false

0001346830

0001346830

2024-06-12

2024-06-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

June 12, 2024

CARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36279 |

|

75-3175693 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

|

400 Atlantic Street

Suite 500

Stamford, Connecticut |

|

|

|

06901 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

| |

|

|

|

|

| Registrant's telephone number, including area code (203) 406-3700 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

CARA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨.

| Item 7.01. |

Regulation FD Disclosure. |

On June 12, 2024, Cara Therapeutics, Inc. (the

“Company”) issued a press release (the “Press Release”) announcing the outcome from the dose-finding

Part A of the KOURAGE-1 study evaluating the efficacy and safety of oral difelikefalin for moderate-to-severe pruritus in adult

patients with notalgia paresthetica (“NP”). Oral difelikefalin did not demonstrate a meaningful clinical benefit at any

dose compared to placebo, resulting in the Company’s decision to discontinue the clinical program in NP. A copy of

the press release is being furnished to the Securities and Exchange Commission as Exhibit 99.1 to this Current Report on

Form 8-K and is incorporated by reference to this Item 7.01.

The information furnished under this Item 7.01, including Exhibit 99.1,

shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any of

the Company’s filings with the Securities and Exchange Commission under the Exchange Act or the Securities Act of 1933, as amended,

whether made before or after the date hereof, regardless of any general incorporation language in such a filing.

| Item 8.01. |

Other Information. |

On June 12, 2024, the Company issued the Press Release

announcing the outcome from the dose-finding Part A of the KOURAGE-1 study evaluating the efficacy and safety of oral

difelikefalin for moderate-to-severe pruritus in adult patients with NP. Oral difelikefalin did not demonstrate a meaningful

clinical benefit at any dose compared to placebo, resulting in the Company’s decision to discontinue the clinical

program in NP.

The Phase 2/3, two-part, multicenter, randomized, double-blind, placebo-controlled,

8-week study was designed to investigate the use of oral difelikefalin for moderate-to-severe pruritus in adult patients with NP. In Part A, patients

were randomized to one of four arms: oral difelikefalin 2 mg twice a day (“BID”), 1 mg BID, 0.25 mg BID or placebo BID for

8 weeks.

Primary Endpoint

The primary endpoint was the proportion of patients achieving a ≥4-point

improvement from baseline in the weekly mean of the daily 24-hour Itch-Numeric Rating Scale (I-NRS) score at Week 8.

Oral difelikefalin did not demonstrate a meaningful clinical benefit

at any dose compared to placebo. The drug was generally well tolerated with a safety profile similar to prior trials.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CARA THERAPEUTICS, INC. |

| |

|

| |

By: |

/s/ RYAN MAYNARD |

| |

|

Ryan Maynard |

| |

|

Chief Financial Officer |

| |

|

(Principal Financial and Accounting Officer) |

Date: June 12, 2024

Exhibit 99.1

Cara Therapeutics Announces Outcome of Part A of KOURAGE-1 Study Evaluating Oral Difelikefalin in Notalgia Paresthetica

– Oral difelikefalin did not demonstrate

meaningful clinical benefit compared to placebo –

– Company will discontinue clinical

program in NP and explore strategic alternatives –

STAMFORD, Conn., June 12, 2024

– Cara Therapeutics, Inc. (Nasdaq: CARA), a development-stage biopharmaceutical company leading a new treatment

paradigm to improve the lives of patients suffering from pruritus, today announced the outcome from the dose-finding Part A of

the KOURAGE-1 study evaluating the efficacy and safety of oral difelikefalin for moderate-to-severe pruritus in adult patients with

notalgia paresthetica (NP). Oral difelikefalin did not demonstrate a meaningful clinical benefit at any dose compared to placebo,

resulting in the Company’s decision to discontinue the clinical program in NP.

“Given our strong proof-of-concept results

in NP and the significant unmet need in this sensory neuropathy, we are disappointed that oral difelikefalin did not demonstrate a meaningful

improvement in pruritus compared to placebo in the KOURAGE-1 Part A study,” said Christopher Posner, President and Chief Executive

Officer of Cara Therapeutics. “We are grateful for the patients and investigators who participated in this study. We will be winding down the Phase 2/3 clinical program in NP and exploring strategic

alternatives focused on maximizing shareholder value.”

KOURAGE-1 Part A was a multicenter, randomized,

double-blind, placebo-controlled study designed to inform the dose and sample size for the pivotal portions of the Phase 2/3 clinical

program. In Part A, 214 patients were randomized to one of four arms: oral difelikefalin 2 mg twice a day (BID), 1 mg BID, 0.25 mg

BID or placebo BID for 8 weeks. The primary endpoint was the proportion of patients achieving a ≥4-point improvement from baseline

in the weekly mean of the daily 24-hour Itch-Numeric Rating Scale (I-NRS) score at Week 8.

Oral difelikefalin did not demonstrate a

meaningful clinical benefit at any dose compared to placebo. The drug was generally well tolerated with a safety profile

similar to prior trials.

As of March 31, 2024, the Company had approximately

$70 million in cash, cash equivalents, and marketable securities.

About Cara Therapeutics

Cara Therapeutics is a development-stage

biopharmaceutical company leading a new treatment paradigm to improve the lives of patients suffering from pruritus. The Company developed

an IV formulation of difelikefalin, which is approved in the United States, EU, and multiple other countries for the treatment of moderate-to-severe

pruritus associated with advanced chronic kidney disease in adults undergoing hemodialysis. The IV formulation is out-licensed worldwide.

For more information, visit www.CaraTherapeutics.com and follow the company on X (Twitter), LinkedIn and Instagram.

Forward-looking Statements

Statements contained in this press release regarding

matters that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Examples of these forward-looking statements include statements concerning the winding down of the Company’s

Phase 2/3 clinical program in NP, the exploration of strategic alternatives and other statements that are not historical facts. Because

such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking

statements. These risks are described more fully in Cara Therapeutics’ filings with the Securities and Exchange Commission, including

the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ending December 31, 2023

and its other documents subsequently filed with or furnished to the Securities and Exchange Commission, including its Form 10-Q for

the quarter ended March 31, 2024. All forward-looking statements contained in this press release speak only as of the date on which

they were made. Cara Therapeutics undertakes no obligation to update such statements to reflect events that occur or circumstances that

exist after the date on which they were made, except as required by law.

MEDIA CONTACT:

Annie Spinetta

6 Degrees

973-768-2170

aspinetta@6degreespr.com

INVESTOR CONTACT:

Iris Francesconi, Ph.D.

Cara Therapeutics

203-406-3700

investor@caratherapeutics.com

v3.24.1.1.u2

Cover

|

Jun. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 12, 2024

|

| Entity File Number |

001-36279

|

| Entity Registrant Name |

CARA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001346830

|

| Entity Tax Identification Number |

75-3175693

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400 Atlantic Street

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06901

|

| City Area Code |

203

|

| Local Phone Number |

406-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CARA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

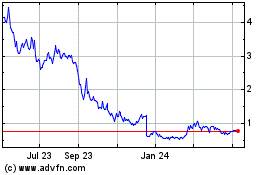

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

From Nov 2024 to Dec 2024

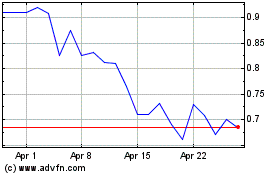

Cara Therapeutics (NASDAQ:CARA)

Historical Stock Chart

From Dec 2023 to Dec 2024