BridgeBio Pharma, Inc. (Nasdaq: BBIO) (BridgeBio or the Company), a

new type of biopharmaceutical company focused on genetic diseases,

today reported its financial results for the third quarter ended

September 30, 2024, and provided an update on the Company’s

operations.

“I’m grateful for the continued progress that we

have seen across our late-stage pipeline, and I’m excited for the

upcoming opportunity to serve patients with ATTR-CM in the

commercial marketplace,” said Dr. Neil Kumar, Ph.D., CEO and

Founder of BridgeBio. “Underpinning this headway is a corporate

experiment we have been conducting for over 9 years now that posits

a new type of biotech business model, and so I’m also proud to have

released our first case study in The Journal of Portfolio

Management, highlighting salient elements of that model.”

Pipeline overview:

|

Program |

Status |

Next expected milestone |

|

Acoramidis for ATTR-CM |

NDA filed with U.S. FDA |

November 29, 2024 PDUFA date |

|

Encaleret for ADH1 |

Enrolling CALIBRATE, Phase 3 study |

Enrollment completion in 2024 |

|

BBP-418 (ribitol) for LGMD2I/R9 |

FORTIFY, Phase 3 study enrollment completed |

Interim analysis in 2025 |

|

Infigratinib for achondroplasia |

Enrolling PROPEL 3, Phase 3 study |

Enrollment completion in 2024 |

|

Infigratinib for hypochondroplasia |

Enrolling observational run-in for ACCEL 2, Phase 2 study |

Enrollment completion date to be announced |

|

BBP-812 for Canavan disease |

Enrolling at high dose in Phase 1/2 study |

Enrollment completion date to be announced |

Late-stage investigational programs

updates:

- Acoramidis – Near-complete transthyretin (TTR)

stabilizer for transthyretin amyloid cardiomyopathy

(ATTR-CM):

- Based on the positive results from ATTRibute-CM, BridgeBio

filed a new drug application (NDA) to the FDA, which has been

accepted with a PDUFA action date of November 29, 2024, and the

late cycle meeting with the FDA has been completed.

- Outcomes data through 42 months from the ongoing long-term

open-label extension (OLE) of ATTRibute-CM, the Company’s Phase 3

study of acoramidis in ATTR-CM, will be shared at the American

Heart Association (AHA) Scientific Sessions on November

18th.

- During the European Society of Cardiology (ESC) 2024, a new

analysis was shared in an oral presentation, showing:

- Increased serum TTR at Day 28 of ATTRibute-CM was correlated

with reduced risk of ACM, cardiovascular mortality (CVM) and CVH in

ATTR-CM.

- A mean of 3.0mg/dL increase in serum transthyretin (TTR) at

Month 1 of the OLE (n=21) and mean of 3.4mg/dL increase in serum

TTR at Month 6 of the OLE (n=18) in participants who switched from

tafamidis and placebo to acoramidis in the ATTRibute-CM study.

- A post-hoc analysis of ATTRibute-CM evaluating the effect of

acoramidis on the composite endpoint of ACM and recurrent CVH

events was shared at the Heart Failure Society of America (HFSA)

Annual Scientific Meeting 2024, which included the following

data:

- A 42% reduction in composite ACM and recurrent CVH events at 30

months observed with acoramidis treatment compared to placebo by

applying a negative binomial regression model (post-hoc)

(p=0.0005).

- A 42% reduction in the total number of ACM and recurrent CVH

events per patient observed over 30 months with acoramidis

treatment compared to placebo.

- A 30.5% hazard reduction in ACM and recurrent CVH events at 30

months observed with acoramidis treatment compared to placebo by

applying the Andersen-Gill model (post-hoc) (p=0.0008).

- BridgeBio announced the initiation of a scientific

collaboration with the CarDS Lab, led by

cardiologist-data scientist, Rohan Khera, M.D., M.S. at the Yale

School of Medicine, for the launch of the TRACE-AI Network, a novel

paradigm of large-scale federated AI screening for

ATTR-CM.

- Upon FDA approval of acoramidis, it is our intent to honor the

courage of our U.S. clinical trial patients by providing them

acoramidis free for life.

- Encaleret – Calcium-sensing receptor (CaSR) antagonist

for autosomal dominant hypocalcemia type 1 (ADH1):

- CALIBRATE, the Phase 3 clinical trial of encaleret in ADH1,

completed screening; the Company anticipates completing enrollment

of the CALIBRATE study in 2024.

- Proof-of-principle data of encaleret, an oral option for

post-surgical hypoparathyroidism, were presented at the American

Society for Bone Mineral Research meeting demonstrating a

concomitant normalization of blood and urine calcium in 86% of

participants within 5 days.

- BBP-418 (ribitol) – Glycosylation substrate for

limb-girdle muscular dystrophy type 2I/R9 (LGMD2I/R9):

- BridgeBio completed enrollment of FORTIFY, the Company’s Phase

3 registrational study of BBP-418 in individuals with LGMD2I/R9,

with topline data readout from the interim analysis expected in

2025.

- BridgeBio believes there is an opportunity to pursue

Accelerated Approval in the U.S. for BBP-418 in LGMD2I/R9 based on

a potential biomarker surrogate endpoint of glycosylated

alpha-dystroglycan (αDG) at time of the interim

analysis.

- The FDA has granted Rare Pediatric Disease Designation for

BBP-418 in the treatment of LGMD2I/R9. If BBP-418 is approved,

BridgeBio may qualify for a Priority Review Voucher, which can be

applied to another therapy in the Company’s pipeline for a shorter

timeline during the review process of a New Drug Application or can

be sold and transferred to another company looking to receive

priority review for one of its applications.

- Infigratinib – FGFR1-3 inhibitor for achondroplasia and

hypochondroplasia:

- The FDA granted Breakthrough Therapy Designation to

infigratinib for demonstrating substantial improvement in efficacy

over available therapies on clinically significant

endpoint(s).

- The PROPEL 3 global Phase 3 registrational study of

infigratinib in achondroplasia continues to enroll; study

completion anticipated by the end of the year. PROPEL, BridgeBio’s

observational lead-in study in achondroplasia for PROPEL 3, has

completed enrollment.

- The initial phase of MyAchonJourney, a new

online resource to support individuals and families living with

achondroplasia, was launched.

- ACCEL 2/3 will be a global Phase 2/3 multicenter, single-dose

study, to evaluate the efficacy and safety of 0.25mg/kg/day of

infigratinib in children living with hypochondroplasia. ACCEL,

BridgeBio’s observational lead-in study for hypochondroplasia,

continues to enroll.

- BBP-812 – Adeno-associated virus (AAV) 9 gene therapy

for Canavan disease:

- The Canavan disease program received RMAT Designation based on

preliminary clinical evidence from the CANaspire Phase 1/2 clinical

trial.

- BridgeBio will leverage the benefits of RMAT designation,

including early and more frequent interactions with the FDA, to

establish an Accelerated Approval pathway for BBP-812.

- New positive data from the high-dose cohort includes:

- Progressive and continued post-dose improvement in gross motor

function (measured by Gross Motor Function Measure (GMFM)-88) and

achievement of motor milestones (measured by Hammersmith Infant

Neurological Examination (HINE)-2).

- In the low-dose cohort, these strikingly divergent trajectories

resulted in statistically significant improvements in achieved

motor function and milestones at 12-months after treatment with

BBP-812, compared to what is observed in and predicted by the

natural history of the disease seen in BridgeBio’s study,

CANinform; data from the high dose cohort are not yet

available.

Third Quarter 2024 Financial

Results:

“We are prepared to launch acoramidis in the U.S.,

upon approval by the FDA, at the end of 2024 as well as to read out

our three ongoing Phase 3 studies in 2025,” said Brian Stephenson,

Ph.D., CFA, Chief Financial Officer of BridgeBio. “As we continue

to move our late-stage pipeline forward, we are excited to also

take an initial step in explaining the thesis and underlying logic

of our decision making with the recent release of our case study in

The Journal of Portfolio Management.”

Cash, Cash Equivalents, and Short-term

Restricted Cash

Cash, cash equivalents and short-term restricted

cash, totaled $405.7 million as of September 30, 2024,

compared to $392.6 million of cash, cash equivalents and short-term

restricted cash as of December 31, 2023. The $13.1 million net

increase in cash, cash equivalents and short-term restricted cash

was primarily attributable to net proceeds received from the term

loan under the credit facility with Blue Owl of $434.0 million, net

proceeds received from various equity financings of $314.7 million,

proceeds from the sale of investments in equity securities of $63.2

million, and special cash dividends received from investments in

equity securities of $25.7 million. These increases in cash, cash

equivalents and short-term restricted cash were primarily offset by

the impacts of refinancing the Company’s previous senior secured

credit term loan, inclusive of prepayment fees and exit-related

costs in aggregate of $473.4 million, net cash used in operating

activities of $325.4 million, purchases of equity securities of

$20.3 million, and repurchase of shares to satisfy tax withholdings

of $6.1 million during the nine months ended September 30,

2024.

Revenue

Revenue for the three and nine months ended

September 30, 2024 were $2.7 million and $216.0 million,

respectively, as compared to $4.1 million and $7.6 million for the

same periods in the prior year.

The decrease of $1.4 million in revenue for the

three months ended September 30, 2024, compared to the same

period in the prior year, was primarily due to the recognition of

services revenue under the exclusive license and collaboration

agreements with Bayer and Kyowa Kirin. Revenue for the three months

ended September 30, 2023 primarily consists of the recognition of

services revenue under the Navire-BMS License Agreement, which

terminated effective June 2024.

The increase of $208.4 million in revenue for the

nine months ended September 30, 2024, compared to the same

period in the prior year, was primarily due to $205.3 million from

recognition of non-refundable upfront payments and service revenue

under the Bayer and the Kyowa Kirin exclusive license and

collaboration agreements.

Operating Costs and Expenses

Operating costs and expenses for the three and

nine months ended September 30, 2024 were $194.5 million and

$583.0 million, respectively, compared to $161.8 million and $437.5

million for the same periods in the prior year.

The overall increase of $32.7 million in operating

costs and expenses for the three months ended September 30,

2024, compared to the same period in the prior year, was primarily

due to an increase of $33.0 million in selling, general and

administrative (SG&A) expenses mainly to support

commercialization readiness efforts which included costs incurred

for marketing, advertising and buildup of salesforce, an increase

of $4.3 million in restructuring, impairment and related charges,

offset by a decrease of $4.6 million in research and development

and other expenses (R&D) mainly due to the deconsolidation of

certain subsidiaries.

The overall increase of $145.5 million in

operating costs and expenses for the nine months ended

September 30, 2024, compared to the same period in the prior

year, was primarily due to an increase of $91.1 million in SG&A

expenses mainly to support commercialization readiness efforts

which included costs incurred for marketing, advertising and

buildup of salesforce, an increase of $50.6 million in R&D

expenses to advance the Company’s pipeline of research and

development programs, and an increase of $3.8 million in

restructuring, impairment and related charges. Operating costs and

expenses for the nine months ended September 30, 2024, include

$25.0 million of nonrecurring deal-related costs for transactions

that were completed during the nine months ended September 30,

2024.

Restructuring, impairment and related charges for

the three and nine months ended September 30, 2024 amounted to

$4.6 million and $10.9 million, respectively. These charges

primarily consisted of impairments and write-offs of long-lived

assets, severance and employee-related costs, and exit and other

related costs. Restructuring, impairment and related charges for

the same periods in the prior year were $0.3 million and $7.2

million, respectively. These charges primarily consisted of winding

down, exit costs, and severance and employee-related costs.

Stock-based compensation expenses included in

operating costs and expenses for the three months ended

September 30, 2024 were $27.1 million, of which $12.1 million

is included in R&D expenses, $15.0 million is included in

SG&A expenses, and less than $0.1 million is included in

restructuring, impairment and related charges. Stock-based

compensation expenses included in operating costs and expenses for

the same period in the prior year were $27.2 million, of which

$14.1 million is included in R&D expenses, and $13.1 million is

included in SG&A expenses.

Stock-based compensation expenses included in

operating costs and expenses for the nine months ended

September 30, 2024 were $77.4 million, of which $29.8 million

is included in R&D expenses, $47.5 million is included in

SG&A expenses, and $0.1 million is included in restructuring,

impairment and related charges. Stock-based compensation expenses

included in operating costs and expenses for the same period in the

prior year were $77.9 million, of which $39.2 million is included

in R&D expenses, and $38.7 million is included in SG&A

expenses.

Total Other Income (Expense), net

Total other income (expense), net for the three and nine months

ended September 30, 2024 were $27.5 million and $91.0 million,

respectively, compared to ($21.8) million and ($53.0) million for

the same periods in the prior year.

The increase in total other income (expense), net

of $49.3 million for the three months ended September 30,

2024, compared to the same period in the prior year, was primarily

due to the Company’s gain on deconsolidation of subsidiaries of

$52.0 million and an increase in other income (expense), net of

$7.1 million mainly due to mark to market fair value adjustments

from the Company’s investments in equity securities. This was

partially offset by a net loss from an equity method investment of

$6.6 million and an increase in interest expense of $2.8

million.

The increase in total other income (expense), net

of $144.0 million for the nine months ended September 30,

2024, compared to the same period in the prior year, was primarily

due to the Company’s gain on deconsolidation of subsidiaries of

$178.3 million and an increase in other income (expense), net of

$15.1 million mainly due to mark to market fair value adjustments

from the Company’s investments in equity securities. These were

partially offset by recognition of a loss on extinguishment of debt

of $26.6 million, a net loss from equity method investments of

$14.5 million and an increase in interest expense of $8.4

million.

Net Loss Attributable to Common

Stockholders of BridgeBio and Net Loss per Share

For the three and nine months ended

September 30, 2024, the Company recorded a net loss

attributable to common stockholders of BridgeBio of $162.0 million

and $270.7 million, respectively, compared to $177.0 million and

$475.1 million, respectively for the three and nine months ended

September 30, 2023.

For the three and nine months ended

September 30, 2024, the Company reported a net loss per share

of $0.86 and $1.46, respectively compared to $1.08 and $2.99,

respectively for the three and nine months ended September 30,

2023.

BRIDGEBIO PHARMA, INC.

Condensed Consolidated Statements of Operations

(in thousands, except shares and per share

amounts)

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

Revenue |

|

$ |

2,732 |

|

|

$ |

4,091 |

|

|

$ |

216,020 |

|

|

$ |

7,558 |

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research, development and other expenses |

|

|

121,042 |

|

|

|

125,734 |

|

|

|

377,905 |

|

|

|

327,333 |

|

|

Selling, general and administrative |

|

|

68,819 |

|

|

|

35,777 |

|

|

|

194,149 |

|

|

|

103,007 |

|

|

Restructuring, impairment and related charges |

|

|

4,621 |

|

|

|

272 |

|

|

|

10,912 |

|

|

|

7,172 |

|

|

Total operating costs and expenses |

|

|

194,482 |

|

|

|

161,783 |

|

|

|

582,966 |

|

|

|

437,512 |

|

|

Loss from operations |

|

|

(191,750 |

) |

|

|

(157,692 |

) |

|

|

(366,946 |

) |

|

|

(429,954 |

) |

|

Other income (expense), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

3,296 |

|

|

|

3,793 |

|

|

|

12,566 |

|

|

|

12,460 |

|

|

Interest expense |

|

|

(23,061 |

) |

|

|

(20,306 |

) |

|

|

(69,469 |

) |

|

|

(61,021 |

) |

|

Gain on deconsolidation of subsidiaries |

|

|

52,027 |

|

|

|

— |

|

|

|

178,321 |

|

|

|

— |

|

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(26,590 |

) |

|

|

— |

|

|

Net loss from equity method investments |

|

|

(6,563 |

) |

|

|

— |

|

|

|

(14,488 |

) |

|

|

— |

|

|

Other income (expense), net |

|

|

1,797 |

|

|

|

(5,283 |

) |

|

|

10,648 |

|

|

|

(4,408 |

) |

|

Total other income (expense), net |

|

|

27,496 |

|

|

|

(21,796 |

) |

|

|

90,988 |

|

|

|

(52,969 |

) |

|

Net loss |

|

|

(164,254 |

) |

|

|

(179,488 |

) |

|

|

(275,958 |

) |

|

|

(482,923 |

) |

|

Net loss attributable to redeemable convertible noncontrolling

interests and noncontrolling interests |

|

|

2,214 |

|

|

|

2,489 |

|

|

|

5,246 |

|

|

|

7,869 |

|

|

Net loss attributable to common stockholders of BridgeBio |

|

$ |

(162,040 |

) |

|

$ |

(176,999 |

) |

|

$ |

(270,712 |

) |

|

$ |

(475,054 |

) |

|

Net loss per share, basic and diluted |

|

$ |

(0.86 |

) |

|

$ |

(1.08 |

) |

|

$ |

(1.46 |

) |

|

$ |

(2.99 |

) |

|

Weighted-average shares used in computing net loss per share,

basic and diluted |

|

|

188,510,372 |

|

|

|

163,308,632 |

|

|

|

184,947,173 |

|

|

|

158,891,152 |

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

Stock-based Compensation |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

Research, development and other expenses |

|

$ |

12,124 |

|

|

$ |

14,144 |

|

|

$ |

29,840 |

|

|

$ |

39,152 |

|

|

Selling, general and administrative |

|

|

14,969 |

|

|

|

13,086 |

|

|

|

47,511 |

|

|

|

38,731 |

|

|

Restructuring, impairment and related charges |

|

|

38 |

|

|

|

— |

|

|

|

81 |

|

|

|

— |

|

|

Total stock-based compensation |

|

$ |

27,131 |

|

|

$ |

27,230 |

|

|

$ |

77,432 |

|

|

$ |

77,883 |

|

BRIDGEBIO PHARMA, INC.

Condensed Consolidated Balance Sheets (In

thousands)

|

|

|

September 30, |

|

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

Assets |

|

(Unaudited) |

|

|

(1) |

|

|

Cash and cash equivalents |

|

$ |

266,324 |

|

|

$ |

375,935 |

|

|

|

Investments in equity securities |

|

|

— |

|

|

|

58,949 |

|

|

|

Receivables from licensing and collaboration agreements |

|

|

478 |

|

|

|

1,751 |

|

|

|

Short-term restricted cash |

|

|

139,409 |

|

|

|

16,653 |

|

|

|

Prepaid expenses and other current assets |

|

|

38,367 |

|

|

|

24,305 |

|

|

|

Investment in nonconsolidated entities |

|

|

160,443 |

|

|

|

— |

|

|

|

Property and equipment, net |

|

|

8,701 |

|

|

|

11,816 |

|

|

|

Operating lease right-of-use assets |

|

|

6,439 |

|

|

|

8,027 |

|

|

|

Intangible assets, net |

|

|

24,525 |

|

|

|

26,319 |

|

|

|

Other assets |

|

|

20,291 |

|

|

|

22,625 |

|

|

|

Total assets |

|

$ |

664,977 |

|

|

$ |

546,380 |

|

|

|

Liabilities, Redeemable Convertible Noncontrolling

Interests and Stockholders’ Deficit |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

13,363 |

|

|

$ |

10,655 |

|

|

|

Accrued and other liabilities |

|

|

109,482 |

|

|

|

122,965 |

|

|

|

Operating lease liabilities |

|

|

10,433 |

|

|

|

13,109 |

|

|

|

Deferred revenue |

|

|

30,398 |

|

|

|

9,823 |

|

|

|

2029 Notes, net |

|

|

738,376 |

|

|

|

736,905 |

|

|

|

2027 Notes, net |

|

|

544,719 |

|

|

|

543,379 |

|

|

|

Term loan, net |

|

|

436,221 |

|

|

|

446,445 |

|

|

|

Other long-term liabilities |

|

|

377 |

|

|

|

5,634 |

|

|

|

Redeemable convertible noncontrolling interests |

|

|

645 |

|

|

|

478 |

|

|

|

Total BridgeBio stockholders' deficit |

|

|

(1,229,922 |

) |

|

|

(1,354,257 |

) |

|

Noncontrolling interests |

|

|

10,885 |

|

|

|

11,244 |

|

|

|

Total liabilities, redeemable convertible noncontrolling interests

and stockholders’ deficit |

|

$ |

664,977 |

|

|

$ |

546,380 |

|

|

|

(1) |

The condensed consolidated financial statements as of and for the

year ended December 31, 2023 are derived from the audited

consolidated financial statements as of that date. |

BRIDGEBIO PHARMA, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited) (In thousands)

|

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(275,958 |

) |

|

$ |

(482,923 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

Stock-based compensation |

|

|

65,673 |

|

|

|

71,685 |

|

|

Loss on extinguishment of debt |

|

|

26,590 |

|

|

|

— |

|

|

Accretion of debt |

|

|

5,399 |

|

|

|

6,724 |

|

|

Depreciation and amortization |

|

|

4,708 |

|

|

|

4,909 |

|

|

Noncash lease expense |

|

|

3,119 |

|

|

|

3,024 |

|

|

Accrual of payment-in-kind interest on term loan |

|

|

— |

|

|

|

6,742 |

|

|

Net loss from equity method investments |

|

|

14,488 |

|

|

|

— |

|

|

Loss (gain) on deconsolidation of subsidiaries |

|

|

(178,321 |

) |

|

|

1,241 |

|

|

Loss (gain) from investment in equity securities, net |

|

|

(8,136 |

) |

|

|

2,951 |

|

|

Other noncash adjustments, net |

|

|

(2,059 |

) |

|

|

(332 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

Receivables from licensing and collaboration agreements |

|

|

1,273 |

|

|

|

11,909 |

|

|

Prepaid expenses and other current assets |

|

|

(17,543 |

) |

|

|

(980 |

) |

|

Other assets |

|

|

(428 |

) |

|

|

1,443 |

|

|

Accounts payable |

|

|

5,257 |

|

|

|

(3,404 |

) |

|

Accrued compensation and benefits |

|

|

5,580 |

|

|

|

(4,156 |

) |

|

Accrued research and development liabilities |

|

|

15,454 |

|

|

|

(10,544 |

) |

|

Operating lease liabilities |

|

|

(4,459 |

) |

|

|

(3,671 |

) |

|

Deferred revenue |

|

|

20,575 |

|

|

|

(4,464 |

) |

|

Accrued professional and other liabilities |

|

|

(6,612 |

) |

|

|

(3,055 |

) |

|

Net cash used in operating activities |

|

|

(325,400 |

) |

|

|

(402,901 |

) |

|

Investing activities: |

|

|

|

|

|

|

|

Purchases of marketable securities |

|

|

(93,811 |

) |

|

|

(29,726 |

) |

|

Maturities of marketable securities |

|

|

95,000 |

|

|

|

82,550 |

|

|

Purchases of investments in equity securities |

|

|

(20,271 |

) |

|

|

(78,314 |

) |

|

Proceeds from sales of investments in equity securities |

|

|

63,229 |

|

|

|

80,963 |

|

|

Proceeds from special cash dividends received from investments in

equity securities |

|

|

25,682 |

|

|

|

— |

|

|

Payment for an intangible asset |

|

|

(4,785 |

) |

|

|

— |

|

|

Purchases of property and equipment |

|

|

(886 |

) |

|

|

(871 |

) |

|

Decrease in cash and cash equivalents resulting from

deconsolidation of subsidiaries |

|

|

(140 |

) |

|

|

(503 |

) |

|

Net cash provided by investing activities |

|

|

64,018 |

|

|

|

54,099 |

|

|

Financing activities: |

|

|

|

|

|

|

|

Proceeds from term loan under Financing Agreement |

|

|

450,000 |

|

|

|

— |

|

|

Issuance costs and discounts associated with term loan under

Financing Agreement |

|

|

(15,986 |

) |

|

|

— |

|

|

Repayment of term loan under Loan and Security Agreement |

|

|

(473,417 |

) |

|

|

— |

|

|

Proceeds from issuance of common stock through public offerings,

net |

|

|

314,741 |

|

|

|

450,264 |

|

|

Proceeds from BridgeBio common stock issuances under ESPP |

|

|

4,502 |

|

|

|

3,397 |

|

|

Proceeds from stock option exercises, net of repurchases |

|

|

808 |

|

|

|

5,222 |

|

|

Transactions with noncontrolling interests |

|

|

— |

|

|

|

1,500 |

|

|

Repurchase of RSU shares to satisfy tax withholding |

|

|

(6,122 |

) |

|

|

(4,325 |

) |

|

Net cash provided by financing activities |

|

|

274,526 |

|

|

|

456,058 |

|

|

Net increase in cash, cash equivalents and restricted cash |

|

|

13,144 |

|

|

|

107,256 |

|

|

Cash, cash equivalents and restricted cash at beginning of

period |

|

|

394,732 |

|

|

|

416,884 |

|

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

407,876 |

|

|

$ |

524,140 |

|

|

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Supplemental Disclosure of Cash Flow

Information: |

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

78,236 |

|

|

$ |

50,826 |

|

|

Supplemental Disclosures of Noncash Investing and Financing

Information: |

|

|

|

|

|

|

|

Unpaid public offering issuance costs |

|

$ |

— |

|

|

$ |

455 |

|

|

Unpaid property and equipment |

|

$ |

274 |

|

|

$ |

192 |

|

|

Transfers to noncontrolling interests |

|

$ |

(4,719 |

) |

|

$ |

(8,313 |

) |

|

Reconciliation of Cash, Cash Equivalents and Restricted

Cash: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

266,324 |

|

|

$ |

505,213 |

|

|

Restricted cash |

|

|

139,409 |

|

|

|

16,652 |

|

|

Restricted cash — Included in “Other assets” |

|

|

2,143 |

|

|

|

2,275 |

|

|

Total cash, cash equivalents and restricted cash at end of period

shown in the condensed consolidated statements of cash flows |

|

$ |

407,876 |

|

|

$ |

524,140 |

|

About BridgeBio Pharma,

Inc.BridgeBio Pharma (BridgeBio) is a new type of

biopharmaceutical company founded to discover, create, test and

deliver transformative medicines to treat patients who suffer from

genetic diseases. BridgeBio’s pipeline of development programs

ranges from early science to advanced clinical trials. BridgeBio

was founded in 2015, and its team of experienced drug discoverers,

developers and innovators are committed to applying advances in

genetic medicine to help patients as quickly as possible. For more

information visit bridgebio.com and

follow us

on LinkedIn, Twitter and Facebook.BridgeBio

Pharma, Inc. Forward-Looking Statements

This press release contains forward-looking

statements. Statements in this press release may include statements

that are not historical facts and are considered forward-looking

within the meaning of Section 27A of the Securities Act of 1933, as

amended (the Securities Act), and Section 21E of the Securities

Exchange Act of 1934, as amended (the Exchange Act), which are

usually identified by the use of words such as “anticipates,”

“believes,” “continues,” “estimates,” “expects,” “hopes,”

“intends,” “may,” “plans,” “projects,” “remains,” “seeks,”

“should,” “will,” and variations of such words or similar

expressions. BridgeBio intends these forward-looking statements to

be covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act and

Section 21E of the Exchange Act. These forward-looking statements,

including express and implied statements relating to the Company’s

clinical trials, including the PDUFA approval date for acoramidis

for the treatment of ATTR-CM; timing to share data from the

long-term open-label extension of ATTRibute-CM; the potential to

receive payments of $500 million and $105 million upon approval of

acoramidis; providing U.S. clinical trial patients acoramidis free

for life, upon approval; timing for completion of enrollment in

PROPEL 3 and completion of the study; timing for sharing top-line

results from FORTIFY for the interim analysis population; the

potential to pursue Accelerated Approval in the U.S. for

ribitol in LGMD2I/R9; the Company’s ability to qualify for a

Priority Review Voucher with respect to ribitol; timing for

completion of enrollment in CALIBRATE; and the expectation of early

and more frequent interactions with the FDA relating to BBP-812 for

the treatment of Canavan disease, among others, reflect the

Company’s current views about the Company’s plans, intentions,

expectations and strategies, which are based on the information

currently available to us and on assumptions the Company has made.

Although the Company believes that its plans, intentions,

expectations and strategies as reflected in or suggested by those

forward-looking statements are reasonable, the Company can give no

assurance that the plans, intentions, expectations or strategies

will be attained or achieved. Furthermore, actual results may

differ materially from those described in the forward-looking

statements and will be affected by a number of risks, uncertainties

and assumptions, including, but not limited to, initial and ongoing

data from the Company’s preclinical studies and clinical trials not

being indicative of final data, the potential size of the target

patient populations the Company’s product candidates are designed

to treat not being as large as anticipated, the design and success

of ongoing and planned clinical trials, future regulatory filings,

approvals and/or sales, despite having ongoing and future

interactions with the FDA or other regulatory agencies to discuss

potential paths to registration for the Company’s product

candidates, the FDA or such other regulatory agencies not agreeing

with the Company’s regulatory approval strategies, components of

the Company’s filings, such as clinical trial designs, conduct and

methodologies, or the sufficiency of data submitted, the continuing

success of the Company’s collaborations, the Company’s ability to

obtain additional funding, including through less dilutive sources

of capital than equity financings, potential volatility in the

Company’s share price, the impacts of current macroeconomic and

geopolitical events, including changing conditions from hostilities

in Ukraine and in Israel and the Gaza Strip, increasing rates of

inflation and changing interest rates, on business operations and

expectations, as well as those risks set forth in the Risk Factors

section of the Company’s most recent Quarterly Report on Form 10-Q

and Annual Report on Form 10-K and the Company’s other filings with

the U.S. Securities and Exchange Commission. Moreover, the Company

operates in a very competitive and rapidly changing environment in

which new risks emerge from time to time. These forward-looking

statements are based upon the current expectations and beliefs of

the Company’s management as of the date of this press release, and

are subject to certain risks and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. Except as required by applicable law,

BridgeBio assumes no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

BridgeBio Contact: Vikram Bali

contact@bridgebio.com (650)-789-8220

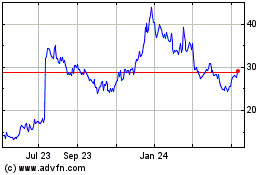

BridgeBio Pharma (NASDAQ:BBIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

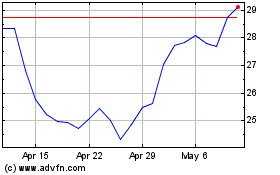

BridgeBio Pharma (NASDAQ:BBIO)

Historical Stock Chart

From Jan 2024 to Jan 2025