UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

Commission

File Number 0-17795

CIRRUS LOGIC, INC.

(Exact name of registrant as specified in its charter)

|

|

|

| DELAWARE |

|

77-0024818 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

800 W. 6th Street, Austin, TX 78701

(Address of principal executive offices)

Registrant’s telephone number, including area code: (512) 851-4000

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form

applies:

| x |

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

SECTION 1 – CONFLICT MINERALS DISCLOSURE

| Item 1.01 |

Conflict Minerals Disclosure and Report |

Cirrus Logic, Inc. (the “Company”) has evaluated its

current product lines and determined that certain products that we manufactured, or contracted to manufacture, during calendar year 2014 use “conflict minerals” that are necessary to the functionality or production of those products.

Conflict minerals are defined by the Securities and Exchange Commission (SEC) as cassiterite, columbite-tantalite, gold, wolframite, or their derivatives, which are limited to tin, tantalum, tungsten, and gold (the “3TG” minerals). The

Company conducted a good faith reasonable country of origin inquiry regarding those 3TG minerals to determine whether any of the 3TG minerals originated in the Democratic Republic of the Congo, the Republic of the Congo, the Central African

Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia, and Angola (the “Covered Countries”), and whether any of the 3TG minerals may be from recycled or scrap sources. Based on its inquiry, the Company concluded that it was

required to conduct due diligence on the source or chain of custody of its 3TG minerals. Accordingly, we have filed a Conflict Minerals Report as Exhibit 1.01 to this Form SD.

A copy of the Company’s Conflict Minerals Report is provided as Exhibit 1.01 hereto and is

publicly available at investor.cirrus.com in the Corporate Governance section of our website.

SECTION 2 – EXHIBITS

The following exhibit is filed as part of this Report:

| |

• |

|

Exhibit 1.01 – Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIRRUS LOGIC, INC. |

|

|

|

|

| Date: June 1, 2015 |

|

|

|

By: |

|

/s/ Gregory S. Thomas |

|

|

|

|

|

|

Name: |

|

Gregory S. Thomas |

|

|

|

|

|

|

Title: |

|

General Counsel |

Exhibit 1.01

Cirrus Logic, Inc.

Conflict Minerals Report

For The Year Ended December 31, 2014

This Conflict Minerals Report (the “Report”) has been prepared by Cirrus Logic, Inc. (the “Company”) pursuant to Rule 13p-1 and Form SD

(the “Rule”), which were promulgated under the Securities Exchange Act of 1934. The Report covers the reporting period January 1, 2014, to December 31, 2014. The Securities and Exchange Commission (the “SEC”) adopted

the Rule in order to implement the reporting and disclosure requirements related to “conflict minerals” as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010.

The Rule imposes certain reporting obligations on SEC registrants whose manufactured products contain certain specified materials that are necessary to the

functionality or production of their products. The specified materials, which are collectively referred to as the “Conflict Minerals,” are defined by the SEC as cassiterite, columbite-tantalite, gold, wolframite, or their derivatives,

which are limited to tin, tantalum, tungsten, and gold (the “3TG” minerals).

According to the Rule, if a registrant has reason to believe that

any of the 3TG minerals in their supply chain may have originated in the Covered Countries, or if the registrant is unable to determine that the 3TG minerals either did not originate in the Covered Countries or were from recycled or scrap sources,

then the issuer must exercise due diligence on the source and chain of custody of the 3TG minerals. The “Covered Countries” for the purposes of the Rule and this Report are the Democratic Republic of the Congo, the Republic of the Congo,

the Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia, and Angola. The registrant must annually submit a report, a Conflict Minerals Report (the “CMR”), to the SEC that includes a description of those due

diligence measures.

The CMR presented herein is not audited per the guidance from the Securities Exchange Commission dated April 29, 2014.

Company Overview

The Company develops high-precision,

analog and mixed-signal integrated circuits for a broad range of innovative customers. Building on its diverse analog and signal-processing patent portfolio, Cirrus Logic delivers highly optimized products for a variety of audio and energy-related

applications. The Company operates from headquarters in Austin, Texas, with offices in Phoenix, Ariz.; Edinburgh, Scotland; Europe, Japan and Asia.

This

Report has been prepared by management of the Company, and includes the activities of all majority-owned subsidiaries and entities that are required to be consolidated.

Description of the Company’s Products Covered by this Report

This Report relates to products: (i) for which 3TG minerals are necessary to the functionality or production of that product; (ii) that were

manufactured, or contracted to be manufactured, by the Company; and (iii) for which the manufacture was completed during calendar year 2014. For purposes of this Report, we have determined the following products include 3TG minerals that are

necessary to the functionality or production of their products: (1) integrated circuits and (2) development and evaluation boards (“Boards”) sold by the Company (collectively, the “Covered Products”).

On April 29, 2014, Cirrus Logic and the board of directors of Wolfson Microelectronics plc., a public limited company incorporated in Scotland

(“Wolfson”), agreed on the terms of a recommended cash offer to be made by Cirrus Logic for the acquisition of the entire issued and to be issued share capital of Wolfson (the “Acquisition”). The acquisition of Wolfson, a

supplier of high performance, mixed-signal integrated circuits for the consumer electronics market, was completed on August 21, 2014. The Company had determined that it will need additional time to perform due diligence on the source and chain

of custody of the 3TG minerals in Wolfson’s products, and therefore, those products are not covered by this Report.

The Company’s Due

Diligence Process

The Company has conducted a good faith reasonable country of origin inquiry (“RCOI”) regarding the 3TG minerals. This RCOI

was reasonably designed to determine whether any of the 3TG minerals originated in the Covered Countries and whether any of the 3TG minerals may be from recycled or scrap sources. Annex I includes a summary of the country of origin information

collected as a result of our RCOI.

The Company also exercised due diligence on the source and chain of custody of the 3TG minerals. Our due diligence

measures have been designed to conform, in all material respects, with the framework provided by the Organisation for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from

Conflict-Affected and High-Risk Areas (the “OECD Guidance”).

The Company’s supply chain with respect to the Covered Products is complex,

and there are many third parties in the supply chain between the ultimate manufacturer of the Covered Products and the original sources of 3TG minerals. In this regard, the Company does not purchase 3TG minerals directly from mines, smelters or

refiners. The Company must therefore rely on its suppliers to provide information regarding the origin of 3TG minerals that are included in the Covered Products. Moreover, the Company believes that the smelters and refiners of the 3TG minerals are

best situated to identify the sources of these materials, and therefore has taken steps to identify the applicable smelters and refiners of 3TG minerals in the Company’s supply chain.

In conjunction with its due diligence process, the Company has adopted a policy relating to 3TG minerals (the

“Company Policy”), incorporating the standards set forth in the OECD Guidance. The Company Policy states that we expect our suppliers to source materials from environmentally and socially responsible supply chains. In addition, the Company

Policy states that our suppliers must report at least annually the origin of the 3TG minerals used in the manufacture of our products. Specifically, suppliers are expected to utilize the Conflict Free Sourcing Initiative (CFSI) Conflict Minerals

Reporting Template to report on the use of 3TG minerals used in the manufacture of our products. As outlined in the OECD Guidance, we participate in groups and forums focused on responsible sourcing of the 3TG minerals, including the Electronic

Industry Citizenship Coalition (EICC) and the Global e-Sustainability Initiative (GeSI) Conflict Free Smelter (CFS) program, which audits smelters’ and refiners’ due diligence activities. The data on which we relied for certain statements

in this report was obtained through our membership in the CFSI, using the Reasonable Country of Origin Inquiry report for member “CRUS.”

More

specifically, our due diligence process on the source and chain of custody of 3TG minerals includes the following steps:

| |

• |

|

Establishment of a strong company management system through: |

| |

• |

|

The adoption of a Conflict Minerals Policy; |

| |

• |

|

The establishment of an internal team of subject matter experts that includes members of our supply chain, purchasing, legal, and quality organizations, and is managed by our General Counsel; |

| |

• |

|

The institution of processes for new suppliers whereby conflict mineral conformance is discussed during initial business reviews; |

| |

• |

|

The inclusion of a flow-down clause in new or renewed supplier contracts relating to the sourcing of 3TG minerals; |

| |

• |

|

We request our suppliers to abide by the Cirrus Logic Supplier Code of Conduct, which is intended to be based on the EICC Code of Conduct; |

| |

• |

|

The strengthening of our participation in CFSI initiatives; and |

| |

• |

|

The provision of multiple communication channels to serve as grievance mechanisms for early warning risk awareness, including the availability of an anonymous reporting hotline available to everyone for reporting

possible violations of the Company’s policies. |

| |

• |

|

Identification and assessment of risks by: |

| |

• |

|

Identifying relevant first-tier suppliers to engage in our due diligence efforts; |

| |

• |

|

Conducting a survey of our supply chain using the template known as the CFSI Reporting template (the “Template”). The Template was developed

to facilitate disclosure and communication of information regarding smelters that provide material to a company’s supply chain. It includes questions regarding a company’s conflict-free policy, engagement with its direct suppliers, and a

listing of the smelters the company and its suppliers use. In addition, the template contains questions about the origin of 3TG minerals included in their products, as well as supplier due diligence. Written instructions and recorded

|

| |

training illustrating the use of the tool is available on EICC’s website. The Template is being used by many companies in their due diligence processes related to 3TG minerals.

|

| |

• |

|

Identifying smelter usage by greatest volume and prioritizing efforts associated with our due diligence with those smelters; |

| |

• |

|

Reviewing and validating smelter information provided by suppliers; and |

| |

• |

|

Comparing the smelters identified by our suppliers against lists of smelters certified as conflict free through the Conflict Free Smelter Program. |

| |

• |

|

Responding to identified risks by: |

| |

• |

|

Reporting to senior management the findings derived from our due diligence efforts; |

| |

• |

|

Designing and implementing training for relevant first tier suppliers to improve their systems of transparency and control; and |

| |

• |

|

Devising and adopting a risk management strategy that seeks to ensure 3TG minerals in our supply chain are DRC conflict-free. |

| |

• |

|

Auditing supply chain due diligence via our support for an industry-developed audit program through CFSI that is administered by independent third-party auditors. The efforts to determine mine or location of origin

of conflict minerals through CFSI is described on the CFSI website at http://www.conflictfreesourcing.org. |

| |

• |

|

Reporting on due diligence through our Specialized Disclosure Report on Form SD and Conflict Mineral Report filed with the SEC and publicly communicated on our website. |

Due Diligence Results

For the 2014 calendar year, we

focused our due diligence efforts on our integrated circuits, which accounted for over 99% of our revenue in 2014. Specifically, we requested a total of 11 manufacturers of our integrated circuits, which covered 100% of the integrated circuits that

we sold in 2014, to respond to our inquiries relating to the use of 3TG minerals in our integrated circuits (or in the production of our integrated circuits). All 11 of those manufacturers responded to our request. Notably, many of the responses

received provided data at company or divisional level for the supplier, and therefore, we were unable to specify the smelters or refiners used by our suppliers on a part-by-part basis. We were therefore unable to determine with certainty which

smelters or refiners are actually in our supply chain, the country of origin of all of the 3TG each part contains, or whether such 3TG comes from recycled or scrap resources.

In addition, we requested information relating to the use of 3TG minerals from our major suppliers and contract manufacturers for Boards that were assembled

in 2014, which represented less than 1% of our revenue during that year. A substantial majority of the responses received were incomplete and/or failed to provide data at a company or division

level. We did not seek information related to each supplier of components that we used on these Boards. Therefore, based on the incomplete set of responses and data, we were unable to determine

which smelters or refiners are actually in the supply chain for our Boards, the country of origin of all of the 3TG each part contains, or whether such 3TG comes from recycled or scrap resources.

Based on our due diligence efforts, we identified the facilities set forth in Annex II that could potentially have processed the necessary 3TG minerals in our

products. None of the smelters identified in our supply chain are known to us as sourcing 3TG minerals that directly or indirectly finances or benefits armed groups in the DRC or adjoining countries. We have indicated the facilities that have been

designated as “conflict free” by CFSI as of May 29, 2015. Of the 84 identified smelters in our supply chain, 81 (or 96%) of the identified smelters successfully passed the CSFI audit, thereby confirming their “conflict-free”

status. Two of the remaining three smelters have committed to undergo an independent audit, but have not completed that audit (indicated as “CFSI active” or “TI-CMC/CFSI active” in Annex II). The final remaining smelter has

joined the Tungsten Industry – Conflict Minerals Council (“TI-CMC”), and is working toward compliance through that organization. Accordingly, these three remaining smelters should be considered conflict undeterminable.

Risk Mitigation

Based on our initial efforts to collect

data, we believe the main risks that we have identified are related to the lack of data and the quality of data, particularly with respect to our development boards and evaluation boards. We intend to take the following steps to improve the due

diligence conducted to further mitigate any risk that the necessary 3TG minerals in our products could benefit armed groups in the DRC or adjoining countries:

| |

a. |

Continue to engage with suppliers and direct them to training resources to attempt to increase the response rate and improve the content of the supplier survey responses, particularly with the suppliers of components

for our Boards; |

| |

b. |

Incorporate conflict minerals data review as part of our annual quality audits that we perform on 100% of our subcontractors; |

| |

c. |

Continue to expand the information sought as it relates to our Boards to include the suppliers for components; |

| |

d. |

Expand our due diligence efforts to include products from Wolfson, which was acquired on August 21, 2014; |

| |

e. |

Prepare for an audit of our 2015 Conflict Minerals Report by engaging an independent third party to audit our 2014 Conflict Minerals Report; |

| |

f. |

Continue participation with CFSI to expand the smelter and refiners participating in the Conflict Free Smelter Program; and |

| |

g. |

Continue to work with the OECD or relevant trade associations to define and improve best practices and encourage responsible sourcing of 3TG minerals in accordance with the OECD Guidance. |

Annex I

|

|

|

| Argentina |

|

Nigeria |

| Argola |

|

Peru |

| Australia |

|

Portugal |

| Austria |

|

Republic of Congo |

| Belgium |

|

Russia |

| Bolivia |

|

Rwanda |

| Brazil |

|

Sierra Leone |

| Burundi |

|

Singapore |

| Canada |

|

Slovakia |

| Central African Republic |

|

South Africa |

| Chile |

|

South Korea |

| China |

|

South Sudan |

| Colombia |

|

Spain |

| Côte d’Ivoire |

|

Suriname |

| Czech Republic |

|

Switzerland |

| Djibouti |

|

Taiwan |

| Egypt |

|

Tanzania |

| Estonia |

|

Thailand |

| Ethiopia |

|

Uganda |

| France |

|

United Kingdom |

| Germany |

|

United States of America |

| Guyana |

|

Vietnam |

| Hungary |

|

Zambia |

| India |

|

Zimbabwe |

| Indonesia |

|

|

| Ireland |

|

|

| Israel |

|

|

| Japan |

|

|

| Kazakhstan |

|

|

| Kenya |

|

|

| Lao |

|

|

| Luxembourg |

|

|

| Madagascar |

|

|

| Malaysia |

|

|

| Mongolia |

|

|

| Mozambique |

|

|

| Myanmar |

|

|

| Namibia |

|

|

| Netherlands |

|

|

Annex II

|

|

|

|

|

|

|

| Metal |

|

Smelter Name |

|

Smelter

Identification |

|

Smelter Status |

| Gold |

|

Allgemeine Gold-und Silberscheideanstalt A.G. |

|

CID000035 |

|

CFSI compliant |

| Gold |

|

Argor-Heraeus SA |

|

CID000077 |

|

CFSI compliant |

| Gold |

|

Asahi Pretec Corporation |

|

CID000082 |

|

CFSI compliant |

| Gold |

|

CCR Refinery – Glencore Canada Corporation |

|

CID000185 |

|

CFSI compliant |

| Gold |

|

Dowa |

|

CID000401 |

|

CFSI compliant |

| Gold |

|

Eco-System Recycling Co., Ltd. |

|

CID000425 |

|

CFSI compliant |

| Gold |

|

Heraeus Ltd. Hong Kong |

|

CID000707 |

|

CFSI compliant |

| Gold |

|

Heraeus Precious Metals GmbH & Co. KG |

|

CID000711 |

|

CFSI compliant |

| Gold |

|

Ishifuku Metal Industry Co., Ltd. |

|

CID000807 |

|

CFSI compliant |

| Gold |

|

Johnson Matthey Inc |

|

CID000920 |

|

CFSI compliant |

| Gold |

|

JX Nippon Mining & Metals Co., Ltd. |

|

CID000937 |

|

CFSI compliant |

| Gold |

|

Kennecott Utah Copper LLC |

|

CID000969 |

|

CFSI compliant |

| Gold |

|

Kojima Chemicals Co., Ltd |

|

CID000981 |

|

CFSI compliant |

| Gold |

|

LS-NIKKO Copper Inc. |

|

CID001078 |

|

CFSI compliant |

| Gold |

|

Materion |

|

CID001113 |

|

CFSI compliant |

| Gold |

|

Matsuda Sangyo Co., Ltd. |

|

CID001119 |

|

CFSI compliant |

| Gold |

|

Metalor Technologies (Hong Kong) Ltd |

|

CID001149 |

|

CFSI compliant |

| Gold |

|

Metalor Technologies SA |

|

CID001153 |

|

CFSI compliant |

| Gold |

|

Metalor USA Refining Corporation |

|

CID001157 |

|

CFSI compliant |

| Gold |

|

Mitsubishi Materials Corporation |

|

CID001188 |

|

CFSI compliant |

| Gold |

|

Mitsui Mining and Smelting Co., Ltd. |

|

CID001193 |

|

CFSI compliant |

| Gold |

|

Nihon Material Co. LTD |

|

CID001259 |

|

CFSI compliant |

| Gold |

|

Ohio Precious Metals, LLC |

|

CID001322 |

|

CFSI compliant |

| Gold |

|

PAMP SA |

|

CID001352 |

|

CFSI compliant |

| Gold |

|

Rand Refinery (Pty) Ltd |

|

CID001512 |

|

CFSI compliant |

| Gold |

|

Royal Canadian Mint |

|

CID001534 |

|

CFSI compliant |

| Gold |

|

Shandong Zhaojin Gold & Silver Refinery Co. Ltd |

|

CID001622 |

|

CFSI compliant |

| Gold |

|

Solar Applied Materials Technology Corp. |

|

CID001761 |

|

CFSI compliant |

| Gold |

|

Sumitomo Metal Mining Co., Ltd. |

|

CID001798 |

|

CFSI compliant |

|

|

|

|

|

|

|

| Gold |

|

Tanaka Kikinzoku Kogyo K.K. |

|

CID001875 |

|

CFSI compliant |

| Gold |

|

Tokuriki Honten Co., Ltd |

|

CID001938 |

|

CFSI compliant |

| Gold |

|

Umicore SA Business Unit Precious Metals Refining |

|

CID001980 |

|

CFSI compliant |

| Gold |

|

United Precious Metal Refining, Inc. |

|

CID001993 |

|

CFSI compliant |

| Gold |

|

Valcambi SA |

|

CID002003 |

|

CFSI compliant |

| Gold |

|

Western Australian Mint trading as The Perth Mint |

|

CID002030 |

|

CFSI compliant |

| Tantalum |

|

Global Advanced Metals Boyertown |

|

CID002557 |

|

CFSI compliant |

| Tantalum |

|

H.C. Starck Co., Ltd. |

|

CID002544 |

|

CFSI compliant |

| Tantalum |

|

H.C. Starck GmbH Goslar |

|

CID002545 |

|

CFSI compliant |

| Tantalum |

|

H.C. Starck GmbH Laufenburg |

|

CID002546 |

|

CFSI compliant |

| Tantalum |

|

H.C. Starck Hermsdorf GmbH |

|

CID002547 |

|

CFSI compliant |

| Tantalum |

|

H.C. Starck Inc. |

|

CID002548 |

|

CFSI compliant |

| Tantalum |

|

H.C. Starck Ltd. |

|

CID002549 |

|

CFSI compliant |

| Tantalum |

|

H.C. Starck Smelting GmbH & Co.KG |

|

CID002550 |

|

CFSI compliant |

| Tantalum |

|

Jiujiang Tanbre Co., Ltd. |

|

CID000917 |

|

CFSI compliant |

| Tantalum |

|

Mitsui Mining & Smelting |

|

CID001192 |

|

CFSI compliant |

| Tantalum |

|

Ningxia Orient Tantalum Industry Co., Ltd. |

|

CID001277 |

|

CFSI compliant |

| Tantalum |

|

Taki Chemicals |

|

CID001869 |

|

CFSI compliant |

| Tantalum |

|

Ulba |

|

CID001969 |

|

CFSI compliant |

| Tin |

|

Alpha |

|

CID000292 |

|

CFSI compliant |

| Tin |

|

Cooper Santa |

|

CID000295 |

|

CFSI compliant |

| Tin |

|

CV United Smelting |

|

CID000315 |

|

CFSI compliant |

| Tin |

|

EM Vinto |

|

CID000438 |

|

CFSI compliant |

| Tin |

|

Fenix Metals |

|

CID000468 |

|

CFSI compliant |

| Tin |

|

Gejiu Non-Ferrous Metal Processing Co. Ltd. |

|

CID000538 |

|

CFSI compliant |

| Tin |

|

Malaysia Smelting Corporation (MSC) |

|

CID001105 |

|

CFSI compliant |

| Tin |

|

Metallo Chimique |

|

CID001143 |

|

CFSI compliant |

| Tin |

|

Mineração Taboca S.A. |

|

CID001173 |

|

CFSI compliant |

| Tin |

|

Minsur |

|

CID001182 |

|

CFSI compliant |

| Tin |

|

Mitsubishi Materials Corporation |

|

CID001191 |

|

CFSI compliant |

| Tin |

|

OMSA |

|

CID001337 |

|

CFSI compliant |

| Tin |

|

PT Bangka Putra Karya |

|

CID001412 |

|

CFSI compliant |

| Tin |

|

PT Bangka Tin Industry |

|

CID001419 |

|

CFSI compliant |

|

|

|

|

|

|

|

| Tin |

|

PT Bukit Timah |

|

CID001428 |

|

CFSI compliant |

| Tin |

|

PT DS Jaya Abadi |

|

CID001434 |

|

CFSI compliant |

| Tin |

|

PT Eunindo Usaha Mandiri |

|

CID001438 |

|

CFSI compliant |

| Tin |

|

PT Mitra Stania Prima |

|

CID001453 |

|

CFSI compliant |

| Tin |

|

PT REFINED BANGKA TIN |

|

CID001460 |

|

CFSI compliant |

| Tin |

|

PT Stanindo Inti Perkasa |

|

CID001468 |

|

CFSI compliant |

| Tin |

|

PT Tambang Timah |

|

CID001477 |

|

CFSI compliant |

| Tin |

|

PT Timah (Persero), Tbk |

|

CID001482 |

|

CFSI compliant |

| Tin |

|

PT Tinindo Inter Nusa |

|

CID001490 |

|

CFSI compliant |

| Tin |

|

Thaisarco |

|

CID001898 |

|

CFSI compliant |

| Tin |

|

White Solder Metalurgia e Mineração Ltda. |

|

CID002036 |

|

CFSI compliant |

| Tin |

|

Yunnan Chengfeng Non-ferrous Metals Co.,Ltd. |

|

CID002158 |

|

CFSI active |

| Tin |

|

Yunnan Tin Company, Ltd. |

|

CID002180 |

|

CFSI compliant |

| Tungsten |

|

Chongyi Zhangyuan Tungsten Co., Ltd. |

|

CID000258 |

|

TI-CMC |

| Tungsten |

|

Ganzhou Huaxing Tungsten Products Co., Ltd. |

|

CID000875 |

|

CFSI compliant |

| Tungsten |

|

Ganzhou Seadragon W & Mo Co., Ltd. |

|

CID002494 |

|

CFSI compliant |

| Tungsten |

|

Global Tungsten & Powders Corp. |

|

CID000568 |

|

CFSI compliant |

| Tungsten |

|

Guangdong Xianglu Tungsten Co., Ltd. |

|

CID000218 |

|

TI-CMC/CFSI active |

| Tungsten |

|

Hunan Chunchang Nonferrous Metals Co., Ltd. |

|

CID000769 |

|

CFSI compliant |

| Tungsten |

|

Xiamen Tungsten (H.C.) Co., Ltd. |

|

CID002320 |

|

CFSI compliant |

| Tungsten |

|

Xiamen Tungsten Co., Ltd |

|

CID002082 |

|

CFSI compliant |

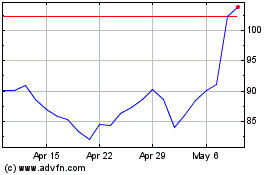

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

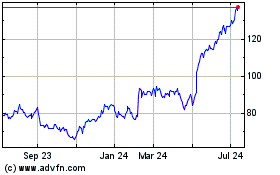

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024