Form 8-K - Current report

July 18 2024 - 4:07PM

Edgar (US Regulatory)

0000810958false00008109582024-07-182024-07-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

July 18, 2024

Date of Report (Date of earliest event reported)

Citizens & Northern Corporation

(Exact name of registrant as specified in its charter)

| | | | |

Pennsylvania | | 0-16084 | | 23-2451943 |

(State or other jurisdiction | | (Commission | | (IRS Employer |

of incorporation) | | File Number) | | Ident. No.) |

| | | | |

90-92 Main Street, Wellsboro, Pennsylvania | | | | 16901 |

(Address of principal executive offices) | | | | (Zip Code) |

(570) 724-3411

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which

registered |

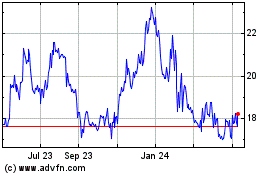

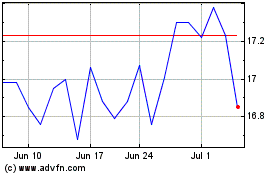

Common Stock, par value $1.00 per share | | CZNC | | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. Results of Operations and Financial Condition

Citizens & Northern Corporation (the “Company”) announced unaudited, consolidated financial results for the three-month and six-months periods ended June 30, 2024. On July 18, 2024, the Company issued a press release titled “C&N Declares Dividend and Announces Second Quarter 2024 Unaudited Financial Results,” a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. Supplemental, unaudited financial information is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

ITEM 9.01. Financial Statements and Exhibits

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| CITIZENS & NORTHERN CORPORATION |

| | |

Dated: July 18, 2024 | By: | /s/ Mark A. Hughes |

| | Mark A. Hughes |

| | Treasurer and Chief Financial Officer |

Exhibit 99.1

| | |

| | Contact: Charity Frantz |

July 18, 2024 | | 570-724-0225 |

| | charityf@cnbankpa.com |

C&N DECLARES DIVIDEND AND ANNOUNCES SECOND QUARTER 2024 UNAUDITED FINANCIAL RESULTS

For Immediate Release:

Wellsboro, PA – Citizens & Northern Corporation (“C&N”) (NASDAQ: CZNC) announced its most recent dividend declaration and its unaudited, consolidated financial results for the three-month and six month periods ended June 30, 2024. C&N’s principal activity is community banking, and the largest subsidiary is Citizens & Northern Bank (the “Bank”).

Highlights:

| ● | Net income was $6,113,000, or $0.40 diluted earnings per share for the second quarter 2024, up from $5,306,000, or $0.35 per diluted share in the first quarter 2024, and $6,043,000, or $0.39 per diluted share in the second quarter 2023. Net income for the six months ended June 30, 2024 was $11,419,000, or $0.74 diluted earnings per share, down from $12,296,000, or $0.80 diluted earnings per share for the first six months of 2023. |

| ● | The net interest margin was 3.31% in the second quarter 2024 as compared to 3.29% in the first quarter 2024 and 3.53% in the second quarter 2023. The net interest margin was 3.30% for the first six months of 2024, down from 3.62% in the corresponding period of 2023. |

| ● | The provision for credit losses was $565,000 in the second quarter 2024, down from $954,000 in the first quarter 2024 and $812,000 in the second quarter 2023. The provision for credit losses was $1,519,000 in the first six months of 2024, up from $460,000 in the first six months of 2023. At June 30, 2024, the allowance for credit losses (“ACL”) was $20,382,000, or 1.08% of gross loans receivable, up from $19,208,000, or 1.04% of gross loans receivable, at December 31, 2023. |

| ● | Total loans receivable increased $20.8 million, or 1.1%, during the quarter ended June 30 2024. Average loans receivable increased 5.2% (annualized) during the second quarter 2024 from the first quarter 2024. Average loans receivable were higher by 6.5% for the six months ended June 30, 2024, as compared to the first six months of 2023. |

| ● | Nonperforming loans totaled $19.6 million, or 1.04% of total loans, at June 30, 2024, up from $19.3 million, or 1.03% of total loans, at March 31, 2024 and $18.4 million, or 0.99% of total loans, at December 31, 2023. Total nonperforming assets were 0.76% of total assets at June 30, 2024, down from 0.78% at March 31, 2024 and up from 0.75% at December 31, 2023. |

| ● | Total deposits increased $63.4 million during the quarter ended June 30, 2024. Average total deposits increased 3.0% (annualized) during the second quarter 2024 from the first quarter 2024 and were 3.6% higher for the six months ended June 30, 2024, as compared to the first six months of 2023. Total deposits, excluding brokered deposits, were $1,999,808 at June 30, 2024, an increase of $73,296,000 or 3.8% from March 31, 2024. |

| ● | At June 30, 2024, estimated uninsured and uncollateralized deposits totaled 21.6% of the Bank’s total deposits. C&N maintains highly liquid sources of available funds, including unused borrowing capacity with the Federal Home Loan Bank of Pittsburgh and the Federal Reserve Bank of Philadelphia and available federal funds lines with other banks, as well as available-for-sale debt securities with a fair value in excess of collateral obligations. At June 30, 2024, available funding from these sources totaled 173.7% of uninsured deposits and 235.1% of uninsured and uncollateralized deposits. |

Dividend Declared and Unaudited Financial Information

On July 18, 2024, C&N’s Board of Directors declared a regular quarterly cash dividend of $0.28 per share. The dividend is payable on August 9, 2024 to shareholders of record as of July 29, 2024.

Highlights related to C&N’s second quarter and June 30, 2024 year-to-date unaudited U.S. GAAP earnings results as compared to results for the first quarter 2024, second quarter 2023 and six months ended June 30, 2023 are presented below.

Second Quarter 2024 as Compared to First Quarter 2024

Net income was $6,113,000, or $0.40 per diluted share, for the second quarter 2024 as compared to $5,306,000, or $0.35 per diluted share, for the first quarter 2024.

| ◾ | Net interest income of $19,445,000 in the second quarter 2024 increased $404,000 from the first quarter 2024. The net interest margin was 3.31% in the second quarter 2024, up 0.02% from 3.29% in the first quarter 2024. The net interest spread decreased 0.01%, as the average rate on interest-bearing liabilities increased 0.11%, while the average yield on earning assets increased 0.10%. |

| ◾ | For the quarter ended June 30, 2024, there was a provision for credit losses of $565,000, a decrease of $389,000 compared to $954,000 in the first quarter 2024. In the second quarter 2024, the ACL on loans increased $359,000 to 1.08% of gross loans receivable at June 30, 2024 from 1.07% at March 31, 2024. In the second quarter 2024, net charge-offs totaled $207,000, or 0.04% (annualized) of average loans receivable. |

| ◾ | Noninterest income of $7,854,000 in the second quarter 2024 increased $1,179,000 from the first quarter 2024 amount. Significant variances included the following: |

| Ø | Other noninterest income of $1,943,000 increased $926,000 from the first quarter 2024, including income of $841,000 recognized in the second quarter from tax credits related to donations with no corresponding amount in the first quarter 2024. |

| Ø | Service charges on deposit accounts increased $154,000 from the first quarter 2024 consistent with a seasonal increase in volume of overdraft and other fees as compared to the typically slower first quarter amounts. |

| Ø | Trust revenue of $2,014,000 increased $117,000 from the first quarter 2024, consistent with recent appreciation in the trading prices of many U.S. equity securities and includes revenue from new business. |

| Ø | Interchange revenue from debit card transactions of $1,089,000 increased $76,000 reflecting an increase in transaction volume. |

| Ø | Loan servicing fees, net, of $130,000 decreased $100,000, as the fair value of servicing rights decreased $69,000 in the second quarter 2024 as compared to an increase of $25,000 in the first quarter 2024. |

| ◾ | Noninterest expense of $19,255,000 in the second quarter 2024 increased $951,000 from the first quarter 2024 amount. Significant variances included the following: |

| Ø | Other noninterest expense of $3,437,000 increased $1,575,000 from the first quarter 2024. Within this category, significant variances included the following: |

| ◾ | Donations expense increased $943,000, reflecting the impact of donations totaling $933,000 made under the Pennsylvania Educational Improvement Tax Credit program in the second quarter which generated the income from tax credits of $841,000 noted above. |

| ◾ | In the first quarter 2024, there was a reduction in expense of $483,000 related to the defined benefit postretirement medical benefit plan, including a curtailment of $469,000 related to plan |

| | adjustments. In comparison, in the second quarter 2024, there was a reduction in expense associated with the postretirement plan of $15,000. |

| Ø | Salaries and employee benefits expense of $11,023,000 decreased $539,000 from the first quarter 2024 including decreases in payroll tax and unemployment compensation expenses of $349,000, reflecting the normal pattern of such costs, as well as decreases in health insurance expenses of $125,000 and severance expense of $78,000. |

| ◾ | The income tax provision of $1,366,000, or 18.3% of pre-tax income for the second quarter 2024 increased $214,000 from $1,152,000, or 17.8% of pre-tax income for the first quarter 2024. The increase in income tax provision reflected the increase in pre-tax income of $1,021,000 for the quarter. |

Second Quarter 2024 as Compared to Second Quarter 2023

Second quarter 2024 net income was $6,113,000, or $0.40 per diluted share, as compared to $6,043,000, or $0.39 per diluted share, in the second quarter 2023. Significant variances were as follows:

| ◾ | Net interest income of $19,445,000 in the second quarter 2024 was $917,000 lower than the second quarter 2023. The net interest margin was 3.31% in the second quarter 2024, down from 3.53% in the second quarter 2023. The interest rate spread decreased 0.37%, as the average rate on interest-bearing liabilities increased 0.85%, while the average yield on earning assets increased 0.48%. |

| ◾ | For the quarter ended June 30, 2024, the provision for credit losses was $565,000, a decrease of $247,000 compared to $812,000 in the second quarter 2023. The ACL as a percentage of gross loans receivable was 1.08% at June 30, 2024 as compared to 1.05% at June 30, 2023. |

| ◾ | Noninterest income of $7,854,000 in the second quarter 2024 increased $1,219,000 from the second quarter 2023 amount. Significant variances included the following: |

| Ø | Other noninterest income of $1,943,000 increased $356,000, including an increase of $145,000 in dividends from FHLB-Pittsburgh and Federal Reserve stock and an increase of $120,000 in income recognized from tax credits related to donations. |

| Ø | Earnings from the increase in cash surrender value of life insurance of $444,000 increased $292,000 from the second quarter 2023 reflecting the earnings on additional Bank-Owned Life Insurance purchased in December 2023. |

| Ø | Trust revenue of $2,014,000 increased $210,000, including an increase of $169,000 in revenue from new business. |

| Ø | Brokerage and insurance revenue of $527,000 increased $162,000 due to an increase in sales volume. |

| Ø | Net gains from sale of loans of $235,000 increased $96,000 from the second quarter 2023, reflecting an increase in volume of residential mortgage loans sold. |

| Ø | Service charges on deposit accounts increased $84,000 from the second quarter 2024 reflecting an increase in volume of fees. |

| ◾ | Noninterest expense of $19,255,000 in the second quarter 2024 increased $533,000 from the second quarter 2023 amount. Significant variances included the following: |

| Ø | Salaries and employee benefits expense of $11,023,000 increased $246,000, or 2.3%, including increases in cash and stock-based incentive compensation expense of $378,000 and base salaries expense of $105,000, while ESOP contributions and Supplemental Executive Retirement Plan (SERP) expenses decreased $233,000. |

| Ø | Data processing and telecommunications of $2,003,000 increased $103,000, including an increase in internet banking costs. |

| Ø | Other noninterest expense of $3,437,000 increased $78,000 from the second quarter 2023. Within this category, significant variances included the following: |

| ◾ | Donations expense increased $165,000 including an increase of $133,000 in PA Educational Improvement Tax Credit program donations made in 2024 compared to 2023. |

| ◾ | Expenses from check fraud, debit card fraud and other operational losses totaled $26,000 in the second quarter 2024 as compared to a net reduction in expense of $110,000 in the second quarter 2023. |

| ◾ | Legal fees totaled $131,000 in 2024 a decrease of $196,000, mainly due to a decrease in fees incurred related to non-litigation-related corporate matters. |

| Ø | Automated teller machine and interchange expense of $473,000 increased $78,000 reflecting increased volume of activity. |

Six Months Ended June 30, 2024 as Compared to Six Months Ended June 30, 2023

Net income for the six-month period ended June 30, 2024 was $11,419,000, or $0.74 per diluted share, as compared to $12,296,000, or $0.80 per diluted share, for the first six months of 2023. Significant variances were as follows:

| ◾ | Net interest income totaled $38,486,000 in the six months ended June 30, 2024, a decrease of $2,657,000 from the total for the first six months of 2023. The net interest margin was 3.30% for the first six months of 2024, down from 3.62% in the corresponding period of 2023. The interest rate spread decreased 0.52%, as the average rate on interest-bearing liabilities was higher by 1.04% while the average yield on earning assets increased 0.52%. |

| ◾ | For the six months ended June 30, 2024, the provision for credit losses was $1,519,000, an increase of $1,059,000 from the first six months of 2023. In the first six months of 2024, the ACL on loans receivable increased $1,174,000 to 1.08% at June 30, 2024 as compared to 1.04% at December 31, 2023. For the first six months ended June 30, 2024, net charge-offs totaled $352,000, or 0.04% (annualized) of average loans receivable. |

| ◾ | Noninterest income totaled $14,529,000 in the first six months of 2024, up $2,285,000 from the total for the first six months of 2023. Significant variances included the following: |

| Ø | Earnings from the increase in cash surrender value of life insurance of $914,000 increased $624,000 reflecting earnings on additional Bank-Owned Life Insurance purchased in December 2023. |

| Ø | Other noninterest income of $2,960,000 increased $602,000 as dividends on FHLB-Pittsburgh and Federal Reserve stock totaled $835,000, an increase of $328,000, and income from tax credits related to donations increased $120,000. |

| Ø | Trust revenue of $3,911,000 increased $330,000, consistent with recent appreciation in the trading prices of many U.S. equity securities and includes revenue from new business. |

| Ø | Brokerage and insurance revenue of $1,066,000 increased $271,000 due to an increase in sales volume. |

| Ø | Net gains from sale of loans of $426,000 increased $213,000, reflecting an increase in volume of residential mortgage loans sold. |

| ◾ | Noninterest expense totaled $37,559,000 for the first six months of 2024, a decrease of $250,000 from the total for the first six months of 2023. Significant variances included the following: |

| Ø | Other noninterest expense of $5,299,000 decreased $567,000. Within this category, significant variances included the following: |

| ◾ | For the first six months of 2024, there was a reduction in expense of $498,000 related to the defined benefit postretirement medical benefit plan, including a curtailment of $469,000 related to plan adjustments in the first quarter 2024 as noted above. In comparison, in the first six months of 2023, there was a reduction in expense associated with the postretirement plan of $10,000. |

| ◾ | Legal fees totaled $273,000 in the first six months of 2024, a decrease of $240,000, mainly due to lower fees incurred related to non-litigation-related corporate matters. |

| ◾ | Donations expense increased $147,000 including an increase of $133,000 in PA Educational Improvement Tax Credit program donations made in the first six months of 2024 compared to the corresponding period in 2023. |

| Ø | Professional fees of $1,070,000 decreased $431,000 as 2023 included $389,000 of conversion costs related to a change in Wealth Management platform for providing brokerage and investment advisory services. |

| Ø | Salaries and employee benefits expense of $22,585,000 increased $381,000, including an increase in base salaries expense of $441,000, or 3.0%, an increase of $207,000 in cash and stock-based incentive compensation and an increase of $78,000 in severance expense, while ESOP and SERP expense decreased $433,000. |

| Ø | Data processing and telecommunications of $3,995,000 increased $159,000, including an increase of $191,000 in internet banking expenses. |

Other Information:

Changes in other unaudited financial information are as follows:

| ◾ | Total assets amounted to $2,593,122,000 at June 30, 2024, up from $2,521,537,000 at March 31, 2024 and $2,470,780,000 at June 30, 2023. |

| ◾ | Cash and due from banks totaled $100,412,000 at June 30, 2024, up $53,964,000 from March 31, 2024 and $48,650,000 from June 30, 2023. The more elevated cash position at June 30, 2024 includes the impact of strong deposit growth in the second quarter 2024. |

| ◾ | The amortized cost of available-for-sale debt securities decreased to $453,944,000 at June 30, 2024 from $457,081,000 at March 31, 2024 and $507,132,000 at June 30, 2023. The fair value of available-for-sale debt securities at June 30, 2024 was lower than the amortized cost basis by $52,799,000, or 11.6%. In comparison, the aggregate unrealized loss position was $51,987,000 (11.4%) at March 31, 2024 and $61,437,000 (12.1%) at June 30, 2023. The unrealized decrease in fair value of the portfolio has resulted from an increase in interest rates as compared to rates when the securities were purchased. Management reviewed the available-for-sale debt securities as of June 30, 2024 and concluded, as of such date, that there were no credit-related declines in fair value and no allowance for credit losses was recorded as of June 30, 2024. |

| ◾ | Gross loans receivable totaled $1,893,207,000 at June 30, 2024, an increase of $20,758,000 (1.1%) from total loans at March 31, 2024 and an increase of $78,697,000 (4.3%) from total loans at June 30, 2023. In comparing outstanding balances at June 30, 2024 and 2023, total commercial loans were up $67,971,000 (5.0%), reflecting growth in owner occupied commercial real estate loans of $39,368,000 and other commercial loans of $38,422,000 offset by a decrease of $9,819,000 in non-owner occupied commercial real estate loans. Within other commercial loans, the outstanding balance of commercial construction and land loans increased $33,771,000, commercial lines of credit increased $8,317,000 and political subdivisions increased $5,004,000 offset by decreases in the outstanding balances of commercial and industrial loans and other commercial loans. Total residential mortgage loans were up $5,591,000 (1.4%), and total consumer loans increased $5,135,000 (9.2%). The outstanding balance of residential mortgage loans originated and serviced by C&N that have been sold to third parties was $321.1 million at June 30, 2024, up $2.9 million (0.9%) from June 30, 2023. |

| ◾ | At June 30, 2024, the recorded investment in non-owner occupied commercial real estate loans for which the primary purpose is utilization of office space by third parties was $96,642,000, or 5.1% of gross loans receivable. At June 30, 2024, within this segment there were two loans with a total recorded investment of $3,885,000 in nonaccrual status with specific allowances totaling $493,000. The remainder of the non-owner occupied commercial real estate loans with a primary purpose of office space utilization were in accrual status with no specific allowance at June 30, 2024. |

| ◾ | Total nonperforming assets as a percentage of total assets was 0.76% at June 30, 2024, down from 0.78% at March 31, 2024 and up from 0.58% at June 30, 2023. Total nonperforming assets were $19.8 million at June 30, 2024 and March 31, 2024 and $14.5 million at June 30, 2023. At June 30, 2024, total loans receivable individually evaluated with an allowance were $6,613,000, with specific allowances (included in the total ACL on loans receivable) totaling $1,230,000. In comparison, at March 31, 2024, loans individually evaluated with an allowance totaled $10,062,000 with specific allowances totaling $1,403,000, and, at June 30, 2023, loans individually evaluated with an allowance totaled $5,785,000 with specific allowances totaling $720,000. |

| ◾ | Deposits totaled $2,059,309,000 at June 30, 2024, up $63,406,000 (3.2%) from $1,995,903,000 at March 31, 2024, despite a decrease in brokered deposits of $9,890,000. Total deposits, excluding brokered deposits, were up $73,296,000 (3.8%) at June 30, 2024 from March 31, 2024. Total deposits were up $49,191,000 (2.4%) at June 30 2024 as compared to June 30, 2023, despite a decrease in brokered deposits of $11,152,000. At June 30, 2024, C&N’s estimated uninsured deposits totaled $605.8 million, or 29.2% of the Bank’s total deposits, as compared to $592.2 million, or 29.2% of the Bank’s total deposits at December 31, 2023. Included in uninsured deposits are deposits collateralized by securities (almost exclusively municipal deposits) totaling $158.3 million, or 7.6% of the Bank’s total deposits, at June 30, 2024. |

| ◾ | C&N maintained highly liquid sources of available funds totaling $1.1 billion at June 30, 2024, including unused borrowing capacity with the Federal Home Loan Bank of Pittsburgh of $719.7 million, unused availability on the Federal Reserve Bank of Philadelphia’s discount window of $18.9 million, available federal funds lines with other banks of $75 million and available-for-sale debt securities with a fair value in excess of collateral obligations of $238.4 million. At June 30, 2024, available funding from these sources totaled 173.7% of uninsured deposits, and 235.1% of uninsured and uncollateralized deposits. |

| ◾ | The outstanding balance of borrowed funds, including Federal Home Loan Bank advances, repurchase agreements, senior notes and subordinated debt, totaled $242,161,000 at June 30, 2024, up $4,913,000 from March 31, 2024 and $56,008,000 from June 30, 2023. |

| ◾ | Total stockholders’ equity was $263,221,000 at June 30, 2024, up from $261,656,000 at March 31, 2024 and from $248,117,000 at June 30, 2023. Within stockholders’ equity, the portion of accumulated other comprehensive loss related to available-for-sale debt securities was $41,710,000 at June 30, 2024, $41,071,000 at March 31, 2024 and $48,536,000 at June 30, 2023. The volatility in stockholders’ equity related to accumulated other comprehensive loss from available-for-sale debt securities has been caused by fluctuations in interest rates including overall increases in rates as compared to market rates when most of C&N’s securities were purchased. Accumulated other comprehensive loss is excluded from C&N’s regulatory capital ratios. |

| ◾ | On September 25, 2023, the Corporation announced a new treasury stock repurchase program. Under this program, C&N is authorized to repurchase up to 750,000 shares of its common stock. During the three-month and six-month periods ended June 30, 2024, 22,496 shares were repurchased for a total cost of $379,000, at an average price of $16.85 per share. At June 30, 2024, there were 727,504 shares available to be repurchased under the program. |

| ◾ | Citizens & Northern Bank is subject to various regulatory capital requirements. At June 30, 2024, Citizens & Northern Bank maintains regulatory capital ratios that exceed all capital adequacy requirements. Management expects the Bank to remain well-capitalized for the foreseeable future. |

| ◾ | Trust assets under management by C&N’s Wealth Management Group amounted to $1,284,674,000 at June 30, 2024, up 4.9% from $1,224,573,000 at March 31, 2024, and up 11.3% from $1,154,728,000 at June 30, 2023. Fluctuations in values of assets under management reflect the impact of market volatility. |

| ◾ | Under U.S. GAAP, interest income on tax-exempt securities and loans are reported at their nominal amounts, with the tax benefit accounted for as a reduction in the income tax provision. C&N presents certain analyses and ratios with net interest income determined on a fully taxable-equivalent basis, which are non-GAAP financial measures as presented. C&N believes presentation of net interest income on a fully taxable-equivalent basis provides investors with meaningful information for purposes of comparing the returns on tax-exempt securities and loans with returns on taxable securities and loans. The excess of net interest income on a fully taxable-equivalent basis over the amounts reported under U.S. GAAP was $202,000, $195,000 and $239,000 for the second quarter 2024, first quarter 2024 and second quarter 2023, respectively. The excess of net interest income on a fully taxable-equivalent basis over the amounts reported under U.S. GAAP was $397,000 for the six months ended June 30, 2024 and $508,000 for the six months ended June 30, 2023. |

Citizens & Northern Corporation is the bank holding company for Citizens & Northern Bank, headquartered in Wellsboro, Pennsylvania which operates 29 banking offices located in Bradford, Bucks, Cameron, Chester, Lycoming, McKean, Potter, Sullivan, Tioga, York and Lancaster Counties in Pennsylvania and Steuben County in New York, as well as a loan production office in Elmira, New York. Citizens & Northern Corporation trades on NASDAQ under the symbol “CZNC.” For more information about Citizens & Northern Bank and Citizens & Northern Corporation, visit www.cnbankpa.com.

Safe Harbor Statement: Except for historical information contained herein, the matters discussed in this release are forward-looking statements. Investors are cautioned that all forward-looking statements involve risks and uncertainty, including without limitation, the following: changes in monetary and fiscal policies of the Federal Reserve Board and the U.S. Government, particularly related to changes in interest rates; changes in general economic conditions; recent adverse developments in the banking industry highlighted by high-profile bank failures and the potential impact of such developments on customer confidence, sources of liquidity and capital funding, and regulatory responses to these developments; C&N’s credit standards and its on-going credit assessment processes might not protect it from significant credit losses; legislative or regulatory changes; downturn in demand for loan, deposit and other financial services in C&N’s market area; increased competition from other banks and non-bank providers of financial services; technological changes and increased technology-related costs; information security breach or other technology difficulties or failures; changes in accounting principles, or the application of generally accepted accounting principles; failure to achieve merger-related synergies and difficulties in integrating the business and operations of acquired institutions; and fraud and cyber malfunction risks as usage of artificial intelligence continues to expand. Citizens & Northern disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

EXHIBIT 99.2 – Supplemental, Unaudited Financial Information

CONDENSED, CONSOLIDATED EARNINGS INFORMATION

(Dollars In Thousands, Except Per Share Data)

(Unaudited)

| | | | | | | | | | | | |

| | | | | | | | | | |

| | 2nd | | 2nd | | | | | | |

| | QUARTER | | QUARTER | | | | | | |

| | 2024 | | 2023 | | $ Incr. (Decr.) | | % Incr. (Decr.) | |

Interest and Dividend Income | | $ | 31,326 | | $ | 28,011 | | $ | 3,315 | | 11.83 | % |

Interest Expense | | | 11,881 | | | 7,649 | | | 4,232 | | 55.33 | % |

Net Interest Income | | | 19,445 | | | 20,362 | | | (917) | | (4.50) | % |

Provision for Credit Losses | | | 565 | | | 812 | | | (247) | | (30.42) | % |

Net Interest Income After Provision for Credit Losses | | | 18,880 | | | 19,550 | | | (670) | | (3.43) | % |

Noninterest Income | | | 7,854 | | | 6,635 | | | 1,219 | | 18.37 | % |

Net Realized Losses on Available-for-sale Debt Securities | | | 0 | | | (1) | | | 1 | | (100.00) | % |

Noninterest Expense | | | 19,255 | | | 18,722 | | | 533 | | 2.85 | % |

Income Before Income Tax Provision | | | 7,479 | | | 7,462 | | | 17 | | 0.23 | % |

Income Tax Provision | | | 1,366 | | | 1,419 | | | (53) | | (3.74) | % |

Net Income | | $ | 6,113 | | $ | 6,043 | | $ | 70 | | 1.16 | % |

Net Income Attributable to Common Shares (1) | | $ | 6,066 | | $ | 5,996 | | $ | 70 | | 1.17 | % |

PER COMMON SHARE DATA: | | | | | | | | | | | | |

Net Income - Basic | | $ | 0.40 | | $ | 0.39 | | $ | 0.01 | | 2.56 | % |

Net Income - Diluted | | $ | 0.40 | | $ | 0.39 | | $ | 0.01 | | 2.56 | % |

Dividends Per Share | | $ | 0.28 | | $ | 0.28 | | $ | 0.00 | | 0.00 | % |

Number of Shares Used in Computation - Basic | | | 15,264,533 | | | 15,231,505 | | | | | | |

Number of Shares Used in Computation - Diluted | | | 15,264,533 | | | 15,231,505 | | | | | | |

| | | | | | | | | | | | |

| | SIX MONTHS ENDED | | | | | | |

| | JUNE 30, | | | | | | |

| | | | | | | | | | |

| | 2024 | | 2023 | | $ Incr. (Decr.) | | % Incr. (Decr.) | |

Interest and Dividend Income | | $ | 61,662 | | $ | 54,150 | | $ | 7,512 | | 13.87 | % |

Interest Expense | | | 23,176 | | | 13,007 | | | 10,169 | | 78.18 | % |

Net Interest Income | | | 38,486 | | | 41,143 | | | (2,657) | | (6.46) | % |

Provision for Credit Losses | | | 1,519 | | | 460 | | | 1,059 | | 230.22 | % |

Net Interest Income After Provision for Credit Losses | | | 36,967 | | | 40,683 | | | (3,716) | | (9.13) | % |

Noninterest Income | | | 14,529 | | | 12,244 | | | 2,285 | | 18.66 | % |

Net Realized Gains on Available-for-sale Debt Securities | | | 0 | | | 6 | | | (6) | | (100.00) | % |

Noninterest Expense | | | 37,559 | | | 37,809 | | | (250) | | (0.66) | % |

Income Before Income Tax Provision | | | 13,937 | | | 15,124 | | | (1,187) | | (7.85) | % |

Income Tax Provision | | | 2,518 | | | 2,828 | | | (310) | | (10.96) | % |

Net Income | | $ | 11,419 | | $ | 12,296 | | $ | (877) | | (7.13) | % |

Net Income Attributable to Common Shares (1) | | $ | 11,333 | | $ | 12,197 | | $ | (864) | | (7.08) | % |

PER COMMON SHARE DATA: | | | | | | | | | | | | |

Net Income - Basic | | $ | 0.74 | | $ | 0.80 | | $ | (0.06) | | (7.50) | % |

Net Income - Diluted | | $ | 0.74 | | $ | 0.80 | | $ | (0.06) | | (7.50) | % |

Dividends Per Share | | $ | 0.56 | | $ | 0.56 | | $ | 0.00 | | 0.00 | % |

Number of Shares Used in Computation - Basic | | | 15,247,557 | | | 15,320,101 | | | | | | |

Number of Shares Used in Computation - Diluted | | | 15,247,557 | | | 15,320,366 | | | | | | |

| (1) | Basic and diluted net income per common share are determined based on net income less earnings allocated to nonvested restricted shares with nonforfeitable dividends. |

CONDENSED, CONSOLIDATED BALANCE SHEET DATA

(Dollars In Thousands)

(Unaudited)

| | | | | | | | | | | | |

| | June 30, | | June 30, | | | |

| | 2024 | | 2023 | | $ Incr. (Decr.) | | % Incr. (Decr.) | |

ASSETS | | | | | | | | | | | | |

Cash & Due from Banks | | $ | 100,412 | | $ | 51,762 | | $ | 48,650 | | 93.99 | % |

Available-for-sale Debt Securities | | | 401,145 | | | 445,695 | | | (44,550) | | (10.00) | % |

Loans, Net | | | 1,872,825 | | | 1,795,454 | | | 77,371 | | 4.31 | % |

Bank-Owned Life Insurance | | | 50,301 | | | 31,504 | | | 18,797 | | 59.67 | % |

Bank Premises and Equipment, Net | | | 21,966 | | | 20,970 | | | 996 | | 4.75 | % |

Deferred Tax Asset, Net | | | 18,375 | | | 20,687 | | | (2,312) | | (11.18) | % |

Intangible Assets | | | 54,779 | | | 55,178 | | | (399) | | (0.72) | % |

Other Assets | | | 73,319 | | | 49,530 | | | 23,789 | | 48.03 | % |

TOTAL ASSETS | | $ | 2,593,122 | | $ | 2,470,780 | | $ | 122,342 | | 4.95 | % |

| | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | |

Deposits | | $ | 2,059,309 | | $ | 2,010,118 | | $ | 49,191 | | 2.45 | % |

Borrowed Funds - Federal Home Loan Bank and Repurchase Agreements | | | 202,523 | | | 146,694 | | | 55,829 | | 38.06 | % |

Senior Notes, Net | | | 14,865 | | | 14,798 | | | 67 | | 0.45 | % |

Subordinated Debt, Net | | | 24,773 | | | 24,661 | | | 112 | | 0.45 | % |

Other Liabilities | | | 28,431 | | | 26,392 | | | 2,039 | | 7.73 | % |

TOTAL LIABILITIES | | | 2,329,901 | | | 2,222,663 | | | 107,238 | | 4.82 | % |

| | | | | | | | | | | | |

STOCKHOLDERS' EQUITY | | | | | | | | | | | | |

Common Stockholders' Equity, Excluding Accumulated | | | | | | | | | | | | |

Other Comprehensive Loss | | | 304,582 | | | 296,190 | | | 8,392 | | 2.83 | % |

Accumulated Other Comprehensive Loss: | | | | | | | | | | | | |

Net Unrealized Losses on Available-for-sale Debt Securities | | | (41,710) | | | (48,536) | | | 6,826 | | (14.06) | % |

Defined Benefit Plans | | | 349 | | | 463 | | | (114) | | (24.62) | % |

TOTAL STOCKHOLDERS' EQUITY | | | 263,221 | | | 248,117 | | | 15,104 | | 6.09 | % |

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY | | $ | 2,593,122 | | $ | 2,470,780 | | $ | 122,342 | | 4.95 | % |

CONDENSED, CONSOLIDATED FINANCIAL HIGHLIGHTS

(Dollars In Thousands, Except Per Share Data)

(Unaudited)

| | | | | | | | | |

| | FOR THE | | | |

| | THREE MONTHS ENDED | | % | |

| | June 30, | | INCREASE | |

| | 2024 | | 2023 | | (DECREASE) | |

EARNINGS PERFORMANCE | | | | | | | | | |

Net Income | | $ | 6,113 | | $ | 6,043 | | 1.16 | % |

Return on Average Assets (Annualized) | | | 0.96 | % | | 0.98 | % | (2.04) | % |

Return on Average Equity (Annualized) | | | 9.46 | % | | 9.60 | % | (1.46) | % |

| | | | | | | | | |

PRE-TAX, PRE-PROVISION NET REVENUE ("PPNR") - NON-GAAP (a) | | | | | | | | | |

PPNR | | $ | 8,246 | | $ | 8,514 | | (3.15) | % |

PPNR (Annualized) as a % of Average Assets | | | 1.29 | % | | 1.38 | % | (6.52) | % |

PPNR (Annualized) as a % of Average Equity | | | 12.76 | % | | 13.53 | % | (5.69) | % |

| | | | | | | | | |

| | AS OF OR FOR THE | | | |

| | SIX MONTHS ENDED | | % | |

| | June 30, | | INCREASE | |

| | 2024 | | 2023 | | (DECREASE) | |

EARNINGS PERFORMANCE - U.S. GENERALLY ACCEPTED ACCOUNTING PRINCIPLES ("GAAP") | | | | | | | | | |

Net Income | | $ | 11,419 | | $ | 12,296 | | (7.13) | % |

Return on Average Assets (Annualized) | | | 0.90 | % | | 1.01 | % | (10.89) | % |

Return on Average Equity (Annualized) | | | 8.79 | % | | 9.75 | % | (9.85) | % |

| | | | | | | | | |

PPNR - NON-GAAP (a) | | | | | | | | | |

PPNR | | $ | 15,853 | | $ | 16,086 | | (1.45) | % |

PPNR (Annualized) as a % of Average Assets | | | 1.25 | % | | 1.32 | % | (5.30) | % |

PPNR (Annualized) as a % of Average Equity | | | 12.20 | % | | 12.76 | % | (4.39) | % |

| | | | | | | | | |

BALANCE SHEET HIGHLIGHTS | | | | | | | | | |

Total Assets | | $ | 2,593,122 | | $ | 2,470,780 | | 4.95 | % |

Available-for-Sale Debt Securities | | | 401,145 | | | 445,695 | | (10.00) | % |

Loans, Net | | | 1,872,825 | | | 1,795,454 | | 4.31 | % |

Allowance for Credit Losses: | | | | | | | | | |

Allowance for Credit Losses on Loans | | | 20,382 | | | 19,056 | | 6.96 | % |

Allowance for Credit Losses on Off-Balance Sheet Exposures | | | 682 | | | 1,154 | | (40.90) | % |

Deposits | | | 2,059,309 | | | 2,010,118 | | 2.45 | % |

| | | | | | | | | |

OFF-BALANCE SHEET | | | | | | | | | |

Outstanding Balance of Mortgage Loans Sold with Servicing Retained | | $ | 321,136 | | $ | 318,267 | | 0.90 | % |

Trust Assets Under Management | | | 1,284,674 | | | 1,154,728 | | 11.25 | % |

| | | | | | | | | |

STOCKHOLDERS' VALUE (PER COMMON SHARE) | | | | | | | | | |

Net Income - Basic | | $ | 0.74 | | $ | 0.80 | | (7.50) | % |

Net Income - Diluted | | $ | 0.74 | | $ | 0.80 | | (7.50) | % |

Dividends | | $ | 0.56 | | $ | 0.56 | | 0.00 | % |

Common Book Value | | $ | 17.12 | | $ | 16.25 | | 5.35 | % |

Tangible Common Book Value (b) | | $ | 13.56 | | $ | 12.64 | | 7.28 | % |

Market Value (Last Trade) | | $ | 17.89 | | $ | 19.30 | | (7.31) | % |

Market Value / Common Book Value | | | 104.50 | % | | 118.77 | % | (12.01) | % |

Market Value / Tangible Common Book Value NON-GAAP (b) | | | 131.93 | % | | 152.69 | % | (13.60) | % |

Price Earnings Multiple | | | 12.09 | | | 12.06 | | 0.25 | % |

Dividend Yield (Annualized) | | | 6.26 | % | | 5.80 | % | 7.93 | % |

Common Shares Outstanding, End of Period | | | 15,375,982 | | | 15,268,096 | | 0.71 | % |

CONDENSED, CONSOLIDATED FINANCIAL HIGHLIGHTS (Continued)

(Dollars In Thousands, Except Per Share Data)

(Unaudited)

| | | | | | | | | |

| | AS OF OR FOR THE | | | |

| | SIX MONTHS ENDED | | % | |

| | June 30, | | INCREASE | |

| | 2024 | | 2023 | | (DECREASE) | |

SAFETY AND SOUNDNESS | | | | | | | | | |

Tangible Common Equity / Tangible Assets (b) | | | 8.21 | % | | 7.99 | % | 2.75 | % |

Nonperforming Assets / Total Assets | | | 0.76 | % | | 0.58 | % | 31.03 | % |

Allowance for Credit Losses / Total Loans | | | 1.08 | % | | 1.05 | % | 2.86 | % |

Total Risk Based Capital Ratio (c) | | | 15.49 | % | | 15.86 | % | (2.33) | % |

Tier 1 Risk Based Capital Ratio (c) | | | 13.09 | % | | 13.37 | % | (2.09) | % |

Common Equity Tier 1 Risk Based Capital Ratio (c) | | | 13.09 | % | | 13.37 | % | (2.09) | % |

Leverage Ratio (c) | | | 9.85 | % | | 9.81 | % | 0.41 | % |

| | | | | | | | | |

AVERAGE BALANCES | | | | | | | | | |

Average Assets | | $ | 2,533,204 | | $ | 2,443,693 | | 3.66 | % |

Average Equity | | $ | 259,783 | | $ | 252,215 | | 3.00 | % |

| | | | | | | | | |

EFFICIENCY RATIO NON-GAAP (d) | | | | | | | | | |

Net Interest Income on a Fully Taxable-Equivalent Basis (d) | | $ | 38,883 | | $ | 41,651 | | (6.65) | % |

Noninterest Income, Excluding Net Realized Gains on Available-for-sale Debt Securities | | | 14,529 | | | 12,244 | | 18.66 | % |

Total (1) | | $ | 53,412 | | $ | 53,895 | | (0.90) | % |

Noninterest Expense (2) | | $ | 37,559 | | $ | 37,809 | | (0.66) | % |

Efficiency Ratio = (2)/(1) | | | 70.32 | % | | 70.15 | % | 0.24 | % |

| (a) | PPNR includes net interest income plus noninterest income minus total noninterest expense but excludes provision (credit) for credit losses, realized gains or losses on securities, the income tax provision and nonrecurring items included in earnings. Management believes disclosure of PPNR provides useful information for evaluating C&N’s financial performance without the impact of unusual items or events that may obscure trends in C&N’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. A reconciliation of this non-GAAP measure to the comparable GAAP measure is provided in Exhibit 99.2 under the table “PPNR- NON- GAAP RECONCILIATION.” |

(b)Tangible common book value per share, tangible common equity as a percentage of tangible assets and market value as a percentage of tangible common book value are non-GAAP ratios. Management believes this non-GAAP information is helpful in evaluating the strength of the C&N's capital and in providing an alternative, conservative valuation of C&N's net worth. The ratios shown above are based on the following calculations of tangible assets and tangible common equity:

| | | | | | | | | |

Total Assets | | $ | 2,593,122 | | $ | 2,470,780 | | | |

Less: Intangible Assets, Primarily Goodwill | | | (54,779) | | | (55,178) | | | |

Tangible Assets | | $ | 2,538,343 | | $ | 2,415,602 | | | |

Total Stockholders' Equity | | $ | 263,221 | | $ | 248,117 | | | |

Less: Intangible Assets, Primarily Goodwill | | | (54,779) | | | (55,178) | | | |

Tangible Common Equity (3) | | $ | 208,442 | | $ | 192,939 | | | |

| | | | | | | | | |

Common Shares Outstanding, End of Period (4) | | | 15,375,982 | | | 15,286,096 | | | |

Tangible Common Book Value per Share = (3)/(4) | | $ | 13.56 | | $ | 12.64 | | | |

(c)Capital ratios for the most recent period are estimated.

(d)The efficiency ratio is a non-GAAP ratio that is calculated as shown above. For purposes of calculating the efficiency ratio, net interest income on a fully taxable-equivalent basis includes amounts of interest income on tax-exempt securities and loans that have been increased to a fully taxable-equivalent basis, using C&N's marginal federal income tax rate of 21%. A reconciliation of net interest income under U.S. GAAP as compared to net interest income as adjusted to a fully taxable-equivalent basis is provided in Exhibit 99.2 under the table “COMPARISON OF INTEREST INCOME AND EXPENSE.”

QUARTERLY CONDENSED, CONSOLIDATED

INCOME STATEMENT INFORMATION

(Dollars In Thousands, Except Per Share Data)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | For the Three Months Ended: |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

Interest income | | $ | 31,326 | | $ | 30,336 | | $ | 30,236 | | $ | 29,118 | | $ | 28,011 |

Interest expense | | | 11,881 | | | 11,295 | | | 10,642 | | | 9,455 | | | 7,649 |

Net interest income | | | 19,445 | | | 19,041 | | | 19,594 | | | 19,663 | | | 20,362 |

Provision (credit) for credit losses | | | 565 | | | 954 | | | 951 | | | (1,225) | | | 812 |

Net interest income after provision (credit) for credit losses | | | 18,880 | | | 18,087 | | | 18,643 | | | 20,888 | | | 19,550 |

Noninterest income | | | 7,854 | | | 6,675 | | | 8,720 | | | 6,489 | | | 6,635 |

Net realized losses on securities | | | 0 | | | 0 | | | (3,042) | | | 0 | | | (1) |

Noninterest expense | | | 19,255 | | | 18,304 | | | 18,399 | | | 17,940 | | | 18,722 |

Income before income tax provision | | | 7,479 | | | 6,458 | | | 5,922 | | | 9,437 | | | 7,462 |

Income tax provision | | | 1,366 | | | 1,152 | | | 1,661 | | | 1,846 | | | 1,419 |

Net income | | $ | 6,113 | | $ | 5,306 | | $ | 4,261 | | $ | 7,591 | | $ | 6,043 |

Net income attributable to common shares | | $ | 6,066 | | $ | 5,267 | | $ | 4,231 | | $ | 7,534 | | $ | 5,996 |

Basic earnings per common share | | $ | 0.40 | | $ | 0.35 | | $ | 0.28 | | $ | 0.50 | | $ | 0.39 |

Diluted earnings per common share | | $ | 0.40 | | $ | 0.35 | | $ | 0.28 | | $ | 0.50 | | $ | 0.39 |

QUARTERLY CONDENSED, CONSOLIDATED

BALANCE SHEET INFORMATION

(In Thousands) (Unaudited)

| | | | | | | | | | | | | | | |

| | As of: | | | | | | | | | | |

| | June 30, | | March 31, | | Dec. 31, | | Sept. 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

ASSETS | | | | | | | | | | | | | | | |

Cash & Due from Banks | | $ | 100,412 | | $ | 46,448 | | $ | 56,878 | | $ | 52,658 | | $ | 51,762 |

Available-for-Sale Debt Securities | | | 401,145 | | | 405,094 | | | 415,755 | | | 429,138 | | | 445,695 |

Loans, Net | | | 1,872,825 | | | 1,852,426 | | | 1,828,931 | | | 1,812,585 | | | 1,795,454 |

Bank-Owned Life Insurance | | | 50,301 | | | 49,857 | | | 63,674 | | | 31,557 | | | 31,504 |

Bank Premises and Equipment, Net | | | 21,966 | | | 21,852 | | | 21,632 | | | 21,267 | | | 20,970 |

Deferred Tax Asset, Net | | | 18,375 | | | 17,703 | | | 17,441 | | | 23,731 | | | 20,687 |

Intangible Assets | | | 54,779 | | | 54,877 | | | 54,974 | | | 55,076 | | | 55,178 |

Other Assets | | | 73,319 | | | 73,280 | | | 56,299 | | | 57,937 | | | 49,530 |

TOTAL ASSETS | | $ | 2,593,122 | | $ | 2,521,537 | | $ | 2,515,584 | | $ | 2,483,949 | | $ | 2,470,780 |

| | | | | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | | | | |

Deposits (1) | | $ | 2,059,309 | | $ | 1,995,903 | | $ | 2,014,806 | | $ | 2,024,997 | | $ | 2,010,118 |

Borrowed Funds - Federal Home Loan Bank and Repurchase Agreements | | | 202,523 | | | 197,655 | | | 172,211 | | | 148,529 | | | 146,694 |

Senior Notes, Net | | | 14,865 | | | 14,848 | | | 14,831 | | | 14,814 | | | 14,798 |

Subordinated Debt, Net | | | 24,773 | | | 24,745 | | | 24,717 | | | 24,689 | | | 24,661 |

Other Liabilities | | | 28,431 | | | 26,730 | | | 26,638 | | | 30,715 | | | 26,392 |

TOTAL LIABILITIES | | | 2,329,901 | | | 2,259,881 | | | 2,253,203 | | | 2,243,744 | | | 2,222,663 |

| | | | | | | | | | | | | | | |

STOCKHOLDERS' EQUITY | | | | | | | | | | | | | | | |

Common Stockholders' Equity, Excluding Accumulated Other Comprehensive Loss | | | 304,582 | | | 302,362 | | | 300,818 | | | 300,031 | | | 296,190 |

Accumulated Other Comprehensive Loss: | | | | | | | | | | | | | | | |

Net Unrealized Losses on Available-for-sale Debt Securities | | | (41,710) | | | (41,071) | | | (38,878) | | | (60,278) | | | (48,536) |

Defined Benefit Plans | | | 349 | | | 365 | | | 441 | | | 452 | | | 463 |

TOTAL STOCKHOLDERS' EQUITY | | | 263,221 | | | 261,656 | | | 262,381 | | | 240,205 | | | 248,117 |

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY | | $ | 2,593,122 | | $ | 2,521,537 | | $ | 2,515,584 | | $ | 2,483,949 | | $ | 2,470,780 |

| | | | | | | | | | | | | | | |

(1) Brokered Deposits (Included in Total Deposits) | | $ | 59,501 | | $ | 69,391 | | $ | 64,369 | | $ | 62,512 | | $ | 70,653 |

AVAILABLE-FOR-SALE DEBT SECURITIES

(In Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 | | March 31, 2024 | | December 31, 2023 | | June 30, 2023 |

| | Amortized | | Fair | | Amortized | | Fair | | Amortized | | Fair | | Amortized | | Fair |

| | Cost | | Value | | Cost | | Value | | Cost | | Value | | Cost | | Value |

Obligations of the U.S. Treasury | | $ | 10,323 | | $ | 9,257 | | $ | 11,324 | | $ | 10,231 | | $ | 12,325 | | $ | 11,290 | | $ | 33,931 | | $ | 30,743 |

Obligations of U.S. Government agencies | | | 10,582 | | | 9,350 | | | 10,637 | | | 9,376 | | | 11,119 | | | 9,946 | | | 22,899 | | | 20,552 |

Bank holding company debt securities | | | 28,955 | | | 23,657 | | | 28,953 | | | 23,469 | | | 28,952 | | | 23,500 | | | 28,948 | | | 23,325 |

Obligations of states and political subdivisions: | | | | | | | | | | | | | | | | | | | | | | | | |

Tax-exempt | | | 113,659 | | | 102,020 | | | 113,181 | | | 102,826 | | | 113,464 | | | 104,199 | | | 125,247 | | | 113,170 |

Taxable | | | 56,294 | | | 47,481 | | | 57,960 | | | 49,255 | | | 58,720 | | | 50,111 | | | 65,715 | | | 55,702 |

Mortgage-backed securities issued or guaranteed by U.S. Government agencies or sponsored agencies: | | | | | | | | | | | | | | | | | | | | | | | | |

Residential pass-through securities | | | 104,708 | | | 93,874 | | | 102,048 | | | 91,116 | | | 105,549 | | | 95,405 | | | 105,027 | | | 92,795 |

Residential collateralized mortgage obligations | | | 46,623 | | | 42,565 | | | 48,477 | | | 44,501 | | | 50,212 | | | 46,462 | | | 40,444 | | | 35,897 |

Commercial mortgage-backed securities | | | 74,510 | | | 64,718 | | | 76,249 | | | 66,121 | | | 76,412 | | | 66,682 | | | 76,780 | | | 65,517 |

Private label commercial mortgage-backed securities | | | 8,290 | | | 8,223 | | | 8,252 | | | 8,199 | | | 8,215 | | | 8,160 | | | 8,141 | | | 7,994 |

Total Available-for-Sale Debt Securities | | $ | 453,944 | | $ | 401,145 | | $ | 457,081 | | $ | 405,094 | | $ | 464,968 | | $ | 415,755 | | $ | 507,132 | | $ | 445,695 |

SUMMARY OF LOANS BY TYPE

(Excludes Loans Held for Sale)

(In Thousands)

| | | | | | | | | | | | |

| | June 30, | | March 31, | | December 31, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2023 |

Commercial real estate - non-owner occupied | | | | | | | | | | | | |

Non-owner occupied | | $ | 489,514 | | $ | 507,223 | | $ | 499,104 | | $ | 505,519 |

Multi-family (5 or more) residential | | | 67,154 | | | 64,866 | | | 64,076 | | | 61,004 |

1-4 Family - commercial purpose | | | 167,296 | | | 167,740 | | | 174,162 | | | 167,260 |

Total commercial real estate - non-owner occupied | | | 723,964 | | | 739,829 | | | 737,342 | | | 733,783 |

Commercial real estate - owner occupied | | | 267,169 | | | 250,145 | | | 237,246 | | | 227,801 |

All other commercial loans: | | | | | | | | | | | | |

Commercial and industrial | | | 77,339 | | | 80,136 | | | 78,832 | | | 80,270 |

Commercial lines of credit | | | 130,924 | | | 121,791 | | | 117,236 | | | 122,607 |

Political subdivisions | | | 89,460 | | | 84,652 | | | 79,031 | | | 84,456 |

Commercial construction and land | | | 114,162 | | | 106,255 | | | 104,123 | | | 80,391 |

Other commercial loans | | | 19,221 | | | 19,971 | | | 20,471 | | | 24,960 |

Total all other commercial loans | | | 431,106 | | | 412,805 | | | 399,693 | | | 392,684 |

Residential mortgage loans: | | | | | | | | | | | | |

1-4 Family - residential | | | 383,494 | | | 387,542 | | | 389,262 | | | 378,698 |

1-4 Family residential construction | | | 26,330 | | | 22,121 | | | 24,452 | | | 25,535 |

Total residential mortgage | | | 409,824 | | | 409,663 | | | 413,714 | | | 404,233 |

Consumer loans: | | | | | | | | | | | | |

Consumer lines of credit (including HELCs) | | | 42,325 | | | 41,204 | | | 41,503 | | | 36,608 |

All other consumer | | | 18,819 | | | 18,803 | | | 18,641 | | | 19,401 |

Total consumer | | | 61,144 | | | 60,007 | | | 60,144 | | | 56,009 |

Total | | | 1,893,207 | | | 1,872,449 | | | 1,848,139 | | | 1,814,510 |

Less: allowance for credit losses on loans | | | (20,382) | | | (20,023) | | | (19,208) | | | (19,056) |

Loans, net | | $ | 1,872,825 | | $ | 1,852,426 | | $ | 1,828,931 | | $ | 1,795,454 |

NON-OWNER OCCUPIED COMMERCIAL REAL ESTATE

(In Thousands)

| | | | | | | | | |

Loan Type | | June 30, | | % of Non-owner | | % of |

| | 2024 | | Occupied CRE | | Total Loans |

Industrial | | $ | 98,840 | | 20.2 | % | | 5.2 | % |

Office | | | 96,642 | | 19.7 | % | | 5.1 | % |

Retail | | | 93,552 | | 19.1 | % | | 4.9 | % |

Hotels | | | 72,915 | | 14.9 | % | | 3.9 | % |

Mixed Use | | | 58,891 | | 12.0 | % | | 3.1 | % |

Other | | | 68,674 | | 14.0 | % | | 3.6 | % |

Total Non-owner Occupied CRE Loans | | $ | 489,514 | | | | | | |

Total Gross Loans | | $ | 1,893,207 | | | | | | |

PAST DUE LOANS AND NONPERFORMING ASSETS

(Dollars In Thousands)

| | | | | | | | | | | | | | |

| | June 30, | | | March 31, | | December 31, | | June 30, | |

| | 2024 | | | 2024 | | 2023 | | 2023 | |

Loans individually evaluated with a valuation allowance | | $ | 6,613 | | | $ | 10,062 | | $ | 7,786 | | $ | 5,785 | |

Loans individually evaluated without a valuation allowance | | | 8,567 | | | | 4,743 | | | 3,478 | | | 3,314 | |

Total individually evaluated loans | | $ | 15,180 | | | $ | 14,805 | | $ | 11,264 | | $ | 9,099 | |

| | | | | | | | | | | | | | |

Total loans past due 30-89 days and still accruing | | $ | 3,088 | | | $ | 6,560 | | $ | 9,275 | | $ | 4,709 | |

| | | | | | | | | | | | | | |

Nonperforming assets: | | | | | | | | | | | | | | |

Total nonaccrual loans | | $ | 19,579 | | | $ | 19,069 | | $ | 15,177 | | $ | 12,827 | |

Total loans past due 90 days or more and still accruing | | | 20 | | | | 227 | | | 3,190 | | | 1,164 | |

Total nonperforming loans | | | 19,599 | | | | 19,296 | | | 18,367 | | | 13,991 | |

Foreclosed assets held for sale (real estate) | | | 181 | | | | 456 | | | 478 | | | 459 | |

Total nonperforming assets | | $ | 19,780 | | | $ | 19,752 | | $ | 18,845 | | $ | 14,450 | |

| | | | | | | | | | | | | | |

Total nonperforming loans as a % of total loans | | | 1.04 | % | | | 1.03 | % | | 0.99 | % | | 0.77 | % |

Total nonperforming assets as a % of assets | | | 0.76 | % | | | 0.78 | % | | 0.75 | % | | 0.58 | % |

Allowance for credit losses as a % of total loans | | | 1.08 | % | | | 1.07 | % | | 1.04 | % | | 1.05 | % |

ANALYSIS OF THE ALLOWANCE FOR CREDIT LOSSES ON LOANS

(In Thousands)

| | | | | | | | | | | | | | | |

| | 3 Months | | 3 Months | | 3 Months | | 6 Months | | 6 Months |

| | Ended | | Ended | | Ended | | Ended | | Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

Balance, beginning of period | | $ | 20,023 | | $ | 19,208 | | $ | 18,346 | | $ | 19,208 | | $ | 16,615 |

Adoption of ASU 2016-13 (CECL) | | | 0 | | | 0 | | | 0 | | | 0 | | | 2,104 |

Charge-offs | | | (236) | | | (180) | | | (134) | | | (416) | | | (201) |

Recoveries | | | 29 | | | 35 | | | 8 | | | 64 | | | 14 |

Net charge-offs | | | (207) | | | (145) | | | (126) | | | (352) | | | (187) |

Provision for credit losses on loans | | | 566 | | | 960 | | | 836 | | | 1,526 | | | 524 |

Balance, end of period | | $ | 20,382 | | $ | 20,023 | | $ | 19,056 | | $ | 20,382 | | $ | 19,056 |

ANALYSIS OF THE PROVISION (CREDIT) FOR CREDIT LOSSES

(In Thousands)

| | | | | | | | | | | | | | |

| | 3 Months | | 3 Months | | 3 Months | 6 Months | | 6 Months |

| | Ended | | Ended | | Ended | Ended | | Ended |

| | June 30, | | March 31, | | June 30, | June 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | 2024 | | 2023 |

Provision (credit) for credit losses: | | | | | | | | | | | | | | |

Loans receivable | | $ | 566 | | $ | 960 | | $ | 836 | $ | 1,526 | | $ | 524 |

Off-balance sheet exposures | | | (1) | | | (6) | | | (24) | | (7) | | | (64) |

Total provision for credit losses | | $ | 565 | | $ | 954 | | $ | 812 | $ | 1,519 | | $ | 460 |

PPNR NON- GAAP RECONCILIATION

(In Thousands)

| | | | | | | | | | | | | | | |

| | Three Months Ended | Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

Calculation of PPNR: | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

Net Income (GAAP) | | $ | 6,113 | | $ | 5,306 | | $ | 6,043 | | $ | 11,419 | | $ | 12,296 |

Add: Provision for income taxes | | | 1,366 | | | 1,152 | | | 1,419 | | | 2,518 | | | 2,828 |

Add: Provision for credit losses | | | 565 | | | 954 | | | 812 | | | 1,519 | | | 460 |

Add: Realized losses (gains) on available-for-sale securities debt securities | | | 0 | | | 0 | | | 1 | | | 0 | | | (6) |

Add: Adjustments to reflect net interest income on a fully taxable-equivalent basis | | | 202 | | | 195 | | | 239 | | | 397 | | | 508 |

PPNR (non-GAAP) | | $ | 8,246 | | $ | 7,607 | | $ | 8,514 | | $ | 15,853 | | $ | 16,086 |

COMPARISON OF INTEREST INCOME AND EXPENSE

(In Thousands)

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

INTEREST INCOME | | | | | | | | | | | | | | | |

Interest-bearing due from banks | | $ | 516 | | $ | 383 | | $ | 309 | | $ | 899 | | $ | 587 |

Available-for-sale debt securities: | | | | | | | | | | | | | | | |

Taxable | | | 2,137 | | | 2,136 | | | 2,152 | | | 4,273 | | | 4,363 |

Tax-exempt | | | 626 | | | 623 | | | 713 | | | 1,249 | | | 1,480 |

Total available-for-sale debt securities | | | 2,763 | | | 2,759 | | | 2,865 | | | 5,522 | | | 5,843 |

Loans receivable: | | | | | | | | | | | | | | | |

Taxable | | | 27,490 | | | 26,703 | | | 24,362 | | | 54,193 | | | 46,793 |

Tax-exempt | | | 730 | | | 670 | | | 700 | | | 1,400 | | | 1,413 |

Total loans receivable | | | 28,220 | | | 27,373 | | | 25,062 | | | 55,593 | | | 48,206 |

Other earning assets | | | 29 | | | 16 | | | 14 | | | 45 | | | 22 |

Total Interest Income | | | 31,528 | | | 30,531 | | | 28,250 | | | 62,059 | | | 54,658 |

| | | | | | | | | | | | | | | |

INTEREST EXPENSE | | | | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | | | | |

Interest checking | | | 2,836 | | | 2,806 | | | 1,512 | | | 5,642 | | | 2,499 |

Money market | | | 1,917 | | | 2,180 | | | 1,112 | | | 4,097 | | | 1,985 |

Savings | | | 52 | | | 55 | | | 63 | | | 107 | | | 126 |

Time deposits | | | 4,509 | | | 3,850 | | | 2,412 | | | 8,359 | | | 3,719 |

Total interest-bearing deposits | | | 9,314 | | | 8,891 | | | 5,099 | | | 18,205 | | | 8,329 |

Borrowed funds: | | | | | | | | | | | | | | | |

Short-term | | | 360 | | | 597 | | | 1,144 | | | 957 | | | 2,241 |

Long-term - FHLB advances | | | 1,855 | | | 1,456 | | | 1,056 | | | 3,311 | | | 1,737 |

Senior notes, net | | | 120 | | | 120 | | | 119 | | | 240 | | | 239 |

Subordinated debt, net | | | 232 | | | 231 | | | 231 | | | 463 | | | 461 |

Total borrowed funds | | | 2,567 | | | 2,404 | | | 2,550 | | | 4,971 | | | 4,678 |

Total Interest Expense | | | 11,881 | | | 11,295 | | | 7,649 | | | 23,176 | | | 13,007 |

| | | | | | | | | | | | | | | |

Net Interest Income | | $ | 19,647 | | $ | 19,236 | | $ | 20,601 | | $ | 38,883 | | $ | 41,651 |

Note: Interest income from tax-exempt securities and loans has been adjusted to a fully taxable-equivalent basis, using C&N’s marginal federal income tax rate of 21%. The following table is a reconciliation of net interest income under U.S. GAAP as compared to net interest income as adjusted to a fully taxable-equivalent basis.

| | | | | | | | | | | | | | | |

(In Thousands) | | Three Months Ended | | Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

Net Interest Income Under U.S. GAAP | | $ | 19,445 | | $ | 19,041 | | $ | 20,362 | | $ | 38,486 | | $ | 41,143 |

Add: fully taxable-equivalent interest income adjustment from tax-exempt securities | | | 67 | | | 69 | | | 103 | | | 136 | | | 230 |

Add: fully taxable-equivalent interest income adjustment from tax-exempt loans | | | 135 | | | 126 | | | 136 | | | 261 | | | 278 |

Net Interest Income as adjusted to a fully taxable-equivalent basis | | $ | 19,647 | | $ | 19,236 | | $ | 20,601 | | $ | 38,883 | | $ | 41,651 |

ANALYSIS OF AVERAGE DAILY BALANCES AND RATES

(Dollars in Thousands)

| | | | | | | | | | | | | | | | |

| | 3 Months | | | | 3 Months | | | | 3 Months | | | |

| | Ended | | Rate of | | Ended | | Rate of | | Ended | | Rate of | |

| | 6/30/2024 | | Return/ | | 3/31/2024 | | Return/ | | 6/30/2023 | | Return/ | |

| | Average | | Cost of | | Average | | Cost of | | Average | | Cost of | |

| | Balance | | Funds % | | Balance | | Funds % | | Balance | | Funds % | |

EARNING ASSETS | | | | | | | | | | | | | | | | |

Interest-bearing due from banks | | $ | 43,139 | | 4.81 | % | $ | 32,725 | | 4.71 | % | $ | 29,861 | | 4.15 | % |

Available-for-sale debt securities, at amortized cost: | | | | | | | | | | | | | | | | |

Taxable | | | 343,971 | | 2.50 | % | | 347,885 | | 2.47 | % | | 395,725 | | 2.18 | % |

Tax-exempt | | | 112,921 | | 2.23 | % | | 113,363 | | 2.21 | % | | 126,839 | | 2.25 | % |

Total available-for-sale debt securities | | | 456,892 | | 2.43 | % | | 461,248 | | 2.41 | % | | 522,564 | | 2.20 | % |

Loans receivable: | | | | | | | | | | | | | | | | |

Taxable | | | 1,792,556 | | 6.17 | % | | 1,774,064 | | 6.05 | % | | 1,697,740 | | 5.76 | % |

Tax-exempt | | | 90,830 | | 3.23 | % | | 85,182 | | 3.16 | % | | 90,111 | | 3.12 | % |

Total loans receivable | | | 1,883,386 | | 6.03 | % | | 1,859,246 | | 5.92 | % | | 1,787,851 | | 5.62 | % |

Other earning assets | | | 2,176 | | 5.36 | % | | 1,384 | | 4.65 | % | | 1,325 | | 4.24 | % |

Total Earning Assets | | | 2,385,593 | | 5.32 | % | | 2,354,603 | | 5.22 | % | | 2,341,601 | | 4.84 | % |

Cash | | | 22,396 | | | | | 20,448 | | | | | 23,084 | | | |

Unrealized loss on securities | | | (56,765) | | | | | (50,849) | | | | | (56,564) | | | |

Allowance for credit losses | | | (20,290) | | | | | (19,484) | | | | | (18,795) | | | |

Bank-owned life insurance | | | 50,018 | | | | | 54,466 | | | | | 31,410 | | | |

Bank premises and equipment | | | 21,994 | | | | | 21,788 | | | | | 21,140 | | | |

Intangible assets | | | 54,827 | | | | | 54,925 | | | | | 55,228 | | | |

Other assets | | | 89,859 | | | | | 82,879 | | | | | 69,213 | | | |

Total Assets | | $ | 2,547,632 | | | | $ | 2,518,776 | | | | $ | 2,466,317 | | | |

| | | | | | | | | | | | | | | | |

INTEREST-BEARING LIABILITIES | | | | | | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | | | | | | |

Interest checking | | $ | 517,145 | | 2.21 | % | $ | 514,905 | | 2.19 | % | $ | 463,300 | | 1.31 | % |

Money market | | | 340,038 | | 2.27 | % | | 362,864 | | 2.42 | % | | 328,581 | | 1.36 | % |

Savings | | | 207,530 | | 0.10 | % | | 213,278 | | 0.10 | % | | 247,434 | | 0.10 | % |

Time deposits | | | 457,885 | | 3.96 | % | | 429,085 | | 3.61 | % | | 375,557 | | 2.58 | % |

Total interest-bearing deposits | | | 1,522,598 | | 2.46 | % | | 1,520,132 | | 2.35 | % | | 1,414,872 | | 1.45 | % |

Borrowed funds: | | | | | | | | | | | | | | | | |

Short-term | | | 27,732 | | 5.22 | % | | 44,642 | | 5.38 | % | | 87,479 | | 5.25 | % |

Long-term - FHLB advances | | | 175,373 | | 4.25 | % | | 142,753 | | 4.10 | % | | 110,982 | | 3.82 | % |

Senior notes, net | | | 14,856 | | 3.25 | % | | 14,840 | | 3.25 | % | | 14,789 | | 3.23 | % |

Subordinated debt, net | | | 24,759 | | 3.77 | % | | 24,731 | | 3.76 | % | | 24,648 | | 3.76 | % |

Total borrowed funds | | | 242,720 | | 4.25 | % | | 226,966 | | 4.26 | % | | 237,898 | | 4.30 | % |

Total Interest-bearing Liabilities | | | 1,765,318 | | 2.71 | % | | 1,747,098 | | 2.60 | % | | 1,652,770 | | 1.86 | % |

Demand deposits | | | 493,922 | | | | | 481,146 | | | | | 533,533 | | | |

Other liabilities | | | 29,972 | | | | | 29,386 | | | | | 28,217 | | | |

Total Liabilities | | | 2,289,212 | | | | | 2,257,630 | | | | | 2,214,520 | | | |

Stockholders' equity, excluding accumulated other comprehensive loss | | | 302,758 | | | | | 301,032 | | | | | 296,015 | | | |

Accumulated other comprehensive loss | | | (44,338) | | | | | (39,886) | | | | | (44,218) | | | |

Total Stockholders' Equity | | | 258,420 | | | | | 261,146 | | | | | 251,797 | | | |

Total Liabilities and Stockholders' Equity | | $ | 2,547,632 | | | | $ | 2,518,776 | | | | $ | 2,466,317 | | | |

Interest Rate Spread | | | | | 2.61 | % | | | | 2.62 | % | | | | 2.98 | % |

Net Interest Income/Earning Assets | | | | | 3.31 | % | | | | 3.29 | % | | | | 3.53 | % |

| | | | | | | | | | | | | | | | |

Total Deposits (Interest-bearing and Demand) | | $ | 2,016,520 | | | | $ | 2,001,278 | | | | $ | 1,948,405 | | | |

(1)Annualized rates of return on tax-exempt securities and loans are presented on a fully taxable-equivalent basis, using C&N’s marginal federal income tax rate of 21%.

(2) | Nonaccrual loans have been included with loans for the purpose of analyzing net interest earnings. |

(3) | Rates of return on earning assets and costs of funds have been presented on an annualized basis. |

ANALYSIS OF AVERAGE DAILY BALANCES AND RATES

(Dollars in Thousands)

| | | | | | | | | | | |

| | Year | | | | Year | | | |

| | Ended | | Rate of | | Ended | | Rate of | |

| | 6/30/2024 | | Return/ | | 6/30/2023 | | Return/ | |

| | Average | | Cost of | | Average | | Cost of | |

| | Balance | | Funds % | | Balance | | Funds% | |

EARNING ASSETS | | | | | | | | | | | |

Interest-bearing due from banks | | $ | 37,932 | | 4.77 | % | $ | 30,744 | | 3.85 | % |

Available-for-sale debt securities, at amortized cost: | | | | | | | | | | | |

Taxable | | | 345,928 | | 2.48 | % | | 402,878 | | 2.18 | % |

Tax-exempt | | | 113,142 | | 2.22 | % | | 129,103 | | 2.31 | % |

Total available-for-sale debt securities | | | 459,070 | | 2.42 | % | | 531,981 | | 2.21 | % |

Loans receivable: | | | | | | | | | | | |

Taxable | | | 1,783,310 | | 6.11 | % | | 1,666,052 | | 5.66 | % |

Tax-exempt | | | 88,006 | | 3.20 | % | | 90,976 | | 3.13 | % |

Total loans receivable | | | 1,871,316 | | 5.97 | % | | 1,757,028 | | 5.53 | % |

Other earning assets | | | 1,780 | | 5.08 | % | | 1,263 | | 3.51 | % |

Total Earning Assets | | | 2,370,098 | | 5.27 | % | | 2,321,016 | | 4.75 | % |

Cash | | | 21,422 | | | | | 22,682 | | | |

Unrealized loss on securities | | | (53,807) | | | | | (58,300) | | | |

Allowance for credit losses | | | (19,887) | | | | | (17,929) | | | |

Bank-owned life insurance | | | 52,242 | | | | | 31,339 | | | |

Bank premises and equipment | | | 21,891 | | | | | 21,328 | | | |

Intangible assets | | | 54,876 | | | | | 55,279 | | | |

Other assets | | | 86,369 | | | | | 68,278 | | | |

Total Assets | | $ | 2,533,204 | | | | $ | 2,443,693 | | | |

| | | | | | | | | | | |

INTEREST-BEARING LIABILITIES | | | | | | | | | | | |

Interest-bearing deposits: | | | | | | | | | | | |

Interest checking | | $ | 516,025 | | 2.20 | % | $ | 460,305 | | 1.09 | % |

Money market | | | 351,451 | | 2.34 | % | | 346,514 | | 1.16 | % |

Savings | | | 210,404 | | 0.10 | % | | 252,214 | | 0.10 | % |

Time deposits | | | 443,485 | | 3.79 | % | | 344,201 | | 2.18 | % |

Total interest-bearing deposits | | | 1,521,365 | | 2.41 | % | | 1,403,234 | | 1.20 | % |

Borrowed funds: | | | | | | | | | | | |

Short-term | | | 36,187 | | 5.32 | % | | 89,611 | | 5.04 | % |

Long-term - FHLB advances | | | 159,063 | | 4.19 | % | | 95,899 | | 3.65 | % |

Senior notes, net | | | 14,848 | | 3.25 | % | | 14,781 | | 3.26 | % |

Subordinated debt, net | | | 24,745 | | 3.76 | % | | 24,634 | | 3.77 | % |

Total borrowed funds | | | 234,843 | | 4.26 | % | | 224,925 | | 4.19 | % |

Total Interest-bearing Liabilities | | | 1,756,208 | | 2.65 | % | | 1,628,159 | | 1.61 | % |

Demand deposits | | | 487,534 | | | | | 536,579 | | | |

Other liabilities | | | 29,679 | | | | | 26,740 | | | |

Total Liabilities | | | 2,273,421 | | | | | 2,191,478 | | | |

Stockholders' equity, excluding accumulated other comprehensive loss | | | 301,895 | | | | | 297,797 | | | |

Accumulated other comprehensive loss | | | (42,112) | | | | | (45,582) | | | |

Total Stockholders' Equity | | | 259,783 | | | | | 252,215 | | | |

Total Liabilities and Stockholders' Equity | | $ | 2,533,204 | | | | $ | 2,443,693 | | | |

Interest Rate Spread | | | | | 2.62 | % | | | | 3.14 | % |

Net Interest Income/Earning Assets | | | | | 3.30 | % | | | | 3.62 | % |

| | | | | | | | | | | |

Total Deposits (Interest-bearing and Demand) | | $ | 2,008,899 | | | | $ | 1,939,813 | | | |

(1)Annualized rates of return on tax-exempt securities and loans are presented on a fully taxable-equivalent basis, using C&N’s marginal federal income tax rate of 21%.

(2) | Nonaccrual loans have been included with loans for the purpose of analyzing net interest earnings. |

(3) | Rates of return on earning assets and costs of funds have been presented on an annualized basis. |

COMPARISON OF NONINTEREST INCOME

(In Thousands)

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

Trust revenue | | $ | 2,014 | | $ | 1,897 | | $ | 1,804 | | $ | 3,911 | | $ | 3,581 |

Brokerage and insurance revenue | | | 527 | | | 539 | | | 365 | | | 1,066 | | | 795 |

Service charges on deposit accounts | | | 1,472 | | | 1,318 | | | 1,388 | | | 2,790 | | | 2,678 |

Interchange revenue from debit card transactions | | | 1,089 | | | 1,013 | | | 1,010 | | | 2,102 | | | 2,017 |

Net gains from sales of loans | | | 235 | | | 191 | | | 139 | | | 426 | | | 213 |

Loan servicing fees, net | | | 130 | | | 230 | | | 190 | | | 360 | | | 312 |

Increase in cash surrender value of life insurance | | | 444 | | | 470 | | | 152 | | | 914 | | | 290 |

Other noninterest income | | | 1,943 | | | 1,017 | | | 1,587 | | | 2,960 | | | 2,358 |

Total noninterest income, excluding realized gains

(losses) on securities, net | | $ | 7,854 | | $ | 6,675 | | $ | 6,635 | | $ | 14,529 | | $ | 12,244 |

COMPARISON OF NONINTEREST EXPENSE

(In Thousands)

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

Salaries and employee benefits | | $ | 11,023 | | $ | 11,562 | | $ | 10,777 | | $ | 22,585 | | $ | 22,204 |

Net occupancy and equipment expense | | | 1,333 | | | 1,450 | | | 1,323 | | | 2,783 | | | 2,725 |

Data processing and telecommunications expenses | | | 2,003 | | | 1,992 | | | 1,900 | | | 3,995 | | | 3,836 |

Automated teller machine and interchange expense | | | 473 | | | 487 | | | 395 | | | 960 | | | 870 |

Pennsylvania shares tax | | | 434 | | | 433 | | | 404 | | | 867 | | | 807 |

Professional fees | | | 552 | | | 518 | | | 564 | | | 1,070 | | | 1,501 |

Other noninterest expense | | | 3,437 | | | 1,862 | | | 3,359 | | | 5,299 | | | 5,866 |

Total noninterest expense | | $ | 19,255 | | $ | 18,304 | | $ | 18,722 | | $ | 37,559 | | $ | 37,809 |

LIQUIDITY INFORMATION

(In Thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Available Credit Facilities | | Outstanding | | | Available | | | Total Credit |

| | June 30, | | March 31, | | Dec. 31, | | | June 30, | | March 31, | | Dec. 31, | | | June 30, | | March 31, | | Dec. 31, |

| | 2024 | | 2024 | | 2023 | | | 2024 | | 2024 | | 2023 | | | 2024 | | 2024 | | 2023 |

Federal Home Loan Bank of Pittsburgh | | $ | 223,853 | | $ | 215,018 | | $ | 189,021 | | | $ | 719,722 | | $ | 712,932 | | $ | 737,824 | | | $ | 943,575 | | $ | 927,950 | | $ | 926,845 |

Federal Reserve Bank Discount Window | | | 0 | | | 0 | | | 0 | | | | 18,884 | | | 19,063 | | | 19,982 | | | | 18,884 | | | 19,063 | | | 19,982 |

Other correspondent banks | | | 0 | | | 0 | | | 0 | | | | 75,000 | | | 75,000 | | | 75,000 | | | | 75,000 | | | 75,000 | | | 75,000 |

Total credit facilities | | $ | 223,853 | | $ | 215,018 | | $ | 189,021 | | | $ | 813,606 | | $ | 806,995 | | $ | 832,806 | | | $ | 1,037,459 | | $ | 1,022,013 | | $ | 1,021,827 |

| | | | | | | | | | |

Uninsured Deposits Information | | June 30, | March 31, | December 31, |

| | 2024 | 2024 | 2023 |

Total Deposits - C&N Bank | | $ | 2,074,806 | | $ | 2,012,167 | | $ | 2,030,909 | |

| | | | | | | | | | |

Estimated Total Uninsured Deposits | | $ | 605,765 | | $ | 568,085 | | $ | 592,206 | |

Portion of Uninsured Deposits that are | | | | | | | | | | |

Collateralized | | | 158,268 | | | 140,063 | | | 151,031 | |

Uninsured and Uncollateralized Deposits | | $ | 447,497 | | $ | 428,022 | | $ | 441,175 | |

| | | | | | | | | | |

Uninsured and Uncollateralized Deposits as | | | | | | | | | | |

a % of Total Deposits | | | 21.6 | % | | 21.3 | % | | 21.7 | % |

| | | | | | | | | | |

Available Funding from Credit Facilities | | $ | 813,606 | | $ | 806,995 | | $ | 832,806 | |

Fair Value of Available-for-sale Debt | | | | | | | | | | |

Securities in Excess of Pledging Obligations | | | 238,375 | | | 259,489 | | | 256,058 | |

Highly Liquid Available Funding | | $ | 1,051,981 | | $ | 1,066,484 | | $ | 1,088,864 | |

| | | | | | | | | | |

Highly Liquid Available Funding as a % of | | | | | | | | | | |

Uninsured Deposits | | | 173.7 | % | | 187.7 | % | | 183.9 | % |

| | | | | | | | | | |

Highly Liquid Available Funding as a % of | | | | | | | | | | |

Uninsured and Uncollateralized Deposits | | | 235.1 | % | | 249.2 | % | | 246.8 | % |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |