Company Announces $200 Million Share Repurchase

Program

Cirrus Logic, Inc. (Nasdaq: CRUS), a leader in high-performance,

low-power ICs for audio and voice signal processing applications,

today posted on its website at http://investor.cirrus.com the

quarterly Shareholder Letter that contains the complete financial

results for the third quarter fiscal year 2019, which ended Dec.

29, 2018, as well as the company’s current business outlook.

“Cirrus Logic reported revenue for the third quarter in line

with our revised expectations as we experienced the effects of the

turbulent macroeconomic environment and reduced demand for

smartphones,” said Jason Rhode, president and chief executive

officer. “Despite these challenges, we are encouraged to see

continued broad-based interest for low-latency, low-power signal

processing across a wide range of product categories. We are making

considerable investments in technologies addressing audio, voice

and other adjacent applications that we believe will fuel growth

opportunities in the coming years.”

Reported Financial Results – Third Quarter FY19

- Revenue of $324.3 million;

- GAAP and non-GAAP gross margin of 50.3

percent and 50.4 percent, respectively;

- GAAP operating expenses of $118.9

million and non-GAAP operating expenses of $100.3 million; and

- GAAP earnings per share of $0.49 and

non-GAAP earnings per share of $0.91.

A reconciliation of the non-GAAP charges is included in the

tables accompanying this press release.

Business Outlook – Fourth Quarter FY19

- Revenue is expected to range between

$200 million and $240 million;

- GAAP gross margin is expected to be

between 49 percent and 51 percent; and

- Combined GAAP R&D and SG&A

expenses are expected to range between $119 million and $125

million, which includes approximately $12 million in share-based

compensation and $7 million in amortization of acquired

intangibles.

Share Repurchase Authorization

The company also announced that its Board of Directors recently

authorized the repurchase of up to an additional $200 million of

the company's common stock, in addition to the $50 million

remaining from the Board’s previous share repurchase authorization

in January 2018. The repurchases will be funded from working

capital and anticipated cash from operations and may occur from

time to time depending on a variety of factors, including general

market and economic conditions and other corporate considerations.

The share repurchase program is designed to comply with all

applicable securities laws and may be suspended or discontinued at

any time without notice.

Cirrus Logic will host a live Q&A session at 5 p.m. EST

today to answer questions related to its financial results and

business outlook. Participants may listen to the conference call on

the Cirrus Logic website. Participants who would like to submit a

question to be addressed during the call are requested to email

investor.relations@cirrus.com. A replay of the webcast can be

accessed on the Cirrus Logic website approximately two hours

following its completion, or by calling (416) 621-4642, or

toll-free at (800) 585-8367 (Access Code: 9569708).

Cirrus Logic, Inc.

Cirrus Logic is a leader in high-performance,

low-power ICs for audio and voice signal processing applications.

Cirrus Logic’s products span the entire audio signal

chain, from capture to playback, providing

innovative products for the world’s top smartphones,

tablets, digital headsets, wearables and emerging smart home

applications. With headquarters in Austin, Texas, Cirrus Logic

is recognized globally for its award-winning corporate

culture. Check us out at www.cirrus.com.

Cirrus Logic and Cirrus are registered trademarks of Cirrus

Logic, Inc. All other company or product names noted herein may be

trademarks of their respective holders.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, Cirrus has provided non-GAAP financial information,

including non-GAAP net income, diluted earnings per share,

operating income and profit, operating expenses, gross margin and

profit, tax expense and tax expense impact on earnings per share. A

reconciliation of the adjustments to GAAP results is included in

the tables below. Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management

believes such information is useful to our investors for

informational and comparative purposes. In addition, certain

non-GAAP financial information is used internally by management to

evaluate and manage the company. The non-GAAP financial information

used by Cirrus Logic may differ from that used by other companies.

These non-GAAP measures should be considered in addition to, and

not as a substitute for, the results prepared in accordance with

GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements

including our statements about our future growth opportunities,

along with estimates for the fourth quarter fiscal year 2019

revenue, gross margin, combined research and development and

selling, general and administrative expense levels, share-based

compensation expense and amortization of acquired intangibles. In

some cases, forward-looking statements are identified by words such

as “expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” “intend,” and variations of these types

of words and similar expressions. In addition, any statements that

refer to our plans, expectations, strategies or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

based on our current expectations, estimates, and assumptions and

are subject to certain risks and uncertainties that could cause

actual results to differ materially. These risks and uncertainties

include, but are not limited to, the following: the level of orders

and shipments during the fourth quarter of fiscal year 2019,

customer cancellations of orders, or the failure to place orders

consistent with forecasts, along with the risk factors listed in

our Form 10-K for the year ended March 31, 2018 and in our other

filings with the Securities and Exchange Commission, which are

available at www.sec.gov. The foregoing information concerning our

business outlook represents our outlook as of the date of this news

release, and we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new developments

or otherwise.

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

(unaudited) (in thousands, except per share data)

Three Months Ended Nine Months Ended

Dec. 29, Sep. 29, Dec. 30, Dec.

29, Dec. 30, 2018 2018 2017

2018 2017 Q3'19 Q2'19 Q3'18

Q3'19 Q3'18 Portable audio products $ 288,640 $

324,049 $ 438,650 $ 824,950 $ 1,101,099 Non-portable audio and

other products 35,655 42,256

44,091 120,133 127,914

Net

sales 324,295 366,305

482,741 945,083

1,229,013 Cost of sales 161,115

181,186 247,653 472,225

620,927

Gross profit 163,180 185,119

235,088 472,858 608,086 Gross margin

50.3 % 50.5 % 48.7 %

50.0 % 49.5 % Research and

development 88,575 96,381 96,978 282,888 270,888 Selling, general

and administrative 30,364 33,160

34,604 96,308 95,504 Total

operating expenses 118,939 129,541

131,582 379,196 366,392

Income from operations 44,241 55,578

103,506 93,662 241,694 Interest income

(expense), net 1,740 1,525 912 4,712 2,231 U.K. pension settlement

(13,768 ) - - (13,768 ) - Other income (expense), net 101

(378 ) 322 (67 ) (813 )

Income before income taxes 32,314 56,725

104,740 84,539 243,112 Provision (benefit) for

income taxes 2,381 (1,448 ) 70,961

705 93,121

Net income

$ 29,933 $ 58,173

$ 33,779 $ 83,834

$ 149,991 Basic earnings per share: $

0.50 $ 0.96 $ 0.53 $ 1.39 $ 2.36 Diluted earnings per share: $ 0.49

$ 0.93 $ 0.52 $ 1.35 $ 2.26 Weighted average number of

shares: Basic 59,511 60,472 63,453 60,482 63,655 Diluted 60,783

62,431 65,557 62,076 66,377 Prepared in accordance with

Generally Accepted Accounting Principles

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL

INFORMATION (unaudited, in thousands, except per share

data) (not prepared in accordance with GAAP)

Non-GAAP financial information is not meant as a substitute

for GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. As a note, the non-GAAP financial information used by

Cirrus Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Three Months Ended Nine Months Ended

Dec. 29, Sep. 29, Dec. 30, Dec.

29, Dec. 30, 2018 2018 2017

2018 2017 Net Income Reconciliation

Q3'19

Q2'19 Q3'18 Q3'19 Q3'18 GAAP Net

Income $ 29,933 $ 58,173 $

33,779 $ 83,834 $ 149,991

Amortization of acquisition intangibles 7,630 12,867 11,600 33,763

34,800 Stock based compensation expense 11,181 13,131 12,512 37,106

36,207 U.K. pension settlement 13,768 - - 13,768 -

Acquisition-related items - - - - (4,048 ) Adjustment to income

taxes (7,003 ) (17,054 ) 46,273

(27,983 ) 31,756

Non-GAAP Net Income $

55,509 $ 67,117 $

104,164 $ 140,488 $

248,706 Earnings Per Share Reconciliation

GAAP Diluted earnings per share $ 0.49

$ 0.93 $ 0.52 $ 1.35

$ 2.26 Effect of Amortization of acquisition

intangibles 0.13 0.21 0.18 0.54 0.52 Effect of Stock based

compensation expense 0.18 0.21 0.19 0.60 0.55 Effect of U.K.

pension settlement 0.23 - - 0.22 - Effect of Acquisition-related

items - - - - (0.06 ) Effect of Adjustment to income taxes

(0.12 ) (0.27 ) 0.70 (0.45 )

0.48

Non-GAAP Diluted earnings per share $

0.91 $ 1.08 $ 1.59

$ 2.26 $ 3.75

Operating Income Reconciliation

GAAP Operating Income

$ 44,241 $ 55,578 $

103,506 $ 93,662 $ 241,694 GAAP

Operating Profit 14 % 15 % 21 % 10 % 20 % Amortization of

acquisition intangibles 7,630 12,867 11,600 33,763 34,800 Stock

compensation expense - COGS 220 170 386 589 1,052 Stock

compensation expense - R&D 6,761 6,834 6,995 20,845 19,289

Stock compensation expense - SG&A 4,200 6,127 5,131 15,672

15,866 Acquisition-related items - -

- - (4,048 )

Non-GAAP

Operating Income $ 63,052 $

81,576 $ 127,618 $

164,531 $ 308,653 Non-GAAP

Operating Profit 19 % 22 % 26 % 17 % 25 % Operating Expense

Reconciliation

GAAP Operating Expenses $

118,939 $ 129,541 $ 131,582

$ 379,196 $ 366,392 Amortization of

acquisition intangibles (7,630 ) (12,867 ) (11,600 ) (33,763 )

(34,800 ) Stock compensation expense - R&D (6,761 ) (6,834 )

(6,995 ) (20,845 ) (19,289 ) Stock compensation expense - SG&A

(4,200 ) (6,127 ) (5,131 ) (15,672 ) (15,866 ) Acquisition-related

items - - - -

4,048

Non-GAAP Operating Expenses

$ 100,348 $ 103,713

$ 107,856 $ 308,916

$ 300,485 Gross Margin/Profit

Reconciliation

GAAP Gross Profit $ 163,180

$ 185,119 $ 235,088 $

472,858 $ 608,086 GAAP Gross Margin 50.3 %

50.5 % 48.7 % 50.0 % 49.5 % Stock compensation expense - COGS

220 170 386 589

1,052

Non-GAAP Gross Profit $

163,400 $ 185,289 $

235,474 $ 473,447 $

609,138 Non-GAAP Gross Margin 50.4 % 50.6 % 48.8 %

50.1 % 49.6 % Effective Tax Rate Reconciliation

GAAP Tax

Expense (Benefit) $ 2,381 $ (1,448

) $ 70,961 $ 705 $

93,121 GAAP Effective Tax Rate 7.4 % -2.6 % 67.7 % 0.8 %

38.3 % Adjustments to income taxes 7,003

17,054 (46,273 ) 27,983 (31,756

)

Non-GAAP Tax Expense $ 9,384 $

15,606 $ 24,688 $

28,688 $ 61,365 Non-GAAP

Effective Tax Rate 14.5 % 18.9 % 19.2 % 17.0 % 19.8 % Tax

Impact to EPS Reconciliation

GAAP Tax Expense (Benefit)

$ 0.04 $ (0.02 ) $

1.08 $ 0.01 $ 1.40 Adjustments

to income taxes 0.12 0.27 (0.70

) 0.45 (0.48 )

Non-GAAP Tax Expense

$ 0.16 $ 0.25 $

0.38 $ 0.46 $ 0.92

CIRRUS LOGIC, INC. CONSOLIDATED

CONDENSED BALANCE SHEET unaudited; in thousands

Dec. 29, Mar. 31,

Dec. 30, 2018 2018 2017 ASSETS Current

assets Cash and cash equivalents $ 219,319 $ 235,604 $ 226,640

Marketable securities 59,793 26,397 12,822 Accounts receivable, net

142,135 100,801 217,619 Inventories 167,879 205,760 192,967 Other

current assets 51,151 45,112

29,445 Total current Assets 640,277 613,674 679,493

Long-term marketable securities 165,063 172,499 173,717 Property

and equipment, net 191,324 191,154 187,143 Intangibles, net 76,389

111,547 126,183 Goodwill 286,678 288,718 288,481 Deferred tax asset

13,131 14,716 16,467 Other assets 24,003

37,809 21,841 Total assets $ 1,396,865

$ 1,430,117 $ 1,493,325 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities Accounts payable $ 108,022

$ 69,850 $ 116,274 Accrued salaries and benefits 23,566 35,721

29,543 Other accrued liabilities 38,175 34,638

29,903 Total current liabilities 169,763

140,209 175,720 Non-current income taxes 78,532 92,753

54,652 Other long-term liabilities 18,769 35,427 51,587

Stockholders' equity: Capital stock 1,349,941 1,312,434 1,301,800

Accumulated deficit (217,871 ) (139,345 ) (92,402 ) Accumulated

other comprehensive income (loss) (2,269 ) (11,361 )

1,968 Total stockholders' equity 1,129,801

1,161,728 1,211,366 Total

liabilities and stockholders' equity $ 1,396,865 $ 1,430,117

$ 1,493,325 Prepared in accordance with

Generally Accepted Accounting Principles

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190130005590/en/

Thurman K. CaseChief Financial OfficerCirrus Logic, Inc.(512)

851-4125Investor.Relations@cirrus.com

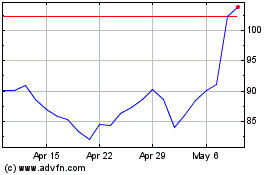

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

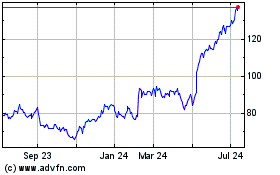

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024