China Liberal Education Holdings Limited (Nasdaq: CLEU) (“China

Liberal”, or the “Company”, or “we”), an educational services

provider in China, today announced its financial results for the

fiscal year ended December 31, 2019.

Mr. Jianxin Zhang, Chairman and CEO of China

Liberal, commented, “We are excited to announce that we achieved

record revenue for fiscal year 2019, which represented a

year-over-year increase of 9.3%. The success of our Company

continues to be driven by our core values of ‘integrity,

professionalism, creativity and innovation’ and our aspiration to

help more Chinese students to achieve their academic and

professional goal. Our successful IPO in May this year marked an

important milestone for both the Company and our shareholders.

Going forward, we will continue focusing on investing in technology

and leveraging our intellectual property, offering our smart campus

solutions to a growing number of partnering schools. In addition,

we will expand our focus to include computer science major,

continue investing in sales and marketing activities to recruit art

students for our one-on-one consulting services, and expanding

classroom-based pre-session training services based on our current

proven one-on-one consulting.”

Fiscal Year 2019 Financial

Highlights

| |

|

For the Fiscal Years Ended December 31, |

| ($ millions, except

per share data) |

|

2019 |

|

|

2018 |

|

|

%Change |

| Revenue |

|

5.26 |

|

|

4.81 |

|

|

9.3 |

% |

| Gross profit |

|

1.90 |

|

|

2.11 |

|

|

-10.0 |

% |

| Gross margin |

|

36.1 |

% |

|

43.9 |

% |

|

-7.7 |

% |

| Income from operations |

|

0.52 |

|

|

0.82 |

|

|

-37.0 |

% |

| Operating profit margin |

|

9.9 |

% |

|

17.1 |

% |

|

-7.2 |

% |

| Net income |

|

0.44 |

|

|

0.92 |

|

|

-52.6 |

% |

| Basic and diluted

earnings per share |

|

0.09 |

|

|

0.17 |

|

|

-47.1 |

% |

- Revenue increased by 9.3% year-over-year to $5.26 million for

the fiscal year ended December 31, 2019 from $4.81 million for the

prior fiscal year.

- Gross profit decreased by 10.0% to $1.90 million for the fiscal

year ended December 31, 2019 from $2.11 million for the prior

fiscal year.

- Gross margins were 36.1% and 43.8% for the fiscal year ended

December 31, 2019 and 2018, respectively.

- Income from operations was $0.52 million for the fiscal year

ended December 31, 2019, compared to income from operations of

$0.82 million for the same period of the prior fiscal year.

Operating profit margin was 9.9% for the fiscal year ended December

31, 2019, compared to operating profit margin of 17.1% for the

prior fiscal year.

- Net income was $0.44 million for the fiscal year ended December

31, 2019, compared to $0.92 million for the prior fiscal year.

- Basic and diluted earnings per share were $0.09 for the fiscal

year ended December 31, 2019, compared to $0.17 for the prior

fiscal year.

Fiscal Year 2019 Financial

Results

Revenue

Revenue increased by 9.3% year-over-year to

$5.26 million for the fiscal year ended December 31, 2019 from

$4.81 million for the prior fiscal year. The increase revenue was

mainly attributable to increased revenue from our technological

consulting services for smart campus solutions in 2019 as compared

to 2018.

| |

|

For the Fiscal Years Ended December 31, |

| ($ millions) |

|

2019 |

|

2018 |

| Revenue |

|

Revenue |

Cost of Revenue |

Gross Margin |

|

Revenue |

Cost of

Revenue |

Gross Margin |

| Sino-foreign joint managed academic programs |

|

2.48 |

1.51 |

39.1 |

% |

|

2.41 |

1.16 |

51.9 |

% |

| Textbook and course material sales |

|

0.01 |

0.01 |

12.6 |

% |

|

0.03 |

0.02 |

33.3 |

% |

| Overseas study consulting services |

|

0.53 |

0.26 |

50.9 |

% |

|

0.55 |

0.06 |

89.1 |

% |

| Technological consulting services for smart campus

solutions |

|

2.23 |

1.58 |

29.1 |

% |

|

1.82 |

1.46 |

19.8 |

% |

| Total |

|

5.26 |

3.36 |

36.1 |

% |

|

4.81 |

2.70 |

43.9 |

% |

For the fiscal year ended December 31, 2019,

revenue from sino-foreign jointly managed academic Programs

increased by $0.07 million, or 2.9%, to $2.48 million from $2.41

million for the prior fiscal year. The increase was primarily

attributable to an increase in average tuition fee of 18.8%, or

$158 per student, with FMP and increase in average tuition fee of

11.4% ,or $119 per student, with Strait College as a result of our

good reputation, attractive learning environment and strengthened

marketing efforts, offset by a decrease in the number of students

by 153, or 6.4%, from 2,389 students in fiscal year 2018 to 2,236

students in fiscal year 2019 because we stopped recruiting and

enrolling new students into the FUT ISEC Program after the Class of

July 2018 graduated. We also suspended recruiting for the NZTC

Program after students graduated in July 2019.

Revenue from sales of textbooks and course

materials decreased by $0.02 million, or 55.7%, to $0.01 million

for the fiscal year ended December 31, 2019 from $0.03 million for

the prior fiscal year. The decrease in textbook and course material

sales was primarily due to the adjustments made by our partnered

schools FMP and Strait College in teaching course content and

curriculum settings, as a result of which, FMP and Strait College

purchased textbooks and course materials from other vendors in

order to match the new curriculum settings. This led to the

decrease in our textbook sales in 2019.

Revenue from overseas study consulting services

decreased by $0.02 million, or 4.0%, to $0.53 million for the

fiscal year ended December 31, 2019 from $0.55 million for the

prior fiscal year. The decrease was mainly because a decrease in

the number of students pursuing art majors in foreign

countries.

Revenue from providing smart campus related

technological consulting service increased by $0.41 million, or

22.6%, to $2.23 million for the fiscal year ended December 31, 2019

from $1.82 million for the prior fiscal year. The increase was

mainly due to the fact that the number of smart campus projects we

undertook increased during 2019.

Cost of revenue

Cost of revenue increased by $0.66 million, or

24.4%, to $3.36 million for the fiscal year ended December 31,

2019, from $2.70 million for the prior fiscal year, primarily due

to the increased hardware and software costs of $0.32 million

associated with the smart campus projects, and increased salary,

welfare and insurance costs for teachers and faculty by $0.18

million because we hired more qualified teachers to provide

one-on-one tutoring to the students for our overseas studying

consulting services.

Gross profit

Gross profit decreased by $0.21 million, or

10.0%, to $1.90 million for the fiscal year ended December 31,

2019, from $2.11 million for the prior fiscal year, while gross

profit margin decreased by 7.8%, from 43.9% in fiscal year 2018 to

36.1% in fiscal year 2019. The decrease in gross profit was

primarily due to our decreased revenue from study abroad consulting

services when average service fee decreased by 16.0% because of a

decrease in the number of students pursuing art majors in foreign

countries. In addition, our smart campus related technological

consulting services require both hardware and software application

and our costs associated with undertaking these projects were

relatively high. As more smart campus projects were executed by us

in 2019, our gross profit and gross margin decreased.

Operating expenses

Selling expenses decreased by $0.11 million, or

15.7%, to $0.59 million for the fiscal year ended December 31,

2019, from $0.70 million for the prior fiscal year. This decrease

in selling expenses was attributable primarily to a decrease in our

brand advertising expenses by $15,713, a decrease in salary and

employee welfare benefit expenses by $123,670, resulting from

cutting down our sales and marketing personnel, offset by an

increase in rent expenses by $101,687.

General and administrative expenses increased by

$0.20 million, or 35.2%, to $0.78 million for the fiscal year ended

December 31, 2019, from $0.58 million for the prior fiscal year,

primarily due to an increase in audit fees of $360,000 in

connection with the audits and reviews of our financial statements

for our initial public offering (“IPO”), offset by a decrease in

rent and property management expense by $70,603 and a decrease in

office expense by $57,355.

Interest Income

Interest income decreased by $82,806 or 93.1%,

to $6,120 for the fiscal year ended December 31, 2019, from $88,926

for the prior fiscal year. In 2018, we advanced a $1,997,726 (RMB13

million) interest bearing short-term loan to a third party Jinjiang

Hengfeng Trading Co., Ltd. (“Hengfeng”) as working capital, with

interest rate of 5% per annum. As a result, we reported higher

interest income on the third-party loan in 2018. In 2019, our

interest income primarily related to interest income generated from

our bank deposits.

Other Income

We recorded other income of $0.07 million for

the fiscal year ended December 31, 2019, compared to $0.18 million

for the prior fiscal year. This decrease was primarily due to the

decrease in the immediate refund of the levied VAT tax in 2019.

Provision for Income Taxes

Provision for income taxes was $0.16 million for

the fiscal year ended December 31, 2019, a decrease of $0.01

million from $0.17 million for the prior fiscal year due to our

decreased taxable income.

Net income

Net income was $0.44 million for the fiscal year

ended December 31, 2019, compared to net income of $0.92 million

for the prior fiscal year. Basic and diluted earnings per share

were $0.09 for the fiscal year ended December 31, 2019, compared to

$0.17 for the prior fiscal year.

Financial Condition

As of December 31, 2019, the Company had cash of

$1.70 million, compared to $2.08 million as of December 31,

2018.

Net cash used in operating activities was $0.34

million for the fiscal year ended December 31, 2019, compared to

net cash provided by operating activities of $0.26 million for the

prior fiscal year.

Net cash used in investing activities was $0.47

million for the fiscal year ended December 31, 2019, compared to

net cash provided by investing activities of $1.88 million for the

prior fiscal year.

Net cash provided by financing activities was

$439,193 for the fiscal year ended December 31, 2019, compared to

$8,094 for the prior fiscal year.

Recent Developments

On May 13, 2020, the Company announced the

closing of its IPO of 1,333,333 ordinary shares at a public

offering price of $6.00 per share, for total gross proceeds of

approximately $8.0 million before deducting underwriting discounts,

commissions and other related expenses. The shares commenced

trading on the Nasdaq Capital Market on May 8, 2020 under the

ticker symbol “CLEU.”

About China Liberal Education Holdings

Limited

China Liberal, headquartered in Beijing, is an

educational services provider in China. It provides a wide range of

services, including those under Sino-foreign jointly managed

academic programs; overseas study consulting services;

technological consulting services for Chinese universities to

improve their campus information and data management system and to

optimize their teaching, operating and management environment,

creating a “smart campus”; and tailored job readiness training to

graduating students. For more information, visit the company’s

website at ir.chinaliberal.com.

Forward-Looking Statements

This document contains forward-looking

statements. In addition, from time to time, we or our

representatives may make forward-looking statements orally or in

writing. We base these forward-looking statements on our

expectations and projections about future events, which we derive

from the information currently available to us. Such

forward-looking statements relate to future events or our future

performance, including: our financial performance and projections;

our growth in revenue and earnings; and our business prospects and

opportunities. You can identify forward-looking statements by those

that are not historical in nature, particularly those that use

terminology such as “may,” “should,” “expects,” “anticipates,”

“contemplates,” “estimates,” “believes,” “plans,” “projected,”

“predicts,” “potential,” or “hopes” or the negative of these or

similar terms. In evaluating these forward-looking statements, you

should consider various factors, including: our ability to change

the direction of the Company; our ability to keep pace with new

technology and changing market needs; and the competitive

environment of our business. These and other factors may cause our

actual results to differ materially from any forward-looking

statement. Forward-looking statements are only predictions. The

forward-looking events discussed in this press release and other

statements made from time to time by us or our representatives, may

not occur, and actual events and results may differ materially and

are subject to risks, uncertainties and assumptions about us. We

are not obligated to publicly update or revise any forward-looking

statement, whether as a result of uncertainties and assumptions,

the forward-looking events discussed in this press release and

other statements made from time to time by us or our

representatives might not occur.

Investor Relations Contact

China Liberal Education Holdings

LimitedEmail:ir@chinaliberal.com

Ascent Investor Relations LLC Ms. Tina

XiaoEmail:tina.xiao@ascent-ir.com Tel: +1 917 609 0333

CHINA LIBERAL EDUCATION HOLDINGS

LIMITED

CONSOLIDATED BALANCE SHEETS

| |

|

As of December 31, |

|

| |

|

2019 |

|

|

2018 |

|

|

ASSETS |

| CURRENT

ASSETS |

|

|

|

|

|

|

|

Cash |

|

$ |

1,702,279 |

|

|

$ |

2,077,166 |

|

|

Accounts receivable, net |

|

|

518,191 |

|

|

|

833,174 |

|

|

Contract receivable, net |

|

|

1,639,213 |

|

|

|

960,237 |

|

|

Advance to suppliers |

|

|

836,766 |

|

|

|

19,885 |

|

|

Deferred initial public offering costs |

|

|

649,451 |

|

|

|

- |

|

|

Due from a related party |

|

|

- |

|

|

|

72,700 |

|

|

Prepaid expenses and other current assets |

|

|

339,260 |

|

|

|

286,052 |

|

|

TOTAL CURRENT ASSETS |

|

|

5,685,160 |

|

|

|

4,249,214 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

77,782 |

|

|

|

101,205 |

|

| Right-of-use lease assets,

net |

|

|

18,372 |

|

|

|

- |

|

| Contract receivable, net |

|

|

1,071,826 |

|

|

|

1,617,186 |

|

| TOTAL NON-CURRENT

ASSETS |

|

|

1,167,980 |

|

|

|

1,718,391 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

6,853,140 |

|

|

$ |

5,967,605 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

| CURRENT

LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

51,071 |

|

|

$ |

121,558 |

|

|

Deferred revenue |

|

|

562,056 |

|

|

|

149,560 |

|

|

Taxes payable |

|

|

404,453 |

|

|

|

244,142 |

|

|

Due to related parties |

|

|

461,633 |

|

|

|

22,591 |

|

|

Operating lease liabilities |

|

|

10,326 |

|

|

|

- |

|

|

Accrued expenses and other current liabilities |

|

|

178,276 |

|

|

|

178,175 |

|

|

TOTAL CURRENT LIABILITIES |

|

|

1,667,815 |

|

|

|

716,026 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities,

non-current |

|

|

5,350 |

|

|

|

- |

|

| TOTAL

LIABILITIES |

|

|

1,673,165 |

|

|

|

716,026 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

Ordinary shares, $0.001 par value, 50,000,000 shares authorized;

5,000,000 shares issued and outstanding |

|

|

5,000 |

|

|

|

5,000 |

|

|

Additional paid in capital |

|

|

4,579,116 |

|

|

|

4,579,116 |

|

|

Statutory reserve |

|

|

379,952 |

|

|

|

294,158 |

|

|

Retained earnings |

|

|

528,315 |

|

|

|

88,967 |

|

|

Accumulated other comprehensive loss |

|

|

(312,408 |

) |

|

|

(234,237 |

) |

|

Total China Liberal Education Holdings Limited shareholders’

equity |

|

|

5,179,975 |

|

|

|

4,733,004 |

|

|

Non-controlling interest |

|

|

- |

|

|

|

518,575 |

|

|

Total shareholders’ equity |

|

|

5,179,975 |

|

|

|

5,251,579 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

$ |

6,853,140 |

|

|

$ |

5,967,605 |

|

CHINA LIBERAL EDUCATION HOLDINGS

LIMITEDCONSOLIDATED STATEMENTS OF INCOME AND

COMPREHENSIVE INCOME

| |

|

For the years endedDecember

31, |

|

| |

|

2019 |

|

|

2018 |

|

|

2017 |

|

| |

|

|

|

|

|

|

|

|

|

| REVENUE,

NET |

|

$ |

5,255,810 |

|

|

$ |

4,808,993 |

|

|

$ |

3,885,886 |

|

| COST OF

REVENUE |

|

|

3,360,694 |

|

|

|

2,702,297 |

|

|

|

2,161,322 |

|

| GROSS

PROFIT |

|

|

1,895,116 |

|

|

|

2,106,696 |

|

|

|

1,724,564 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling expenses |

|

|

593,215 |

|

|

|

704,060 |

|

|

|

541,424 |

|

| General and administrative

expenses |

|

|

783,241 |

|

|

|

579,500 |

|

|

|

408,762 |

|

| Total operating expenses |

|

|

1,376,456 |

|

|

|

1,283,560 |

|

|

|

950,186 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME FROM

OPERATIONS |

|

|

518,660 |

|

|

|

823,136 |

|

|

|

774,378 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER

INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

6,120 |

|

|

|

88,926 |

|

|

|

70,743 |

|

| Other income, net |

|

|

69,162 |

|

|

|

180,191 |

|

|

|

187,794 |

|

| Total other income, net |

|

|

75,282 |

|

|

|

269,117 |

|

|

|

258,537 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME

TAXES |

|

|

593,942 |

|

|

|

1,092,253 |

|

|

|

1,032,915 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME TAX

PROVISION |

|

|

156,038 |

|

|

|

167,813 |

|

|

|

158,109 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

|

437,904 |

|

|

|

924,440 |

|

|

|

874,806 |

|

| Less: net income attributable to

non-controlling interest |

|

|

- |

|

|

|

81,779 |

|

|

|

5,800 |

|

| NET INCOME ATTRIBUTABLE

TO CHINA LIBERAL EDUCATION HOLDINGS LIMITED |

|

$ |

437,904 |

|

|

$ |

842,661 |

|

|

$ |

869,006 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE

INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

| Total foreign currency

translation adjustment |

|

|

(78,171 |

) |

|

|

(260,983 |

) |

|

|

238,632 |

|

| TOTAL COMPREHENSIVE

INCOME |

|

|

359,733 |

|

|

|

663,457 |

|

|

|

1,113,438 |

|

| Less: comprehensive income (loss)

attributable to non-controlling interest |

|

|

- |

|

|

|

(22,871 |

) |

|

|

198 |

|

| COMPREHENSIVE INCOME

ATTRIBUTABLE TO CHINA LIBERAL EDUCATION HOLDINGS

LIMITED |

|

$ |

359,733 |

|

|

$ |

686,328 |

|

|

$ |

1,113,240 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| EARNINGS PER

SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

0.09 |

|

|

$ |

0.17 |

|

|

$ |

0.17 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE NUMBER

OF SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

5,000,000 |

|

|

|

5,000,000 |

|

|

|

5,000,000 |

|

CHINA LIBERAL EDUCATION HOLDINGS

LIMITEDCONSOLIDATED STATEMENTS OF CASH

FLOWS

| |

|

For the years endedDecember

31, |

|

| |

|

2019 |

|

|

2018 |

|

|

2017 |

|

| |

|

|

|

|

|

|

|

|

|

| Cash flows from operating

activities |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

437,904 |

|

|

$ |

924,440 |

|

|

$ |

874,806 |

|

|

Adjusted to reconcile net income to cash provided by (used in)

operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

40,038 |

|

|

|

45,347 |

|

|

|

46,649 |

|

|

Amortization of right-of-use lease assets |

|

|

2,533 |

|

|

|

- |

|

|

|

- |

|

|

Loss from disposal of fixed assets |

|

|

- |

|

|

|

- |

|

|

|

22,223 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

306,781 |

|

|

|

(243,769 |

) |

|

|

(552,457 |

) |

|

Contract receivable, net |

|

|

(176,968 |

) |

|

|

(1,848,073 |

) |

|

|

(813,737 |

) |

|

Advance to suppliers |

|

|

(824,141 |

) |

|

|

1,484,014 |

|

|

|

(1,471,166 |

) |

|

Deferred initial public offering costs |

|

|

(650,092 |

) |

|

|

- |

|

|

|

- |

|

|

Due from a related party |

|

|

72,371 |

|

|

|

(75,571 |

) |

|

|

- |

|

|

Prepaid expenses and other current assets |

|

|

(57,406 |

) |

|

|

(130,282 |

) |

|

|

(20,178 |

) |

|

Right-of-use lease asset |

|

|

(21,062 |

) |

|

|

- |

|

|

|

- |

|

|

Accounts payable |

|

|

(69,500 |

) |

|

|

(42,786 |

) |

|

|

121,143 |

|

|

Deferred revenue |

|

|

417,987 |

|

|

|

53,000 |

|

|

|

(1,847,265 |

) |

|

Taxes payable |

|

|

164,879 |

|

|

|

78,988 |

|

|

|

(48,262 |

) |

|

Operating lease liabilities |

|

|

15,810 |

|

|

|

- |

|

|

|

- |

|

|

Accrued expenses and other current liabilities |

|

|

2,434 |

|

|

|

16,507 |

|

|

|

(26,949 |

) |

| Net cash provided by (used in)

operating activities |

|

|

(338,432 |

) |

|

|

261,816 |

|

|

|

(3,715,193 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(17,738 |

) |

|

|

(83,515 |

) |

|

|

(9,353 |

) |

|

Acquisition of 8.8228% non-controlling interest in China Liberal

Beijing |

|

|

(453,669 |

) |

|

|

- |

|

|

|

- |

|

|

Repayment of loan receivable |

|

|

- |

|

|

|

1,964,844 |

|

|

|

443,931 |

|

|

Loan to a third party |

|

|

- |

|

|

|

- |

|

|

|

(1,923,703 |

) |

|

Collection of an investment deposit |

|

|

- |

|

|

|

- |

|

|

|

1,659,491 |

|

|

Collection of a short-term investment |

|

|

- |

|

|

|

- |

|

|

|

2,663,589 |

|

| Net cash (used in) provided by

investing activities |

|

|

(471,407 |

) |

|

|

1,881,329 |

|

|

|

2,833,955 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing

activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital contribution from non-controlling interest |

|

|

- |

|

|

|

- |

|

|

|

453,669 |

|

|

Proceeds from related party borrowings |

|

|

439,193 |

|

|

|

8,094 |

|

|

|

1,580 |

|

| Net cash provided by financing

activities |

|

|

439,193 |

|

|

|

8,094 |

|

|

|

455,249 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of changes of

foreign exchange rates on cash |

|

|

(4,241 |

) |

|

|

(82,043 |

) |

|

|

(4,738 |

) |

| Net (decrease) increase

in cash |

|

|

(374,887 |

) |

|

|

2,069,196 |

|

|

|

(430,727 |

) |

| Cash, beginning of

year |

|

|

2,077,166 |

|

|

|

7,970 |

|

|

|

438,697 |

|

| Cash, end of

year |

|

$ |

1,702,279 |

|

|

$ |

2,077,166 |

|

|

$ |

7,970 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosure

of cash flow information |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest expense |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

Cash paid for income tax |

|

$ |

18,657 |

|

|

$ |

79,830 |

|

|

$ |

208,936 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosure

of non-cash investing and financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer of non-controlling interest |

|

$ |

87,238 |

|

|

$ |

- |

|

|

$ |

- |

|

|

Right-of-use assets obtained in exchange for

operating lease obligations |

|

$ |

21,062 |

|

|

$ |

- |

|

|

$ |

- |

|

|

Capital restructuring |

|

$ |

- |

|

|

$ |

2,935,589 |

|

|

$ |

- |

|

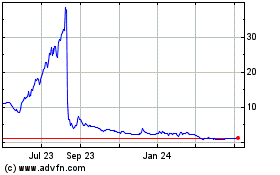

China Liberal Education (NASDAQ:CLEU)

Historical Stock Chart

From Dec 2024 to Jan 2025

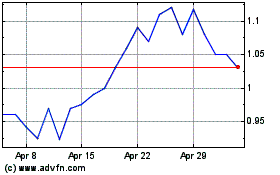

China Liberal Education (NASDAQ:CLEU)

Historical Stock Chart

From Jan 2024 to Jan 2025