Cerevel Therapeutics Reports Second Quarter 2023 Financial Results and Business Updates

August 02 2023 - 6:30AM

Cerevel Therapeutics, (Nasdaq: CERE), a company dedicated to

unraveling the mysteries of the brain to treat neuroscience

diseases, today reported financial results for the second quarter

ended June 30, 2023 and provided key pipeline and business updates.

“The science and innovation at Cerevel are extraordinary,

matched only by the passion and dedication of the team I’ve had the

honor to get to know over the last two months,” said Ron Renaud,

president and chief executive officer of Cerevel Therapeutics. “We

remain focused on execution as we prepare for a pivotal year in

2024 with data from multiple late-stage clinical trials in

schizophrenia, epilepsy, and Parkinson’s disease.”

Pipeline HighlightsLeveraging its deep

understanding of neurocircuitry and targeted receptor subtype

selectivity, Cerevel is advancing its broad and diverse pipeline of

novel neuroscience product candidates.

Below are the latest updates for Cerevel’s lead programs.

Emraclidine: an M4-selective

positive allosteric modulator (PAM) in development for

schizophrenia and Alzheimer’s disease psychosis.

- Cerevel is conducting two adequately-powered placebo-controlled

Phase 2 trials in schizophrenia in which emraclidine is being

studied as a once-daily medication without the need for titration,

known as EMPOWER-1 and EMPOWER-2.

- Due to recent slower-than-expected enrollment in the U.S. and

delays in the startup of certain ex-U.S. clinical sites, data for

both trials are now expected in the second half of 2024.

- The 52-week open-label safety extension trial, EMPOWER-3, is

also continuing enrollment.

- In order to support a potential registrational package for

emraclidine in schizophrenia, Cerevel is also prioritizing the

completion of the necessary non-clinical and clinical pharmacology

studies in addition to its Phase 2 program.

- To support development in Alzheimer's disease psychosis as a

second potential indication for emraclidine, Cerevel initiated a

Phase 1 multiple ascending dose trial to evaluate the safety,

tolerability and pharmacokinetics of emraclidine in elderly healthy

volunteers, 65-85 years old.

- The FDA granted Fast Track designation for emraclidine for the

treatment of hallucinations and delusions associated with

Alzheimer's disease psychosis.

Darigabat: an

α2/3/5-selective GABAA receptor PAM currently under development for

epilepsy and panic disorder.

- Cerevel is conducting the REALIZE trial, a Phase 2

proof-of-concept trial in focal epilepsy, and a corresponding

open-label safety extension trial.

- Data readout for the REALIZE trial is expected mid-year

2024.

- Cerevel also recently initiated the ADAPT trial, a Phase 2

proof-of-concept trial in panic disorder.

Tavapadon: a D1/D5

partial agonist currently in Phase 3 for the treatment

of Parkinson’s disease.

- Tavapadon has the potential to be a first-in-class D1/D5

selective partial agonist for Parkinson’s disease, as both

monotherapy and adjunctive treatment.

- All three of Cerevel’s Phase 3 trials as monotherapy

(early-stage) and adjunctive (late-stage) in Parkinson’s disease

(TEMPO-1, -2, and -3) are ongoing, along with the corresponding

open-label extension trial (TEMPO-4).

- Data is expected in the first half of 2024 for TEMPO-3 and in

the second half of 2024 for TEMPO-1 and TEMPO-2.

CVL-871: a D1/D5

partial agonist in development for treatment

of dementia-related apathy.

- Cerevel is conducting a Phase 2a exploratory trial in

dementia-related apathy.

- Due to continued challenges that clinical sites have

experienced in identifying the appropriate patient population for

this novel indication, the timeline for this trial is under

review.

In addition to these lead programs, Cerevel is advancing its

early clinical pipeline and discovery programs, which include:

- CVL-354, a selective kappa opioid

receptor antagonist (KORA) for the treatment of major

depressive disorder and substance use disorder.

- Selective M4 agonist program for the

treatment of psychiatric and neurological indications.

- Selective PDE4 inhibitor (PDE4D-sparing)

program for the treatment of psychiatric, neuroinflammatory and

other disorders.

Financial Results for the Second Quarter

2023

- Cash Position:

Cash, cash equivalents and marketable securities as of June 30,

2023, were $825.1 million. Cerevel’s cash, cash

equivalents, and marketable securities are expected to support all

planned data readouts in 2024 and fund operations into

2025.

- R&D Expense: Research and development

expense for the second quarter and six months ended June 30, 2023,

was $74.1 million and $152.3 million, respectively, compared to

$72.5 million and $127.6 million for the prior year periods. Total

research and development expense includes equity-based compensation

expense of $7.2 million and $13.6 million for the second quarter

and six months ended June 30, 2023, respectively. These amounts

compare to equity-based compensation expense of $4.8 million and

$8.8 million for the prior year periods. The increases in R&D

expense reflect the advancement of our tavapadon and darigabat

programs, including the initiation of our Phase 2 proof-of-concept

trial for darigabat in panic disorder, as well as increases in

personnel costs, including equity-based compensation. Additionally,

expenses associated with emraclidine for the comparative periods

reflect an increase in expense incurred in the current year for the

advancement of our two ongoing Phase 2 trials and the open-label

extension trial in schizophrenia, and the initiation of our Phase 1

trial to support future development in Alzheimer's disease

psychosis in December 2022, offset by a decrease in expense

incurred in relation to our ambulatory blood pressure monitoring

trial that was completed in December 2022.

- G&A Expense:

General and administrative expense for the second quarter and six

months ended June 30, 2023, was $22.8 million and $44.1 million,

respectively, compared to $20.5 million and $38.0 million for the

prior year periods. Total general and administrative expense

include equity-based compensation expense of $7.3 million and $13.5

million for the second quarter and six months ended June 30, 2023,

respectively. These amounts compare to equity-based compensation

expense of $5.3 million and $9.9 million for the prior year

periods. Compared to the same periods in the prior year, the

increases in general and administrative expense were primarily

driven by higher personnel costs, including equity-based

compensation, partially offset by a reduction in spend associated

with professional fees.

Conference Call Information

Cerevel will host a conference call and webcast today, August 2,

at 8:00 a.m. ET to discuss its second quarter 2023 financial

results and key pipeline and business updates. To access the call,

please register at this link. Once registered, you will receive the

dial-in information and a unique PIN number.A live webcast of the

call, along with supporting slides, will be available on the

investors section of Cerevel’s website at investors.cerevel.com.

Following the live webcast, an archived version of the call will be

available on the website.

About Cerevel TherapeuticsCerevel Therapeutics

is dedicated to unraveling the mysteries of the brain to treat

neuroscience diseases. The company is tackling diseases by

combining its deep expertise in neurocircuitry with a focus on

targeted receptor subtype selectivity and a differentiated approach

to pharmacology. Cerevel Therapeutics has a diversified pipeline

comprised of five clinical-stage investigational therapies and

several preclinical compounds with the potential to treat a range

of neuroscience diseases, including schizophrenia, Alzheimer’s

disease psychosis, epilepsy, panic disorder, and Parkinson’s

disease. Headquartered in Cambridge, Mass., Cerevel Therapeutics is

advancing its current research and development programs while

exploring new modalities through internal research efforts,

external collaborations, or potential acquisitions. For more

information, visit www.cerevel.com.

Special Note Regarding Forward-Looking

StatementsThis press release contains forward-looking

statements that are based on management’s beliefs and assumptions

and on information currently available to management. In some

cases, you can identify forward-looking statements by the following

words: “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing” or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words. These statements

involve risks, uncertainties and other factors that may cause

actual results, levels of activity, performance or achievements to

be materially different from the information expressed or implied

by these forward-looking statements. Although we believe that we

have a reasonable basis for each forward-looking statement

contained in this press release, we caution you that these

statements are based on a combination of facts and factors

currently known by us and our projections of the future, about

which we cannot be certain. Forward-looking statements in this

press release include, but are not limited to, statements about:

the potential attributes and benefits of our product candidates;

the format, timing and objectives of our product development

activities and clinical trials; the timing and outcome of

regulatory interactions, including whether activities meet the

criteria to serve as registrational; the ability to compete with

other companies currently marketing or engaged in the development

of treatments for relevant indications; the size and growth

potential of the markets for product candidates and ability to

serve those markets; the rate and degree of market acceptance of

product candidates, if approved; and the sufficiency of our cash

position. We cannot assure you that the forward-looking statements

in this press release will prove to be accurate. Furthermore, if

the forward-looking statements prove to be inaccurate, the

inaccuracy may be material. Actual performance and results may

differ materially from those projected or suggested in the

forward-looking statements due to various risks and uncertainties,

including, among others: clinical trial results may not be

favorable; uncertainties inherent in the product development

process (including with respect to the timing of results and

whether such results will be predictive of future results); the

impact of COVID-19, the post-COVID environment and other factors on

the timing, progress and results of clinical trials; our ability to

recruit and enroll suitable patients in our clinical trials,

including the effectiveness of mitigation measures; whether and

when, if at all, our product candidates will receive approval from

the FDA or other regulatory authorities, and for which, if any,

indications; competition from other biotechnology companies;

uncertainties regarding intellectual property protection; and other

risks identified in our SEC filings, including those under the

heading “Risk Factors” in our Quarterly Report on Form 10-Q filed

with the SEC on May 3, 2023 and our subsequent SEC filings. In

light of the significant uncertainties in these forward-looking

statements, you should not regard these statements as a

representation or warranty by us or any other person that we will

achieve our objectives and plans in any specified time frame, or at

all. The forward-looking statements in this press release represent

our views as of the date of this press release. We anticipate that

subsequent events and developments will cause our views to change.

However, while we may elect to update these forward-looking

statements at some point in the future, we have no current

intention of doing so except to the extent required by applicable

law. You should, therefore, not rely on these forward-looking

statements as representing our views as of any date subsequent to

the date of this press release.

Media Contact:Anna RobinsonCerevel Therapeutics

anna.robinson@cerevel.com

Investor Contact:Matthew CalistriCerevel

Therapeuticsmatthew.calistri@cerevel.com

| TABLE 1 |

|

|

|

|

|

|

|

|

|

|

|

|

| CEREVEL THERAPEUTICS

HOLDINGS, INC. |

|

| CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

| (unaudited, in

thousands, except share amounts and per share amounts) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

74,081 |

|

|

$ |

72,539 |

|

|

$ |

152,262 |

|

|

$ |

127,562 |

|

|

|

General and administrative |

|

|

22,762 |

|

|

|

20,467 |

|

|

|

44,132 |

|

|

|

37,974 |

|

|

|

Total operating expenses |

|

|

96,843 |

|

|

|

93,006 |

|

|

|

196,394 |

|

|

|

165,536 |

|

|

| Loss from

operations |

|

|

(96,843 |

) |

|

|

(93,006 |

) |

|

|

(196,394 |

) |

|

|

(165,536 |

) |

|

| Interest

income, net |

|

|

9,820 |

|

|

|

667 |

|

|

|

18,896 |

|

|

|

962 |

|

|

| Interest

expense |

|

|

(2,640 |

) |

|

|

— |

|

|

|

(5,276 |

) |

|

|

— |

|

|

| Other income

(expense), net |

|

|

(9,765 |

) |

|

|

1,868 |

|

|

|

(20,855 |

) |

|

|

5,809 |

|

|

| Loss before

income taxes |

|

|

(99,428 |

) |

|

|

(90,471 |

) |

|

|

(203,629 |

) |

|

|

(158,765 |

) |

|

| Income tax

benefit (provision), net |

|

|

(107 |

) |

|

|

— |

|

|

|

(192 |

) |

|

|

— |

|

|

| Net

loss |

|

$ |

(99,535 |

) |

|

$ |

(90,471 |

) |

|

$ |

(203,821 |

) |

|

$ |

(158,765 |

) |

|

| Net loss per

share, basic and diluted |

|

$ |

(0.63 |

) |

|

$ |

(0.61 |

) |

|

$ |

(1.30 |

) |

|

$ |

(1.07 |

) |

|

|

Weighted-average shares used in calculating net loss per share,

basic and diluted |

|

|

157,050,677 |

|

|

|

148,295,716 |

|

|

|

156,850,632 |

|

|

|

148,141,180 |

|

|

| |

|

|

|

|

|

|

|

|

|

| TABLE 2 |

|

|

|

|

|

|

|

|

| CEREVEL THERAPEUTICS

HOLDINGS, INC. |

|

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

|

| (unaudited, in

thousands) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

|

June 30, 2023 |

|

December 31, 2022 |

|

|

ASSETS |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

175,763 |

|

$ |

136,521 |

|

|

Marketable securities |

|

|

560,663 |

|

|

755,509 |

|

|

Prepaid expenses and other current assets |

|

|

15,247 |

|

|

13,621 |

|

|

Total current assets |

|

|

751,673 |

|

|

905,651 |

|

| Marketable

securities |

|

|

88,637 |

|

|

58,126 |

|

| Property and

equipment, net |

|

|

27,246 |

|

|

27,467 |

|

| Operating

lease assets |

|

|

21,016 |

|

|

21,820 |

|

| Restricted

cash |

|

|

1,960 |

|

|

1,867 |

|

| Other

long-term assets |

|

|

3,821 |

|

|

2,891 |

|

|

Total assets |

|

$ |

894,353 |

|

$ |

1,017,822 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| Current

liabilities |

|

$ |

65,560 |

|

$ |

72,564 |

|

| Operating

lease liabilities, net of current portion |

|

|

29,537 |

|

|

31,190 |

|

| 2027

convertible senior notes, net |

|

|

336,446 |

|

|

335,482 |

|

| Financing

liabilities |

|

|

112,310 |

|

|

57,348 |

|

| Total

stockholders’ equity |

|

|

350,500 |

|

|

521,238 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

894,353 |

|

$ |

1,017,822 |

|

| |

|

|

|

|

|

| TABLE 3 |

|

|

|

|

|

|

| CEREVEL THERAPEUTICS

HOLDINGS, INC. |

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (unaudited, in

thousands) |

| |

|

|

|

|

|

|

| |

|

For the Six Months Ended June 30, |

| |

|

|

2023 |

|

|

|

2022 |

|

| Net cash

flows used in operating activities |

|

$ |

(172,250 |

) |

|

$ |

(125,304 |

) |

| Net cash

flows provided by investing activities |

|

|

172,536 |

|

|

|

25,752 |

|

| Net cash

flows provided by financing activities |

|

|

39,049 |

|

|

|

42,419 |

|

|

Net increase (decrease) in cash, cash equivalents and restricted

cash |

|

|

39,335 |

|

|

|

(57,133 |

) |

|

Cash, cash equivalents and restricted cash, beginning of the

period |

|

|

138,388 |

|

|

|

197,218 |

|

|

Cash, cash equivalents and restricted cash, end of the period |

|

$ |

177,723 |

|

|

$ |

140,085 |

|

| |

|

|

|

|

| Note: |

|

|

|

|

| Cash, cash equivalents

and restricted cash balances include restricted cash of $2.0

million and $1.9 million as of June 30, 2023 and June 30, 2022,

respectively. |

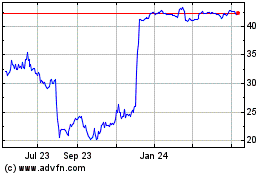

Cerevel Therapeutics (NASDAQ:CERE)

Historical Stock Chart

From Feb 2025 to Mar 2025

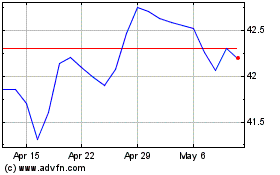

Cerevel Therapeutics (NASDAQ:CERE)

Historical Stock Chart

From Mar 2024 to Mar 2025