UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K/A

Amendment No. 1

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2020

Commission File Number: 333-231839

CHINA SXT PHARMACEUTICALS, INC.

(Translation of registrant’s name into

English)

178 Taidong Rd North, Taizhou

Jiangsu, China

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally

organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been

distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a

Form 6-K submission or other Commission filing on EDGAR.

Explanatory Note

On March 31, 2020, China SXT Pharmaceuticals,

Inc. (the “Company”) furnished to the U.S. Securities and Exchange Commission (the “Commission”)

a report on Form 6-K to report that the Company relied on an order issued by the Commission on March 4, 2020 (Release No. 34-88318),

as modified on March 25, 2020 (Release No. 34-88465) (the “Order”), and avail itself a 45-day extension for

filing of its interim financial statements on Form 6-K for the six months ended on September 30, 2019 (the “Original Report”),

which is originally due on March 31, 2020, as a result of the COVID-19 outbreak.

The Company is filing this Amendment No. 1

(this “Amendment”) to the Original Report, as filed with the Commission on April 22, 2020. This Amendment is

furnished by the Company solely to disclose that the Company had filed the Original Report after March 31, 2020 in reliance on

the Order.

In December 2019, a novel strain of coronavirus

was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world,

including the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease

(COVID-19) a “Public Health Emergency of International Concern,” and on March 11, 2020, the World Health Organization

characterized the outbreak as a “pandemic.” Jiangsu Province, where we conduct a substantial part of our business,

was materially impacted by the COVID-19. The Company has been following the recommendations of local health authorities to minimize

exposure risk for its employees, including the temporary closures of our offices and production, and having employees work remotely.

Our on-site work was not resumed until mid-March, 2020 upon the approval from the local government. As a result of the above-mentioned

factors, the Company’s books and records were not easily accessible, resulting in delay in preparation, compilation and completion

of the Original Report.

Except as described above, this Amendment does

not amend, modify or update the information in, or exhibits to, the Original Report, and we have not updated disclosures included

therein to reflect any subsequent developments or events. This Amendment should be read in conjunction with the Original Report

and with our other filings made with the SEC subsequent to the filing of the Original Report.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENT

This Current Report contains forward-looking

statements. All statements contained in this Current Report other than statements of historical fact are forward-looking statements.

The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “seek” and similar expressions are intended to identify forward-looking

statements. We have based these forward-looking statements largely on our current expectations and projections about future events

and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term

business operations and objectives, and financial needs.

These forward-looking statements are subject

to a number of risks, uncertainties and assumptions, including, but not limited to, the following: the effects of the COVID-19

outbreak, including its impact on the demand for our products; the duration of the COVID-19 outbreak and severity of such

outbreak in regions where we operate; the pace of recovery following the COVID-19 outbreak; our ability to implement

cost containment and business recovery strategies; the adverse effects of the COVID-19 outbreak on our business or the market

price of our ordinary shares, the Company's goals and strategies; the Company's future business development; product and service

demand and acceptance; changes in technology; economic conditions; reputation and brand; the impact of competition and pricing;

government regulations; fluctuations in general economic and business conditions in China and assumptions underlying or related

to any of the foregoing and other risks contained in reports filed by the Company with the Securities and Exchange Commission.

In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Current Report may not occur

and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements

as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or

occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance, or achievements. Except as required by applicable law, we undertake no duty to

update any of these forward-looking statements after the date of this Current Report or to conform these statements to actual results

or revised expectations.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Operating Metrics for the period from April 1, 2019 to September

30, 2019.

The

following table presents the selected condensed consolidated financial information of our company. The selected condensed consolidated

statements of operations data for the six months period ended September 30, 2019, 2018 and the selected condensed consolidated

balance sheets data as of September 30, 2019, and March 31, 2019 have been derived from our unaudited condensed consolidated interim

financial statements, which are included in this interim report. Our unaudited condensed consolidated interim financial statements

are prepared and presented in accordance with accounting principles generally accepted in the United States, or U.S. GAAP. Our

historical results do not necessarily indicate results expected for any future period.

|

|

●

|

Revenues declined by $0.70 million, or 17.9%, for the six months ended September 30, 2019 to $3.22 million from $3.92 million for the same period of the prior fiscal year. Revenues decline were attributable to Advanced TCMP product types demand adjustment made by some customers but were partially offset by the engagement of new Fine TCMP customers and 4 solid beverage products as part of the Company’s TCM Homologous Supplements (“TCMHS”) products that were developed and commercially launched in April 2019. Decline in revenue was primarily due to procurement adjustment of existing customers such as hospitals.

|

|

|

●

|

GAAP gross profit decreased by 31.3% to $1.84 million for the six months ended September 30, 2019 from $2.68 million for the same period of the prior fiscal year. Gross margin declined by 11.2 percentage points to 57.2% for the six months ended September 30, 2019 from 68.4% for the same period of the prior fiscal year mainly due to packaging requirement changes that drove up Regular TCMP cost of revenues. Gross profit decline was resulted from revenue decline, change of packaging requirements, and product types combination, i.e. smaller or bigger packaging, that led to increase in production cost and cost of revenues.

|

|

|

●

|

GAAP operating loss was $0.22 million for the six months ended September 30, 2019 compared to GAAP operating income of $1.33 million for the same period of the prior fiscal year as a result of revenues decline and increased packaging cost.

|

|

|

●

|

Non-GAAP operating loss was $0.09 million for the six months ended September 30 after adjusted for depreciation and amortization, 2019 compared to non-GAAP operating income of $1.43 million for the same period of the prior fiscal year.

|

|

|

●

|

GAAP net loss was $2.35 million, or ($0.10) per share, for the six months ended September 30, 2019, compared to net income of $1.00 million, or $0.05 per share, for the same period of the prior fiscal year owing to $1.67million of Convertible Notes interest and expenses, $0.22 million of Investor Relations and US legal fees that were not in the same period of prior fiscal year.

|

|

|

●

|

Non-GAAP net loss was $0.67 million, or ($0.03) per share after adjusted for depreciation, intangibles amortization, accretion of convertible notes finance cost and convertible notes interest for the six months ended September 30, 2019, compared to net income of $1.0 million, or $0.05 per share, for the same period of the prior fiscal year.

|

|

|

●

|

Adjusted EBITDA loss was $1.66 million for the six months ended September 30, 2019, compared to adjusted EBITDA of $1.43 million for the same period of the prior fiscal year.

|

Selected Financial Data

The following information is derived from our

Unaudited Financial Results for the Six Months Ended September 30, 2019 and 2018, attached hereto as Exhibit 99.1.

Results of Operations for the Six Months

Period Ended September 30, 2019 Compared to the Six Months Period Ended September 30, 2018

|

For the Six Months Ended September 30

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

Amount

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

3,215,147

|

|

|

$

|

3,917,707

|

|

|

$

|

(702,560

|

)

|

|

|

(17.9

|

)

|

|

Cost of revenue

|

|

|

(1,375,762

|

)

|

|

|

(1,239,023

|

)

|

|

|

(136,739

|

)

|

|

|

11.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

|

|

1,839,385

|

|

|

|

2,678,684

|

|

|

|

(839,299

|

)

|

|

|

(31.3

|

)

|

|

|

|

|

57.2

|

%

|

|

|

68.4

|

%

|

|

|

|

|

|

|

(11.2

|

)

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses

|

|

|

(774,253

|

)

|

|

|

(838,217

|

)

|

|

|

63,964

|

|

|

|

(7.6

|

)

|

|

General and administrative expenses

|

|

|

(1,285,885

|

)

|

|

|

(513,532

|

)

|

|

|

(772,353

|

)

|

|

|

150.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

(2,060,138

|

)

|

|

|

(1,351,749

|

)

|

|

|

(708,389

|

)

|

|

|

52.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) / Income from operations

|

|

|

(220,753

|

)

|

|

|

1,326,935

|

|

|

|

(1,547,688

|

)

|

|

|

(116.6

|

)

|

|

|

|

|

-6.9

|

%

|

|

|

33.9

|

%

|

|

|

|

|

|

|

(40.7

|

)

|

|

Other income, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(2,170,561

|

)

|

|

|

1,501

|

|

|

|

(2,172,062

|

)

|

|

|

(144,707.7

|

)

|

|

Other income, net

|

|

|

38,079

|

|

|

|

(984

|

)

|

|

|

39,063

|

|

|

|

(3,969.8

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other expenses, net

|

|

|

(2,132,482

|

)

|

|

|

517

|

|

|

|

(2,132,999

|

)

|

|

|

(412,572.3

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) / Income before income taxes

|

|

|

(2,353,235

|

)

|

|

|

1,327,452

|

|

|

|

(3,680,687

|

)

|

|

|

(277.3

|

)

|

|

Income tax expense

|

|

|

5,166

|

|

|

|

(332,406

|

)

|

|

|

337,572

|

|

|

|

(101.6

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Loss) /Income

|

|

$

|

(2,348,069

|

)

|

|

$

|

995,046

|

|

|

$

|

(3,343,115

|

)

|

|

|

(336.0

|

)

|

We generated revenues

primarily from manufacture and sales of three types of traditional Chinese medicine pieces (the “TCMP”) products: Advanced

TCMP, Fine TCMP, Regular TCMP, and TCM Homologous Supplements (“TCMHS”) products.

TCMHS is a classification of health-supporting food used traditionally in China as TCM but which are also consumed as food, which

recently has been developed and commercialized.

The following table

sets forth the breakdown of revenues by revenue source for each period presented:

|

|

|

For the Six Months Ended September 30,

|

|

|

(In US$, except percentages)

|

|

2019

|

|

|

2018

|

|

|

|

|

% Change

|

|

|

Revenues

|

|

$

|

3,215,147

|

|

|

$

|

3,917,707

|

|

|

|

|

|

-17.9

|

%

|

|

- Advanced TCMP

|

|

$

|

1,100,405

|

|

|

$

|

2,124,588

|

|

|

|

|

|

-48.2

|

%

|

|

- Fine TCMP

|

|

$

|

656,397

|

|

|

$

|

175,146

|

|

|

|

|

|

274.8

|

%

|

|

- Regular TCMP

|

|

$

|

1,297,974

|

|

|

$

|

1,617,973

|

|

|

|

|

|

-19.8

|

%

|

|

- TCMHS Solid Beverages

|

|

$

|

160,371

|

|

|

$

|

-

|

|

|

|

|

|

100.0

|

%

|

|

Gross profit

|

|

$

|

1,839,385

|

|

|

$

|

2,678,684

|

|

|

|

|

|

-31.3

|

%

|

|

Gross margin

|

|

|

57.2

|

%

|

|

|

68.4

|

%

|

|

-11.2

|

|

|

percentage points

|

|

|

Operating (loss) / income

|

|

$

|

(220,753

|

)

|

|

$

|

1,326,935

|

|

|

|

|

|

-116.6

|

%

|

|

Operating margin

|

|

|

(6.9

|

)%

|

|

|

33.9

|

%

|

|

-40.7

|

|

|

percentage points

|

|

|

Net (loss) / income

|

|

$

|

(2,348,069

|

)

|

|

$

|

995,046

|

|

|

|

|

|

-336.0

|

%

|

|

Net margin

|

|

|

(73.0

|

)%

|

|

|

25.40

|

%

|

|

-98.4

|

|

|

percentage points

|

|

|

(Loss) / Earnings per share

|

|

$

|

(0.10

|

)

|

|

$

|

0.05

|

|

|

|

|

|

-307.7

|

%

|

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP NET (LOSS) / INCOME

TO ADJUSTED EBITDA

(In US$, except percentages)

(Unaudited)

|

|

|

For the six months ended September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

GAAP net (loss) / income

|

|

$

|

(2,348,069

|

)

|

|

$

|

995,046

|

|

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

133,540

|

|

|

|

99,413

|

|

|

Interest expense

|

|

|

604,476

|

|

|

|

(4,010

|

)

|

|

Interest (income) and other

|

|

|

(4,990

|

)

|

|

|

2,509

|

|

|

Other income / (expenses)

|

|

|

(38,079

|

)

|

|

|

984

|

|

|

Provision for income taxes

|

|

|

(5,166

|

)

|

|

|

332,406

|

|

|

Adjusted EBITDA

|

|

$

|

(1,658,288

|

)

|

|

$

|

1,426,348

|

|

|

Adjusted EBITDA as % of revenue

|

|

|

-51.6

|

%

|

|

|

36.4

|

%

|

RECONCILIATION OF GAAP OPERATING (LOSS) /

INCOME TO NON-GAAP OPERATING (LOSS) / INCOME

(In US$)

(Unaudited)

|

|

|

For the six months ended September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

GAAP operating (loss) / income

|

|

$

|

(220,753

|

)

|

|

$

|

1,326,935

|

|

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

133,540

|

|

|

|

99,413

|

|

|

Non-GAAP operating (loss) / income

|

|

$

|

(87,213

|

)

|

|

$

|

1,426,348

|

|

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP NET (LOSS) / INCOME

TO NON-GAAP NET (LOSS) / INCOME

(In US$, except per share data)

(Unaudited)

|

|

|

For the six months ended September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

GAAP net (loss) / income

|

|

$

|

(2,348,069

|

)

|

|

$

|

995,046

|

|

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangibles amortization

|

|

|

4,111

|

|

|

|

3,547

|

|

|

Amortization of convertible notes interest

|

|

|

1,672,708

|

|

|

|

—

|

|

|

Non-GAAP net (loss) / income

|

|

$

|

(671,250

|

)

|

|

$

|

998,593

|

|

|

GAAP net (loss) / income per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.10

|

)

|

|

$

|

0.05

|

|

|

Diluted

|

|

$

|

(0.10

|

)

|

|

$

|

0.05

|

|

|

Non-GAAP net (loss) / income per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.03

|

)

|

|

$

|

0.05

|

|

|

Diluted

|

|

$

|

(0.03

|

)

|

|

$

|

0.05

|

|

|

Shares used in computing GAAP net income (loss) per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

22,725,512

|

|

|

|

20,000,000

|

|

|

Diluted

|

|

|

22,725,512

|

|

|

|

20,000,000

|

|

|

Shares used in computing non-GAAP net income per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

22,725,512

|

|

|

|

20,000,000

|

|

|

Diluted

|

|

|

22,725,512

|

|

|

|

20,000,000

|

|

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

SUMMARY OF DEPRECIATION, INTANGIBLES AMORTIZATION,

AMORTIZATION OF CONVERTIBLE NOTES INTEREST

AND ISSUANCE COST

(In US$)

(Unaudited)

|

|

|

For the six months ended September 30,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

$

|

129,429

|

|

|

$

|

95,866

|

|

|

Intangibles amortization

|

|

|

4,111

|

|

|

|

3,547

|

|

|

Amortization of convertible notes interest

|

|

|

1,672,708

|

|

|

|

—

|

|

|

Total

|

|

$

|

1,806,248

|

|

|

$

|

99,413

|

|

Revenues

We generated revenues primarily from manufacture

and sales of three types of traditional Chinese medicine pieces (the “TCMP”) products: Advanced TCMP, Fine TCMP and

Regular TCMP. For the six months ended September 30, 2019, the total revenues decreased by $0.7 million, or 17.9%, to $3.22 million

from $3.92 million for the same period of the prior fiscal year. Decrease in total revenues was primarily due to the decrease in

sales of Advanced TCMP products and were partly offset by the increase in the sales of Fine TCMP products and newly launched Homologous

Supplements (“TCMHS”), a classification of health-supporting food used traditionally in China as TCM but also consumed

as food. As for the TCMHS, the company has developed and commercially launched four solid beverage products in April 2019.

Regular TCMP

We currently manufacture 427 Regular TCMP

products listed on China Pharmacopoeia (version 2015) Part I for hospitals and drug stores in treatment of various diseases or

serving as dietary supplements. Sales of Regular TCMP products decreased by $0.32 million, or 19.8%, to $1.30 million for the six

months ended September 30, 2019 from $1.62 million for the same period of the prior fiscal year. Decrease in sales of Regular TCMP

products is consistent with the company’s plan to shift from low margin Regular TCMPs and to focus more on the business of

high margin Fine and Advanced TCMPs.

Fine TCMP

We currently produce over 20 Fine TCMP

products for drug stores and hospitals. Our Fine TCMP products are manufactured manually only from the high-quality authentic ingredients

derived from their regions of origin. Sales of Fine TCMP products increased by $0.48 million, or 274.8%, to $0.66 million for the

six months ended September 30, 2019 from $0.18 million for the same period of the prior fiscal year. The exponential growth in

sales was attributable to engagement of a new major customer.

Advanced TCMP

Advanced TCMP is comprised of 8 Directly Oral

TCMP products (the “Directly-Oral-TCMP”) and 9 After-soaking-oral TCMP products (the “After-Soaking-Oral-TCMP”).

Both Directly Oral TCMP and After-soaking-oral TCMP are new types of Advanced TCMP. Sales of Advanced TCMP products decreased by

$1.02 million, or 48.2%, to $1.10 million for the six months ended September 30, 2019 from $2.12 million for the same period of

the prior fiscal year. Decrease in sales of Advanced TCMP products of $1.02 million was due to product types demand adjustment

made by some customers and was partially offset by the increased sales of Fine TCMP and newly launched 4 solid beverage products

that contributed $0.16 million.

TCMHS Solid Beverages

Four solid beverage products as part of the

Company’s TCMHS products were developed and commercially launched in April 2019 and generated $0.16 million revenues in its

nascent launch with encouraging growth.

Sales of Advanced TCMP, Fine TCMP, Regular

TCMP, and TCMHS products accounted for 34.2%, 20.4%, 40.4%, and 5% of total revenues, respectively, for the six months ended September

30, 2019, compared to 54.2%, 4.5%, 41.3%, and 0% of total revenues, respectively, for the same period of the prior fiscal year.

Gross profit

Cost of revenues primarily include cost of

materials, direct labors, overhead, and other related incidental expenses that are directly attributable to the Company’s

principal operations. Total cost of goods sold increased by $0.14 million, or 11%, to $1.38 million for the six months ended September

30, 2019 from $1.24 million for the same period of the prior fiscal year. Increase in cost of revenues was driven by change of

packaging requirements and product types combination that led to increase in production cost.

Gross profit decreased by $0.84 million, or

31.3%, to $1.84 million for the six months ended September 30, 2019 from $2.68 million for the same period of the prior fiscal

year. Gross margin was 57.2% for the six months ended September 30, 2019, compared to 68.4% for the same period of the prior fiscal

year.

Operating income

Selling expenses primarily consisted of transportation,

sales staff payroll, welfare expenses, travelling expenses, advertisement and promotion expenses, and distribution expenses. For

the six months ended September 30, 2019, selling expenses decreased by $0.06 million, or 7.6%, to $0.77 million from $0.84 million

for the same period of the prior fiscal year. Decrease in selling expenses was primarily due to the combined effect of a decrease

in revenues of $0.70 million.

General and administrative expenses primarily

consisted of staff payroll and welfare expenses, research and development, entertainment expenses, travelling expenses, depreciation

and amortization expenses for administrative purposes, and office supply expenses. For the six months ended September 30, 2019,

general and administrative expenses increased by $0.77 million, or 150.4%, to $1.29 million from $0.51 million for the same period

of the prior fiscal year. Increase in general and administrative expenses was related to an increase of $0.09 million in research

and development expense, an increase of $0.22 million in legal and investor relations fees, $0.19 million repairs and maintenance

expenses.

As a result, total operating expenses increased

by $0.71 million, or 52.4%, to $2.06 million for the six months ended September 30, 2019 from $1.35 million for the same period

of the prior fiscal year.

Operating income decreased by $1.55 million,

or 116.6%, to $0.22 million operating loss for the six months ended September 30, 2019 from $1.33 million operating income for

the same period of the prior fiscal year. Operating margin was -6.9% for the six months ended September 30, 2019, compared to 33.9%

for the same period of the prior fiscal year. Decrease in operating margin was primarily due to decrease in gross margin, increase

in operating expenses after initial public offering, etc.

Finance cost increased by $2.17 million, or

144,707.7%, to $2.17 million interest cost for the six months ended September 30, 2019 from $1,501 interest income for the same

period of the prior fiscal year attributable to $1.67 million and $0.47 million of Convertible Notes accretion of finance cost

and interest expense.

Income before income taxes

Total net other loss, which includes interest

income and expenses, and other non-operating income, was $2.13 million, netting other expenses for the six months ended September

30, 2019, compared to $517 net other income for the same period of the prior fiscal year. This increase was primarily due to $1.67

million of Convertible Notes interest, issuance cost, debt discount, and transaction cost amortization.

Income before income taxes decreased by $3.68

million, or 277.3%, to $2.35 million loss before income taxes for the six months ended September 30, 2019 from $1.33 million income

before income taxes for the same period of the prior fiscal year. Decrease was primarily due to decrease in gross profit, increase

in legal and investor relations fees of $0.22 million after IPO, Convertible Notes accretion of finance cost of $1.67 million and

interest expense of $0.47 million.

Provision for income taxes was $5,166 for the

six months ended September 30, 2019, compared to $0.33 million for the same period of the prior fiscal year.

Net income and EPS

Net income decreased by $3.34 million, or 336%,

to $2.35 million net loss for the six months ended September 30, 2019 from $1 million net income for the same period of the prior

fiscal year.

Loss per share was ($0.10) for the six months

ended September 30, 2019, compared to earnings per share of $0.05 for the same period of the prior fiscal year.

Liquidity and Financial Resources

As of September 30, 2019, the Company had cash

and cash equivalents and restricted cash of $8.32 million, compared to $9.29 million at March 31, 2019. Accounts receivable and

inventories were $4.57 million and $0.85 million, respectively, as of September 30, 2019, compared to $4.26 million and $1.01 million,

respectively, at March 31, 2019. Total current assets and current liabilities were $17.54 million and $10.76 million, respectively,

leading to a current ratio of 1.63 as of September 30, 2019. This compared to total current assets and current liabilities of $15.59

million and $6.32 million, respectively, and current ratio of 2.47 at March 31, 2019.

Net cash used in operating activities was $2.02

million for the six months ended September 30, 2019, compared to $0.47 million for the same period of the prior fiscal year. Increase

in net cash used in operating activities was primarily due to increase in prepayments and other receivables.

Increase in net cash used in investing activities

was attributable to long-term investment of $3.6 million and loan receivable of $1.5 million.

Increase in net cash provided by financing

activities was mainly driven by convertible notes placement.

Relevant PRC statutory

laws and regulations permit payments of dividends by the Company’s PRC subsidiary and VIE only from their retained earnings,

if any, determined in accordance with PRC GAAP. In addition, the Company’s subsidiary and VIE in China are required to make

annual appropriations of 10% of after-tax profit to a general reserve fund or statutory reserve fund until such reserve has reached

50% of its registered capital based on the enterprise’s PRC statutory accounts. Paid in capital of the PRC subsidiary and

VIE included in the Company’s condensed consolidated net assets are also non-distributable for dividend purposes. As a result

of these PRC laws and regulations, the Company’s PRC subsidiary and VIE are restricted in their abilities to transfer net

assets to the Company in the form of dividends, loans or advances. The Company is expected to focus the operation mainly in PRC

and is not expected to have significant operations outside the PRC in the foreseeable future, and is not expected to have significant

transfer of cash to and/or from the PRC subsidiary and VIE.

According to applicable

PRC laws and regulations, a number of conditions must be met before any dividends of a wholly foreign owned enterprise, such as

our PRC subsidiary, may be distributed. In accordance with the Implementation Rules of Wholly Foreign-Owned Enterprise Law of the

PRC promulgated by the State Council, prior to the payment of any dividend, our PRC subsidiary is required to (i) reserve funds

from its profit of current accounting year to make up its losses for the previous accounting years, (ii) pay the income taxes pursuant

to applicable tax laws of the PRC and (iii) reserve accumulated funds to improve our PRC subsidiary’s ability to withstand

operation risks. Therefore, the PRC regulations could conceivably limit the amount of dividends that can be paid by our PRC subsidiary

although our PRC subsidiary has historically not paid any dividends. We believe that such limitation will exist in the future.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Non-GAAP Financial Measures

In addition to disclosing financial measures

prepared in accordance with U.S. generally accepted accounting principles (GAAP), this filing and the accompanying tables contain

certain non-GAAP financial measures. We calculate adjusted EBITDA by adding back or removing the following items to or from GAAP

net income (loss): depreciation and amortization, interest expense, interest (income) and other, and provision for income taxes.

We calculate non-GAAP operating income as GAAP operating income excluding depreciation and amortization. We calculate non-GAAP

net income as GAAP net income (loss) excluding intangibles amortization, amortization of debt discount and issuance costs, accretion

of finance costs on convertible notes, and amortization of interest costs on convertible notes. Non-GAAP financial measures do

not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies. The

company considers these non-GAAP financial measures to be important because they provide useful measures of the operating

performance of the company, exclusive of factors that do not directly affect what we consider to be our core operating performance,

as well as unusual events. The company’s management uses these measures to illustrate underlying trends in the company’s

business that could otherwise be masked by the effect of income or expenses that are excluded from non-GAAP measures. In addition,

investors often use similar measures to evaluate the operating performance of a company. Non-GAAP financial measures are presented

only as supplemental information for purposes of understanding the company’s operating results. The non-GAAP financial measures

should not be considered a substitute for financial information presented in accordance with GAAP. Please see the reconciliation

of non-GAAP financial measures set forth herein and attached to this release.

Recent Development

PIPE Transaction

On April 16, 2019, the company entered into

a Securities Purchase Agreement with certain unaffiliated institutional investors relating to a private placement by the company

of (1) Senior Convertible Notes (the “Convertible Notes”) in the aggregate principal amount of $15 million, consisting

of (i) a Series A Note in the principal amount of $ 10 million , and (ii) a Series B Note in the principal amount of $ 5 million

and (2) warrants (the “Warrants”) to purchase such amount of shares of the company’s ordinary shares equal to

50% of the shares issuable upon conversion of the Notes, exercisable for a period of five years at an initial exercise price of

$8.38, for consideration consisting of (i) a cash payment of $10,000,000, and (ii) a secured promissory note payable by the Investors

to the Company in the principal amount of $5 million. All amounts outstanding under the Notes will mature and will be due and payable

on or before October 2, 2020.

Limited Partnership Agreement

In June 2019, Taizhou

Suxuantang entered into a limited partnership agreement with Huangshan Panjie Investment Management Co., Ltd. (the “GP”),

one of the general partners of Huangshan Panjie Investment LLP Fund (“the Fund”), to join the Fund as a limited partner.

The GP will take 20% carried interest. Pursuant to the limited partnership agreement and its supplements, the Taizhou Suxuantang

is committed to contribute $7 million (RMB50 million) into the Fund in two installments, with one installment of $3.5 million (RMB

25 million) made on June 14, 2019, and the second installment of $3.5 million (RMB 25 million) to be made no later than October

31, 2019. As of the date of this interim report, the GP provided written assurance that second installment of $3.5 million (RMB

25 million) will not be required and such obligation will be borne by the GP and Fund if the contribution obligation is being called

upon.

Receipt of Event of Default Redemption Notices

On July 23 and 29, 2019, the company received

from the investors an Event of Default Redemption Notice claimed that the company failed to timely make the instalment payment

and elected to effect the redemption of $14,318,462.62 comprising in aggregate the entire principal amount, accrued and unpaid

Interest. In addition, demand for the company to purchase the Series A Warrant issued for the Event of Default Black Scholes Value

of not less than $1,208,384.07 was made.

Entry into Forbearance Agreements, Lock-Up

Agreements, Leak-Out Agreements, and the Mutual Releases

Upon negotiation with the Investors, on December

13, 2019, the company entered into certain Forbearance and Amendment Agreements (the “Forbearance Agreement”) with

each Investor and agreed to redeem the Series A Notes for an aggregate redemption price of $10,939,410.21 in installments as set

forth in the Forbearance Agreement. Concurrently with the execution of the Forbearance Agreements, the Investors and the Company

have entered into the Lock-Up Agreements, Leak-Out Agreements and Mutual Releases.

Material Terms of Forbearance Agreements

Upon the execution of the Forbearance Agreements,

the Investor shall Net (as defined in the Series B Note) all Restricted Principal (as defined in the Series B Note) outstanding

under the Series B Note against the amounts outstanding under the Investor Note (as defined in the Series B Note), after which

the Investor Note, the Series B Note and the Series B Warrant shall no longer remain outstanding.

Pursuant to the Forbearance Agreement, commencing

on the Effective Date till the earlier of (1) 5:00PM, New York city time on October 15, 2020, (or, if earlier, such date when all

the Forbearance Redemption Amounts (as defined therein) are fully paid) and (2) the time of any breach by the Company of any term

or provision of this Agreement or the occurrence of any Event of Default that is not an “Existing Default” as set forth

in the Schedule I of the Forbearance Agreements or an “Additional Forborne Default” as set forth in the Schedule II

of the Forbearance Agreement (such earlier date, the “Forbearance Expiration Date”, such period from the Effective

Date to the Forbearance Expiration Date, the “Forbearance Period”), the Investors agreed, among other things, to the

following:

(a) to forbear from (i) taking any action to

enforce their Redemption Notice with respect to certain existing defaults (the “Existing Defaults”) including but not

limited to such defaults as described in the Redemption Notices, and (ii) issuing any new demand for redemption of the Series A

Note on the basis of certain additional defaults (the “Additional Forborne Defaults”), including but not limited to

the occurrence of the event that the aggregate daily dollar trading volume of the Company’s ordinary shares does not exceed

$1,500,000, and that the volume weighted average price of the Company’s ordinary shares on any two trading days during the

thirty trading day period ending on the trading day immediately preceding such date of determination fails to exceed $2.14.

(b) not to effect any conversions of the Series

A Note or Alternate Conversions except for conversions or Alternate Conversions of the Series A Note and/or exercises of the Series

A Warrant, in each case, on any Trading Day where the trading price of the Ordinary Shares is at least $2.50 (as adjusted for share

splits, share dividends, share combinations, recapitalizations and similar events on or after the date hereof) (such price, a “Forbearance

Conversion Floor” and each such conversion, a “Permitted Transaction”); provided, that any Ordinary Shares issued

in a Permitted Transaction (other than Applied Pre-Delivery Shares or any Ordinary Shares issued upon conversion of any Forbearance

Redemption Amount that the Company has failed to pay in cash either prior to, or during, the applicable Payment Grace Period (as

defined in Schedule II of the Forbearance Agreement) with respect thereto)(collectively, the “Excluded Leak-Out Shares”))

shall be subject to the Leak-Out Agreement. If the Company or its agents do not deliver conversion shares pursuant to such aforementioned

conversion, the Investor may apply any remaining Pre-Delivered Shares to satisfy such obligations (on a share-for-share basis,

against the Ordinary Shares not timely delivered in such aforementioned conversion);

(c) not to effect any Installment Conversion,

Installment Redemption, Disclosure Delay Payments or Event of Default Redemption (as defined in the Notes, solely with respect

to the Existing Defaults and Additional Forborne Defaults) prior to the Forbearance Expiration Date other than as permitted under

this Agreement

(d) not to exercise the Series A Warrant during

the Forbearance Period (other than exercises of the Series A Warrant in Permitted Transactions);

(e) to return the original share certificate

representing the Pre-Delivered Shares (other than Applied Pre-Delivery Shares (as defined below)) to the Company for cancellation

upon the Company’s payment of the full Forbearance Redemption Amounts (as defined below),

(f) to execute and deliver to the Company certain

lock-up agreements with respect to the Pre-Delivered Shares (each a “Lock-Up Agreement”, collectively “Lock-Up

Agreements”) , certain mutual release (each a “Mutual Release”, collectively, the “Mutual Releases”)

and to execute and deliver to the Company the Leak-Out Agreement (as defined below)

In consideration for the above, the Company

agreed to the followings:

(a) in lieu of the payment of the redemption

price as stated in each Redemption Notices respectively, the Company shall (I) pay to each Investor $500,000 (the “Initial

Forbearance Fee”) on or prior to December 16, 2019, and (II) commencing on January 24th 2020, redeem the Series A Notes for

an aggregate redemption price of $10,939,410.21 (the “Forbearance Redemption Price”), in accordance with Section

8 of the Series A Note, but replacing the applicable Installment Dates and Installment Amounts (including, Principal Amounts, Interest

and Make-Whole Amounts with respect thereto) with the dates (each a “New Installment Date”) and amounts (each, a “New

Installment Amount”), respectively and (III) pay the aggregate amount of any payment obligations of the Company arising after

the date hereof pursuant to the Sections 3(c)(ii), 20 or 24(c) of the Series A Note, 9(k) of the Securities Purchase Agreement,

and/or Sections 2(e), 6 and 7 of the Registration Rights Agreement, (each such amounts, an “Ancillary Redemption Amount”,

and together with the New Installment Amounts, each an “Additional Forbearance Redemption Amount”, and together with

the Initial Forbearance Fee, each a “Forbearance Redemption Amount”);

(b) If the Company fails to pay any New Installment

Amount within 5 days of the applicable New Installment Date pursuant to the Installment Notice (as defined in Section 8 of the

Series A Note), the Investor may convert the applicable New Installment Amount in one or multiple conversion notices as an Alternate

Conversion pursuant to Section 3(e) of the Series A Note with the Forbearance Conversion Floor and the Leak-Out Agreement being

disregarded for such conversions and such conversions deemed a Permitted Transaction for the purposes of this Agreement and any

sales of such Ordinary Shares shall not be included in the applicable Daily Limit (as defined in the Leak-Out Agreement) with respect

thereto. In the event that the Company or its agents do not deliver applicable Conversion Shares pursuant to any conversion in

accordance with Section 3 of the Series A Note, the Investor may apply any remaining Pre-Delivered Shares to satisfy such obligations

(on a share-for-share basis, against the Ordinary Shares not timely delivered in such aforementioned conversion) (each an “Applied

Pre-Delivery Share”);

(c) In accordance with Section 2(h) of the

Series A Warrant, the Company agreed to adjust the exercise price of the Series A Warrant from $8.38 to $2.50 (subject to further

adjustment in accordance with the terms of the Series A Warrant); and

(d) the Company shall cause all restrictive

legends on the Pre-Delivered Shares to be removed and delivery of un-legended Pre-Delivery Shares into the Investor’s custodian’s

account pursuant to the DWAC instructions set forth therein.

Material Terms of Lock-Up Agreements

Pursuant to the Lock-Up Agreement, except that

investors may pledge the Pre-Delivered Shares in connection with a bona fide margin account or other loan or financing arrangement

secured by the Pre-Delivered Shares, the Investors agreed not to make any hedge, swap or other agreement that transfers, in whole

or in part, any of the economic consequences of ownership of the Pre-Delivered Shares (excluding the Applied Pre-Delivery Shares,

the “Locked Shares”). The investor also agreed to provide, up to three (3) times during the forbearance period,

evidence reasonably satisfactory to the Company within two (2) Business Days after receipt of the Company’s written request,

showing that the Locked Shares remain in the account of the Investor. In the event that prior to the expiration of the Forbearance

Period, the aggregate number of Ordinary Shares held in the brokerage account of such Investor is less than the Locked Shares,

the undersigned shall within one (1) Business Day of the Company’s written request, return the Locked Shares to the Company

for cancellation by directing the Investors’ broker to initiate a DWAC withdrawal of the Pre-Delivered Shares and delivering

duly executed cancellation instructions along with the original certificates (if any) evidencing the Pre-Delivered Shares, original

stock power with medallion guaranteed and corporate resolution approving such cancellation to the Company’s transfer agent.

Material terms of Leak-Out Agreements

Pursuant to the Leak-Out Agreements, each Investor

(together with certain of its affiliates) has agreed to not sell, dispose or otherwise transfer, directly or indirectly (including,

without limitation, any sales, short sales, swaps or any derivative transactions that would be equivalent to any sales or short

positions) any Ordinary Shares issued in any Permitted Transaction (collectively, the “Restricted Securities”), on

any Trading Day (as defined in Series A Notes) (each date of determination, each a “Measuring Date”), if such sale,

together with all prior sales of Restricted Securities by the Investor on such Measuring Date, exceed 20% of the daily composite

trading volume of the Ordinary Shares (as reported by Bloomberg, LP for such Measuring Date) (the “Daily Limit”); provided

that any other sales of Restricted Shares on such Measuring Date (excluding any sales of Restricted Securities) shall not be included

in the Daily Limit calculation above.

Further, this restriction will not apply to

sales or transfers of any such shares of Restricted Shares in transactions with any Person (an “Assignee”); provided,

that as a condition to any such sale or transfer an authorized signatory of the Company and such Assignee duly execute and deliver

a leak-out agreement in the form of this Leak-Out Agreement with respect to such transferred Restricted Securities (or such securities

convertible or exercisable into Restricted Securities, as applicable) (an “Assignee Agreement”) and sales of the Investor

and all Assignees shall be aggregated for all purposes of this Leak-Out Agreement and all Assignee Agreements.

Material Terms of Mutual Release

In accordance with the Mutual Release, both

parties agree not to bring any and all charges, complaints, liabilities, claims and demands of any nature whatsoever solely with

respect to the Notes and the Warrants against each other effective upon the full payment of the forbearance redemption amounts.

Entry into Amended Leak-Out Agreements

Upon the execution the Due to the Company’s

failure to obtain timely approval from State Administration of Foreign Exchange in People’s Republic of China to redeem Series

A Notes in cash as previously contemplated, the Company separately amended and restated the Leak-Out Agreements (each an “Amended

Leak-Out Agreement”) with each Investor on March 3, 2020 (“Effective Date”).

Material Terms of the Amended Leak-Out Agreements

Pursuant to the Amended Leak-Out Agreements,

each Investor (together with certain of its affiliates) has agreed to not sell, dispose or otherwise transfer, directly or indirectly

(including, without limitation, any sales, short sales, swaps or any derivative transactions that would be equivalent to any sales

or short positions) any Series A Conversion Shares converted during the period commencing on the Effective Date and ending on the

later of (x) the date the Series A Note issued to the Investor no longer remains outstanding and (y) such date as the Investor

(and/or its Affiliates) shall have sold all Series A Conversion Shares, (collectively, the “Restricted Securities”),

on any Trading Day (as defined in Series A Notes) (each date of determination, each a “Measuring Date”), if such sale,

together with all prior sales of Restricted Securities by the Investor on such Measuring Date, exceed 20% of the daily composite

trading volume of the Ordinary Shares (as reported by Bloomberg, LP for such Measuring Date) (the “Daily Limit”); provided

that the sales of any other shares of Ordinary Shares (excluding any sales of Restricted Securities) on such applicable Measuring

Date shall not be included in the Daily Limit calculation above.

In addition, if the Investor on a given date

desires to convert the Series A Note, in whole or in part, and the aggregate of the Conversion Amount of all conversions from December

13, 2019 through, and including, such date of determination (including the Conversion Amount of the proposed conversion) exceeds

the sum of (x) the aggregate New Installment Amounts (as set forth in the Forbearance Agreement) and (y) any other unpaid amounts

under the Forbearance Agreement (including, without limitation, the Initial Forbearance Fee), in the aggregate, that have become

due and payable (or would have become due and payable, assuming the Forbearance Agreement remained in full force and effect through,

and including, such date of determination) in accordance with the Forbearance Agreement on or prior to such date of determination,

the Investor shall be prohibited from effecting such conversion (the “Conversion Limit”).

Notwithstanding the foregoing Conversion Limit,

as of any time of determination, if both (x) the daily average composite trading volume of the Ordinary Share (as reported by Bloomberg,

LP for such Measuring Date) exceeds 1.5 million and (y) the trading price of the Ordinary Share as of such time of determination

exceeds the Closing Bid Price (as defined in the Series A Note) of the Ordinary Share as of the Trading Day immediately prior to

such Measuring Date, the Investor shall be permitted to convert, in one or more conversions on such Measuring Date, up to an additional

aggregate amount (which shall be excluded from the Conversion Limit) not to exceed the lesser of (i) 500,000 shares of Ordinary

Share and (ii) 20% of the daily average composite trading volume of the Ordinary Shares.

The Outbreak of COVID-19

In December 2019, a novel strain of coronavirus

was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world,

including the United States. On January 30, 2020, the World Health Organization declared the outbreak of the coronavirus disease

(COVID-19) a “Public Health Emergency of International Concern,” and on March 11, 2020, the World Health Organization

characterized the outbreak as a “pandemic.” Governments in affected countries are imposing travel bans, quarantines

and other emergency public health measures, which have caused material disruption to businesses globally resulting in an economic

slowdown. These measures, though temporary in nature, may continue and increase depending on developments in the COVID-19’s

outbreak.

Jiangsu Province, where we conduct a substantial

part of our business, was materially impacted by the COVID-19. We have been following the recommendations of local health authorities

to minimize exposure risk for our employees, including the temporary closures of our offices and production, and having employees

work remotely. Our on-site work was not resumed until mid-March, 2020 upon the approval from the local government. Due to the extended

lock-down and self-quarantine policies in China, we have experienced significant business disruption for the past two and a half

months. Some of our employees in other provinces are still subject to the lock-down policy implemented by the local governments

and could not return to work. Our production was resumed in mid-March, 2020, and was picking up slowly due to the material impacts

of COVID-19 on our logistics.

The extent to which the COVID-19 continues

to impact the Company’s business, sales, and results of operations will depend on future developments, which are highly uncertain

and will include emerging information concerning the severity of the coronavirus and the actions taken by governments and private

businesses to attempt to contain the coronavirus, but is likely to result in a material impact on our business operations at least

for the near term.

Statement Regarding Unaudited Financial

Information

The unaudited financial

information set forth above is subject to adjustments that may be identified when audit work is performed on the Company’s

year-end financial statements, which could result in significant differences from this unaudited financial information.

Exhibit.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CHINA SXT PHARMACEUTICAL, INC.

|

|

|

|

|

|

|

By:

|

/s/ Feng Zhou

|

|

|

|

Feng Zhou

|

|

|

|

Chief Executive Officer

|

Date: May 22, 2020

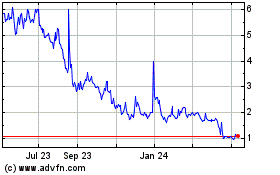

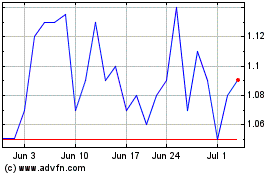

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Feb 2024 to Feb 2025