00017235802023Q2false1/100017235802023-01-032023-07-030001723580bfi:CommonStockParValue00001PerShare2Member2023-01-032023-07-030001723580bfi:RedeemableWarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOElevenPointFiveZeroPerShare1Member2023-01-032023-07-0300017235802023-08-11xbrli:shares00017235802023-07-03iso4217:USD00017235802023-01-02iso4217:USDxbrli:shares00017235802023-04-042023-07-0300017235802022-04-012022-06-3000017235802022-01-012022-06-300001723580bfi:RoyaltyAndOtherFeesMember2023-04-042023-07-030001723580bfi:RoyaltyAndOtherFeesMember2022-04-012022-06-300001723580bfi:RoyaltyAndOtherFeesMember2023-01-032023-07-030001723580bfi:RoyaltyAndOtherFeesMember2022-01-012022-06-300001723580bfi:RoyaltyBrandDevelopmentAndCoOpMember2023-04-042023-07-030001723580bfi:RoyaltyBrandDevelopmentAndCoOpMember2022-04-012022-06-300001723580bfi:RoyaltyBrandDevelopmentAndCoOpMember2023-01-032023-07-030001723580bfi:RoyaltyBrandDevelopmentAndCoOpMember2022-01-012022-06-300001723580us-gaap:RetainedEarningsMember2023-01-032023-07-030001723580us-gaap:RetainedEarningsMember2022-04-012022-06-300001723580us-gaap:CommonStockMember2022-03-310001723580us-gaap:AdditionalPaidInCapitalMember2022-03-310001723580us-gaap:RetainedEarningsMember2022-03-3100017235802022-03-310001723580us-gaap:CommonStockMember2022-04-012022-06-300001723580us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001723580us-gaap:CommonStockMember2022-06-300001723580us-gaap:AdditionalPaidInCapitalMember2022-06-300001723580us-gaap:RetainedEarningsMember2022-06-3000017235802022-06-300001723580us-gaap:CommonStockMember2023-04-030001723580us-gaap:AdditionalPaidInCapitalMember2023-04-030001723580us-gaap:RetainedEarningsMember2023-04-0300017235802023-04-030001723580us-gaap:CommonStockMember2023-04-042023-07-030001723580us-gaap:AdditionalPaidInCapitalMember2023-04-042023-07-030001723580us-gaap:CommonStockMember2023-07-030001723580us-gaap:AdditionalPaidInCapitalMember2023-07-030001723580us-gaap:RetainedEarningsMember2023-07-030001723580us-gaap:CommonStockMember2021-12-310001723580us-gaap:AdditionalPaidInCapitalMember2021-12-310001723580us-gaap:RetainedEarningsMember2021-12-3100017235802021-12-310001723580us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001723580us-gaap:CommonStockMember2022-01-012022-06-300001723580us-gaap:RetainedEarningsMember2022-01-012022-06-300001723580us-gaap:CommonStockMember2023-01-020001723580us-gaap:AdditionalPaidInCapitalMember2023-01-020001723580us-gaap:RetainedEarningsMember2023-01-020001723580us-gaap:AdditionalPaidInCapitalMember2023-01-032023-07-030001723580us-gaap:CommonStockMember2023-01-032023-07-03bfi:storebfi:brand0001723580bfi:BurgerFiSegmentMember2023-07-030001723580bfi:AnthonysSegmentMember2023-07-030001723580bfi:CompanyOwnedStoresMember2023-07-030001723580us-gaap:FranchiseMember2023-07-030001723580bfi:CompanyOwnedStoresMember2023-01-020001723580us-gaap:FranchiseMember2023-01-020001723580bfi:CompanyOwnedStoresMemberbfi:BurgerFiSegmentMember2023-01-020001723580us-gaap:FranchiseMemberbfi:BurgerFiSegmentMember2023-01-020001723580bfi:BurgerFiSegmentMember2023-01-020001723580bfi:CompanyOwnedStoresMemberbfi:BurgerFiSegmentMember2021-12-310001723580us-gaap:FranchiseMemberbfi:BurgerFiSegmentMember2021-12-310001723580bfi:BurgerFiSegmentMember2021-12-310001723580bfi:CompanyOwnedStoresMemberbfi:BurgerFiSegmentMember2023-01-032023-07-030001723580us-gaap:FranchiseMemberbfi:BurgerFiSegmentMember2023-01-032023-07-030001723580bfi:BurgerFiSegmentMember2023-01-032023-07-030001723580bfi:CompanyOwnedStoresMemberbfi:BurgerFiSegmentMember2022-01-012023-01-020001723580us-gaap:FranchiseMemberbfi:BurgerFiSegmentMember2022-01-012023-01-020001723580bfi:BurgerFiSegmentMember2022-01-012023-01-020001723580bfi:CompanyOwnedStoresMemberbfi:BurgerFiSegmentMember2023-07-030001723580us-gaap:FranchiseMemberbfi:BurgerFiSegmentMember2023-07-030001723580bfi:AnthonysSegmentMemberbfi:CompanyOwnedStoresMember2023-01-020001723580us-gaap:FranchiseMemberbfi:AnthonysSegmentMember2023-01-020001723580bfi:AnthonysSegmentMember2023-01-020001723580bfi:AnthonysSegmentMemberbfi:CompanyOwnedStoresMember2021-12-310001723580us-gaap:FranchiseMemberbfi:AnthonysSegmentMember2021-12-310001723580bfi:AnthonysSegmentMember2021-12-310001723580bfi:AnthonysSegmentMemberbfi:CompanyOwnedStoresMember2023-01-032023-07-030001723580us-gaap:FranchiseMemberbfi:AnthonysSegmentMember2023-01-032023-07-030001723580bfi:AnthonysSegmentMember2023-01-032023-07-030001723580bfi:AnthonysSegmentMemberbfi:CompanyOwnedStoresMember2022-01-012023-01-020001723580us-gaap:FranchiseMemberbfi:AnthonysSegmentMember2022-01-012023-01-020001723580bfi:AnthonysSegmentMember2022-01-012023-01-020001723580bfi:AnthonysSegmentMemberbfi:CompanyOwnedStoresMember2023-07-030001723580us-gaap:FranchiseMemberbfi:AnthonysSegmentMember2023-07-030001723580us-gaap:SubsequentEventMemberbfi:BurgerFiSegmentMember2023-07-042023-08-160001723580bfi:AnthonysSegmentMemberus-gaap:SubsequentEventMember2023-07-042023-08-160001723580us-gaap:SecuredDebtMember2023-07-030001723580bfi:Second82ndSMLLCCBFNY82LLCBurgerFiInternationalLLCAndBurgerFiInternationalIncMemberus-gaap:SubsequentEventMemberus-gaap:SettledLitigationMember2023-08-142023-08-140001723580bfi:BFDaniaBeachLLCMember2023-07-030001723580bfi:BFDaniaBeachLLCMember2023-01-020001723580bfi:AnthonysSegmentMember2023-07-030001723580us-gaap:LeaseholdImprovementsMember2023-07-030001723580us-gaap:LeaseholdImprovementsMember2023-01-020001723580us-gaap:MachineryAndEquipmentMember2023-07-030001723580us-gaap:MachineryAndEquipmentMember2023-01-020001723580us-gaap:ComputerEquipmentMember2023-07-030001723580us-gaap:ComputerEquipmentMember2023-01-020001723580us-gaap:FurnitureAndFixturesMember2023-07-030001723580us-gaap:FurnitureAndFixturesMember2023-01-020001723580us-gaap:VehiclesMember2023-07-030001723580us-gaap:VehiclesMember2023-01-020001723580us-gaap:FranchiseRightsMember2023-07-030001723580us-gaap:FranchiseRightsMember2023-01-020001723580us-gaap:TrademarksAndTradeNamesMemberbfi:BurgerFiSegmentMember2023-07-030001723580us-gaap:TrademarksAndTradeNamesMemberbfi:BurgerFiSegmentMember2023-01-020001723580us-gaap:TrademarksAndTradeNamesMemberbfi:AnthonysSegmentMember2023-07-030001723580us-gaap:TrademarksAndTradeNamesMemberbfi:AnthonysSegmentMember2023-01-020001723580bfi:ReefKitchensLicenseAgreementMember2023-07-030001723580bfi:ReefKitchensLicenseAgreementMember2023-01-020001723580bfi:VegeFiProductMember2023-07-030001723580bfi:VegeFiProductMember2023-01-020001723580bfi:LiquorLicenseMember2023-07-030001723580bfi:LiquorLicenseMember2023-01-020001723580bfi:FranchiseRevenuesMember2023-04-042023-07-030001723580bfi:FranchiseRevenuesMember2022-04-012022-06-300001723580bfi:FranchiseRevenuesMember2023-01-032023-07-030001723580bfi:FranchiseRevenuesMember2022-01-012022-06-300001723580bfi:PublicWarrantsMember2023-01-032023-07-030001723580us-gaap:WarrantMember2023-01-032023-07-030001723580us-gaap:OverAllotmentOptionMemberus-gaap:CommonStockMember2023-01-032023-07-030001723580us-gaap:RestrictedStockMember2023-01-032023-07-030001723580bfi:StoresAcquiredFromStockholderMember2023-01-23bfi:location0001723580bfi:StoresAcquiredFromStockholderMember2023-01-232023-01-230001723580us-gaap:RelatedPartyMember2023-01-020001723580srt:AffiliatedEntityMember2022-04-012022-06-300001723580srt:AffiliatedEntityMemberbfi:EntityUnderCommonOwnershipWithSignificantShareholderMemberbfi:LeasedBuildingSpaceMember2020-01-010001723580bfi:LeasedBuildingSpaceMember2022-04-012022-06-300001723580bfi:LeasedBuildingSpaceMember2022-01-012022-06-300001723580srt:AffiliatedEntityMemberbfi:EntityUnderCommonOwnershipWithSignificantShareholderMemberbfi:LeasedBuildingSpaceAmendmentMember2022-02-280001723580srt:AffiliatedEntityMemberbfi:EntityUnderCommonOwnershipWithSignificantShareholderMemberbfi:LeasedBuildingSpaceAmendmentMember2023-04-042023-07-030001723580srt:AffiliatedEntityMemberbfi:EntityUnderCommonOwnershipWithSignificantShareholderMemberbfi:LeasedBuildingSpaceAmendmentMember2023-01-032023-07-030001723580bfi:IndependentContractorAgreementMembersrt:AffiliatedEntityMember2022-09-010001723580bfi:StrategicAdvisoryServices2023ProgramMemberbfi:ConsultantMembersrt:AffiliatedEntityMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-032023-01-030001723580srt:ChiefOperatingOfficerMemberus-gaap:CommonStockMember2023-01-032023-01-030001723580bfi:StrategicAdvisoryServices2023ProgramMemberbfi:ConsultantMembersrt:AffiliatedEntityMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-032023-07-030001723580bfi:StrategicAdvisoryServices2023ProgramMemberbfi:ConsultantMembersrt:AffiliatedEntityMemberus-gaap:RestrictedStockUnitsRSUMember2023-04-042023-07-030001723580srt:ChiefOperatingOfficerMemberus-gaap:CommonStockMember2022-01-032022-01-030001723580bfi:ConsultantMembersrt:AffiliatedEntityMemberus-gaap:RestrictedStockUnitsRSUMemberbfi:StrategicAdvisoryServices2022ProgramMember2022-01-012022-06-300001723580bfi:ConsultantMembersrt:AffiliatedEntityMemberus-gaap:RestrictedStockUnitsRSUMemberbfi:StrategicAdvisoryServices2022ProgramMember2022-04-012022-06-300001723580bfi:ConsultantMembersrt:AffiliatedEntityMemberus-gaap:RestrictedStockUnitsRSUMemberbfi:StrategicAdvisoryServices2022ProgramMember2023-01-032023-07-030001723580bfi:ConsultantMembersrt:AffiliatedEntityMemberus-gaap:RestrictedStockUnitsRSUMemberbfi:StrategicAdvisoryServices2022ProgramMember2023-04-042023-07-0300017235802023-06-03xbrli:pure0001723580us-gaap:PendingLitigationMemberbfi:Second82ndSMLLCCBFNY82LLCBurgerFiInternationalLLCAndBurgerFiInternationalIncMember2021-08-11bfi:claim0001723580us-gaap:PendingLitigationMemberbfi:Second82ndSMLLCCBFNY82LLCBurgerFiInternationalLLCAndBurgerFiInternationalIncMember2021-08-112021-08-110001723580bfi:Second82ndSMLLCCBFNY82LLCBurgerFiInternationalLLCAndBurgerFiInternationalIncMemberus-gaap:SettledLitigationMember2021-08-112021-08-110001723580us-gaap:PendingLitigationMemberbfi:LionPointCapitalAllegationMember2021-03-092022-08-260001723580us-gaap:PendingLitigationMemberbfi:BurgerGuysOfDaniaPointeEtAlVBFILLCMember2021-05-212021-05-210001723580us-gaap:PendingLitigationMemberbfi:AllRoundFoodBakeryProductsIncVBurgerFiInternationalLLCAndNerisBakeryProductsIncEtAlMember2020-02-012020-02-290001723580bfi:EmployeeRetentionClaimsMember2023-07-030001723580us-gaap:SecuredDebtMember2023-01-020001723580bfi:RelatedPartyNoteMember2023-07-030001723580bfi:RelatedPartyNoteMember2023-01-020001723580us-gaap:LineOfCreditMember2023-07-030001723580us-gaap:LineOfCreditMember2023-01-020001723580bfi:CreditAgreementMemberus-gaap:LineOfCreditMember2023-07-030001723580us-gaap:SecuredDebtMemberbfi:CreditAgreementMember2023-02-242023-02-240001723580us-gaap:JuniorSubordinatedDebtMemberbfi:NewJuniorSubordinatedSecuredNotesMember2023-02-240001723580bfi:CreditAgreementMember2023-07-030001723580bfi:InterestPeriodPeriodOneMemberbfi:CreditAgreementMember2023-07-030001723580bfi:InterestPeriodPeriodTwoMemberbfi:CreditAgreementMember2023-07-030001723580bfi:InterestPeriodPeriodThreeMemberbfi:CreditAgreementMember2023-07-030001723580bfi:InterestPeriodPeriodFourMemberbfi:CreditAgreementMember2023-07-030001723580bfi:InterestPeriodPeriodFiveMemberbfi:CreditAgreementMember2023-07-030001723580bfi:CreditAgreementMemberbfi:LoansPayableNoncurrentMember2023-07-030001723580bfi:CreditAgreementMemberbfi:LoansPayableNoncurrentMember2023-04-042023-07-030001723580bfi:CreditAgreementMemberbfi:LoansPayableNoncurrentMember2023-01-032023-07-030001723580us-gaap:RelatedPartyMemberbfi:CreditAgreementMemberbfi:LoansPayableNoncurrentMember2023-07-030001723580us-gaap:RelatedPartyMemberbfi:CreditAgreementMemberbfi:LoansPayableNoncurrentMember2023-01-020001723580bfi:CreditAgreementMember2023-04-042023-07-030001723580bfi:CreditAgreementMember2022-04-012022-06-300001723580bfi:CreditAgreementMember2023-01-032023-07-030001723580bfi:CreditAgreementMember2022-01-012022-06-3000017235802023-02-242023-02-240001723580bfi:PublicWarrantsMember2023-07-030001723580us-gaap:PrivatePlacementMember2023-07-030001723580bfi:PrivateWarrantsMember2023-07-030001723580bfi:WorkingCapitalWarrantsMember2023-07-030001723580bfi:UPOUnitsExercisePriceOneMember2023-01-032023-07-030001723580us-gaap:MeasurementInputSharePriceMember2023-07-030001723580us-gaap:MeasurementInputSharePriceMember2023-01-0200017235802023-01-050001723580bfi:OmnibusEquityIncentivePlanMember2023-07-030001723580bfi:OmnibusEquityIncentivePlanMember2023-01-020001723580us-gaap:RestrictedStockUnitsRSUMember2023-01-020001723580us-gaap:RestrictedStockUnitsRSUMember2023-01-032023-07-030001723580us-gaap:RestrictedStockUnitsRSUMember2023-07-030001723580us-gaap:RestrictedStockUnitsRSUMember2023-04-042023-07-030001723580us-gaap:FairValueInputsLevel1Member2023-07-030001723580us-gaap:FairValueInputsLevel3Member2023-07-030001723580us-gaap:FairValueInputsLevel2Member2023-07-030001723580us-gaap:FairValueInputsLevel1Member2023-01-020001723580us-gaap:FairValueInputsLevel2Member2023-01-020001723580us-gaap:FairValueInputsLevel3Member2023-01-020001723580bfi:PrivateWarrantsMember2023-01-020001723580us-gaap:MeasurementInputRiskFreeInterestRateMember2023-07-030001723580us-gaap:MeasurementInputRiskFreeInterestRateMember2023-01-020001723580us-gaap:MeasurementInputExpectedTermMember2023-07-03utr:Y0001723580us-gaap:MeasurementInputExpectedTermMember2023-01-020001723580us-gaap:MeasurementInputPriceVolatilityMember2023-07-030001723580us-gaap:MeasurementInputPriceVolatilityMember2023-01-020001723580us-gaap:MeasurementInputExpectedDividendRateMember2023-07-030001723580us-gaap:MeasurementInputExpectedDividendRateMember2023-01-02bfi:Segment0001723580srt:ParentCompanyMember2023-04-042023-07-030001723580srt:ParentCompanyMember2022-04-012022-06-300001723580bfi:BurgerFiSegmentMember2023-04-042023-07-030001723580bfi:BurgerFiSegmentMember2022-04-012022-06-300001723580bfi:AnthonysSegmentMember2023-04-042023-07-030001723580bfi:AnthonysSegmentMember2022-04-012022-06-300001723580srt:ParentCompanyMember2023-01-032023-07-030001723580srt:ParentCompanyMember2022-01-012022-06-300001723580bfi:BurgerFiSegmentMember2022-01-012022-06-300001723580bfi:AnthonysSegmentMember2022-01-012022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 10-Q

________________________________________________

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended July 3, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number: 001-38417

__________________________________________________

BurgerFi International, Inc.

(Exact name of Registrant as specified in its Charter)

____________________________________________________

| | | | | |

| Delaware | 82-2418815 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

| |

200 West Cypress Creek Rd., Suite 220 Fort Lauderdale, FL | 33309 |

| (Address of principal executive offices) | (Zip Code) |

(954) 618-2000

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

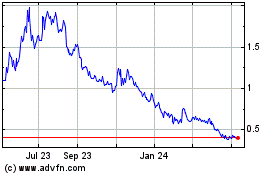

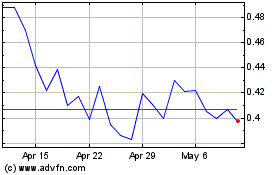

| Common Stock, par value $0.0001 per share | | BFI | | The Nasdaq Stock Market LLC |

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share | | BFIIW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☒ | | Smaller reporting company | | ☒ |

| | | | | | |

| | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the registrant’s Common Stock outstanding as of August 11, 2023 was 26,800,100

Table of Contents

Forward-Looking and Cautionary Statements

This Quarterly Report on Form 10-Q contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements may appear throughout this Quarterly Report on Form 10-Q, including without limitation, the following sections: Part 1, Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our Annual Report on Form 10-K for the year ended January 2, 2023 and this Quarterly Report on Form 10-Q, and in particular, the risks discussed under the caption “Risk Factors” in Item 1A of such reports and those discussed in other documents we file with the Securities and Exchange Commission (the “SEC”). We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Part I. Financial Information.

Item 1. Financial Statements.

BurgerFi International Inc., and Subsidiaries

Consolidated Balance Sheets

| | | | | | | | | | | |

| Unaudited | | |

| (in thousands, except for per share data) | July 3, 2023 | | January 2, 2023 |

| Assets | | | |

| Current Assets | | | |

| Cash | $ | 10,711 | | | $ | 11,917 | |

| Accounts receivable, net | 1,457 | | | 1,926 | |

| Inventory | 1,438 | | | 1,320 | |

| Assets held for sale | 1,527 | | | 732 | |

| Prepaid expenses and other current assets | 1,525 | | | 2,564 | |

| Total Current Assets | $ | 16,658 | | | $ | 18,459 | |

| Property & equipment, net | 18,247 | | | 19,371 | |

| Operating right-of-use assets, net | 45,565 | | | 45,741 | |

| | | |

| Goodwill | 31,621 | | | 31,621 | |

| Intangible assets, net | 155,213 | | | 160,208 | |

| Other assets | 971 | | | 1,380 | |

| Total Assets | $ | 268,275 | | | $ | 276,780 | |

| Liabilities and Stockholders' Equity | | | |

| Current Liabilities | | | |

| Accounts payable - trade and other | $ | 7,723 | | | $ | 8,464 | |

| Accrued expenses | 8,381 | | | 10,589 | |

| Short-term operating lease liability | 12,274 | | | 9,924 | |

| Short-term borrowings, including finance leases | 3,485 | | | 4,985 | |

| Other current liabilities | 2,842 | | | 6,241 | |

| Total Current Liabilities | $ | 34,705 | | | $ | 40,203 | |

| Non-Current Liabilities | | | |

| Long-term borrowings, including finance leases | 49,786 | | | 53,794 | |

Redeemable preferred stock, $0.0001 par value, 10,000,000 shares authorized, 2,120,000 shares issued and outstanding as of July 3, 2023 and January 2, 2023, $53 million principal redemption value, respectively | 53,482 | | | 51,418 | |

| Long-term operating lease liability | 40,889 | | | 40,748 | |

| Related party note payable | 14,412 | | | 9,235 | |

| Deferred income taxes | 1,223 | | | 1,223 | |

| Other non-current liabilities | 1,330 | | | 1,212 | |

| Total Liabilities | $ | 195,827 | | | $ | 197,833 | |

| Commitments and Contingencies - Note 8 | | | |

| Stockholders' Equity | | | |

Common stock, $ 0.0001 par value, 100,000,000 shares authorized, 26,724,218, and 22,257,772 shares issued and outstanding as of July 3, 2023 and January 2, 2023, respectively | 2 | | | 2 | |

| Additional paid-in capital | 314,749 | | | 306,096 | |

| Accumulated deficit | (242,303) | | | (227,151) | |

| Total Stockholders' Equity | $ | 72,448 | | | $ | 78,947 | |

| Total Liabilities and Stockholders' Equity | $ | 268,275 | | | $ | 276,780 | |

See accompanying notes to consolidated financial statements.

BurgerFi International Inc., and Subsidiaries

Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Six Months Ended | | |

| (in thousands, except for per share data) | July 3, 2023 | | June 30, 2022 | | July 3, 2023 | | June 30, 2022 | | | | |

| Revenue | | | | | | | | | | | |

| Restaurant sales | $ | 40,808 | | | $ | 42,236 | | | $ | 84,124 | | | $84,592 | | | | |

| Royalty and other fees | 2,190 | | | 2,611 | | | 4,160 | | | 4,714 | | | | | |

| Royalty - brand development and co-op | 429 | | | 451 | | | 870 | | | 922 | | | | | |

| | | | | | | | | | | |

| Total Revenue | $ | 43,427 | | | $ | 45,298 | | | $ | 89,154 | | | $ | 90,228 | | | | | |

| Restaurant level operating expenses: | | | | | | | | | | | |

| Food, beverage and paper costs | 10,772 | | | 12,545 | | | 22,382 | | | 25,352 | | | | | |

| Labor and related expenses | 12,699 | | | 12,328 | | | 25,916 | | | 24,910 | | | | | |

| Other operating expenses | 7,760 | | | 7,421 | | | 15,216 | | | 14,613 | | | | | |

| Occupancy and related expenses | 3,930 | | | 3,890 | | | 7,763 | | | 7,725 | | | | | |

| General and administrative expenses | 5,812 | | | 7,406 | | | 12,388 | | | 13,432 | | | | | |

| Depreciation and amortization expense | 3,295 | | | 4,730 | | | 6,522 | | | 9,174 | | | | | |

| Share-based compensation expense | 556 | | | 909 | | | 5,230 | | | 8,285 | | | | | |

| Brand development, co-op and advertising expenses | 933 | | | 1,126 | | | 2,029 | | | 1,839 | | | | | |

| Goodwill and intangible asset impairment | — | | | 55,168 | | | — | | | 55,168 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Restructuring costs and other charges, net | 1,135 | | | 52 | | | 2,174 | | | 1,040 | | | | | |

| | | | | | | | | | | |

| Total Operating Expenses | $ | 46,892 | | | $ | 105,575 | | | $ | 99,620 | | | $ | 161,538 | | | | | |

| Operating Loss | (3,465) | | | (60,277) | | | (10,466) | | | (71,310) | | | | | |

| Interest expense, net | (2,211) | | | (2,246) | | | (4,289) | | | (4,318) | | | | | |

| (Loss) gain on change in value of warrant liability | (318) | | | 1,858 | | | (391) | | | 1,324 | | | | | |

| | | | | | | | | | | |

| Other loss | (5) | | | (47) | | | (5) | | | (80) | | | | | |

| Loss before income taxes | $ | (5,999) | | | $ | (60,712) | | | $ | (15,151) | | | $ | (74,384) | | | | | |

| Income tax (expense) benefit | (2) | | | 335 | | | (2) | | | 447 | | | | |

| Net loss | $ | (6,001) | | | $ | (60,377) | | | $ | (15,153) | | | $ | (73,937) | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | | | |

| Basic | 24,891,449 | | | 22,214,628 | | | 24,216,199 | | | 22,089,799 | | | | | |

| Diluted | 24,891,449 | | | 22,214,628 | | | 24,216,199 | | | 22,089,799 | | | | | |

| | | | | | | | | | | |

| Net loss per common share: | | | | | | | | | | | |

| Basic and Diluted | $ | (0.24) | | | $ | (2.72) | | | $ | (0.63) | | | $ | (3.35) | | | | | |

| | | | | | | | | | | |

See accompanying notes to consolidated financial statements.

BurgerFi International Inc., and Subsidiaries

Consolidated Statements of Changes in Stockholders’ Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Total |

| (in thousands, except for share data) | Shares | | Amount | | | |

| Balance as of March 31, 2022 | 22,042,583 | | | $ | 2 | | | $ | 303,383 | | | $ | (137,279) | | | $ | 166,106 | |

| Share-based compensation | 238,514 | | | — | | | 909 | | | — | | | 909 | |

| Vested shares issued | — | | | — | | | — | | | — | | | — | |

| Shares issued in acquisition of Anthony's* | — | | | — | | | — | | | — | | | — | |

| Shares withheld for taxes | (27,865) | | | — | | | (101) | | | — | | | (101) | |

| Net income | — | | | — | | | — | | | (60,377) | | | (60,377) | |

| Balance as of June 30, 2022 | 22,253,232 | | | $ | 2 | | | $ | 304,191 | | | $ | (197,656) | | | $ | 106,537 | |

| | | | | | | | | |

| | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Total |

| (in thousands, except for share data) | Shares | | Amount | | | |

| Balance as of April 3, 2023 | 23,823,105 | | | $ | 2 | | | $ | 310,768 | | | (236,302) | | | $ | 74,468 | |

| Shares issued in private placement | 2,868,853 | | | — | | | 3,436 | | | | 3,436 | |

| Share-based compensation | — | | | — | | | 556 | | | — | | | 556 | |

| Vested shares issued | 41,883 | | | — | | | — | | | — | | | — | |

| Shares issued in legal settlement | — | | | — | | | — | | | — | | | — | |

| Shares withheld for taxes | (9,623) | | | — | | | (11) | | | — | | | (11) | |

| Net loss | — | | | — | | | — | | | (6,001) | | | (6,001) | |

| Balance as of July 3, 2023 | 26,724,218 | | | $ | 2 | | | $ | 314,749 | | | $ | (242,303) | | | $ | 72,448 | |

| | | | | | | | | |

| | | | | | | |

| | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | |

| | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Total |

| (in thousands, except for share data) | Shares | | Amount | | | |

| Balance as of December 31, 2021 | 21,303,500 | | | $ | 2 | | | $ | 296,992 | | | $ | (123,719) | | | $ | 173,275 | |

| Share-based compensation | — | | | — | | | 4,475 | | | — | | | 4,475 | |

| Shares issued for share-based compensation | 965,676 | | | — | | | 3,810 | | | — | | | 3,810 | |

| Shares issued in acquisition of Anthony's* | 123,131 | | | — | | | — | | | — | | | — | |

| Shares withheld for taxes | (139,075) | | | — | | | (1,086) | | | — | | | (1,086) | |

| Net income | — | | | — | | | — | | | (73,937) | | | (73,937) | |

| Balance as of June 30, 2022 | 22,253,232 | | | $ | 2 | | | $ | 304,191 | | | $ | (197,656) | | | $ | 106,537 | |

| | | | | | | | | |

| | | | | | | | | |

| Common Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Total |

| (in thousands, except for share data) | Shares | | Amount | | | |

| Balance as of January 2, 2023 | 22,257,772 | | | $ | 2 | | | $ | 306,096 | | | $ | (227,151) | | | $ | 78,947 | |

| Shares issued in private placement | 2,868,853 | | | — | | | 3,436 | | | | | 3,436 | |

| Share-based compensation | — | | | — | | | 5,230 | | | — | | | 5,230 | |

| Vested share issued | 1,681,057 | | | — | | | — | | | — | | | — | |

| Shares issued in legal settlement | 200,000 | | | — | | | 352 | | | — | | | 352 | |

| Shares withheld for taxes | (283,464) | | | — | | | (365) | | | — | | | (365) | |

| Net loss | — | | | — | | | — | | | (15,153) | | | (15,153) | |

| Balance as of July 3, 2023 | 26,724,218 | | | $ | 2 | | | $ | 314,749 | | | $ | (242,303) | | | $ | 72,448 | |

| | | | | | | | | |

*Timing of share issuance differs from recognition of related financial statement dollar amounts.

See accompanying notes to consolidated financial statements.

BurgerFi International Inc., and Subsidiaries

Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended |

| (in thousands) | July 3, 2023 | | June 30, 2022 |

| Cash Flows (Used in) Provided by Operating Activities | | | |

| Net loss | $ | (15,153) | | | $ | (73,937) | |

| Adjustments to reconcile net loss income to net cash (used in) provided by operating activities | | | |

| Goodwill impairment | — | | | 55,168 | |

| | | |

| Depreciation and amortization | 6,522 | | | 9,174 | |

| | | |

| Share-based compensation | 5,230 | | | 8,285 | |

| Loss on legal settlement | 131 | | | — | |

| Forfeited franchise deposits | (374) | | | (433) | |

| Non-cash lease cost | (36) | | | 112 | |

| Loss (gain) on change in value of warrant liability | 391 | | | (1,324) | |

| (Gain) loss on disposal of property and equipment | (10) | | | 385 | |

| Deferred income taxes | — | | | (447) | |

| Other non-cash interest | 2,378 | | | 2,290 | |

| Other, net | 108 | | | 32 | |

| Changes in operating assets and liabilities | | | |

| Accounts receivable | 480 | | | 270 | |

| Inventory | (97) | | | 35 | |

| Prepaid expenses and other assets | 1,410 | | | 225 | |

| Accounts payable - trade | (784) | | | 2,120 | |

| Accrued expenses and other current liabilities | (2,924) | | | 1,895 | |

| Other long-term liabilities | 112 | | | 38 | |

| Cash Flows (Used in) Provided by Operating Activities | $ | (2,616) | | | $ | 3,888 | |

| Net Cash Flows Provided By Investing Activities | | | |

| Purchases of property and equipment | (1,046) | | | (1,056) | |

| Proceeds from the sale of property and equipment | 26 | | | 1,025 | |

| | | |

| | | |

| Net Cash Flows Used in Investing Activities | $ | (1,020) | | | $ | (31) | |

| Net Cash Flows Used in Financing Activities | | | |

| Proceeds from issuance of common stock | 3,436 | | | — | |

| Payments on borrowings | (5,662) | | | (1,667) | |

| Proceeds from related party note payable | 5,100 | | | — | |

| | | |

| Tax payments for restricted stock upon vesting | (368) | | | (1,086) | |

| Debt issuance costs | — | | | (164) | |

| Repayments of finance leases | (76) | | | (82) | |

| Net Cash Flows Provided by (Used in) Financing Activities | $ | 2,430 | | | $ | (2,999) | |

| Net (Decrease) Increase in Cash and Cash Equivalents | (1,206) | | | 858 | |

| Cash and Cash Equivalents, beginning of period | 11,917 | | | 14,889 | |

| Cash and Cash Equivalents, end of period | $ | 10,711 | | | $ | 15,747 | |

| | | | | | | | | | | |

| Supplemental cash flow disclosures: | | | |

| Cash paid for interest | $ | 1,664 | | | $ | 1,454 | |

| Fair value of net liabilities assumed in legal settlement | $ | (79) | | | $ | — | |

| Fair value of common stock issued in legal settlement | $ | (352) | | | $ | — | |

| ROU assets obtained in the exchange for lease liabilities: | | | |

| | | |

| Operating leases | $ | 4,677 | | | $ | — | |

| | | |

| | | |

| | | |

| | | |

See accompanying notes to consolidated financial statements.

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

1. Organization

BurgerFi International, Inc. and its wholly owned subsidiaries (“BurgerFi,” or the “Company,” also “we,” “us,” and “our”), is a multi-brand restaurant company that develops, markets and acquires fast-casual and premium-casual dining restaurant concepts around the world, including corporate-owned stores and franchises located in the United States, Puerto Rico and Saudi Arabia.

As of July 3, 2023, the Company had 174 franchised and corporate-owned restaurants of the two following brands:

BurgerFi. BurgerFi is a fast-casual “better burger” concept with 114 franchised and corporate-owned restaurants as of July 3, 2023, offering burgers, hot dogs, crispy chicken, hand-cut fries, frozen custard shakes, beer, wine and more.

Anthony’s. Anthony’s is a pizza and wing brand that operated 60 corporate-owned casual restaurant locations, as of July 3, 2023. The concept is centered around a coal-fired oven, and its menu offers “well-done” pizza, coal-fired chicken wings, homemade meatballs, and a variety of handcrafted sandwiches and salads.

Corporate-owned stores and Franchised stores

Store activity for the six months ended July 3, 2023 and the year ended January 2, 2023 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| July 3, 2023 | | January 2, 2023 |

| Corporate-owned | | Franchised | | Total | | Corporate-owned | | Franchised | | Total |

| Total BurgerFi and Anthony's | 87 | | | 87 | | | 174 | | | 85 | | | 89 | | | 174 | |

| | | | | | | | | | | |

| BurgerFi stores, beginning of the period | 25 | | | 89 | | | 114 | | | 25 | | | 93 | | | 118 | |

| BurgerFi stores opened | — | | | 5 | | | 5 | | | 3 | | | 8 | | | 11 | |

| BurgerFi stores acquired / (transferred) | 2 | | | (2) | | | — | | | (3) | | | 3 | | | — | |

| BurgerFi stores closed | — | | | (5) | | | (5) | | | — | | | (15) | | | (15) | |

| BurgerFi total stores, end of the period | 27 | | | 87 | | | 114 | | | 25 | | | 89 | | | 114 | |

| | | | | | | | | | | |

| Anthony's stores, beginning of period | 60 | | | — | | | 60 | | | 61 | | | — | | | 61 | |

| Anthony's stores opened | — | | | — | | | — | | | — | | | — | | | — | |

| Anthony's stores closed | — | | | — | | | — | | | (1) | | | — | | | (1) | |

| Anthony's total stores, end of the period | 60 | | | — | | | 60 | | | 60 | | | — | | | 60 | |

| | | | | | | | | | | |

Store totals included two international stores at July 3, 2023 and one international store at January 2, 2023. Subsequent to July 3, 2023, the Company closed one Burgerfi and one Anthony’s store.

2. Summary of Significant Accounting Policies

Basis of Presentation

These consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) assuming the Company will continue as a going concern. The going concern assumption contemplates the realization of assets and satisfaction of liabilities in the normal course of business. However, as discussed below and elsewhere through the Quarterly Report on Form 10-Q, substantial doubt about the Company’s ability to continue as a going concern exists. Please see Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, as well as Risk Factors in the Company’s Annual Report on Form 10-K for the year ended January 2, 2023 (the “2022 Form 10-K”), for further information.

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

The Company’s credit agreement (“Credit Agreement”) with a syndicate of banks has approximately $52.8 million in financing outstanding as of July 3, 2023, and expires on September 30, 2025. The Credit Agreement contains numerous covenants, including those whereby the Company is required to meet certain trailing twelve-month quarterly financial ratios and a minimum liquidity requirement. The Company was in compliance with all of the covenants under the Credit Agreement as of July 3, 2023.

As discussed in Note 8 “Commitments and Contingencies” to the consolidated financial statements included within this report, in the case of Second 82nd SM, LLC v. BF NY 82, LLC et al., the Court entered an order granting the Landlord’s Motion for Summary Judgment and ordered a damages hearing on the motion. As a result, unless the parties otherwise agree to a settlement prior to the damages hearing, the Company expects a judgment to be entered against it of at least approximately $1.2 million. The parties, however, continue to discuss possible settlement prior to the damages hearing, including re-opening the BurgerFi restaurant, as well as the payment, including timing, of past due rent amounts to the Landlord. In addition, the Company is considering other alternatives, including the need to refinance or restructure its debt, sell assets, or seek to raise additional capital, including debt or equity. If the Company is unable to implement one or more of these options or is otherwise unsuccessful in negotiating a settlement, which the Company believes is unlikely, and the court entered a final judgment against the Company, management believes it is possible that the Company will not be in compliance with certain of the financial covenants in its Credit Agreement, which would constitute a breach of the Credit Agreement and an event of default if not cured in accordance with its terms.

Any such default would allow the lenders to call the debt sooner than its maturity date of September 30, 2025. In the event that the lenders do call the debt during the next 12 months as the result of a covenant breach, the Company is not forecasted to have the readily available funds to repay the debt, which raises substantial doubt about the Company’s ability to continue as a going concern within one year after the date the consolidated financial statements are issued.

The Company has been and continues to be in communication with the Landlord to negotiate a settlement prior to the damages hearing and is also considering other capital raising options to address any potential judgment, as well as any issues related to meeting the covenant requirements over the next 12 months. Management cannot, however, predict the results of any such negotiations or actions.

The consolidated financial statements do not include any adjustments related to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that results from the uncertainty described above.

The accompanying condensed consolidated financial statements are unaudited and have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and with the instructions for Form 10-Q and Rule 8-03 of Regulation S-X. Pursuant to these rules and regulations, certain information and footnote disclosures normally included in the annual audited consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or omitted. The accompanying condensed consolidated balance sheet as of January 3, 2023 is derived from the Company’s audited financial statements as of that date. Because certain information and footnote disclosures have been condensed or omitted, these condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto as of and for the year ended January 2, 2023 contained in the 2022 Form 10-K.

We are required to evaluate events occurring after July 3, 2023 for recognition and disclosure in the unaudited consolidated financial statements for the quarter and six month periods ended July 3, 2023. Events are evaluated based on whether they represent information existing as of July 3, 2023, which require recognition, or new events occurring after July 3, 2023 which do not require recognition but require disclosure if the event is significant. We evaluated events occurring subsequent to July 3, 2023 through the date of issuance of these unaudited consolidated financial statements.

On July 28, 2022, our Board of Directors approved the change to a 52-53-week fiscal year ending on the Monday nearest to December 31 of each year in order to improve the alignment of financial and business processes following the acquisition of Anthony’s. Our second fiscal quarter of 2023 ended on July 3, 2023. Our current fiscal year will end on January 1, 2024. As of June 30, 2022, the BurgerFi brand operated on a calendar year-end and the Anthony’s brand operated on a 52-53-week fiscal year. Differences arising from the different fiscal period-ends were not deemed material for the quarter ended June 30, 2022.

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

Principles of Consolidation

The consolidated financial statements present the consolidated financial position, results from operations and cash flows of BurgerFi International, Inc., and its wholly owned subsidiaries. All material balances and transactions between the entities have been eliminated in consolidation.

Reclassifications

Certain reclassifications have been made to the prior year presentation to conform to the current year presentation.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingencies at the date of the unaudited consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

New Accounting Pronouncements

The Company reviewed all recently issued accounting pronouncements and concluded that they were not applicable or not expected to have a significant impact on the accompanying consolidated financial statements.

Employer Retention Tax Credits

As of July 3, 2023 and January 2, 2023, the Company had $0.1 million and $1.5 million, respectively, of receivables related to the Taxpayer Certainty and Disaster Relief Act of 2020 included in prepaid expenses and other current assets in the accompanying consolidated balance sheets.

Prepaid expenses

The Company routinely issues prepayments to landlords, insurers and vendors in the ordinary course of business. As of July 3, 2023 and January 2, 2023, the Company had $1.3 million and $0.9 million, respectively of prepayments included in prepaid expenses and other current assets in the accompanying consolidated balance sheets.

Assets Held for Sale

The Company has classified assets held for sale in the accompanying consolidated balance sheets $1.5 million as of July 3, 2023 and $0.7 million as of January 2, 2023 of certain store property and equipment, and intangible assets that the Company expects to be sold within one year. Assets held for sale are reviewed each reporting period to ensure that the fair value less cost to sell exceeds the carrying value.

In February 2020, the Company entered into an asset purchase agreement with an unrelated third party for the sale of substantially all of the assets used in connection with the operation of BF Dania Beach, LLC. The closing of this transaction has been delayed due to additional negotiation that has been on-going. In the event the transaction is terminated, the Company will begin operating this BurgerFi restaurant, and return the deposit of $0.9 million included in other current assets to the unrelated third-party purchaser. Assets used in the operations of BF Dania Beach, LLC totaling $0.7 million have been classified as held for sale in the accompanying consolidated balance sheets as of July 3, 2023 and January 2, 2023. In March 2023, the Company approved a plan for sale of an intangible asset of an Anthony’s location with a carrying value of $0.8 million, which is classified as held for sale in the accompanying consolidated balance sheets as of July 3, 2023.

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

Other Current Liabilities

The Company incurs liabilities associated with the sale of gift cards and gift certificates. As of July 3, 2023 and January 2, 2023, the Company had $1.0 million and $1.8 million, respectively of gift card and gift certificate liabilities included in other current liabilities on the accompanying consolidated balance sheets.

The Company incurs liabilities resulting from its customer loyalty program. As of July 3, 2023 and January 2, 2023, the Company had $0.9 million and $0.8 million, respectively of liabilities for loyalty program in the accompanying consolidated balance sheets.

Restructuring Costs

Restructuring costs include management and employee separation, severance, and relocation costs, as well as store closure related charges. All costs are expensed as incurred, and are reflected as “Restructuring costs and other charges, net” in the accompanying consolidated statements of operations. Restructuring costs and other charges, net for the quarter and six months ended July 3, 2023 was $1.1 million and $2.2 million, respectively. For the quarter and six months ended July 3, 2023, $1.1 million, respectively, related to severance for the departure of Chief Executive Officer and Chief Financial Officer. During the six months ended July 3, 2023, $1.1 million was recorded primarily in connection with the Company’s Credit Facility requirements to raise additional capital or debt. Restructuring costs and other charges, net for the quarter and six months ended June 30, 2022 of $0.1 million and $1.0 million, respectively, related to store pre-opening costs and store closure costs.

3. Property & Equipment

Property and equipment consisted of the following:

| | | | | | | | | | | |

| (in thousands) | July 3, 2023 | | January 2, 2023 |

| Leasehold improvements | $ | 17,623 | | | $ | 17,029 | |

| Kitchen equipment and other equipment | 8,450 | | | 8,196 | |

| Computers and office equipment | 1,549 | | | 1,468 | |

| Furniture and fixtures | 2,870 | | | 2,677 | |

| Vehicles | 6 | | | 37 | |

| 30,498 | | | 29,407 | |

| Less: Accumulated depreciation and amortization | (12,251) | | | (10,036) | |

| Property and equipment – net | $ | 18,247 | | | $ | 19,371 | |

Depreciation and amortization expense on property and equipment totaled $1.2 million and $2.3 million for the quarter and six months ended July 3, 2023. Depreciation and amortization expense on property and equipment totaled $2.6 million and $4.9 million for the quarter and and six months ended June 30, 2022. Depreciation and amortization expense decreased due to assets fully depreciating and impairments taken during 2022.

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

4. Goodwill and Intangible Assets, Net

The following is a summary of the components of goodwill and intangible assets, net:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| July 3, 2023 | | January 2, 2023 |

| (in thousands) | Amount | | Accumulated Amortization | | Net Carrying Value | | Amount | | Accumulated Amortization | | Net Carrying Value |

| Intangible assets subject to amortization: | | | | | | | | | | | |

| Franchise agreements | $ | 24,839 | | | $ | (9,019) | | | $ | 15,820 | | | $ | 24,839 | | | $ | (7,245) | | | $ | 17,594 | |

| BurgerFi trade names / trademarks | 83,033 | | | (7,035) | | | 75,998 | | | 83,035 | | | (5,650) | | | 77,385 | |

| Anthony's trade names / trademarks | 60,690 | | | (3,372) | | | 57,318 | | | 60,691 | | | (2,360) | | | 58,331 | |

| License agreement | 1,177 | | | (1,131) | | | 46 | | | 1,176 | | | (1,063) | | | 113 | |

| VegeFi product | 135 | | | (34) | | | 101 | | | 135 | | | (28) | | | 107 | |

| Subtotal | $ | 169,874 | | | $ | (20,591) | | | $ | 149,283 | | | $ | 169,876 | | | $ | (16,346) | | | $ | 153,530 | |

| Liquor licenses | $ | 5,930 | | | $ | — | | | $ | 5,930 | | | $ | 6,678 | | | $ | — | | | $ | 6,678 | |

| | | | | | | | | | | |

| Total intangible assets, net | | | | | $ | 155,213 | | | | | | | $ | 160,208 | |

| | | | | | | | | | | |

| Goodwill: | | | | | | | | | | | |

| BurgerFi | $ | — | | | | | | | $ | — | | | | | |

| Anthony's | 31,621 | | | | | | | 31,621 | | | | | |

| Total | $ | 31,621 | | | | | | | $ | 31,621 | | | | | |

| | | | | | | | | | | |

Intangible asset amortization expense totaled $2.1 million for the quarters ended July 3, 2023 and June 30, 2022 and $4.2 million for the six months ended July 3, 2023 and June 30, 2022.

5. Contract Liabilities

A roll forward of contract liabilities included of which the current portion is included in other current liabilities and other noncurrent liabilities on our consolidated balance sheet is as follows:

| | | | | | | | | | | | | | |

| | Six Months Ended |

| (in thousands) | | July 3, 2023 | | June 30, 2022 |

| Balance, beginning of period | | $ | 1,092 | | | $2,577 |

| Initial/Transfer franchise fees received | | 203 | | | 291 | |

| Revenue recognized for stores open and transfers during period | | (100) | | | (253) | |

| Revenue recognized related to franchise agreement terminations | | (374) | | | (433) | |

| Other unearned revenue (recognized) received | | (39) | | | — | |

| Balance, end of period | | $ | 782 | | | $2,182 |

Franchise Revenue

Revenue recognized during the periods included in royalty and other fees on our consolidated statement of operations shown was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Six Months Ended |

| (in thousands) | July 3, 2023 | | June 30, 2022 | | July 3, 2023 | | June 30, 2022 |

| Franchise Fees | $ | 380 | | | $ | 534 | | | $ | 513 | | | $ | 686 | |

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

6 Net Loss Per Share

Net Loss per common share is computed by dividing Net Loss by the weighted average number of common shares outstanding for the period. The Company has considered the effect of (1) warrants outstanding to purchase 15,063,800 shares of common stock and (2) 75,000 shares of common stock and warrants to purchase 75,000 shares of common stock in the unit purchase option, (3) 1,724,639 shares of restricted stock units outstanding in the calculation of income per share, and (4) the impact of any dividends associated with our redeemable preferred stock. As the effect of these on the computation of net loss per common share would have been anti-dilutive, they were excluded from the weighted average number of common shares outstanding.

Basic and diluted net loss per common share is calculated as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands, except for per share data) | Quarter Ended | | Six Months Ended | | | |

| Numerator: | July 3, 2023 | | June 30, 2022 | | July 3, 2023 | | June 30, 2022 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net loss available to common stockholders - diluted | $ | (6,001) | | | $ | (60,377) | | | $ | (15,153) | | | $ | (73,937) | | | | | | |

| | | | | | | | | | | | |

| Denominator: | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Diluted weighted-average shares outstanding | 24,891,449 | | | 22,214,628 | | | 24,216,199 | | | 22,089,799 | | | | | | |

| | | | | | | | | | | | |

| Basic and diluted net loss per common share | $ | (0.24) | | | $ | (2.72) | | | $ | (0.63) | | | $ | (3.35) | | | | | | |

| | | | | | | | | | | | |

For the quarter and and six months ended July 3, 2023 and June 30, 2022, there were no dilutive warrants.

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

7. Related Party Transactions

The Company is affiliated with various entities through common control and ownership.

On January 23, 2023, the Company settled a claim filed by a significant stockholder. The settlement resulted in the transfer of five BurgerFi entities from the stockholder to the Company of which two were operating stores and three were entities that historically had operated stores but have since closed. The fair value of consideration paid in the settlement was $0.9 million and included $0.5 million in cash and the issuance of 200,000 shares in common stock valued at $0.4 million. The fair value of net liabilities assumed in the transaction was $0.1 million which included lease liabilities and operating assets and liabilities including property and equipment of two operating stores, net of pre-existing liabilities accrued.

The accompanying consolidated balance sheets as of January 2, 2023 reflect amounts related to periodic advances between the Company and these entities for working capital and other needs as due from related companies or due to related companies, as appropriate. There were no amounts due from related companies as of July 3, 2023 as a result of the settlement with the significant stockholder. There was approximately $0.3 million due from related parties included in other assets in the accompanying consolidated balance sheets as of January 2, 2023.

During 2022, the Company received royalty revenue from the two operating stores that were transferred on January 23, 2023 as a result of the settlement with the significant stockholder of $0.1 million for the quarter and six months ended June 30, 2022.

The Company leased building space for its former corporate office from an entity under common ownership with a significant stockholder. This lease had a 36-month term, effective January 1, 2020. In January 2022, the Company exercised its right to terminate this lease effective as of July 2022. For the quarter and six months ended June 30, 2022, rent expense related to this lease was approximately $0.1 million.

Pursuant to a lease amendment entered into in February 2022, the Company leases building space for its corporate office from an entity controlled by the Company's Executive Chairman of the Board. This lease has a 10-year term with an option to renew. For the quarter and six months ended July 3, 2023, and June 30, 2022, rent expense was approximately $0.1 million and $0.2 million, respectively.

The Company has an independent contractor agreement with a corporation (the “Consultant”) for which the Chief Operating Officer (the “Consultant Principal”) of Lionheart Capital, LLC, an entity controlled by the Company’s Executive Chairman of the Board, serves as President. Pursuant to the terms of the agreements, the Consultant shall provide certain strategic advisory services to the Company in exchange for total annual cash compensation and expense reimbursements of $0.1 million, payable monthly.

On January 3, 2023, the Company awarded the Consultant Principal an $0.1 million bonus in connection with the Company’s amendment and extension of its Credit Facility and granted the Consultant Principal 38,000 unrestricted shares of common stock of the Company. The Company recorded share-based compensation associated with this grant of approximately $0.1 million for the six months ended July 3, 2023. There was no expense included for the quarter ended July 3, 2023.

On January 3, 2022, the Company granted the Consultant Principal 37,959, respectively, of unrestricted shares of common stock of the Company. The Company recorded share-based compensation associated with this grant of approximately $0.1 million and $0.2 million, respectively, during the quarter and and six months ended June 30, 2022 and $0.2 million for the six months ended July 3, 2023. There was no expense included for the quarter ended July 3, 2023.

On June 3, 2023, the Company entered into a stock purchase agreement with an investing entity for the sale of 2,868,853 shares of Company common stock at an issuance price of $1.22 per share for a total of $3.4 million. Upon the execution of this agreement, the investing entity became a holder of approximately 11% of the Company’s outstanding common stock at July 3, 2023.

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

8. Commitments and Contingencies

Litigation

John Walker, Individually and On Behalf of all Other Similarly Situated v. BurgerFi International, Inc. et al (in the United States District Court, Southern District of Florida, Case No. 023-cv-60657). On April 6, 2023, John Walker, on behalf of himself and other similarly situated plaintiffs, filed a class action lawsuit against the Company and certain current and former executives alleging that the Company violated certain securities laws by making false and misleading statements or failed to disclose that (1) the Company had overstated the effectiveness of its acquisition and growth strategies, and (2) the Company had misrepresented the purported benefits of the Anthony’s acquisition and the post-acquisition business and financial prospects of the Company. On July 20, 2023, the court appointed John Walker and Joseph Poalino as co-lead plaintiffs in the matter. We believe that all claims are meritless and plan to vigorously defend these allegations. Management is unable to determine the likelihood of a loss or range of loss, if any, which may result from the case described above, and, therefore, no contingent liability has been recorded as of January 2, 2023 or July 3, 2023; any losses, however, may be material to the Company's financial position and results of operations.

Second 82nd SM, LLC v. BF NY 82, LLC, BurgerFi International, LLC and BurgerFi International, Inc. (in the Supreme Court of the State of New York County of New York, having index No. 654907/2021 filed August 11, 2021). A lawsuit was filed by Second 82nd SM, LLC (“Landlord”) against BF NY 82, LLC (“Tenant”) whereby Landlord brought a seven-count lawsuit for, among other things, breach of the lease agreement and underlying guaranty of the lease. The amount of damages Landlord is seeking approximately $1.5 million, which constitutes back rent, late charges, real estate taxes, illuminated sign charges and water/sewer charges. On November 3, 2021, the Company filed a Motion to Dismiss the Complaint. On November 17, 2021, the Tenant filed an Answer to Landlord’s Complaint and a cross claim against the Company, which the Company answered on December 7, 2021. On December 22, 2021, the Company filed its Response in Opposition to Landlord’s Motion for Summary Judgment and Memo in further Support of its Motion to Dismiss. The Company turned over possession of the property in early 2023. On July 5, 2023, the Landlord filed a Motion of Summary Judgment seeking approximately $1.2 million in past due rent payments. On August 14, 2023, the Court entered an order granting the Landlord’s Motion for Summary Judgment and ordered a damages hearing on the motion, which has not yet been scheduled. As a result, unless the parties otherwise agree to a settlement prior to the damages hearing, the Company expects a judgment to be entered against it of at least approximately $1.2 million. The parties continue to discuss possible settlement, including re-occupying the location, as well as the payment, including timing, of past due rent amounts to the Landlord. In the event of any such final judgment following the damages hearing, which the Company believes would be unlikely because it intends to enter into a settlement prior to the damages hearing or, if not, plans to raise additional capital prior to any judgment, it is possible the Company would not be in compliance with its Credit Agreement covenants, which could result in an event of default and an acceleration of all outstanding debt under the Credit Agreement. See Risk Factors included in our 2022 Form 10-K for a discussion of the potential material consequences to such an event.

Lion Point Capital, L.P.(“Lion Point”) v. BurgerFi International, Inc. (Supreme Court of the State of New York County of New York, Index No. 653099/2022, filed August 26, 2022. A lawsuit filed by Lion Point against the Company, alleging that the Company failed to timely register Lion Point’s shares in violation of the registration rights agreement to which Lion Point is a party, which allegedly resulted in losses in excess of $26 million. In November 2022, as amended in February 2023, the Company filed its answer to the complaint. On April 13, 2023, Lion Point filed a Motion for Summary Judgment, and the Company responded with its reply on June 22, 2023. The Company continues to believe that all claims are meritless and plans to vigorously defend these allegations. Management is unable to determine the likelihood of a loss or range of loss, if any, which may result from the case described above, and, therefore, no contingent liability has been recorded as of January 2, 2023 or July 3, 2023; any losses, however, may be material to the Company's financial position and results of operations.

Burger Guys of Dania Pointe, et. al. v. BFI, LLC (Circuit Court of the 15th Judicial Circuit in and for Palm Beach County, Florida, Case No. 50-2021-CA -006501-XXXX-MB filed May 21, 2021). In response to a demand letter issued by BurgerFi to Gino Gargiulo, a former franchisee, demanding that Mr. Gargiulo pay the balance owed under an asset purchase agreement wherein BurgerFi sold the Dania Beach, Florida BurgerFi location to Mr. Gargiulo, Mr. Gargiulo filed suit against BurgerFi claiming, in addition to other matters, that no further monies are owed under the asset purchase agreement and alleges that the Company is responsible for one of Mr. Gargiulo’s failed franchises in Sunny Isles, Florida, losses he has allegedly sustained at his Dania Beach location, and reimbursement of expenses in connection with his marketing company. Mr. Gargiulo seeks damages in excess of $2 million in the aggregate. The parties attended mediation

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

on January 20, 2022, which ended in an impasse. Mr. Gargiulo amended his complaint in April 2022, which, among other matters, amended the defendant parties. In October 2022, the Company filed an additional motion to dismiss the amended complaint and a motion to stay discovery. In January 2023, Mr. Gargiulo filed a third amended complaint. In March 2023, the Company filed an answer to Mr. Gargiulo’s complaint and a counterclaim against Mr. Gargiulo relating to the breach of the asset purchase agreement discussed above. The matter is scheduled for trial in the second half of 2023. We believe that all Mr. Gargiulo claims are meritless, and the Company plans to vigorously defend these allegations. Management is unable to determine the likelihood of a loss or range of loss, if any, which may result from the case described above, and, therefore, no contingent liability has been recorded as of January 2, 2023 or July 3, 2023; any losses, however, may be material to the Company's financial position and results of operations.

All Round Food Bakery Products, Inc. v. BurgerFi International, LLC and Neri’s Bakery Products, Inc. et al (Supreme Court Westchester County, New York (Index Number 52170-2020)). In a suit filed in February 2020, the plaintiff, All Round Food Bakery Products, Inc. (“All Round Food”) alleges breach of contract and lost profits in excess of $1 million over the course of the supply agreement with the Company and Neri’s Bakery Products, Inc. (“Neri’s” and together with the Company, the “Defendants”). The Defendants assert, among other matters, that the supply agreement amongst the parties, whereby All Round Food was warehousing BurgerFi products produced by Neri’s, was terminated when All Round Food failed to cure its material breach of the supply agreement after due notice. The parties attended several additional court ordered mediations during over the last several months to attempt to resolve the dispute, however, no resolution has been reached. We believe that all claims are meritless, and the Company plans to vigorously defend these allegations. Management is unable to determine the likelihood of a loss or range of loss, if any, which may result from the case described above, and, therefore, no contingent liability has been recorded as of January 2, 2023 or July 3, 2023; any losses, however, may be material to the Company's financial position and results of operations.

Employment Related Claims.

In July 2021, the Company received a demand letter from the attorney of one of its now former hourly restaurant employees. The letter alleges that the former employee was sexually harassed by one of her co-workers. The demand letter claims that the Company discriminated and retaliated against the former employee based on her gender and age and also alleged intentional infliction of emotional distress, negligent hiring, negligent training, and negligent supervision. While the Company entered into a partial settlement with the former employee in December 2022 for a de minimus cash amount relating solely to the discrimination claim, the other claims remain.

While the Company believes that all claims of the above mentioned Employment Related Claims, which are covered under the Company’s insurance policies, are meritless, and it plans to defend these allegations, it is reasonably possible that the Company may ultimately be required to pay damages to the claimants, which could be up to $0.5 million or more in aggregate compensatory damages, attorneys’ fees and costs. Management believes that any liability, in excess of applicable insurance coverages or accruals, which may result from these claims, would not be significant to the Company’s financial position or results of operations.

General Liability and Other Claims.

The Company is subject to other legal proceedings and claims that arise during the normal course of business, including landlord disputes, slip and fall cases, and various food related matters. While it intends to vigorously defend these matters, it is reasonably possible that the Company may be required to pay substantial damages to the claimants. Management believes that any liability, in excess of applicable insurance coverages or accruals, which may result from these claims, would not be significant to the Company’s financial position or results of operations.

Purchase Commitments

From time to time, we enter into purchase commitments for certain food commodities in the normal course of business. As of July 3, 2023, we entered into approximately $3.2 million in unconditional purchase obligations over the next twelve months.

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

9. Leases

The Company has entered into various lease agreements and these agreements expire on various dates through 2032 and have renewal options.

The components of lease expense for the periods shown is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Six Months Ended |

| (in thousands) | Classification | July 3, 2023 | | June 30, 2022 | | July 3, 2023 | | June 30, 2022 |

| Operating lease cost | Occupancy and related expenses

Pre-opening costs

Store closure costs | $ | 3,218 | | | $ | 3,097 | | | $ | 6,463 | | | $ | 6,348 | |

| Finance lease cost: | | | | | | | | |

| Amortization of right-of-use assets | Depreciation and amortization expense | 55 | | | 82 | | | 113 | | | 134 | |

| Interest on lease liabilities | Interest expense | 13 | | | 19 | | | 27 | | | 31 | |

| Less: Sublease income | Occupancy and related expenses | (47) | | | (47) | | | (94) | | | (94) | |

| Total lease cost | | $ | 3,239 | | | $ | 3,151 | | | $ | 6,509 | | | $ | 6,419 | |

| | | | | | | | |

| | | | | | | | |

The maturity of the Company's operating and finance lease liabilities as of July 3, 2023 is as follows:

| | | | | | | | | | | |

| (in thousands) | Operating Leases | | Finance Leases |

| One Year | $ | 12,274 | | | $ | 142 | |

| Two Years | 12,154 | | | 182 | |

| Three Years | 11,687 | | | 167 | |

| Four Years | 9,804 | | | 158 | |

| Five Years | 8,173 | | | 152 | |

| Thereafter | 10,217 | | | 208 | |

| | | |

| Total undiscounted lease payments | 64,309 | | | 1,009 | |

| Less: present value adjustment | (11,146) | | | (158) | |

| Total net lease liabilities | $ | 53,163 | | | $ | 851 | |

As most of the Company's leases do not provide an implicit rate, the Company uses its incremental borrowing rate based on the information available at the commencement date in determining the present value of lease payments. The Company gives consideration to its recent debt issuances as well as publicly available data for instruments with similar characteristics when calculating its incremental borrowing rates.

A summary of lease terms and discount rates for finance and operating leases is as follows:

| | | | | | | | | | | |

| July 3, 2023 | | June 30, 2022 |

| Weighted-average remaining lease term (in years) | | | |

| Operating leases | 5.8 | | 6.4 |

| Finance leases | 5.9 | | 6.6 |

| Weighted-average discount rate | | | |

| Operating leases | 7.1 | % | | 6.0 | % |

| Finance leases | 6.0 | % | | 6.0 | % |

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

10. Debt

| | | | | | | | | | | |

| (in thousands) | July 3, 2023 | | January 2, 2023 |

| Term loan | $ | 52,880 | | | $ | 54,507 | |

| Related party note payable | 15,100 | | | 10,000 | |

| Revolving line of credit | — | | | 4,000 | |

| Other notes payable | 744 | | | 780 | |

| Finance lease liability | 851 | | | 933 | |

| Total Debt | $ | 69,575 | | | $ | 70,220 | |

| Less: Unamortized debt discount to related party note | (688) | | | (765) | |

| Less: Unamortized debt issuance costs | (1,204) | | | (1,441) | |

| Total Debt, net | 67,683 | | | 68,014 | |

| Less: Short-term borrowings, including finance leases | (3,485) | | | (4,985) | |

| Total Long-term borrowings, including finance leases and related party note payable | $ | 64,198 | | | $ | 63,029 | |

The Company is party to a credit agreement with a syndicate of commercial banks (as amended, the “Credit Agreement”), which provides the Company with lender financing structured as a $52.9 million term loan and a $4.0 million available under the line of credit as of July 3, 2023, with a maturity date of September 30, 2025.

On February 1, 2023, the Credit Agreement was amended through the Fourteenth Amendment and subsequently on February 24, 2023 further amended through the Fifteenth Amendment resulting in the Company and its subsidiaries entering into a Secured Promissory Note (the “Note”) with CP7 Warming Bag L.P., an affiliate of L. Catterton Fund L.P., as lender (the “Junior Lender”), pursuant to which the Junior Lender continued that certain delayed draw term loan (the “Delayed Draw Term Loan”) of $10.0 million, under the Credit Agreement, which is junior subordinated secured indebtedness, and also provided $5.1 million of new junior subordinated secured indebtedness, to the Company (collectively (the “Junior Indebtedness”), for a total of $15.1 million in junior subordinated secured debt on terms reasonably acceptable to the Required Lenders (as defined in the Credit Agreement), including, without limitation, that (1) such indebtedness shall not mature until at least two (2) years after the maturity date of the credit facility of September 30, 2025; (2) no payments of cash interest shall be made on such indebtedness until after the repayment in full of the obligations under the Credit Agreement; and (3) no scheduled or voluntary payments of principal shall be made until after the repayment in full of the obligations under the Credit Agreement.

The terms of the Credit Agreement require the Company to repay the principal of the term loan in quarterly installments with the balance due at the maturity date, as follows:

| | | | | | | | |

| in thousands | | |

| 2023 | | $ | 3,254 | |

| 2024 | | 3,254 | |

| 2025 | | 46,372 | |

| Total | | $ | 52,880 | |

The Credit Agreement, including the term loan and revolving line of credit, is secured by substantially all of the Company’s assets and incur interest on outstanding amounts at the following rates per annum through maturity:

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

| | | | | |

| Time Period | Interest Rate |

| Through December 31, 2022 | 6.75% |

| From January 1, 2023 through June 15 2023 | 6.75% |

| From June 16, 2023 through December 31, 2023 | 6.75% |

| From January 1, 2024 through June 15, 2024 | 7.25% |

| From June 16, 2024 through maturity | 7.75% |

The Delayed Draw Term Loan is a non-interest bearing loan and accordingly was recorded at fair value as part of the Anthony’s acquisition which resulted in a debt discount of approximately $1.3 million and is being amortized over the period of the Delayed Draw Term Loan. For the quarter and six months periods ended July 3, 2023, the Company recorded $0.1 million of amortization of the debt discount, which is included within interest expense in the accompanying consolidated statements of operations.

The Junior Indebtedness, which accrues interest at 4% per annum (i) is secured by a second lien on substantially all of the assets of the the Company and the subsidiary guarantors (the “Guarantors”) pursuant to the terms and that certain Guaranty and Security Agreement, dated February 24, 2023, by and among the Guarantors and the junior lender, (ii) is subject to the terms of that certain Intercreditor and Subordination Agreement dated February 24, 2023, by and between the Administrative Agent and the junior lender and acknowledged by the borrowers and the guarantors, and (iii) matures on the date that is the second anniversary of the maturity date under the Credit Agreement (the “Junior Maturity Date”) (September 30, 2027, based on the maturity date under the Credit Agreement of September 30, 2025).

Under the terms of the Junior Indebtedness, no payments of cash interest or payments of principal shall be due until the Junior Maturity Date, and no voluntary prepayments may be made on the Junior Indebtedness prior to the Junior Maturity Date until after the repayment in full of the obligations under the Credit Agreement.

The Company had $14.4 million and $9.2 million recorded, net of unamortized discount under the Junior Indebtedness as of July 3, 2023 and January 2, 2023, respectively, included in related party note payable in the accompanying consolidated balance sheets.

The amendments to the Credit Agreement and the Delayed Draw Term Loan were accounted for as modifications of debt in the Company’s accompanying consolidated financial statements.

For the quarter and six months ended July 3, 2023 and June 30, 2022, interest expense consisted of:

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Six Months Ended |

| (in thousands) | July 3, 2023 | | June 30, 2022 | | July 3, 2023 | | June 30, 2022 |

| Interest on credit agreement | $ | 1,079 | | | $ | 1,024 | | | $ | 2,130 | | | $ | 1,830 | |

| Amortization of debt issuance costs | 38 | | | 110 | | | 77 | | | 292 | |

| Amortization of related party note discount | 130 | | | 128 | | | 237 | | | 255 | |

| Non-cash interest on redeemable preferred stock | 1,042 | | | 963 | | | 2,064 | | | 1,908 | |

| Other interest expense (income) | (78) | | | 20 | | | (218) | | | 33 | |

| $ | 2,211 | | | $ | 2,246 | | | $ | 4,289 | | | $ | 4,318 | |

BurgerFi International Inc., and Subsidiaries

Notes to Consolidated Financial Statements (Unaudited)

11. Income Taxes

For the quarter and six months ended July 3, 2023, the Company's effective income tax rate was 0.0%. The difference from the U.S. corporate statutory federal income tax rate of 21%, is primarily the result of the valuation allowance applied to reduce the Company’s deferred tax assets to the amount that is more likely than not to be realized. For the quarter and six months ended June 30, 2022, the Company's effective income tax rate was 0.6%, differing from the U.S. corporate statutory federal income tax rate of 21%, and the difference is primarily the result of the valuation allowance applied to reduce the Company’s deferred tax assets to the amount that is more likely than not to be realized. As of July 3, 2023, the Company had unrecognized tax benefits of $0.2 million.

12. Stockholders' Equity

Common Stock

The Company is authorized to issue 100,000,000 shares of common stock with a par value of $0.0001 per share. Holders of the Company’s common stock are entitled to one vote for each share. At July 3, 2023 and January 2, 2023, there were 26,724,218 shares and 22,257,772 shares of common stock outstanding, respectively.

Preferred Stock