UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 3)*

comScore,

Inc.

(Name

of Issuer)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

20564W204

(CUSIP

Number)

with

a copy to:

| Cerberus

Capital Management, L.P. |

|

Robert

G. Minion, Esq. |

| Attn:

Andrew Kandel, Chief Compliance Officer |

|

Lowenstein

Sandler LLP |

| 875

Third Avenue, 10th Floor |

|

1251

Avenue of the Americas, 17th Floor |

| New

York, NY 10022 |

|

New

York, NY 10020 |

| (212)

891-2100 |

|

(646)

414-6930 |

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

July

24, 2024

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

CUSIP

No. 20564W204

| 1. |

Names

of Reporting Persons:

Pine

Investor, LLC

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions):

(a)

☐

(b)

☒

|

| 3. |

SEC

Use Only

|

| 4. |

Source

of Funds (See Instructions): OO

|

| 5. |

Check

if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e): ☐

|

| 6. |

Citizenship

or Place of Organization:

Delaware

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7.

|

Sole

Voting Power:

|

1,717,085

(1) |

| 8.

|

Shared

Voting Power:

|

0 |

| 9.

|

Sole

Dispositive Power:

|

1,717,085

(1) |

| 10. |

Shared

Dispositive Power:

|

0 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person: |

1,717,085

(1)

|

| 12. |

Check if

the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions):

|

☒

(1) |

| 13. |

Percent of

Class Represented by Amount in Row (11):

|

26.4%

(1) |

| 14. |

Type of Reporting

Person (See Instructions):

|

OO |

(1)

Represents (i) 1,603,578 shares of common stock, par value $0.001 per share (“Common Stock”), of comScore, Inc., a Delaware

corporation (the “Issuer”), issuable upon conversion of 31,928,301 shares of the Issuer’s Series B Convertible Preferred

Stock, par value $0.001 per share (“Series B Preferred Stock”), held by Pine Investor, LLC (“Pine”); (ii) 109,654

shares of outstanding Common Stock beneficially owned by the Reporting Persons; and (iii) 3,853 shares of Common Stock underlying vested,

deferred stock units resulting from restricted stock unit awards previously granted by the Issuer to Nana Banerjee and assigned by Dr.

Banerjee to Cerberus Capital Management, L.P., a Delaware limited partnership (“Cerberus”, and together with Pine, the “Reporting

Persons”). See the discussion in Items 4 through 6 of this Schedule 13D.

CUSIP

No. 20564W204

| 1. |

Names

of Reporting Persons: |

| |

|

|

Cerberus

Capital Management, L.P.

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions): |

| |

(a)

☐ |

| |

(b)

☒

|

| 3. |

SEC

Use Only

|

| 4. |

Source

of Funds (See Instructions): OO

|

| 5. |

Check

if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e): ☐

|

| 6. |

Citizenship

or Place of Organization: |

| |

|

| |

Delaware |

Number

of

Shares

Beneficially

Owned

by

Each

Reporting Person With |

7.

|

Sole

Voting Power:

|

1,717,085

(1) |

| 8.

|

Shared

Voting Power:

|

0 |

| 9.

|

Sole

Dispositive Power:

|

1,717,085

(1) |

| 10. |

Shared

Dispositive Power:

|

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting

Person: |

1,717,085 (1) |

| |

|

|

| 12. |

Check if the

Aggregate Amount in Row (11) Excludes Certain Shares |

☒ (1) |

| |

(See Instructions): |

|

| |

|

|

| 13. |

Percent

of Class Represented by Amount in Row (11): | 26.4%

(1) |

| |

|

|

| 14. |

Type of Reporting

Person (See Instructions):

|

IA |

(1)

Represents (i) 1,603,578 shares of Common Stock issuable upon conversion of 31,928,301 shares of Series B Preferred Stock held by Pine;

(ii) 109,654 shares of outstanding Common Stock beneficially owned by the Reporting Persons; and (iii) 3,853 shares of Common Stock underlying

vested, deferred stock units resulting from restricted stock unit awards previously granted by the Issuer to Nana Banerjee and assigned

by Dr. Banerjee to Cerberus. See the discussion in Items 4 through 6 of this Schedule 13D.

Item

5. Interest in Securities of the Issuer.

Item

5 is hereby amended in its entirety as follows:

The

Reporting Persons may be deemed to beneficially own, in the aggregate, 1,717,085 shares of Common Stock, consisting of (i) 1,603,578

shares of Common Stock issuable upon conversion of 31,928,301 shares of Series B Preferred Stock beneficially owned by the Reporting

Persons, based upon the conversion rate of the Series B Preferred Stock including accrued dividends; (ii) 109,654 outstanding shares

of Common Stock beneficially owned by the Reporting Persons; and (iii) 3,853 shares of Common Stock underlying vested, deferred stock

units resulting from restricted stock unit awards previously granted by the Issuer to Nana Banerjee in 2021 in respect of director fees

and assigned by Dr. Banerjee to Cerberus. The Series B Preferred Stock is convertible into shares of Common Stock at any time at the

holder’s option, based on a conversion rate subject to certain adjustments, including for anti-dilution and accrued dividends (which

accrue at 7.5% per annum), determined in the manner set forth in the Certificate of Designations of the Series B Preferred Stock (as

amended from time to time, the “Certificate of Designations”).

The

aggregate of 1,717,085 shares of Common Stock referred to above as beneficially owned by the Reporting Persons represents approximately

26.4% of the outstanding shares of Common Stock, based upon 4,889,646 shares of Common Stock outstanding as of July 24, 2024 as reported

by the Issuer to the Reporting Persons, as calculated pursuant to Rule 13d-3 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”).

As

a result of the Amended and Restated Stockholders Agreement (as defined below), the Reporting Persons may be deemed to be members of

a group with the parties to the Amended and Restated Stockholders Agreement under Section 13(d) of the Exchange Act. Neither the filing of this Statement nor any of its contents shall be deemed to constitute an admission by any Reporting Person

that, except as expressly set forth herein, it has or shares beneficial ownership of any shares of Common Stock held by any other person

for purposes of Section 13(d) of the Exchange Act or for any other purpose, and such beneficial ownership thereof is expressly disclaimed.

Cerberus,

either directly or through one or more intermediate entities, including Pine, has the sole power to vote or to direct the voting of and

the sole power to dispose or direct the disposition of the shares of Common Stock beneficially owned by it, subject to the restrictions

described in Item 6.

On

July 24, 2024 (the “Issuance Date”), the Issuer entered into a Subscription Agreement with Pine (the “Subscription

Agreement”) to effect the issuance to Pine of 4,419,098 additional shares of Series B Preferred Stock, resulting in Pine owning

the aggregate 31,928,301 shares of Series B Preferred Stock as referenced above. The additional shares of Series B Preferred Stock were

issued to Pine exchange for (a) waiver of the Issuer’s obligation to pay accrued dividends totaling approximately $10.9 million

to Pine on its existing Series B Preferred Stock holdings for dividend periods ended in 2023 and 2024, and (b) entry into the Amended

and Restated Stockholders Agreement (as defined below).

Except

as disclosed herein, the Reporting Persons have not effected any transactions during the past sixty (60) days from the date of this filing

in any securities of the Issuer.

No

other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities

described in this Statement.

Item

6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Item

6 is hereby amended by adding thereto the language set forth below:

Subscription

Agreement

Pine

entered into the Subscription Agreement with the Issuer described in Item 5 above, pursuant to which the issuance to Pine of the

4,419,098 additional shares of Series B Preferred Stock was effected. Each of Charter Communications Holding Company, LLC and

Liberty Broadband Corporation (together with Pine, the “Stockholders”) entered into substantially similar subscription

agreements with the Issuer, providing for like issuances of Series B Preferred Stock to each such Stockholder (collectively with the

issuance to Pine, the “Issuance”), on the same terms and for like consideration as provided in Pine’s agreement

(waiver of dividend obligations owing to such Stockholders for dividend periods ended in 2023 and 2024, and entry into the Amended

and Restated Stockholders Agreement). The Subscription Agreement contains representations, warranties and covenants of the

Stockholder, as well as other obligations of the parties. The Subscription Agreement also provides for registration rights with

respect to the Series B Preferred Stock and the shares of Common Stock issuable upon conversion of such Series B Preferred Stock in

accordance with the terms of the Registration Rights Agreement, dated March 10, 2021, by and between the Issuer and the parties

thereto.

The

foregoing summary of Pine’s waiver of certain prior dividends on the Series B Preferred Stock, and Pine’s Subscription Agreement,

does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of Pine’s Series B Preferred

Stockholder Waiver, dated July 23, 2024, and the full text of Pine’s Subscription Agreement, copies of which are incorporated by

reference as Exhibit 1 and Exhibit 2, respectively, to this Statement and are incorporated into this Item 6 by reference.

Amended

and Restated Stockholders Agreement

In

connection with the Issuance and on the Issuance Date, the Issuer and the Stockholders also amended and restated the Stockholders Agreement,

dated March 10, 2021, by and among the Issuer and the parties thereto (the “Original Stockholders Agreement” and as amended and restated,

the “Amended and Restated Stockholders Agreement”).

The

Amended and Restated Stockholders Agreement, among other things, (a) removed the provisions of the Original Stockholders Agreement that

had either expired by their terms or been rendered inapplicable with the passage of time, (b) gave effect to the Issuance, and (c) clarified

the impact of the Issuance and potential future issuances of Series B Preferred Stock and Common Stock as dividends pursuant to the Certificate

of Designations. The Amended and Restated Stockholders Agreement clarified that additional shares of Series B Preferred Stock issued

in the Issuance, and any Series B Preferred Stock or Common Stock that may be issuable in the future as dividends, do not increase any

Stockholder’s right to designate individuals to serve on the Issuer’s Board of Directors (the “Board”).

The

Original Stockholders Agreement provided Stockholders with the right to require the Issuer to pay a one-time dividend (the “Special Dividend”)

equal to the highest dividend the Board determines can be paid at the time subject to certain limitations. Under the Original Stockholders

Agreement, if an aggregate $100 million of Special Dividends and Annual Dividends (as defined in the Certificate of Designations) have

been paid on the Series B Preferred Stock, the Issuer is required, subject to certain limitations, to use any remaining amount of the

Special Dividend to pay a pro rata dividend on the Common Stock (with the Series B Preferred Stock participating on an as-converted basis).

The Amended and Restated Stockholders Agreement clarified that the $100.0 million Special Dividend threshold is reduced by $32.8 million,

equal to the aggregate liquidation preference of the additional Series B Preferred Stock issued in the Issuance. Immediately following

the Issuance, and taking into account Annual Dividends previously paid, the current Special Dividend threshold is $47.0 million.

Under

the Original Stockholders Agreement, subject to certain conditions, each Stockholder agreed to vote, or provide a written consent or

proxy with respect to, its Voting Stock (as defined in the Original Stockholders Agreement) (a) in favor of each Stockholder’s director

designees, and (b) in a neutral manner in the election of any directors nominated by the Board for election who are not designees of

a Stockholder. The Amended and Restated Stockholders Agreement clarified that the additional shares of Series B Preferred Stock issued

in the Issuance, as well as any Series B Preferred Stock or Common Stock that may be issuable in the future as dividends pursuant to

the Certificate of Designations, are subject to this obligation. In addition, the Amended and Restated Stockholders Agreement provided

that to the extent any outstanding shares of Common Stock held by a Stockholder as of the Issuance Date would otherwise cause the aggregate

voting power of all Voting Stock held by the Stockholders to exceed 49.99% on the record date for any vote, such Stockholder will vote,

or provide a written consent or proxy with respect to, such Common Stock in a neutral manner on all matters upon which such Stockholder

is entitled to vote, with such provision to expire when the aggregate voting power of the Stockholders ceases to exceed 49.99%. The Certificate

of Designations already provides for neutral voting on all matters with respect to Series B Preferred Stock that exceeds 16.66% per Stockholder

or 49.99% in aggregate on an as-converted basis.

The

foregoing summary of the Amended and Restated Stockholders Agreement does not purport to be complete and is subject to, and is qualified

in its entirety by, the full text of the Amended and Restated Stockholders Agreement, which is incorporated by reference as Exhibit 3

to this Statement and is incorporated into this Item 6 by reference.

Item

7. Material to be Filed as Exhibits.

Item

7 is hereby amended by adding thereto the following additional Exhibits:

| Ex. 1. |

Series B Preferred Stockholder Waiver, dated July 23, 2024, from Pine Investor, LLC (incorporated by reference from Exhibit 4.3 to the Current Report on Form 8-K of the Issuer filed with the Securities and Exchange Commission on July 25, 2024). |

| |

|

| Ex. 2. |

Subscription Agreement, dated July 24, 2024, by and between comScore, Inc. and Pine Investor, LLC (incorporated by reference from Exhibit 10.3 to the Current Report on Form 8-K of the Issuer filed with the Securities and Exchange Commission on July 25, 2024). |

| |

|

| Ex. 3. |

Amended and Restated Stockholders Agreement, dated July 24, 2024, by and among comScore, Inc., Charter Communications Holding Company, LLC, Liberty Broadband Corporation and Pine Investor, LLC (incorporated by reference from Exhibit 10.4 to the Current Report on Form 8-K of the Issuer filed with the Securities and Exchange Commission on July 25, 2024). |

Signature

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete

and correct.

| Date:

July 26, 2024 |

PINE

INVESTOR, LLC |

| |

|

|

| |

By: |

/s/

Alexander D. Benjamin |

| |

Name: |

Alexander

D. Benjamin |

| |

Title: |

Managing

Director |

| Date:

July 26, 2024 |

CERBERUS

CAPITAL MANAGEMENT, L.P. |

| |

|

|

| |

By: |

/s/

Alexander D. Benjamin |

| |

Name: |

Alexander

D. Benjamin |

| |

Title: |

Chief

Legal Officer and |

| |

|

Senior Managing Director |

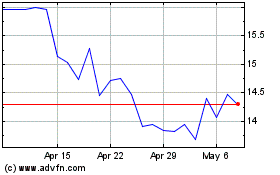

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Jun 2024 to Jul 2024

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Jul 2023 to Jul 2024