UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the date of June 27, 2023

Commission File Number 001-39124

Centogene N.V.

(Translation of registrant's name into English)

Am Strande

7

18055 Rostock

Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F..X.. Form 40-F.....

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Centogene N.V.

On June 27, 2023, Centogene N.V. (the

“Company”), issued a press release announcing its partnership with Lifera titled “CENTOGENE and Lifera, a

Biopharma Company Owned by the PIF, Enter Strategic Collaboration – Forming Saudi Arabian Joint Venture to Increase Access to Leading

Data-Driven Multiomic Testing and Securing CENTOGENE $30 Million Investment”. A copy of the press release is attached hereto

as Exhibit 99.1.

Joint Venture Agreement

On June 26, 2023, the Company entered into

a joint venture agreement (the “Joint Venture Agreement”) with Pharmaceutical Investment Company (“PIC”)

(referred to in the press release as “Lifera”), a closed joint stock company incorporated pursuant to the laws of Saudi Arabia

and a wholly-owned subsidiary of the Public Investment Fund based in Riyadh, to form a joint venture under the laws of Saudi Arabia. Pursuant

to the Joint Venture Agreement, and subject to the terms and conditions contained therein, the Company and PIC have agreed to establish

a limited liability company in Saudi Arabia (the “JV”).

Pursuant to the Joint Venture Agreement, PIC

shall contribute 80% (SAR 80,000,000) and the Company shall contribute 20% (SAR 20,000,000) of the initial capital for the JV, which

will be used to fund its operations including the establishment of a laboratory center of excellence in Saudi Arabia

(“KSA”) for genetic and multiomic testing (including, without limitation, genomics, epigenomics, transcriptomics,

proteomics and metabolomics). In addition, the Company will grant the JV exclusive rights to the Company’s technology and

intellectual property in the KSA and provide laboratory and consultancy services to the JV throughout the development of the

laboratory center, pursuant to a license agreement, lab services agreement and consultancy agreement (the “Commercial

Agreements”) to be negotiated and entered into by and between the Company and the JV. It is currently contemplated that such Commercial Agreements will provide for milestone payments of up to approximately fifty million

dollars ($50,000,000) and revenue-based royalties until the year 2033.

Formation of the JV is conditioned, among other

things, on foreign direct investment and other regulatory clearances, no material adverse change having occurred with respect to the Company

and agreement by PIC and the Company on the terms of the Commercial Agreements.

PIC will be entitled to appoint four managers

to the board of managers for the JV, including the chairman, and the Company will be entitled to appoint one manager, who shall serve

as the vice-chairman. The audit committee shall be appointed by the shareholders and shall comprise one member designated for appointment

by PIC, one member designated for appointment by the Company, and one member jointly appointed by PIC and the Company. The Company shall

be entitled to nominate the chief executive officer for the JV (subject to approval by PIC) and PIC shall be entitled to nominate the

chief financial officer (subject to approval by the Company). The Joint Venture Agreement sets forth certain board and shareholder reserved

matters, and procedures for the resolution of conflicts of interest between the members of management for the JV and the JV’s shareholders.

Each of PIC and the Company shall be entitled

to a right of first refusal on the transfer of shares in the JV by the other shareholder. In addition, the Company shall be subject to

restrictions on the transfer of its shareholding in the JV until the later of (i) the fifth anniversary of the incorporation of the JV

and (ii) the date of accreditation of the laboratory to be established by the JV, provided that such restrictions shall fall away immediately

after such accreditation in the event that the Company’s shareholding in the JV falls below 10% or the JV completes an initial public

offering. In the event that PIC decides to dispose of 50% or more of its shares in the JV, the Company and any other shareholders may

exercise a tag-along right to require that PIC ensure that the proposed buyer also buys the Company’s or any such other shareholders’

shares in the JV.

The Company has agreed that, for as long as the

Company is a shareholder in the JV and for a period of two years thereafter, it will not establish, operate or manage any other genomics

wet or dry laboratory or similar business, in the KSA or any other member state of the Gulf Cooperation Council (“GCC”),

that competes with the JV. The Company has also agreed that for as long as the Company is a shareholder in the JV and for a period of

two years thereafter, subject to the limitations set forth in the Joint Venture Agreement, the Company will not, directly or indirectly,

compete with the JV in the KSA or in any other GCC member state, other than the provision of services to the Company’s existing

clients until December 31, 2023. The Company must use reasonable best efforts to transfer its existing clients to the JV. The Company

must also first offer to the JV any material opportunity that arises for the Company in another GCC member state.

For as long as the Company is a shareholder

in the JV and for a period of two years thereafter, PIC may not establish, operate or manage a wet or dry laboratory or similar

business that competes with the JV outside the GCC. In addition, PIC has agreed, for as long as PIC is a shareholder in the JV and

for a period of two years thereafter, not to establish, operate or manage any other wet or dry laboratory or similar business that

competes with the JV in the KSA. However, such limitations on operating in KSA and the GCC shall not apply to PIC if, (i) following a

change of control of the Company, the Company materially breaches its obligations with respect to the Joint Venture Agreement and

the Commercial Agreements and/or (ii) any of the Commercial Agreements are terminated for any reason other than a Company default thereunder. PIC and the Company have also agreed not to solicit each other’s employees as long as they are

shareholders in the JV.

After the laboratory established by the JV

has obtained (1) CAP Laboratory Accreditation from the College of American Pathologists and (2) certification pursuant to the

Clinical Laboratory Improvement Amendments, or equivalent internationally recognized accreditation or certification as mutually

agreed by the Parties (and in any event no sooner than five years from the signing of the Joint Venture Agreement), and subject to

the voting rights of shareholders, the readiness of the JV and market conditions, the Company and PIC have agreed to discuss an

initial public offering of the common shares of the JV (“IPO”) on the Saudi Arabian Main Market (Tadawul) or any

other reputable stock exchange, whether through a primary or secondary offering of Shares. If they agree to pursue an IPO, they must

each use their reasonable efforts and take all customarily required actions to cooperate with the JV to cause such IPO to occur.

If either PIC or the Company, directly or through

their representatives in the JV, fail to adopt a resolution reserved for a vote of the board of the JV or the shareholders of the JV,

in accordance with the Joint Venture Agreement, within 3 months from when the resolution was brought to a vote, then it will be considered

a “Deadlock Event.” In the event of a Deadlock Event, either party may give notice to the other of such Deadlock Event.

Within 15 days of receipt of such notice, the parties must raise the issue with their chairmen (with respect to the Company, the chairman

of the supervisory board) and the chairmen must use reasonable efforts to resolve the deadlock within 45 days. If the issue is not resolved

within such 45 days, the full boards of PIC and the Company must use reasonable efforts to resolve the issue. In the event the issue is

still not resolved, PIC shall first have the right to require the Company to sell its shares in the JV to PIC within 90 days. In the event

PIC does not require the Company to sell its shares, the Company may require PIC to sell its shares in the JV to the Company or that PIC

buy the Company’s shares in the JV, with PIC having the right to choose whether it wants to purchase or sell the JV shares, and

must do so within 90 days.

The Company has agreed to indemnify PIC for five

years from the date of the establishment of the JV for all losses incurred, suffered or sustained by the JV and/or PIC, relating to, resulting

from or arising out of any claim in relation to the infringement of any third party intellectual property right or absence of any requisite

permissions, in each case in relation to the patient data or samples, or data, information or results generated from such patient data

that is provided by the Company. However, the Company has no liability unless the losses sustained by the JV and/or PIC in any calendar

year exceeds SAR 375,000 (in which case, the Company’s liability will be for the whole amount of such losses for such calendar year).

The aggregate liability of the Company for any such losses (including all legal and other costs and expenses), may not exceed SAR 37,500,000.

The JV and PIC are subject to customary obligations to first use reasonable efforts to recover from any insurance they may have that covers

any such losses and from any third party who may be liable.

The term of the Joint Venture Agreement is indefinite,

subject to customary exceptions for early termination (including a failure to meet the conditions to the incorporation of the JV on or

before the date that is 120 days from the signing of the Joint Venture Agreement, the winding-up of the Company and the completion of

any initial public offering of shares in the JV).

The Joint Venture Agreement is expressed to be

governed by the laws of the KSA. Disputes will be settled by arbitration in accordance with the arbitration rules of the Saudi Centre

for Commercial Arbitration.

The foregoing summary of the Joint Venture Agreement

is subject to, and qualified in its entirety by, the full text of the Joint Venture Agreement, a copy of which is attached hereto as Exhibit

99.2.

Convertible Loan Agreement

In connection with the Joint Venture Agreement, PIC and the Company

have agreed to enter into a convertible loan agreement (the “Loan Agreement”), pursuant to which PIC will agree to

loan the Company $30,000,000 (the “Principal Amount”). The signing of the Loan Agreement will occur simultaneously

with and is conditioned upon the incorporation of the JV which is itself conditioned, as described above, among other things, on foreign

direct investment and other regulatory clearances, no material adverse change having occurred with respect to the Company and agreement

by PIC and the Company on the terms of the Commercial Agreements.

Interest on the Principal Amount will be payable in kind (PIK) at

a rate of 12.8% per annum (based on a 365-day year) (the “Stated Interest”) and will be due, along with the

Principal Amount and any additional interest, on or before the date that is six months from the date the Loan Agreement is executed

(the “Maturity Date”). Each of the Principal Amount, the Stated Interest and any additional interest will be

payable in new common shares of the Company at the conversion price (initially $2.20 per common share) (the “Conversion

Price”). In addition, upon the Maturity Date (or any earlier conversion of the loan) the Company shall pay to PIC a

conversion fee (the “Conversion Fee”) in common shares in an amount equal to the quotient obtained by dividing

$1,000,000 by the Conversion Price. The Conversion Price is subject to customary adjustment mechanics. PIC may convert the Loan in

its entirety at any time after the 30-day volume-weighted average price of the common shares of the Company has been equal to or

greater than the Conversion Price for at least 20 trading days (whether or not consecutive) during a period of 30 consecutive

trading days. The Loan may also be converted, at PIC’s option, upon the occurrence of a “Fundamental

Change,” defined as (i) the acquisition by any party (or parties acting in concert) of common shares of the Company

representing more than fifty percent (50%) of the voting power of all of the Company’s common shares; (ii) the consummation of

(a) any sale, lease or other transfer, in one transaction or a series of transactions, of all or substantially all of the assets of

the Company and its subsidiaries, taken as a whole, to any person, or (b) any transaction or series of related transactions (whether

by means of merger, demerger, consolidation, share exchange, business combination, reclassification, recapitalization, acquisition,

liquidation or otherwise), the result of which is the Company’s shareholders prior to such transaction or series of

transactions cease to own more than fifty percent (50%) of all classes of common equity of the Company or its successor following

any such transaction or series of transaction; or (iii) the Company’s shareholders approving any plan or proposal for the

liquidation or dissolution of the Company, provided that no such occurrence shall constitute a Fundamental Change where, in the case

of a transaction or event described in clause (i) or (ii) above, (A) DPE Deutsche Private Equity GmbH, (B) Careventures Fund II

S.C.Sp and (C) TVM Life Science Innovation I, L.P. or their respective Affiliates (including Affiliates jointly owned thereof), each

continue, immediately after such transaction or event described in clause (i) or (ii) to be the direct or indirect beneficial owner

of substantially the same number of common shares of the Company (or replacement equity interests in the surviving entity, acquirer,

successor, or transferee, as applicable (or the parent entity thereof)) as each beneficially owned as of the date of execution of

the Loan Agreement. In the case of any conversion by PIC prior to the Maturity Date the Company shall pay to PIC, in addition to the

Principal Amount, accrued and unpaid Stated Interest and accrued and unpaid additional interest (if any), the Conversion Fee.

The Company will have the right to convert the loan, at the Company’s

option, at any time prior to the Maturity Date into a number of common shares of the Company equal to the quotient obtained by dividing

(x) the Principal Amount of the loan plus the amount of Stated Interest that would have accrued through the Maturity Date at an annual

interest rate of 13.77% on the Principal Amount of the Loan (or $2.0 million) and accrued and unpaid additional interest (if any) by (y)

the Conversion Price. Upon any such conversion at the Company’s option, the Company shall also pay to PIC the Conversion Fee.

Under the terms of the Loan Agreement, the Company will agree to apply

the Principal Amount to fund its working capital and general corporate purposes, as well as to fund the Company’s portion of the

initial capitalization costs with respect to the JV (approximately $5,000,000).

The Loan Agreement includes customary representations and warranties

as well as customary covenants, including a prohibition on mergers or other business combinations (subject to customary exceptions), and

is subject to customary conditions, including the absence of any material adverse change with respect to the Company. In addition, PIC

shall have the right to nominate two directors to the supervisory board of directors of the Company.

The Company will also agree in connection with the Loan Agreement not

to incur any additional secured indebtedness without the consent of PIC, unless the loan provided by PIC is secured on an equal basis,

and in any case, other than the Loan and Security Agreement with Oxford Finance LLC (“Oxford”). The Company will also

agree not to refinance its Oxford Loan and Security Agreement in an aggregate principal amount that exceeds $50,000,000 without the consent

of PIC.

Following the conversion of the loan into common shares of the Company

and the acquisition by any person, directly or indirectly, of beneficial ownership (within the meaning of Rule 13d-3 under the Exchange

Act) of a greater percentage of shares of the Company than PIC then holds, the Company and PIC must negotiate in good faith and enter

into a shareholders agreement between the two parties containing customary minority rights in favor of PIC. If the Company has not undergone

a take private, the terms of the shareholders agreement will be limited to customary negative consent rights (limited to the following

matters: amendments to charter documents, material acquisitions, material agreements, incurrence of indebtedness, material changes to

the nature of the business, related party transactions, and amendments to the Joint Venture documents) and, in each case, will be subject

to limitations and qualifications to be agreed between the parties.

The Loan Agreement contains customary events of default, including

failure to pay any accrued and unpaid interest on the loan; failure to provide notice of a Fundamental Change; failure to comply with

the obligation to convert the loan in accordance with the terms of the Loan Agreement; default with respect other material indebtedness;

bankruptcy; failure to cure default of any other obligations of the Loan Agreement within 30 days after notice of the default by PIC to

the Company; and failure to comply with certain provisions of the Joint Venture Agreement, Preemptive Rights Agreement (as defined below)

and Second Registration Rights Agreement (as defined below).

The Loan Agreement is expressed to be governed

by the laws of the State of New York. Disputes will be settled by arbitration in accordance with the comprehensive rules and procedures

of Judicial Arbitration & Mediation Services (JAMS).

The foregoing summary of the Loan Agreement does not purport to be

complete and is subject to, and qualified in its entirety by, the full text of the form of Loan Agreement attached as Exhibit 99.3 to

this Current Report on Form 6-K, which is incorporated herein by reference.

Preemptive Rights Agreement

In connection with the Loan Agreement, and conditioned upon the same

conditions applicable thereto, as described above, the Company has agreed to enter into a preemptive rights agreement with PIC (the “Preemptive

Rights Agreement”) pursuant to which the Company will agree that following a Fundamental Change, and for as long as PIC holds

at least 10% of the outstanding common shares of the Company, if the Company intends to issue new shares, it must first offer PIC the

opportunity to buy all or a portion of such shares. PIC shall have the right to buy up to the proportion of new shares that equals the

proportion of common shares held by PIC in the Company. If PIC does not elect to buy all or a portion of the new shares, the Company shall

have the right to sell the new shares within 90 days to a third party at terms not less favorable than those offered to PIC.

The foregoing summary of the Preemptive Rights Agreement does not purport

to be complete and is subject to, and qualified in its entirety by, the full text of the form of Preemptive Rights Agreement attached

as Exhibit 99.4 to this Current Report on Form 6-K, which is incorporated herein by reference.

Second Registration Rights Agreement

In connection with the Loan Agreement, and conditioned upon the same

conditions applicable thereto, as described above, the Company has agreed to enter into a registration rights agreement with PIC (the

“Second Registration Rights Agreement”) pursuant to which the Company will agree under certain circumstances to file

a registration statement to register the resale of the shares held by PIC and its permitted transferees, subject to certain exceptions,

as well as to cooperate in certain public offerings of such shares. Registration of these shares under the Securities Act would result

in these shares becoming freely tradable without restriction under the Securities Act immediately upon the effectiveness of the registration,

except for shares purchased by affiliates.

The foregoing summary of the Second Registration Rights Agreement does

not purport to be complete and is subject to, and qualified in its entirety by, the full text of the form of Second Registration Rights

Agreement attached as Exhibit 99.5 to this Current Report on Form 6-K, which is incorporated herein by reference.

Right of First Offer Agreement

In connection with the Loan Agreement, and conditioned upon the same conditions applicable thereto,

as described above, certain existing shareholders of the Company have agreed to enter into a right of first offer agreement with PIC (the

“ROFO Agreement”). The full text of the form of ROFO Agreement is attached as Exhibit 99.6 to this Current Report on Form

6-K, and is incorporated herein by reference.

Oxford Consent and Term Sheet for Amendment to Oxford Loan and Security

Agreement

On June 26, 2023, Oxford consented (the

“Consent”) to permit the Joint Venture Agreement, the Loan Agreement, the Commercial Agreements, the Preemptive

Rights Agreement, the Second Registration Rights Agreement and the transactions contemplated by the foregoing, under its existing

Loan and Security Agreement with the Company (the “Loan and Security Agreement”), originally dated January 31, 2022.

Oxford has also agreed not to require the Company to comply with the covenant to maintain €9,100,000 of cash collateral

pursuant to Section 6.6 of the Loan and Security Agreement until at least October 31, 2023, by which time the Loan Agreement is

expected to have closed.

Oxford and

the Company have agreed to make certain amendments to the Loan and Security Agreement concurrently with the closing of the Loan Agreement,

set forth on the term sheet (the “Term Sheet”) attached as Exhibit E to the Consent. The Term Sheet includes a reduction

in interest rate, the removal of the $5 million repayment covenant, the removal of the €9,100,000 cash collateral maintenance covenant,

the extension of the interest-only payment period and the maturity date, a reduction in the final payment fee and other amendments and

modifications set forth therein.

Oxford’s

consent to the Joint Venture documents is conditioned on (a) any loans incurred under the Loan Agreement being subordinated to the obligations

under the Loan and Security Agreement pursuant to the subordination agreement in the form attached as Exhibit F to the Consent (the “Subordination

Agreement”), (b) Oxford and the Company entering into an amendment to the Loan and Security Agreement and the other Loan Documents

(as defined therein) to the extent necessary to incorporate the terms set forth in the Term Sheet and (c) the absence of an Event of

Default under and as defined in the Loan and Security Agreement.

The foregoing summary of the Consent, the Term Sheet and the Subordination

Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the forms of such Consent,

Term Sheet, Subordination Agreement and the other exhibits to the Consent, all of which are attached as Exhibit 99.7 to this Current Report

on Form 6-K and are incorporated herein by reference.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: June 27, 2023

| |

CENTOGENE N.V.

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Jose Miguel Coego Rios |

| |

|

Name: |

Jose Miguel Coego Rios |

| |

|

Title: |

Chief Financial Officer |

Exhibit Index

| Exhibit |

Description of Exhibit |

| 99.1 |

Press Release dated June 27, 2023 |

| 99.2*+ |

Joint Venture Agreement dated June 26, 2023 |

| 99.3*+ |

Form of Loan Agreement |

| 99.4+ |

Form of Preemptive Rights Agreement |

| 99.5+ |

Form of Registration Rights Agreement |

| 99.6+ |

Form of ROFO Agreement |

| 99.7* |

Oxford Consent and Term Sheet for Amendment to Oxford Loan and Security Agreement dated June 26, 2023 |

| |

|

*Certain schedules and attachments to this exhibit have been omitted

pursuant to Regulation S-K, Item 601(a)(5). The registrant hereby undertakes to furnish copies of any of the omitted schedules and exhibits

upon request by the U.S. Securities and Exchange Commission

+The Company has omitted portions of the exhibits attached

hereto pursuant to Item 601(b)(10)(iv) of Regulation S-K on the basis that the Company customarily and actually treats that information

as private or confidential and the omitted information is not material.

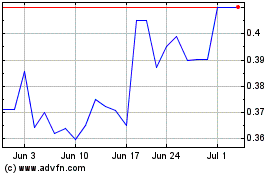

Centogene NV (NASDAQ:CNTG)

Historical Stock Chart

From Jun 2024 to Jul 2024

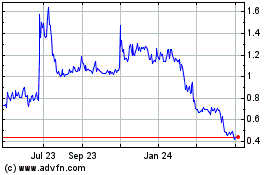

Centogene NV (NASDAQ:CNTG)

Historical Stock Chart

From Jul 2023 to Jul 2024