Company Continues to Expect a Return to Growth

in FY20

Cirrus Logic, Inc. (Nasdaq: CRUS), a leader in high performance,

low-power ICs for audio and voice signal processing applications,

today posted on its website at http://investor.cirrus.com the

quarterly Shareholder Letter that contains the complete financial

results for the second quarter fiscal year 2019, which ended Sep.

29, 2018, as well as the company’s current business outlook.

“Cirrus Logic delivered Q2 revenue significantly above guidance

as we experienced solid demand for our portable audio components

ahead of customer product launches,” said Jason Rhode, president

and chief executive officer. “While we are pleased with our

results, we remain focused on executing on our product roadmap and

expanding share with new and existing customers. As we move into

FY20, we believe the company is well positioned to capitalize on

the increasing demand for compelling audio, voice and haptic

products which we expect to contribute to our return to

year-over-year revenue growth.”

Reported Financial Results – Second Quarter FY19

- Revenue of $366.3 million;

- GAAP and non-GAAP gross margin of 50.5

percent and 50.6 percent, respectively;

- GAAP operating expenses of $129.5

million and non-GAAP operating expenses of $103.7 million; and

- GAAP earnings per share of $0.93 and

non-GAAP earnings per share of $1.08.

A reconciliation of the non-GAAP charges is included in the

tables accompanying this press release.

Business Outlook – Third Quarter FY19

- Revenue is expected to range between

$360 million and $400 million;

- GAAP gross margin is expected to be

between 49 percent and 51 percent; and

- Combined GAAP R&D and SG&A

expenses are expected to range between $122 million and $128

million, which includes approximately $12 million in share-based

compensation and $8 million in amortization of acquired

intangibles.

Cirrus Logic will host a live Q&A session at 5:30 p.m. EDT

today to answer questions related to its financial results and

business outlook. Participants may listen to the conference call on

the Cirrus Logic website. Participants who would like to submit a

question to be addressed during the call are requested to email

investor.relations@cirrus.com. A replay of the webcast can be

accessed on the Cirrus Logic website approximately two hours

following its completion, or by calling (416) 621-4642, or

toll-free at (800) 585-8367 (Access Code: 9875228).

Cirrus Logic, Inc.

Cirrus Logic is a leader in high performance,

low-power ICs for audio and voice signal processing applications.

Cirrus Logic’s products span the entire audio signal

chain, from capture to playback, providing

innovative products for the world’s top smartphones,

tablets, digital headsets, wearables and emerging smart home

applications. With headquarters in Austin, Texas, Cirrus Logic

is recognized globally for its award-winning corporate

culture. Check us out at www.cirrus.com.

Cirrus Logic and Cirrus are registered trademarks of Cirrus

Logic, Inc. All other company or product names noted herein may be

trademarks of their respective holders.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, Cirrus has provided non-GAAP financial information,

including non-GAAP net income, diluted earnings per share, diluted

share count, operating income and profit, operating expenses, gross

margin and profit, tax expense and tax expense impact on earnings

per share. A reconciliation of the adjustments to GAAP results is

included in the tables below. Non-GAAP financial information is not

meant as a substitute for GAAP results, but is included because

management believes such information is useful to our investors for

informational and comparative purposes. In addition, certain

non-GAAP financial information is used internally by management to

evaluate and manage the company. The non-GAAP financial information

used by Cirrus Logic may differ from that used by other companies.

These non-GAAP measures should be considered in addition to, and

not as a substitute for, the results prepared in accordance with

GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements

including our statements about our future growth opportunities, our

ability to expand share with new and existing customers, our

expectations with respect to our ability to capitalize on

increasing demand for compelling audio, voice and haptic products,

our ability to return to year-over-year revenue growth, along with

estimates for the third quarter fiscal year 2019 revenue, gross

margin, combined research and development and selling, general and

administrative expense levels, share-based compensation expense and

amortization of acquired intangibles. In some cases,

forward-looking statements are identified by words such as

“expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” “intend,” and variations of these types

of words and similar expressions. In addition, any statements that

refer to our plans, expectations, strategies or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

based on our current expectations, estimates, and assumptions and

are subject to certain risks and uncertainties that could cause

actual results to differ materially. These risks and uncertainties

include, but are not limited to, the following: the level of orders

and shipments during the third quarter and remainder of fiscal year

2019, customer cancellations of orders, or the failure to place

orders consistent with forecasts, along with the timing and success

of new product ramps and the extent to which customers adopt our

new technologies and devices in new markets such as haptics; and

the risk factors listed in our Form 10-K for the year ended March

31, 2018 and in our other filings with the Securities and Exchange

Commission, which are available at www.sec.gov. The foregoing

information concerning our business outlook represents our outlook

as of the date of this news release, and we undertake no obligation

to update or revise any forward-looking statements, whether as a

result of new developments or otherwise.

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

(unaudited) (in thousands, except per share data)

Three Months Ended

Six Months Ended

Sep. 29, Jun. 30, Sep. 23, Sep. 29,

Sep. 23, 2018 2018 2017 2018

2017 Q2'19 Q1'19 Q2'18 Q2'19

Q2'18 Portable audio products $ 324,049 $ 212,260 $ 381,761

$ 536,309 $ 662,449 Non-portable audio and other products

42,256 42,223 43,776

84,479 83,823

Net sales

366,305 254,483

425,537 620,788

746,272 Cost of sales 181,186

129,924 214,255 311,110

373,274

Gross profit 185,119 124,559

211,282 309,678 372,998 Gross margin

50.5 % 48.9 % 49.7 %

49.9 % 50.0 % Research and

development 96,381 97,932 90,353 194,313 173,910 Selling, general

and administrative 33,160 32,784

30,041 65,944 60,900 Total

operating expenses 129,541 130,716

120,394 260,257 234,810

Income (loss) from operations 55,578

(6,157 ) 90,888 49,421 138,188

Interest income (expense), net 1,525 1,447 725 2,972 1,319

Other income (expense), net (378 ) 210

(1,116 ) (168 ) (1,135 )

Income (loss) before

income taxes 56,725 (4,500 ) 90,497

52,225 138,372 Provision (benefit) for income taxes

(1,448 ) (228 ) 17,197 (1,676 )

22,160

Net income (loss) $

58,173 $ (4,272 ) $

73,300 $ 53,901 $

116,212 Basic earnings (loss) per share: $

0.96 $ (0.07 ) $ 1.16 $ 0.88 $ 1.82 Diluted earnings (loss) per

share: $ 0.93 $ (0.07 ) $ 1.10 $ 0.86 $ 1.74 Weighted

average number of shares: Basic 60,472 61,462 63,431 60,967 63,764

Diluted 62,431 61,462 66,360 62,810 66,761

Prepared in accordance with Generally

Accepted Accounting Principles

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL

INFORMATION (unaudited, in thousands, except per share

data) (not prepared in accordance with GAAP)

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. As a note, the non-GAAP financial information used by

Cirrus Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Three Months Ended Six

Months Ended Sep. 29, Jun. 30,

Sep. 23, Sep. 29, Sep.

23, 2018 2018 2017 2018 2017

Net Income Reconciliation

Q2'19 Q1'19 Q2'18

Q2'19 Q2'18 GAAP Net Income (Loss) $

58,173 $ (4,272 ) $

73,300 $ 53,901 $ 116,212

Amortization of acquisition intangibles 12,867 13,266 11,600 26,133

23,200 Stock based compensation expense 13,131 12,794 12,292 25,925

23,695 Acquisition-related items - - - - (4,048 ) Adjustment to

income taxes (17,054 ) (3,926 ) (7,260 )

(20,980 ) (14,517 )

Non-GAAP Net Income

$ 67,117 $ 17,862

$ 89,932 $ 84,979

$ 144,542 Earnings Per Share

Reconciliation

GAAP Diluted earnings (loss) per share

$ 0.93 $ (0.07 ) $

1.10 $ 0.86 $ 1.74 Effect of

Amortization of acquisition intangibles 0.21 0.21 0.18 0.42 0.35

Effect of Stock based compensation expense 0.21 0.20 0.19 0.41 0.36

Effect of Acquisition-related items - - - - (0.06 ) Effect of

Adjustment to income taxes (0.27 ) (0.06 )

(0.11 ) (0.34 ) (0.22 )

Non-GAAP Diluted earnings

per share $ 1.08 $ 0.28

$ 1.36 $ 1.35

$ 2.17 Diluted Shares Reconciliation

GAAP Diluted shares 62,431 61,462

66,360 62,810 66,761 Effect of weighted

dilutive shares - 1,723 -

- -

Non-GAAP Diluted shares

62,431 63,185

66,360 62,810

66,761 Operating Income Reconciliation

GAAP

Operating Income (Loss) $ 55,578 $

(6,157 ) $ 90,888 $

49,421 $ 138,188 GAAP Operating Profit (Loss)

15 % -2 % 21 % 8 % 19 % Amortization of acquisition intangibles

12,867 13,266 11,600 26,133 23,200 Stock compensation expense -

COGS 170 199 328 369 666 Stock compensation expense - R&D 6,834

7,250 6,034 14,084 12,294 Stock compensation expense - SG&A

6,127 5,345 5,930 11,472 10,735 Acquisition-related items -

- - -

(4,048 )

Non-GAAP Operating Income $ 81,576

$ 19,903 $ 114,780

$ 101,479 $ 181,035

Non-GAAP Operating Profit 22 % 8 % 27 % 16 % 24 % Operating

Expense Reconciliation

GAAP Operating Expenses $

129,541 $ 130,716 $ 120,394

$ 260,257 $ 234,810 Amortization of

acquisition intangibles (12,867 ) (13,266 ) (11,600 ) (26,133 )

(23,200 ) Stock compensation expense - R&D (6,834 ) (7,250 )

(6,034 ) (14,084 ) (12,294 ) Stock compensation expense - SG&A

(6,127 ) (5,345 ) (5,930 ) (11,472 ) (10,735 ) Acquisition-related

items - - - -

4,048

Non-GAAP Operating Expenses

$ 103,713 $ 104,855

$ 96,830 $ 208,568

$ 192,629 Gross Margin/Profit

Reconciliation

GAAP Gross Profit $ 185,119

$ 124,559 $ 211,282 $

309,678 $ 372,998 GAAP Gross Margin 50.5 %

48.9 % 49.7 % 49.9 % 50.0 % Stock compensation expense - COGS

170 199 328 369

666

Non-GAAP Gross Profit $

185,289 $ 124,758 $

211,610 $ 310,047 $

373,664 Non-GAAP Gross Margin 50.6 % 49.0 % 49.7 %

49.9 % 50.1 % Effective Tax Rate Reconciliation

GAAP Tax

Expense (Benefit) $ (1,448 ) $

(228 ) $ 17,197 $ (1,676

) $ 22,160 GAAP Effective Tax Rate -2.6 % 5.1

% 19.0 % -3.2 % 16.0 % Adjustments to income taxes 17,054

3,926 7,260 20,980

14,517

Non-GAAP Tax Expense $

15,606 $ 3,698 $

24,457 $ 19,304 $

36,677 Non-GAAP Effective Tax Rate 18.9 % 17.2 % 21.4

% 18.5 % 20.2 % Tax Impact to EPS Reconciliation

GAAP Tax

Expense (Benefit) $ (0.02 ) $

- $ 0.26 $ (0.03 )

$ 0.33 Adjustments to income taxes 0.27

0.06 0.11 0.34

0.22

Non-GAAP Tax Expense $ 0.25

$ 0.06 $ 0.37 $

0.31 $ 0.55

CONSOLIDATED CONDENSED BALANCE SHEET unaudited; in

thousands Sep. 29, Mar.

31, Sep. 23, 2018 2018 2017 ASSETS

Current assets Cash and cash equivalents $ 195,857 $ 235,604 $

180,198 Marketable securities 48,701 26,397 15,446 Accounts

receivable, net 206,789 100,801 232,380 Inventories 142,315 205,760

210,791 Other current assets 48,910 45,112

31,185 Total current Assets 642,572 613,674

670,000 Long-term marketable securities 151,207 172,499

133,547 Property and equipment, net 193,218 191,154 177,523

Intangibles, net 86,769 111,547 131,235 Goodwill 287,368 288,718

289,248 Deferred tax asset 13,733 14,716 30,511 Other assets

29,527 37,809 23,703 Total

assets $ 1,404,394 $ 1,430,117 $ 1,455,767

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities

Accounts payable $ 88,473 $ 69,850 $ 131,125 Accrued salaries and

benefits 30,154 35,721 35,651 Other accrued liabilities

37,275 34,638 24,414

Total current liabilities

155,902 140,209 191,190 Non-current income taxes 79,127

92,753 51,830 Other long-term liabilities 26,390 35,427 12,831

Stockholders' equity: Capital stock 1,338,586 1,312,434

1,288,669 Accumulated deficit (182,453 ) (139,345 ) (92,180 )

Accumulated other comprehensive income (loss) (13,158 )

(11,361 ) 3,427 Total stockholders' equity

1,142,975 1,161,728 1,199,916

Total liabilities and stockholders' equity $ 1,404,394

$ 1,430,117 $ 1,455,767

Prepared in accordance with Generally

Accepted Accounting Principles

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181101005897/en/

Cirrus Logic, Inc.Thurman K. Case, 512-851-4125Chief Financial

OfficerInvestor.Relations@cirrus.com

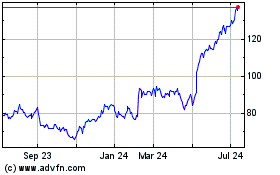

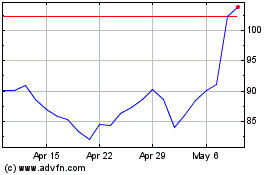

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024