Cogent Biosciences Reports First Quarter 2024 Financial Results

May 07 2024 - 8:00AM

Cogent Biosciences, Inc. (Nasdaq: COGT), a biotechnology

company focused on developing precision therapies for genetically

defined diseases, today provided a business update and announced

financial results for the first quarter ended March 31, 2024.

“Our team made important progress in the first quarter,” said

Andrew Robbins, the Company’s President and Chief Executive

Officer. “Based on the emerging clinical results demonstrating the

potential of bezuclastinib in both systemic mastocytosis and GIST

patients, we have experienced very strong interest in our ongoing

clinical trials from patients and investigators. We remain on track

to complete enrollment in APEX and PEAK by the end of this year,

and to complete enrollment in SUMMIT during 2Q 2025. This should

allow us to report topline results from all three

registration-directed trials during 2025. Following our successful

financing in February, we are well positioned with a cash runway

into 2027, allowing us to complete our ongoing studies while

continuing to broaden our portfolio with a robust research pipeline

of novel compounds.”

Recent Business Highlights

- Reported positive Part 1b data from the Company’s ongoing

SUMMIT trial evaluating bezuclastinib in patients with nonadvanced

systemic mastocytosis (NonAdvSM) at the 2024 American Academy of

Allergy Asthma & Immunology Annual Meeting (AAAAI) meeting and

initiated the registration-directed SUMMIT Part 2.

- Selected the 100 mg once-daily recommended Phase 2 dose (RP2D)

based on:

- 51% week 12 mean improvement in Total Symptom Score (TSS),

including 70% of patients achieving ≥50% reduction in TSS at week

12

- 49% week 12 mean improvement in quality-of-life (MC-QoL)

- Safety and tolerability profile generally similar to placebo

with no grade 3/4 events, and no bleeding, edema or cognitive

events, no dose reductions and no discontinuations

- Presented preclinical data from the company’s ErbB2 candidate

at the American Association of Cancer Research (AACR) annual

meeting.

- The new preclinical data described CGT4255’s exceptional

stability in human whole blood and liver cytosol fractions, high

oral bioavailability and low clearance across preclinical species.

CGT4255 also demonstrated 80% brain penetrance in mice and was

well-tolerated at 10x maximally efficacious concentration,

resulting in mouse tumor regression, suggesting potential

best-in-class properties.

- Completed oversubscribed private placement, resulting in $213.4

million net proceeds, extending the company’s cash runway into

2027.

Upcoming Milestones

- Share updated clinical data from the lead-in portion of the

PEAK trial at the American Society of Clinical Oncology (ASCO)

annual meeting taking place May 31-June 4, 2024. PEAK is the

Company’s ongoing Phase 3 trial evaluating bezuclastinib in

combination with sunitinib in patients with Gastrointestinal

Stromal Tumors (GIST). Cogent remains on track to complete

enrollment in PEAK by the end of 2024 and report top-line results

by the end of 2025. ASCO Poster

detailsTitle: Peak part 1 summary: A

phase 3, randomized, open-label multicenter clinical study of

bezuclastinib (CGT9486) and sunitinib combination versus sunitinib

in patients with gastrointestinal stromal tumors

(GIST)Session Type and Title: Poster Session –

SarcomaSession Date and Time: June 1, 2024,

1:30 PM-4:30 PM CDT

- Complete enrollment in APEX in patients with advanced systemic

mastocytosis (AdvSM) by the end of 2024 and report top-line results

mid-2025.

- Complete enrollment in SUMMIT Part 2 in the second quarter of

2025 and report top-line results by the end of 2025.

First Quarter 2024 Financial Results

Cash and Cash Equivalents: As

of March 31, 2024, cash, cash equivalents and marketable

securities were $435.7 million as compared to $273.2 million

as of December 31, 2023. Total cash spend in the quarter was $51.2

million, including a non-recurring payment of $8.6 million related

to annual performance-based bonus compensation. Based on its

current plans, the company expects its existing cash, cash

equivalents and marketable securities will be sufficient to fund

its operating expenses and capital expenditure requirements into

2027 and through clinical readouts from ongoing SUMMIT, PEAK, and

APEX registration-directed trials.

R&D Expenses: Research and development

expenses were $52.7 million for the first quarter of 2024 compared

to $36.0 million for the first quarter of 2023. The increase was

primarily due to costs associated with accelerating enrollment in

both SUMMIT and PEAK clinical trials, on-going APEX costs and

costs related to development of the research pipeline. R&D

expenses include non-cash stock compensation expense of $4.4

million for the first quarter of 2024 as compared to $3.0 million

for the first quarter of 2023.

G&A Expenses: General and

administrative expenses were $9.7 million for the first quarter of

2024 compared to $7.2 million for the first quarter of 2023. The

increase was primarily due to the growth of the organization.

G&A expenses include non-cash stock compensation expense of

$5.0 million for the first quarter of 2024 as compared to $2.9

million for the first quarter of 2023.

Net Loss: Net loss was $58.3 million for

the first quarter of 2024 compared to a net loss of $38.6 million

for the first quarter of 2023.

About Cogent Biosciences, Inc. Cogent

Biosciences is a biotechnology company focused on developing

precision therapies for genetically defined diseases. The most

advanced clinical program, bezuclastinib, is a selective tyrosine

kinase inhibitor that is designed to potently inhibit the KIT D816V

mutation as well as other mutations in KIT exon 17. KIT D816V is

responsible for driving systemic mastocytosis, a serious disease

caused by unchecked proliferation of mast cells. Exon 17 mutations

are also found in patients with advanced gastrointestinal stromal

tumors (GIST), a type of cancer with strong dependence on oncogenic

KIT signaling. In addition to bezuclastinib, the Cogent Research

Team is developing a portfolio of novel targeted therapies to help

patients fighting serious, genetically driven diseases initially

targeting mutations in FGFR2, ErbB2 and PI3Kα. Cogent Biosciences

is based in Waltham, MA and Boulder, CO. Visit our website for more

information at www.cogentbio.com. Follow Cogent Biosciences on

social media: X (formerly known as Twitter) and LinkedIn.

Information that may be important to investors will be routinely

posted on our website and X.

Forward Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, including, but

not limited to, statements regarding the Company’s clinical

development plans and timelines, including the expectation to

complete enrollment in APEX by the end of 2024 and to report

top-line results mid-2025, the expectation to complete enrollment

in SUMMIT Part 2 in the second quarter of 2025 and to report

top-line results by the end of 2025, the expectation to complete

enrollment in PEAK by the end of 2024 and to report top-line

results by the end of 2025, plans to share updated clinical data

from the lead-in portion of PEAK at the ASCO annual meeting in the

second quarter of 2024, the Company’s projected cash runway into

2027, the therapeutic potential of bezuclastinib in both systemic

mastocytosis and GIST patients, and the potential best-in-class

properties of the Company’s preclinical ErbB2 candidate. The use of

words such as, but not limited to, "anticipate," "believe,"

"continue," "could," "estimate," "expect," "intend," "may,"

"might," "plan," "potential," "predict," "project," "should,"

"target," "will," or "would" and similar words expressions are

intended to identify forward-looking statements. Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are based on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, our clinical results, the rate of

enrollment in our clinical trials and other future conditions. New

risks and uncertainties may emerge from time to time, and it is not

possible to predict all risks and uncertainties. No representations

or warranties (expressed or implied) are made about the accuracy of

any such forward-looking statements. We may not actually achieve

the forecasts or milestones disclosed in our forward-looking

statements, and you should not place undue reliance on our

forward-looking statements. Such forward-looking statements are

subject to a number of material risks and uncertainties including

but not limited to those set forth under the caption "Risk Factors"

in Cogent's most recent Annual Report on Form 10-K filed with

the SEC, as well as discussions of potential risks,

uncertainties, and other important factors in our subsequent

filings with the SEC. Any forward-looking statement speaks

only as of the date on which it was made. Neither we, nor our

affiliates, advisors or representatives, undertake any obligation

to publicly update or revise any forward-looking statement, whether

as result of new information, future events or otherwise, except as

required by law. These forward-looking statements should not be

relied upon as representing our views as of any date subsequent to

the date hereof.

|

COGENT BIOSCIENCES, INC. |

|

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

|

(in thousands, except share and per share amounts) |

|

|

(unaudited) |

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

| Operating expenses: |

|

|

|

|

|

|

Research and development |

$ |

52,705 |

|

|

$ |

36,038 |

|

|

General and administrative |

|

9,699 |

|

|

|

7,199 |

|

|

Total operating expenses |

|

62,404 |

|

|

|

43,237 |

|

| Loss from operations |

|

(62,404 |

) |

|

|

(43,237 |

) |

| Other income: |

|

|

|

|

|

|

Interest income |

|

4,057 |

|

|

|

2,268 |

|

|

Other income, net |

|

(1 |

) |

|

|

682 |

|

|

Change in fair value of CVR liability |

|

— |

|

|

|

1,700 |

|

|

Total other income, net |

|

4,056 |

|

|

|

4,650 |

|

| Net loss |

$ |

(58,348 |

) |

|

$ |

(38,587 |

) |

| Net loss per share attributable

to common stockholders, basic and diluted |

$ |

(0.62 |

) |

|

$ |

(0.55 |

) |

| Weighted average common shares

outstanding, basic and diluted |

|

94,804,659 |

|

|

|

70,734,950 |

|

| |

|

|

|

|

|

|

|

|

COGENT BIOSCIENCES, INC. |

|

SELECTED CONDENSED CONSOLIDATED BALANCE SHEET

DATA |

|

(in thousands) |

|

(unaudited) |

| |

|

|

|

|

|

| |

March 31, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

|

Cash, cash equivalents and marketable securities |

$ |

435,740 |

|

|

$ |

273,170 |

|

| Working capital |

$ |

405,217 |

|

|

$ |

232,603 |

|

| Total assets |

$ |

476,111 |

|

|

$ |

313,437 |

|

| Total liabilities |

$ |

53,777 |

|

|

$ |

55,635 |

|

| Total stockholders’ equity |

$ |

422,334 |

|

|

$ |

257,802 |

|

| |

|

|

|

|

|

|

|

Contact:Christi WaarichSenior Director,

Investor Relationschristi.waarich@cogentbio.com617-830-1653

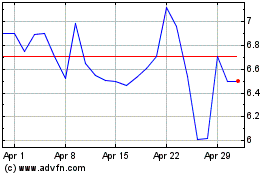

Cogent Biosciences (NASDAQ:COGT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cogent Biosciences (NASDAQ:COGT)

Historical Stock Chart

From Dec 2023 to Dec 2024