0001262976false00012629762024-09-112024-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

Form 8-K

| | | | | |

| CURRENT REPORT |

| Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

| Date of Report (Date of earliest event reported): | September 11, 2024 |

__________________________________________

Cimpress plc

(Exact Name of Registrant as Specified in Its Charter)

__________________________________________

| | | | | | | | | | | | | | | | | |

| Ireland | | 000-51539 | | 98-0417483 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

| First Floor Building 3, | Finnabair Business and Technology Park A91 XR61 |

| Dundalk, Co. Louth |

| Ireland |

| (Address of Principal Executive Offices) |

Registrant’s telephone number, including area code: +353 42 938 8500

not applicable

(Former Name or Former Address, if Changed Since Last Report)

__________________________________________

| | | | | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company, as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Exchange on Which Registered |

| Ordinary Shares, nominal value per share of €0.01 | | CMPR | | NASDAQ | Global Select Market |

Item 7.01 Regulation FD Disclosure

On or around the closing of the offering (the “Offering”) of senior notes due 2032 referred to below, Cimpress plc (the “Company”) intends to enter into an amendment to the credit agreement governing its Senior Secured Credit Facilities (the “Credit Agreement Amendment”). The Credit Agreement Amendment will, among other things, extend the maturity of the revolving credit facility from May 2026 to September 2029 (subject to a springing maturity to the date that is 91 days prior to the maturity date of the term loan facility if the term loan facility has not been extended, repaid or refinanced on or prior to such date) and amend the interest rate applicable to any loans under the revolving credit facility. The Company does not expect the Credit Agreement Amendment to materially change its covenants or commitment amounts. Although the Company is in negotiations regarding the Credit Agreement Amendment there can be no assurance that the Company will enter into an amendment to the credit agreement governing its Senior Secured Credit Facilities as described herein or at all. The closing of the Credit Agreement Amendment is not contingent upon the consummation of the Offering and the consummation of the Offering is not contingent upon the closing of the Credit Agreement Amendment.

The information in this Item 7.01 is not "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor is it incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events

Private offering of senior notes

On September 11, 2024, the Company issued a press release announcing the launch of the Offering of senior notes due 2032 (the “Notes”). A copy of the press release is attached hereto as Exhibit 99.1.

Redemption of 7.0% Senior Notes due 2026

The Company also issued on the date hereof a notice of redemption of all of its outstanding 7.0% Senior Notes due 2026 (the “2026 Notes”), which is subject to completion of the senior notes offering in an aggregate principal amount equal to or greater than $500.0 million.

The information contained in this Item 8.01 is for informational purposes only and shall not constitute a notice of redemption for the 2026 Notes or an offer to sell or the solicitation of an offer to buy the 2026 Notes or the Notes, nor shall there be any sale of the Notes in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Forward-Looking Statements

Some of the statements in this Current Report on Form 8-K are “forward-looking” and are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. These “forward-looking” statements include statements relating to, among other things, the Offering, the Credit Agreement Amendment and the intended use of proceeds of the Offering. These statements involve risks and uncertainties that may cause results to differ materially from the statements set forth in this Current Report on Form 8-K, including market conditions and the risks and uncertainties referenced from time to time in the Company’s filings with the Securities and Exchange Commission. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to such statements to reflect any change in its expectations with regard thereto or any changes in the events, conditions or circumstances on which any such statement is based.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit | | |

| No. | | Description |

| | Press release dated September 11, 2024 entitled “Cimpress Announces Offering of $525 Million of Senior Notes Due 2032” |

| 104 | | Cover Page Interactive Data File, formatted in iXBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| September 11, 2024 | Cimpress plc |

| | | | | | | | |

| | By: | /s/ Sean E. Quinn |

| | Sean E. Quinn |

| | Executive Vice President and Chief Financial Officer |

Contacts:

Investor Relations:

Meredith Burns

ir@cimpress.com

+1.781.652.6480

Media Relations:

Sara Litwiller

mediarelations@cimpress.com

Cimpress Announces Offering of $525 Million of Senior Notes Due 2032

Dundalk, Ireland, September 11, 2024 -- Cimpress plc (Nasdaq: CMPR) today announced it has commenced, subject to market conditions, a private offering (the “Offering”) of $525.0 million in aggregate principal amount of senior notes due 2032 (the "notes").

Concurrently with the consummation of the Offering, we intend to amend our existing credit agreement to, among other things, extend the maturity of our revolving credit facility and amend the interest rate applicable to any loans under our revolving credit facility (the “Credit Agreement Amendment”).

We intend to use the net proceeds of this offering, together with cash on hand, to fund the redemption of all of our existing 7.0% Senior Notes due 2026 and to pay all related fees and expenses related to the Offering and the Credit Agreement Amendment. The transaction is expected to be leverage neutral other than covering the full amount of transaction fees. The consummation of the Offering is not contingent upon the closing of the Credit Agreement Amendment and the closing of the Credit Agreement Amendment is not contingent upon the consummation of the Offering.

The notes have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act, and other applicable securities laws. Within the United States, the notes will only be offered to persons who are reasonably believed to be “qualified institutional buyers,” as defined in Rule 144A under the Securities Act. Outside the United States, the notes will only be offered to persons other than “U.S. persons,” as defined in Rule 902 under the Securities Act, in offshore transactions in reliance upon Regulation S under the Securities Act.

This press release is neither an offer to sell nor the solicitation of an offer to buy the notes or any security and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.

Some of the statements in this press release are “forward-looking” and are made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. These “forward-looking” statements include statements relating to, among other things, the Offering, the Credit Agreement Amendment and the intended use of proceeds of the Offering. These statements involve risks and uncertainties that may cause results to differ materially from the statements set forth in this press release, including market conditions and the risks and uncertainties referenced from time to time in the Company’s

filings with the Securities and Exchange Commission. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to such statements to reflect any change in its expectations with regard thereto or any changes in the events, conditions or circumstances on which any such statement is based.

About Cimpress

Cimpress plc (Nasdaq: CMPR) invests in and builds customer-focused, entrepreneurial, print mass-customization businesses for the long term. Mass customization is a competitive strategy which seeks to produce goods and services to meet individual customer needs with near mass production efficiency. Cimpress businesses include BuildASign, Drukwerkdeal, Exaprint, National Pen, Packstyle, Pixartprinting, Printi, VistaPrint, and WIRmachenDRUCK.

Cimpress and the Cimpress logo are trademarks of Cimpress plc or its subsidiaries. All other brand and product names appearing on this announcement may be trademarks or registered trademarks of their respective holders.

v3.24.2.u1

Cover Page

|

Sep. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 11, 2024

|

| Entity Registrant Name |

Cimpress plc

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

000-51539

|

| Entity Tax Identification Number |

98-0417483

|

| Entity Address, Address Line One |

First Floor Building 3,

|

| Entity Address, Address Line Two |

Finnabair Business and Technology Park A91 XR61

|

| Entity Address, City or Town |

Dundalk, Co. Louth

|

| Entity Address, Country |

IE

|

| City Area Code |

353

|

| Local Phone Number |

42 938 8500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Ordinary Shares, nominal value per share of €0.01

|

| Trading Symbol |

CMPR

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0001262976

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

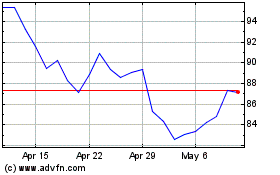

Cimpress (NASDAQ:CMPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

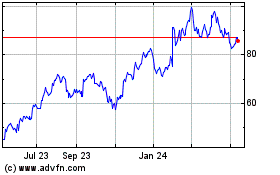

Cimpress (NASDAQ:CMPR)

Historical Stock Chart

From Dec 2023 to Dec 2024