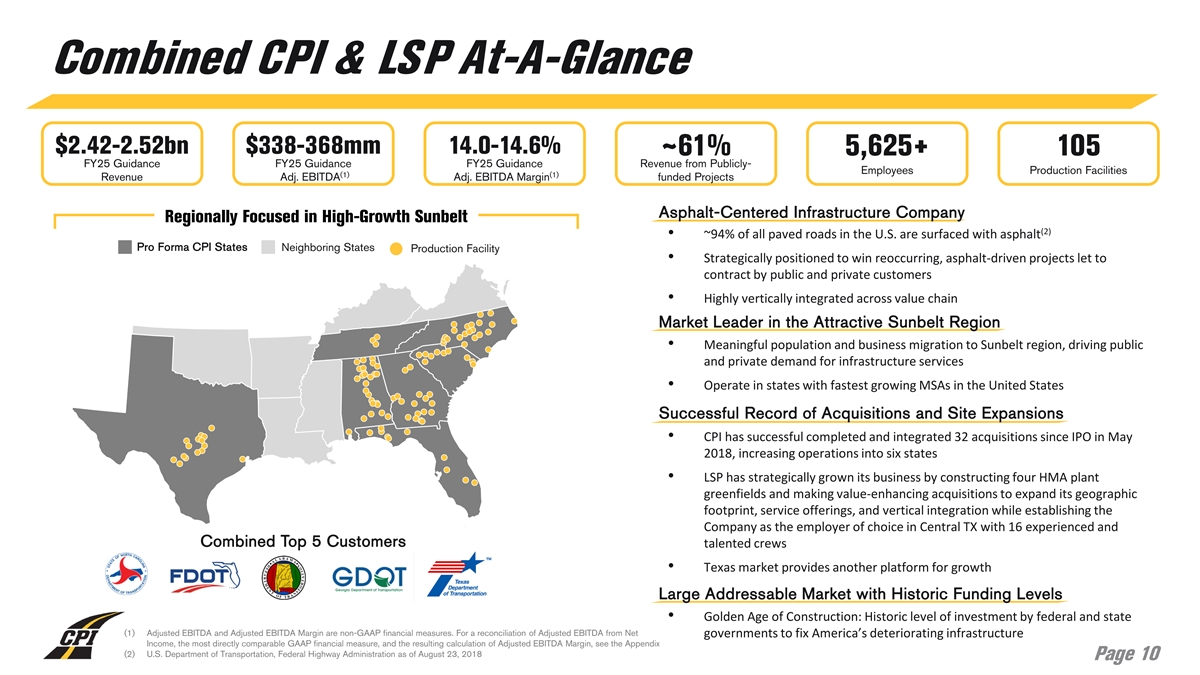

The Company is also furnishing a copy of a presentation (the “Presentation”) containing additional information concerning the Acquisition that the Company intends to use in one or more meetings with investors or analysts. A copy of the Presentation is furnished as Exhibit 99.3 to this Current Report and is incorporated by reference herein.

The information furnished pursuant to this Item 7.01, including Exhibits 99.2 and 99.3, shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act and will not be incorporated by reference into any filing under the Securities Act or the Exchange Act unless specifically identified therein as being incorporated therein by reference.

In connection with its entry into the Purchase Agreement, the Company entered into a debt commitment letter, dated October 20, 2024, with Bank of America, N.A. (“Bank of America”), BofA Securities, PNC Bank, National Association (“PNC Bank”) and PNCCM, pursuant to which, subject to the terms and conditions set forth therein, Bank of America and PNC Bank committed to provide a 364-day senior secured bridge loan facility in an aggregate principal amount of up to $750.0 million (the “Bridge Loan Facility”). The Company may elect to borrow under the Bridge Loan Facility in the event that proceeds from other financing sources sufficient to consummate the Acquisition are not available on or prior to the Closing.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this Current Report (including in the accompanying press releases and Presentation) that are not statements of historical or current fact constitute “forward-looking statements” within the meaning of Section 21E of the Exchange Act. These statements may be identified by the use of words such as “may,” “will,” “expect,” “should,” “anticipate,” “intend,” “project,” “outlook,” “believe” and “plan.” The forward-looking statements contained in this Current Report include, without limitation, statements related to financing of the Acquisition and the Closing. These and other forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could significantly affect expected results. Important factors that could cause actual results to differ materially from those expressed in the forward-looking statements include, among others: the ultimate outcome of the Acquisition; the Company’s ability to consummate the Acquisition; the ability of the Company, Lone Star and the Sellers to satisfy the closing conditions set forth in the Purchase Agreement; the Company’s ability to finance the Acquisition; the Company’s indebtedness, including the indebtedness the Company expects to incur and/or assume in connection with the Acquisition and the need to generate sufficient cash flows to service and repay such debt; the Company’s ability to meet expectations regarding the timing, completion and accounting and tax treatments of the Acquisition; the possibility that the Company may be unable to successfully integrate Lone Star’s operations with those of the Company; the possibility that such integration may be more difficult, time-consuming or costly than expected; the risk that operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, contractors and customers) may be greater than expected following the Acquisition or the public announcement of the Acquisition; the Company’s ability to retain certain key employees of Lone Star; potential litigation relating to the Acquisition that could be instituted against the Company or its directors; and the risks, uncertainties and factors set forth under “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and its subsequently filed Quarterly Reports on Form 10-Q. Forward-looking statements speak only as of the date they are made. The Company assumes no obligation to update forward-looking statements to reflect actual results, subsequent events, or circumstances or other changes affecting such statements except to the extent required by applicable law.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 2.1* |

|

Unit Purchase Agreement, dated as of October 20, 2024, by and among Construction Partners, Inc., Asphalt Inc., LLC, the Sellers listed on the signature pages thereto, and John J. Wheeler, in his capacity as the Sellers’ Representative. |

|

|

| 99.1 |

|

Press release dated October 21, 2024. |

|

|

| 99.2 |

|

Press release dated October 21, 2024. |

|

|

| 99.3 |

|

Investor Presentation. |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| * |

Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish to the Securities and Exchange Commission a copy of any omitted schedule or exhibit upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CONSTRUCTION PARTNERS, INC. |

|

|

|

|

| Date: October 21, 2024 |

|

|

|

By: |

|

/s/ Gregory A. Hoffman |

|

|

|

|

|

|

Gregory A. Hoffman Senior Vice President and Chief Financial Officer |

Exhibit 2.1

Execution Version

UNIT PURCHASE AGREEMENT

BY AND AMONG

JOHN J.

WHEELER,

(as a Seller and in his capacity as the Sellers’ Representative hereunder)

AARON CABAZA,

PATRICK

WHEELER HERITAGE TRUST,

TYLER WHEELER HERITAGE TRUST,

NOLAN WHEELER HERITAGE TRUST,

KAITLIN WHEELER HERITAGE TRUST,

ASPHALT INC. EMPLOYEE INVESTMENTS, LLC,

ASPHALT INC., LLC,

AND

CONSTRUCTION PARTNERS, INC.

DATED AS OF OCTOBER 20, 2024

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

| ARTICLE 1 CERTAIN DEFINITIONS |

|

|

1 |

|

|

|

|

| Section 1.1 |

|

Definitions |

|

|

1 |

|

|

|

| ARTICLE 2 PURCHASE AND SALE |

|

|

16 |

|

|

|

|

| Section 2.1 |

|

Purchase and Sale of the Units |

|

|

16 |

|

|

|

|

| Section 2.2 |

|

Closing of the Transactions Contemplated by this Agreement |

|

|

18 |

|

|

|

|

| Section 2.3 |

|

Actions to be Taken at the Closing |

|

|

19 |

|

|

|

|

| Section 2.4 |

|

Purchase Price Adjustment |

|

|

21 |

|

|

|

|

| Section 2.5 |

|

Purchase Price Allocation |

|

|

24 |

|

|

|

|

| Section 2.6 |

|

Withholding |

|

|

25 |

|

|

|

|

| Section 2.7 |

|

Payments to the Sellers |

|

|

25 |

|

|

|

| ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

|

|

25 |

|

|

|

|

| Section 3.1 |

|

Organization and Qualification |

|

|

25 |

|

|

|

|

| Section 3.2 |

|

Capitalization of the Group Companies |

|

|

26 |

|

|

|

|

| Section 3.3 |

|

Authority |

|

|

27 |

|

|

|

|

| Section 3.4 |

|

Financial Statements; No Undisclosed Material Liabilities |

|

|

27 |

|

|

|

|

| Section 3.5 |

|

Consents and Approvals; No Violations |

|

|

28 |

|

|

|

|

| Section 3.6 |

|

Material Contracts |

|

|

29 |

|

|

|

|

| Section 3.7 |

|

Absence of Certain Changes or Events |

|

|

30 |

|

|

|

|

| Section 3.8 |

|

Absence of Litigation |

|

|

32 |

|

|

|

|

| Section 3.9 |

|

Compliance; Permits |

|

|

33 |

|

|

|

|

| Section 3.10 |

|

Employee Benefit Plans |

|

|

34 |

|

|

|

|

| Section 3.11 |

|

Environmental Matters |

|

|

35 |

|

|

|

|

| Section 3.12 |

|

Intellectual Property |

|

|

36 |

|

|

|

|

| Section 3.13 |

|

Labor Matters |

|

|

37 |

|

|

|

|

| Section 3.14 |

|

Insurance |

|

|

39 |

|

|

|

|

| Section 3.15 |

|

Tax Matters |

|

|

39 |

|

|

|

|

| Section 3.16 |

|

No Brokers |

|

|

41 |

|

|

|

|

| Section 3.17 |

|

Real Property |

|

|

41 |

|

|

|

|

| Section 3.18 |

|

Personal Property |

|

|

42 |

|

|

|

|

| Section 3.19 |

|

Significant Customers and Vendors |

|

|

43 |

|

|

|

|

| Section 3.20 |

|

Terms of Service; Product Liability |

|

|

43 |

|

|

|

|

| Section 3.21 |

|

Capital Expenditures |

|

|

44 |

|

-i-

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

|

| Section 3.22 |

|

Inventories |

|

|

44 |

|

|

|

|

| Section 3.23 |

|

Accounts and Notes Receivable and Payable |

|

|

44 |

|

|

|

|

| Section 3.24 |

|

Banks; Powers of Attorney |

|

|

45 |

|

|

|

|

| Section 3.25 |

|

Transactions with Affiliates |

|

|

45 |

|

|

|

|

| Section 3.26 |

|

Government Contracts |

|

|

45 |

|

|

|

|

| Section 3.27 |

|

Exclusivity of Representations and Warranties |

|

|

46 |

|

|

|

| ARTICLE 4 REPRESENTATIONS AND WARRANTIES OF THE SELLERS |

|

|

47 |

|

|

|

|

| Section 4.1 |

|

Organization |

|

|

47 |

|

|

|

|

| Section 4.2 |

|

Units |

|

|

47 |

|

|

|

|

| Section 4.3 |

|

Authority |

|

|

47 |

|

|

|

|

| Section 4.4 |

|

Consents and Approvals; No Violations |

|

|

47 |

|

|

|

|

| Section 4.5 |

|

No Brokers |

|

|

48 |

|

|

|

|

| Section 4.6 |

|

Absence of Litigation |

|

|

48 |

|

|

|

|

| Section 4.7 |

|

Securities Matters; Investigation; Non-Reliance |

|

|

48 |

|

|

|

|

| Section 4.8 |

|

Exclusivity of Representations and Warranties |

|

|

49 |

|

|

|

| ARTICLE 5 REPRESENTATIONS AND WARRANTIES OF BUYER |

|

|

49 |

|

|

|

|

| Section 5.1 |

|

Organization |

|

|

50 |

|

|

|

|

| Section 5.2 |

|

Authority |

|

|

50 |

|

|

|

|

| Section 5.3 |

|

Consents and Approvals; No Violations |

|

|

50 |

|

|

|

|

| Section 5.4 |

|

Debt Commitment Letter |

|

|

50 |

|

|

|

|

| Section 5.5 |

|

No Brokers |

|

|

52 |

|

|

|

|

| Section 5.6 |

|

Absence of Litigation |

|

|

52 |

|

|

|

|

| Section 5.7 |

|

Purchase for Investment; Investigation |

|

|

52 |

|

|

|

|

| Section 5.8 |

|

Capitalization of Buyer |

|

|

52 |

|

|

|

|

| Section 5.9 |

|

No Stockholder Approval |

|

|

52 |

|

|

|

|

| Section 5.10 |

|

Buyer Subsidiaries |

|

|

52 |

|

|

|

|

| Section 5.11 |

|

Nasdaq Listing |

|

|

53 |

|

|

|

|

| Section 5.12 |

|

Financial Statements |

|

|

53 |

|

|

|

|

| Section 5.13 |

|

Absence of Certain Changes |

|

|

53 |

|

|

|

|

| Section 5.14 |

|

Securities Laws Matters |

|

|

53 |

|

|

|

|

| Section 5.15 |

|

Exclusivity of Representations and Warranties |

|

|

54 |

|

-ii-

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

| ARTICLE 6 COVENANTS |

|

|

54 |

|

|

|

|

| Section 6.1 |

|

Conduct of Business of the Group Companies |

|

|

54 |

|

|

|

|

| Section 6.2 |

|

Transfer Taxes |

|

|

55 |

|

|

|

|

| Section 6.3 |

|

Access to Information; Contact with Employees, Vendors and Others |

|

|

55 |

|

|

|

|

| Section 6.4 |

|

Consents; Efforts to Consummate; Governmental Filings |

|

|

55 |

|

|

|

|

| Section 6.5 |

|

Publicity; Confidentiality |

|

|

57 |

|

|

|

|

| Section 6.6 |

|

Indemnification; Directors’ and Officers’ Insurance |

|

|

57 |

|

|

|

|

| Section 6.7 |

|

Documents and Information |

|

|

58 |

|

|

|

|

| Section 6.8 |

|

Contact with Customers, Vendors and Other Business Relations |

|

|

58 |

|

|

|

|

| Section 6.9 |

|

Employee Benefit Matters |

|

|

59 |

|

|

|

|

| Section 6.10 |

|

Further Assurances |

|

|

60 |

|

|

|

|

| Section 6.11 |

|

Exclusive Dealing |

|

|

60 |

|

|

|

|

| Section 6.12 |

|

Financing |

|

|

61 |

|

|

|

|

| Section 6.13 |

|

Tax Covenants |

|

|

65 |

|

|

|

|

| Section 6.14 |

|

Payoff Letters and Invoices |

|

|

67 |

|

|

|

|

| Section 6.15 |

|

R&W Insurance Policy |

|

|

67 |

|

|

|

|

| Section 6.16 |

|

Use of Name |

|

|

67 |

|

|

|

|

| Section 6.17 |

|

HSR Clearance |

|

|

67 |

|

|

|

|

| Section 6.18 |

|

Third Party Consents; Permits; Restrictive Covenant Agreements |

|

|

67 |

|

|

|

| ARTICLE 7 CONDITIONS TO CONSUMMATION OF THE TRANSACTIONS CONTEMPLATED BY THIS

AGREEMENT |

|

|

67 |

|

|

|

|

| Section 7.1 |

|

Conditions to the Obligations of Buyer |

|

|

67 |

|

|

|

|

| Section 7.2 |

|

Conditions to the Obligations of the Sellers and the Company |

|

|

68 |

|

|

|

|

| Section 7.3 |

|

Frustration of Closing Conditions |

|

|

69 |

|

|

|

| ARTICLE 8 TERMINATION |

|

|

69 |

|

|

|

|

| Section 8.1 |

|

Termination |

|

|

69 |

|

|

|

|

| Section 8.2 |

|

Procedure upon Termination |

|

|

70 |

|

|

|

|

| Section 8.3 |

|

Effect of Termination |

|

|

70 |

|

|

|

| ARTICLE 9 SURVIVAL; EXCLUSIVE REMEDY |

|

|

71 |

|

|

|

|

| Section 9.1 |

|

Survival of Representations, Warranties and Covenants of the Company, Sellers and Buyer |

|

|

71 |

|

|

|

|

| Section 9.2 |

|

Buyer’s Right to Setoff Against Holdback |

|

|

72 |

|

|

|

|

| Section 9.3 |

|

Indemnification by Buyer |

|

|

73 |

|

|

|

|

| Section 9.4 |

|

Remedies Exclusive |

|

|

73 |

|

-iii-

TABLE OF CONTENTS

(continued)

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

| ARTICLE 10 MISCELLANEOUS |

|

|

74 |

|

|

|

|

| Section 10.1 |

|

Amendment |

|

|

74 |

|

|

|

|

| Section 10.2 |

|

Extension; Waiver |

|

|

74 |

|

|

|

|

| Section 10.3 |

|

Entire Agreement; Assignment |

|

|

75 |

|

|

|

|

| Section 10.4 |

|

Notices |

|

|

75 |

|

|

|

|

| Section 10.5 |

|

Governing Law |

|

|

76 |

|

|

|

|

| Section 10.6 |

|

Fees and Expenses |

|

|

76 |

|

|

|

|

| Section 10.7 |

|

Construction; Section Headings; Draftsmanship; Interpretation |

|

|

76 |

|

|

|

|

| Section 10.8 |

|

Exhibits and Schedules |

|

|

77 |

|

|

|

|

| Section 10.9 |

|

Parties in Interest |

|

|

77 |

|

|

|

|

| Section 10.10 |

|

Severability |

|

|

77 |

|

|

|

|

| Section 10.11 |

|

Counterparts; Delivery |

|

|

78 |

|

|

|

|

| Section 10.12 |

|

Knowledge |

|

|

78 |

|

|

|

|

| Section 10.13 |

|

No Recourse |

|

|

78 |

|

|

|

|

| Section 10.14 |

|

Venue |

|

|

78 |

|

|

|

|

| Section 10.15 |

|

WAIVER OF JURY TRIAL |

|

|

79 |

|

|

|

|

| Section 10.16 |

|

Service of Process |

|

|

79 |

|

|

|

|

| Section 10.17 |

|

Conflicts; Privileges |

|

|

79 |

|

|

|

|

| Section 10.18 |

|

Time of Essence |

|

|

80 |

|

|

|

|

| Section 10.19 |

|

Acknowledgment of Buyer |

|

|

80 |

|

|

|

|

| Section 10.20 |

|

Sellers’ Representative |

|

|

81 |

|

Annexes and Exhibits

Annex A – Pro Rata Percentages

Exhibit A – Agreed

Accounting Principles

Exhibit B – BRI Conditional Purchase Agreement Term Sheet

Exhibit C – Form of Lock-Up Agreement

Exhibit D – Form of Seller Questionnaire

Exhibit E –

Reference Statement

-iv-

UNIT PURCHASE AGREEMENT

This UNIT PURCHASE AGREEMENT (as amended, modified or supplemented from

time-to-time in accordance with the terms hereof, this “Agreement”), dated as of October 20, 2024, is made by and among Asphalt Inc., LLC (doing

business as Lone Star Paving), a Texas limited liability company (the “Company”), the individual sellers listed on the signature page hereto (each a “Seller” and collectively, the “Sellers”),

Construction Partners, Inc., a Delaware corporation (“Buyer”), and John J. Wheeler, in his capacity as the Sellers’ representative hereunder (the “Sellers’ Representative”). The Company, Sellers and Buyer

shall be referred to herein from time-to-time collectively as the “Parties” and each individually as a “Party”.

WHEREAS, the Sellers own beneficially and of record all of the issued and outstanding membership units of the Company (the

“Units”);

WHEREAS, the Parties desire that, upon the terms and subject to the conditions hereof, Buyer will

purchase from the Sellers, and the Sellers will sell to Buyer, all of the Units in exchange for the consideration set forth in this Agreement;

WHEREAS, on October 17, 2024, LSAIH (a) acquired 8,250 Membership Units (the “Purchased ACE Units”) of ACE

Aggregates pursuant to that certain Unit Purchase Agreement, by and among LSAIH, Lone Star Assets II, LLC, BBCD Holdings, LLC, Daniel Corrigan and CW Investments LLC, and (b) subsequently distributed the Purchased ACE Units and LSAIH’s

existing 2,750.00 Membership Units in ACE Aggregates to the Company (the “ACE Distribution”);

WHEREAS, effective

as of the ACE Distribution, ACE Aggregates became a wholly-owned subsidiary of the Company;

WHEREAS, on October 17, 2024,

following the effectiveness of the ACE Distribution, the Company, (a) contributed all of the equity of Burnet Ranch LLC, and by operation of law, through the contribution of such equity, all of the real estate and related assets held by Burnet

Ranch LLC, to LSAIH, and (b) subsequently distributed all of the equity of LSAIH to the Sellers (together, the “Spinoff Transactions”);

WHEREAS, concurrently with the execution of this Agreement, the Sellers and the Persons set forth on Schedule 1.1(a) have

entered into restrictive covenant and release agreements with Buyer (the “Restrictive Covenant Agreements”), which agreements will become effective as of and conditional upon the Closing; and

WHEREAS, concurrently with the execution of this Agreement, the employees set forth on Schedule 1.1(b) have entered into

employment agreements with the Company (the “Employment Agreements”), which agreements will become effective as of and conditional upon the Closing.

NOW, THEREFORE, in consideration of the foregoing and the respective covenants, representations and warranties set forth herein,

and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows:

ARTICLE 1

CERTAIN

DEFINITIONS

Section 1.1 Definitions. As used in this Agreement, the following terms have the respective meanings

set forth below.

“A/R and Warranty Dispute Notice” has the meaning set forth in

Section 2.1(c)(iii).

“A/R and Warranty Review Period” has the meaning set forth in

Section 2.1(c)(iii).

“ACE Aggregates” means ACE Aggregates, LLC a Texas limited liability

company.

“ACE Distribution” has the meaning set forth in the Recitals.

“Acquisition Transaction” has the meaning set forth in Section 6.11.

“Actual Fraud” means intentional and actual fraud under Delaware Law in the making of any representation or warranty set

forth in this Agreement (and, for the avoidance of doubt, not based upon any theory or doctrine of securities fraud, fraudulent conveyance or constructive or equitable fraud).

“Affiliate” means, with respect to any Person, any other Person who, directly or indirectly, through one or more

intermediaries, controls, is controlled by, or is under common control with, such Person. The term “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a

Person, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlled by” and “under common control with” have meanings correlative thereto. For purposes of the foregoing, (a) for

all periods prior to the Closing, neither Buyer, on the one hand, nor any Group Company, on the other hand, will be treated as an Affiliate of the other, and (b) for all periods after the Closing, neither Seller, on the one hand, nor any Group

Company, on the other hand, will be treated as an Affiliate of the other.

“Affiliate Agreements” has the meaning set

forth in Section 2.3(b)(vi).

“AFS” has the meaning set forth in

Section 10.17(a).

“AFS Client Communications” has the meaning set forth in

Section 10.17(d).

“Agreed Accounting Principles” means in accordance with GAAP as in effect at

the date of the financial statement to which it refers, using and applying the same accounting principles, practices, procedures, policies and methods (with consistent classifications, judgments, elections, inclusions, exclusions and valuation and

estimation methodologies) used and applied by the Company in the preparation of the Audited Balance Sheets, subject in all respects to the principles, adjustments, notes and assumptions set forth on Exhibit A.

“Agreement” has the meaning set forth in the preamble to this Agreement.

“Alternative Financing” has the meaning set forth in Section 6.12(b).

“Ancillary Documents” means the BRI Conditional Purchase Agreement, the R&W Binder, the R&W Insurance Policy, the Lock-Up Agreements, the Restrictive Covenant Agreements, and each other agreement, document, instrument and/or certificate contemplated by this Agreement to be executed in connection with the transactions

contemplated hereby.

“Antitrust Laws” means the Sherman Act, the Clayton Act, the HSR Act, the Federal Trade Commission

Act and all other federal, state and foreign statutes, rules, regulations, Orders, administrative and judicial doctrines, and other Laws that are designed or intended to prohibit, restrict or regulate actions having the purpose or effect of

monopolization, restraint of trade or lessening of competition.

2

“Audited Balance Sheets” has the meaning set forth in

Section 3.4(a).

“Balance Sheet Date” has the meaning set forth in

Section 3.4(a).

“BRI Conditional Purchase Agreement” has the meaning set forth in

Section 2.3(a)(vi).

“Burnet Ranch LLC” means Burnet Ranch Investments, LLC, a Texas limited

liability company.

“Business Day” means a day other than a Saturday, Sunday, or other day on which the Federal Reserve

Bank located in Dallas, Texas, is closed.

“Buyer” has the meaning set forth in the preamble to this Agreement.

“Buyer 401(k) Plan” has the meaning set forth in Section 6.9(c).

“Buyer Cure Period” has the meaning set forth in Section 8.1(c)(i).

“Buyer Dispute Notice” has the meaning set forth in Section 9.3.

“Buyer Dispute Period” has the meaning set forth in Section 9.3.

“Buyer Material Adverse Effect” means any Circumstance that does, or would reasonably be expected to, have a material adverse

effect on the ability of Buyer to consummate the transactions contemplated by this Agreement.

“Buyer SEC Reports” has

the meaning set forth in Section 5.14(a).

“Cash and Cash Equivalents” means, as of any time,

the aggregate amount of all cash and cash equivalents of the LSP Working Capital Group, in each case, excluding restricted cash and any cash held or maintained by any member of the LSP Working Capital Group for the benefit of a third person, in each

case calculated in accordance with the Agreed Accounting Principles. For the avoidance of doubt, cash on hand shall (a) be calculated net of issued but uncleared checks and pending electronic debits, and (b) include uncleared checks and

drafts received or deposited for the account of any member of the LSP Working Capital Group.

“Cash Purchase Price” has

the meaning set forth in Section 2.1(b).

“Change in Control Payments” means any transaction

bonuses, severance payments or other employee-related change of control payments payable by any Group Company or LSAIH as of or after the Closing Date (including the Group Companies’ or LSAIH’s share of withholding, payroll, employment or

similar Taxes, if any, associated therewith) as a result of the consummation of the sale of the Units at the Closing contemplated by this Agreement or as a result of any Person that is not the Company exercising a contractual right based on the

consummation of the sale of the Units at the Closing contemplated by this Agreement.

“Circumstance” means any change,

development, circumstance, effect, condition, occurrence, event or fact.

“Class A Common Stock” means

the Class A common stock, $0.001 par value per share, of Buyer.

3

“Closing” has the meaning set forth in

Section 2.2.

“Closing A/R and Warranty Statement” has the meaning set forth in

Section 2.1(c)(iii).

“Closing AFDA Amount” has the meaning set forth in

Section 2.1(c)(iv).

“Closing Buyer Common Stock Price” means the average of the daily closing

sales prices of a share of Class A Common Stock as reported on The Nasdaq Global Select Market for the ten (10) consecutive trading days immediately preceding (but not including) the Closing Date.

“Closing Cash Payment” has the meaning set forth in Section 2.3(a)(iii).

“Closing CPI Shares” means 3,000,000 shares of Class A Common Stock. In the event of any stock split, reverse stock

split, stock dividend (including any dividend or distribution of securities convertible into capital stock), reorganization, reclassification, combination, recapitalization or other like change with respect to the Class A Common Stock occurring

after the date hereof and prior to the Effective Time, all references herein to specified numbers of shares of any class or series affected thereby, and all calculations provided for that are based upon numbers of shares of any class or series (or

trading prices therefor) affected thereby, shall be equitably adjusted to the extent necessary to provide the Parties the same economic effect as contemplated by this Agreement prior to such stock split, reverse stock split, stock dividend,

reorganization, reclassification, combination, recapitalization or other like change.

“Closing Date” has the meaning set

forth in Section 2.2.

“Closing Date Cash” means the sum of all Cash and Cash Equivalents (if

denominated in a currency other than United States dollars, expressed in United States dollars calculated based on the relevant currency exchange rate in effect (as published in The Wall Street Journal)) as of the Effective Time.

“Closing Date Schedule” has the meaning set forth in Section 2.4(c).

“Closing Debt Payoff Amount” has the meaning set forth in Section 2.4(c).

“Closing Net Working Capital Amount” means the Current Assets less the Current Liabilities, as calculated as of the Effective

Time in accordance with the Agreed Accounting Principles.

“COBRA” means the Consolidated Omnibus Budget Reconciliation

Act of 1985, as amended.

“Code” means the Internal Revenue Code of 1986.

“Commercial or Transactional Tax Agreements” means commercial or transactional agreements not primarily related to Taxes that

contain agreements or arrangements relating to the apportionment, sharing, assignment or allocation of Taxes (such as financing agreements with Tax gross-up obligations or leases with Tax escalation provisions

or stock or asset purchase agreements with Tax indemnity provisions).

“Company” has the meaning set forth in the

preamble to this Agreement.

“Company 401(k) Plan” has the meaning set forth in Section 6.9(c).

“Company 401(k) Plan Termination” has the meaning set forth in Section 6.9(c).

4

“Company Documents” has the meaning set forth in

Section 3.3.

“Company Marks” has the meaning set forth in

Section 6.16.

“Company Material Adverse Effect” means any Circumstance that, individually or

in the aggregate, (a) does, or would reasonably be expected to, prevent, materially delay or materially impair Seller’s or the Company’s consummation of the transactions contemplated by this Agreement or (b) has had or would

reasonably be expected to have a material adverse effect upon the financial condition, business, assets, Liabilities or results of operations of the Group Companies, taken as a whole; provided, however, that, for purposes of the

foregoing clause (b), none of the following shall be deemed in itself, either alone or in combination, to constitute a “Company Material Adverse Effect”, and shall not be taken into account in determining whether a “Company Material

Adverse Effect” has occurred or would be expected to occur: (i) conditions affecting the economy generally of any country in which the Group Companies conduct business, (ii) any national or international political or social

conditions, including an outbreak or escalation of hostilities, acts of terrorism, military acts, political instability or other national or international calamity, crisis or emergency, or any governmental or other response to the foregoing, in each

case whether or not involving the United States, (iii) any change in conditions in the United States, foreign or global financial, banking or securities markets generally (including any disruption thereof and any decline in the price of any

security or any market index or any change in interest or exchange rates), (iv) changes in GAAP, (v) changes in any Law or other binding directives issued by any Governmental Authority, (vi) any existing Circumstance of which Buyer has

knowledge as of the date hereof, (vii) any adverse Circumstance (including any change in general legal, regulatory, political, economic or business conditions) that is generally applicable to the industries or markets in which the Group

Companies operate, (viii) any pandemic, epidemic or public health emergencies, or any escalation or worsening thereof, any hurricane, earthquake, flood, or other natural disasters, (ix) any action taken by any Group Company with the

written consent of Buyer, (x) the negotiation, execution, announcement or pendency of this Agreement and the transactions contemplated hereby, including any impact thereof on relationships, contractual or otherwise, with any customers, vendors,

distributors, partners or Employees, (xi) any failure by the Group Companies to meet any internal or published projections, forecasts or revenue or earnings predictions for any period ending (or for which revenues or earnings are released) on

or after the date of this Agreement, provided, however, that, subject in all respects to the exceptions set forth in clauses (i) through (x) above and (xii) and (xiii) below, any Circumstance that caused or contributed to

such failure to meet projections, forecasts or predictions may be taken into account in determining whether a “Company Material Adverse Effect” has occurred or would be expected to occur, (xii) the taking of any action required by

this Agreement, the Ancillary Documents or the other agreements contemplated hereby, including compliance with the terms hereof and thereof and the completion of the transactions required hereby and thereby or (xiii) any adverse Circumstance

that is cured prior to the Closing; provided, however, with respect to a matter described in any of the foregoing clauses (i), (ii), (iii), (v) and (vii), that if such Circumstance has a disproportionate effect on the Group Companies

relative to similarly situated Persons operating in the industries in which the Group Companies operate, then only the disproportionate aspect of such effect may be taken into account in determining whether a Company Material Adverse Effect has

occurred or will occur.

“Company Subsidiary” has the meaning set forth in Section 3.2(b).

“Confidential Information” means all information and/or data relating to any Group Company or its business that may provide

economic or other value, actual or potential, to any Group Company from not being generally known to, or readily ascertainable through proper means by, another person who can obtain value from the disclosure or use of such information or any Group

Company would not want a competitor to know or have, including “know how”, trade secrets, customer lists, vendor lists, details of consultant and employment Contracts, pricing policies, operational methods, marketing plans or

5

strategies, product development techniques or plans, business acquisition plans (including identified acquisition targets), technical processes, designs and design projects, processes,

inventions, software, source codes, object codes, systems documentation and other business affairs (other than data or information that is generally available to the public on the date of this Agreement or that becomes generally available to the

public other than as a result of (a) a disclosure in violation of any confidentiality obligations or by any of the Sellers or their Affiliates or Representatives in breach or violation of any confidentiality obligation owing to Buyer or any

Group Company, or (b) a disclosure by Buyer or its Affiliates or Representatives in breach or violation of any confidentiality obligation owing to the Sellers or any Group Company).

“Confidentiality Agreement” means that certain Confidentiality Agreement, dated as of May 17, 2024, by and between the

Company and Buyer.

“Contract” means any agreement, contract, subcontract, lease, sublease, indenture, note, bond, letter

of credit, mortgage, purchase order, commitment, arrangement, instrument or obligation, whether written or oral, that is binding and legally enforceable against any Person which is party thereto or to which any of the assets of such Person are

subject and bound.

“Current Assets” means, in respect of the LSP Working Capital Group as of any date, the current

assets of the LSP Working Capital Group, determined on a consolidated basis and in accordance with, and subject to the specific adjustments set forth on, Exhibit A, but shall not include (a) Cash and Cash Equivalents,

(b) intercompany assets among the LSP Working Capital Group, or (c) deferred Tax assets.

“Current Liabilities”

means, in respect of the LSP Working Capital Group as of any date, the current liabilities of the LSP Working Capital Group, determined on a consolidated basis and in accordance, and subject to the specific adjustments set forth on, Exhibit

A, but shall not include any portion of (a) the Debt Payoff Amount, (b) any Transaction Expenses paid by Buyer, the Group Companies or LSAIH, including any payment of Transaction Expenses made by Buyer pursuant to

Section 2.3(a)(ii), (c) intercompany liabilities among the LSP Working Capital Group, or (d) deferred Tax liabilities.

“Current Representation” has the meaning set forth in Section 10.17(a).

“D&O Indemnified Parties” has the meaning set forth in Section 6.6(c).

“D&O Tail Policy” has the meaning set forth in Section 6.6(b).

“Data Room” means, together, (i) that certain virtual data site room established by the Company with Datasite and

(ii) that certain virtual data room established by Buyer with Sharefile, for purposes of the transactions contemplated hereby and Buyer’s due diligence investigation related thereto, containing certain documents and other information

relating to the Group Companies and LSAIH.

“Debt Commitment Letter” has the meaning set forth in

Section 5.4.

“Debt Financing” has the meaning set forth in

Section 5.4.

“Debt Financing Parties” means (a) the Debt Financing Sources, (b) all

Affiliates of the Debt Financing Sources, and (c) all current, former or future directors, officers, managers, members, employees, partners, trustees, shareholders, equityholders, limited partners, controlling persons, agents, advisors,

attorneys and representatives of each Person identified in the foregoing clauses (a) and (b) and, in each case of clauses (a) through (c), their respective successors and assigns; provided, that Buyer and its Affiliates shall not

constitute Debt Financing Parties.

6

“Debt Financing Source” means Bank of America, N.A. and PNC Bank, National

Association (together with any lenders, agents, arrangers or other parties providing commitments or otherwise party to the Debt Commitment Letter).

“Debt Payoff Amount” means the aggregate amount of Indebtedness of the Group Companies (including, for the avoidance of

doubt, the aggregate amount of Indebtedness of the Concrete and Precast Redemption Notes (as such term is defined in the Disclosure Schedule)).

“Debt Payoff Letters” has the meaning set forth in Section 2.3(b)(iii).

“Definitive Financing Agreements” has the meaning set forth in Section 6.12(a)(i).

“Designated Accounting Firm” means BDO USA P.C., or if the Sellers’ Representative or Buyer shall discover a bona

fide conflict with respect to such firm or if such firm resigns or refuses for any reason to resolve any dispute in accordance with Section 2.4(d), an independent nationally recognized accounting firm (which firm shall

not have any material relationship with any Seller or Buyer) mutually agreed to in writing by the Sellers’ Representative and Buyer.

“Designated Person” has the meaning set forth in Section 10.17(b).

“Disclosure Schedule” means the Disclosure Schedule delivered by the Company and Buyer concurrently with the execution and

delivery of this Agreement.

“Dispute Notice” has the meaning set forth in Section 2.4(d)(ii).

“Effective Time” means 11:59 p.m. (Austin, Texas time) on the day immediately preceding the Closing Date.

“Employee” means any individual who is an employee, whether by Contract, common law or otherwise, of any Group Company.

“Employee Benefit Plan” means each (a) “employee benefit plan” (as such term is defined in Section 3(3) of

ERISA) and all other employee benefit plan, program or arrangement, agreement, policy, practice, commitment, Contract or understanding (whether qualified or nonqualified, written or unwritten, or subject to ERISA), including profit sharing, stock

purchase, stock option, restricted stock, stock appreciation right, stock bonus, employee stock ownership, savings, severance, retention, employment, consulting,

change-of-control, bonus compensation, incentive, compensation, deferred compensation, supplemental unemployment, layoff, salary continuation, retirement, pension,

health, life insurance, dental, disability, accident, group insurance, vacation, holiday, sick leave, fringe benefit or welfare plans, and any trust, escrow or other agreement related thereto, which currently is sponsored, established, maintained or

contributed to or required to be contributed to by any Group Company or for which any Group Company has any Liability, contingent or otherwise, and (b) “multiemployer plan,” as that term is defined in Section 4001 of ERISA and any

“employee benefit plan” (as defined in Section 3(3) of ERISA) that is subject to Title IV of ERISA or Section 412 of the Code which any Group Company or ERISA Affiliate maintains or contributes to or is required to contribute to

or with respect to which any Group Company or any ERISA Affiliate has any Liability, contingent or otherwise.

“Employment

Agreements” has the meaning set forth in the recitals to this Agreement.

7

“Environmental Laws” means any federal, state or local Law regulating the

protection of the environment, health and safety, species and their habitats or natural resources, or pollution or contamination of or the discharge of materials to the air, soil, surface water, drinking water or groundwater, and includes, the

Comprehensive Environmental Response, Compensation and Liability Act of 1980, 42 U.S.C. § 9601, et seq., the Resource Conservation and Recovery Act, 42 U.S.C. § 6901, et seq., the Clean Water Act, 33 U.S.C. § 1251, et seq., and the

Clean Air Act, 42 U.S.C. § 740l-7671q, the Hazardous Materials Transportation Act, 42 U.S.C. §1801 et seq., the Clean Air Act, 42 U.S.C. § 7401 et seq., the Toxic Substances Control Act, 15 U.S.C. § 2601 et seq., the Oil

Pollution Act of 1990, 33 U.S.C. § 2701, et seq., the Safe Drinking Water Act, 42 U.S.C. § 300f, et seq., the Endangered Species Act, 16 U.S.C. 1531 et seq., the Federal Insecticide, Fungicide, and Rodenticide Act, 7 U.S.C. §§

136 et seq., the Emergency Planning and Community Right-to-Know Act, 42 U.S.C. §§ 11001, et seq., the Migratory Bird Treaty Act, 16 U.S.C. 703 et seq., the

Federal Mine Safety and Health Act of 1977, Pub. L. 91-173 as amended by Pub. L. 95-164 (30 U.S.C. 801 et seq.), and the Occupational Safety and Health Act, 29 U.S.C.

§651, et seq. and the regulations promulgated pursuant thereto, and analogous state or local law, as such of the foregoing are promulgated and in effect on or prior to the Closing Date.

“Environmental Permits” has the meaning set forth in Section 3.11(a).

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the rules and regulations issued

thereunder, as may be amended from time to time.

“ERISA Affiliate” shall mean any trade or business (whether or not

incorporated) which is or at any time preceding the date of this Agreement would have been treated as a “single employer” with any Group Company under Section 414(b), (c), (m), or (o) of the Code or part of the same controlled

group with any Group Company under Section 4001 of ERISA.

“Estimated Closing Date Cash” has the meaning set forth

in Section 2.4(a).

“Estimated Closing Debt Payoff Amount” has the meaning set forth in

Section 2.4(a).

“Estimated Closing Statement” has the meaning set forth in

Section 2.4(a).

“Estimated Net Working Capital Amount” means $60,000,000.

“Estimated Transaction Expenses” has the meaning set forth in Section 2.4(a).

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Expense Invoices” has the meaning set forth in Section 2.3(b)(iv).

“Expert Calculations” has the meaning set forth Section 2.4(d)(iv).

“Final Allocation” has the meaning set forth in Section 2.5.

“Financial Statements” has the meaning set forth in Section 3.4(a).

“Financing Marketing Documents” has the meaning set forth in Section 6.12(e)(i)(A).

“Former Employee” means any individual who was previously employed by any Group Company, whether by Contract, common law or

otherwise, but who is no longer employed by the Group Company as of the date hereof.

8

“Fundamental Representations” means the representations and warranties set

forth in Section 3.1 (Organization and Qualification), Section 3.2 (Capitalization of the Group Companies), Section 3.3 (Authority),

Section 3.5(b)(i) (No Violations), Section 3.16 (No Brokers), Section 4.1 (Organization), Section 4.2 (Units),

Section 4.3 (Authority), Section 4.4(b)(i) (No Violations), Section 4.5 (No Brokers), Section 5.1 (Organization),

Section 5.2 (Authority), Section 5.5 (No Brokers), and Section 5.8 (Capitalization of Buyer).

“GAAP” means United States generally accepted accounting principles.

“Governing Documents” means the legal document(s) by which any Person (other than an individual) establishes its legal

existence or which govern its internal affairs or relate, in any material respect, to the transfer of securities of such Person, in each case, as amended, restated, supplemented or otherwise modified. For example, the “Governing Documents”

of a corporation are its certificate of incorporation and bylaws, the “Governing Documents” of a limited partnership are its limited partnership agreement and certificate of limited partnership and the “Governing Documents” of a

limited liability company are its operating agreement and certificate of formation. For the avoidance of doubt, any voting agreements, stockholder agreements, investor rights agreements and similar documents, instruments or agreements to which any

Person is a party shall constitute the Governing Documents of such Person.

“Government Bid” means any bid, proposal,

offer or quote made by any Group Company prior to the Closing Date, and all amendments, modifications or supplements thereto, which, if accepted, or selected for award, would result in a Government Contract.

“Government Contract” means any Contract, including any letter contract, service agreement, consulting agreement, purchase

order, delivery order, shipping order or blanket purchase agreement, subcontract, or any financial assistance agreement or other transaction agreement, between (a) any Group Company, on the one hand, and any Governmental Authority, on the other

hand, or (b) any Group Company and any prime contractor, higher-tier subcontractor, or reseller to any Governmental Authority; provided, however, that no task, purchase or delivery order issued under an overarching Government

Contract vehicle will constitute a separate Government Contract for purposes of this definition, but will instead be part of the Government Contract under which it was issued. “Government Contract” includes all amendments, modifications,

and options relating to any of the foregoing or any other vehicle whatsoever pursuant to which funding is provided to any Group Company by any Governmental Authority, including through a prime contractor or higher-tiered subcontractor.

“Government Official” has the meaning set forth in Section 3.9(c).

“Governmental Authority” means any (a) nation, region, state, province, county, city, town, village, district or other

jurisdiction, (b) federal, state, local, municipal, foreign or other government or political subdivision thereof, (c) governmental or quasi-governmental authority of any nature (including any governmental agency, branch, department,

official, or entity and any court or other tribunal), whether foreign or domestic, or (d) body exercising or entitled to exercise any administrative, executive, judicial, legislative, police, regulatory, self-regulatory or taxing authority or

power of any nature, whether foreign or domestic, including any arbitral tribunal.

“Gross Closing A/R” has the meaning

set forth in Section 2.1(c)(iv).

“Group Companies” means, collectively, the Company, each of

the Company Subsidiaries, and Burnet Ranch LLC, and the term “Group Company” means any one of the foregoing.

“Group

Company IP Agreements” has the meaning set forth in Section 3.12(c).

9

“Group Company IP Rights” has the meaning set forth in

Section 3.12(a).

“Hazardous Substance” means (a) any liquid, gaseous or solid material,

substance or waste that requires removal, remediation or reporting under any Environmental Law or is listed, classified or regulated as a “hazardous waste” or “hazardous substance” (or any other similar term) pursuant to any

Environmental Law or that is regulated because of its effect or potential effect on human health or the environment, and (b) any petroleum product or by-product (or any fraction thereof), crude oil,

petroleum-derived substances, asbestos, polychlorinated biphenyls, PFAS or urea formaldehyde.

“Holdback Amount” has the

meaning set forth in Section 2.1(c)(iv).

“Holdback Adjustment Amount” has the meaning set

forth in Section 2.1(c)(iv).

“Holdback Quarterly Payment Amount” has the meaning set forth in

Section 2.1(c)(iv).

“Holdback Release Date” has the meaning set forth in

Section 2.1(c)(iv).

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976,

as amended.

“Indebtedness” means, as of any time with respect to any Person, without duplication, the outstanding

principal amount of, and accrued and unpaid interest on, any obligations of any such Person consisting of: (a) indebtedness for borrowed money, indebtedness issued or incurred in substitution or exchange for indebtedness for borrowed money or

for deferred or contingent purchase price of property or services (including the maximum amount, in each case, of any deferred pay-out or earn-out, any post-closing true-ups or “seller notes” payable with respect to the acquisition of any business, assets or securities, but excluding any trade payables and accrued expenses arising in the Ordinary Course of Business

and included in the calculation of Closing Net Working Capital Amount), (b) indebtedness evidenced by any note, bond, debenture or other debt security, (c) commitments or obligations by which any such Person assures a creditor against loss,

including reimbursement obligations in respect to letters of credit, surety bonds, performance bonds, licensing or bid bonds, or other similar instruments, in each case only to the extent drawn or otherwise not contingent, (d) capitalized lease

obligations that are classified as a liability in accordance with the Agreed Accounting Principles; (e) all Liabilities of arising out of interest rate and currency swap arrangements; (f) the accrued, unpaid amount of income Taxes,

including Texas franchise Taxes of the LSP Working Capital Group for the Pre-Closing Tax Period first due after the Closing Date (other than Taxes that are imposed as a result of Buyer’s breach of

covenants set forth in Section 6.13(d)), net of all income Tax credits that may be used by the LSP Working Capital Group to reduce such income Taxes of the LSP Working Capital Group; (g) all guaranties of such Person

in connection with any of the foregoing; and (h) all fees, accrued and unpaid interest, premiums or penalties related to any of the foregoing; provided, that “Indebtedness” shall not include any such Liabilities or

obligations that are solely between or among members of the LSP Working Capital Group. The income Tax amounts in clause (f) above shall be computed: (w) net of all income Tax payments (including estimated income Tax payments and

prepayments or overpayments of income Taxes) previously made with respect to such income Taxes, (x) based on current practices and procedures of the relevant Group Company, and (y) by taking into account deductions attributable to the

Transaction Expenses to the extent available to offset such income Taxes under applicable Law, determined under a “more likely than not” standard; provided, that amounts in clause (w), (x) and (y) to be taken into account shall

not exceed an amount that would result in the amount in clause (f) above being less than zero dollars ($0).

“Independent

Contractor” means a Person providing services to any Group Company on the date hereof who is not an Employee.

10

“Initial Cash Purchase Price” has the meaning set forth in

Section 2.1(a).

“Inspection” has the meaning set forth in

Section 6.3(a).

“Intellectual Property Rights” means all patents, patent applications,

trademarks, service marks and trade names, all goodwill associated therewith and all registrations and applications therefor, copyrights, copyright registrations and applications, Internet domain names, software, trade secrets, and know how, in each

case, to the extent protectable by applicable Law.

“Interim Balance Sheet” has the meaning set forth in

Section 3.4(a).

“Inventory” has the meaning set forth in

Section 3.22.

“Key Employees” means the employees set forth on Schedule 1.1(d).

“Law” means any code, law (including any principle of common law), Order, writ, ordinance, rule, regulation, legally binding

guidance, statute or treaty of any Governmental Authority having jurisdiction over the applicable Person(s), or over any of their respective properties or businesses.

“Leased Real Property” has the meaning set forth in Section 3.17(b).

“Leases” has the meaning set forth in Section 3.17(b).

“Lender Protective Provisions” means the provisions set forth in 10.1, 10.3, 10.5, 10.9,

10.13, 10.14 and 10.15.

“Liability” means any liability, debt, obligation, deficiency, interest,

Tax, penalty, fine, judgment, or other loss (including loss of benefit or relief), cost or expenses of any kind or nature, whether known or unknown, asserted or unasserted, absolute or contingent, accrued or unaccrued, determined or determinable,

liquidated or unliquidated, and whether due or to become due and regardless of when or by whom asserted.

“Lien” means,

with respect to any asset, liens, pledges, voting agreements, voting trusts, proxy agreements, security interests, mortgages and other possessory interests, conditional sale or other title retention agreements, assessments, easements, rights-of-way, rights of first refusal, defects in title, encroachments, options, or other encumbrances of any kind.

“Lock-Up Agreements” has the meaning set forth in

Section 2.3(a)(viii).

“Lookback Date” means the date that is three (3) years prior to the

date of this Agreement.

“Losses” means all damages, losses, Liabilities, obligations, deficiencies, demands, judgments,

interest, fines, penalties, claims, suits, actions, causes of action, assessments, awards, costs and expenses (including reasonable attorneys’ and other professionals’ fees and expenses), whether or not involving a third-party claim.

“LSAIH” means LSA Investment Holdings, LLC, a Texas limited liability company.

“LSP Working Capital Group” means the Group Companies, other than Burnet Ranch LLC.

“Material Contract” has the meaning set forth in Section 3.6.

11

“Net Working Capital” means, as of any date, Current Assets as of such date

minus Current Liabilities as of such date.

“New Plans” has the meaning set forth in

Section 6.9(a).

“Nonparty Affiliate” has the meaning set forth in

Section 10.13.

“Notice of Claim” means a written notice that specifies in reasonable detail,

in each case, to the extent then-known, (a) the breach of any covenant, warranty or representation set forth in this Agreement or any certificate furnished under this Agreement or other matter (including the sections of this Agreement that are

the subject of such breach or other matter) pursuant to which Losses are being claimed by an indemnified party, (b) the bases underlying such asserted breach, and (c) the total damages sought (estimated, if necessary and to the extent

feasible).

“OCB Purchase Orders” means purchase, task and sale orders and project contracts in substantially the form

made available to Buyer entered into in the Ordinary Course of Business.

“Off-the-Shelf Software” means any computer software that is licensed for use on desktop or laptop computers, mobile devices (including smartphones, tablets and

e-readers), network servers or similar devices, in each case to the extent not licensed through a written agreement executed by the licensee (as opposed to clickwrap, browsewrap, or shrinkwrap licenses or

terms and conditions that are not substantially negotiable). Off-the-Shelf Software includes Microsoft Office and similar office productivity software (including

individual programs contained therein), endpoint agents, web browsers and other Internet access software, and local operating systems such as iOS, macOS, Microsoft Windows, and Android.

“Order” means settlement, stipulation, order, writ, judgment, injunction, decree, ruling, determination or award of any

Governmental Authority.

“Ordinary Course of Business” means the usual and ordinary course of normal day-to-day operations of the business of the Group Companies, consistent (in scope, manner, amount and otherwise) with each of the Group Companies’ respective past