Cathay General Bancorp (the “Company,” “we,” “us,” or “our”)

(Nasdaq: CATY), the holding company for Cathay Bank, today

announced its unaudited financial results for the quarter and year

ended December 31, 2024. The Company reported net income of $286.0

million, or $3.95 per diluted share, for the year ended December

31, 2024 and net income of $80.2 million, or $1.12 per diluted

share, for the fourth quarter of 2024.

FINANCIAL PERFORMANCE

Three months ended Year ended December 31, (unaudited) December 31,

2024 September 30, 2024 December 31, 2023

2024

2023

Net income

$80.2 million

$ 67.5 million

$82.5 million

$286.0 million

$354.1 million

Basic earnings per common share

$1.13

$0.94

$1.14

$3.97

$4.88

Diluted earnings per common share

$1.12

$0.94

$1.13

$3.95

$4.86

Return on average assets

1.37%

1.15%

1.40%

1.22%

1.56%

Return on average total stockholders' equity

11.18%

9.50%

12.21%

10.18%

13.56%

Efficiency ratio

45.70%

51.11%

53.84%

51.35%

46.97%

HIGHLIGHTS

- Net interest margin increased to 3.07% during the fourth

quarter from 3.04% in the third quarter.

- Total loans, excluding loans held for sale, decreased to $19.38

billion, or 0.9%, from $19.55 billion in 2023.

- Total deposits increased $360.8 million, or 1.9%, to $19.69

billion in 2024.

“We are pleased by the increase in the net interest margin

compared to the third quarter of 2024. During the quarter, we

repurchased 506,651 shares at an average cost of $47.10 per share

for a total of $23.9 million,” commented Chang M. Liu, President

and Chief Executive Officer of the Company.

INCOME STATEMENT REVIEW

FOURTH QUARTER 2024 COMPARED TO THE THIRD QUARTER

2024

Net income for the quarter ended December 31, 2024, was $80.2

million, an increase of $12.7 million, or 18.8%, compared to net

income of $67.5 million for the third quarter of 2024. Diluted

earnings per share for the fourth quarter of 2024 was $1.12 per

share compared to $0.94 per share for the third quarter of

2024.

Return on average stockholders’ equity was 11.18% and return on

average assets was 1.37% for the quarter ended December 31, 2024,

compared to a return on average stockholders’ equity of 9.50% and a

return on average assets of 1.15% in the third quarter of 2024.

Net interest income before provision for credit losses

Net interest income before provision for credit losses increased

$1.8 million, or 1.1%, to $171.0 million during the fourth quarter

of 2024, compared to $169.2 million in the third quarter of 2024.

The increase was due primarily to a decrease in interest deposit

expense, partially offset by a decrease in interest income from

loans and securities.

The net interest margin was 3.07% for the fourth quarter of 2024

compared to 3.04% for the third quarter of 2024.

For the fourth quarter of 2024, the yield on average

interest-earning assets was 5.92%, the cost of funds on average

interest-bearing liabilities was 3.75%, and the cost of average

interest-bearing deposits was 3.72%. In comparison, for the third

quarter of 2024, the yield on average interest-earning assets was

6.10%, the cost of funds on average interest-bearing liabilities

was 3.99%, and the cost of average interest-bearing deposits was

3.95%. The decrease in the yield on average interest-bearing

liabilities resulted mainly from lower interest rates on deposits

driven by the lower repricing of maturing time deposits in the

fourth quarter. The decrease in the yield on average

interest-earning assets resulted mainly from lower interest rates

on loans due to the decreasing rate environment. The net interest

spread, defined as the difference between the yield on average

interest-earning assets and the cost of funds on average

interest-bearing liabilities, was 2.17% for the fourth quarter of

2024, compared to 2.11% for the third quarter of 2024.

Provision for credit losses

The Company recorded a provision for credit losses of $14.5

million in the fourth quarter of 2024 compared to $14.5 million in

the third quarter of 2024. As of December 31, 2024, the allowance

for credit losses decreased by $1.9 million to $171.4 million, or

0.88% of gross loans, compared to $173.2 million, or 0.89% of gross

loans as of September 30, 2024.

The following table sets forth the charge-offs and recoveries

for the periods indicated:

Three months ended Year ended December 31, December 31, 2024

September 30, 2024 December 31, 2023

2024

2023

(In thousands) (Unaudited)

Charge-offs: Commercial loans

$

14,064

$

2,666

$

1,392

$

26,926

$

13,909

Construction loans

—

—

4,221

—

4,221

Real estate loans (1)

2,472

1,805

—

4,531

5,341

Installment and other loans

7

7

—

15

15

Total charge-offs

16,543

4,478

5,613

31,472

23,486

Recoveries: Commercial loans

75

88

1,426

1,102

2,990

Construction loans

—

—

—

—

—

Real estate loans (1)

133

186

55

694

2,918

Installment and other loans

2

1

—

2

—

Total recoveries

210

275

1,481

1,798

5,908

Net charge-offs/(recoveries)

$

16,333

$

4,203

$

4,132

$

29,674

$

17,578

(1) Real estate loans include commercial mortgage loans,

residential mortgage loans and equity lines.

Non-interest income

Non-interest income, which includes revenues from depository

service fees, letters of credit commissions, securities gains

(losses), wealth management fees, and other sources of fee income,

was $15.5 million for the fourth quarter of 2024, a decrease of

$4.9 million, or 23.9%, compared to $20.4 million for the third

quarter of 2024. The decrease was primarily due to a decrease of

$5.6 million in gain on equity securities, when compared to the

third quarter of 2024.

Non-interest expense

Non-interest expense decreased $11.7 million, or 12.0%, to $85.2

million in the fourth quarter of 2024 compared to $96.9 million in

the third quarter of 2024. The decrease in non-interest expense in

the fourth quarter of 2024 was primarily due to a decrease of $13.3

million, in amortization expense of investments in low-income

housing and alternative energy partnerships, a decrease of $2.1

million in FDIC and State assessments offset, in part, by an

increase $1.7 million in professional services expense and an

increase of $1.7 million in salaries and employee benefits, when

compared to the third quarter of 2024. The efficiency ratio,

defined as non-interest expense divided by the sum of net interest

income before provision for loan losses plus non-interest income,

was 45.70% in the fourth quarter of 2024 compared to 51.11% for the

third quarter of 2024.

Income taxes

The effective tax rate for the fourth quarter of 2024 was 7.57%

compared to 13.61% for the third quarter of 2024. The effective tax

rate includes the impact of alternative energy investments and

low-income housing tax credits.

BALANCE SHEET REVIEW

Gross loans were $19.38 billion as of December 31, 2024, a

decrease of $172.2 million, or 0.9%, from $19.55 billion as of

December 31, 2023. The decrease was primarily due to decreases of

$207.0 million, or 6.3%, in commercial loans, $149.7 million, or

2.6%, in residential mortgage loans, $103.0 million, or 24.4%, in

construction loans and $15.9 million, or 6.5%, in home equity loans

offset by an increase of $304.3 million, or 3.1%, in commercial

real estate loans. For the fourth quarter of 2024, gross loans

increased by $2.4 million, or 0.05% annualized.

The loan balances and composition as of December 31, 2024,

compared to September 30, 2024, and December 31, 2023, are

presented below:

December 31, 2024 September 30, 2024 December 31, 2023 (In

thousands) (Unaudited) Commercial loans

$

3,098,004

$

3,106,994

$

3,305,048

Construction loans

319,649

307,057

422,647

Commercial real estate loans

10,033,830

9,975,272

9,729,581

Residential mortgage loans

5,689,097

5,750,546

5,838,747

Equity lines

229,995

226,838

245,919

Installment and other loans

5,380

6,886

6,198

Gross loans

$

19,375,955

$

19,373,593

$

19,548,140

Allowance for loan losses

(161,765)

(163,733)

(154,562)

Unamortized deferred loan fees

(10,541)

(10,505)

(10,720)

Total loans held for investment, net

$

19,203,649

$

19,199,355

$

19,382,858

Loans held for sale

$

—

$

5,190

$

—

Total deposits were $19.69 billion as of December 31, 2024, an

increase of $360.8 million, or 1.9%, from $19.33 billion as of

December 31, 2023.

The deposit balances and composition as of December 31, 2024,

compared to September 30, 2024, and December 31, 2023, are

presented below:

December 31, 2024

September 30, 2024

December 31, 2023

(In thousands) (Unaudited) Non-interest-bearing demand deposits

$

3,284,342

$

3,253,823

$

3,529,018

NOW deposits

2,205,695

2,093,861

2,370,685

Money market deposits

3,372,773

3,134,460

3,049,754

Savings deposits

1,252,788

1,215,974

1,039,203

Time deposits

9,570,601

10,245,823

9,336,787

Total deposits

$

19,686,199

$

19,943,941

$

19,325,447

ASSET QUALITY REVIEW

As of December 31, 2024, total non-accrual loans were $169.2

million, an increase of $102.5 million, or 153.7%, from $66.7

million as of December 31, 2023, and an increase of $6.4 million,

or 3.9%, from $162.8 million as of September 30, 2024.

The allowance for loan losses was $161.8 million and the

allowance for off-balance sheet unfunded credit commitments was

$9.7 million as of December 31, 2024. The allowances represent the

amount estimated by management to be appropriate to absorb expected

credit losses inherent in the loan portfolio, including unfunded

credit commitments. The allowance for loan losses represented 0.83%

of period-end gross loans, and 93.39% of non-performing loans as of

December 31, 2024. The comparable ratios were 0.79% of period-end

gross loans, and 209.33% of non-performing loans as of December 31,

2023.

The changes in non-performing assets and loan modifications to

borrowers experiencing financial difficulty as of December 31,

2024, compared to December 31, 2023, and September 30, 2024, are

presented below:

(In thousands) (Unaudited)

December 31, 2024

December 31, 2023

%

Change

September 30, 2024

%

Change

Non-performing assets Accruing loans past due 90 days or

more

$

4,050

$

7,157

(43

)

$

6,931

(42

)

Non-accrual loans: Construction loans

—

7,736

(100

)

—

—

Commercial real estate loans

83,128

32,030

160

87,577

(5

)

Commercial loans

59,767

14,404

315

52,074

15

Residential mortgage loans

26,266

12,511

110

23,183

13

Total non-accrual loans:

$

169,161

$

66,681

154

$

162,834

4

Total non-performing loans

173,211

73,838

135

169,765

2

Other real estate owned

23,071

19,441

19

18,277

26

Total non-performing assets

$

196,282

$

93,279

110

$

188,042

4

Allowance for loan losses

$

161,765

$

154,562

5

$

163,733

(1

)

Total gross loans outstanding, at period-end

$

19,375,955

$

19,548,140

(1

)

$

19,373,593

0

Allowance for loan losses to non-performing loans, at

period-end

93.39%

209.33%

96.45%

Allowance for loan losses to gross loans, at period-end

0.83%

0.79%

0.85%

The ratio of non-performing assets to total assets was 0.85% as

of December 31, 2024, compared to 0.40% as of December 31, 2023.

Total non-performing assets increased $103.0 million, or 110.4%, to

$196.3 million as of December 31, 2024, compared to $93.3 million

as of December 31, 2023, primarily due to an increase of $102.5

million, or 153.7%, in non-accrual loans, and $3.6 million, or

18.7%, in other real estate owned, offset, by a decrease of $3.1

million, or 43.4%, in accruing loans past due 90 days or more.

CAPITAL ADEQUACY REVIEW

As of December 31, 2024, the Company’s Tier 1 risk-based capital

ratio of 13.55%, total risk-based capital ratio of 15.09%, and Tier

1 leverage capital ratio of 10.97%, calculated under the Basel III

capital rules, continue to place the Company in the “well

capitalized” category for regulatory purposes, which is defined as

institutions with a Tier 1 risk-based capital ratio equal to or

greater than 8%, a total risk-based capital ratio equal to or

greater than 10%, and a Tier 1 leverage capital ratio equal to or

greater than 5%. As of December 31, 2023, the Company’s Tier 1

risk-based capital ratio was 12.84%, total risk-based capital ratio

was 14.31%, and Tier 1 leverage capital ratio was 10.55%.

FULL YEAR REVIEW

Net income for the year ended December 31, 2024, was $286.0

million, a decrease of $68.1 million, or 19.2%, compared to net

income of $354.1 million for the year ended December 31, 2023.

Diluted earnings per share for the year ended December 31, 2024,

was $3.95 compared to $4.86 per share for the year ended December

31, 2023. The net interest margin for the year ended December 31,

2024, was 3.04% compared to 3.45% for the year ended December 31,

2023.

Return on average stockholders’ equity was 10.18% and return on

average assets was 1.22% for the year ended December 31, 2024,

compared to a return on average stockholders’ equity of 13.56% and

a return on average assets of 1.56% for the year ended December 31,

2023. The efficiency ratio for the year ended December 31, 2024,

was 51.35% compared to 46.97% for the year ended December 31,

2023.

CONFERENCE CALL

Cathay General Bancorp will host a conference call to discuss

its fourth quarter and year-end 2024 financial results this

afternoon, Wednesday, January 22, 2025, at 3:00 p.m., Pacific Time.

Analysts and investors may dial in and participate in the

question-and-answer session. To access the call, please dial

1-833-816-1377 and enter Conference ID 10195683. The presentation

accompanying this call and access to the live webcast is available

on our site at www.cathaygeneralbancorp.com and a replay of the

webcast will be archived for one year within 24 hours after the

event.

ABOUT CATHAY GENERAL BANCORP

Cathay General Bancorp is a publicly traded company (Nasdaq:

CATY) and is the holding company for Cathay Bank, a California

state-chartered bank. Founded in 1962, Cathay Bank offers a wide

range of financial services and currently operate over 60 branches

across the United States in California, New York, Washington,

Texas, Illinois, Massachusetts, Maryland, Nevada, and New Jersey.

Overseas, it has a branch outlet in Hong Kong, and representative

offices in Beijing, Shanghai, and Taipei. To learn more about

Cathay Bank, please visit www.cathaybank.com. Cathay General

Bancorp’s website is at www.cathaygeneralbancorp.com. Information

set forth on such websites is not incorporated into this press

release.

FORWARD-LOOKING STATEMENTS

Statements made in this press release, other than statements of

historical fact, are forward-looking statements within the meaning

of the applicable provisions of the Private Securities Litigation

Reform Act of 1995 regarding management’s beliefs, projections, and

assumptions concerning future results and events. These

forward-looking statements may include, but are not limited to,

such words as “aims,” “anticipates,” “believes,” “can,” “continue,”

“could,” “estimates,” “expects,” “hopes,” “intends,” “may,”

“plans,” “projects,” “predicts,” “potential,” “possible,”

“optimistic,” “seeks,” “shall,” “should,” “will,” and variations of

these words and similar expressions. Forward-looking statements are

based on estimates, beliefs, projections, and assumptions of

management and are not guarantees of future performance. These

forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ materially

from our historical experience and our present expectations or

projections. Such risks and uncertainties and other factors

include, but are not limited to, adverse developments or conditions

related to or arising from local, regional, national and

international business, market and economic conditions and events

and the impact they may have on us, our customers and our

operations, assets and liabilities; possible additional provisions

for loan losses and charge-offs; credit risks of lending activities

and deterioration in asset or credit quality; extensive laws and

regulations and supervision that we are subject to including

potential future supervisory action by bank supervisory

authorities; increased costs of compliance and other risks

associated with changes in regulation; higher capital requirements

from the implementation of the Basel III capital standards;

compliance with the Bank Secrecy Act and other money laundering

statutes and regulations; potential goodwill impairment; liquidity

risk; fluctuations in interest rates; risks associated with

acquisitions and the expansion of our business into new markets;

inflation and deflation; real estate market conditions and the

value of real estate collateral; our ability to generate

anticipated returns on our investments and financings, including in

tax-advantaged projects; environmental liabilities; our ability to

compete with larger competitors; our ability to retain key

personnel; successful management of reputational risk; natural

disasters, public health crises and geopolitical events; general

economic or business conditions in Asia, and other regions where

Cathay Bank has operations; failures, interruptions, or security

breaches of our information systems; our ability to adapt our

systems to technological changes; risk management processes and

strategies; adverse results in legal proceedings; certain

provisions in our charter and bylaws that may affect acquisition of

the Company; changes in accounting standards or tax laws and

regulations; market disruption and volatility; restrictions on

dividends and other distributions by laws and regulations and by

our regulators and our capital structure; issuance of preferred

stock; successfully raising additional capital, if needed, and the

resulting dilution of interests of holders of our common stock; the

soundness of other financial institutions; and general competitive,

economic political, and market conditions and fluctuations.

These and other factors are further described in Cathay General

Bancorp’s Annual Report on Form 10-K for the year ended December

31, 2023 (Item 1A in particular), other reports filed with the

Securities and Exchange Commission (“SEC”), and other filings

Cathay General Bancorp makes with the SEC from time to time. Actual

results in any future period may also vary from the past results

discussed in this press release. Given these risks and

uncertainties, readers are cautioned not to place undue reliance on

any forward-looking statements. Any forward-looking statement

speaks only as of the date on which it is made, and, except as

required by law, we undertake no obligation to update or review any

forward-looking statement to reflect circumstances, developments or

events occurring after the date on which the statement is made or

to reflect the occurrence of unanticipated events.

CATHAY GENERAL BANCORP

CONSOLIDATED FINANCIAL

HIGHLIGHTS

(Unaudited)

Three months ended Year ended December 31, (In thousands,

except per share data) December 31, 2024 September 30, 2024

December 31, 2023

2024

2023

Financial performance Net interest income before

provision for credit losses

$

171,012

$

169,155

$

182,138

$

674,055

$

741,746

Provision for credit losses

14,500

14,500

1,723

37,500

25,978

Net interest income after provision for credit losses

156,512

154,655

180,415

636,555

715,768

Non-interest income

15,473

20,365

23,101

55,664

68,292

Non-interest expense

85,219

96,867

110,498

374,677

380,478

Income before income tax expense

86,766

78,153

93,018

317,542

403,582

Income tax expense

6,565

10,639

10,492

31,563

49,458

Net income

$

80,201

$

67,514

$

82,526

$

285,979

$

354,124

Net income per common share: Basic

$

1.13

$

0.94

$

1.14

$

3.97

$

4.88

Diluted

$

1.12

$

0.94

$

1.13

$

3.95

$

4.86

Cash dividends paid per common share

$

0.34

$

0.34

$

0.34

$

1.36

$

1.36

Selected ratios Return on average assets

1.37%

1.15%

1.40%

1.22%

1.56%

Return on average total stockholders’ equity

11.18%

9.50%

12.21%

10.18%

13.56%

Efficiency ratio

45.70%

51.11%

53.84%

51.35%

46.97%

Dividend payout ratio

29.95%

36.04%

29.92%

34.26%

27.85%

Yield analysis (Fully taxable equivalent)

Total interest-earning assets

5.92%

6.10%

5.99%

6.02%

5.78%

Total interest-bearing liabilities

3.75%

3.99%

3.59%

3.90%

3.11%

Net interest spread

2.17%

2.11%

2.40%

2.12%

2.67%

Net interest margin

3.07%

3.04%

3.27%

3.04%

3.45%

Capital ratios December 31, 2024 September 30,

2024 December 31, 2023 Tier 1 risk-based capital ratio

13.55%

13.32%

12.84%

Total risk-based capital ratio

15.09%

14.87%

14.31%

Tier 1 leverage capital ratio

10.97%

10.82%

10.55%

. . .

CATHAY GENERAL BANCORP

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands, except share and per share data) December 31,

2024 September 30, 2024 December 31, 2023

Assets Cash

and due from banks

$

157,167

$

182,542

$

173,988

Short-term investments and interest bearing deposits

882,353

1,156,223

654,813

Securities available-for-sale (amortized cost of $1,668,661 at

December 31, 2024, $1,602,696 at September 30, 2024 and $1,726,080

at December 31, 2023)

1,547,128

1,508,356

1,604,570

Loans held for sale

—

5,190

—

Loans

19,375,955

19,373,593

19,548,140

Less: Allowance for loan losses

(161,765)

(163,733)

(154,562)

Unamortized deferred loan fees, net

(10,541)

(10,505)

(10,720)

Loans, net

19,203,649

19,199,355

19,382,858

Equity securities

34,429

35,741

40,406

Federal Home Loan Bank stock

17,250

17,250

17,746

Other real estate owned, net

23,071

18,277

19,441

Affordable housing investments and alternative energy partnerships,

net

289,611

280,091

315,683

Premises and equipment, net

88,676

89,158

91,097

Customers’ liability on acceptances

14,061

12,043

3,264

Accrued interest receivable

97,779

95,351

97,673

Goodwill

375,696

375,696

375,696

Other intangible assets, net

3,335

3,590

4,461

Right-of-use assets- operating leases

28,645

30,543

32,076

Other assets

291,831

265,037

267,762

Total assets

$

23,054,681

$

23,274,443

$

23,081,534

Liabilities and Stockholders’ Equity Deposits:

Non-interest-bearing demand deposits

$

3,284,342

$

3,253,823

$

3,529,018

Interest-bearing deposits: NOW deposits

2,205,695

2,093,861

2,370,685

Money market deposits

3,372,773

3,134,460

3,049,754

Savings deposits

1,252,788

1,215,974

1,039,203

Time deposits

9,570,601

10,245,823

9,336,787

Total deposits

19,686,199

19,943,941

19,325,447

Advances from the Federal Home Loan Bank

60,000

60,000

540,000

Other borrowings for affordable housing investments

17,740

17,783

15,787

Long-term debt

119,136

119,136

119,136

Acceptances outstanding

14,061

12,043

3,264

Lease liabilities - operating leases

30,851

32,906

34,797

Other liabilities

280,990

258,321

306,528

Total liabilities

20,208,977

20,444,130

20,344,959

Stockholders' equity

2,845,704

2,830,313

2,736,575

Total liabilities and equity

$

23,054,681

$

23,274,443

$

23,081,534

Book value per common share

$

40.16

$

39.66

$

37.66

Number of common shares outstanding

70,863,324

71,355,869

72,668,927

CATHAY GENERAL BANCORP

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three months ended Year ended December 31, December 31, 2024

September 30, 2024 December 31, 2023

2024

2023

(In thousands, except share and per share data)

Interest and

Dividend Income Loan receivable, including loan fees

$

300,991

$

310,311

$

302,477

$

1,217,166

$

1,130,242

Investment securities

13,587

15,125

14,885

59,307

51,717

Federal Home Loan Bank stock

379

375

392

1,684

1,349

Deposits with banks

15,025

13,680

15,509

56,818

58,914

Total interest and dividend income

329,982

339,491

333,263

1,334,975

1,242,222

Interest Expense Time deposits

111,082

119,786

97,826

458,490

331,997

Other deposits

44,557

45,918

43,282

177,775

135,965

Advances from Federal Home Loan Bank

766

1,885

7,289

14,283

22,164

Long-term debt

2,194

2,351

1,759

8,129

6,480

Short-term borrowings

371

396

969

2,243

3,870

Total interest expense

158,970

170,336

151,125

660,920

500,476

Net interest income before provision for credit losses

171,012

169,155

182,138

674,055

741,746

Provision for credit losses

14,500

14,500

1,723

37,500

25,978

Net interest income after provision for credit losses

156,512

154,655

180,415

636,555

715,768

Non-Interest Income Net (losses)/gains from equity

securities

(1,312)

4,253

8,950

(7,516)

18,248

Debt securities losses, net

—

—

—

1,107

(3,000)

Letters of credit commissions

2,063

2,081

1,744

7,749

6,716

Depository service fees

1,674

1,572

1,423

6,574

6,432

Wealth management fees

6,194

6,545

4,820

24,055

17,506

Other operating income

6,854

5,914

6,164

23,695

22,390

Total non-interest income

15,473

20,365

23,101

55,664

68,292

Non-Interest Expense Salaries and employee benefits

42,526

40,859

40,101

167,376

154,149

Occupancy expense

5,724

5,938

5,387

23,281

22,270

Computer and equipment expense

4,923

4,753

4,579

20,135

17,478

Professional services expense

8,761

7,021

8,279

30,986

32,491

Data processing service expense

4,234

4,330

3,718

16,370

14,728

FDIC and State assessments

1,198

3,250

14,358

14,279

23,588

Marketing expense

1,518

1,614

1,110

6,520

5,887

Other real estate owned expense

368

596

195

2,699

761

Amortization of investments in low income housing and alternative

energy partnerships

10,728

24,077

26,119

72,633

86,616

Amortization of core deposit intangibles

250

250

251

1,098

1,310

Acquisition, integration and restructuring costs

—

—

671

—

671

Other operating expense

4,989

4,179

5,730

19,300

20,529

Total non-interest expense

85,219

96,867

110,498

374,677

380,478

Income before income tax expense

86,766

78,153

93,018

317,542

403,582

Income tax expense

6,565

10,639

10,492

31,563

49,458

Net income

$

80,201

$

67,514

$

82,526

$

285,979

$

354,124

Net income per common share: Basic

$

1.13

$

0.94

$

1.14

$

3.97

$

4.88

Diluted

$

1.12

$

0.94

$

1.13

$

3.95

$

4.86

Cash dividends paid per common share

$

0.34

$

0.34

$

0.34

$

1.36

$

1.36

Basic average common shares outstanding

71,168,983

71,786,624

72,652,779

72,068,850

72,573,025

Diluted average common shares outstanding

71,491,518

72,032,456

72,906,310

72,327,017

72,862,628

CATHAY GENERAL BANCORP

AVERAGE BALANCES – SELECTED

CONSOLIDATED FINANCIAL INFORMATION

(Unaudited)

Three months ended (In thousands)(Unaudited) December 31,

2024 September 30, 2024 December 31, 2023

Interest-earning

assets:

Average

Balance

Average

Yield/Rate (1)

Average

Balance

Average

Yield/Rate (1)

Average

Balance

Average

Yield/Rate (1)

Loans (1)

$

19,345,616

6.19%

$

19,455,521

6.35%

$

19,330,187

6.21%

Taxable investment securities

1,542,577

3.50%

1,638,414

3.67%

1,594,267

3.71%

FHLB stock

17,250

8.75%

17,250

8.65%

19,599

7.94%

Deposits with banks

1,265,496

4.72%

1,035,534

5.26%

1,130,806

5.44%

Total interest-earning assets

$

22,170,939

5.92%

$

22,146,719

6.10%

$

22,074,859

5.99%

Interest-bearing liabilities: Interest-bearing demand

deposits

$

2,131,978

1.85%

$

2,134,807

2.10%

$

2,466,263

2.14%

Money market deposits

3,259,771

3.52%

3,073,384

3.75%

3,200,455

3.33%

Savings deposits

1,306,584

1.76%

1,212,870

1.85%

1,112,454

1.11%

Time deposits

9,932,776

4.45%

10,250,601

4.65%

9,208,820

4.21%

Total interest-bearing deposits

$

16,631,109

3.72%

$

16,671,662

3.95%

$

15,987,992

3.50%

Other borrowed funds

111,142

4.07%

186,838

4.86%

600,483

5.46%

Long-term debt

119,136

7.33%

119,136

7.85%

119,136

5.86%

Total interest-bearing liabilities

16,861,387

3.75%

16,977,636

3.99%

16,707,611

3.59%

Non-interest-bearing demand deposits

3,318,350

3,230,150

3,598,385

Total deposits and other borrowed funds

$

20,179,737

$

20,207,786

$

20,305,996

Total average assets

$

23,332,869

$

23,353,025

$

23,304,836

Total average equity

$

2,854,994

$

2,828,379

$

2,681,899

Year ended (In thousands)(Unaudited) December 31, 2024

December 31, 2023

Interest-earning assets:

Average

Balance

Average

Yield/Rate (1)

Average

Balance

Average

Yield/Rate (1)

Loans (1)

$

19,434,614

6.26%

$

18,763,271

6.02%

Taxable investment securities

1,621,477

3.66%

1,558,877

3.32%

FHLB stock

18,681

9.02%

18,620

7.25%

Deposits with banks

1,098,488

5.17%

1,141,720

5.16%

Total interest-earning assets

$

22,173,260

6.02%

$

21,482,488

5.78%

Interest-bearing liabilities: Interest-bearing demand

deposits

$

2,186,726

2.05%

$

2,388,080

1.71%

Money market deposits

3,166,318

3.65%

3,164,739

2.72%

Savings deposits

1,151,427

1.52%

1,070,405

0.83%

Time deposits

10,022,826

4.57%

8,849,293

3.75%

Total interest-bearing deposits

$

16,527,297

3.85%

$

15,472,517

3.02%

Other borrowed funds

315,086

5.24%

505,218

5.15%

Long-term debt

119,136

6.82%

119,136

5.44%

Total interest-bearing liabilities

16,961,519

3.90%

16,096,871

3.11%

Non-interest-bearing demand deposits

3,283,586

3,705,788

Total deposits and other borrowed funds

$

20,245,105

$

19,802,659

Total average assets

$

23,368,429

$

22,705,192

Total average equity

$

2,809,620

$

2,610,582

(1) Yields and interest earned include net loan fees.

Non-accrual loans are included in the average balance.

CATHAY GENERAL BANCORP

GAAP to NON-GAAP

RECONCILIATION

SELECTED CONSOLIDATED

FINANCIAL INFORMATION

(Unaudited)

The Company uses certain non-GAAP

financial measures to provide supplemental information regarding

the Company’s performance. Tangible equity and tangible equity to

tangible assets ratio are non-GAAP financial measures. Tangible

equity and tangible assets represent stockholders’ equity and total

assets, respectively, which have been reduced by goodwill and other

intangible assets. Given that the use of such measures and ratios

is prevalent in the banking industry, and such measures and ratios

are used by banking regulators and analysts, the Company has

included them below for discussion.

As of

December 31, 2024

September 30, 2024

December 31, 2023

(In thousands) (Unaudited) Stockholders' equity

(a)

$

2,845,704

$

2,830,313

$

2,736,575

Less: Goodwill

(375,696)

(375,696)

(375,696)

Other intangible assets (1)

(3,335)

(3,590)

(4,461)

Tangible equity

(b)

$

2,466,673

$

2,451,027

$

2,356,418

Total assets

(c)

$

23,054,681

$

23,274,443

$

23,081,534

Less: Goodwill

(375,696)

(375,696)

(375,696)

Other intangible assets (1)

(3,335)

(3,590)

(4,461)

Tangible assets

(d)

$

22,675,650

$

22,895,157

$

22,701,377

Number of common shares outstanding

(e)

70,863,324

71,355,869

72,668,927

Total stockholders' equity to total assets ratio

(a)/(c)

12.34%

12.16%

11.86%

Tangible equity to tangible assets ratio

(b)/(d)

10.88%

10.71%

10.38%

Tangible book value per share

(b)/(e)

$

34.81

$

34.35

$

32.43

Three Months Ended

Twelve Months Ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

(In thousands) (Unaudited) Net Income

$

80,201

$

67,514

$

82,526

$

285,979

$

354,124

Add: Amortization of other intangibles (1)

256

264

262

1,127

1,294

Tax effect of amortization adjustments (2)

(76)

(78)

(78)

(334)

(384)

Tangible net income

(f)

$

80,381

$

67,700

$

82,710

$

286,772

$

355,034

Return on tangible common equity (3)

(f)/(b)

13.03%

11.05%

14.04%

11.63%

15.07%

(1) Includes core deposit intangibles and mortgage servicing

(2) Applied the statutory rate of 29.65%. (3) Annualized

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122752656/en/

Heng W. Chen (626) 279-3652

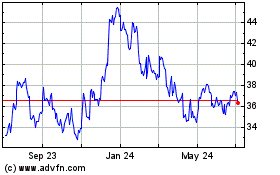

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Dec 2024 to Jan 2025

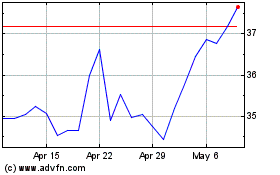

Cathay General Bancorp (NASDAQ:CATY)

Historical Stock Chart

From Jan 2024 to Jan 2025