0001158172false12-3100011581722024-06-122024-06-1200011581722024-12-312024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): June 12, 2024

COMSCORE, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-33520 | | 54-1955550 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

11950 Democracy Drive

Suite 600

Reston, Virginia 20190

(Address of principal executive offices, including zip code)

(703) 438–2000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 per share | | SCOR | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

At an annual meeting of stockholders of comScore, Inc. (the "Company") held on June 12, 2024 (the "Annual Meeting"), the Company's stockholders adopted an amendment to the Certificate of Designations of the Company's Series B Convertible Preferred Stock, par value $0.001 per share ("Series B Preferred Stock"), to clarify that the price thresholds in Sections 4(c)(i)(a), (b) and (c) of the Certificate of Designations shall be adjusted as appropriate to give effect to the reverse stock split effectuated by the Company on December 20, 2023. The disclosure set forth in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously disclosed, the Board of Directors (the "Board") of the Company previously approved, subject to stockholder approval, an amendment to the comScore, Inc. Amended and Restated 2018 Equity and Incentive Compensation Plan (the "Plan") to increase the number of shares of Company common stock available for grant under the Plan by 900,000. The Company's stockholders approved the amendment at the Annual Meeting, and the amendment became effective on June 12, 2024. A detailed description of the material terms of the Plan, as amended, appears under the caption "Proposal No. 5– Approval of an Amendment to the comScore, Inc. 2018 Equity and Incentive Compensation Plan (as Amended and Restated Effective as of July 9, 2020)" in the Company's proxy statement filed with the Securities and Exchange Commission on April 29, 2024, which description is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On June 17, 2024, the Company filed a Certificate of Amendment to the Certificate of Designations of the Series B Preferred Stock (the "COD Certificate of Amendment") with the Secretary of State of the State of Delaware. The COD Certificate of Amendment became effective with the Secretary of State upon filing. As previously disclosed, the COD Certificate of Amendment clarifies that the price thresholds in Sections 4(c)(i)(a), (b) and (c) of the Certificate of Designations shall be adjusted as appropriate to give effect to the reverse stock split effectuated by the Company on December 20, 2023.

The foregoing summary of the COD Certificate of Amendment does not purport to be complete and is subject to, and is qualified in its entirety by, the full text of the COD Certificate of Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

The Annual Meeting was held on June 12, 2024. The final results of voting on the proposals submitted to a vote of the Company's stockholders at the Annual Meeting are set forth below. These results include votes cast by holders of the Company's common stock and Series B Preferred Stock on an as-converted basis, as well as votes cast by holders of the Series B Preferred Stock as a separate class on Proposal No. 6.

Proposal No. 1

Four Class II directors were elected to serve for terms expiring at the Company's 2027 annual meeting of stockholders, to hold office until their respective successors have been duly elected and qualified. The election results were as follows:

| | | | | | | | | | | | | | | | | | | | |

Nominee (1) | | For | | Withheld | | Broker Non-Votes |

Jon Carpenter | | 6,538,342 | | 115,127 | | 867,648 |

Leslie Gillin (2) | | 5,956,572 | | 696,897 | | 867,648 |

Bill Livek | | 6,498,030 | | 155,439 | | 867,648 |

Matt McLaughlin | | 6,535,725 | | 117,744 | | 867,648 |

(1) The election results for each nominee reflect neutral voting by holders of the Series B Preferred Stock, as required by the Stockholders Agreement, dated March 10, 2021, by and among the Company and such holders and described in the Company's proxy statement filed with the Securities and Exchange Commission on April 29, 2024. The Company's incumbent directors standing for election received, on average, over 95% support from holders of the Company's common stock voted at the meeting.

(2) Voting results for Ms. Gillin (at 90% support) were impacted by an institutional investor's policies that prescribed voting against all Compensation Committee members based on opposition to the Company's equity plan proposal, as described above.

Proposal No. 2

The compensation of the Company's named executive officers was approved, on a non-binding advisory basis, as follows:

| | | | | | | | | | | | | | | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes |

5,980,447 | | 100,838 | | 572,184 | | 867,648 |

Proposal No. 3

The recommendation to hold an advisory vote on executive compensation every year was approved, on a non-binding advisory basis, as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

1 Year | | 2 Years | | 3 Years | | Abstain | | Broker Non-Votes |

6,004,082 | | 22,044 | | 57,889 | | 569,454 | | 867,648 |

In light of the results of the advisory vote on Proposal No. 3, the Board determined that the Company will hold a stockholder vote on executive compensation every year until the next required advisory vote on the frequency of stockholder votes on executive compensation.

Proposal No. 4

The appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2024 was ratified as follows:

| | | | | | | | | | | | | | | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes |

6,894,089 | | 51,192 | | 575,836 | | 0 |

Proposal No. 5

The amendment to the Plan was approved as follows:

| | | | | | | | | | | | | | | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes |

5,544,262 | | 442,620 | | 666,587 | | 867,648 |

Proposal No. 6

The amendment to the Certificate of Designations of the Series B Preferred Stock was adopted by holders of the Company's common stock and Series B Preferred Stock voting on an as-converted basis as follows:

| | | | | | | | | | | | | | | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes |

6,007,041 | | 37,576 | | 608,852 | | 867,648 |

The amendment to the Certificate of Designations of the Series B Preferred Stock was adopted by holders of the Series B Preferred Stock voting as a separate class as follows:

| | | | | | | | | | | | | | | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes |

82,527,609 | | 0 | | 0 | | 0 |

Item 8.01 Other Events.

On June 12, 2024, at the initiative of the Chairman of the Board, Nana Banerjee, the Board determined to reduce the annual cash retainer for Dr. Banerjee's service as Chairman by 50% for the upcoming compensation term, which begins on July 1, 2024. The annual retainer will be reduced from $150,000 per year to $75,000 per year. Dr. Banerjee recommended the reduction in furtherance of the Company's previously announced efforts to improve cost efficiency and align resources with strategic priorities.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 3.1 | | |

| | |

101.INS | | XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

| | |

101.SCH | | Inline XBRL Taxonomy Extension Schema Document |

| | |

101.CAL | | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| | |

101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase Document |

| | |

101.LAB | | Inline XBRL Taxonomy Extension Label Linkbase Document |

| | |

101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| | |

104 | | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| comScore, Inc. |

| |

| By: | | /s/ Mary Margaret Curry |

| | Mary Margaret Curry |

| | Chief Financial Officer and Treasurer |

Date: June 18, 2024

Second Amendment to the

Certificate of Designations of

Series B Convertible Preferred Stock,

Par Value $0.001,

of comScore, Inc.

COMSCORE, Inc., a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “Corporation”), in accordance with the provisions of Section 242 thereof, hereby certifies that the following resolutions amending the rights of the Series B Convertible Preferred Stock (the “Series B Preferred Stock”) (a) were duly adopted by the Board of Directors of the Corporation (the “Board of Directors”) pursuant to authority conferred upon the Board of Directors by the provisions of the Amended and Restated Certificate of Incorporation of the Corporation, as amended (the “Certificate of Incorporation”), and the Amended and Restated Bylaws of the Corporation (the “Bylaws”), at a duly held meeting of the Board of Directors held on April 5, 2024, and (b) were consented to by (i) the holders of at least a majority of the outstanding shares of common stock of the Corporation, par value $0.001 per share, and the Series B Preferred Stock (on an as-converted basis and in accordance with the terms of the Certificate of Designations (as defined below)), and (ii) the holders of at least 75% of the outstanding shares of Series B Preferred Stock, in each case, at a duly held meeting on June 12, 2024.

RESOLVED, that effective upon the filing of this Certificate of Amendment to the Certificate of Designations of Series B Convertible Preferred Stock (this “Certificate of Amendment”), the Certificate of Designations of Series B Convertible Preferred Stock dated and filed with the Delaware Secretary of State on March 10, 2021, as amended on June 16, 2023 (the “Certificate of Designations”), is hereby amended as follows:

1.The following clause (iv) is hereby added to the end of Section 4(c) in the Certificate of Designations:

(iv) Notwithstanding anything to the contrary herein, with respect to the price thresholds provided in Sections 4(c)(i)(a), (b) and (c), such thresholds shall be adjusted as appropriate to give effect to the reverse stock split effectuated by the Company on December 20, 2023.

RESOLVED FURTHER, that the Certificate of Designations as amended by the Certificate of Amendment shall remain in full force and effect except as expressly amended hereby.

IN WITNESS WHEREOF, the Company has caused this Second Amendment to the Certificate of Designations to be executed this 12th day of June 2024.

COMSCORE, INC.

By: /s/ Ashley Wright

Name: Ashley Wright

Title: Secretary

v3.24.1.1.u2

Cover Page

|

Dec. 31, 2024 |

Jun. 12, 2024 |

| Cover [Abstract] |

|

|

| Document Type |

|

8-K

|

| Document Period End Date |

|

Jun. 12, 2024

|

| Entity Registrant Name |

|

COMSCORE, INC.

|

| Entity Incorporation, State or Country Code |

|

DE

|

| Entity File Number |

|

001-33520

|

| Entity Tax Identification Number |

|

54-1955550

|

| Entity Address, Address Line One |

|

11950 Democracy Drive

|

| Entity Address, Address Line Two |

|

Suite 600

|

| Entity Address, City or Town |

|

Reston

|

| Entity Address, State or Province |

|

VA

|

| Entity Address, Postal Zip Code |

|

20190

|

| City Area Code |

|

703

|

| Local Phone Number |

|

438–2000

|

| Written Communications |

|

false

|

| Soliciting Material |

|

false

|

| Pre-commencement Tender Offer |

|

false

|

| Pre-commencement Issuer Tender Offer |

|

false

|

| Title of 12(b) Security |

|

Common Stock, par value $0.001 per share

|

| Trading Symbol |

|

SCOR

|

| Security Exchange Name |

|

NASDAQ

|

| Entity Emerging Growth Company |

|

false

|

| Entity Central Index Key |

|

0001158172

|

| Amendment Flag |

|

false

|

| Current Fiscal Year End Date |

--12-31

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

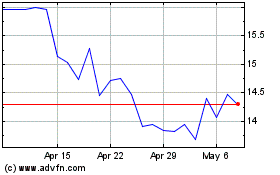

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Dec 2024 to Jan 2025

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Jan 2024 to Jan 2025