Completes Acquisition of Leading Voice-Based

Technology Supplier Acoustic Technologies

Cirrus Logic, Inc. (Nasdaq: CRUS), a leader in high-precision

analog and digital signal processing components, today posted on

its investor relations website at http://investor.cirrus.com the

quarterly Shareholder Letter that contains the complete financial

results for the third quarter fiscal year 2014, which ended Dec.

28, as well as the company’s current business outlook.

“We delivered strong revenue, operating profit and EPS results

for the third quarter,” said Jason Rhode, president and chief

executive officer. “While our business is typically driven by

product cycles that weight our revenue more heavily towards the

September and December quarters, we expect to exceed our operating

profit goal of 20 percent in FY14 and we remain committed to this

long-term target. We are extremely excited to be taping out a wave

of new products in advanced geometries this year as we look to

capitalize on strategic opportunities in audio with new and

existing customers, especially the growing trend of voice as a

powerful interface to a wide variety of devices. We anticipate

these products will contribute to future revenue growth as early as

calendar year 2015.”

Reported Financial Results – Third Quarter FY14

- Revenue of $218.9 million;

- Gross margin of 47.4 percent;

- GAAP operating expenses of $51 million

and non-GAAP operating expenses of $45 million; and

- GAAP diluted earnings per share of

$0.63 and non-GAAP diluted earnings per share of $0.89.

A reconciliation of the non-GAAP charges is included in the

tables accompanying this press release.

Business Outlook – Fourth Quarter FY14

- Revenue is expected to range between

$130 million and $150 million;

- Gross margin is expected to be between

47 percent and 49 percent; and

- Combined R&D and SG&A expenses

are expected to range between $51 million and $55 million, which

includes approximately $6 million in share-based compensation and

amortization of acquired intangibles.

Cirrus Logic will host a live Q&A session at 5 p.m. EST

today to answer questions related to its financial results and

business outlook. Participants may listen to the conference call on

the Cirrus Logic website. Participants who would like to submit a

question to be addressed during the call are requested to email

investor.relations@cirrus.com. A replay of the webcast can be

accessed on the Cirrus Logic website approximately two hours

following its completion, or by calling (404) 537-3406, or

toll-free at (855) 859-2056 (Access Code: 27210276).

Cirrus Logic, Inc.

Cirrus Logic develops high-precision, analog and mixed-signal

integrated circuits for a broad range of innovative customers.

Building on its diverse analog and signal-processing patent

portfolio, Cirrus Logic delivers highly optimized products for a

variety of audio and energy-related applications. The company

operates from headquarters in Austin, Texas, with offices in

Phoenix, Ariz., Europe, Japan and Asia. More information about

Cirrus Logic is available at www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, Cirrus has provided non-GAAP financial information,

including operating expenses, net income, operating profit and

diluted earnings per share. A reconciliation of the adjustments to

GAAP results is included in the tables below. Non-GAAP financial

information is not meant as a substitute for GAAP results, but is

included because management believes such information is useful to

our investors for informational and comparative purposes. In

addition, certain non-GAAP financial information is used internally

by management to evaluate and manage the company. The non-GAAP

financial information used by Cirrus Logic may differ from that

used by other companies. These non-GAAP measures should be

considered in addition to, and not as a substitute for, the results

prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements,

including our estimates of fourth quarter fiscal year 2014 revenue,

gross margin, combined research and development and selling,

general and administrative expense levels, share-based compensation

expense and amortization of acquired intangibles. In some cases,

forward-looking statements are identified by words such as

“expect,” “anticipate,” “target,” “project,” “believe,” “goals,”

“opportunity,” “estimates,” “intend,” and variations of these types

of words and similar expressions. In addition, any statements that

refer to our plans, expectations, strategies or other

characterizations of future events or circumstances are

forward-looking statements. These forward-looking statements are

based on our current expectations, estimates and assumptions and

are subject to certain risks and uncertainties that could cause

actual results to differ materially. These risks and uncertainties

include, but are not limited to, the following: the level of orders

and shipments during the fourth quarter of fiscal year 2014, as

well as customer cancellations of orders, or the failure to place

orders consistent with forecasts; and the risk factors listed in

our Form 10-K for the year ended March 30, 2013, and in our other

filings with the Securities and Exchange Commission, which are

available at www.sec.gov. The foregoing information concerning our

business outlook represents our outlook as of the date of this news

release, and we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new developments

or otherwise.

Cirrus Logic and Cirrus are trademarks of Cirrus Logic, Inc.

Summary financial data follows:

CIRRUS LOGIC, INC.

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS

(unaudited) (in thousands, except per share data)

Three Months Ended

Nine Months Ended

Dec. 28, Sep. 28, Dec. 29, Dec.

28, Dec. 29, 2013 2013 2012

2013 2012 Q3'14 Q2'14 Q3'13

Q3'14 Q3'13 Audio products $ 206,388 $ 179,912 $

300,010 $ 529,966 $ 558,671 Energy products 12,495

10,759 10,123 34,713

44,242

Net revenue 218,883

190,671 310,133

564,679 602,913 Cost of

sales 115,034 91,223 152,083

281,884 291,336

Gross

Profit 103,849 99,448 158,050

282,795 311,577 Gross Margin 47.4

% 52.2 % 51.0 % 50.1

% 51.7 % Research and development

32,426 29,722 29,608 90,678 83,986 Selling, general and

administrative 18,625 19,215 19,021 57,038 57,274 Restructuring and

other costs 12 (154 ) 3,539 (572 ) 3,539 Gain on sale of asset - -

(247 ) - (247 ) Patent settlements, net - -

- 695 - Total

operating expenses 51,063 48,783

51,921 147,839 144,552

Operating income 52,786 50,665 106,129

134,956 167,025 Interest income, net 222 201

76 581 334 Other income (expense), net (45 ) (38 )

(31 ) (100 ) (94 )

Income before income

taxes 52,963 50,828 106,174 135,437

167,265 Provision (benefit) for income taxes 11,463

17,461 38,312 39,928

57,027

Net income $

41,500 $ 33,367 $

67,862 $ 95,509 $

110,238 Basic earnings per share: $ 0.66 $

0.53 $ 1.04 $ 1.51 $ 1.70 Diluted earnings per share: $ 0.63 $ 0.50

$ 0.99 $ 1.45 $ 1.60 Weighted average number of shares:

Basic 62,854 63,217 65,055 63,170 64,859 Diluted 65,368 66,125

68,866 65,894 68,946 Prepared in accordance with Generally

Accepted Accounting Principles

CIRRUS LOGIC, INC. RECONCILIATION BETWEEN GAAP AND

NON-GAAP FINANCIAL INFORMATION (unaudited, in thousands,

except per share data) (not prepared in accordance with

GAAP) Non-GAAP financial information is not meant as a

substitute for GAAP results, but is included because management

believes such information is useful to our investors for

informational and comparative purposes. In addition, certain

non-GAAP financial information is used internally by management to

evaluate and manage the company. As a note, the non-GAAP financial

information used by Cirrus Logic may differ from that used by other

companies. These non-GAAP measures should be considered in addition

to, and not as a substitute for, the results prepared in accordance

with GAAP.

Three Months Ended

Nine Months Ended

Dec. 28, Sep. 28, Dec. 29, Dec.

28, Dec. 29, 2013 2013 2012

2013 2012 Net Income Reconciliation

Q3'14

Q2'14 Q3'13 Q3'14 Q3'13 GAAP Net

Income $ 41,500 $ 33,367 $

67,862 $ 95,509 $ 110,238

Amortization of acquisition intangibles 275 - - 275 604 Stock based

compensation expense 6,016 5,739 6,026 17,529 15,762 International

sales reorganization charges - - (47 ) - (47 ) Restructuring and

other costs, net 12 (154 ) 3,539 (572 ) 3,539 Gain on asset sale -

- (247 ) - (247 ) Patent settlements, net - - - 695 - Provision

(benefit) for income taxes 10,300 16,378

35,667 36,839 52,602

Non-GAAP Net Income $ 58,103

$ 55,330 $ 112,800

$ 150,275 $ 182,451

Earnings Per Share Reconciliation

GAAP Diluted earnings

per share $ 0.63 $ 0.50 $

0.99 $ 1.45 $ 1.60 Effect of

Amortization of acquisition intangibles - - - - 0.01 Effect of

Stock based compensation expense 0.10 0.09 0.09 0.27 0.23 Effect of

Restructuring and other costs, net - - 0.05 (0.01 ) 0.05 Effect of

Patent settlements, net - - - 0.01 - Effect of Provision (benefit)

for income taxes 0.16 0.25 0.51 0.56 0.76

Non-GAAP Diluted earnings per share $

0.89 $ 0.84 $ 1.64

$ 2.28 $ 2.65

Operating Income Reconciliation

GAAP Operating Income

$ 52,786 $ 50,665 $

106,129 $ 134,956 $ 167,025 GAAP

Operating Profit 24 % 27 % 34 % 24 % 28 % Amortization of

acquisition intangibles 275 - - 275 604 Stock compensation expense

- COGS 332 239 218 577 455 Stock compensation expense - R&D

2,834 2,158 3,234 7,846 7,574 Stock compensation expense - SG&A

2,850 3,342 2,574 9,106 7,733 International sales reorganization

charges - - (47 ) - (47 ) Restructuring and other costs, net 12

(154 ) 3,539 (572 ) 3,539 Gain on asset sale - - (247 ) - (247 )

Patent settlements, net - - -

695 -

Non-GAAP Operating

Income $ 59,089 $ 56,250

$ 115,400 $ 152,883

$ 186,636 Non-GAAP Operating Profit 27

% 30 % 37 % 27 % 31 % Operating Expense Reconciliation

GAAP Operating Expenses $ 51,063 $

48,783 $ 51,921 $ 147,839

$ 144,552 Amortization of acquisition intangibles

(275 ) - - (275 ) (604 ) Stock compensation expense - R&D

(2,834 ) (2,158 ) (3,234 ) (7,846 ) (7,574 ) Stock compensation

expense - SG&A (2,850 ) (3,342 ) (2,574 ) (9,106 ) (7,733 )

International sales reorganization charges - - 47 - 47

Restructuring and other costs, net (12 ) 154 (3,539 ) 572 (3,539 )

Gain on asset sale - - 247 - 247 Patent settlements, net -

- - (695 ) -

Non-GAAP Operating Expenses $ 45,092

$ 43,437 $ 42,868

$ 130,489 $ 125,396

CIRRUS LOGIC, INC.

CONSOLIDATED CONDENSED BALANCE SHEET unaudited; in

thousands Dec. 28, Sep. 28, Dec.

29, 2013 2013 2012 ASSETS Current assets

Cash and cash equivalents $ 74,690 $ 68,886 $ 87,452 Restricted

investments - - - Marketable securities 215,792 199,423 60,717

Accounts receivable, net 109,535 97,640 170,683 Inventories 69,985

91,247 135,023 Deferred tax asset 33,155 38,398 53,140 Other

current assets 25,662 23,978

21,775 Total Current Assets 528,819 519,572 528,790

Long-term marketable securities 37,115 40,254 - Property and

equipment, net 102,542 101,885 100,534 Intangibles, net 13,427

4,734 4,920 Goodwill 16,335 6,027 6,027 Deferred tax asset 17,354

16,638 36,466 Other assets 6,848 10,051

15,761 Total Assets $ 722,440 $ 699,161

$ 692,498 LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities Accounts payable $ 60,493 $ 56,868 $ 95,493

Accrued salaries and benefits 13,937 16,894 13,752 Other accrued

liabilities 12,881 6,313 13,992 Deferred income on shipments to

distributors 4,998 4,858 5,579

Total Current Liabilities 92,309 84,933 128,816 Other

long-term obligations 5,108 11,231 10,131 Stockholders'

equity: Capital stock 1,069,113 1,055,256 1,033,549 Accumulated

deficit (443,322 ) (451,532 ) (479,225 ) Accumulated other

comprehensive loss (768 ) (727 ) (773 ) Total

Stockholders' Equity 625,023 602,997

553,551 Total Liabilities and Stockholders' Equity $

722,440 $ 699,161 $ 692,498 Prepared in

accordance with Generally Accepted Accounting Principles

Cirrus Logic, Inc.Investor Contact:Thurman K. Case,

512-851-4125Chief Financial

OfficerInvestor.Relations@cirrus.com

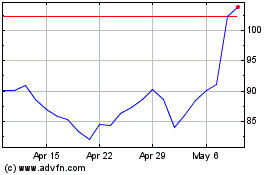

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

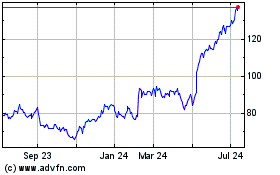

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024