Strong Demand for Portable Audio Drives

September Quarter Revenue Growth

Cirrus Logic, Inc. (Nasdaq: CRUS), a leader in high-precision

analog and digital signal processing components, today posted on

its investor relations website at http://investor.cirrus.com the

quarterly Shareholder Letter that contains the complete financial

results for the second quarter fiscal year 2015, which ended Sept.

27, 2014, as well as the company’s current business outlook.

“Q2 was an outstanding quarter for Cirrus Logic, as strong

demand for portable audio products drove revenue above

expectations. In addition, we were pleased to have closed the

acquisition of Wolfson Microelectronics on Aug. 21,” said Jason

Rhode, president and chief executive officer. “The acquisition

further strengthens Cirrus Logic’s position as a market leader and

helps accelerate critical R&D programs we believe will fuel

revenue growth in the future.”

Reported Financial Results – Second Quarter FY15

- Revenue of $210.2 million, including

$197.2 million from Cirrus Logic and $13 million from five weeks of

Wolfson Microelectronics;

- GAAP gross margin of 47.8 percent and

non-GAAP gross margin of 48.7 percent;

- GAAP operating expenses of $82.5

million and non-GAAP operating expenses of $57.3 million. GAAP

operating expense includes $18.7 million in acquisition costs and

$6.5 million of share-based compensation and amortization of

acquired intangibles; and

- GAAP diluted earnings per share of

$0.01 and non-GAAP diluted earnings per share of $0.68.

A reconciliation of the non-GAAP charges is included in the

tables accompanying this press release.

Business Outlook – Third Quarter FY15

- Revenue is expected to range between

$265 million and $285 million;

- GAAP gross margin is expected to be

between 42 percent and 44 percent, which includes roughly 200 basis

points of costs associated with the fair value write up of acquired

inventory; and

- Combined R&D and SG&A expenses

are expected to range between $86 million and $90 million, which

includes approximately $9 million in share-based compensation and

$7 million in amortization of acquired intangibles.

Cirrus Logic will host a live Q&A session at 5 p.m. EDT

today to answer questions related to its financial results and

business outlook. Participants may listen to the conference call on

the Cirrus Logic website. Participants who would like to submit a

question to be addressed during the call are requested to email

investor.relations@cirrus.com. A replay of the webcast can be

accessed on the Cirrus Logic website approximately two hours

following its completion, or by calling (404) 537-3406, or

toll-free at (855) 859-2056 (Access Code: 13896797).

Cirrus Logic, Inc.

Cirrus Logic develops high-precision, analog and mixed-signal

integrated circuits for a broad range of innovative customers.

Building on its diverse analog and signal-processing patent

portfolio, Cirrus Logic delivers highly optimized products for a

variety of audio, industrial and energy-related applications. The

company operates from headquarters in Austin, Texas, with offices

in the United States, United Kingdom, Europe, Japan and Asia. More

information about Cirrus Logic is available at www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, Cirrus has provided non-GAAP financial information,

including gross margins, operating expenses, net income, operating

profit and diluted earnings per share. A reconciliation of the

adjustments to GAAP results is included in the tables below.

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. The non-GAAP financial information used by Cirrus

Logic may differ from that used by other companies. These non-GAAP

measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements,

including our estimates of third quarter fiscal year 2015 revenue,

gross margin, combined research and development and selling,

general and administrative expense levels, share-based compensation

expense, amortization of acquired intangibles and acquisition

related costs associated with the fair value write up of acquired

inventory. In some cases, forward-looking statements are identified

by words such as “expect,” “anticipate,” “target,” “project,”

“believe,” “goals,” “opportunity,” “estimates,” “intend,” and

variations of these types of words and similar expressions. In

addition, any statements that refer to our plans, expectations,

strategies or other characterizations of future events or

circumstances are forward-looking statements. These forward-looking

statements are based on our current expectations, estimates and

assumptions and are subject to certain risks and uncertainties that

could cause actual results to differ materially. These risks and

uncertainties include, but are not limited to, the following: the

level of orders and shipments during the third quarter of fiscal

year 2015, as well as customer cancellations of orders, or the

failure to place orders consistent with forecasts; and the risk

factors listed in our Form 10-K for the year ended March 29, 2014,

and in our other filings with the Securities and Exchange

Commission, which are available at www.sec.gov. The foregoing

information concerning our business outlook represents our outlook

as of the date of this news release, and we undertake no obligation

to update or revise any forward-looking statements, whether as a

result of new developments or otherwise.

Cirrus Logic, Cirrus and Wolfson are registered trademarks of

Cirrus Logic, Inc. or its subsidiaries. All other company or

product names noted herein may be trademarks of their respective

holders.

Summary financial data follows:

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED

STATEMENT OF OPERATIONS (unaudited) (in thousands,

except per share data) Three Months Ended Six

Months Ended Sep. 27, Jun. 28, Sep.

28, Sep. 27, Sep. 28, 2014 2014

2013 2014 2013 Q2'15 Q1'15

Q2'14 Q2'15 Q2'14 Portable audio products $

163,563 $ 112,570 $ 150,949 $ 276,132 $ 267,556 Non-portable audio

and other products 46,651 39,995

39,722 86,647 78,240

Net

sales 210,214 152,565

190,671 362,779

345,796 Cost of sales 109,647

77,190 91,223 186,837

166,850

Gross profit 100,567 75,375

99,448 175,942 178,946 Gross margin

47.8 % 49.4 % 52.2 %

48.5 % 51.7 % Research and

development 44,557 39,777 29,722 84,334 58,252 Selling, general and

administrative 21,545 19,683 19,215 41,228 38,413 Restructuring and

other 1,455 - (154 ) 1,455 (584 ) Acquisition related costs 14,937

- - 14,937 - Patent infringement settlements, net -

- - - 695

Total operating expenses 82,494 59,460

48,783 141,954 96,776

Operating income 18,073 15,915

50,665 33,988 82,170 Interest income

(expense), net (2,670 ) (467 ) 201 (3,137 ) 359 Other income

(expense), net (11,994 ) 501 (38 )

(11,493 ) (55 )

Income before income taxes

3,409 15,949 50,828 19,358

82,474 Provision for income taxes 2,557

5,701 17,461 8,258 28,465

Net income $ 852 $

10,248 $ 33,367 $

11,100 $ 54,009 Basic

earnings per share: $ 0.01 $ 0.17 $ 0.53 $ 0.18 $ 0.85 Diluted

earnings per share: $ 0.01 $ 0.16 $ 0.50 $ 0.17 $ 0.82

Weighted average common shares outstanding: Basic 62,241 62,032

63,217 62,137 63,329 Diluted 65,085 64,688 66,125 64,892 66,203

Prepared in accordance with Generally Accepted Accounting

Principles

CIRRUS LOGIC, INC. RECONCILIATION BETWEEN

GAAP AND NON-GAAP FINANCIAL INFORMATION (unaudited, in

thousands, except per share data) (not prepared in

accordance with GAAP) Non-GAAP financial information is

not meant as a substitute for GAAP results, but is included because

management believes such information is useful to our investors for

informational and comparative purposes. In addition, certain

non-GAAP financial information is used internally by management to

evaluate and manage the company. As a note, the non-GAAP financial

information used by Cirrus Logic may differ from that used by other

companies. These non-GAAP measures should be considered in addition

to, and not as a substitute for, the results prepared in accordance

with GAAP.

Three Months Ended Six

Months Ended Sep. 27, Jun. 28, Sep.

28, Sep. 27, Sep. 28, 2014 2014

2013 2014 2013 Net Income Reconciliation

Q2'15 Q1'15 Q2'14 Q2'15 Q2'14

GAAP Net Income $ 852 $ 10,248

$ 33,367 $ 11,100 $

54,009 Amortization of acquisition intangibles 2,524 246 -

2,770 - Stock based compensation expense 6,496 5,622 5,739 12,118

11,513 Provision for litigation expenses and settlements - - - -

695 Restructuring and other costs, net 1,455 - (154 ) 1,455 (584 )

Wolfson acquisition items 30,875 2,304 - 33,179 - Provision for

income taxes 1,764 5,226 16,378

6,990 26,539

Non-GAAP Net

Income $ 43,966 $ 23,646

$ 55,330 $ 67,612

$ 92,172 Earnings Per Share

Reconciliation

GAAP Diluted earnings per share $

0.01 $ 0.16 $ 0.50 $

0.17 $ 0.82 Effect of Amortization of

acquisition intangibles 0.04 - - 0.04 - Effect of Stock based

compensation expense 0.10 0.09 0.09 0.19 0.17 Effect of Provision

for litigation expenses and settlements - - - - 0.01 Effect of

Restructuring and other costs, net 0.03 - - 0.02 (0.01 ) Effect of

Wolfson acquisition items 0.47 0.04 - 0.51 - Effect of Provision

for income taxes 0.03 0.08 0.25 0.11 0.40

Non-GAAP Diluted earnings per share $

0.68 $ 0.37 $ 0.84

$ 1.04 $ 1.39

Operating Income Reconciliation

GAAP Operating Income

$ 18,073 $ 15,915 $

50,665 $ 33,988 $ 82,170 GAAP

Operating Profit 9 % 10 % 27 % 9 % 24 % Amortization of acquisition

intangibles 2,524 246 - 2,770 - Stock compensation expense - COGS

253 231 239 484 245 Stock compensation expense - R&D 2,781

2,543 2,158 5,324 5,012 Stock compensation expense - SG&A 3,462

2,848 3,342 6,310 6,256 Provision for litigation expenses and

settlements - - - - 695 Restructuring and other costs, net 1,455 -

(154 ) 1,455 (584 ) Wolfson acquisition items 16,547

2,192 - 18,739 -

Non-GAAP Operating Income $ 45,095

$ 23,975 $ 56,250

$ 69,070 $ 93,794

Non-GAAP Operating Profit 21 % 16 % 30 % 19 % 27 % Operating

Expense Reconciliation

GAAP Operating Expenses $

82,494 $ 59,460 $ 48,783

$ 141,954 $ 96,776 Amortization of

acquisition intangibles (2,524 ) (246 ) - (2,770 ) - Stock

compensation expense - R&D (2,781 ) (2,543 ) (2,158 ) (5,324 )

(5,012 ) Stock compensation expense - SG&A (3,462 ) (2,848 )

(3,342 ) (6,310 ) (6,256 ) Provision for litigation expenses and

settlements - - - - (695 ) Restructuring and other costs, net

(1,455 ) - 154 (1,455 ) 584 Wolfson acquisition items

(14,937 ) (2,192 ) - (17,129 ) -

Non-GAAP Operating Expenses $ 57,335

$ 51,631 $ 43,437

$ 108,966 $ 85,397

Gross Margin/Profit Reconciliation

GAAP Gross Margin

$ 100,567 $ 75,375 $

99,448 $ 175,942 $ 178,946 GAAP

Gross Profit 47.8 % 49.4 % 52.2 % 48.5 % 51.7 % Wolfson acquisition

items 1,610 - - 1,610 - Stock compensation expense - COGS

253 231 239 484

245

Non-GAAP Gross Margin $

102,430 $ 75,606 $

99,687 $ 178,036 $

179,191 Non-GAAP Gross Profit 48.7 % 49.6 % 52.3 %

49.1 % 51.8 %

CIRRUS LOGIC, INC.

CONSOLIDATED CONDENSED BALANCE SHEET (in thousands)

Sep. 27, Mar. 29, Sep. 28, 2014

2014 2013 (unaudited) (unaudited) ASSETS Current

assets Cash and cash equivalents $ 48,214 $ 31,850 $ 68,886

Marketable securities 85,796 263,417 199,423 Accounts receivable,

net 126,161 63,220 97,640 Inventories 121,169 69,743 91,247

Deferred tax assets 16,435 22,024 38,398 Other current assets

29,089 25,079 23,978

Total current assets 426,864 475,333 519,572 Long-term

marketable securities 9,228 89,243 40,254 Property and equipment,

net 133,458 103,650 101,885 Intangibles, net 187,030 11,999 4,734

Goodwill 265,410 16,367 6,027 Deferred tax assets 24,998 25,065

16,638 Other assets 17,658 3,087

10,051 Total assets $ 1,064,646 $ 724,744 $

699,161 LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities Accounts payable $ 81,549 $ 51,932 $ 56,868 Accrued

salaries and benefits 17,706 13,388 16,894 Other accrued

liabilities 34,946 11,572 6,313 Deferred income 5,218

5,631 4,858 Total current liabilities

139,419 82,523 84,933 Other long-term liabilities 25,376

4,863 11,231 Long-term debt 226,439 - - Stockholders'

equity: Capital stock 1,104,379 1,078,878 1,055,256 Accumulated

deficit (430,144 ) (440,634 ) (451,532 ) Accumulated other

comprehensive loss (823 ) (886 ) (727 ) Total

stockholders' equity 673,412 637,358

602,997 Total liabilities and stockholders' equity $

1,064,646 $ 724,744 $ 699,161 Prepared

in accordance with Generally Accepted Accounting Principles

Cirrus Logic, Inc.Investor Contact:Thurman K. Case,

512-851-4125Chief Financial

OfficerInvestor.Relations@cirrus.com

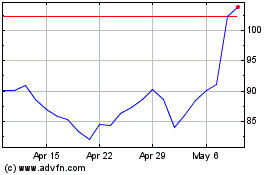

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

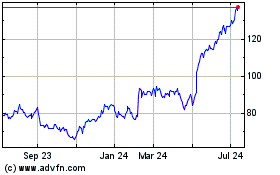

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024