Cenntro Inc. (NASDAQ: CENN) (“Cenntro” or “the Company”),

a pioneering electric commercial vehicle company with advanced,

market-validated, and purpose-built vehicles, has reported its

financial and operational results for the third quarter ended

September 30, 2024.

Third Quarter 2024 Financial and Operational

Highlights:

- Third quarter 2024 net revenue of $16.7 million increased 190%

compared to $5.8 million for the third quarter of 2023.

- United States (“US”) sales volume increased to $10.3 million in

the third quarter of 2024 from $0.2 million for the third quarter

of 2023.

- Adjusted EBITDA loss for the third quarter of 2024 of $7.5

million compared to a loss of $12.1 million for the third quarter

of 2023.

- Sold 662 Electric Commercial Vehicles in the third quarter of

2024.

- Sold 78 Logistar™ 400 Class 4 vehicles in the US market

compared to 1 vehicle in the third quarter of 2023.

- Sold 334 Avantier™ vehicles in Europe and South American

markets in the third quarter of 2024 compared to 21 vehicles in the

third quarter of 2023.

- Sold 230 iChassis kits in the third quarter of 2024 compared to

103 kits in the third quarter of 2023.

Peter Wang, Chief Executive Officer illustrated: “In the third

quarter of 2024, we continued our steady growth in the US market,

selling and delivering Cenntro products as we positioned the

Company for a longer-term profitable future. During the third

quarter, we sold a total of 662 vehicles across our portfolio,

compared to 298 vehicles in the prior year period. Additionally, we

sold 230 units of our iChassis in the third quarter, although these

units are not inclusive of the number of vehicles sold because

iChassis is not considered a complete vehicle. We expect a

significant revenue increase in the US market as we continue to

shift our strategy to focus towards North American sales, and

introduction of additional new models in the US market.

“For new models during the quarter, we announced our newest

Class 4 addition to our Logistar series, the Logistar® 450

(“LS450”) model for sale and distribution in the US and global

markets. The new LS450 has received California Air Resources Board

Executive Order (“CARB”) Certification and a Certificate of

Conformity from the US Environmental Protection Agency (“EPA”). The

LS450 is equipped with a 128Kwh battery capacity, offering an

improved range compared to its predecessor model, the LS400. We

also obtained a CARB Executive Order and a Certificate of

Conformity from the EPA for the Logistar® 300 model, a Class 3

delivery truck. We introduced the Deepstar® 864 (“DS864”), a Class

8 drayage truck in October 2024, at our ‘Cenntro Day 2024’ at the

Ontario Convention Center in Ontario, California. Lastly, we

recently announced that Avantier Motors Corporation, our wholly

owned subsidiary, launched two new electric vehicle models tailored

for the European market following the strong reception of the

Avantier C; the Avantier Ex, a mini electric commercial vehicle,

and the Avantier Commuter, an entry-level electric passenger car.

Both models join Avantier’s existing product line as the company

continues its mission to revolutionize urban mobility through

innovative, sustainable electric vehicles.

“At our California-based electric commercial vehicles (“ECVs”)

production and distribution assembly facility in Ontario, CA, we

are now producing the Metro, LS400, LS450 and LS300, with

full-scale production capabilities for these and future models. As

of October 2024, the facility has assembled and delivered over 150

vehicles to customers in the North American west coast. With the

ramp-up of this facility, we are increasing vehicle delivery

efficiency as we continue to expand sales in North America’s west

coast market.

“Looking ahead, we are diligently working to diversify our

portfolio and develop new vehicle models that align with market

demands, and keep pace with new regulations, technologies and

features. We are focused on expanding our geographic footprint for

production, distribution, and service infrastructure, especially in

the US market. Taken together, we believe our strategy is

positioning us to become a significant presence in commercial EV

sales and production,” concluded Mr. Wang.

Third Quarter 2024 Financial Results

Net Revenue

Net revenues for the three months ended September 30, 2024 were

approximately $16.7 million, an increase of 190% from approximately

$5.8 million for the three months ended September 30, 2023. The

increase was primarily due to an increase in vehicle sales, spare

parts sales, and sales of iChassis.

Gross Profit

Gross Profit for the three months ended September 30, 2024 was

approximately $4.0 million, an increase of approximately $3.3

million from approximately $0.7 million of gross profit for the

three months ended September 30, 2023. For the three months ended

September 30, 2024 and 2023, our overall gross margin was

approximately 24.2% and 12.4%, respectively. Our gross margin of

vehicle sales for the three months ended September 30, 2024 and

2023 was 23.5% and 15.7%, respectively. The increase of our overall

gross profit was mainly caused by an increase in the gross profit

of our vehicle sales and spare-part sales of approximately $6.8

million and $0.5 million, respectively, offset by the increase in

the inventory write-down of approximately $4.0 million.

Operating Expenses

Total operating expenses were approximately $14.4 million in the

third quarter of 2024, compared to $13.3 million in the third

quarter of 2023.

Selling and marketing expenses for the three months ended

September 30, 2024, were approximately $5.0 million, an increase of

approximately $2.4 million or approximately 91.4% from

approximately $2.6 million for the three months ended September 30,

2023. The increase in selling and marketing expenses was primarily

attributed to the increase in marketing expenses and marketing

related professional fee of approximately $2.3 million and $0.3

million, respectively, offset by a decrease in freight of

approximately $0.2 million.

General and administrative expenses for the three months ended

September 30, 2024 were approximately $7.9 million, a decrease of

approximately $1.1 million or approximately 12.5% from

approximately $9.1 million for the three months ended September 30,

2023. The decrease in general and administrative expenses in 2024

was primarily attributed to a decrease in share-based compensation,

legal and professional fee and salary, lease ROU amortization and

social insurance of $1.1 million, $0.6 million, $0.1 million and

$0.2 million, respectively, offset by the increase in leasehold

improvement depreciation, rental expense and others of

approximately $0.3 million, $0.2 million and $0.4 million,

respectively, the increase in others was mainly caused by the

increase in fees related to garage liability insurance.

Research and development expenses for the three months ended

September 30, 2024 were approximately $1.5 million, a decrease of

approximately $0.2 million or approximately 9.7% from approximately

$1.6 million for the three months ended September 30, 2023. The

decrease in research and development expenses in 2024 was primarily

attributed to the decrease in design and development expenditures,

share-based compensations and others of approximately $0.06

million, $0.09 million and $0.06 million, respectively.

Net Loss

Net loss was approximately $9.0 million in the third quarter of

2024, compared with net loss of $16.1 million in the third quarter

of 2023.

Adjusted EBITDA

Adjusted EBITDA was approximately ($7.5) million in the third

quarter of 2024, compared with Adjusted EBITDA of ($12.1) million

in the third quarter of 2023.

Nine Months 2024 Financial Results

Net Revenue

Net revenues for the nine months ended September 30, 2024 were

approximately $28.4 million, an increase of approximately $15.0

million or 111.2% from approximately $13.5 million for the nine

months ended September 30, 2023. The increase was primarily due to

an increase in vehicle sales, spare parts sales, and sales of

iChassis.

Gross Profit

Gross Profit for the nine months ended September 30, 2024 was

approximately $5.3 million, an increase of approximately $3.2

million from approximately $2.1 million of gross loss for the nine

months ended September 30, 2023. For the nine months ended

September 30, 2024 and 2023, our overall gross margin was

approximately 18.6% and 15.3%, respectively. Our gross margin of

vehicle sales for the nine months ended September 30, 2024 and 2023

was 19.2% and 16.3%, respectively. The increase of our overall

gross profit was mainly caused by an increase in the gross profit

of our vehicle sales and spare-part sales of approximately $8.5

million and $0.4 million, respectively, offset by the increase in

the inventory write-down of approximately $5.7 million.

Operating Expenses

Total operating expenses were approximately $33.9 million for

the nine months ended September 30, 2024, compared with $38.3

million in the nine months ended September 30, 2023.

Selling and marketing expenses for the nine months ended

September 30, 2024 were approximately $7.7 million, an increase of

approximately $0.4 million or approximately 5.7% from approximately

$7.2 million for the nine months ended September 30, 2023. The

increase in selling and marketing expenses in 2024 was primarily

attributed to the increase in marketing expenses and marketing

related professional fee of approximately $1.7 million and $0.7

million, respectively, offset by the decrease in salary expense,

freight and share-based compensations of approximately $1.0

million, $0.6 million and $0.4 million, respectively.

General and administrative expenses for the nine months ended

September 30, 2024 were approximately $21.9 million, a decrease of

approximately $3.8 million or approximately 14.7% from

approximately $25.7 million for the nine months ended September 30,

2023. The decrease in general and administrative expenses in 2024

was primarily attributed to a decrease in legal and professional

fees, office expenses and share-based compensations of

approximately $2.1 million, $1.7 million and $1.5 million,

respectively, offset by the increase in salary and social insurance

expense, lease ROU amortization, amortization, leasehold

improvement depreciation and others of approximately $0.7 million,

$0.3 million, $0.2 million, $0.3 million and $0.1 million,

respectively.

Research and development expenses for the nine months ended

September 30, 2024 were approximately $4.3 million, a decrease of

approximately $1.1 million or approximately 19.7% from

approximately $5.3 million for the nine months ended September 30,

2023. The decrease in research and development expenses in 2024 was

primarily attributed to the decrease in design and testing material

expenditures of approximately $1.3 million, offset by the increase

in salary expense of approximately $0.4 million.

Net Loss

Net loss was approximately $27.4 million in the nine months

ended September 30, 2024, compared with net loss of $41.3 million

in the nine months ended September 30, 2023.

Balance Sheet

Cash and cash equivalents were approximately $21.8 million as of

September 30, 2024, compared with $29.4 million as of December 31,

2023.

Adjusted EBITDA

Adjusted EBITDA was approximately ($23.1) million in the nine

months ended September 30, 2024, compared with Adjusted EBITDA of

$(33.9) million in the nine months ended September 30, 2023.

We define Adjusted EBITDA as net income (or net loss) before net

interest expense, income tax expense, depreciation and amortization

as further adjusted to exclude the impact of stock-based

compensation expense and other non-recurring expenses including

expenses related to TME Acquisition, expenses related to one-off

payment inherited from the original Naked Brand Group, impairment

of goodwill, convertible bond issuance fee, loss on redemption of

convertible promissory notes, loss on exercise of warrants, and

change in fair value of convertible promissory notes and derivative

liability. We present Adjusted EBITDA because we consider it to be

an important supplemental measure of our performance and believe it

is frequently used by securities analysts, investors, and other

interested parties in the evaluation of companies in our industry.

Management believes that investors’ understanding of our

performance is enhanced by including this non-GAAP financial

measure as a reasonable basis for comparing our ongoing results of

operations.

US-GAAP NET INCOME (LOSS) TO ADJUSTED

EBITDA RECONCILIATION

Three Months ended September

30,

Nine Months ended

September 30,

2024

2023

2024

2023

(Expressed in U.S. Dollars)

(Unaudited)

(Unaudited)

Net loss

$

(8,981,587

)

$

(16,103,199

)

$

(27,405,605

)

$

(41,294,342

)

Interest expense, net

34,198

84,573

58,744

137,726

Income tax expense

(12,434

)

(384

)

(47,149

)

25,084

Depreciation and amortization

630,270

425,217

1,605,514

1,213,489

Share-based compensation expense

870,094

2,154,710

2,643,214

4,565,000

Loss on redemption of convertible

promissory notes

-

(966

)

-

(865

)

Loss on exercise of warrants

(910

)

1,134

(910

)

228,749

Change in fair value of convertible

promissory notes and derivative liability

6,724

(15,143

)

(1,808

)

(88,568

)

Loss from acquisition of Antric

-

1,316,772

-

1,316,772

Adjusted EBITDA

$

(7,453,645

)

$

(12,137,286

)

$

(23,148,000

)

$

(33,896,955

)

Represents a non-GAAP financial measure.

About Cenntro

Cenntro (NASDAQ: CENN) is a leading maker and provider of

electric commercial vehicles (“ECVs”). Cenntro's purpose-built ECVs

are designed to serve a variety of commercial applications

inclusive of its line of class 1 to class 8 trucks. Cenntro is

building a globalized supply-chain, as well as the manufacturing,

distribution, and service capabilities for its innovative and

reliable products. Cenntro continues to evolve its products

capabilities through advanced battery, powertrain, and smart

driving technologies. For more information, please visit Cenntro's

website at: www.cenntroauto.com.

Forward-Looking Statements

This communication contains "forward-looking statements" within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that are not historical facts.

Such statements may be, but need not be, identified by words such

as "may," "believe," "anticipate," "could," "should," "intend,"

"plan," "will," "aim(s)," "can," "would," "expect(s),"

"estimate(s)," "project(s)," "forecast(s)," "positioned,"

"approximately," "potential," "goal," "strategy," "outlook" and

similar expressions. Examples of forward-looking statements

include, among other things, statements regarding assembly and

distribution capabilities, decentralized production, and fully

digitalized autonomous driving solutions. All such forward-looking

statements are based on management's current beliefs, expectations

and assumptions, and are subject to risks, uncertainties and other

factors that could cause actual results to differ materially from

the results expressed or implied in this communication. For

additional risks and uncertainties that could impact Cenntro’s

forward-looking statements, please see disclosures contained in

Cenntro's public filings with the SEC, including the "Risk Factors"

in Cenntro's Annual Report on Form 10-K filed with the Securities

and Exchange Commission on April 1, 2024 and which may be viewed at

www.sec.gov.

CENNTRO INC.

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

(Expressed in U.S. dollars,

except for the number of shares)

September 30,

2024

December 31,

2023

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

21,822,485

$

29,375,727

Restricted cash

1,009,263

196,170

Short-term investment

9,647

4,236,588

Accounts receivable, net

4,556,857

6,530,801

Inventories

35,882,436

43,909,564

Prepayment and other current assets

20,971,578

20,391,150

Amounts due from related parties -

current

524,892

287,439

Total current assets

84,777,158

104,927,439

Non-current assets:

Long-term investment, net

4,078,386

4,685,984

Investment in equity securities

26,341,901

26,158,474

Property, plant and equipment, net

20,175,445

20,401,521

Goodwill

225,171

223,494

Intangible assets, net

6,623,871

6,873,781

Right-of-use assets

16,049,893

20,039,625

Other non-current assets, net

1,563,361

2,227,672

Total non-current assets

75,058,028

80,610,551

Total Assets

$

159,835,186

$

185,537,990

LIABILITIES AND EQUITY

LIABILITIES

Current liabilities:

Accounts payable

$

6,164,060

$

6,797,852

Short-term loans and current portion of

long-term loans

262,836

-

Accrued expenses and other current

liabilities

5,349,282

4,263,887

Contractual liabilities

4,958,315

3,394,044

Operating lease liabilities, current

4,605,336

4,741,599

Convertible promissory notes

9,952,000

9,956,000

Contingent liabilities

45,333

26,669

Deferred government grant, current

104,076

108,717

Amounts due to related parties

-

10,468

Total current liabilities

31,441,238

29,299,236

Non-current liabilities:

Long-term loans

361,400

-

Contingent liabilities non-current

213,326

230,063

Deferred tax liabilities

196,887

228,086

Deferred government grant, non-current

1,875,786

1,929,733

Derivative liability - investor

warrant

12,141,241

12,189,508

Derivative liability - placement agent

warrant

3,457,052

3,456,578

Operating lease liabilities,

non-current

13,288,324

16,339,619

Total non-current liabilities

31,534,016

34,373,587

Total Liabilities

$

62,975,254

$

63,672,823

Commitments and contingencies

EQUITY

Common stock (No par value;30,866,614 and

30,828,778 shares issued and outstanding as of September 30, 2024

and December 31, 2023, respectively)

-

-

Additional paid in capital

405,029,683

402,337,393

Accumulated deficit

(301,408,251

)

(274,023,501

)

Accumulated other comprehensive loss

(6,913,396

)

(6,444,485

)

Total equity attributable to

shareholders

96,708,036

121,869,407

Non-controlling interests

151,896

(4,240

)

Total Equity

$

96,859,932

$

121,865,167

Total Liabilities and Equity

$

159,835,186

$

185,537,990

CENNTRO INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS

(Expressed in U.S. dollars,

except for the number of shares)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

Net revenues

$

16,731,340

$

5,762,831

$

28,443,831

$

13,470,895

Cost of goods sold

(12,688,393

)

(5,045,364

)

(23,161,743

)

(11,411,439

)

Gross profit

4,042,947

717,467

5,282,088

2,059,456

OPERATING EXPENSES:

Selling and marketing expenses

(5,027,864

)

(2,626,829

)

(7,651,305

)

(7,238,563

)

General and administrative expenses

(7,934,755

)

(9,071,910

)

(21,945,891

)

(25,715,387

)

Research and development expenses

(1,476,684

)

(1,634,796

)

(4,292,153

)

(5,347,785

)

Total operating expenses

(14,439,303

)

(13,333,535

)

(33,889,349

)

(38,301,735

)

Loss from operations

(10,396,356

)

(12,616,068

)

(28,607,261

)

(36,242,279

)

OTHER EXPENSE:

Interest expense, net

(34,198

)

(84,573

)

(58,744

)

(137,726

)

Loss from long-term investment

(11,152

)

(107,069

)

(28,262

)

(236,672

)

Loss from acquisition of Antric Gmbh

-

(1,316,772

)

-

(1,316,772

)

Loss from acquisition of Hezhe

-

-

(149,872

)

-

Impairment of long-term investment

-

(2,668

)

-

(1,157,334

)

Gain on redemption of convertible

promissory notes

-

966

-

865

Gain/(Loss) on exercise of warrants

910

(1,134

)

910

(228,749

)

Change in fair value of convertible

promissory notes and derivative liability

(6,724

)

15,143

1,807

88,568

Change in fair value of equity

securities

262,417

(1,879,593

)

756,868

(1,166,125

)

Foreign currency exchange gain (loss),

net

1,838,505

(311,204

)

1,108,826

(1,667,475

)

(Loss)/ Gain from cross-currency swaps

(705

)

-

882

-

Other (expense) income, net

(646,718

)

199,389

(477,908

)

794,441

Loss before income taxes

(8,994,021

)

(16,103,583

)

(27,452,754

)

(41,269,258

)

Income tax benefit (expense)

12,434

384

47,149

(25,084

)

Net loss

(8,981,587

)

(16,103,199

)

(27,405,605

)

(41,294,342

)

Less: net loss attributable to

non-controlling interests

(9,815

)

(534

)

(20,855

)

(159,244

)

Net loss attributable to the Company’s

shareholders

$

(8,971,772

)

$

(16,102,665

)

(27,384,750

)

(41,135,098

)

OTHER COMPREHENSIVE LOSS

Foreign currency translation

adjustment

916,164

(931,345

)

(461,126

)

(3,419,038

)

Total comprehensive loss

(8,065,423

)

(17,034,544

)

(27,866,731

)

(44,713,380

)

Less: total comprehensive loss

attributable to non-controlling interests

(5,226

)

(534

)

(13,070

)

(183,812

)

Total comprehensive loss to the

Company’s shareholders

$

(8,060,197

)

$

(17,034,010

)

(27,853,661

)

(44,529,568

)

Weighted average number of shares

outstanding, basic and diluted *

30,841,106

30,444,909

30,832,928

30,400,293

Loss per share, basic and diluted *

(0.29

)

(0.53

)

(0.89

)

(1.35

)

CENNTRO INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in U.S. dollars,

except for the number of shares)

For the Nine Months

Ended

September 30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net cash used in operating

activities

$

(12,912,011

)

$

(45,588,906

)

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchase of equity investment

-

(680,932

)

Purchase of property, plant and

equipment

(720,445

)

(7,329,509

)

Purchase of land use right and

property

-

(2,183,430

)

Purchase of other intangible assets

-

(7,502

)

Acquisition of CAE's equity interests

-

(1,924,557

)

Acquisition of Antric Gmbh's equity

interests

-

(1

)

Cash acquired from acquisition of Antric

Gmbh

-

1,376

Net of cash acquired of 60% of Hezhe’s

equity interests

(355,400

)

-

Purchase of short-term investment

(4,167,970

)

-

Proceeds from short-term investment

8,431,348

-

Cash dividend received

55,573

-

Proceeds from disposal of property, plant

and equipment

41,495

842

Loans provided to third parties

-

(790,000

)

Proceeds from interest and redemption of

equity securities investment

1,573,441

-

Net cash provided by (used in)

investing activities

4,858,042

(12,913,713

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from bank loans

662,836

-

Repayment of bank loans

(38,600

)

(602,477

)

Loans proceed from third parties

708,832

-

Repayment of loans to third parties

(90,000

)

-

Redemption of convertible promissory

notes

-

(47,534,119

)

Net cash provided by (used in)

financing activities

1,243,068

(48,136,596

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

70,752

(2,614,204

)

Net decrease in cash, cash equivalents and

restricted cash

(6,740,149

)

(109,253,419

)

Cash, cash equivalents and restricted cash

at beginning of period

29,571,897

154,096,801

Cash, cash equivalents and restricted cash

at end of period

$

22,831,748

$

44,843,382

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Interest paid

$

553,654

$

1,200,673

Income tax paid

$

-

$

4,829

SUPPLEMENTAL DISCLOSURE OF NON-CASH

INVESTING AND FINANCING ACTIVITIES:

Convention from debt to equity interest of

HW Electro Co., Ltd.

$

-

$

1,000,000

Cashless exercise of warrants

$

49,076

$

2,168,185

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112024850/en/

Investor Relations Contact: Chris Tyson MZ North America

CENN@mzgroup.us 949-491-8235

Company Contact: PR@cenntroauto.com

IR@cenntroauto.com

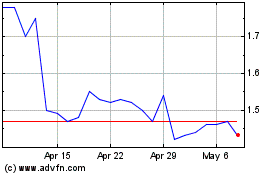

Cenntro (NASDAQ:CENN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cenntro (NASDAQ:CENN)

Historical Stock Chart

From Jan 2024 to Jan 2025