Chijet Motor Company, Inc. (Nasdaq: CJET) (“Chijet” or

“we”, “our”, or the “Company”), a high-tech enterprise

engaged in the development, manufacture, sales, and service of

traditional fuel vehicles and new energy vehicles (“NEV”) in China,

today announced its unaudited financial results for the six months

ended June 30, 2023.

Financial Summary for the Six Months

Ended June 30, 2023 (all results compared to the

six months ended June 30, 2022, unless otherwise

noted)

- Revenues were $2.6 million, a decrease of 73.2%

- Units of vehicles sold reached 309, a decrease of 71.8%

- Parts and Other sales reached $0.5 million, a decrease of

78.4%

- Gross margin was negative 670%, compared with negative

215%

- Net loss was $57.6 million, compared with $48.3 million

Recent Development

We have consummated the business combination

with Jupiter Wellness Acquisition Corp., a special purpose

acquisition company (“SPAC”), on June 1, 2023 pursuant to the

Business Combination Agreement (BCA), dated October 25, 2022. On

the closing date, a total of 160,359,631 ordinary shares of Chijet

Motor Company Inc. were issued and outstanding, including those

were issued to Chijet sellers, represented by Mr. Mu, Hongwei, of

152,130,300 ordinary shares. On June 2, 2023, the Company commenced

trading on the Nasdaq Capital Market (NASDAQ: CJET). The successful

completion of the merger and the listing represents a key moment in

the Company’s journey towards growth and expansion.

2023 also marks a pivotal year in the Company’s

strategic development. We are actively advancing our new energy

strategy, reducing the production and sales ratio of fuel vehicles,

and comprehensively preparing for the upcoming launch of new energy

products. During the 6 months ended on June 30, 2023, we combined

the innovative vitality of pure electric vehicles with mature,

large-scale production capabilities to move forward with

implementing the three major strategic transformations:

(a) The initiation of a new product platform

development, leading to a product portfolio dominated by new energy

vehicles, supplemented by hybrid models, and complemented by

traditional fuel vehicles. This resulted in the integration of

three major product platform series and the commencement of new

product development and technological research.

(b) The implementation of domestic and

international market expansion, establishing a strategic layout

with equal sales volumes domestically and internationally, in order

to achieve the coordinated development of both markets. We have

already received a total of 29,900 non-binding intent orders,

including 18,200 from international markets and 11,700 domestically

as of today.

(c) The advancement of the integration between

the former state-owned and the current private enterprise

structure. Through organizational integration, we formed a

corporate structure through Chijet Motor Company, Inc. as the

global capital and financing platform, Shandong Baoya New Energy

Vehicle Co., Ltd. as the business operation entity, and FAW Jilin

as the manufacturing site, realizing a transformation in our modern

corporate management and governance system.

During the strategic transformation process, the

Company’s operations in the first half of the year were impacted by

the pandemic and regulatory policies:

(a) COVID-19 impact:

Due to the relaxation of strict control measures

against COVID-19, the Company had to suspend operations for nearly

five months due to infections, which affected the implementation of

our strategy and normal operations.

(b) Impact of policies and regulations on

financing processes and production and sales:

Since the end of last year, we had financing

plans from overseas amounting to $310 million, of which we had

entered negotiation of term letters and preparation for signing

binding contracts, with plans to go public and raise capital

simultaneously. Certain conditions of our original financing plan

have changed during the course, as a result, the capital raised

from the reverse merge with SPAC process did not meet our target,

which has negatively impacted our operations.

Additionally, on May 9, 2023, China’s Ministry

of Industry and Information Technology and other departments

announced the implementation of the National VI emission standards

that from July 1, 2023, nationwide production and sales of vehicles

that do not meet the National VI emission standards, Stage 6B, were

completely banned. This has also affected the planned manufacture

and sales of our fuel vehicles.

Results of Operations

| |

|

For the six months ended |

|

| |

|

June 30 |

|

|

(In thousands USD $) |

|

2023(unaudited) |

|

|

2022(unaudited) |

|

|

% Change |

|

|

Total revenue |

|

2,615 |

|

|

9,751 |

|

|

(73 |

)% |

| Cost of revenue |

|

(3,410 |

) |

|

(10,018 |

) |

|

(66 |

)% |

| Cost of revenue - idle

capacity |

|

(16,725 |

) |

|

(20,668 |

) |

|

(19 |

)% |

| Gross loss |

|

(17,520 |

) |

|

(20,935 |

) |

|

(16 |

)% |

| Research and development |

|

5,504 |

|

|

6,759 |

|

|

(19 |

)% |

| Selling, general and

administration |

|

29,471 |

|

|

30,004 |

|

|

(2 |

)% |

| Other income |

|

363 |

|

|

370 |

|

|

(2 |

)% |

| Interest income |

|

597 |

|

|

504 |

|

|

18 |

% |

|

Interest expense |

|

(7,491 |

) |

|

(7,349 |

) |

|

2 |

% |

| Government grant |

|

1,823 |

|

|

16,041 |

|

|

(89 |

)% |

| Loss on equity investment |

|

(289 |

) |

|

(16 |

) |

|

1706 |

% |

| Other expenses |

|

(99 |

) |

|

(109 |

) |

|

(9 |

)% |

|

Provision for income taxes |

|

- |

|

|

- |

|

|

- |

|

| Net loss |

|

(57,591 |

) |

|

(48,257 |

) |

|

19 |

% |

| |

|

|

|

|

|

|

|

|

|

Total revenues were $2,615,000

for the six months ended 2023, representing a decrease of 73% from

$9,751,000 for the same period of 2022 as described in more detail

below.

Revenue from vehicle sales were $2,092,000 for

the six months ended June 30, 2023, representing a decrease of 71%

from $7,328,000 for the six months ended June 30, 2022. The

year-over-year decrease was mainly attributable to lower fuel

vehicle deliveries as a result of the Company’s proactive strategic

transformation, as well as the implementation of the National VI

emission standards, which reduced the sales of fuel vehicles.

Revenue from parts and others were $523,000 for

the six months ended June 30, 2023, representing a decrease of 78%

from $2,423,000 for the six months ended June 30, 2022. The

year-over-year decrease in revenue from parts, accessories, and

other sales was in line with lower vehicle sale.

Cost of revenues was $3,410,000

for the six months ended June 30, 2023, representing a decrease of

66.0% from $10,018,000 for the six months ended June 30, 2022. The

decrease in cost of revenues was mainly attributable to i) decrease

in sales of vehicles in line with the vehicle deliveries as

described above, and ii) reduction in depreciation expenses of

machinery and equipment since some were fully depreciated on and

before June 30, 2023.

Cost of revenues – idle

capacity was $16,725,000 for the six months ended June 30,

2023, representing a decrease of 19.1% from $20,668,000 for the six

months ended June 30, 2022. The decrease in idle capacity was

mainly attributable to reduction in depreciation expenses of

machinery and equipment since some were fully depreciated on and

before June 30, 2023, partially offset by the shutdown period for

the six months ended June 30, 2023 of about 5.7 months compared to

5.5 months for the six months ended June 30, 2022.

Gross margin was negative 670%

in the six months ended June 30, 2023, compared with negative 215%

in the six months ended June 30, 2022.

Research and development

expenses were $5,504,000 for the six months ended June 30,

2023, representing a decrease of 18.6% from $6,759,000 for the six

months ended June 30, 2022. The year-over-year decrease was mainly

attributable to lower expenses incurred in research and development

projects as the FB77 project is approaching the final phase.

Concurrently, the delay in capital raising has necessitated a

recalibration of our research and development project

timelines.

Selling, general and administrative

expenses were $29,471,000 for the six months ended June

30, 2023, representing a decrease of 1.8% from $30,004,000 for the

six months ended June 30, 2022. The year-over-year decrease in

selling, general and administrative was primarily attributable to

the decreased selling expenses in line with lower vehicle sale,

partially offset by increase in mold compensation costs of FAW

Jilin to suppliers to ensure production readiness for fulfilling

our on-hand and perspective orders.

Interest expense remained

relatively stable at $7,491,000 for the six months ended June 30,

2023 as compared to $7,349,000 for the six months ended June 30,

2022.

Government grant was $1,823,000

for the six months ended June 30, 2023, representing a decrease of

88.6% from $16,041,000 for the six months ended June 30, 2022. The

year-over-year decrease in government grant was mainly attributable

to the recalibration the process of our research and development

and construction of the Yantai manufacturing base, leading to a

corresponding reduction in the matching amount of government

subsidies.

Net loss was $57,591,000 for

the six months ended June 30, 2023, compared with $48,257,000 in

the six months ended June 30, 2022.

Net loss attributable to shareholders of

Chijet was $39,826,000 for the six months ended June 30,

2023, compared with $32,211,000 in the six months ended June 30,

2022.

Basic and diluted net loss per

share were $0.26 in the six months ended June 30, 2023,

compared with negative $0.21 in the six months ended June 30,

2022.

Balance sheet

Cash and cash equivalents were $18,247,000 as of

June 30, 2023, representing a decrease of 52% from $37,918,000 as

of December 31, 2022. The decrease was mainly attributable to the

enlarged cash outflow from operating activities as a result of

decreased cash receipt from sales and increased payment made to

suppliers of FAW Jilin.

Restricted cash was $3,538,000 as of June 30,

2023, representing a decrease of 71% from $12,105,000 as of

December 31, 2022. The decrease was mainly attributable to the

decrease of guarantee deposits required by the banks in order to

issue bank notes payable.

Other current assets were $11,586,000 as of June

30, 2023, representing a decrease of 49% from $22,905,000 as of

December 31, 2022. The decrease was mainly attributable to the

decrease of prepayments for materials as a result of decreased

production activity of FAW Jilin.

Property, plant and equipment were $189,454,000

as of June 30, 2023, representing a decrease of 13% from

$217,902,000 as of December 31, 2022. The decrease was mainly

attributable to normal depreciation as well as the disposals of

machinery and equipment.

Accounts and notes payable were $12,914,000 as

of June 30, 2023, representing a decrease of 55% from $28,784,000

as of December 31, 2022. The decrease was mainly attributable to an

accelerated payment to suppliers and matured bank notes were

settled.

Liquidity and Capital

Resources

Historically, we have financed our operations

mainly through financing from our shareholders, payments received

from our customers, and cash received from government grant. We had

cash and cash equivalents of $18,247,000 and $37,918,000 on June

30,2023 and December 31, 2022, respectively. As of June 30, 2023

the Company had working capital deficit of $352,688,000. The

Company has a plan of operations and acknowledges that its plan of

operations may not result in generating positive working capital in

the near future.

We tend to think that our cash on hand,

including the current available cash and cash equivalents on our

balance sheet is insufficient to fully meet our capital expenditure

requirements. Therefore, we have made corresponding adjustments to

the Company’s original business plan, however the current available

cash and cash equivalents may still be insufficient to meet our

working capital and capital expenditure requirements for at least

the next 12 months from the date of this report.

To the extent that our current resources are

insufficient to satisfy our cash requirements, we may need to seek

additional equity or debt financing, and will continue to seek

government grants. If the financing is not available, or if the

terms of financing are less desirable than we expect, or fail to

obtain government grants, we may be forced to decrease our level of

investment in product development or delay, scale back or abandon

all or part of our original growth strategy, which could have an

adverse impact on our business and financial prospects.

Even though management believes that it will be

able to successfully execute its business plan, which includes

increasing market acceptance of the Company’s products to boost its

sales volume to achieve economies of scale while applying more

effective marketing strategies and cost control measures to better

manage operating cash flow position, obtain third-party financing

and capital issuance, and meet the Company’s future liquidity

needs, there can be no assurances in that regard. These matters

raise substantial doubt about the Company’s ability to continue as

a going concern. The consolidated financial statements do not

include any adjustments that might result from the outcome of this

material uncertainty.

Outlook

On December 4, 2023, we anticipate that for the

full year of 2024, our sales revenue will range between $362

million and $434 million. The total number of vehicles delivered is

expected to be between 30,000 to 36,000 units, including sales from

five new models. Of these new models, the sales of pure electric

and hybrid models are projected to account for 65.5% of the total.

Based on our business plan, we are optimistic about achieving our

sales revenue and volume forecasts for 2024. However, there is a

heightened level of uncertainty regarding our full-year performance

for 2024 if we are unable to secure sufficient funding, or if the

funding conditions are not as favorable as anticipated, or if we

fail to receive government grants. Despite this uncertainty, we

plan to initiate a follow-on public offering and also initiated an

intent of cooperation for debt financing with a funder.

As we look ahead to 2024, it shapes up to be a

landmark year for us in the realm of advanced technology,

particularly with the widespread implementation of solid-state

batteries. These batteries will feature the latest mass-produced

cell with an energy density of 350wh/kg, aiming to extend vehicle

range to 700km. We project to complete the design and prototype of

these vehicles equipped with these solid-state batteries,

conducting tests and trials. We are closely tracking the market

conditions and results of similar battery applications.

Additionally, we plan to initiate the development of hydrogen fuel

cell applications in vehicles. In 2024, we expect to complete the

related system design, structural design, and control strategy

research, as well as finalize the design and prototype of these

vehicles featuring the hydrogen fuel cell technology, and conduct

testing and validation work.

Exchange Rate

This press release contains translations of

certain Chinese Renminbi (“RMB”) amounts into U.S. dollars (“US$”)

at specified rates solely for the convenience of the readers.

Unless otherwise stated, all translations from RMB to US$ were made

at the rate of RMB7.2540 to US$1.00 for the items in balance sheets

and at the rate of RMB6.9293 to US$1.00 for the items in statements

of operations and comprehensive loss, the exchange rate in effect

as of June 30, 2023, as set forth in the exchangerates.org.uk. The

Company makes no representation that the RMB or US$ amounts

referred could be converted into US$ or RMB, as the case may be, at

any particular rate or at all.

About Chijet Motor Company,

Inc.

The primary business of Chijet is the

development, manufacture, sales, and service of traditional fuel

vehicles and NEVs. State-of-the-art manufacturing systems and

stable supply chain management enable the Company to provide

consumers with products of high performance at reasonable prices.

In addition to its large modern vehicle production base in Jilin,

China, a factory in Yantai, China will be dedicated to NEV

production upon completion of its construction. Chijet has a

management team of industry veterans with decades of experience in

engineering and design, management, financing, industrial

production, and financial management. For additional information

about Chijet, please visit www.chijetmotors.com.

Chijet Contact:2888 Donshan StreetGaoxin

Automobile Industrial ParkJilin City, JL.

P.R.China0535-2766202EMAIL: info@chijetmotors.com

Investor Relations Contact:Skyline Corporate

Communications Group, LLCScott Powell, PresidentOne Rockefeller

Plaza, 11th FloorNew York, NY 10020Office: (646) 893-5835

x2Email:info@skylineccg.com

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995. Chijet’s

actual results may differ from its expectations, estimates and

projections and consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “might” and “continues,” and

similar expressions are intended to identify such forward-looking

statements. These forward-looking statements include, without

limitation, statements regarding Chijet’s leadership team, Chijet’s

continued growth and financial and operational improvements, along

with those other risks described under the heading “Risk Factors”

in the prospectus Chijet filed with the Securities and Exchange

Commission (the “SEC”) on March 30, 2023, and those that are

included in any of Chijet’s future filings with the SEC. These

forward-looking statements involve significant risks and

uncertainties that could cause actual results to differ materially

from expected results. Most of these factors are outside of the

control of Chijet and are difficult to predict. Should one or more

of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking

statements. Readers are cautioned not to place undue reliance upon

any forward-looking statements, which speak only as of the date

made. Chijet undertakes no obligation to update forward-looking

statements to reflect events or circumstances after the date they

were made except as required by law or applicable regulation.

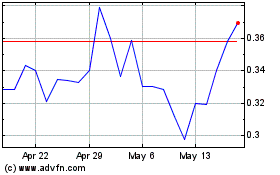

Chijet Motor (NASDAQ:CJET)

Historical Stock Chart

From Jan 2025 to Feb 2025

Chijet Motor (NASDAQ:CJET)

Historical Stock Chart

From Feb 2024 to Feb 2025