Cirrus Logic, Inc. (Nasdaq: CRUS), a leader in high-precision

analog and digital signal processing components, today announced

financial results for the fourth quarter and fiscal year 2011,

which ended March 26, 2011.

Revenue for the quarter was $91.4 million, up 46 percent

compared to $62.6 million in the same quarter a year ago, and down

4 percent sequentially from $95.6 million in the previous quarter.

Revenue for fiscal year 2011 totaled $370 million, a 67 percent

increase compared to $221 million in fiscal year 2010.

Gross margin for the quarter was 50 percent, and reflects the

charge of $4.2 million related to the production issue the company

disclosed on April 14, 2011. This compares to gross margins of 56

percent in the fourth quarter a year ago, and 55 percent in the

previous quarter. The company’s long term gross margin target

remains 55 percent. Gross margin for fiscal year 2011 was 55

percent, compared to 54 percent in fiscal year 2010.

Total GAAP operating expenses for the quarter were $32.4

million, compared to $29.4 million in the previous quarter.

Non-GAAP operating expenses for the quarter were $29.7 million

compared to $28.0 million in the previous quarter.

GAAP operating margin was 15 percent for the March quarter and

23 percent for fiscal year 2011. Operating margin on a non-GAAP

basis was 18 percent for the March quarter and 24 percent for

fiscal year 2011.

GAAP net income for the quarter was $130.4 million, or $1.80 per

share, based on 72.3 million average diluted shares outstanding and

$203.5 million, or $2.82 per share, based on 72.1 million average

diluted shares for fiscal year 2011. Net income includes a $117

million net tax benefit, as the company revalued the deferred tax

asset due to improved business performance. Non-GAAP net income for

the quarter was $16.0 million, or $0.22 per diluted share and $89.3

million, or $1.24 per diluted share for fiscal year 2011.

A reconciliation of the non-GAAP charges is included in a table

below.

“FY11 was an outstanding year for Cirrus Logic, as we grew

revenue 67 percent, maintained our 55 percent gross margins target,

and increased operating profit from 13 percent to 24 percent on a

non-GAAP basis,” said Jason Rhode, president and chief executive

officer, Cirrus Logic. “We have made excellent progress on our

strategic initiatives in both audio and energy, and we expect

meaningful new product introductions from multiple customers

throughout the year.”

Outlook for First Quarter FY 2012 (ending June 25,

2011):

- Revenue is expected to range between

$88 million and $94 million;

- Gross margin is expected to be between

51 percent and 54 percent, and reflects the residual impact of the

production yield issues the company disclosed on April 14, 2011;

and

- Combined R&D and SG&A expenses

are expected to range between $32 million and $35 million, which

include approximately $2.7 million in share-based compensation and

amortization of acquisition-related intangibles expenses.

Other Highlights and Company News

- A new ultra low power DSP, optimized

for portable devices, is ramping into production.

- Total cash from operations was $20.4

million for the March quarter and $86.9 million for fiscal year

2011, an increase of approximately 246% compared with fiscal year

2010.

- Total employee headcount during the

quarter increased to 570 employees, a net increase of 21

employees.

- The company began construction on its

new headquarters facility at 800 W. Sixth Street in downtown

Austin, which is expected to be completed in the summer of

2012.

- Jason Rhode, president and chief

executive officer, will be presenting at the Jefferies Global

Technology Conference in New York on May 13, at 9:00 a.m. EDT. A

live webcast will be available in the Investor Relations section of

the Cirrus Logic website.

Conference Call

Cirrus Logic management will hold a conference call to discuss

the company’s results for the fourth quarter and fiscal year 2011,

on April 28, at 10:30 a.m. EDT. The conference call will be

simulcast over the internet in the Investor Relations section of

the company website at http://investor.cirrus.com. A replay of the

conference call will be available on the website listed above

beginning one hour following the completion of the call, or by

calling (303) 590-3030, or toll-free at (800) 406-7325 (Access

Code: 4430704).

Shareholders who would like to submit a question to be addressed

during the call are requested to email

investor.relations@cirrus.com.

Cirrus Logic, Inc.

Cirrus Logic develops high-precision, analog and mixed-signal

integrated circuits for a broad range of innovative customers.

Building on its diverse analog and signal-processing patent

portfolio, Cirrus Logic delivers highly optimized products for a

variety of audio and energy-related applications. The company

operates from headquarters in Austin, Texas, with offices in

Tucson, Ariz., Europe, Japan and Asia. More information about

Cirrus Logic is available at www.cirrus.com.

Use of non-GAAP Financial Information

To supplement Cirrus Logic's financial statements presented on a

GAAP basis, Cirrus has provided non-GAAP financial information,

including operating expenses, net income, operating margin and

diluted earnings per share. A reconciliation of the adjustments to

GAAP results is included in the tables below. Non-GAAP financial

information is not meant as a substitute for GAAP results, but is

included because management believes such information is useful to

our investors for informational and comparative purposes. In

addition, certain non-GAAP financial information is used internally

by management to evaluate and manage the company. As a note, the

non-GAAP financial information used by Cirrus Logic may differ from

that used by other companies. These non-GAAP measures should be

considered in addition to, and not as a substitute for, the results

prepared in accordance with GAAP.

Safe Harbor Statement

Except for historical information contained herein, the matters

set forth in this news release contain forward-looking statements,

including our estimates of first quarter fiscal year 2012 revenue,

our future growth rate, gross margin, combined research and

development and selling, general and administrative expense levels,

share-based compensation expense, and amortization of acquired

intangible expenses. In some cases, forward-looking statements are

identified by words such as “expect,” “anticipate,” “target,”

“project,” “believe,” “goals,” “opportunity,” “estimates,”

“intend,” and variations of these types of words and similar

expressions. In addition, any statements that refer to our plans,

expectations, strategies or other characterizations of future

events or circumstances are forward-looking statements. These

forward-looking statements are based on our current expectations,

estimates and assumptions and are subject to certain risks and

uncertainties that could cause actual results to differ materially.

These risks and uncertainties include, but are not limited to, the

following: the level of orders and shipments during the first

quarter of fiscal year 2012, as well as customer cancellations of

orders, or the failure to place orders consistent with forecasts;

the loss of a key customer; and the risk factors listed in our Form

10-K for the year ended March 27, 2010, and in our other filings

with the Securities and Exchange Commission, which are available at

www.sec.gov. The foregoing information concerning our business

outlook represents our outlook as of the date of this news release,

and we undertake no obligation to update or revise any

forward-looking statements, whether as a result of new developments

or otherwise.

Cirrus Logic and Cirrus are trademarks of Cirrus Logic Inc.

CRUS-F

Summary financial data follows:

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED

STATEMENT OF OPERATIONS

(unaudited)

(in thousands, except per share data)

Three Months

Ended Twelve Months Ended Mar. 26, Dec.

25, Mar. 27, Mar. 26, Mar. 27, 2011

2010 2010 2011 2010 Q4'11

Q3'11 Q4'10 Q4'11 Q4'10 Audio products

$ 66,965 $ 72,716 $ 40,540 $ 264,840 $ 153,661 Energy products

24,468 22,909 22,099

104,731 67,328

Net revenue

91,433 95,625

62,639 369,571

220,989 Cost of sales 45,415

43,163 27,355 167,576

102,258

Gross Profit 46,018 52,462

35,284 201,995 118,731 Operating

expenses: Research and development 17,044 16,348 13,724 63,934

51,421 Selling, general and administrative 15,252 13,431 12,678

58,066 45,923 Restructuring and other costs, net - (395 ) 572 6 493

Charge (benefit) from non-marketable securities - - - 500 (500 )

Provision (benefit) for litigation expenses and settlements 57 (30

) - 162 (2,610 ) Patent purchase agreement, net -

- - (4,000 ) (1,400 )

Total operating expenses 32,353 29,354

26,974 118,668 93,327

Operating income 13,665 23,108

8,310 83,327 25,404 Interest income,

net 187 212 237 860 1,345 Other income (expense), net 40

(31 ) (20 ) 27 (66 )

Income before income taxes 13,892 23,289

8,527 84,214 26,683 Benefit for income taxes

(116,514 ) (1,332 ) (11,831 ) (119,289

) (11,715 )

Net income $ 130,406

$ 24,621 $ 20,358

$ 203,503 $ 38,398

Basic income per share: $ 1.91 $ 0.36 $ 0.31 $ 3.00 $ 0.59 Diluted

income per share: $ 1.80 $ 0.34 $ 0.31 $ 2.82 $ 0.59

Weighted average number of shares: Basic 68,164 68,074 65,517

67,857 65,338 Diluted 72,344 71,695 66,595 72,103 65,626

Prepared in accordance with Generally Accepted Accounting

Principles

CIRRUS LOGIC, INC. CONSOLIDATED

CONDENSED BALANCE SHEET

(unaudited)

(in thousands) Mar. 26,

Dec. 25, Mar. 27, 2011

2010 2010 ASSETS Current assets Cash and cash

equivalents $ 37,039 $ 28,491 $ 16,109 Restricted investments 5,786

5,755 5,855 Marketable securities 159,528 156,052 85,384 Accounts

receivable, net 39,098 37,266 23,963 Inventories 40,497 40,196

35,396 Other current assets 37,522 22,612

18,148 Total Current Assets 319,470 290,372

184,855 Long-term marketable securities 12,702 - 34,278

Property and equipment, net 34,563 32,919 18,674 Intangibles, net

20,125 20,688 21,896 Goodwill 6,027 6,027 6,027 Deferred tax asset

102,136 360 339 Other assets 1,598 1,618

1,541 Total Assets $ 496,621 $ 351,984

$ 267,610 LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities Accounts payable $ 27,639 $ 25,371 $ 20,340

Accrued salaries and benefits 12,402 9,509 9,962 Other accrued

liabilities 5,169 5,034 5,100 Deferred income on shipments to

distributors 6,844 7,108 6,488

Total Current Liabilities 52,054 47,022 41,890

Long-term restructuring accrual 113 179 596 Other long-term

obligations 6,075 6,113 6,523 Stockholders' equity: Capital

stock 991,947 982,610 952,803 Accumulated deficit (552,814 )

(683,220 ) (733,553 ) Accumulated other comprehensive loss

(754 ) (720 ) (649 ) Total Stockholders' Equity

438,379 298,670 218,601

Total Liabilities and Stockholders' Equity $ 496,621 $

351,984 $ 267,610 Prepared in accordance with

Generally Accepted Accounting Principles

CIRRUS LOGIC,

INC. RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL

INFORMATION (unaudited, in thousands, except per share

data) (not prepared in accordance with GAAP)

Non-GAAP financial information is not meant as a substitute for

GAAP results, but is included because management believes such

information is useful to our investors for informational and

comparative purposes. In addition, certain non-GAAP financial

information is used internally by management to evaluate and manage

the company. As a note, the non-GAAP financial information used by

Cirrus Logic may differ from that used by other companies. These

non-GAAP measures should be considered in addition to, and not as a

substitute for, the results prepared in accordance with GAAP.

Three Months Ended Twelve Months Ended

Mar. 26, Dec. 25, Mar. 27, Mar. 26,

Mar. 27, 2011 2010 2010 2011

2010 Net Income Reconciliation

Q4'11 Q3'11

Q4'10 Q4'11 Q4'10 GAAP Net Income

$ 130,406 $ 24,621 $

20,358 $ 203,503 $ 38,398

Amortization of acquisition intangibles 353 353 404 1,429 1,616

Stock based compensation expense 2,294 1,467 1,181 8,142 5,314

Facility Related adjustments - - - (96 ) (397 ) International sales

reorganization charges - - - 790 - Provision (benefit) for

litigation expenses and settlements 57 (30 ) - 162 (2,610 )

Restructuring and other costs, net - (395 ) 572 6 493 Charge

(benefit) from non-marketable securities - - - 500 (500 ) Patent

purchase agreement, net - - - (4,000 ) (1,400 ) Benefit for income

taxes (117,078 ) (1,847 ) (11,838 )

(121,154 ) (11,838 )

Non-GAAP Net Income $

16,032 $ 24,169 $

10,677 $ 89,282 $

29,076 Earnings Per Share Reconciliation

GAAP Diluted income per share $ 1.80 $

0.34 $ 0.31 $ 2.82 $

0.59 Effect of Amortization of acquisition intangibles - - -

0.02 0.02 Effect of Stock based compensation expense 0.03 0.02 0.02

0.11 0.08 Effect of Facility Related adjustments - - - - (0.01 )

Effect of International sales reorganization charges - - - 0.01 -

Effect of Provision (benefit) for litigation expenses and

settlements - - - - (0.04 ) Effect of Restructuring and other

costs, net - - 0.01 - 0.01 Effect of Charge (benefit) from

non-marketable securities - - - 0.01 (0.01 ) Effect of Patent

purchase agreement, net - - - (0.05 ) (0.02 ) Effect of Benefit for

income taxes (1.61 ) (0.02 ) (0.18 )

(1.68 ) (0.18 )

Non-GAAP Diluted income per share

$ 0.22 $ 0.34 $

0.16 $ 1.24 $ 0.44

Operating Income Reconciliation

GAAP Operating

Income $ 13,665 $ 23,108 $

8,310 $ 83,327 $ 25,404 GAAP

Operating Margin 15 % 24 % 13 % 23 % 11 % Amortization of

acquisition intangibles 353 353 404 1,429 1,616 Stock compensation

expense - COGS 78 46 61 243 211 Stock compensation expense -

R&D 924 579 501 2,641 1,881 Stock compensation expense -

SG&A 1,292 842 619 5,258 3,222 Facility Related adjustments - -

- (96 ) (397 ) International sales reorganization charges - - - 790

- Provision (benefit) for litigation expenses and settlements 57

(30 ) - 162 (2,610 ) Restructuring and other costs, net - (395 )

572 6 493 Charge (benefit) from non-marketable securities - - - 500

(500 ) Patent purchase agreement, net - -

- (4,000 ) (1,400 )

Non-GAAP

Operating Income $ 16,369 $

24,503 $ 10,467 $

90,260 $ 27,920 Non-GAAP

Operating Margin 18 % 26 % 17 % 24 % 13 % Operating Expense

Reconciliation

GAAP Operating Expenses $

32,353 $ 29,354 $ 26,974

$ 118,668 $ 93,327 Amortization of

acquisition intangibles (353 ) (353 ) (404 ) (1,429 ) (1,616 )

Stock compensation expense - R&D (924 ) (579 ) (501 ) (2,641 )

(1,881 ) Stock compensation expense - SG&A (1,292 ) (842 ) (619

) (5,258 ) (3,222 ) Facility Related adjustments - - - 96 397

International sales reorganization charges - - - (790 ) - Benefit

(provision) for litigation expenses and settlements (57 ) 30 - (162

) 2,610 Restructuring and other costs, net - 395 (572 ) (6 ) (493 )

Benefit (charge) from non-marketable securities - - - (500 ) 500

Patent purchase agreement, net - -

- 4,000 1,400

Non-GAAP

Operating Expenses $ 29,727 $

28,005 $ 24,878 $

111,978 $ 91,022

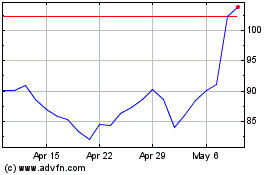

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jun 2024 to Jul 2024

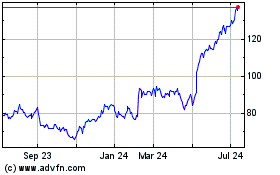

Cirrus Logic (NASDAQ:CRUS)

Historical Stock Chart

From Jul 2023 to Jul 2024