Resolute Holdings I, LP and its affiliated vehicles (“Resolute”),

an investment firm under the leadership of David Cote and Tom

Knott, and CompoSecure, Inc. (Nasdaq: CMPO) (“CompoSecure” or the

“Company”), a leader in metal payment cards, security, and

authentication solutions, today announced that certain shareholders

of CompoSecure have entered into Stock Purchase Agreements

(collectively, the “SPA”) with Resolute, pursuant to which Resolute

will acquire a majority interest in CompoSecure and eliminate its

dual-class structure.

The David Cote Family is investing $372 million

through Resolute and Dave Cote will become the executive chairman

of the board of directors of CompoSecure upon closing of the

transaction. Resolute will become the majority shareholder of the

Company and will focus on deploying operational and M&A best

practices to drive long-term value creation for all shareholders.

Importantly, the transaction will remove the dual-share structure,

delivering higher retained annual cash flow and better alignment of

all shareholders with the elimination of the tax distributions

related to the Class B units.

David Cote said, “CompoSecure meets all the

criteria I look for when making an investment and I am thrilled

that Resolute will become the Company’s majority shareholder.

CompoSecure has a high-quality management team led by CEO Jon Wilk,

a leading market position in its industry, attractive long-term

growth prospects, technological differentiation, and robust free

cash flow generation. Tom and I see significant opportunity to

continue growing CompoSecure while also diversifying the business

and customer base through incremental M&A. In our view, it is

the perfect first investment for Resolute and we are excited to get

started creating additional shareholder value.”

CompoSecure CEO, Jon Wilk said, “I am very

pleased to announce this strategic transaction that will simplify

our corporate structure and continue to unlock shareholder value. I

am also thrilled to have David Cote serve as executive chairman of

the board of directors. David’s career and track record is

unparalleled, setting the standard for how organizations can

simultaneously drive both short and long-term performance to

realize their full potential. We believe his experience steering

global organizations, such as Honeywell and Vertiv, will be

invaluable to CompoSecure as we enter a new phase of growth and

value creation for shareholders, employees, and customers.”

Mitchell Hollin, Partner at LLR Partners, a

long-term CompoSecure Class B stockholder, added, “LLR is grateful

to have been part of CompoSecure’s growth since our investment in

the company in 2015. Michele Logan, Jon and the rest of the

CompoSecure team have built a market leader that I believe is well

positioned for the long-term. We look forward to seeing

CompoSecure’s continued success in partnership with David, Tom and

Resolute.”

The Stock Purchase

Agreements

Under the terms of the SPA, the selling

shareholders will exchange the entirety of their Class B units and

associated Class B shares for Class A shares, eliminating the

current dual-share class structure. Resolute will subsequently

purchase 49.3 million of the corresponding Class A shares to

acquire majority control of the Company. As a result of the

transaction, The David Cote Family is expected to have voting

control of approximately 60% of total shares outstanding as of the

closing date.

The Company’s current management team, including

Jon Wilk, CompoSecure’s chief executive officer, are expected to

continue in their current roles at the Company, while the board of

directors will include the appointment of Dave Cote, Tom Knott and

other representatives from Resolute to replace Mitchell Hollin, of

LLR Partners, and Michele Logan, co-founder of CompoSecure, who

will depart from the board of directors upon closing of the

transaction. Upon closing of the transaction, the size of the board

will be expanded to eleven members, and a majority of the Board

will be independent directors.

Goldman Sachs & Co. LLC is serving as

financial advisor to Resolute, and Paul, Weiss, Rifkind,

Wharton & Garrison LLP is serving as legal advisor.

A special committee of CompoSecure’s Board of

Directors, which is comprised solely of independent directors and

was formed in connection with the transaction (the “Special

Committee”), after receiving advice from an independent legal

counsel and financial advisor, unanimously approved the proposed

transactions to which CompoSecure is a party. The Special Committee

was advised by Potter Anderson & Corroon LLP (Wilmington, DE)

and Houlihan Lokey, Inc.

The transaction is expected to close by

September 30, 2024, subject to customary closing conditions and

regulatory approvals, including Hart-Scott-Rodino clearance.

About Resolute Holdings

Resolute Holdings is an investment firm,

controlled by Dave Cote, former CEO of Honeywell International,

Inc. (“Honeywell”) and current Executive Chairman of Vertiv

Holdings Co (“Vertiv”), and Tom Knott, former Head of Permanent

Capital Strategies at The Goldman Sachs Group, Inc. (“Goldman

Sachs”). Mr. Cote and Mr. Knott formed Resolute Holdings to invest

in businesses that can benefit from the systematic deployment of

the operating system Mr. Cote has developed over his career.

Mr. Cote completed approximately 170 M&A

transactions during his tenure as CEO of Honeywell and as current

Executive Chairman at Vertiv. Mr. Cote brings over 40 years of

operating experience across a wide range of industrial sectors with

a proven track record of delivering outsized shareholder value

through disciplined portfolio management and accretive M&A.

Mr. Knott was formerly the Head of Permanent

Capital Strategies in the Asset Management Division of Goldman

Sachs and was also CEO of GS Acquisition Holdings Corp and GS

Acquisition Holdings Corp II, respectively bringing public both

Vertiv and Mirion Technologies, Inc. Mr. Knott brings over 14 years

of investing experience across a wide range of sectors.

About CompoSecure

Founded in 2000, CompoSecure is a technology

partner to market leaders, fintech’s and consumers enabling trust

for millions of people around the globe. The company combines

elegance, simplicity and security to deliver exceptional

experiences and peace of mind in the physical and digital world.

CompoSecure’s innovative payment card technology and metal cards

with Arculus security and authentication capabilities deliver

unique, premium branded experiences, enable people to access and

use their financial and digital assets, and ensure trust at the

point of a transaction. For more information, please

visit www.CompoSecure.com and www.GetArculus.com.

Contacts

For Resolute Holdings

Tom Knottinfo@resoluteholdings.com

For CompoSecure

Anthony PiniellaHead of Communications (917)

208-7724apiniella@composecure.com

Sean Mansouri, CFAElevate IR(720)

330-2829CMPO@elevate-ir.com

Forward-Looking Statements

This press release contains forward-looking

statements as defined by the Private Securities Litigation Reform

Act of 1995. These statements are based on the beliefs and

assumptions of management or Resolute Holdings, as appliable.

Although CompoSecure and Resolute Holdings, as applicable, believes

that its plans, intentions, and expectations reflected in or

suggested by these forward-looking statements are reasonable,

CompoSecure, Resolute Holdings and their affiliates cannot assure

you that it will achieve or realize these plans, intentions, or

expectations. Forward-looking statements are inherently subject to

risks, uncertainties, and assumptions. Generally, statements that

are not historical facts, including statements concerning

CompoSecure’s or Resolute Holdings’ possible or assumed future

actions, business strategies, events, or results of operations, are

forward-looking statements. In some instances, these statements may

be preceded by, followed by or include the words “believes,”

“estimates,” “expects,” “projects,” “forecasts,” “may,” “will,”

“should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends”

or the negatives of these terms or variations of them or similar

terminology. Forward-looking statements are not guarantees of

performance. You should not put undue reliance on these statements

which speak only as of the date hereof. You should understand that

the following important factors, among others, could affect

CompoSecure’s future results and could cause those results or other

outcomes to differ materially from those expressed or implied in

these forward-looking statements: the ability to consummate the

transactions contemplated by the SPA; the ability of CompoSecure to

diversify its business and customer base; the ability of

CompoSecure to create value for its shareholders and generate

robust free cash flow; the ability of CompoSecure to grow and

manage growth profitably, maintain relationships with customers,

compete within its industry and retain its key employees; the

possibility that CompoSecure may be adversely impacted by other

global economic, business, competitive and/or other factors; the

outcome of any legal proceedings that may be instituted against

CompoSecure, Resolute Holdings or others; future exchange and

interest rates; and other risks and uncertainties, including those

under “Risk Factors” in filings that have been made or will be made

with the Securities and Exchange Commission. CompoSecure and

Resolute Holdings undertake no obligations to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

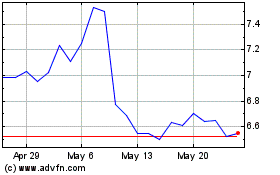

CompoSecure (NASDAQ:CMPO)

Historical Stock Chart

From Jul 2024 to Aug 2024

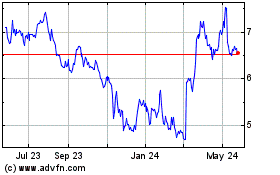

CompoSecure (NASDAQ:CMPO)

Historical Stock Chart

From Aug 2023 to Aug 2024