false000152493112/3100015249312023-07-272023-07-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 27, 2023

CHUY’S HOLDINGS, INC.

(Exact Name Of Registrant As Specified In Its Charter)

| | | | | | | | |

| Delaware | 001-35603 | 20-5717694 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

1623 Toomey Rd.

Austin, Texas 78704

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (512) 473-2783

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

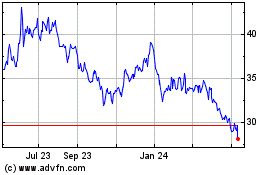

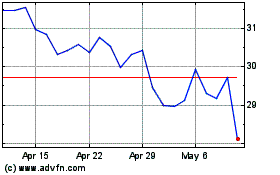

| Common Stock, par value $0.01 per share | CHUY | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 27, 2023, at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Chuy’s Holdings, Inc. (the “Company”), the Company’s stockholders approved the Chuy’s Holdings, Inc. 2023 Employee Stock Purchase Plan (the “2023 Employee Stock Purchase Plan”). The purpose of the 2023 Employee Stock Purchase Plan is to encourage employee stock ownership, thus aligning employee interests with those of the Company’s stockholders, and to enhance the ability of the Company to attract, motivate and retain qualified employees.

For additional information regarding the 2023 Employee Stock Purchase Plan, see “Proposal 3-Approval of the Chuy’s Holdings, Inc. 2023 Employee Stock Purchase Plan” in the Company’s definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on June 7, 2023 (the “Proxy Statement”).

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the 2023 Employee Stock Purchase Plan, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

At the Annual Meeting, the Company’s stockholders approved (1) an amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Charter Amendment”) to eliminate personal liability of officers for monetary damages for breach of fiduciary duty as an officer and (2) an amendment to the Company’s Amended and Restated Bylaws (the “Bylaw Amendment”) to add an exclusive forum provision.

On July 27, 2023, the Company filed the Charter Amendment with the Delaware Secretary of State, which became effective upon filing. Additionally, the Bylaw Amendment became effective on July 27, 2023. The foregoing descriptions do not purport to be complete and are qualified in their entirety by reference to the full text of the Charter Amendment and the Bylaw Amendment, copies of which are filed as Exhibit 3.1 and Exhibit 3.2 to this Current Report on Form 8-K and incorporated herein by reference.

On July 27, 2023, the Board of Directors of the Company amended and restated the Company’s Bylaws (the “Amended and Restated Bylaws”). Among other things, the Amended and Restated Bylaws enhance disclosure and procedural requirements in connection with stockholder nominations of directors, including by:

•requiring any stockholder submitting a director nomination notice to represent as to whether such stockholder intends to solicit proxies in support of director nominees other than the Board of Directors’ nominees in accordance with Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”);

•requiring such nominating stockholder to provide sufficient evidence, at the Company’s request, that certain requirements of Rule 14a-19 under the Exchange Act have been satisfied;

•providing that the Company will disregard proxies or votes solicited for such stockholder’s nominees if such stockholder fails to comply with the requirements of Rule 14a-19 or for a stockholder’s nominees or proposals if any of the information it provides to the Company is inaccurate in any material respect;

•requiring that disclosures in the nominating or proposing stockholder’s notice be updated so that they are accurate as of the record date and 10 business days prior to the meeting date;

•requiring that the nominating or proposing stockholder notify the Company of any inaccuracy or change in such stockholder’s notice within two business days after becoming aware of such inaccuracy or change;

•clarifying that the number of candidates a stockholder may nominate for election at a meeting may not exceed the number of directors to be elected at such meeting and that stockholders may not make additional or substitute nominations following the expiration of the applicable nomination deadline; and

•incorporating other technical changes in light of the universal proxy rules adopted by the Securities and Exchange Commission.

The Amended and Restated Bylaws also incorporate the Bylaw Amendment. The foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended and Restated Bylaws attached hereto as Exhibit 3.3 to this Current Report on Form 8-K and incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On July 27, 2023, the Company held its Annual Meeting. All matters submitted for approval by the Company’s stockholders, as described in the Company’s Proxy Statement, were approved. The number of shares of common stock entitled to vote at the Annual Meeting was 18,045,286, representing the number of shares outstanding as of May 30, 2023, the record date for the Annual Meeting.

The results of each matter voted on were as follows:

1. Election of directors. The following directors were elected for terms expiring at the 2026 annual meeting of stockholders:

| | | | | | | | | | | |

| Votes For | Votes Withheld | Broker Non-Votes |

| Steve Hislop | 15,337,991 | 937,178 | 555,714 |

| Jon Howie | 13,206,687 | 3,068,482 | 555,714 |

| Jody Bilney | 12,104,636 | 4,170,533 | 555,714 |

2. Approval, on an advisory basis, of the compensation of the Company’s named executive officers. The compensation of the Company’s named executive officers was approved.

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 15,844,016 | 428,760 | 2,393 | 555,714 |

3. Approval of the Company’s 2023 Employee Stock Purchase Plan. The plan was approved.

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 16,260,780 | 12,690 | 1,699 | 555,714 |

4. Approval of an amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate personal liability of officers for monetary damages for breach of fiduciary duty as an officer. The amendment was approved.

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 13,727,416 | 2,539,316 | 8,437 | 555,714 |

5. Approval of an amendment to the Company’s Amended and Restated Bylaws to add an exclusive forum provision. The amendment was approved.

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 13,575,341 | 2,698,675 | 1,153 | 555,714 |

6. Ratification of appointment of RSM US LLP as the Company’s independent registered public accounting firm for 2023. The appointment was ratified.

| | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions |

| 16,772,832 | | 57,330 | | 721 |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

Exhibit

Number | Description |

| Certificate of Amendment to the Amended and Restated Certificate of Incorporation |

| First Amendment to the Amended and Restated Bylaws |

| Amended and Restated Bylaws |

| Chuy’s Holdings, Inc. 2023 Employee Stock Purchase Plan |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | CHUY’S HOLDINGS, INC. |

| | |

| By: | /s/ Jon W. Howie |

| | Name: Jon W. Howie

Title: Vice President and Chief Financial Officer |

Date: July 28, 2023

CERTIFICATE OF AMENDMENT

TO

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

CHUY’S HOLDINGS, INC.

Chuy’s Holdings, Inc. (the “Company”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify:

FIRST: that at a meeting of the Board of Directors of the Company (the “Board of Directors”) held on April 27, 2023 resolutions were duly adopted setting forth a proposed amendment to the Amended and Restated Certificate of Incorporation of the Company (a) declaring said amendment advisable and in the best interest of the Company and its stockholders and (b) directing that the proposed amendment be considered by the stockholders of the Company at the next annual meeting of stockholders.

SECOND: that the Amended and Restated Certificate of Incorporation of the Company be amended by adding a new Section 2 of Article VIII that reads as follows:

Section 2: Elimination of Monetary Liability for Officers. No officer of the Company shall be personally liable to the Company or its stockholders for monetary damages for any breach of fiduciary duty as an officer. Notwithstanding the foregoing sentence, an officer shall be liable to the extent provided by applicable law: (A) for any breach of the officer’s duty of loyalty to the Company or its stockholders, (B) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (C) for any transaction from which such officer derived an improper personal benefit, or (D) in any action by or in the right of the Company. Solely for purposes of this Section 2 of Article VIII, “officer” shall have the meaning provided in Section 102(b)(7) of the DGCL as currently in effect and as it may hereafter be amended.

Any repeal or modification of the foregoing provisions of this Section 2 of Article VIII by the stockholders of the Company shall not adversely affect any right or protection of an officer of the Company existing at the time of such repeal or modification.

THIRD: that pursuant to resolution of its Board of Directors, an annual meeting of the stockholders of the Company was duly called and held on July 27, 2023, upon notice in accordance with Section 222 of the DGCL at which meeting the necessary number of shares as required by statute were voted in favor of the amendment.

FOURTH: that said amendment was duly adopted in accordance with the provisions of Section 242 of the DGCL.

AmericasActive:18240854.2

IN WITNESS WHEREOF, the Company has caused this Certificate of Amendment to be executed by Tim Larson, the Secretary of the Company, on this 27th day of July 2023.

By: /s Tim Larson__________________________

Tim Larson

Vice President, General Counsel and Secretary

AmericasActive:18240854.2

FIRST AMENDMENT

TO

AMENDED AND RESTATED BYLAWS

OF

CHUY’S HOLDINGS, INC.

This First Amendment (this “Amendment”) to the Amended and Restated Bylaws (the “Bylaws”) of Chuy’s Holdings, Inc. (the “Company”) was adopted by the Board of Directors, subject to stockholder approval, on April 27, 2023 and by the stockholders of the Company at the Company’s annual meeting of stockholders on July 27, 2023. This Amendment is effective as of July 27, 2023.

The Bylaws have been amended to add a new Bylaw 41 as follows:

41. Exclusive Forum For Certain Litigation. Unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, if and only if the Court of Chancery of the State of Delaware lacks subject matter jurisdiction, any state court located within the State of Delaware or, if and only if all such state courts lack subject matter jurisdiction, the federal district court for the District of Delaware) shall be the sole and exclusive forum for the following types of actions or proceedings under Delaware statutory or common law: (a) any derivative action or proceeding brought on behalf of the Company; (b) any action asserting a breach of a fiduciary duty owed by any director, officer or other employee of the Company to the Company or the Company’s stockholders; (c) any action asserting a claim against the Company or any director or officer or other employee of the Company arising pursuant to any provision of the DGCL, the Company’s Amended and Restated Certificate of Incorporation or these Bylaws; (d) any action or proceeding to interpret, apply, enforce or determine the validity of the Company’s Amended and Restated Certificate of Incorporation or these Bylaws (including any right, obligation, or remedy thereunder); (e) any action or proceeding as to which the DGCL confers jurisdiction to the Court of Chancery of the State of Delaware; or (f) any action asserting a claim against the Company or any director or officer or other employee of the Company that is governed by the internal affairs doctrine, in all cases to the fullest extent permitted by law and subject to the court’s having personal jurisdiction over the indispensable parties named as defendants. This Bylaw 41 shall not apply to suits brought to enforce a duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction.

Unless the Company consents in writing to the selection of an alternative forum, the federal district courts of the United States of America shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933, subject to and contingent upon a final adjudication in the State of Delaware of the enforceability of such exclusive forum provision.

Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Company shall be deemed to have notice of and to have consented to the provisions of this Bylaw 41.

AmericasActive:18302010.2

CHUY’S HOLDINGS, INC.

AMENDED AND RESTATED BYLAWS

Adopted and Effective on July 27, 2023

| | | | | | | | | | | |

| STOCKHOLDERS MEETINGS | 1 | |

| 1. | | Time and Place of Meetings | 1 | |

| 2. | | Annual Meetings | 1 | |

| 3. | | Special Meetings | 1 | |

| 4. | | Notice of Meetings | 1 | |

| 5. | | Inspectors | 2 | |

| 6. | | Quorum | 2 | |

| 7. | | Voting; Proxies | 2 | |

| 8. | | Order of Business | 2 | |

| 9. | | Notice of Stockholder Proposals | 2 | |

| 10. | | Notice of Director Nominations | 4 | |

| 11. | | Additional Provisions Relating to the Notice of Stockholder Business and Director Nominations | 6 | |

| 12. | | Record Dates | 9 | |

| 13. | | Adjournments | 9 | |

| DIRECTORS | 9 | |

| 14. | | Function | 9 | |

| 15. | | Number, Election and Terms | 9 | |

| 16. | | Vacancies and Newly Created Directorships | 9 | |

| 17. | | Removal | 10 | |

| 18. | | Resignation | 10 | |

| 19. | | Regular Meetings | 10 | |

| 20. | | Special Meetings | 10 | |

| 21. | | Quorum | 10 | |

| 22. | | Participation in Meetings by Remote Communications | 10 | |

| 23. | | Committees | 11 | |

| 24. | | Compensation | 11 | |

| 25. | | Rules | 11 | |

| 26. | | Co-Chairmen or Chairman of the Board | 11 | |

TABLE OF CONTENTS

(continued)

Page

| | | | | | | | | | | |

| NOTICES | 11 | |

| 27. | | Generally | 11 | |

| 28. | | Waivers | 12 | |

| OFFICERS | 12 | |

| 29. | | Generally | 12 | |

| 30. | | Compensation | 12 | |

| 31. | | Succession | 12 | |

| 32. | | Authority and Duties | 12 | |

| STOCK | 13 | |

| 33. | | Uncertificated Shares | 13 | |

| 34. | | Transfer | 13 | |

| 35. | | Classes of Stock | 13 | |

| 36. | | Lost, Stolen or Destroyed Certificates | 13 | |

| GENERAL | 13 | |

| 37. | | Fiscal Year | 13 | |

| 38. | | Reliance Upon Books, Reports and Records | 14 | |

| 39. | | Amendments | 14 | |

| 40. | | Certain Defined Terms | 14 | |

| 41. | | Exclusive Forum for Certain Litigation | 14 | |

STOCKHOLDERS MEETINGS

1.Time and Place of Meetings. All meetings of stockholders will be held at such time and place, within or without the State of Delaware, as may be designated by the Board of Directors (the “Board”) of Chuy’s Holdings, Inc., a Delaware corporation (the “Company”), from time to time or, in the absence of a designation by the Board, one of the Co-Chairmen or the Chairman of the Board if there is only one, the Chief Executive Officer or the Secretary, and stated in the notice of the meeting. Notwithstanding the foregoing, the Board may, in its sole discretion, determine that a meeting of stockholders will not be held at any place, but may instead be held by means of remote communications, subject to such guidelines and procedures as the Board may adopt from time to time. The Board may postpone and reschedule any previously scheduled annual or special meeting of stockholders.

2.Annual Meetings. At each annual meeting of stockholders, the stockholders will elect, by a plurality of the votes of the shares present in person or represented by proxy at such meeting and entitled to vote on the election of directors, the directors to succeed those directors whose terms expire at such meeting and will transact such other business as may properly be brought before the meeting in accordance with Bylaws 8, 9, 10 and 11.

3.Special Meetings. A special meeting of stockholders may be called only by (a) one of the Co-Chairmen or the Chairman if there is only one, (b) the Chief Executive Officer, or (c) the Secretary within 10 calendar days after receipt by one of the Co-Chairmen or the Chairman if there is only one and the Secretary of the written request of a majority of the total number of directors that the Company would have if there were no vacancies on the Board (the “Whole Board”), in each case to transact only such business as is properly brought before the meeting in accordance with Bylaw 8 and specified in the notice of the meeting. Special meetings of holders of any outstanding Preferred Stock, if any, may be called in the manner and for the purposes provided in the applicable Preferred Stock Designation.

4.Notice of Meetings. Written notice of every meeting of stockholders, stating the place, if any, date and time thereof, the means of remote communications, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such meeting, and, in the case of a special meeting, the purpose or purposes for which the meeting is called, will be given, in a form permitted by Bylaw 27 or by the General Corporation Law of the State of Delaware, as amended (the “DGCL”), not less than 10 nor more than 60 calendar days before the date of the meeting to each stockholder of record entitled to vote at such meeting, except as otherwise provided by law. When a meeting is adjourned to another place, date, or time, notice need not be given of the adjourned meeting if the place, if any, date and time thereof, and the means of remote communications, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such adjourned meeting are announced at the meeting at which the adjournment is taken; provided, however, that if the adjournment is for more than 30 calendar days, or if after the adjournment a new record date is fixed for the adjourned meeting, written notice of the place, if any, date and time thereof, and the means of remote communications, if any, by which stockholders and proxy holders may be deemed to be present in person and vote at such adjourned meeting must be given in conformity herewith. At any adjourned meeting, any business may be transacted which properly could have been transacted at the original meeting.

5.Inspectors. The Board will, in advance of any meeting of stockholders, appoint one or more inspectors to act at the meeting and make a written report thereof. The Board may designate one or more persons as alternate inspectors to replace any inspector who fails to act. If no inspector or alternate is able to act at a meeting of stockholders, the presiding officer of the meeting will appoint one or more inspectors to act at the meeting.

6.Quorum. Except as otherwise provided by law or in a Preferred Stock Designation, the holders of a majority of the stock issued and outstanding and entitled to vote thereat, present in person or represented by proxy, will constitute a quorum at a meeting of stockholders for the transaction of business thereat. If, however, such quorum is not present or represented at any meeting of stockholders, the stockholders entitled to vote thereat, present in person or represented by proxy, will have the power to adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum is present or represented.

7.Voting; Proxies. Except as otherwise provided by law, by the Company’s Amended and Restated Certificate of Incorporation, or in a Preferred Stock Designation, each stockholder will be entitled at every meeting of the stockholders to one vote for each share of stock having voting power standing in the name of such stockholder on the books of the Company on the record date for the meeting and such votes may be cast either in person or by proxy. Every proxy must be authorized in a manner permitted by Section 212 of the DGCL (or any successor provision). When a quorum is present at any meeting of stockholders, the affirmative vote of the majority of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter will be the act of the stockholders in all matters other than the election of directors, or as otherwise provided in these Bylaws, the Amended and Restated Certificate of Incorporation, a Preferred Stock Designation, or by law.

8.Order of Business. One of the Co-Chairmen or the Chairman if there is only one or an officer of the Company designated from time to time by a majority of the Whole Board, will call meetings of stockholders to order and will act as presiding officer thereof. Unless otherwise determined by the Board prior to the meeting, the presiding officer of the meeting of stockholders will also determine the order of business and have the authority in his or her sole discretion to determine the rules of procedure and regulate the conduct of any such meeting, including, without limitation, by imposing restrictions on the persons (other than stockholders of the Company or their duly appointed proxy holders) that may attend any such stockholders’ meeting, by ascertaining whether any stockholder or his or her proxy holder may be excluded from any meeting of stockholders based upon any determination by the presiding officer, in his or her sole discretion, that any such person has disrupted or is likely to disrupt the proceedings thereat, by determining the circumstances in which any person may make a statement or ask questions at any meeting of stockholders, by ruling on all procedural questions that may arise during or in connection with the meeting, by determining whether any nomination or business proposed to be brought before the meeting has been properly brought before the meeting.

9.Notice of Stockholder Proposals.

(a)Business to Be Conducted at Annual Meeting. At an annual meeting of stockholders, only such business may be conducted as has been properly brought before the meeting. To be properly brought before an annual meeting, business (other than the nomination of a person for election as a director, which is governed by Bylaw 10, and to the extent

applicable, Bylaw 11) must be (i) brought before the meeting by or at the direction of the Board or (ii) otherwise properly brought before the meeting by a stockholder who (A) has complied with all applicable requirements of this Bylaw 9 and Bylaw 11 in relation to such business, (B) was a stockholder of record of the Company at the time of giving the notice required by Bylaw 11(a) and is a stockholder of record of the Company at the time of the annual meeting, and (C) is entitled to vote at the annual meeting. For the avoidance of doubt, the foregoing clause (ii) will be the exclusive means for a stockholder to submit business before an annual meeting of stockholders (other than proposals properly made in accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (such act, and the rules and regulations promulgated thereunder, the “Exchange Act”) and included in the notice of meeting given by or at the direction of the Board).

(b)Required Form for Stockholder Proposals. To be in proper written form, a stockholder’s notice to the Secretary must set forth:

(i)Information Regarding the Proposing Person. As to each Proposing Person (as such term is defined in Bylaw 11(g)(ii)):

(A)the name and address of such Proposing Person, as they appear on the Company’s stock transfer book;

(B)the class, series and number of shares of the Company beneficially owned of record by such Proposing Person (including any shares of any class or series of the Company as to which such Proposing Person has a right to acquire beneficial ownership, whether such right is exercisable immediately or only after the passage of time);

(C)a representation (1) that the stockholder giving the notice is a holder of record of stock of the Company entitled to vote at the annual meeting and intends to appear in person or by proxy at the annual meeting to bring such business before the annual meeting and (2) as to whether any Proposing Person intends to deliver a proxy statement and form of proxy to holders of at least the percentage of shares of the Company entitled to vote and required to approve the proposal and, if so, identifying such Proposing Person;

(D)a description of (1) any option, warrant, convertible security, stock appreciation right or similar right (including any derivative securities, as defined under Rule 16a-1 under the Exchange Act), whether or not presently exercisable, with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of securities of the Company or with a value derived in whole or in part from the value of any class or series of securities of the Company, whether or not such instrument or right is subject to settlement in whole or in part in the underlying class or series of securities of the Company or otherwise, directly or indirectly held of record or owned beneficially by such Proposing Person and (2) each other direct or indirect opportunity of such Proposing Person to profit or share in any profit derived from, or to manage the risk or benefit from, any increase or decrease in the value of the Company’s securities, in each case regardless of whether (x) such interest conveys any voting rights in such security to such Proposing Person, (y) such interest is required to be, or is capable of being, settled through delivery of such security, or (z) such Proposing Person may have entered into other transactions that hedge the economic effect of any such interest (any such interest referred to in this clause (D), being a “Derivative Interest”);

(E)any proxy, contract, arrangement, understanding or relationship pursuant to which the Proposing Person has a right to vote any shares of the Company or which has the affect of increasing or decreasing the voting power of such Proposing Person;

(F)any rights directly or indirectly held of record or beneficially by the Proposing Person to dividends on the shares of the Company that are separated or separable from the underlying shares of the Company;

(G)any performance-related fees (other than an asset-based fee) to which the Proposing Person may be entitled as a result of any increase or decrease in the value of shares of the Company or Derivative Interests; and

(H)any other information relating to such Proposing Person that would be required to be disclosed in a proxy statement or other filing required pursuant to Section 14(a) of the Exchange Act to be made in connection with a general solicitation of proxies or consents by such Proposing Person in support of the business proposed to be brought before the meeting.

(ii)Information Regarding the Proposal: As to each item of business that the stockholder giving the notice proposes to bring before the annual meeting:

(A)a description in reasonable detail of the business desired to be brought before the annual meeting and the reasons why such stockholder or any other Proposing Person believes that the taking of the action or actions proposed to be taken would be in the best interests of the Company and its stockholders;

(B)a description in reasonable detail of any material interest of any Proposing Person in such business and a description in reasonable detail of all agreements, arrangements and understandings among the Proposing Persons or between any Proposing Person and any other person or entity in connection with the proposal; and

(C)the text of the proposal or business (including the text of any resolutions proposed for consideration).

(c)No Right to Have Proposal Included. A stockholder is not entitled to have its proposal included in the Company’s proxy statement and form of proxy solely as a result of such stockholder’s compliance with the foregoing provisions of this Bylaw 9.

(d)Requirement to Attend Annual Meeting. If a stockholder does not appear at the annual meeting to present its proposal, such proposed business will not be transacted (notwithstanding that proxies in respect of such vote may have been received by the Company).

10.Notice of Director Nominations.

(a)Nomination of Directors. Subject to the rights, if any, of any series of Preferred Stock to nominate or elect directors under circumstances specified in a Preferred Stock Designation, only persons who are nominated in accordance with the procedures set forth in this Bylaw 10 and Bylaw 11 will be eligible to serve as directors. Nominations of persons for election as directors of the Company may be made only at an annual meeting of stockholders (i) by or at the direction of the Board or (ii) by a stockholder who (A) has complied with all applicable requirements of this Bylaw 10 and Bylaw 11 in relation to such nomination, (B) was a stockholder of record of the Company at the time of giving the notice required by Bylaw 11(a)

and is a stockholder of record of the Company at the time of the annual meeting, and (C) is entitled to vote at the annual meeting.

(b)Required Form for Stockholder Proposals. To be in proper written form, a stockholder’s notice to the Secretary must set forth:

(i)Information Regarding the Nominating Person. (A) As to each Nominating Person (as such term is defined in Bylaw 11(g)(iii)), the information set forth in Bylaw 9(b)(i) (except that for purposes of this Bylaw 10, the term “Nominating Person” will be substituted for the term “Proposing Person” in all places it appears in Bylaw 9(b)(i) and any reference to “business” or “proposal” therein will be deemed to be a reference to the “nomination” contemplated by this Bylaw 10).

(B) A written representation from such Nominating Person, any Stockholder Nominee (as such term is defined in Bylaw 11(g)(iv)) and/or any of their affiliates as to whether any of them intends or is part of a group that intends to engage in a solicitation in support of director nominees other than the Board’s nominees in accordance with Rule 14a-19 promulgated under the Exchange Act (including a statement that any such person intends to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on the election of directors in support of director nominees other than the Board’s nominees), and, if so, confirming the names of the participants in the solicitation (as defined in Item 4 of Schedule 14A under the Exchange Act).

(C) A certificate executed by the Nominating Person certifying that such Nominating Person will: (1) comply with Rule 14a-19 promulgated under the Exchange Act in connection with such stockholder’s solicitation of proxies in support of any Stockholder Nominee; (2) notify the Company as promptly as practicable of any determination by the Nominating Person to no longer solicit proxies for the election of any Stockholder Nominee as a director at the annual meeting; and (3) furnish such other or additional information as the Company may request for the purpose of determining whether the requirements of these Bylaws have been complied with and of evaluating any nomination or other business described in the stockholder’s notice.

(ii)Information Regarding the Nominee: As to each person whom the stockholder giving notice proposes to nominate for election as a director:

(A)all information with respect to such proposed nominee that would be required to be set forth in a stockholder’s notice pursuant to Bylaw 9(b)(i) if such proposed nominee were a Nominating Person;

(B)all information relating to such proposed nominee that would be required to be disclosed in a proxy statement or other filing required pursuant to Section 14(a) under the Exchange Act to be made in connection with a general solicitation of proxies for an election of directors in a contested election (including such proposed nominee’s written consent to be named in the proxy statement as a nominee and to serve as a director if elected);

(C)all information that would be required to be disclosed pursuant to Items 403 and 404 under Regulation S-K if the stockholder giving the notice or any other Nominating Person were the “registrant” for purposes of such rule and the proposed nominee were a director or executive officer of such registrant;

(D)a written questionnaire with respect to the identity, background and qualification of the proposed nominee and the background of any other person or entity on whose behalf the nomination is being made (which questionnaire will be provided by the Secretary upon written request);

(E)a written representation and agreement (in the form provided by the Secretary upon written request) that the proposed nominee (1) is not and will not become a party to (x) any agreement, arrangement or understanding with, and has not given any commitment or assurance to, any person or entity as to how the proposed nominee, if elected as a director of the Company, will act or vote on any issue or question (a “Voting Commitment”) that has not been disclosed to the Company or (y) any Voting Commitment that could limit or interfere with the proposed nominee’s ability to comply, if elected as a director of the Company, with the proposed nominee’s fiduciary duties under applicable law, (2) is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than the Company with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director that has not been disclosed to the Company and (3) if elected as a director of the Company, the proposed nominee would be in compliance and will comply, with all applicable publicly disclosed corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines of the Company.

The Company may require any proposed nominee to furnish such other information as may be reasonably required by the Company to determine the qualifications and eligibility of such proposed nominee to serve as a director.

(c)No Right to Have Proposal Included. A stockholder is not entitled to have its nominees included in the Company’s proxy statement solely as a result of such stockholder’s compliance with the foregoing provisions of this Bylaw 10.

(d)Requirement to Attend Annual Meeting. If a stockholder does not appear at the annual meeting to present its nomination, such nomination will be disregarded.

11.Additional Provisions Relating to the Notice of Stockholder Business and Director Nominations.

(a)Timely Notice. To be timely, a stockholder’s notice required by Bylaw 9(a) or Bylaw 10(a) must be delivered to or mailed and received by the Secretary at the principal executive offices of the Company not less than 90 nor more than 120 calendar days prior to the first anniversary of the date on which the Company held the preceding year’s annual meeting of stockholders; provided, however, that if the date of the annual meeting is advanced more than 30 calendar days prior to or delayed by more than 30 calendar days after the anniversary of the preceding year’s annual meeting, notice by the stockholder to be timely must be so delivered not later than the close of business on the later of the 90th calendar day prior to such annual meeting and the 10th calendar day following the day on which public disclosure of the date of such meeting is first made. In no event will the public disclosure of an adjournment of an annual meeting commence a new time period for the giving of a stockholder’s notice as described above.

(b)Updating Information in Notice. A stockholder providing notice of business proposed to be brought before an annual meeting pursuant to Bylaw 9 or notice of any nomination to be made at an annual meeting pursuant to Bylaw 10 must further update and supplement such notice, if necessary, and at least as of the record date and 10 business days prior to the meeting or any adjournment or postponement thereof, so that the information provided or required to be provided in such notice pursuant to Bylaw 9 or Bylaw 10, as applicable, is true and correct at all times up to and including the date of the meeting and any adjournment or postponement thereof. Such update and supplement will be delivered to, or mailed and received by, the Secretary at the principal executive offices of the Company, (i) in the case of the update and supplement required to be made as of the record date, not later than the later of five business days after the record date for the meeting and five business days after the first public disclosure of the record date for the meeting, (ii) in the case of the update and supplement required to be made as of 10 business days prior to the meeting or any adjournment or postponement thereof, not later than eight business days prior to the date for the meeting or any adjournment or postponement thereof and (iii) in any other case where the stockholder becomes aware of any inaccuracy or change, not later than two business days after becoming aware of such inaccuracy or change. If a Proposing Person, Nominating Person or Stockholder Nominee fails to provide such update or supplement within such time periods, the information required to be provided pursuant to Bylaw 9 or Bylaw 10 may be deemed not to have been provided in accordance with the procedures prescribed by Bylaw 9 or Bylaw 10.

(c)Determinations of Form, Etc. The presiding officer of any annual meeting will, if the facts warrant, determine that a proposal was not made in accordance with the procedures prescribed by Bylaw 9 and this Bylaw 11 or that a nomination was not made in accordance with the procedures prescribed by Bylaw 10 and this Bylaw 11, and if he or she should so determine, he or she will so declare to the meeting and the defective proposal or nomination, as applicable, will be disregarded (notwithstanding that proxies in respect of such vote may have been received by the Company). If the Proposing Person or Nominating Person, as applicable, does not appear at the annual meeting to present its proposal or nomination, as applicable, such proposed business will not be transacted and such nomination will be disregarded, respectively (notwithstanding that proxies in respect of such vote may have been received by the Company). If any information or certifications submitted pursuant to Bylaw 9, Bylaw 10 and Bylaw 11 by any Proposing Person or Nominating Person, including any information, certifications or questionnaires from a Stockholder Nominee, is inaccurate in any material respect, such information, certification or questionnaire may be deemed not to have been provided in accordance with the procedures prescribed by Bylaw 9, Bylaw 10 and Bylaw 11.

(d)Number of Stockholder Nominees. A Nominating Person does not have the right to (i) nominate a number of Stockholder Nominees that exceeds the number of directors to be elected at the annual meeting or (ii) substitute or replace any Stockholder Nominee unless such substitute or replacement is nominated in accordance with the procedures prescribed by Bylaw 10 and Bylaw 11 (including the timely provision of all information and certifications with respect to such substitute or replacement Stockholder Nominee in accordance with the deadlines set forth in Bylaw 11). If the Company provides notice to a Nominating Person that the number of Stockholder Nominees proposed by such Nominating Person exceeds the number of directors to be elected at a meeting, the Nominating Person must provide written notice to the Company

within five business days stating the names of the Stockholder Nominees that have been withdrawn so that the number of Stockholder Nominees proposed by such Nominating Person no longer exceeds the number of directors to be elected at a meeting. If any individual who is nominated in accordance with Bylaw 10 and Bylaw 11 becomes unwilling or unable to serve on the Board, then the nomination with respect to such individual will be disregarded (notwithstanding that proxies in respect of such vote may have been received by the Company).

(e)Compliance with Rule 14a-19. The Company will disregard a nomination of a director nominee (notwithstanding that proxies in respect of such vote may have been received by the Company) other than the Company’s nominees if the Nominating Person abandons the solicitation or does not (i) comply with Rule 14a-19 promulgated under the Exchange Act, including any failure by the Nominating Person to (A) provide the Company with any notices required thereunder in a timely manner or (B) comply with the requirements of Rule 14a-19(a)(2) and Rule 14a-19(a)(3) promulgated under the Exchange Act, or (ii) timely provide evidence in accordance with the following sentence that is sufficient, in the discretion of the Board, to demonstrate that such Nominating Person has met the requirements of Rule 14a-19(a)(3) promulgated under the Exchange Act. Upon request by the Company, if any Nominating Person provides notice pursuant to Rule 14a-19(b) promulgated under the Exchange Act (or is not required to provide notice because the information required by Rule 14a-19(b) has been provided in a preliminary or definitive proxy statement previously filed by such Nominating Person), such Nominating Person shall deliver to the Company, no later than five business days prior to the annual meeting, evidence that is sufficient, in the discretion of the Board, to demonstrate that such Nominating Person has met the requirements of Rule 14a-19(a)(3) promulgated under the Exchange Act.

(f)Proxy Card. Any stockholder directly or indirectly soliciting proxies from other stockholders must use a proxy card color other than white; white is reserved for the exclusive use by the Board.

(g)Certain Definitions.

(i)For purposes of Bylaw 9, Bylaw 10 and this Bylaw 11, “public disclosure” means disclosure in a press release reported by the Dow Jones News Service, Associated Press or comparable national news service or in a document filed by the Company with the Securities and Exchange Commission pursuant to Exchange Act or furnished by the Company to stockholders.

(ii)For purposes of Bylaw 9 and this Bylaw 11, “Proposing Person” means (A) the stockholder providing the notice of business proposed to be brought before an annual meeting, (B) the beneficial owner or beneficial owners, if different, on whose behalf the notice of the business proposed to be brought before the annual meeting is made, and (C) any Affiliate or Associate (each within the meaning of Rule 12b-2 under the Exchange Act) of such stockholder or beneficial owner.

(iii)For purposes of Bylaw 10 and this Bylaw 11, “Nominating Person” means (A) the stockholder providing the notice of the nomination proposed to be made at an annual meeting, (B) the beneficial owner or beneficial owners, if different, on whose behalf the notice of nomination proposed to be made at the annual meeting is made, and (C) any Affiliate or Associate (each within the meaning of Rule 12b-2 under the Exchange Act) of such stockholder or beneficial owner.

(iv)For purposes of Bylaw 10 and this Bylaw 11, “Stockholder Nominee” means an individual nominated by a Nominating Person for election to the Board.

12.Record Dates.

(a)Voting Record Dates. In order that the Company may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, the Board may fix a record date, which will not be more than 60 nor less than 10 calendar days before the date of such meeting. If no record date is fixed by the Board, the record date for determining stockholders entitled to notice of or to vote at a meeting of stockholders will be at the close of business on the calendar day next preceding the day on which notice is given, or, if notice is waived, at the close of business on the calendar day next preceding the day on which the meeting is held. A determination of stockholders of record entitled to notice of or to vote at a meeting of the stockholders will apply to any adjournment of the meeting; provided, however, that the Board may fix a new record date for the adjourned meeting.

(b)Payment Record Dates. In order that the Company may determine the stockholders entitled to receive payment of any dividend or other distribution or allotment of any rights or the stockholders entitled to exercise any rights in respect of any change, conversion or exchange of stock, or for the purpose of any other lawful action, the Board may fix a record date, which record date will not be more than 60 calendar days prior to such action. If no record date is fixed, the record date for determining stockholders for any such purpose will be at the close of business on the calendar day on which the Board adopts the resolution relating thereto.

(c)Identity of Registered Holder. The Company will be entitled to treat the person in whose name any share of its stock is registered as the owner thereof for all purposes, and will not be bound to recognize any equitable or other claim to, or interest in, such share on the part of any other person, whether or not the Company has notice thereof, except as expressly provided by applicable law.

13.Adjournments. A meeting of stockholders may be adjourned from time to time by the presiding officer of the meeting or the holders of a majority of the stock present in person or represented by proxy at such meeting.

DIRECTORS

14.Function. The business and affairs of the Company will be managed under the direction of the Board.

15.Number, Election and Terms. Subject to the rights, if any, of any series of Preferred Stock to elect additional directors under circumstances specified in a Preferred Stock Designation, and to the minimum and maximum number of authorized directors provided in the Amended and Restated Certificate of Incorporation, the authorized number of directors may only be changed by resolutions of the Board. The directors, other than those who may be elected by the holders of any series of the Preferred Stock, will be classified with respect to the time for which they severally hold office in accordance with the provisions of the Amended and Restated Certificate of Incorporation.

16.Vacancies and Newly Created Directorships. Subject to the rights, if any, of the holders of any series of Preferred Stock to elect additional directors under circumstances

specified in a Preferred Stock Designation, newly created directorships resulting from any increase in the authorized number of directors and any vacancies on the Board resulting from death, resignation, disqualification, removal or other cause may be filled only by the affirmative vote of a majority of the remaining directors then in office, even though less than a quorum of the Board, or by a sole remaining director. Any director elected in accordance with the preceding sentence will hold office for the remainder of the full term of the class of directors in which the new directorship was created or the vacancy occurred and until such director’s successor is elected and qualified. No decrease in the authorized number of directors will shorten the term of any incumbent director.

17.Removal. Subject to the rights, if any, of the holders of any series of Preferred Stock specified in a Preferred Stock Designation, any director may be removed from office by the stockholders only for cause and only in the manner provided in the Amended and Restated Certificate of Incorporation.

18.Resignation. Any director may resign at any time upon notice given in writing or by electronic transmission to one of the Co-Chairmen or the Chairman if there is only one or the Secretary. Any resignation is effective when the resignation is delivered to the Company unless the resignation specifies a later effective date or an effective date determined upon the happening of an event or events.

19.Regular Meetings. Regular meetings of the Board may be held immediately after the annual meeting of the stockholders and at such other time and place either within or without the State of Delaware as may from time to time be determined by the Board. Notice of regular meetings of the Board need not be given.

20.Special Meetings. Special meetings of the Board may be called by one of the Co-Chairmen or the Chairman if there is only one or the Chief Executive Officer on one day’s notice to each director by whom such notice is not waived, given in a form permitted by Bylaw 27 or by the DGCL, and will be called by one of the Co-Chairmen or the Chairman if there is only one or the Chief Executive Officer, in like manner and on like notice, on the written request of a majority of the Whole Board. Special meetings of the Board may be held at such time and place either within or without the State of Delaware as is determined by the Board or specified in the notice of any such meeting.

21.Quorum. At all meetings of the Board, a majority of the Whole Board will constitute a quorum for the transaction of business. Except for action to be taken by committees of the Board as provided in Bylaw 23, and except for actions required by these Bylaws or the Amended and Restated Certificate of Incorporation to be taken by a majority of the Whole Board, the act of a majority of the directors present at any meeting at which there is a quorum will be the act of the Board. If a quorum is not present at any meeting of the Board, the directors present thereat may adjourn the meeting from time to time to another place, time, or date, without notice other than announcement at the meeting, until a quorum is present.

22.Participation in Meetings by Remote Communications. Members of the Board or any committee designated by the Board may participate in a meeting of the Board or any such committee, as the case may be, by means of conference telephone or other communications equipment by means of which all persons participating in the meeting can hear each other, and such participation in a meeting will constitute presence in person at the meeting.

23.Committees. The Board may designate one or more committees, each committee to consist of one or more of the directors. The Board may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of the committee. In the absence or disqualification of a member of a committee, the member or members present at any meeting and not disqualified from voting, whether or not such member or members constitute a quorum, may unanimously appoint another member of the Board to act at the meeting in the place of any such absent or disqualified member. Any such committee, to the extent provided in the resolution of the Board, or in these Bylaws, will have and may exercise all the powers and authority of the Board in the management of the business and affairs of the Company, and may authorize the seal of the Company to be affixed to all papers which may require it; but no such committee will have the power or authority in reference to the following matters: (a) approving or adopting, or recommending to the stockholders, any action or matter (other than the election or removal of directors) expressly required by the DGCL to be submitted to stockholders for approval or (b) making, adopting, amending or repealing any provision of these Bylaws.

24.Compensation. The Board may establish the compensation of directors, including, without limitation, compensation for membership on the Board and on committees of the Board, attendance at meetings of the Board or committees of the Board, and for other services provided to the Company or at the request of the Board.

25.Rules. The Board may adopt rules and regulations for the conduct of meetings and the oversight of the management of the affairs of the Company.

26.Co-Chairmen or Chairman of the Board. The Whole Board may at its discretion elect the Co-Chairmen or a Chairman from among the directors who shall not be considered an officer of the Company. A Co-Chairman or the Chairman if there is only one may be removed from that capacity by a majority vote of the Whole Board. If the Board has Co-Chairmen or a Chairman, one of the Co-Chairmen or the Chairman if there is only one, shall preside at meetings of the Board and of the stockholders of the Company and exercise and perform such other powers and duties as may from time to time be assigned to him by the Board or as may be prescribed by these Bylaws. In the absence of one of the Co-Chairmen or the Chairman if there is only one, such other director of the Company designated by a majority of the Board shall act as chairman of any such meeting. The Board or one of the Chairmen or the Chairman if there is only one may appoint a Vice Chairman of the Board to exercise and perform such other powers and duties as may from time to time be assigned to him by the Board, one of the Chairmen or by the Chairman.

NOTICES

27.Generally.

(a)Form of Notices. Except as otherwise provided by law, these Bylaws, or the Amended and Restated Certificate of Incorporation, whenever by law or under the provisions of the Amended and Restated Certificate of Incorporation or these Bylaws notice is required to be given to any director or stockholder, it will not be construed to require personal notice, but such notice may be given in writing, by mail or courier service or, to the extent permitted by the DGCL, by electronic transmission, addressed to such director or stockholder. Any notice sent to stockholders by mail or courier service shall be sent to the address of such stockholder as it

appears on the records of the Company, with postage thereon prepaid, and such notice will be deemed to be given at the time when the same is deposited in the United States mail or with the courier service. Notices sent by electronic transmission shall be deemed effective as set forth in Section 232 of the DGCL. For purposes of this Bylaw 27, “electronic transmission” means any form of communication, not directly involving the physical transmission of paper, that creates a record that may be retained, retrieved and reviewed by a recipient thereof, and that may be directly reproduced in paper form by such a recipient through an automated process.

(b)Notices to Directors. Notices to directors may be given by mail or courier service, telephone, electronic transmission or as otherwise may be permitted by these Bylaws.

28.Waivers. Whenever any notice is required to be given by law or under the provisions of the Amended and Restated Certificate of Incorporation or these Bylaws, a waiver thereof in writing, signed by the person entitled to such notice, or a waiver by electronic transmission by the person entitled to such notice, whether before or after the time of the event for which notice is to be given, will be deemed equivalent to such notice. Attendance of a person at a meeting will constitute a waiver of notice of such meeting, except when the person attends a meeting for the express purpose of objecting at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened.

OFFICERS

29.Generally. The officers of the Company will be elected annually by the Board and will consist of a Chief Executive Officer, a Secretary and a Treasurer, all of whom shall be elected at the annual meeting of the Board. The Board may also choose any or all of the following: a President, one or more Vice Presidents (who may be given particular designations with respect to authority, function, or seniority), one or more Assistant Secretaries, one or more Assistant Treasurers and such other officers as the Board may from time to time determine. Notwithstanding the foregoing, the Board may authorize the Chief Executive Officer to appoint any person to any office other than the Secretary or Treasurer. Any number of offices may be held by the same person. Any of the offices may be left vacant from time to time as the Board may determine. In the case of the absence or disability of any officer of the Company or for any other reason deemed sufficient by a majority of the Board, the Board may delegate the absent or disabled officer’s powers or duties to any other officer or to any director.

30.Compensation. The compensation of all directors who are also officers and agents of the Company and the executive officers of the Company will be fixed by the Board or by a committee of the Board. The Board may fix or delegate the power to fix, the compensation of other officers and agents of the Company to an officer of the Company.

31.Succession. The officers of the Company will hold office until their successors are elected and qualified or until such officer’s earlier death, resignation or removal. Any officer may be removed at any time by the affirmative vote of a majority of the Whole Board. Any vacancy occurring in any office of the Company may be filled by the Board or by one of the Chairmen or the Chairman if there is only one.

32.Authority and Duties. Each of the officers of the Company will have such authority and will perform such duties as are customarily incident to their respective offices or as may be specified from time to time by the Board.

STOCK

33.Uncertificated Shares. Except as otherwise provided in a resolution approved by the Board, all shares of capital stock of the Company issued after the date hereof shall be uncertificated. In the event the Board elects to provide in a resolution that certificates shall be issued to represent any shares of capital stock of the Company, such certificates shall be numbered and shall be signed by, or in the name of the Company by, one of the Chairmen or the Chairman if there is only one, or the Chief Executive Officer or the Chief Financial Officer, and by the Treasurer or an Assistant Treasurer or the Secretary or an Assistant Secretary. Any or all of the signatures on a certificate may be a facsimile signature. In case any officer, transfer agent or registrar who has signed or whose facsimile signature has been placed upon a certificate shall have ceased to be such officer, transfer agent or registrar before such certificate is issued, it may be issued by the Company with the same effect as if he or she were such officer, transfer agent or registrar at the date of issue.

34.Transfer. Transfers of shares shall be made upon the books of the Company (a) only by the holder of record thereof, or by a duly authorized agent, transferee or legal representative and (b) in the case of certificated shares, upon the surrender to the Company of the certificate or certificates for such shares. No transfer shall be made that is inconsistent with the provisions of applicable law.

35.Classes of Stock. The powers, designations, preferences and relative, participating, optional, or other special rights of each class or series of stock represented by certificates, if any, and the qualifications, limitations or restrictions of such preferences and/or rights will be set forth in full or summarized on the face or back of the certificates representing such class or series of stock or, in lieu thereof, on the face or back of such certificates will be a statement that the Company will furnish without charge to each stockholder who so requests the powers, designations, preferences and relative, participating, optional, or other special rights of each class of stock or series thereof and the qualifications, limitations or restrictions of such preferences and/or rights. Except as otherwise expressly provided by law, the rights and obligations of the holders of uncertificated stock and the rights and obligations of the holders of certificates representing stock of the same class and series shall be identical.

36.Lost, Stolen or Destroyed Certificates. The Secretary may direct a new certificate or certificates or uncertificated shares to be issued in place of any certificate or certificates theretofore issued by the Company alleged to have been lost, stolen or destroyed, upon the making of an affidavit of that fact, satisfactory to the Secretary, by the person claiming the certificate of stock to be lost, stolen or destroyed. As a condition precedent to the issuance of a new certificate or certificates, the Secretary may require the owners of such lost, stolen or destroyed certificate or certificates to give the Company a bond in such sum and with such surety or sureties as the Secretary may direct as indemnity against any claims that may be made against the Company with respect to the certificate alleged to have been lost, stolen or destroyed or the issuance of the new certificate or uncertificated shares.

GENERAL

37.Fiscal Year. The fiscal year of the Company will end on the last Sunday of the calendar year or such other date as may be fixed from time to time by the Board.

38.Reliance Upon Books, Reports and Records. Each director, each member of a committee designated by the Board, and each officer of the Company will, in the performance of his or her duties, be fully protected in relying in good faith upon the records of the Company and upon such information, opinions, reports, or statements presented to the Company by any of the Company’s officers or employees, or committees of the Board, or by any other person or entity as to matters the director, committee member, or officer believes are within such other person’s professional or expert competence and who has been selected with reasonable care by or on behalf of the Company.

39.Amendments. Except as otherwise provided by law or by the Amended and Restated Certificate of Incorporation or these Bylaws, these Bylaws or any of them may be amended in any respect or repealed at any time, either (a) at any meeting of stockholders, provided that any amendment or supplement proposed to be acted upon at any such meeting has been described or referred to in the notice of such meeting, or (b) by the Board, provided that no amendment adopted by the Board may vary or conflict with any amendment adopted by the stockholders in accordance with the Amended and Restated Certificate of Incorporation and these Bylaws. Notwithstanding the foregoing and anything contained in these Bylaws to the contrary, Bylaws 1, 3, 8, 9, 10, 11, 15, 16, 17 and 39 may not be amended or repealed by the stockholders, and no provision inconsistent therewith may be adopted by the stockholders, without the affirmative vote of the holders of at least 66-2/3% of the Voting Stock, voting together as a single class.

40.Certain Defined Terms. Capitalized terms used herein and not otherwise defined have the meanings given to them in the Amended and Restated Certificate of Incorporation.

41.Exclusive Forum For Certain Litigation. Unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, if and only if the Court of Chancery of the State of Delaware lacks subject matter jurisdiction, any state court located within the State of Delaware or, if and only if all such state courts lack subject matter jurisdiction, the federal district court for the District of Delaware) shall be the sole and exclusive forum for the following types of actions or proceedings under Delaware statutory or common law: (a) any derivative action or proceeding brought on behalf of the Company; (b) any action asserting a breach of a fiduciary duty owed by any director, officer or other employee of the Company to the Company or the Company’s stockholders; (c) any action asserting a claim against the Company or any director or officer or other employee of the Company arising pursuant to any provision of the DGCL, the Company’s Amended and Restated Certificate of Incorporation or these Bylaws; (d) any action or proceeding to interpret, apply, enforce or determine the validity of the Company’s Amended and Restated Certificate of Incorporation or these Bylaws (including any right, obligation, or remedy thereunder); (e) any action or proceeding as to which the DGCL confers jurisdiction to the Court of Chancery of the State of Delaware; or (f) any action asserting a claim against the Company or any director or officer or other employee of the Company that is governed by the internal affairs doctrine, in all cases to the fullest extent permitted by law and subject to the court’s having personal jurisdiction over the indispensable parties named as defendants. This Bylaw 41 shall not apply to suits brought to enforce a duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction.

Unless the Company consents in writing to the selection of an alternative forum, the federal district courts of the United States of America shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933, subject to and contingent upon a final adjudication in the State of Delaware of the enforceability of such exclusive forum provision.

Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Company shall be deemed to have notice of and to have consented to the provisions of this Bylaw 41.

CHUY’S HOLDINGS, INC.

2023 EMPLOYEE STOCK PURCHASE PLAN

1.Purpose. The purpose of the Plan is to provide employees of the Company and its Designated Companies with an opportunity to purchase Common Stock through accumulated Contributions. The Company intends for the Plan to qualify as an “employee stock purchase plan” under Section 423 of the Code and the provisions of the Plan will be construed so as to extend and limit Plan participation in a uniform and nondiscriminatory basis consistent with the requirements of Section 423 of the Code.

2.Definitions.

(a)“Administrator” means the Board or any Committee designated by the Board to administer the Plan pursuant to Section 14.

(b)“Affiliate” means a Person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, the Person specified. An entity shall be deemed an Affiliate for purposes of this definition only for such periods as the requisite ownership or control relationship is maintained. For purposes of this definition, “control” (including with correlative meanings, the terms “controlling,” “controlled by,” or “under common control with”), as used with respect to any Person, shall mean the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities or by contract or otherwise

(c)“Applicable Laws” means the requirements relating to the administration of equity-based awards under U.S. state corporate laws, U.S. federal and state securities laws, the Code, any stock exchange or quotation system on which the Common Stock is listed or quoted and the applicable laws of any foreign country or jurisdiction where options are, or will be, granted under the Plan.

(d)“Beneficial Owner” (or any variant thereof) has the meaning defined in Rule 13d-3 under the Exchange Act.

(e)“Board” means the Board of Directors of the Company.

(f)“Change in Control” shall be deemed to have occurred if an event set forth in any one of the following paragraphs shall have occurred:

(i)any Person, other than the Company or a Subsidiary thereof, becomes the Beneficial Owner, directly or indirectly, of securities of the Company representing more than 50% of the combined voting power of the Company’s then outstanding voting securities (the “Outstanding Company Voting Securities”), excluding any Person who becomes such a Beneficial Owner in connection with a transaction described in clause (A) of paragraph (iii) below or any acquisition directly from the Company; or

(ii)the following individuals cease for any reason to constitute a majority of the number of Directors then serving on the Board: individuals who, during any period of two consecutive years, constitute the Board and any new Director (other than a Director whose initial assumption of office is in connection with an actual or threatened election contest, including, but not limited to, a consent solicitation, relating to the election of Directors of the Company) whose appointment or election by the Board or nomination for election by the Company’s stockholders was approved or recommended by a vote of at least two-thirds of the Directors then still in office who either were Directors at the beginning of the two year period or whose appointment, election or nomination for election was previously so approved or recommended; or

(iii)the consummation of a merger or consolidation of the Company or any Subsidiary thereof with any other corporation, other than a merger or consolidation (A) that results in the Outstanding Company Voting Securities immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least 50% of the combined voting power of the Outstanding Company Voting Securities (or such surviving entity or, if the Company or the entity surviving such merger is then a subsidiary, the ultimate parent thereof) outstanding immediately after such merger or consolidation, and (B) immediately following which the individuals who comprise the Board immediately prior thereto constitute at least a majority of the Board of the entity surviving such merger or consolidation or, if the Company or the entity surviving such merger is then a subsidiary, the ultimate parent thereof; or

(iv)the consummation of a plan of complete liquidation or dissolution of the Company or there is consummated an agreement for the sale or disposition by the Company of all or substantially all of the Company’s assets, other than (A) a sale or disposition by the Company of all or substantially all of the Company’s assets to an entity, at least 50% of the combined voting power of the voting securities of which are owned directly or indirectly by stockholders of the Company following the completion of such transaction in substantially the same proportions as their ownership of the Company immediately prior to such sale or (B) a sale or disposition of all or substantially all of the Company’s assets immediately following which the individuals who comprise the Board immediately prior thereto constitute at least a majority of the board of directors of the entity to which such assets are sold or disposed or, if such entity is a subsidiary, the ultimate parent thereof.

(g)“Code” means the U.S. Internal Revenue Code of 1986, as amended. Reference to a specific section of the Code will include such section, any valid regulation or other official applicable guidance promulgated under such section, and any comparable provision of any future legislation or regulation amending, supplementing or superseding such section or regulation.

(h)“Committee” means a committee of the Board appointed in accordance with Section 14 hereof.

(i)“Common Stock” means the common stock of the Company, par value $0.01 per share.

(j)“Company” means Chuy’s Holdings, Inc., a Delaware corporation, or any successor thereto.

(k)“Compensation” includes an Eligible Employee’s base salary or base hourly wage, but excludes overtime pay, commissions, bonuses and other incentive compensation. The Administrator, in its discretion, may, on a uniform and nondiscriminatory basis, establish a different definition of Compensation for a subsequent Offering Period.

(l)“Contributions” means the payroll deductions and other additional payments that the Company may permit to be made by a Participant to fund the exercise of options granted pursuant to the Plan.

(m)“Designated Company” means any Subsidiary of the Company that has been designated by the Administrator from time to time in its sole discretion as eligible to participate in the Plan.

(n)“Director” means a member of the Board.

(o)“Eligible Employee” means any individual who is a common law employee providing services to the Company or a Designated Company and is customarily employed for at least 20 hours per week by the Employer. For purposes of the Plan, the employment relationship will be treated as continuing intact while the individual is on sick leave or other leave of absence that the Employer approves or is legally protected under Applicable Laws. Where the period of leave exceeds three months and the individual’s right to reemployment is not guaranteed either by statute or by contract, the employment relationship will be deemed to have terminated three months and one day following the commencement of such leave. Notwithstanding the foregoing, the Administrator, in its discretion, from time to time may, prior to an Enrollment Date for all options to be granted on such Enrollment Date in an Offering, determine (on a uniform and nondiscriminatory basis or as otherwise permitted by U.S. Treasury Regulation Section 1.423-2) that the definition of Eligible Employee will or will not, as applicable, include an individual if he or she: (i) has not completed at least two years of service since his or her last hire date (or such lesser period of time as may be determined by the Administrator in its discretion), (ii) customarily works not more than 20 hours per week (or such lesser period of time as may be determined by the Administrator in its discretion), (iii) customarily works not more than five months per calendar year (or such lesser period of time as may be determined by the Administrator in its discretion), (iv) is a highly compensated employee within the meaning of Section 414(q) of the Code, or (v) is a highly compensated employee within the meaning of Section 414(q) of the Code with compensation above a certain level or is an officer or subject to the disclosure requirements of Section 16(a) of the Exchange Act, provided the exclusion is applied with respect to each Offering in an identical manner to all highly compensated individuals of the Employer whose Eligible Employees are participating in that Offering. Each exclusion will be applied with respect to an Offering in a manner complying with U.S. Treasury Regulation Section 1.423-2(e)(2)(ii).

(p)“Employer” means the employer of the applicable Eligible Employee(s).

(q)“Enrollment Date” means the first Trading Day of an Offering Period.

(r)“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended, including the rules and regulations promulgated thereunder.

(s)“Exercise Date” means a date on which each outstanding option granted under the Plan will be exercised (except if the Plan has been terminated), as may be determined by the Administrator, in its discretion and on a uniform and nondiscriminatory basis from time to time prior to an Enrollment Date for all options to be granted on such Enrollment Date. For purposes of clarification, there may be multiple Exercise Dates during an Offering Period.