As

filed with the Securities and Exchange Commission on November 15, 2023

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

CINGULATE

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

86-3825535 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

1901

W. 47th Place

Kansas

City, KS 66205

(913)

942-2300

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Shane

J. Schaffer

Chief

Executive Officer

Cingulate

Inc.

1901

W. 47th Place

Kansas

City, KS 66205

(913)

942-2300

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Michael

J. Lerner, Esq.

Steven

M. Skolnick, Esq.

Lowenstein

Sandler LLP

1251

Avenue of the Americas

New

York, New York 10020

(212)

262-6700 |

Approximate

date of commencement of proposed sale to public:

As

soon as practicable after this Registration Statement is declared effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION |

|

DATED NOVEMBER 15, 2023 |

Up to Shares of Common Stock

Up to Series A Warrants to Purchase

up to Shares of Common Stock

Up to Series B Warrants to Purchase

up to Shares of Common Stock

Up to Pre-Funded Warrants to

Purchase up Shares of Common Stock

Up to Shares of Common Stock

Underlying the Series A Warrants, Series B Warrants and Pre-Funded Warrants

Up to Placement Agent Warrants

to Purchase up to Shares of Common Stock

Up to Shares of Common Stock Underlying

the Placement Agent Warrants

Cingulate

Inc.

We are offering up to

shares of common stock, par value $0.0001 per share, together with Series A warrants to purchase up to

shares of common stock, which we refer to as the “Series A warrants,” and Series B warrants to purchase up to

shares of common stock, which we refer to as the “Series B warrants,” at an assumed combined public offering price of

$ per share and accompanying warrants (the last reported

sale price of our common stock on the Nasdaq Capital Market, or Nasdaq, on , 2023). The Series A warrants and the Series

B warrants are hereinafter referred to as the “warrants.” Each share of our common stock is being sold together with one

Series A warrant to purchase one share of common stock and one Series B warrant to purchase one-half of a share of common stock.

The Series A warrants will have an exercise price of $ per

share (100% of the combined public offering price per share of common stock and accompanying warrants) and will be exercisable beginning

on the effective date of stockholder approval of the issuance of the shares upon exercise of the warrants (“Warrant Stockholder

Approval”), provided however, if the Pricing Conditions (as defined below) are met, the Series A warrants will be exercisable upon

issuance (the “Initial Exercise Date”). The Series A warrants will expire on the five-year anniversary of the Initial

Exercise Date. The Series B warrants will have an exercise price of $ per

share (100% of the combined public offering price per share of common stock and accompanying warrants) and will be exercisable beginning

on the Initial Exercise Date. The Series B warrants will expire on the two-year anniversary of the Initial Exercise Date. This

prospectus also relates to the offering of the shares of common stock issuable upon exercise of the Series A warrants and Series B warrants.

As used herein “Pricing Conditions” means that the combined offering price per share and accompanying warrants is such that

the Warrant Stockholder Approval is not required under Nasdaq rules because either (i) the offering is an at-the-market offering under

Nasdaq rules and such price equals or exceeds the sum of (a) the applicable “Minimum Price” per share under Nasdaq rule 5635(d)

plus (b) $0.125 per whole share of common stock underlying the warrants or (ii) the offering is a discounted offering where the pricing

and discount (including attributing a value of $0.125 per whole share underlying the warrants) meet the pricing requirements under the

Nasdaq rules.

We are also offering to those

investors, if any, whose purchase of shares of our common stock in this offering would result in such investor, together with its affiliates

and certain related parties, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our outstanding common

stock following the consummation of this offering, the opportunity to purchase, in lieu of the common stock that would otherwise result

in the investor’s beneficial ownership exceeding 4.99% (or, at the election of the investor, 9.99%), pre-funded warrants each to

purchase one share of our common stock at an exercise price of $0.0001, which we refer to as the “pre-funded warrants.” Each

pre-funded warrant will be exercisable upon issuance and will expire when exercised in full. Each pre-funded warrant is being sold together

with one Series A warrant to purchase one share of common stock and one Series B warrant to purchase one-half of a share of

common stock. The public offering price for each pre-funded warrant and the accompanying warrants is equal to the price per share of

common stock and the accompanying warrants being sold to the public in this offering, minus $0.0001. This prospectus also relates to

the offering of the shares of common stock issuable upon exercise of the pre-funded warrants.

For each pre-funded warrant we sell, the number

of shares of common stock we sell in this offering will be decreased on a one-for-one basis. The shares of common stock and/or pre-funded

warrants and the accompanying warrants can only be purchased together in this offering but will be issued separately and will be immediately

separable upon issuance.

This

offering will terminate on , 2023, unless we decide to terminate the offering (which we may do at any time in our discretion)

prior to that date. We will have one closing for all the securities purchased in this offering. The combined public offering price per

share (or pre-funded warrant) and accompanying warrants will be fixed for the duration of this offering.

We

have engaged , or the placement agent, to act as our exclusive placement agent in connection with

this offering. The placement agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by

this prospectus. The placement agent is not purchasing or selling any of the securities we are offering and the placement agent is not

required to arrange the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay to the placement

agent the placement agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus.

Since we will deliver the securities to be issued in this offering upon our receipt of investor funds, there is no arrangement for funds

to be received in escrow, trust or similar arrangement. There is no minimum offering requirement as a condition of closing of this offering.

Because there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the securities

offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive

a refund in the event that we do not sell an amount of securities sufficient to pursue our business goals described in this prospectus.

In addition, because there is no escrow account and no minimum offering amount, investors could be in a position where they have invested

in our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. Further,

any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we

would be able to use such funds to effectively implement our business plan. See the section entitled “Risk Factors” for more

information. We will bear all costs associated with the offering. See “Plan of Distribution” on page 18 of this prospectus

for more information regarding these arrangements.

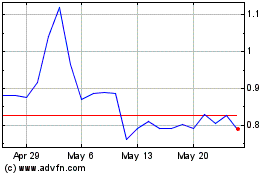

Our

common stock is listed on the Nasdaq Capital Market under the symbol “CING.” The closing price of our common stock on Nasdaq

on November 14, 2023 was $0.2952 per share. There is no established public trading market for the pre-funded warrants, Series

A warrants or Series B warrants, and we do not expect such a market to develop. We do not intend to apply to list the pre-funded warrants,

Series A warrants or Series B warrants on any securities exchange or other nationally recognized trading system. Without an active trading

market, the liquidity of the pre-funded warrants, Series A warrants and Series B Warrants will be limited.

Certain

information in this prospectus is based on an assumed public offering price of $ per share and accompanying warrants (the

last reported sale price of our common stock on Nasdaq on , 2023). The actual public offering price will be determined

between us and the placement agent based on market conditions at the time of pricing, and may be at a discount to the current market

price of our common stock. Therefore, the recent market price per share of common stock used throughout this prospectus as an assumed

combined public offering price may not be indicative of the final offering price.

We

are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced

public company reporting requirements.

Investing

in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 5

of this prospectus and in the documents incorporated by reference into this prospectus for a discussion of information that should be

considered in connection with an investment in our securities.

| | |

Per Share and Accompanying Warrants | | |

Per Pre-Funded Warrant and Accompanying

Warrants | | |

Total | |

| Public offering price | |

$ | | | |

| | | |

$ | | |

| Placement agent fees(1) | |

$ | | | |

| | | |

$ | | |

| Proceeds to us, before expenses (2) | |

$ | | | |

| | | |

$ | | |

| (1) |

We

have agreed to pay the placement agent a cash fee equal to 7.0% of the gross proceeds raised in this offering.

We have also agreed to reimburse the placement agent for certain of its offering related expenses, including reimbursement for

non-accountable expenses in an amount up to $50,000, legal fees and expenses in the amount of up to $100,000, and for its clearing

expenses in the amount of $15,950. In addition, we have agreed to issue the placement agent or its designees warrants to purchase

a number of shares of common stock equal to 5.0% of the shares of common stock sold in this offering (including the shares

of common stock issuable upon the exercise of the pre-funded warrants), at an exercise price of $ per

share, which represents 125% of the public offering price per share and accompanying warrant. For a description of compensation

to be received by the placement agent, see “Plan of Distribution” for more information. |

| (2) |

Because

there is no minimum number of securities or amount of proceeds required as a condition to

closing in this offering, the actual public offering amount, placement agent fees, and proceeds

to us, if any, are not presently determinable and may be substantially less than the total

maximum offering amounts set forth above. For more information, see “Plan of Distribution.” |

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Delivery

of the securities offered hereby is expected to be made on or about ,

2023, subject to satisfaction of customary closing conditions.

The

date of this prospectus is , 2023.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus

as well as additional information described under “Incorporation of Certain Information By Reference,” before deciding

to invest in our securities.

We

have not, and the placement agent and its affiliates have not, authorized anyone to provide you with any information or to make

any representation not contained or incorporated by reference in this prospectus or any related free writing prospectus. We do not, and

the placement agent and its affiliates do not, take any responsibility for, and can provide no assurance as to the reliability

of, any information that others may provide to you. This prospectus is not an offer to sell or an offer to buy securities in any jurisdiction

where offers and sales are not permitted. The information in this prospectus is accurate only as of its date, regardless of the time

of delivery of this prospectus or any sale of securities. You should also read and consider the information in the documents to which

we have referred you under the caption “Where You Can Find More Information” in the prospectus.

Neither

we nor the placement agent have done anything that would permit a public offering of the securities or possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the

United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the

offering of the securities and the distribution of this prospectus outside of the United States.

The

information incorporated by reference or provided in this prospectus contains statistical data and estimates, including those relating

to market size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and

research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications,

studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal

company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions

have been verified by any independent source.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider

before making your investment decision. Before investing in our securities, you should carefully read this entire prospectus and the

documents incorporated by reference herein, including the “Risk Factors” section in this prospectus and under similar captions

in the documents incorporated by reference into this prospectus. If any of the risks materialize, our business, financial condition,

operating results, and prospects could be materially and adversely affected. In that event, the price of our securities could decline,

and you could lose part or all of your investment. Unless we state otherwise or the context otherwise requires, the terms “we,”

“us,” “our,” “our business,” “the Company” and “Cingulate” refer to and similar

references refer: (1) on or following the consummation of the Reorganization Merger (as defined below), including our initial public

offering, to Cingulate Inc. and its consolidated subsidiaries, including Cingulate Therapeutics LLC, or CTx; and (2) prior to

the consummation of the Reorganization Merger, including our initial public offering, to CTx and its consolidated subsidiaries.

Overview

We

are a biopharmaceutical company using our proprietary Precision Timed ReleaseTM (PTRTM) drug delivery platform

technology to build and advance a pipeline of next-generation pharmaceutical products designed to improve the lives of patients suffering

from frequently diagnosed conditions characterized by burdensome daily dosing regimens and suboptimal treatment outcomes. With an initial

focus on the treatment of Attention Deficit/Hyperactivity Disorder (ADHD), we are identifying and evaluating additional therapeutic areas

where our PTR technology may be employed to develop future product candidates, such as anxiety disorders. Our PTR platform incorporates

a proprietary Erosion Barrier Layer (EBL) designed to allow for the release of drug substance at specific, pre-defined time intervals,

unlocking the potential for once-daily, multi-dose tablets.

We

are targeting the ADHD stimulant-based treatment market, with an estimated US market size of $18 billion as of September 2022. Stimulants

are the most commonly prescribed class of medications for ADHD and account for more than 90% of all ADHD medication prescriptions in

the United States, where approximately 80 million stimulant prescriptions were written during the 12-months ended September 2022. By

contrast, non-stimulant medications are typically employed only in the second-line or adjunctive therapy setting and account for 10%

of all ADHD medication prescriptions. Extended-release, or long-acting, dosage forms of stimulant medications are most frequently deployed

as the first-line treatment for ADHD and constitute approximately 59% of ADHD stimulant prescriptions by volume and nearly 83% of the

dollars. Most of these extended-release dosage forms are approved for once-daily dosing in the morning and were designed to eliminate

the need for re-dosing during the day. However, with the current ‘once-daily’ extended-release dosage forms, most patients

still receive a second or “booster” dose for administration later in the day (typically in the early afternoon) to achieve

entire active-day coverage and suffer from a multitude of unwanted side effects as a result. We believe there is a significant, unmet

need within the current treatment paradigm for true once-daily ADHD stimulant medications with lasting duration and superior side effect

profiles to better serve the needs of patients throughout their entire active-day.

Our

two proprietary, first-line stimulant medications: CTx-1301 (dexmethylphenidate) and CTx-1302 (dextroamphetamine), are being developed

for the treatment of ADHD in the three main patient segments: children (ages 6 -12), adolescents (ages 13-17), and adults (ages18+).

Both CTx-1301 and CTx-1302 are designed to address the key shortcomings of currently approved stimulant therapies by: providing an immediate

onset of action (within 30 minutes); offering ‘entire active-day’ duration; eliminating the need for a ‘booster/recovery’

dose of short-acting stimulant medications; minimizing or eliminating the rebound/crash symptoms associated with early medication ‘wear-off;’

and providing favorable tolerability with a controlled descent of drug blood levels. Furthermore, by eliminating the ‘booster’

dose used by up to 60% of ADHD patients in conjunction with their primary medication, we believe our product candidates will provide

important societal and economic benefits: reducing the abuse and diversion associated with short-acting stimulant medications; allowing

physicians to prescribe one medication versus two; allowing patients to pay for one medication versus two; and allowing payers to reimburse

one medication versus two.

Going

Concern

This offering is being

made on a best efforts basis and we may sell fewer than all of the securities offered hereby and may receive significantly less in net

proceeds from this offering. Assuming that we receive a minimum of $

of proceeds from this offering, we believe that the net proceeds from this offering, together with our cash on hand, will satisfy our

capital needs until

under our current business plan and assuming that we receive $

of proceeds from this offering, we believe that the net proceeds from this offering, together with our cash on hand, will satisfy our

capital needs until

under our current business plan. Following this offering, we will need to raise additional capital to fund our operations and continue

to support our planned development and commercialization activities.

Nasdaq

Our common stock and warrants

are currently listed for trading on Nasdaq. On May 16, 2023, we received a notice from Nasdaq stating that we no longer comply with the

minimum stockholders’ equity requirement under Nasdaq Listing Rule 5550(b)(1) for continued listing. We submitted a plan of compliance

to Nasdaq on June 30, 2023. On July 28, 2023, Nasdaq notified us that that it granted an extension until November 13, 2023 to regain

compliance with the minimum stockholders’ equity requirement, conditioned upon achievement

of certain milestones included in the plan of compliance previously submitted to Nasdaq, including a plan to raise additional capital.

On November 14, 2023, we received a letter from Nasdaq indicating that, based upon the Company’s continued non-compliance with

the Minimum Stockholders’ Equity Rule, the Listing Qualifications Staff of Nasdaq had determined to delist the Company’s

securities from Nasdaq unless the Company timely requests a hearing before the Nasdaq Hearings Panel (the “Panel”). We intend

to timely request a hearing before the Panel, at which hearing we will request an extension within which to evidence compliance with

all applicable requirements for continued listing on Nasdaq, including compliance with the Minimum Stockholders’ Equity Rule. Our

request for a hearing will stay any suspension or delisting action by the Staff pending the hearing and the expiration of any additional

extension period granted by the Panel following the hearing. We intend to continue to take definitive steps in an effort to evidence

compliance with the Minimum Stockholders’ Equity Rule; however, there can be no assurance that the Panel will grant our request

for continued listing or that we will be able to evidence compliance with the Minimum Stockholders’ Equity Rule within any extension

period that may be granted by the Panel. Following this offering,

we believe we will need to raise additional capital to evidence compliance with the Minimum Stockholders’ Equity Rule.

In

addition, on July 28, 2023, we received notice from Nasdaq indicating that we are not in compliance with the requirement to maintain

a minimum bid price of $1.00 per share for continued listing on Nasdaq. We were provided a compliance period of 180 calendar days from

the date of the notice, or until January 24, 2024, to regain compliance with the minimum closing bid requirement, pursuant to Nasdaq

Listing Rule 5810(c)(3)(A). We may be eligible for an additional 180 calendar day compliance period. There can be no assurance that we

will regain compliance with the minimum closing bid requirement during the 180-day compliance period, secure a second period of 180 days

to regain compliance or maintain compliance with the other Nasdaq listing requirements.

We

will continue to monitor the closing bid price of our common stock and may, if appropriate, consider available options, including implementation

of a reverse stock split of our common stock, to regain compliance with the minimum closing bid requirement. If we seek to implement

a reverse stock split in order to remain listed on Nasdaq, the announcement or implementation of such a reverse stock split could negatively

affect the price of our common stock and/or warrants.

We

must satisfy Nasdaq’s continued listing requirements, including, among other things, a minimum stockholders’ equity of $2.5

million and a minimum closing bid price of $1.00 per share or risk delisting, which could have a material adverse effect on our business.

If our common stock and warrants are delisted from Nasdaq, it could materially reduce the liquidity of our common stock and warrants

and result in a corresponding material reduction in the price of our common stock and warrants as a result of the loss of market efficiencies

associated with Nasdaq and the loss of federal preemption of state securities laws. In addition, delisting could harm our ability to

raise capital through alternative financing sources on terms acceptable to us, or at all, and may result in the potential loss of confidence

by investors, suppliers, customers and employees and fewer business development opportunities. If our common stock and warrants are delisted,

it could be more difficult to buy or sell our common stock and warrants or to obtain accurate quotations, and the price of our common

stock and warrants could suffer a material decline. Delisting could also impair our ability to raise capital on acceptable terms, if

at all.

Our

Organizational Structure

Cingulate

Inc. is a Delaware corporation that was formed to serve as a holding company. In connection with our initial public offering, we effected

certain organizational transactions. On September 29, 2021, Cingulate acquired Cingulate Therapeutics LLC, or CTx, through the merger

of a wholly-owned acquisition subsidiary of Cingulate with and into CTx (the “Reorganization Merger”). As a result of the

Reorganization Merger, CTx became a wholly-owned subsidiary of Cingulate. Unless otherwise stated or the context otherwise requires,

all information in this prospectus reflects the consummation of the Reorganization Merger.

Corporate

Information

Our

primary executive offices are located at 1901 West 47th Place, Kansas City, Kansas 66205 and our telephone number is (913)

942-2300. Our website address is www.cingulate.com. The information contained on, or that can be accessed through, our website

is not part of this prospectus and should not be considered as part of this prospectus or in deciding whether to purchase our securities.

Cingulate,

PTR, Cingulate Therapeutics, Enfoqis, Enfoqus, Trodesca, Ivoqus, Taylerza, Tymprezi, Accomplish, Mastery and our logo are some of our

trademarks used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other

organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus may appear without the ® and

™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under

applicable law, our rights or the right of the applicable licensor to these trademarks and tradenames.

Implications

of Being an Emerging Growth Company

As

a company with less than $1.235 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth

company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage

of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. These provisions

include:

| |

● |

reduced

obligations with respect to financial data, including presenting only two years of audited financial statements and only two years

of selected financial data in this prospectus; |

| |

|

|

| |

● |

an

exception from compliance with the auditor attestation requirement of Section 404 of the Sarbanes-Oxley Act of 2002, as amended,

or the Sarbanes-Oxley Act; |

| |

|

|

| |

● |

reduced

disclosure about our executive compensation arrangements in our periodic reports, proxy statements and registration statements; and |

| |

|

|

| |

● |

exemptions

from the requirements of holding non-binding advisory votes on executive compensation or golden parachute arrangements. |

We

may take advantage of exemptions for up to five years or such earlier time that we are no longer an emerging growth company. Accordingly,

the information contained herein may be different than the information you receive from other public companies in which you hold stock.

We would cease to be an emerging growth company upon the earliest to occur of: (1) the last day of the fiscal year in which we have more

than $1.235 billion in annual gross revenue; (2) December 31, 2026; (3) the date we are deemed to be a “large accelerated

filer” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act; and (4) the date on which we

have during the previous three-year period issued more than $1.0 billion in non-convertible debt securities.

The

JOBS Act also permits us, as an emerging growth company, to take advantage of an extended transition period to comply with the new or

revised accounting standards applicable to public companies and thereby allow us to delay the adoption of those standards until those

standards would apply to private companies. We have irrevocably elected to avail ourselves of this exemption and therefore, we will not

be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

THE

OFFERING

The

following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full

text and more specific details contained elsewhere in this prospectus and in the documents incorporated by reference.

| Common

Stock Offered |

|

shares. |

| |

|

|

| Pre-Funded Warrants Offered |

|

We are also offering to those investors, if any, whose

purchase of shares of our common stock in this offering would result in such investor, together with its affiliates and certain related

parties, beneficially owning more than 4.99% (or, at the election of the investor, 9.99%) of our outstanding common stock following

the consummation of this offering, the opportunity to purchase, in lieu of the common stock that would otherwise result in the investor’s

beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%), pre-funded warrants each to purchase one share

of our common stock at an exercise price of $0.0001, which we refer to as pre-funded warrants. Each

pre-funded warrant is being sold together with one Series A warrant to purchase one share of common stock and one Series B warrant

to purchase one-half of a share of common stock. The combined public offering price for each pre-funded warrant and accompanying

warrants is equal to the combined public offering price per share of common stock and accompanying warrants being sold in this offering,

minus $0.0001. For each pre-funded warrant we sell, the number of shares of common stock we sell will be decreased on a one-for-one

basis. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the pre-funded warrants.

See “Description of Securities We Are Offering” for additional information. |

| |

|

|

| Warrants Offered |

|

Each

share of common stock or pre-funded warrant is being offered together with one Series A

warrant to purchase one share of common stock and one Series B warrant to purchase one-half

of a share of common stock. The Series A warrants will have an exercise price of $ per

share (100% of the combined public offering price per share of common stock and accompanying

warrants) and will be exercisable beginning on the effective date of the Warrant Stockholder

Approval, provided however, if the Pricing Conditions are met, the Series A warrants will

be exercisable upon issuance (the “Initial Exercise Date”). The Series A warrants

will expire on the five-year anniversary of the Initial Exercise Date. The Series

B warrants will have an exercise price of $ per

share (100% of the combined public offering price per share of common stock and accompanying

warrants) and will be exercisable beginning on the Initial Exercise Date. The Series B warrants

will expire on the two-year anniversary of the Initial Exercise Date. See “Description

of Securities We Are Offering” for additional information.

|

| |

|

|

| Common

Stock Outstanding prior to this Offering (1) |

|

18,740,006 shares. |

| |

|

|

| Common

Stock Outstanding after this Offering (1) |

|

shares

assuming we sell only shares of common stock and no pre-funded warrants and no exercise of the warrants offered hereby. |

| |

|

|

| Use

of Proceeds |

|

We

estimate that the net proceeds of this offering assuming no exercise of the warrants, after deducting placement agent fees and estimated

offering expenses, will be approximately $ ,

assuming we sell only shares of common stock and no pre-funded warrants and assuming no exercise of the warrants. We intend to use

all of the net proceeds we receive from this offering for continued research and development and commercialization activities of

CTx-1301, and for working capital, capital expenditures and general corporate purposes, including investing further in research and

development efforts. Assuming that we receive a minimum of $

of proceeds from this offering, we believe that the net proceeds from this offering, together with our cash on hand, will satisfy our

capital needs until

under our current business plan and assuming that we receive $

of proceeds from this offering, we believe that the net proceeds from this offering, together with our cash on hand, will satisfy our

capital needs until

under our current business plan. Following this offering, we will need to raise additional capital to fund our operations and continue

to support our planned development and commercialization activities. See “Use of Proceeds.” |

| |

|

|

| Nasdaq

Capital Markets Symbol |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “CING.”

We do not intend to apply to list the pre-funded warrants, Series A warrants or Series

B warrants on any securities exchange or other nationally recognized trading system. Without

an active trading market, the liquidity of the pre-funded warrants, Series A warrants and

Series B warrants will be limited. |

| |

|

|

| Lock-up |

|

All

of our directors and executive officers have agreed, subject to certain exceptions, not to sell, transfer or dispose of, directly

or indirectly, any of our common stock or securities convertible into or exercisable or exchangeable for our common stock for a period

of 90 days after the closing of this offering. See “Plan of Distribution” for more information. |

| |

|

|

| Placement

Agent Warrants |

|

We

have agreed to issue to the placement agent or its designees, warrants, or the placement agent warrants, to purchase

up to 5.0% of the aggregate number of shares of common stock sold in this offering (including the shares of

common stock issuable upon the exercise of the pre-funded Warrants) at an exercise price equal to 125% of the public

offering price per share and accompanying warrants to be sold in this offering. The placement agent warrants will be exercisable

upon issuance and will expire five years from the commencement of sales under this offering. See “Plan of Distribution”

for additional information. |

| |

|

|

| Risk

Factors |

|

Investment

in our securities involves a high degree of risk and could result in a loss of your entire investment. See “Risk Factors”

beginning on page 5, and the other information included and incorporated by reference in this prospectus for a discussion

of the factors you should consider carefully before deciding to invest in our securities. |

(1) The number of shares of our common stock to be

outstanding immediately after this offering is based on 18,740,006 shares of our common stock outstanding as of November 10,

2023 and excludes, as of such date, the following:

| |

● |

1,452,745

shares of our common stock issuable upon exercise

of outstanding stock options issued under our 2021 Equity Incentive Plan (the “2021 Plan”), with a weighted average exercise

price of $2.99 per share; |

| |

|

|

| |

● |

1,333,565

shares of our common stock that are available

for future issuance under the 2021 Plan; |

| |

|

|

| |

● |

15,734,070

shares of common stock issuable upon the exercise

of the warrants with a weighted average exercise price of $2.32 per share; and |

| |

|

|

| |

● |

10,682,235 shares of common

stock issuable upon the exercise of pre-funded warrants with a weighted average exercise price of $0.0001 per share. |

Unless expressly indicated or the context requires

otherwise, all information in this prospectus assumes (i) we issue no pre-funded warrants and (ii) no exercise of the warrants

offered hereby.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to purchase our securities, including the shares

of common stock offered by this prospectus, you should carefully consider the risks and uncertainties described under “Risk Factors”

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, any subsequent Quarterly Report on Form 10-Q and our other

filings with the SEC, all of which are incorporated by reference herein. If any of these risks actually occur, our business, financial

condition and results of operations could be materially and adversely affected and we may not be able to achieve our goals, the value

of our securities could decline and you could lose some or all of your investment. Additional risks not presently known to us or that

we currently believe are immaterial may also significantly impair our business operations. If any of these risks occur, our business,

results of operations or financial condition and prospects could be harmed. In that event, the market price of our common stock and the

value of the warrants could decline, and you could lose all or part of your investment.

Risks

Related to Our Financial Position and Need for Capital

This offering is being made on a best

efforts basis and we may sell fewer than all of the securities offered hereby and may receive significantly less in net proceeds from

this offering, which will provide us only limited working capital

This offering is being made on a best efforts

basis and we may sell fewer than all of the securities offered hereby and may receive significantly less in net proceeds from this offering.

Assuming that we receive a minimum of $

of proceeds from this offering, we believe that the net proceeds from this offering, together with our cash on hand, will satisfy our

capital needs until

under our current business plan and assuming that we receive $

of proceeds from this offering, we believe that the net proceeds from this offering, together with our cash on hand, will satisfy our

capital needs until

under our current business plan. Following this offering, we will need to raise additional capital to fund our operations and continue

to support our planned development and commercialization activities.

Following

this offering, we will need to raise additional capital to complete the development and commercialization efforts for CTx-1301, CTx-1302

and/or CTx-2103. If we are unable to raise capital when needed, we could be forced to delay, reduce or terminate certain of our development

programs or other operations.

Following

this offering, we will need to raise additional capital to fund our operations and continue to support our planned development and commercialization

activities. The amount and timing of our future funding requirements will depend on many factors, including:

| |

● |

the

timing, rate of progress and cost of any clinical trials and other manufacturing/product development activities for our current and

any future product candidates that we develop, in-license or acquire; |

| |

|

|

| |

● |

the

results of the clinical trials for our product candidates in the United States and any foreign countries; |

| |

|

|

| |

● |

the

timing of, and the costs involved in, FDA approval and any foreign regulatory approval of our product candidates, if at all; |

| |

|

|

| |

● |

the

number and characteristics of any additional future product candidates we develop or acquire; |

| |

|

|

| |

● |

our

ability to establish and maintain strategic collaborations, licensing, co-promotion or other arrangements and the terms and timing

of such arrangements; |

| |

|

|

| |

● |

the

cost of commercialization activities if our current or any future product candidates are approved for sale, including manufacturing,

marketing, sales and distribution costs; |

| |

|

|

| |

● |

the

degree and rate of market acceptance of any approved products; |

| |

|

|

| |

● |

costs

under our third-party manufacturing and supply arrangements for our current and any future product candidates and any products we

commercialize; |

| |

● |

costs

and timing of completion of any additional outsourced commercial manufacturing or supply arrangements that we may establish; |

| |

|

|

| |

● |

costs

of preparing, filing, prosecuting, maintaining, defending and enforcing any patent claims and other intellectual property rights

associated with our product candidates; |

| |

|

|

| |

● |

costs

associated with prosecuting or defending any litigation that we are or may become involved in and any damages payable by us that

result from such litigation; |

| |

|

|

| |

● |

costs

associated with any product recall that could occur; |

| |

● |

costs

of operating as a public company; |

| |

|

|

| |

● |

the

holder of our $3.0 million amended and restated promissory note not demanding payment prior to maturity; |

| |

|

|

| |

● |

the

emergence, approval, availability, perceived advantages, relative cost, relative safety and relative efficacy of alternative and

competing products or treatments; |

| |

|

|

| |

● |

costs

associated with any acquisition or in-license of products and product candidates, technologies or businesses; and |

| |

|

|

| |

● |

personnel,

facilities and equipment requirements. |

We

cannot be certain that additional funding will be available on acceptable terms, or at all. In addition, future debt financing into which

we may enter may impose upon us covenants that restrict our operations, including limitations on our ability to incur liens or additional

debt, pay dividends, redeem our stock, make certain investments and engage in certain merger, consolidation or asset sale transactions.

If

we are unable to raise additional capital when required or on acceptable terms, we may be required to significantly delay, scale back

or discontinue the development or commercialization of one or more of our product candidates, restrict our operations or obtain funds

by entering into agreements on unattractive terms, which would likely have a material adverse effect on our business, stock price and

our relationships with third parties with whom we have business relationships, at least until additional funding is obtained. If we do

not have sufficient funds to continue operations, we could be required to seek bankruptcy protection or other alternatives that would

likely result in our securityholders losing some or all of their investment in us. In addition, our ability to achieve profitability

or to respond to competitive pressures would be significantly limited.

In

addition, if we are unable to secure sufficient capital to fund our operations, we may have to enter into strategic collaborations that

could require us to share commercial rights to CTx-1301, CTx-1302, and/or CTx-2103 with third parties in ways that we currently do not

intend or on terms that may not be favorable to us or our securityholders.

We have incurred a history of operating

losses and expect to continue to incur substantial costs for the foreseeable future. We are not currently profitable, and we may never

achieve or sustain profitability. Our financial situation creates doubt whether we will continue as a going concern.

We have never generated revenue

from operations, are unlikely to generate revenues for several years, and are currently operating at a loss and expect our operating

costs will increase significantly as we incur costs related to formulation/manufacturing development, the clinical trials for our drug

candidates and operating as a public company. We expect to incur expenses without corresponding revenues unless and until we are able

to obtain regulatory approval and successfully commercialize our lead product candidate, CTx-1301, and our other assets, CTx-1302

and CTx-2103. We may never be able to obtain regulatory approval for the marketing of our drug candidates in any indication in the

United States or internationally. Even if we obtain regulatory approval for CTx-1301, CTx-1302 and/or CTx-2103, development expenses

will continue to increase for any future assets. As CTx-1301 Phase 3 clinical trials advance in pursuit of FDA approval, we will

incur additional clinical development expenses. We have incurred recurring losses since inception and had an accumulated deficit of approximately

$86.0 million as of September 30, 2023. These conditions raise substantial doubt about our ability to continue as a going

concern, meaning that we may be unable to continue operations for the foreseeable future or realize assets and discharge liabilities

in the ordinary course of operations. If we are unable to obtain funding, we will be forced to delay, reduce or eliminate some or all

of our research and development programs, product portfolio expansion or commercialization efforts, or we may be unable to continue operations.

Although we continue to pursue these plans, there can be no assurance that we will be successful in obtaining sufficient funding on terms

acceptable to us to fund continuing operations, if at all.

We will continue to expend

substantial cash resources for the foreseeable future for the clinical development of our product candidates and development of any other

indications and product candidates we may choose to pursue. These expenditures will include costs associated with manufacturing and clinical

development, such as conducting clinical trials, manufacturing operations and product candidate supply, as well as marketing and selling

any products approved for sale. In particular, our Phase 3 trials in the United States will require substantial funds to complete. Because

the conduct and results of any clinical trial are highly uncertain, we cannot reasonably estimate the actual amounts necessary to successfully

complete the development and commercialization of our current and any future product candidates.

Risks

Related to This Offering and Ownership of Our Common Stock

If we fail to regain compliance with the

continued listing requirements of Nasdaq, our common stock and/or warrants may be delisted and the price of our common stock and/or warrants

and our ability to access the capital markets could be negatively impacted.

Our common stock and warrants

are currently listed for trading on Nasdaq. On May 16, 2023, we received a notice from Nasdaq stating that we no longer comply with the

minimum stockholders’ equity requirement under Nasdaq Listing Rule 5550(b)(1) for continued listing. We submitted a plan of compliance

to Nasdaq on June 30, 2023. On July 28, 2023, Nasdaq notified us that that it granted an extension until November 13, 2023 to regain

compliance with the minimum stockholders’ equity requirement, conditioned upon achievement

of certain milestones included in the plan of compliance previously submitted to Nasdaq, including a plan to raise additional capital.

On November 14, 2023, we received a letter from Nasdaq indicating that, based upon the Company’s continued non-compliance with

the Minimum Stockholders’ Equity Rule, the Listing Qualifications Staff of Nasdaq had determined to delist the Company’s

securities from Nasdaq unless the Company timely requests a hearing before the Nasdaq Hearings Panel (the “Panel”). We intend

to timely request a hearing before the Panel, at which hearing we will request an extension within which to evidence compliance with

all applicable requirements for continued listing on Nasdaq, including compliance with the Minimum Stockholders’ Equity Rule. Our

request for a hearing will stay any suspension or delisting action by the Staff pending the hearing and the expiration of any additional

extension period granted by the Panel following the hearing. We intend to continue to take definitive steps in an effort to evidence

compliance with the Minimum Stockholders’ Equity Rule; however, there can be no assurance that the Panel will grant our request

for continued listing or that we will be able to evidence compliance with the Minimum Stockholders’ Equity Rule within any extension

period that may be granted by the Panel. Following this offering, we believe we will need to raise additional capital to evidence compliance

with the Minimum Stockholders’ Equity Rule.

In addition, on July 28, 2023,

we received notice from Nasdaq indicating that we are not in compliance with the requirement to maintain a minimum bid price of $1.00

per share for continued listing on Nasdaq. We were provided a compliance period of 180 calendar days from the date of the notice, or

until January 24, 2024, to regain compliance with the minimum closing bid requirement, pursuant to Nasdaq Listing Rule 5810(c)(3)(A).

We may be eligible for an additional 180 calendar day compliance period. There can be no assurance that we will regain compliance with

the minimum closing bid requirement during the 180-day compliance period, secure a second period of 180 days to regain compliance or

maintain compliance with the other Nasdaq listing requirements.

We will continue to monitor

the closing bid price of our common stock and may, if appropriate, consider available options, including implementation of a reverse

stock split of our common stock, to regain compliance with the minimum closing bid requirement. If we seek to implement a reverse stock

split in order to remain listed on Nasdaq, the announcement or implementation of such a reverse stock split could negatively affect the

price of our common stock and/or warrants.

We must satisfy Nasdaq’s

continued listing requirements, including, among other things, a minimum stockholders’ equity of $2.5 million and a minimum closing

bid price of $1.00 per share or risk delisting, which could have a material adverse effect on our business. If our common stock and warrants

are delisted from Nasdaq, it could materially reduce the liquidity of our common stock and warrants and result in a corresponding material

reduction in the price of our common stock and warrants as a result of the loss of market efficiencies associated with Nasdaq and the

loss of federal preemption of state securities laws. In addition, delisting could harm our ability to raise capital through alternative

financing sources on terms acceptable to us, or at all, and may result in the potential loss of confidence by investors, suppliers, customers

and employees and fewer business development opportunities. If our common stock and warrants are delisted, it could be more difficult

to buy or sell our common stock and warrants or to obtain accurate quotations, and the price of our common stock and warrants could suffer

a material decline. Delisting could also impair our ability to raise capital on acceptable terms, if at all.

Because

management has broad discretion as to the use of the net proceeds from this offering, you may not agree with how we use them, and such

proceeds may not be applied successfully.

Our

management will have considerable discretion over the use of proceeds from this offering. We currently intend to use the net proceeds

from this offering for continued research and development and commercialization activities for CTx-1301, and for working capital, capital

expenditures, and general corporate purposes, including investing further in research and development efforts. However, our management

will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not

necessarily improve our operating results or enhance the value of our securities, or that you otherwise do not agree with. You will be

relying on the judgment of our management concerning these uses and you will not have the opportunity, as part of your investment decision,

to assess whether the proceeds are being used appropriately. The failure of our management to apply these funds effectively could, among

other things, result in unfavorable returns and uncertainty about our prospects, each of which could cause the price of our securities

to decline.

If

you purchase securities in this offering, you will suffer immediate dilution of your investment.

You will incur immediate and

substantial dilution as a result of this offering. The public offering price per share of common stock and accompanying warrants and

the public offering price per pre-funded warrant and accompanying warrants will be substantially higher than the as adjusted net tangible

book value per share of our common stock after giving effect to this offering. Therefore, if you purchase securities in this offering,

you will pay a price per share of common stock you acquire that substantially exceeds our pro forma net tangible book value per share

after this offering. Based on an assumed public offering price of $ per share of common stock and accompanying warrants (the

last reported sale price of our common stock on the Nasdaq Capital Market on , 2023) and our net tangible book deficit

as of September 30, 2023, you will experience immediate dilution of $ per share, representing the difference between

our as adjusted net tangible book value per share after giving effect to this offering and the assumed public offering price.

There is no public market for the pre-funded

warrants or warrants offered by us.

There is no established

public trading market for the pre-funded warrants or warrants, and we do not expect such a market to develop. In addition, we do not

intend to apply to list the pre-funded warrants or warrants on any national securities exchange or other nationally recognized trading

system. Without an active trading market, the liquidity of the pre-funded warrants and warrants will be limited.

Holders of pre-funded warrants and warrants

purchased in this offering will have no rights as common stockholders until such holders exercise their pre-funded warrants or warrants

and acquire our common stock.

Until holders of the pre-funded

warrants and warrants acquire shares of our common stock upon exercise thereof, such holders will have no rights with respect to the

shares of our common stock underlying the pre-funded warrants and warrants. Upon exercise of the pre-funded warrants and warrants, the

holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the

exercise date.

The warrants are speculative in nature.

The warrants do not confer

any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent

the right to acquire shares of common stock at a fixed price for a limited period of time. Moreover, following this offering, the market

value of the warrants, if any, will be uncertain and there can be no assurance that the market value of the warrants will equal or exceed

their imputed offering price. The warrants will not be listed or quoted for trading on any market or exchange. There can be no assurance

that the market price of our common stock will ever equal or exceed the exercise price of the warrants, and consequently, the warrants

may expire valueless.

The warrants are not exercisable until stockholder

approval, provided however, if the Pricing Conditions are met, the warrants will be exercisable upon issuance.

The Series A warrants will have

an exercise price of $ per share (100% of the combined

public offering price per share of common stock and accompanying warrants) and will be exercisable beginning on the effective date of

the Warrant Stockholder Approval, provided however, if the Pricing Conditions are met, the Series A warrants will be exercisable upon

issuance (the “Initial Exercise Date”). The Series A warrants will expire on the five-year anniversary of the Initial

Exercise Date. The Series B warrants will have an exercise price of $

per share (100% of the combined public offering price per share of common stock and accompanying warrants) and will be exercisable beginning

on the Initial Exercise Date. The Series B warrants will expire on the two-year anniversary of the Initial Exercise Date.

While we intend to promptly

seek Warrant Stockholder Approval, there is no guarantee that the Warrant Stockholder Approval will ever be obtained. If we are unable

to obtain the Warrant Stockholder Approval, the warrants may have no value.

Purchasers

who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers

that purchase without the benefit of a securities purchase agreement.

In

addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that

enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue

a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the

securities purchase agreement including: (i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for

one year from closing, subject to certain exceptions; (iii) agreement to not enter into any financings for 60 days from closing;

and (iv) indemnification for breach of contract.

This

is a best efforts offering, with no minimum amount of securities is required to be sold, and we may not raise the amount of capital we

believe is required for our business plans, including our near-term business plans.

The

placement agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement

agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar

amount of the securities. There is no required minimum number of securities that must be sold as a condition to completion of this offering.

Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, placement

agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth above.

We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and

investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to support our

continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required

for our operations in the short-term and may need to raise additional funds, which may not be available or available on terms acceptable

to us.

Because

there is no minimum required for the offering to close, investors in this offering will not receive a refund in the event that we do

not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus.

We

have not specified a minimum offering amount nor have or will we establish an escrow account in connection with this offering. Because

there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in our company,

but we are unable to fulfill our objectives due to a lack of interest in this offering. Further, because there is no escrow account in

operation and no minimum investment amount, any proceeds from the sale of securities offered by us will be available for our immediate

use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. Investor funds

will not be returned under any circumstances whether during or after the offering.

If

securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price

and trading volume could decline.

The

trading market for our common stock and warrants will depend in part on the research and reports that securities or industry analysts

publish about us or our business. We currently have limited research coverage by securities and industry analysts. If we fail to maintain

adequate coverage by securities or industry analysts, the trading price for our stock would be negatively impacted. If one or more of

the analysts who covers us downgrades our stock or publishes inaccurate or unfavorable research about our business, our stock price would

likely decline. If one or more of these analysts ceases coverage of us or fails to publish reports on us regularly, demand for our stock

could decrease, which could cause our stock price and trading volume to decline.

Future

sales of our common stock, warrants, or securities convertible into our common stock may depress our stock price.

The

price of our common stock or warrants could decline as a result of sales of a large number of shares of our common stock or warrants

or the perception that these sales could occur. These sales, or the possibility that these sales may occur, also might make it more difficult

for us to sell equity securities in the future at a time and at a price that we deem appropriate.

In

addition, in the future, we may issue additional shares of common stock, warrants or other equity or debt securities convertible into

common stock in connection with a financing, acquisition, litigation settlement, employee arrangements or otherwise. We may also issue

additional shares of common stock to satisfy our outstanding promissory note in favor of Werth Family Investment Associates LLC, an entity

controlled by Peter Werth, a member of our Board of Directors. Any such issuances could result in substantial dilution to

our existing stockholders and could cause the price of our common stock or warrants to decline.

We

do not anticipate paying any cash dividends on our common stock in the foreseeable future.

We

do not anticipate paying any cash dividends on our common stock in the foreseeable future. We currently intend to retain any future earnings

to finance the operation and expansion of our business, and we do not expect to declare or pay any dividends in the foreseeable future.

Consequently, stockholders must rely on sales of their common stock after price appreciation, which may never occur, as the only way

to realize any future gains on their investment. There is no guarantee that shares of our common stock will appreciate in value or even

maintain the price at which stockholders have purchased their shares.

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus and any documents we incorporate by reference contain forward-looking statements that involve substantial risks and uncertainties.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “intend,” “target,”

“project,” “estimate,” “believe,” “estimate,” “predict,” “potential”

or “continue” or the negative of these terms or other similar expressions intended to identify statements about the future.

These statements speak only as of the date of this prospectus and involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements. We have based these forward-looking statements largely on our

current expectations and projections about future events and financial trends that we believe may affect our business, financial condition

and results of operations. These forward-looking statements include, without limitation, statements about the following:

| |

● |

our ability to maintain compliance with the continued

listing requirements of the Nasdaq Capital Market; |

| |

|

|

| |

● |

our

lack of operating history and need for additional capital; |

| |

|

|

| |

● |

our

plans to develop and commercialize our product candidates; |

| |

|

|

| |

● |

the

timing of our planned clinical trials for CTx-1301, CTx-1302, and CTx-2103; |

| |

|

|

| |

● |

the

timing of our New Drug Application (NDA) submissions for CTx-1301, CTx-1302, and CTx-2103; |

| |

|

|

| |

● |

the

timing of and our ability to obtain and maintain regulatory approvals for CTx-1301, CTx-1302, CTx-2103, or any other future product

candidate; |

| |

|

|

| |

● |

the

clinical utility of our product candidates; |

| |

|

|

| |

● |

our

commercialization, marketing and manufacturing capabilities and strategy; |

| |

|

|

| |

● |

our

expected use of cash;

|

| |

● |

our

competitive position and projections relating to our competitors or our industry; |

| |

● |

our

ability to identify, recruit, and retain key personnel; |

| |

|

|

| |

● |

the

impact of laws and regulations; |

| |

|

|

| |

● |

our

expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act

of 2012 (the “JOBS Act”); |

| |

|

|

| |

● |

our

plans to identify additional product candidates with significant commercial potential that are consistent with our commercial objectives;

and |

| |

|

|

| |

● |

our

estimates regarding future revenue and expenses. |

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some

of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events

and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially

from those projected in the forward-looking statements. You should refer to the “Risk Factors” section of this prospectus

and the documents we incorporate by reference for a discussion of important factors that may cause our actual results to differ materially

from those expressed or implied by our forward-looking statements. Moreover, we operate in an evolving environment. New risk factors

and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties.

As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus and the documents we incorporate

by reference will prove to be accurate. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking

statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. You should,

however, review the factors and risks and other information we describe in the reports we will file from time to time with the SEC after

the date of this prospectus.

You

should read this prospectus and the documents that we incorporate by reference in this prospectus and have filed as exhibits to the registration

statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different

from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering will be approximately $ after deducting placement agent fees and

estimated offering expenses payable by us and assuming no sale of any pre-funded warrants and no exercise of the warrants. However,

because this is a best efforts offering with no minimum number of securities or amount of proceeds as a condition to closing, the actual

offering amount, the placement agent’s fees and net proceeds to us are not presently determinable and may be substantially less

than the maximum amounts set forth on the cover page of this prospectus, and we may not sell all or any of the securities we are offering.

As a result, we may receive significantly less in net proceeds.

We

intend to use all of the net proceeds we receive from this offering for continued research and development and commercialization activities

of CTx-1301, and for working capital, capital expenditures and general corporate purposes, including investing further in research and

development efforts.

Although

we currently anticipate that we will use the net proceeds from this offering as described above, there may be circumstances where a reallocation

of funds is necessary. The amounts and timing of our actual expenditures will depend upon numerous factors, including our sales and marketing

and commercialization efforts, demand for our products, our operating costs and the other factors described under “Risk Factors”

in this prospectus and the documents incorporated by reference herein. Accordingly, our management will have flexibility in applying

the net proceeds from this offering. An investor will not have the opportunity to evaluate the economic, financial or other information

on which we base our decisions on how to use the proceeds.

Pending

our use of the net proceeds from this offering, we intend to invest the net proceeds in a variety of capital preservation investments,

including short-term, investment-grade, interest-bearing instruments and U.S. government securities.

DILUTION

If

you invest in our securities in this offering, your ownership interest will be immediately diluted to the extent of the difference

between the combined public offering price per share and accompanying warrants and the as adjusted net tangible book value

per share of our common stock immediately after this offering.

As of September 30, 2023,

we had a net tangible book deficit of approximately $(0.1 million), or approximately $(0.01) per share of common stock.

Our net tangible book deficit per share represents our total tangible assets less total liabilities, divided by the number of shares

of our common stock outstanding as of September 30, 2023.

After giving effect to the sale

of shares of common stock and accompanying warrants in this offering at an assumed public offering price of $