Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

December 20 2021 - 5:23PM

Edgar (US Regulatory)

Filed pursuant to Rule 424(b)(3)

File No. 333-229042

Calamos Convertible Opportunities and Income Fund (the "Fund") Supplement dated December 20, 2021 to the Fund's Prospectus dated March 1, 2021, and as supplemented March 5, 2021, August 27, 2021 and September 30, 2021

The subsection titled "Primary Investments" in the section titled "Investment Policies" on page 4 of the Prospectus is deleted in its entirety and replaced with the following:

Primary Investments. Under normal circumstances, the Fund invests at least 80% of its managed assets in a diversified portfolio of convertible securities and non-convertible income securities.(1) The portion of the Fund's assets invested in convertible securities and non-convertible income securities will vary from time to time consistent with the Fund's investment objective, changes in equity prices and changes in interest rates and other economic and market factors, although, under normal circumstances, the Fund will invest at least 35% of its managed assets in convertible securities. The Fund invests in securities with a broad range of maturities. The average term to maturity of the Fund's securities typically will range from two to ten years. See "Investment Objective and Principal Investment Strategies — Principal Investment Strategies."

(1) This is a non-fundamental policy and may be changed by the Board of Trustees of the Fund provided that shareholders are provided with at least 60 days' prior written notice of any change as required by the rules under the 1940 Act.

The first paragraph of the subsection titled "Principal Investment Strategies" in the section titled "Investment Objective and Principal Investment Strategies" on page 29 of the Prospectus is deleted in its entirety and replaced with the following:

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of its managed assets in a diversified portfolio of convertible securities and non-convertible income securities. This is a non-fundamental policy and may be changed by the Board of Trustees of the Fund provided that shareholders are provided with at least 60 days' prior written notice of any change as required by the rules under the 1940 Act. The portion of the Fund's assets invested in convertible securities and non-convertible income securities will vary from time to time consistent with the Fund's investment objective, changes in equity prices and changes in interest rates and other economic and market factors, although, under normal circumstances, the Fund will invest at least 35% of its managed assets in convertible securities. The Fund invests in securities with a broad range of maturities. The average term to maturity of the Fund's securities typically will range from two to ten years.

Please retain this supplement for future reference

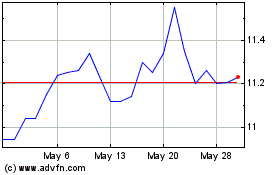

Calamos Convertible Oppo... (NASDAQ:CHI)

Historical Stock Chart

From Aug 2024 to Sep 2024

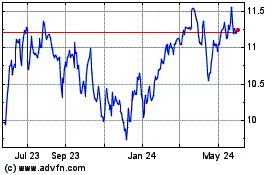

Calamos Convertible Oppo... (NASDAQ:CHI)

Historical Stock Chart

From Sep 2023 to Sep 2024