SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

______________

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): October

22, 2015

|

|

CIRRUS

LOGIC, INC.

|

|

|

(Exact

name of Registrant as specified in its charter)

|

|

Delaware

|

|

0-17795

|

|

77-0024818

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

800 West 6th Street, Austin, TX

|

|

|

78701

|

|

|

(Address

of Principal Executive Offices)

|

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (512)

851-4000

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

⃞

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

⃞

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

⃞

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

⃞

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On October 28, 2015, the Company issued a press release announcing its

results for its second quarter and first six months of fiscal year

2016. The full text of the press release is furnished as Exhibit No.

99.1 to this Current Report on Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangement of

Certain Officers.

On October 22, 2015, as part of its annual review of executive

compensation, the Compensation Committee (the “Committee”) of the Board

of Directors of Cirrus Logic, Inc. approved the following equity grants

for the Company’s named executive officers:

|

Named Executive

Officer

|

Position

|

Stock Option

Awards

|

Restricted Stock

Unit Awards

|

Performance-based Restricted

Stock Units

|

|

Jason P. Rhode

|

President and Chief Executive Officer

|

126,263

|

41,667

|

31,328

|

|

Thurman K. Case

|

Chief Financial Officer, Principal Accounting Officer

|

21,780

|

7,188

|

5,404

|

|

Andrew Brannan

|

Vice President, Worldwide Sales

|

20,833

|

6,875

|

5,169

|

|

Rashpal Sahota

|

Vice President and Audio General Manager, Cirrus Logic International

|

20,833

|

6,875

|

5,169

|

The price of the stock option awards will be set at the closing price on

the Company’s stock on the Company’s regularly scheduled monthly grant

date of November 4, 2015. The options will have a term of ten years and

25% will vest one year from the grant date, and the remaining options

will vest 1/36th monthly thereafter until fully vested after four

years. The restricted stock unit awards will also be granted on

November 4, 2015, and 100% of the shares underlying the restricted stock

unit awards will vest on the third anniversary of the grant date.

In addition, the Company has decided to expand the use of

Performance-based Restricted Stock Units (“PBRSUs”) this year to all of

the Company’s Named Executive Officers. The Committee believes that the

use of PBRSUs will further promote the achievement of our long-term

strategic and operational objectives by strengthening the link of our

Named Executive Officers’ compensation to stockholder value

creation. In particular, the PBRSUs awarded in 2015 compare our total

stockholder return (“TSR”) over a three-year performance period

(commencing at the date of grant, November 4, 2015) against the TSR of

companies comprising an established technology sector index (the

Philadelphia Semiconductor Index). The total shares awarded pursuant to

the PBRSUs at the end of the three-year performance period will be

determined based on our TSR performance over such period relative to the

TSR of members of that index. If the Company’s percentile rank at the

end of the three-year period is below the 25th percentile, no shares

will be awarded. A payment equal to or above the target units can only

be earned if our percentile rank of TSR is equal to or exceeds the 50th

percentile of the companies comprising the members of the Philadelphia

Semiconductor Index. If the Company’s percentile rank at the end of the

three-year vest period is at the 75th percentile or above, the number of

shares that will be awarded will be 200% of the target units. At the

25th percentile, the number of shares that will be awarded will be 25%

of the target units. Percentage payout of the number of shares awarded

will be interpolated between these points based on the Company’s

relative TSR. For example, if the Company’s relative TSR performance is

at the 60th percentile of the companies comprising the Philadelphia

Semiconductor Index at the time the awards vest, then the Company will

pay out 140% of the target units. In addition, the total share payout

is capped at a 100% percent payout when the Company’s TSR is negative.

All equity awards are subject to continued service through each vesting

date.

Based on the Committee’s assessment of the compensation at peer

companies, the Company’s performance over the previous twelve months,

and other factors as described in the Company’s most recent proxy

statement, the Committee approved the above equity grants. The Committee

further weighted the relative value of each of the these long term

equity awards generally as one-third RSU’s, one third stock options, and

one third PRBRUs based on an estimated expense for each type of award.

Item 7.01 Regulation FD.

On October 28, 2015, in addition to issuing a press release, the Company

posted on its website a shareholder letter to investors summarizing the

financial results for its second quarter and first six months of fiscal

year 2016. The full text of the shareholder letter is furnished as

Exhibit No. 99.2 to this Current Report on Form 8-K.

Item 8.01 Other Events.

On October 28, 2015, the Company announced that the Cirrus Logic Board

of Directors authorized a share repurchase program of up to $200 million

of the company’s common stock. The repurchases are expected to be funded

from working capital and anticipated cash from operations, and may occur

from time to time depending on general market and economic

conditions. The timing of the repurchases and the actual amount

purchased will depend on a variety of factors including the market price

of the company's shares, general market and economic conditions, and

other corporate considerations. The share repurchase program is

designed to comply with all applicable securities laws, and may be

suspended or discontinued at any time without notice.

A copy of the press release announcing the share repurchase program is

attached to this Form 8-K as Exhibit 99.1.

Use of Non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP

basis, Cirrus has provided certain non-GAAP financial information,

including operating expenses, net income, income from operations,

operating margin and diluted earnings per share. A reconciliation of the

adjustments to GAAP results is included in the tables to the press

release furnished as Exhibit No. 99.1 to this Current Report on Form

8-K. Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and comparative

purposes. In addition, certain non-GAAP financial information is used

internally by management to evaluate and manage the company. As a note,

the non-GAAP financial information used by Cirrus Logic may differ from

that used by other companies. These non-GAAP measures should be

considered in addition to, and not as a substitute for, the results

prepared in accordance with GAAP.

The information contained in Items 2.02, 7.01, and 9.01 in this Current

Report on Form 8-K and the exhibits furnished hereto contain

forward-looking statements regarding the Company and cautionary

statements identifying important factors that could cause actual results

to differ materially from those anticipated. In addition, this

information shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of that section, nor shall they be

deemed incorporated by reference in any filing under the Securities Act

of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

|

|

(d) Exhibits

|

|

|

|

|

|

|

Exhibit

|

Description

|

|

|

|

|

|

|

Exhibit 99.1

|

Cirrus Logic, Inc. press release dated October 28, 2015

|

|

|

Exhibit 99.2

|

Cirrus Logic, Inc. shareholder letter dated October 28, 2015

|

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, Registrant has

duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

|

|

CIRRUS LOGIC, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

October 28, 2015

|

By:

|

/s/ Thurman K. Case

|

|

|

|

|

|

Name: Thurman K. Case

|

|

|

|

|

|

Title: Chief Financial Officer

|

|

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

|

|

|

99.1

|

Registrant’s press release dated October 28, 2015

|

|

99.2

|

Cirrus Logic, Inc. shareholder letter dated October 28, 2015

|

Exhibit 99.1

Cirrus

Logic Reports Q2 Revenue of $306.8 Million

Company

Expects Significant Year Over Year Growth in Q3 and Announces Additional

$200 Million Share Repurchase Authorization

AUSTIN, Texas--(BUSINESS WIRE)--October 28, 2015--Cirrus Logic, Inc.

(Nasdaq: CRUS), a leader in high-precision analog and digital

signal processing products, today posted on its investor relations

website at http://investor.cirrus.com the quarterly Shareholder

Letter that contains the complete financial results for the second

quarter fiscal year 2016, which ended Sept. 26, 2015, as well as the

company’s current business outlook.

“We are pleased with our results for the September quarter as strong

demand for our smart codecs and amplifiers fueled sequential and

year-over-year growth,” said Jason Rhode, president and chief executive

officer. “FY16 has been a great year for Cirrus Logic as share gains and

content increases have driven strong growth. We are excited by the

progress we made this past quarter toward the strategic initiatives that

are expected to drive continued growth in FY17.”

Reported Financial Results – Second Quarter FY16

-

Revenue of $306.8 million;

-

GAAP gross margin of 46.4 percent and non-GAAP gross margin of 46.5

percent;

-

GAAP operating expenses of $98.1 million; non-GAAP operating expenses

of $80.9 million; and

-

GAAP diluted earnings per share of $0.53 and non-GAAP diluted earnings

per share of $0.65.

A reconciliation of the non-GAAP charges is included in the tables

accompanying this press release.

Business Outlook – Third Quarter FY16

-

Revenue is expected to range between $370 million and $400 million;

-

GAAP gross margin is expected to be between 46 percent and 48 percent;

and

-

Combined GAAP R&D and SG&A expenses are expected to range between $100

million and $104 million, which includes approximately $8 million in

share-based compensation and $8 million in amortization of acquired

intangibles.

Share Repurchase Authorization

The company also announced that its Board of Directors has authorized

the repurchase of up to an additional $200 million of the company's

common stock, in addition to the $32.5 million remaining from the

Board’s previous share repurchase authorization in November 2012. The

repurchases will be funded from working capital and anticipated cash

from operations and may occur from time to time depending on a variety

of factors, including the market price of the company's shares, general

market and economic conditions and other corporate considerations. The

share repurchase program is designed to comply with all applicable

securities laws, and may be suspended or discontinued at any time

without notice.

Cirrus Logic will host a live Q&A session at 5 p.m. EDT today to answer

questions related to its financial results and business outlook.

Participants may listen to the conference call on the Cirrus Logic

website. Participants who would like to submit a question to be

addressed during the call are requested to email investor.relations@cirrus.com.

A replay of the webcast can be accessed on the Cirrus Logic website

approximately two hours following its completion, or by calling (404)

537-3406, or toll-free at (855) 859-2056 (Access Code: 75505782).

Cirrus Logic, Inc.

Cirrus Logic develops high-precision, analog and mixed-signal integrated

circuits for a broad range of innovative customers. Building on its

diverse analog and signal-processing patent portfolio, Cirrus Logic

delivers highly optimized products for a variety of audio, industrial

and energy-related applications. The company operates from headquarters

in Austin, Texas, with offices in the United States, United Kingdom,

Australia, Japan and Asia. More information about Cirrus Logic is

available at www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a GAAP

basis, Cirrus has provided non-GAAP financial information, including

gross margins, operating expenses, net income, operating profit and

income, tax expenses, effective tax rate and diluted earnings per share.

A reconciliation of the adjustments to GAAP results is included in the

tables below. Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management believes

such information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage the

company. The non-GAAP financial information used by Cirrus Logic may

differ from that used by other companies. These non-GAAP measures

should be considered in addition to, and not as a substitute for, the

results prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters set

forth in this news release contain forward-looking statements, including

future growth opportunities and our estimates of third quarter fiscal

year 2016 revenue, gross margin, combined research and development and

selling, general and administrative expense levels, share-based

compensation expense and amortization of acquired intangibles. In some

cases, forward-looking statements are identified by words such as

“expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” “intend,” and variations of these types of

words and similar expressions. In addition, any statements that

refer to our plans, expectations, strategies or other characterizations

of future events or circumstances are forward-looking statements. These

forward-looking statements are based on our current expectations,

estimates and assumptions and are subject to certain risks and

uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, but are not limited to, the

following: the level of orders and shipments during the third quarter of

fiscal year 2016, as well as customer cancellations of orders, or the

failure to place orders consistent with forecasts; and the risk factors

listed in our Form 10-K for the year ended March 28, 2015, and in our

other filings with the Securities and Exchange Commission, which are

available at www.sec.gov. The foregoing information concerning

our business outlook represents our outlook as of the date of this news

release, and we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new developments or

otherwise.

Cirrus Logic and Cirrus are registered trademarks of Cirrus Logic, Inc.

All other company or product names noted herein may be trademarks of

their respective holders.

Summary financial data follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

|

|

(unaudited)

|

|

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

Six Months Ended

|

|

|

|

|

Sep. 26,

|

|

Jun. 27,

|

|

Sep. 27,

|

|

|

Sep. 26,

|

|

Sep. 27,

|

|

|

|

|

2015

|

|

2015

|

|

2014

|

|

|

2015

|

|

2014

|

|

|

|

|

Q2'16

|

|

Q1'16

|

|

Q2'15

|

|

|

Q2'16

|

|

Q2'15

|

|

Portable audio products

|

|

|

$

|

257,152

|

|

|

$

|

235,866

|

|

|

$

|

163,563

|

|

|

|

$

|

493,018

|

|

|

$

|

276,133

|

|

|

Non-portable audio and other products

|

|

|

|

49,604

|

|

|

|

46,767

|

|

|

|

46,651

|

|

|

|

|

96,371

|

|

|

|

86,646

|

|

|

Net sales

|

|

|

|

306,756

|

|

|

|

282,633

|

|

|

|

210,214

|

|

|

|

|

589,389

|

|

|

|

362,779

|

|

|

Cost of sales

|

|

|

|

164,535

|

|

|

|

150,179

|

|

|

|

109,647

|

|

|

|

|

314,714

|

|

|

|

186,837

|

|

|

Gross profit

|

|

|

|

142,221

|

|

|

|

132,454

|

|

|

|

100,567

|

|

|

|

|

274,675

|

|

|

|

175,942

|

|

|

Gross margin

|

|

|

|

46.4

|

%

|

|

|

46.9

|

%

|

|

|

47.8

|

%

|

|

|

|

46.6

|

%

|

|

|

48.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

|

67,258

|

|

|

|

65,835

|

|

|

|

44,557

|

|

|

|

|

133,093

|

|

|

|

84,334

|

|

|

Selling, general and administrative

|

|

|

|

30,103

|

|

|

|

29,119

|

|

|

|

21,545

|

|

|

|

|

59,222

|

|

|

|

41,228

|

|

|

Acquisition related costs

|

|

|

|

-

|

|

|

|

-

|

|

|

|

14,937

|

|

|

|

|

-

|

|

|

|

14,937

|

|

|

Restructuring and other

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,455

|

|

|

|

|

-

|

|

|

|

1,455

|

|

|

Patent agreement and other

|

|

|

|

752

|

|

|

|

(12,500

|

)

|

|

|

-

|

|

|

|

|

(11,748

|

)

|

|

|

-

|

|

|

Total operating expenses

|

|

|

|

98,113

|

|

|

|

82,454

|

|

|

|

82,494

|

|

|

|

|

180,567

|

|

|

|

141,954

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

|

44,108

|

|

|

|

50,000

|

|

|

|

18,073

|

|

|

|

|

94,108

|

|

|

|

33,988

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

|

(601

|

)

|

|

|

(638

|

)

|

|

|

(2,670

|

)

|

|

|

|

(1,239

|

)

|

|

|

(3,137

|

)

|

|

Other income (expense), net

|

|

|

|

(524

|

)

|

|

|

136

|

|

|

|

(11,994

|

)

|

|

|

|

(388

|

)

|

|

|

(11,493

|

)

|

|

Income before income taxes

|

|

|

|

42,983

|

|

|

|

49,498

|

|

|

|

3,409

|

|

|

|

|

92,481

|

|

|

|

19,358

|

|

|

Provision for income taxes

|

|

|

|

8,103

|

|

|

|

16,144

|

|

|

|

2,557

|

|

|

|

|

24,247

|

|

|

|

8,258

|

|

|

Net income

|

|

|

$

|

34,880

|

|

|

$

|

33,354

|

|

|

$

|

852

|

|

|

|

$

|

68,234

|

|

|

$

|

11,100

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share:

|

|

|

$

|

0.55

|

|

|

$

|

0.53

|

|

|

$

|

0.01

|

|

|

|

$

|

1.08

|

|

|

$

|

0.18

|

|

|

Diluted earnings per share:

|

|

|

$

|

0.53

|

|

|

$

|

0.50

|

|

|

$

|

0.01

|

|

|

|

$

|

1.03

|

|

|

$

|

0.17

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

63,346

|

|

|

|

63,274

|

|

|

|

62,241

|

|

|

|

|

63,310

|

|

|

|

62,137

|

|

|

Diluted

|

|

|

|

66,329

|

|

|

|

66,410

|

|

|

|

65,085

|

|

|

|

|

66,378

|

|

|

|

64,892

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepared in accordance with Generally Accepted Accounting

Principles

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

|

|

(unaudited, in thousands, except per share data)

|

|

(not prepared in accordance with GAAP)

|

|

|

|

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. As a note, the non-GAAP financial information used by

Cirrus Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Certain modifications to prior year non-GAAP presentation has been

made and had no material effect on the results of operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Six Months Ended

|

|

|

|

|

Sep. 26,

|

|

Jun. 27,

|

|

Sep. 27,

|

|

Sep. 26,

|

|

Sep. 27,

|

|

|

|

|

2015

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

Net Income Reconciliation

|

|

|

Q2'16

|

|

Q1'16

|

|

Q2'15

|

|

Q2'16

|

|

Q2'15

|

|

GAAP Net Income

|

|

|

$

|

34,880

|

|

|

$

|

33,354

|

|

|

$

|

852

|

|

|

$

|

68,234

|

|

|

$

|

11,100

|

|

|

Amortization of acquisition intangibles

|

|

|

|

8,133

|

|

|

|

7,141

|

|

|

|

2,524

|

|

|

|

15,274

|

|

|

|

2,770

|

|

|

Stock based compensation expense

|

|

|

|

8,688

|

|

|

|

8,271

|

|

|

|

6,496

|

|

|

|

16,959

|

|

|

|

12,118

|

|

|

Patent agreement and other

|

|

|

|

752

|

|

|

|

(12,500

|

)

|

|

|

-

|

|

|

|

(11,748

|

)

|

|

|

-

|

|

|

Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,455

|

|

|

|

-

|

|

|

|

1,455

|

|

|

Wolfson acquisition items

|

|

|

|

-

|

|

|

|

-

|

|

|

|

30,875

|

|

|

|

-

|

|

|

|

33,179

|

|

|

Adjustments to income tax

|

|

|

|

(9,492

|

)

|

|

|

(175

|

)

|

|

|

1,764

|

|

|

|

(9,667

|

)

|

|

|

6,990

|

|

|

Non-GAAP Net Income

|

|

|

$

|

42,961

|

|

|

$

|

36,091

|

|

|

$

|

43,966

|

|

|

$

|

79,052

|

|

|

$

|

67,612

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Diluted earnings per share

|

|

|

$

|

0.53

|

|

|

$

|

0.50

|

|

|

$

|

0.01

|

|

|

$

|

1.03

|

|

|

$

|

0.17

|

|

|

Effect of Amortization of acquisition intangibles

|

|

|

|

0.12

|

|

|

|

0.11

|

|

|

|

0.04

|

|

|

|

0.23

|

|

|

|

0.04

|

|

|

Effect of Stock based compensation expense

|

|

|

|

0.13

|

|

|

|

0.12

|

|

|

|

0.10

|

|

|

|

0.26

|

|

|

|

0.18

|

|

|

Effect of Patent agreement and other

|

|

|

|

0.01

|

|

|

|

(0.19

|

)

|

|

|

-

|

|

|

|

(0.18

|

)

|

|

|

-

|

|

|

Effect of Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0.03

|

|

|

|

-

|

|

|

|

0.02

|

|

|

Effect of Wolfson acquisition items

|

|

|

|

-

|

|

|

|

-

|

|

|

|

0.47

|

|

|

|

-

|

|

|

|

0.50

|

|

|

Effect of Adjustments to income tax

|

|

|

|

(0.14

|

)

|

|

|

-

|

|

|

|

0.03

|

|

|

|

(0.15

|

)

|

|

|

0.11

|

|

|

Non-GAAP Diluted earnings per share

|

|

|

$

|

0.65

|

|

|

$

|

0.54

|

|

|

$

|

0.68

|

|

|

$

|

1.19

|

|

|

$

|

1.02

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Operating Income

|

|

|

$

|

44,108

|

|

|

$

|

50,000

|

|

|

$

|

18,073

|

|

|

$

|

94,108

|

|

|

$

|

33,988

|

|

|

GAAP Operating Profit

|

|

|

|

14

|

%

|

|

|

18

|

%

|

|

|

9

|

%

|

|

|

16

|

%

|

|

|

9

|

%

|

|

Amortization of acquisition intangibles

|

|

|

|

8,133

|

|

|

|

7,141

|

|

|

|

2,524

|

|

|

|

15,274

|

|

|

|

2,770

|

|

|

Stock compensation expense - COGS

|

|

|

|

380

|

|

|

|

325

|

|

|

|

253

|

|

|

|

705

|

|

|

|

484

|

|

|

Stock compensation expense - R&D

|

|

|

|

4,126

|

|

|

|

3,868

|

|

|

|

2,781

|

|

|

|

7,994

|

|

|

|

5,324

|

|

|

Stock compensation expense - SG&A

|

|

|

|

4,182

|

|

|

|

4,078

|

|

|

|

3,462

|

|

|

|

8,260

|

|

|

|

6,310

|

|

|

Patent agreement and other

|

|

|

|

752

|

|

|

|

(12,500

|

)

|

|

|

-

|

|

|

|

(11,748

|

)

|

|

|

-

|

|

|

Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,455

|

|

|

|

-

|

|

|

|

1,455

|

|

|

Wolfson acquisition items

|

|

|

|

-

|

|

|

|

-

|

|

|

|

16,547

|

|

|

|

-

|

|

|

|

18,739

|

|

|

Non-GAAP Operating Income

|

|

|

$

|

61,681

|

|

|

$

|

52,912

|

|

|

$

|

45,095

|

|

|

$

|

114,593

|

|

|

$

|

69,070

|

|

|

Non-GAAP Operating Profit

|

|

|

|

20

|

%

|

|

|

19

|

%

|

|

|

21

|

%

|

|

|

19

|

%

|

|

|

19

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expense Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Operating Expenses

|

|

|

$

|

98,113

|

|

|

$

|

82,454

|

|

|

$

|

82,494

|

|

|

$

|

180,567

|

|

|

$

|

141,954

|

|

|

Amortization of acquisition intangibles

|

|

|

|

(8,133

|

)

|

|

|

(7,141

|

)

|

|

|

(2,524

|

)

|

|

|

(15,274

|

)

|

|

|

(2,770

|

)

|

|

Stock compensation expense - R&D

|

|

|

|

(4,126

|

)

|

|

|

(3,868

|

)

|

|

|

(2,781

|

)

|

|

|

(7,994

|

)

|

|

|

(5,324

|

)

|

|

Stock compensation expense - SG&A

|

|

|

|

(4,182

|

)

|

|

|

(4,078

|

)

|

|

|

(3,462

|

)

|

|

|

(8,260

|

)

|

|

|

(6,310

|

)

|

|

Patent agreement and other

|

|

|

|

(752

|

)

|

|

|

12,500

|

|

|

|

-

|

|

|

|

11,748

|

|

|

|

-

|

|

|

Restructuring and other costs, net

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(1,455

|

)

|

|

|

-

|

|

|

|

(1,455

|

)

|

|

Wolfson acquisition items

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(14,937

|

)

|

|

|

-

|

|

|

|

(17,129

|

)

|

|

Non-GAAP Operating Expenses

|

|

|

$

|

80,920

|

|

|

$

|

79,867

|

|

|

$

|

57,335

|

|

|

$

|

160,787

|

|

|

$

|

108,966

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin/Profit Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Gross Margin

|

|

|

$

|

142,221

|

|

|

$

|

132,454

|

|

|

$

|

100,567

|

|

|

$

|

274,675

|

|

|

$

|

175,942

|

|

|

GAAP Gross Profit

|

|

|

|

46.4

|

%

|

|

|

46.9

|

%

|

|

|

47.8

|

%

|

|

|

46.6

|

%

|

|

|

48.5

|

%

|

|

Wolfson acquisition items

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,610

|

|

|

|

-

|

|

|

|

1,610

|

|

|

Stock compensation expense - COGS

|

|

|

|

380

|

|

|

|

325

|

|

|

|

253

|

|

|

|

705

|

|

|

|

484

|

|

|

Non-GAAP Gross Margin

|

|

|

$

|

142,601

|

|

|

$

|

132,779

|

|

|

$

|

102,430

|

|

|

$

|

275,380

|

|

|

$

|

178,036

|

|

|

Non-GAAP Gross Profit

|

|

|

|

46.5

|

%

|

|

|

47.0

|

%

|

|

|

48.7

|

%

|

|

|

46.7

|

%

|

|

|

49.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective Tax Rate Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Tax Expense

|

|

|

$

|

8,103

|

|

|

$

|

16,144

|

|

|

$

|

2,557

|

|

|

$

|

24,247

|

|

|

$

|

8,258

|

|

|

GAAP Effective Tax Rate

|

|

|

|

18.9

|

%

|

|

|

32.6

|

%

|

|

|

75.0

|

%

|

|

|

26.2

|

%

|

|

|

42.7

|

%

|

|

Adjustments to income tax

|

|

|

|

9,492

|

|

|

|

175

|

|

|

|

(1,764

|

)

|

|

|

9,667

|

|

|

|

(6,990

|

)

|

|

Non-GAAP Tax Expense

|

|

|

$

|

17,595

|

|

|

$

|

16,319

|

|

|

$

|

793

|

|

|

$

|

33,914

|

|

|

$

|

1,268

|

|

|

Non-GAAP Effective Tax Rate

|

|

|

|

29.1

|

%

|

|

|

31.1

|

%

|

|

|

1.8

|

%

|

|

|

30.0

|

%

|

|

|

1.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Impact to EPS Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Tax Expense

|

|

|

$

|

0.12

|

|

|

$

|

0.24

|

|

|

$

|

0.04

|

|

|

$

|

0.37

|

|

|

$

|

0.13

|

|

|

Adjustments to income tax

|

|

|

|

0.14

|

|

|

|

-

|

|

|

|

(0.03

|

)

|

|

|

0.15

|

|

|

|

(0.11

|

)

|

|

Non-GAAP Tax Expense

|

|

|

$

|

0.26

|

|

|

$

|

0.24

|

|

|

$

|

0.01

|

|

|

$

|

0.52

|

|

|

$

|

0.02

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIRRUS LOGIC, INC.

|

|

CONSOLIDATED CONDENSED BALANCE SHEET

|

|

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sep. 26,

|

|

Mar. 28,

|

|

Sep. 27,

|

|

|

|

|

2015

|

|

2015

|

|

2014

|

|

ASSETS

|

|

|

(unaudited)

|

|

|

|

(unaudited)

|

|

Current assets

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

$

|

56,333

|

|

|

$

|

76,401

|

|

|

$

|

48,214

|

|

|

Marketable securities

|

|

|

|

86,460

|

|

|

|

124,246

|

|

|

|

85,796

|

|

|

Accounts receivable, net

|

|

|

|

169,423

|

|

|

|

112,608

|

|

|

|

126,161

|

|

|

Inventories

|

|

|

|

143,867

|

|

|

|

84,196

|

|

|

|

121,169

|

|

|

Deferred tax asset

|

|

|

|

8,502

|

|

|

|

18,559

|

|

|

|

16,435

|

|

|

Other current assets

|

|

|

|

51,329

|

|

|

|

35,903

|

|

|

|

29,089

|

|

|

Total current Assets

|

|

|

|

515,914

|

|

|

|

451,913

|

|

|

|

426,864

|

|

|

|

|

|

|

|

|

|

|

|

Long-term marketable securities

|

|

|

|

22,393

|

|

|

|

60,072

|

|

|

|

9,228

|

|

|

Property and equipment, net

|

|

|

|

158,529

|

|

|

|

144,346

|

|

|

|

133,458

|

|

|

Intangibles, net

|

|

|

|

179,816

|

|

|

|

175,743

|

|

|

|

187,030

|

|

|

Goodwill

|

|

|

|

289,565

|

|

|

|

263,115

|

|

|

|

265,410

|

|

|

Deferred tax asset

|

|

|

|

25,603

|

|

|

|

25,593

|

|

|

|

24,998

|

|

|

Other assets

|

|

|

|

20,474

|

|

|

|

27,996

|

|

|

|

17,658

|

|

|

Total assets

|

|

|

$

|

1,212,294

|

|

|

$

|

1,148,778

|

|

|

$

|

1,064,646

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

$

|

111,023

|

|

|

$

|

112,213

|

|

|

$

|

81,549

|

|

|

Accrued salaries and benefits

|

|

|

|

29,156

|

|

|

|

24,132

|

|

|

|

17,706

|

|

|

Deferred income

|

|

|

|

5,582

|

|

|

|

6,105

|

|

|

|

5,218

|

|

|

Other accrued liabilities

|

|

|

|

42,181

|

|

|

|

34,128

|

|

|

|

34,946

|

|

|

Total current liabilities

|

|

|

|

187,942

|

|

|

|

176,578

|

|

|

|

139,419

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

|

160,439

|

|

|

|

180,439

|

|

|

|

226,439

|

|

|

Other long-term liabilities

|

|

|

|

34,990

|

|

|

|

34,990

|

|

|

|

25,376

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

Capital stock

|

|

|

|

1,183,262

|

|

|

|

1,159,494

|

|

|

|

1,104,379

|

|

|

Accumulated deficit

|

|

|

|

(352,374

|

)

|

|

|

(400,613

|

)

|

|

|

(430,144

|

)

|

|

Accumulated other comprehensive loss

|

|

|

|

(1,965

|

)

|

|

|

(2,110

|

)

|

|

|

(823

|

)

|

|

Total stockholders' equity

|

|

|

|

828,923

|

|

|

|

756,771

|

|

|

|

673,412

|

|

|

Total liabilities and stockholders' equity

|

|

|

$

|

1,212,294

|

|

|

$

|

1,148,778

|

|

|

$

|

1,064,646

|

|

|

|

|

|

|

|

|

|

|

|

Prepared in accordance with Generally Accepted Accounting

Principles

|

CONTACT:

Cirrus Logic, Inc.

Thurman K. Case, 512-851-4125

Chief

Financial Officer

Investor.Relations@cirrus.com

Exhibit 99.2

1 October 28, 2015 Letter

to Shareholders Q2 FY16 FY13 CIRRUS LOGIC, INC. 800 WEST SIXTH STREET,

AUSTIN, TEXAS 78701

2 October 28, 2015 Dear

Shareholders, Cirrus Logic delivered solid results for the September

quarter as demand for portable audio products drove revenue up nine

percent sequentially and 46 percent year over year. We delivered GAAP

EPS of $0.53 and non--‐GAAP EPS of $0.65 on revenue of $306.8 million.

The sequential and year--‐over--‐year uptick in revenue was

predominantly due to increased shipments of our 55--‐nanometer and

65--‐nanometer smart codecs and boosted amplifiers. Further, we are

pleased to announce the Board of Directors has authorized an additional

$200 million to repurchase shares of the company’s common stock. FY16

continues to be an outstanding year as share gains and content increases

drive strong growth. We are very encouraged with the progress we made

this past quarter toward our strategic initiatives that we believe will

fuel sustained growth in FY17. In the handset market we have

successfully expanded our content in existing customers, captured new

smart codec sockets with a leading manufacturer and are actively engaged

with numerous other market leaders to further broaden our customer base.

We continue to invest substantially in R&D as we target rapidly growing

markets where our ultra low power, sophisticated analog and mixed signal

processing components add value and an ability to differentiate. With a

comprehensive portfolio of audio and voice products and an Figure A:

Cirrus Logic Q2 FY16 GAAP to Non-GAAP Reconciliation GAAP Other Non-GAAP

Revenue $306.8 $306.8 Gross Margin Dollars $142.2 $0.4 $142.6 Gross

Margin Percent 46.4% 46.5% Operating Expense $98.1 ($17.2) $80.9

Operating Income $44.1 $17.6 $61.7 Operating Income Percent 14% 20%

Other Income / (Expense) ($1.1) ($1.1) Income Tax Benefit / (Expense)

($8.1) ($9.5) ($17.6) Net Income $34.9 $8.1 $43.0 Diluted EPS $0.53

$0.12 $0.65 *Complete GAAP to Non-GAAP reconciliations available on page

12 $ millions, except EPS

3 extensive roadmap we

believe our technology is particularly well suited for smartphones,

digital headsets, smart accessories and the connected home. As a leading

innovator in audio and voice technology, we are well positioned to

capitalize on these market opportunities and deliver growth in the

coming years. Revenue and Gross Margins Revenue for the second quarter

was $306.8 million, up nine percent sequentially and 46 percent year

over year. While the sequential and year--‐over--‐year increase was

primarily fueled by strong demand for our portable audio products, we

also experienced an increase in sales of certain automotive and consumer

components. Two customers each contributed more than 10 percent of total

revenue in the September quarter, representing 63 percent and 18 percent

of sales. Our relationship with our largest customer remains outstanding

with design activity continuing on various products. While we understand

there is intense interest in this customer, in accordance with our

policy, we do not discuss specifics about our business relationship. In

the December quarter, we expect revenue to range from $370 million to

$400 million, representing a 26 percent increase sequentially and 29

percent year over year at the midpoint. This increase is primarily due

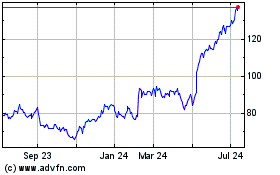

to accelerating shipments of our smart codecs and amplifiers. Q2/FY14

Q3/FY14 Q4/FY14 Q1/FY15 Q2/FY15 Q3/FY15 Q4/FY15 Q1/FY16 Q2/FY16 Q3/FY16

$191 $219 $150 $153 $210 $299 $255 $283 $307 $385* *Midpoint of guidance

as of October 28, 2015 Figure B: Cirrus Logic Revenue Q2 FY14 to Q3 FY16

(M)

4 GAAP and non--‐GAAP gross

margin for the September quarter were 46.4 percent and 46.5 percent

respectively, as a higher mix of portable audio products was offset by

supply chain improvements. In the December quarter, we expect gross

margin to range from 46 percent to 48 percent. Operating Profit,

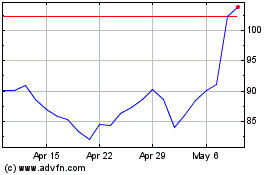

Earnings and Cash Operating margin in the September quarter was

approximately 14 percent GAAP and 20 percent on a non--‐GAAP basis. GAAP

operating expenses were $98.1 million and non--‐GAAP operating expenses

were $80.9 million. GAAP operating expenses include approximately $8.3

million in share--‐based compensation and $8.1 million in amortization

of acquired intangibles. The sequential increase in operating expense

primarily reflects higher costs associated with additional headcount and

employee expenses. The substantial increase in operating expenses on a

year--‐over--‐year basis is largely due to the acquisition of Wolfson

Microelectronics and, to a lesser extent, additional headcount and

employee expenses. In the December quarter GAAP R&D and SG&A expenses

should range from $100 million to $104 million, including roughly $8

million in share--‐based compensation and $8 million in amortization of

acquired intangibles. This estimate includes higher employee expenses,

contract labor working to accelerate key R&D projects and costs

associated with our Austin facilities. Our total headcount exiting Q2

was 1,198. Figure C: Revenue by Product and Customer 63% 18% 19% Revenue

by Customer Q2/FY16 Customer A Customer B Other 84% 16% Revenue by

Product Q2/FY16 Portable Audio Non-Portable Audio & Other

5 GAAP earnings per share

for the quarter were $0.53, up $0.03 sequentially and $0.52 year over

year. The year ago earnings per share reflects roughly $0.47 in costs

associated with the acquisition of Wolfson Microelectronics. Non--‐GAAP

earnings per share were $0.65, up $0.11 quarter over quarter and down

$0.03 year over year. The non--‐GAAP earnings per share for the

September quarter includes approximately $0.26 of tax related expense

that was not reflected in Q2 FY15 as the company had a significant

amount of deferred tax assets and other tax credits that quarter. Our

ending cash balance in the September quarter was $165.2 million, down

from $273.4 million the prior quarter. This sequential decline is

primarily due to timing of receivables, an increase in inventory ahead

of product ramps, repurchase of common stock and the initial up--‐front

payment of $37.2 million associated with the acquisition of two small

technology companies that bolster our software capabilities. The

company’s balance sheet reflects $160.4 million of debt, unchanged from

the prior quarter. Interest expense related to this debt is currently

expected to be approximately $1 million per quarter. In the September

quarter we used roughly $19.2 million to repurchase 652,296 shares of

common stock at an average price of $29.44. Since announcing our $200

million share repurchase program in November 2012, we have reduced our

shares outstanding by roughly 6.9 million shares. Further, the Board of

Directors recently authorized the Company to repurchase up to an

additional $200 million of the company’s common stock. We will continue

to evaluate potential uses of cash including investment in R&D,

acquisitions, the repurchase of shares and repayment of debt. Figure D:

Cirrus Logic GAAP R&D and SG&A Expenses/Headcount Q2 FY14 to Q3 FY16 678

735 751 739 1,099** 1,102 1,104 1,125 1,198$ 0 10 20 30 40 50 60 70 80

90 100 $M Q2/FY14 Q3/FY14 Q4/FY14 Q1/FY15 Q2/FY15 Q3/FY15 Q4/FY15

Q1/FY16 Q2/FY16 Q3/FY16 Expense* SG&A R&D Headcount *Reflects midpoint

of combined R&D and SG&A guidance as of October 28, 2015 **Operating

expense and headcount increase reflects acquisition of Wolfson

Microelectronics ($ millions, except headcount) 5 weeks of the

6 Taxes and Inventory Our

GAAP tax expense for the September quarter was $8.1 million. The

non--‐GAAP tax expense was $17.6 million, which excludes a $4.6 million

benefit associated with adjustments to deferred federal taxes related to

R&D credits and includes $4.9M related to the tax effect of higher

non--‐GAAP income in various jurisdictions. We anticipate a worldwide

GAAP and non--‐GAAP effective tax rate of approximately 30 percent for

FY16. Moving forward, we expect a growing portion of our revenue and

income will be generated offshore; accordingly, our worldwide effective

tax rate has the potential to be reduced in FY17 and beyond. Q2 ending

inventory was $143.9 million, up $17.7 million from $126.2 million in

Q1. Inventory in the December quarter is expected to decline as we

fulfill accelerated product demand. Company Strategy Cirrus Logic is

leveraging our relationships with many industry leaders to increase

content and cross--‐sell additional components including smart codecs,

amplifiers and MEMS microphones. We are pleased with the progress that

we made in the September quarter as we continued to execute on strategic

initiatives that are contributing to growth in FY16 and are expected to

drive further growth in FY17. During the quarter, we increased our

content with several existing customers as we successfully ramped our

new 55--‐nanometer smart codecs and began volume shipments of a

65--‐nanometer smart codec and MEMS microphones into multiple new

Android handsets. With a wide range of products and a robust roadmap the

company is laser--‐focused on growing content at our top three

smartphone customers while expanding share with other market leaders. We

remain actively engaged with leading OEMs and are encouraged by their

desire to provide compelling audio and voice solutions across a variety

of flagship and mid--‐tier platforms. Longer term, as features such as

noise cancellation and always--‐on voice move beyond

7 smartphones, we believe

there is significant potential for our disruptive smart codec technology

in the digital headset and smart accessory markets. In today’s connected

world consumers expect OEMs to continuously deliver products with new

innovative features and a high--‐quality, consistent user experience,

across various platforms and form factors. Demand for our components has

grown as customers strive to differentiate their products with audio and

voice features beyond the capability of what is enabled with standard

reference designs for applications processors and wireless chipsets.

During the quarter, we ramped a general market smart codec and

microphones in multiple handsets that are based on a range of third

party applications processors. The adoption of our components in these

handsets highlights the importance customers are placing on the power,

performance and value of the solutions we provide. We were also

delighted to see early adoption of features previously found in

high--‐end handsets being deployed in mobile phones using mid--‐tier

applications processors. We continue to view the proliferation of audio

and voice features across flagship and mid--‐tier smartphones as a

meaningful growth driver in the coming years. Further, customers are

increasingly asking for components with more processing capability

(MIPS) and memory at even lower power levels, particularly in the

Android ecosystem where OEMs rely heavily on software algorithms to

differentiate. Recognizing this fundamental need, the company continues

to invest in solutions that improve features such as audio playback in

headphones and speakers, always--‐on voice and voice command. When

combined with a well--‐established ecosystem of third--‐party partners

who have ported their algorithms to our platform, we offer our customers

a wide range of audio and voice features that are difficult to

replicate. This approach has been very well received and we are actively

engaged with numerous OEMs on next generation smart codec designs.

Market demand for louder, high--‐quality sound from smartphone speakers

is driving a substantial growth opportunity for Cirrus Logic’s boosted

amplifiers. As OEMs push toward thinner industrial designs, the hardware

and software complexity associated with delivering this experience to

consumers is rising, placing more pressure on design engineers as less

physical space is available and the acoustic environment is much more

8 challenging. Although the

amplifier market is very competitive with many incumbent suppliers, we

believe our technology is differentiated by our highly power--‐efficient

hardware that enables compact board designs and includes sophisticated

software to control and protect the speaker while enhancing the sound

quality for the user. Further, we believe our ability to co--‐design our

boosted amplifiers and smart codecs as a system is a great advantage in

terms of delivering a highly optimized solution. We are making a

significant investment in this technology, as we believe amplifiers will

continue to play a crucial role in the audio signal chain for many

years. To support our efforts, in the September quarter we acquired a

small company that bolsters our speaker protection and linearization

software capabilities. We are optimistic about our opportunities going

forward and expect continued growth in amplifiers over the next year as

we gradually gain traction in this thriving market. As smartphones have

become more sophisticated, the need for innovative smart accessories

such as digital headsets and other wearables has grown. While this

market is still in its infancy we have experienced a notable trend in

our customers’ desire to move from basic headsets to smarter, more

capable accessories, which can dramatically improve the user experience

with high--‐fidelity audio playback and advanced features such as active

noise cancellation. Addressing this emerging market, our solution

integrates a low--‐power DSP and an advanced mixed--‐signal codec that

provides high performance audio/voice and a new adaptive active noise

cancelation system. This system adapts in real--‐time to both external

conditions and the user’s ears to deliver a world--‐class experience

regardless of headset form factor and fit. We believe this technology

will enable OEMs to provide a compelling consumer experience at price

points well below the leading solutions on the market today. We are

excited about our opportunity in digital headsets and are very

encouraged by our discussions with many of the leading mobile and

headset OEMs. We are currently in the qualification process and expect

to gain momentum in this market over the next 12 to 18 months.

Longer--‐term, the company is positioned to leverage the technology we

have developed for mobile into adjacent markets including wearables and

the connected home,

9 where voice will likely

be a primary interface. While these markets are relatively undeveloped

today with regard to advanced audio and voice functionality, we have a

variety of customers actively targeting innovative products and

applications. In fact, we are shipping a new smart codec designed

specifically for wearables in a recently introduced watch. As a leader

in ultra low power, high performance analog and digital signal

processing our expansion into wearables and the connected home is one of

many layers of our growth strategy. FY16 is shaping up to be an

outstanding year as the company increases share and content with

existing customers. As we move beyond FY16, with a broad range of

products and a robust roadmap, Cirrus Logic is poised to capitalize on

the rapidly expanding opportunities in flagship and mid--‐tier

smartphones, digital headsets, and ultimately wearables and the

connected home. We are extremely pleased to have been named one of the

top 10 employers in the United States on the 2015 annual Best Small and

Medium Workplaces list by the Great Place to Work® Institute. Cirrus

Logic has been recognized for the past five years and was ranked number

8 on this year’s annual list, which was published in FORTUNE® magazine

and distinguishes companies that have exceptional workplace cultures. It

is vital for the success of our business that we attract and retain

talented employees. With this in mind we have developed a corporate

culture that encourages innovation, creativity and timely execution,

while fostering integrity, trust and camaraderie. Summary and Guidance

For the December quarter we expect the following results: • Revenue to

range between $370 million and $400 million; • GAAP gross margin to be

between 46 percent and 48 percent; and

10 • Combined GAAP R&D and

SG&A expenses to range between $100 million and $104 million, including

approximately $8 million in share--‐based compensation expense and $8

million in amortization of acquired intangibles. In summary, we are very

pleased with our financial results for the second quarter as sales of

our 55--‐nanometer and 65--‐nanometer smart codecs and boosted

amplifiers accelerated. Cirrus Logic’s substantial investment in R&D,

diverse product portfolio spanning the entire audio signal chain and

innovative strategic roadmap have positioned the company as an industry

leader. We continue to be very excited about our outlook for growth in

FY16 and FY17 as demand for our audio and voice products continues to

gain momentum. Sincerely, Jason Rhode Thurman Case President and Chief

Executive Officer Chief Financial Officer Conference Call Q&A Session

Cirrus Logic will host a live Q&A session at 5 p.m. EDT today to answer

questions related to its financial results and business outlook.

Participants may listen to the conference call on the Cirrus Logic

website. Participants who would like to submit a question to be

addressed during the call are requested to email

investor.relations@cirrus.com.

11 A replay of the webcast

can be accessed on the Cirrus Logic website approximately two hours

following its completion, or by calling (404) 537--‐3406, or toll--‐free

at (855) 859--‐ 2056 (Access Code: 75505782). Use of Non--‐GAAP

Financial Information To supplement Cirrus Logic's financial statements

presented on a GAAP basis, Cirrus has provided non--‐ GAAP financial

information, including gross margins, operating expenses, net income,

operating profit and income, tax expenses, effective tax rate and

diluted earnings per share. A reconciliation of the adjustments to GAAP

results is included in the tables below. Non--‐GAAP financial

information is not meant as a substitute for GAAP results, but is

included because management believes such information is useful to our

investors for informational and comparative purposes. In addition,

certain non--‐GAAP financial information is used internally by

management to evaluate and manage the company. The non--‐GAAP financial

information used by Cirrus Logic may differ from that used by other

companies. These non--‐GAAP measures should be considered in addition

to, and not as a substitute for, the results prepared in accordance with

GAAP. Safe Harbor Statement Except for historical information contained

herein, the matters set forth in this news release contain

forward--‐looking statements, including expectations for growth and

product ramps in the third quarter and fiscal year 2017 and beyond, and

our estimates of third quarter fiscal year 2016 revenue, gross margin,

combined research and development and selling, general and

administrative expense levels, share--‐based compensation expense and

amortization of acquired intangibles. In some cases, forward--‐ looking

statements are identified by words such as “expect,” “anticipate,”

“target,” “project,” “believe,” “goals,” “opportunity,” “estimates,”

“intend,” and variations of these types of words and similar

expressions. In addition, any statements that refer to our plans,

expectations, strategies or other characterizations of future events or

circumstances are forward--‐looking statements. These forward--‐ looking

statements are based on our current expectations, estimates and

assumptions and are subject to certain risks and uncertainties that

could cause actual results to differ materially. These risks and

uncertainties include, but are not limited to, the following: the level

of orders and shipments during the third quarter of fiscal year 2016, as

well as customer cancellations of orders, or the failure to place orders

consistent with forecasts; and the risk factors listed in our Form

10--‐K for the year ended March 28, 2015, and in our other filings with

the Securities and Exchange Commission, which are available at

www.sec.gov. The foregoing information concerning our business outlook

represents our outlook as of the date of this news release, and we

undertake no obligation to update or revise any forward--‐looking

statements, whether as a result of new developments or otherwise.

Summary financial data follows:

12 CIRRUS LOGIC, INC.

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS (unaudited) (in

thousands, except per share data) Three Months Ended Six Months Ended

Sep. 26, Jun. 27, Sep. 27, Sep. 26, Sep. 27, 2015 2015 2014 2015 2014

Q2'16 Q1'16 Q2'15 Q2'16 Q2'15 Portable audio products $ 257,152 $

235,866 $ 163,563 $ 4 93,018 $ 276,133 Non-portable audio and other

products 49,604 46,767 46,651 96,371 86,646 Net sales 306,756 282,633

210,214 5 89,389 362,779 Cost of sales 164,535 150,179 109,647 3 14,714

186,837 Gross profit 142,221 132,454 100,567 2 74,675 175,942 Gross

margin 46.4% 46.9% 47.8% 46.6% 48.5% Research and development 67,258

65,835 44,557 1 33,093 84,334 Selling, general and administrative 30,103

29,119 21,545 59,222 41,228 Acquisition related costs - - 14,937 -

14,937 Restructuring and other - - 1,455 - 1,455 Patent agreement and

other 752 ( 12,500) - (11,748) - Total operating expenses 98,113 82,454

82,494 1 80,567 141,954 Income from operations 44,108 50,000 18,073

94,108 33,988 Interest expense, net (601) (638) (2,670) (1,239) (3,137)

Other income (expense), net (524) 136 (11,994) (388) ( 11,493) Income

before income taxes 42,983 49,498 3,409 92,481 19,358 Provision for

income taxes 8,103 16,144 2,557 24,247 8,258 Net income $ 34,880 $

33,354 $ 852 $ 6 8,234 $ 11,100 Basic earnings per share: $ 0.55 $ 0.53

$ 0.01 $ 1.08 $ 0.18 Diluted earnings per share: $ 0.53 $ 0.50 $ 0.01 $

1.03 $ 0.17 Weighted average number of shares: Basic 63,346 63,274

62,241 63,310 62,137 Diluted 66,329 66,410 65,085 66,378 64,892 Prepared

in accordance with Generally Accepted Accounting Principles

13 CIRRUS LOGIC, INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION

(unaudited, in thousands, except per share data) (not prepared in

accordance with GAAP) Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management believes

such information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage the

company. As a note, the non-GAAP financial information used by Cirrus

Logic may differ from that used by other companies. These non-GAAP