0001158172false00011581722023-12-122023-12-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 12, 2023

COMSCORE, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-33520 | | 54-1955550 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

11950 Democracy Drive

Suite 600

Reston, Virginia 20190

(Address of principal executive offices, including zip code)

(703) 438–2000

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 per share | | SCOR | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On December 12, 2023, comScore, Inc. (the "Company") held a special meeting of stockholders of the Company (the "Special Meeting"). At the Special Meeting, the Company's stockholders approved a proposal to adopt an amendment to the Amended and Restated Certificate of Incorporation ("Certificate of Amendment") for the purpose of effecting the Reverse Stock Split and the Authorized Share Reduction (each as defined in Item 8.01 below). The final results of voting on the proposal are set forth below. These results include votes cast by holders of the Company's common stock, par value $0.001 ("Common Stock") and Series B Convertible Preferred Stock ("Series B Preferred Stock") on an as-converted basis, as well as votes cast by holders of the Series B Preferred Stock as a separate class.

Proposal No. 1

The Certificate of Amendment was adopted by holders of the Common Stock and Series B Preferred Stock voting on an as-converted basis as follows:

| | | | | | | | | | | | | | | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes |

139,872,638 | | 4,666,993 | | 8,942,159 | | 0 |

The Certificate of Amendment was adopted by holders of the Series B Preferred Stock voting as a separate class as follows:

| | | | | | | | | | | | | | | | | | | | |

For | | Against | | Abstain | | Broker Non-Votes |

82,527,609 | | 0 | | 0 | | 0 |

The Company did not present Proposal No. 2 (the approval of an adjournment of the Special Meeting, if necessary, to solicit additional proxies if there were insufficient votes to approve Proposal No. 1) at the Special Meeting.

Item 7.01 Regulation FD Disclosure.

On December 18, 2023, the Company issued a press release regarding the Reverse Stock Split. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The information contained in this Item 7.01 is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, unless expressly incorporated by reference in such filing.

Item 8.01 Other Events.

As disclosed above, at the Special Meeting the Company's stockholders approved a reverse stock split of all outstanding shares of Common Stock at a ratio ranging between 1-for-2 and 1-for-30, with the exact ratio within such range to be determined by the Company's Board of Directors (the "Reverse Stock Split"). The stockholders also approved a reduction in the number of authorized shares of Common Stock by the same ratio as the Reverse Stock Split (the "Authorized Share Reduction").

On December 12, 2023, the Board of Directors approved a final reverse stock split ratio of 1-for-20 (the "Reverse Stock Split Ratio"). The Reverse Stock Split is expected to become effective at 9:00 a.m. Eastern Time on Wednesday, December 20, 2023, with the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware. The Company's Common Stock is expected to commence trading on a split-adjusted basis on the Nasdaq Global Select Market ("Nasdaq") at market open on December 20, 2023, under the existing trading symbol "SCOR." The new CUSIP number for the Company's Common Stock following the Reverse Stock Split will be 20564W204.

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders who would otherwise be entitled to receive fractional shares as a result of the Reverse Stock Split will be entitled to a cash payment in lieu thereof at a price equal to the fraction of a share to which the stockholder would otherwise be entitled multiplied by the product of (a) the closing price of the Common Stock on Nasdaq on the trading day immediately preceding the effective date of the Reverse Stock Split and (b) the Reverse Stock Split Ratio.

Additional information about the Reverse Stock Split can be found in the Company's definitive proxy statement filed with the U.S. Securities and Exchange Commission (the "SEC") on October 31, 2023, which is available on the SEC's website (www.sec.gov).

This Item 8.01 contains forward-looking statements within the meaning of federal and state securities laws, including, without limitation, the Company's expectations, plans and opinions regarding the timing and effectiveness of the Reverse Stock Split, trading

of the Common Stock on a split-adjusted basis and the treatment of fractional shares. These statements involve risks and uncertainties that could cause actual events to differ materially from expectations, including, but not limited to, the Company's ability to effect the Reverse Stock Split, changes in Nasdaq listing standards or other regulatory requirements, the impact of the Reverse Stock Split on the Common Stock, and the Company's ability to achieve its expected strategic, financial and operational plans. For additional discussion of risk factors, please refer to the Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other filings that the Company makes from time to time with the SEC, which are available on the SEC's website (www.sec.gov).

Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date such statements are made. The Company does not intend or undertake, and expressly disclaims, any duty or obligation to publicly update any forward-looking statements to reflect events, circumstances or new information after the date of this press release, or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| | |

101.INS | | XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

| | |

101.SCH | | Inline XBRL Taxonomy Extension Schema Document |

| | |

101.CAL | | Inline XBRL Taxonomy Extension Calculation Linkbase Document |

| | |

101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase Document |

| | |

101.LAB | | Inline XBRL Taxonomy Extension Label Linkbase Document |

| | |

101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document |

| | |

104 | | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| comScore, Inc. |

| |

| By: | | /s/ Mary Margaret Curry |

| | Mary Margaret Curry |

| | Chief Financial Officer and Treasurer |

Date: December 18, 2023

Comscore Moves Ahead with Reverse Stock Split

As indicated in Comscore’s October shareholder letter, a reverse split is needed to comply with Nasdaq listing requirements

Continued positive momentum with expected achievement of 2023 financial guidance while launching differentiated new products, setting Comscore up for a strong 2024 and beyond

RESTON VA, December 18, 2023 – Comscore, Inc. (Nasdaq: SCOR) (“Comscore” or the “Company”) announced today that it will move forward with a 1-for-20 reverse stock split of its issued and outstanding common stock. The Company expects its common stock to begin trading on a split-adjusted basis on the Nasdaq Global Select Market with the opening of trading on Wednesday, December 20, 2023.

The reverse stock split was approved on December 12, 2023 by Comscore’s Board of Directors, following approval by the Company’s shareholders at a special meeting held on the same date, with the authorization to determine the final split ratio (within a specified range) granted to the Board of Directors. The reverse stock split is intended to bring Comscore into compliance with Nasdaq’s $1.00 per share minimum bid price requirement for continued listing and make the Company’s stock more attractive to a broader range of institutional and other investors.

Comscore’s common stock will continue to trade on the Nasdaq Global Select Market under the symbol “SCOR” following the reverse stock split, with a new CUSIP number of 20564W204. After the reverse stock split, the number of outstanding shares of common stock will be reduced from approximately 95.1 million to approximately 4.8 million, subject to adjustment for fractional shares. No fractional shares will be issued in connection with the split, and shareholders who would otherwise be entitled to a fractional share will receive a proportional cash payment. Proportional adjustments will be made to the number of shares of common stock issuable upon conversion or exercise of the Company’s preferred stock, equity awards and warrants, as well as the applicable conversion or exercise price.

“While we are disappointed that market conditions led to this reverse split, we are encouraged by our recent performance as we continue to pursue clear financial, operational and strategic opportunities to deliver growth and value for our shareholders and clients. We expect to meet the 2023 financial guidance we published in November and see strong growth potential for 2024 and beyond,” said Jon Carpenter, Chief Executive Officer of Comscore.

Comscore’s transfer agent, Equiniti Trust Company, LLC, will act as the exchange agent for the reverse stock split and will provide instructions to shareholders regarding the process. Additional information concerning the reverse stock split can be found in Comscore’s definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on October 31, 2023.

About Comscore

Comscore (NASDAQ: SCOR) is a global, trusted partner for planning, transacting and evaluating media across platforms. With a data footprint that combines digital, linear TV, over-the-top and theatrical viewership intelligence with advanced audience insights, Comscore empowers media buyers and sellers to quantify their multi-screen behavior and make meaningful business decisions with confidence. A proven leader in measuring digital and TV audiences and advertising at scale, Comscore is the industry's emerging, third-party source for reliable and comprehensive cross-platform measurement.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of federal and state securities laws, including, without limitation, our expectations, plans and opinions regarding achievement of 2023 financial guidance; financial, operational and strategic opportunities; product development and innovation; the timing and effectiveness of the reverse stock split; the treatment of fractional shares; our continued listing on the Nasdaq Global Select Market; our future compliance with Nasdaq’s minimum bid price requirement and other listing standards; the attractiveness of our common stock to a broader range of investors; and delivery of growth and value for shareholders. These statements involve risks and uncertainties that could cause actual events to differ materially from expectations, including, but not limited to, declines in the trading price of our common stock; changes in investor policies or preferences; changes in Nasdaq listing standards or other regulatory requirements; changes in our business and customer, partner and vendor relationships; external market conditions and competition; declines in ad spending or other macroeconomic factors; and our ability to achieve our expected strategic, financial and operational plans. For additional discussion of risk factors, please refer to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and other filings that we make from time to time with the U.S. Securities and Exchange Commission (the “SEC”), which are available on the SEC's website (www.sec.gov).

Investors are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date such statements are made. We do not intend or undertake, and expressly disclaim, any duty or obligation to publicly update any forward-looking statements to

reflect events, circumstances or new information after the date of this press release, or to reflect the occurrence of unanticipated events.

Media:

Kai Heslop

KCSA Strategic Communications

comscore@kcsa.com

Investors:

John Tinker

Comscore, Inc.

(212) 203-2129

jtinker@comscore.com

v3.23.4

Cover Page

|

Dec. 12, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 12, 2023

|

| Entity Registrant Name |

COMSCORE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33520

|

| Entity Tax Identification Number |

54-1955550

|

| Entity Address, Address Line One |

11950 Democracy Drive

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Reston

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

20190

|

| City Area Code |

703

|

| Local Phone Number |

438–2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SCOR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001158172

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

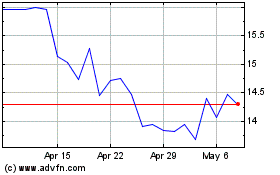

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Nov 2024 to Dec 2024

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Dec 2023 to Dec 2024