Filed Pursuant to Rule 424(b)(5)

File No. 333-274893

PROSPECTUS SUPPLEMENT

(To Prospectus dated January 26, 2024)

BLUE HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY

55,200,000 Ordinary Shares

We are

offering directly to certain institutional investors pursuant to this prospectus supplement, the accompanying prospectus, and those certain

Securities Purchase Agreements, dated January 5, 2025, by and among Blue Hat Interactive Entertainment Technology (the “Company”)

and the institutional investors signatories thereto 55,200,000 (the “Shares”, or “Securities”) of our ordinary

shares, par value $0.01 per share (the “Ordinary Shares”). We are offering the Ordinary Shares in this offering at a price

per share of $0.08.

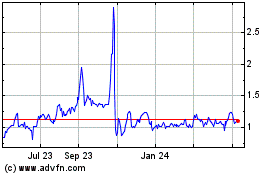

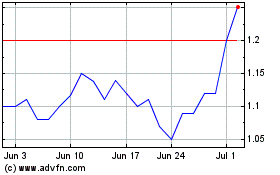

Our Ordinary

Shares trade on the NASDAQ Capital Market under the symbol “BHAT.” The last reported sale price of our Ordinary Shares on

the NASDAQ Capital Market on January 3, 2025 was $0.1478 per share. For a more detailed description of the Ordinary Shares, see the section

entitled “Description of the Securities We are Offering” beginning on page S-11 of this prospectus supplement.

The aggregate

market value of our outstanding Ordinary Shares held by non-affiliates was $13,254,541.99 based on 58,398,281 Ordinary Shares outstanding,

of which 53,488,870 shares are held by non-affiliates, and a per share price of $0.2478, which was the last reported price on the NASDAQ

Capital Market of our Ordinary Shares on November 7, 2024. During the prior 12 calendar month period that ends on and includes the date

of this prospectus supplement, we did not issue or sell any of securities pursuant to General Instruction I.B.5. of Form F-3 and accordingly

we may sell up to $4,418,180.66 of our Ordinary Shares hereunder.

We intend

to use the net proceeds received from the offering for working capital and other general corporate purposes. Additional information regarding

our intended use of the proceeds of the offering is set forth in the section entitled “Use of Proceeds” beginning on

page S-9 of this prospectus supplement.

We have

retained Maxim Group LLC to act as exclusive placement agent (the “Placement Agent”) in connection with this offering. The

Placement Agent has agreed to use its reasonable best efforts to sell the securities offered by this prospectus supplement and the accompanying

prospectus. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific

number or dollar amount of securities. We have agreed to pay the Placement Agent the Placement Agent fees set forth in the table below.

There is no arrangement for funds to be received in escrow, trust, or similar arrangement. We will bear all costs associated with the

offering. See “Plan of Distribution” beginning on page S-14 of this prospectus supplement for more information regarding

these arrangements.

| | |

Per Share | |

Total |

| Offering price | |

$ | 0.08 | | |

$ | 4,416,000 | |

| Placement Agent’s fees | |

$ | 0.0056 | | |

$ | 309,120 | |

| Proceeds, before other expenses, to us(1) | |

$ | 0.0744 | | |

$ | 4,106,880 | |

| (1) | We agreed to pay the Placement Agent a cash fee equal to 7.0% of the aggregate gross proceeds raised in

this offering. In addition, we have agreed to reimburse the Placement Agent for certain out-of-pocket expenses up to $50,000. See “Plan

of Distribution” beginning on page S-14 of this prospectus supplement for additional information with respect to the compensation

we will pay and expenses we will reimburse to the Placement Agent in connection with this offering. |

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page S-8

of this prospectus supplement and in the documents we incorporate by reference in this prospectus supplement and the accompanying prospectus.

In addition, see “Risk Factors” in our Annual Report on Form 20-F/A for the year ended December 31, 2023, which has

been filed with the Securities and Exchange Commission and is incorporated by reference into this prospectus supplement and the accompanying

prospectus. You should carefully consider these risk factors, as well as the information contained in this prospectus supplement and the

accompanying prospectus, before you invest.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to

the contrary is a criminal offense.

We estimate the total expenses of this offering, excluding the placement agency

fees, will be approximately 65,000. Because there is no minimum offering amount required in this offering, the actual offering amount,

the Placement Agent fees and net proceeds to us, if any, in this offering may be substantially less than the total offering amounts set

forth above. We are not required to sell any specific number or dollar amount of the securities offered in this offering, but the Placement

Agent will use its reasonable efforts to arrange for the sale of all of the securities offered.

We expect

to deliver the securities offered pursuant to this prospectus supplement on or about January 7, 2025.

MAXIM GROUP LLC

The date of this prospectus

supplement is January 5, 2025

TABLE OF CONTENTS

Prospectus Supplement

Base Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement is a supplement to the accompanying prospectus that is also a part of this document. This prospectus supplement

and the accompanying prospectus, dated January 26, 2024, are part of a registration statement on Form F-3 (File No. 333-274893) that we

filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. Under this shelf

registration process, we may offer and sell from time to time in one or more offerings the securities described in the accompanying prospectus.

This

document is in two parts. The first part is this prospectus supplement, which describes the securities we are offering and the terms of

the offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference

into the accompanying prospectus. The second part is the accompanying prospectus, which provides more general information, some of which

may not apply to the securities offered by this prospectus supplement. Generally, when we refer to this “prospectus,” we are

referring to both documents combined. To the extent there is a conflict between the information contained in this prospectus supplement,

on the one hand, and the information contained in the accompanying prospectus or any document incorporated by reference therein, on the

other hand, you should rely on the information in this prospectus supplement. We urge you to carefully read this prospectus supplement

and the accompanying prospectus and any related free writing prospectus, together with the information incorporated herein and therein

by reference as described under the heading “Where You Can Find Additional Information,” before buying any of the securities

being offered.

You should

rely only on the information that we have provided or incorporated by reference in this prospectus supplement and the accompanying prospectus

and any related free writing prospectus that we may authorize to be provided to you. We have not, and the Placement Agent has not, authorized

anyone to provide you with different information. No other dealer, salesperson or other person is authorized to give any information or

to represent anything not contained in this prospectus supplement and the accompanying prospectus or any related free writing prospectus

that we may authorize to be provided to you. You must not rely on any unauthorized information or representation. This prospectus supplement

is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so.

You should assume that the information in this prospectus supplement and the accompanying prospectus or any related free writing prospectus

is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only

as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement and the accompanying

prospectus or any related free writing prospectus, or any sale of a security.

This

prospectus supplement contains summaries of certain provisions contained in some of the documents described herein, but reference is made

to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies

of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus supplement is a part, and you may obtain copies of those documents as described below under the heading

“Where You Can Find More Information.”

Unless otherwise mentioned or

unless the context requires otherwise, all references in this prospectus to the “Company,” “we,” “us,”

“our” refer to Blue Hat Interactive Entertainment Technology, a Cayman Islands company, its subsidiaries, and our consolidated

entities; all references to “$,” “dollars” or “U.S. dollars” refer to the legal currency of the United

States; all references to “PRC” refer to the People’s Republic of China; all references to “RMB” refer to

the legal currency of People’s Republic of China; and all references to “shares” or “Ordinary Shares” refers

to the authorized Ordinary Shares of Blue Hat Interactive Entertainment Technology, par value $0.01 per share. This prospectus supplement

and the information incorporated by reference herein and therein include trademarks, service marks and trade names owned by us or other

companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus are the property of

their respective owners.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This

prospectus supplement, accompanying prospectus and the documents that we have filed with the SEC that are incorporated by reference in

this prospectus supplement contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of

1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act and may involve material risks, assumptions and

uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,” “will,”

“should,” “believe,” “might,” “expect,” “anticipate,” “intend,”

“plan,” “estimate,” and similar words, although some forward-looking statements are expressed differently.

Any forward

looking statements contained in this prospectus supplement, accompanying prospectus and the documents that we have filed with the SEC

that are incorporated by reference in this prospectus supplement are only estimates or predictions of future events based on information

currently available to our management and management’s current beliefs about the potential outcome of future events. Whether these

future events will occur as management anticipates, whether we will achieve our business objectives, and whether our revenues, operating

results, or financial condition will improve in future periods are subject to numerous risks. There are a number of important factors

that could cause actual results to differ materially from the results anticipated by these forward-looking statements. These important

factors include those that we discuss under the heading “Risk Factors” and in other sections of our Annual Report on Form

20-F/A for the fiscal year ended December 31, 2023 (the “Form 20-F/A”), as well as in our other reports filed from time to

time with the SEC that are incorporated by reference into this prospectus supplement and the accompanying prospectus. You should read

these factors and the other cautionary statements made in this prospectus supplement, the accompanying prospectus and in the documents

we incorporate by reference into this prospectus supplement and the accompanying prospectus as being applicable to all related forward-looking

statements wherever they appear in this prospectus supplement or the documents we incorporate by reference into this prospectus supplement

and the accompanying prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual

results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by

these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required by law.

PROSPECTUS SUPPLEMENT SUMMARY

This summary is not complete

and does not contain all of the information that you should consider before investing in the securities offered by this prospectus supplement.

You should read this summary together with the entire prospectus supplement and accompanying prospectus, including our risk factors (as

provided for herein and incorporated by reference), financial statements, the notes to those financial statements and the other documents

that are incorporated by reference in this prospectus supplement, before making an investment decision. You should carefully read the

information described under the heading “Where You Can Find More Information.” We have not authorized anyone to provide you

with information different from that contained in this prospectus supplement. The information contained in this prospectus supplement

is accurate only as of the date of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or of

any sale of our securities.

We were

an advanced high-tech solutions provider focusing on the production, development, and operation of augmented reality (AR) interactive

entertainment games and toys. Our product portfolio included interactive educational materials, mobile games, toys with mobile game features,

and immersive educational courses. In addition, we have previously ventured into the Internet Data Center (IDC) business. Impacted by

the pandemic, we underwent a restructuring of our company’s operations in 2023. By dismantling the VIE structure and divesting from

unprofitable segments, starting from the fourth quarter of 2022, we shifted our business focus towards commodity trading, including chemicals,

jewelry, and precious metals such as gold.

The core

of our business lies in our proprietary technology. Our patents, trademarks, copyrights, and other intellectual property rights serve

to distinguish our products, protect them from infringement, and foster our competitive advantages. To ensure the value of our technology

and developments, we actively seek patent, trademark, and copyright protections. As of January 3, 2025, our intellectual property portfolio

includes 224 authorized patents, 14 applications for international patents under the Patent Cooperation Treaty (PCT), 794 artistic copyrights,

94 registered trademarks, and 134 software copyrights. Our mobile-connected entertainment platform enables us to connect physical items

to mobile devices through wireless technologies, creating a unique interactive user experience. Our goal is to create a rich visual and

interactive environment for users through the integration of real objects and virtual scenery. We believe this combination provides users

with a more natural form of human-computer interaction and enhances users’ perception of reality, thus providing a more diversified

entertainment experience.

Our proprietary

technology, product research and development, marketing channels, and brand operation are the cornerstones of our business. Building upon

these accumulated technological capabilities, we have expanded and will continue to operate in bulk commodity trading related fields such

as jewelry and gold, and empower industry participants with AI technology. This includes, but is not limited to, providing efficient and

intelligent marketing content creation services for jewelers and offering data analysis services for gold derivatives traders.

Our Business Operations

We,

through the operations of our subsidiaries headquartered in Xiamen, China, primarily operate a gold trading and supply chain business

through our subsidiaries. Our business model encompasses physical gold trading, gold derivatives trading, and the development of AI-enabled

trading platforms. In August 2024, we completed our first major gold acquisition of 1,000 kilograms for approximately $66.49 million from

Macau Rongxin Precious Metals Technology Co., Ltd., marking our entry into large-scale gold trading.

Our

operations are supported by key licenses and strategic partnerships. Our Hong Kong subsidiary, Golden Alpha Strategy Ltd., holds a Category

A Registration for dealing in precious metals from the Hong Kong Customs and Excise Department. We have established partnerships with

GTC GROUP LLC in Dubai for derivatives trading and Sichuan Jinyinghe Industrial Co., Ltd. for developing our gold supply chain business

in the Shenzhen Shuibei market, one of China's largest gold trading centers with annual transaction volumes exceeding RMB 1 trillion.

We

create value by providing capital, technology, and connections across the gold supply chain. Our target customers include gold refineries,

wholesalers, and retailers. We aim to address industry challenges such as fragmented markets, limited financing channels, and operational

inefficiencies through our AI-enabled trading platforms and supply chain solutions. Our management team believes the gold industry is

transitioning from rapid growth to high-quality development, presenting strategic opportunities for market consolidation and technological

innovation.

The

growth of our business is driven by several key market factors. We are seeing increased institutional demand, particularly from central

banks expanding their gold reserves. The gold market is also transitioning from a fragmented structure to a more consolidated one, creating

opportunities for well-positioned companies. Additionally, there is rising demand for efficient trading solutions powered by advanced

technology.

Looking

ahead, we plan to expand our business beyond physical gold trading into derivatives trading. This expansion includes the development of

sophisticated online trading platforms and enhancement of our AI-enabled services. Geographically, we aim to extend our presence into

European and North American markets. Unlike traditional retail-focused precious metals businesses, our operations are not significantly

affected by seasonal factors as gold trading occurs continuously throughout the year in both institutional and retail markets.

Our business

is not significantly affected by seasonal factors as gold trading occurs year-round in both institutional and retail markets.

Intellectual Property

The core

of our business is our proprietary technology. As a result, we strive to maintain a robust intellectual property portfolio. Our patents,

trademarks, copyrights, and other intellectual property rights serve to distinguish and protect our products from infringement and contribute

to our competitive advantages. To secure the value of our technology and developments, we are aggressive in pursuing a combination of

patent, trademark, and copyright protection for our proprietary technologies.

Competition

We compete with existing gold traders and suppliers around the world, and

we may also face competition from new and emerging companies. We consider our principal competitors to be those companies that provide

gold to the market, including De Beer, Barrick Gold Corporation, etc.

Compared

to our company, our current and potential competitors may have:

| ● |

better established credibility and market reputations, longer operating histories, and broader product offerings; |

| |

|

| ● |

significantly greater financial, technical, marketing and other resources, |

| |

|

| ● |

multiple product offerings, which may enable them to offer bundled discounts for customers purchasing multiple products or other incentives that we cannot match or offer. |

The principal

competitive factors in our market include:

| ● |

brand recognition and reputation; |

| |

|

| ● |

flexible purchasing and payment methods; |

| |

|

| ● |

efficient operational process and services; and |

| |

|

| ● |

the performance and reliability of products and platforms. |

Blue

Hat Cayman and its subsidiaries usually operate independently and transfer funds through loans and intercompany transactions. We raised

capital for a total amount of $25.182 million from 2020 to 2023 through various financings. Blue Hat Interactive Entertainment Technology

Limited (“Blue Hat HK”), our wholly-owned Hong Kong intermediary holding subsidiary, passed the funds from the investors in

these financings to Blue Hat Fujian, through loans regulated under contract agreements, and Blue Hat WOFE, through intercompany transactions.

As of the date of this annual report, the total amount that Blue Hat Cayman has invested in and lent to Blue Hat Fujian and Blue Hat WOFE

are approximately $1.77 million and $14.81 million, respectively.

As of

the date of this prospectus supplement, the Company has not distributed any dividends to the investors, nor does the Company intend to

distribute any dividends in any form in the near future. The Company currently intends to retain the earnings to re-invest into the daily

operations.

The tables

below show the cash transfer between the Company and its subsidiaries for the fiscal years ended December 31, 2023, 2022 and 2021.

| For the year ended December 31, 2023 |

| No. |

|

Transfer From |

|

Transfer to |

|

Approximate Value ($) |

|

Note |

| 1 |

|

Blue Hat Interactive Entertainment Technology |

|

Blue Hat Interactive Entertainment Technology Limited |

|

2,800,000.00 |

|

Loan |

| 2 |

|

Blue Hat Interactive Entertainment Technology Limited |

|

Fujian Blue Hat Group Co, Ltd |

|

2,800,000.00 |

|

Investment |

| |

|

|

|

|

|

|

|

|

| For the year ended December 31, 2022 |

| No. |

|

Transfer From |

|

Transfer to |

|

Approximate Value ($) |

|

Note |

| 1 |

|

Blue Hat Interactive Entertainment Technology |

|

Blue Hat Interactive Entertainment Technology Limited |

|

1,768,000.00 |

|

Loan |

| 2 |

|

Blue Hat Interactive Entertainment Technology Limited |

|

Fujian Blue Hat Group Co, Ltd |

|

1,768,000.00 |

|

Investment |

| |

|

|

|

|

|

|

|

|

| For the year ended December 31, 2021 |

| No. |

|

Transfer From |

|

Transfer to |

|

Approximate Value ($) |

|

Note |

| 1 |

|

Blue Hat Interactive Entertainment Technology |

|

Blue Hat Interactive Entertainment Technology Limited |

|

7,150,000.00 |

|

Loan |

| 2 |

|

Blue Hat Interactive Entertainment Technology Limited |

|

Xiamen Duwei Consulting Management Co., Ltd. |

|

7,150,000.00 |

|

Investment |

We

are a holding company incorporated in the Cayman Islands and are not a Chinese operating company. This holding company structure involves

unique risks to investors. As a holding company with no material operations of our own, we conduct a substantial majority of our operations

through our subsidiaries in the People’s Republic of China (“China” or the “PRC”). The charts

below summarize our corporate legal structure and identify our subsidiaries:

Corporate Information

Our principal

executive office is located at 7th Floor, Building C, No. 1010 Anling Road, Huli District, Xiamen, China 361009. Our telephone number

is 86-592-228-0081. Our registered office in the Cayman Islands is located at the offices of Walkers Corporate Limited, Cayman Corporate

Centre, 27 Hospital Road, George Town, Grand Cayman KY1-9008, Cayman Islands.

THE OFFERING

| Ordinary Shares outstanding prior to this offering |

58,398,281 Ordinary Shares. |

| |

|

| Ordinary Shares offered by us |

55,200,000 Ordinary Shares |

| |

|

| Offering price per share |

$0.08 |

| |

|

| Ordinary Shares to be outstanding after this offering |

113,598,281 Ordinary Shares. |

| |

|

| Use of proceeds |

We estimate that the net proceeds of this offering, after deducting Placement Agent fees and estimated offering expenses, will be approximately $4.0 million. We intend to use any proceeds from the offering for working capital and other general corporate purposes. For additional information, refer to the section entitled “Use of Proceeds” beginning on page S-9 of this prospectus supplement. |

| |

|

| Risk factors |

Investing in our Ordinary Shares involves a high degree of risk. You should carefully consider the information set forth in the section entitled “Risk Factors” beginning on page S-8 of this prospectus supplement; beginning on page 11 of the accompanying base prospectus, and beginning on page 8 of the Form 20-F/A, for a discussion of information that should be considered in connection with an investment in our Ordinary Shares. |

| |

|

| Nasdaq symbol |

Our Ordinary Shares are listed on Nasdaq under the symbol “BHAT.” |

The number of Ordinary Shares

to be outstanding after this offering is based on 58,398,281 Ordinary Shares outstanding at January 3, 2025.

RISK FACTORS

Investment in any securities

offered pursuant to this prospectus supplement and the accompanying prospectus involves risks. You should carefully consider the risk

factors described below, in the accompany base prospectus, and in our 20-F/A incorporated by reference in this prospectus supplement and

the accompanying prospectus, any amendment or update thereto reflected in subsequent filings with the SEC, including in our annual reports

on Form 20-F/A, and all other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus,

as updated by our subsequent filings under the Exchange Act. The risks and uncertainties we have described are not the only ones

we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations.

The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

The Chinese government may intervene with or

influence our business at any time. That may negatively influence our operation, our ability to continue listing on U.S. exchange and

the value of our shares may significantly decline or be worthless, which would materially affect the interest of our shareholders.

The Chinese central or local governments

may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts

on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including

any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local

variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions

thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

As such, our business segments

may be subject to various government and regulatory interference in the provinces in which they operate. The Company could be subject

to regulation by various political and regulatory entities, including various local and municipal agencies and government sub-divisions.

The Company may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure

to comply. The Chinese government may intervene with or influence our operations at any time with little advance notice, which could result

in a material change in our operations and in the value of our shares.

Future sales or the

potential for future sales of our securities may cause the trading price of our Ordinary Shares to decline and could impair our ability

to raise capital through subsequent equity offerings.

Sales

of a substantial number of Ordinary Shares or other securities in the public markets, or the perception that these sales may occur, could

cause the market price of our Ordinary Shares or other securities to decline and could materially impair our ability to raise capital

through the sale of additional securities.

We have broad discretion

over the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad

discretion in the application of the net proceeds from this offering, including for any of the purposes described in “Use of Proceeds,”

and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately.

Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use

may vary substantially from their currently intended use. Our management might not apply our net proceeds in ways that ultimately increase

the value of your investment. The failure by our management to apply the net proceeds from this offering effectively could harm our business.

If we do not invest or apply the net proceeds from this offering in ways that enhance shareholder value, we may fail to achieve expected

financial results, which could cause the price of our Ordinary Shares to decline.

Raising additional

capital, including as a result of this offering, and the sale of additional Ordinary Shares or other equity securities could result in

dilution to our shareholders, while the incurrence of debt may impose restrictions on our operations.

We may require additional cash

resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to

pursue. If our cash resources are insufficient to satisfy our cash requirements, we may seek to sell equity or debt securities or obtain

a credit facility. The sale of equity securities would result in dilution to our shareholders. The incurrence of indebtedness would result

in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations.

Furthermore, the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the

market price of our Ordinary Shares to decline and existing shareholders may not agree with our financing plans or the terms of such financings.

DIVIDEND POLICY

Our board

of directors has discretion on whether to distribute dividends, subject to certain requirements of Cayman Islands law. In addition, our

shareholders may by ordinary resolution declare a dividend, but no dividend may exceed the amount recommended by our board of directors.

In either case, all dividends are subject to certain restrictions under Cayman Islands law, namely that our company may only pay dividends

out of profits or share premium account, and provided always that in no circumstances may a dividend be paid if this would result in our

company being unable to pay its debts as they fall due in the ordinary course of business. Even if we decide to pay dividends, the form,

frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition,

contractual restrictions and other factors that the board of directors may deem relevant.

We do

not have any present plan to pay any cash dividends on our Ordinary Shares in the foreseeable future after this offering. We currently

intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business.

We are

a holding company incorporated in the Cayman Islands. We rely on dividends from our subsidiaries in China for our cash requirements, including

any payment of dividends to our shareholders. PRC regulations may restrict the ability of our PRC subsidiaries to pay dividends to us.

See “Item 4. Information on the Company—B. Business Overview—Regulation on Foreign Exchange—Dividend Distribution”

in our Form 20-F/A, which is incorporated by reference in this prospectus supplement and the accompanying prospectus.

USE OF PROCEEDS

We estimate that the net proceeds

of this offering, after deducting Placement Agent fees and estimated offering expenses, will be approximately $4.0 million. We intend

to use any proceeds from the offering for working capital and other general corporate purposes.

CAPITALIZATION

The following table sets forth

our capitalization as of December 31, 2023 presented on:

| |

● |

on an as adjusted basis to give effect to the sale of the Ordinary Shares, after deducting the estimated offering expenses payable by us. |

You should read this table together

with Item 5. Operating and Financial Review and Prospects” and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” of the Form 20-F/A, and our consolidated financial statements and note included in the information incorporated

by reference into this prospectus supplement and the accompanying prospectus.

| | |

As

of

December

31, 2023 | |

|

| (in US$

millions) | |

Actual | |

As

adjusted |

| Cash

and Cash Equivalents | |

$ | 0.41 | | |

$ | 0.41 | |

| Shareholders’

Equity: | |

| | | |

| | |

| Ordinary

Shares, par value $0.01, 500,000,000 Ordinary Shares authorized, 58,398,281 shares issued and outstanding as of December 31, 2023 | |

| 0.58 | | |

| 1.13 | |

| Additional

paid-in capital | |

| 93.83 | | |

| 97.38 | |

| Statutory

Reserves | |

| 2.14 | | |

| 2.14 | |

| Retained

Earnings | |

| (56.83 | ) | |

| (56,83 | ) |

| Accumulated

other comprehensive loss | |

| 0.90 | | |

| 0.90 | |

| Total

Shareholders’ Equity | |

| 40.62 | | |

| 44.72 | |

| Total

Capitalization(1) | |

$ | 41.03 | | |

$ | 45.13 | |

Note:

| (1) | Total capitalization equals the sum of convertible note and total shareholders’ equity. |

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

Ordinary Shares

The following is a summary of

our share capital and certain provisions of our Second Amended and Restated Memorandum and Articles of Association. This summary does

not purport to be complete and is qualified in its entirety by the provisions of our Second Amended and Restated Memorandum and Articles

of Association and applicable provisions of the laws of the Cayman Islands.

See “Where You Can Find

More Information” elsewhere in this prospectus for information on where you can obtain copies of our articles of incorporation and

our bylaws, which have been filed with and are publicly available from the SEC.

The authorized share capital of

the Company is $5,000,000 divided into 500,000,000 Ordinary Shares of $0.01 par value each with power for the Company, subject to the

provisions of the Companies Act (as revised) and the Second Amended and Restated Articles of Association.

As of January 3, 2025, there were

58,398,281 Ordinary Shares issued and outstanding.

Our Ordinary Shares are currently

traded on the NASDAQ Capital Market under the symbol “BHAT.”

Voting and Meetings

As a condition of admission to

a shareholders’ meeting, a shareholder must be duly registered as our shareholder at the applicable record date for that meeting

and all calls or installments then payable by such shareholder to us in respect of our Ordinary Shares must have been paid. Subject to

any special rights or restrictions as to voting then attached to any shares, at any general meeting every shareholder who is present in

person or by proxy (or, in the case of a shareholder being a corporation, by its duly authorized representative not being himself or herself

a shareholder entitled to vote) shall have one vote per share.

As a Cayman Islands exempted company,

we are not obliged by the Companies Act to call annual general meetings; however, our Second Amended and Restated Memorandum and

Articles of Association provide that in each year we will hold an annual general meeting of shareholders at a time determined by our board

of directors. Also, we may, but are not required to (unless required by the Companies Act), in each year hold any other extraordinary

general meeting.

The Companies Act of the Cayman

Islands provides shareholders with only limited rights to requisition a general meeting, and does not provide shareholders with any right

to put any proposal before a general meeting. However, these rights may be provided in a company’s articles of association. Our Second

Amended and Restated Memorandum and Articles of Association provide that upon the requisition of shareholders representing not less than

two-thirds of the voting rights entitled to vote at general meetings, our board will convene an extraordinary general meeting and put

the resolutions so requisitioned to a vote at such meeting. However, shareholders may propose only ordinary resolutions to be put to a

vote at such meeting and shall have no right to propose resolutions with respect to the election, appointment or removal of directors

or with respect to the size of the board. Our Second Amended and Restated Memorandum and Articles of Association provide no other

right to put any proposals before annual general meetings or extraordinary general meetings. Subject to regulatory requirements, our annual

general meeting and any extraordinary general meetings must be called by not less than ten (10) clear days’ notice prior to the

relevant shareholders meeting and convened by a notice discussed below. Alternatively, upon the prior consent of all holders entitled

to attend and vote (with regards to an annual general meeting), and the holders of 95% in par value of the shares entitled to attend and

vote (with regard to an extraordinary general meeting), that meeting may be convened by a shorter notice and in a manner deemed appropriate

by those holders.

We will give notice of each general

meeting of shareholders by publication on our website and in any other manner that we may be required to follow in order to comply with

Cayman Islands law, Nasdaq and SEC requirements. The holders of registered shares may be convened for a shareholders’ meeting by

means of letters sent to the addresses of those shareholders as registered in our shareholders’ register, or, subject to certain

statutory requirements, by electronic means. We will observe the statutory minimum convening notice period for a general meeting of shareholders.

A quorum for a general meeting

consists of any one or more persons holding or representing by proxy not less than one-third of our issued voting shares entitled to vote

upon the business to be transacted.

A resolution put to the vote of

the meeting shall be decided on a poll. An ordinary resolution to be passed by the shareholders requires the affirmative vote of a simple

majority of the votes cast by, or on behalf of, the shareholders entitled to vote present in person or by proxy and voting at the meeting.

A special resolution requires the affirmative vote of no less than two-thirds of the votes cast by the shareholders entitled to vote who

are present in person or by proxy at a general meeting (except for certain matters described below which require an affirmative vote of

two-thirds). Both ordinary resolutions and special resolutions may also be passed by a unanimous written resolution signed by all the

shareholders of our company, as permitted by the Companies Act and our Second Amended and Restated Memorandum and Articles of Association.

Our Second Amended and Restated

Memorandum and Articles of Association provide that the affirmative vote of no less than two-thirds of votes cast by the shareholders

entitled to vote who are present in person or by proxy at a general meeting shall be required to approve any amendments to any provisions

of our Second Amended and Restated Memorandum and Articles of Association that relate to or have an impact upon the procedures regarding

the election, appointment, removal of directors and size of the board.

Dividends

Subject to the Companies Act,

our shareholders may, by resolution passed by a simple majority of the voting rights entitled to vote at the general meeting, declare

dividends (including interim dividends) to be paid to our shareholders but no dividend shall be declared in excess of the amount recommended

by our board of directors. Dividends may be declared and paid out of funds lawfully available to us. Except as otherwise provided by the

rights attached to shares, all dividends shall be declared and paid according to the amounts paid up on the shares on which the dividend

is paid. All dividends shall be paid in proportion to the number of Ordinary Shares a shareholder holds during any portion or portions

of the period in respect of which the dividend is paid; but, if any share is issued on terms providing that it shall rank for dividend

as from a particular date, that share shall rank for dividend accordingly. Our board of directors may also declare and pay dividends out

of the share premium account or any other fund or account which can be authorized for this purpose in accordance with the Companies Act.

In addition, our board of directors

may resolve to capitalize any undivided profits not required for paying any preferential dividend (whether or not they are available for

distribution) or any sum standing to the credit of the our share premium account or capital redemption reserve; appropriate the sum resolved

to be capitalized to the shareholders who would have been entitled to it if it were distributed by way of dividend and in the same proportions

and apply such sum on their behalf either in or towards paying up the amounts, if any, for the time being unpaid on any shares held by

them respectively, or in paying up in full unissued shares or debentures of a nominal amount equal to such sum, and allot the shares or

debentures credited as fully paid to those shareholders, or as they may direct, in those proportions, or partly in one way and partly

in the other; resolve that any shares so allotted to any shareholder in respect of a holding by him/her of any partly-paid shares rank

for dividend, so long as such shares remain partly paid, only to the extent that such partly paid shares rank for dividend; make such

provision by the issue of fractional certificates or by payment in cash or otherwise as they determine in the case of shares or debentures

becoming distributable in fractions; and authorize any person to enter on behalf of all our shareholders concerned in an agreement with

us providing for the allotment of them respectively, credited as fully paid, of any shares or debentures to which they may be entitled

upon such capitalization, any agreement made under such authority being binding on all such shareholders.

Transfers of Shares

Subject to any applicable restrictions

set forth in our Second Amended and Restated Memorandum and Articles of Association, any of our shareholders may transfer all or a portion

of their Ordinary Shares by an instrument of transfer in the usual or common form or in the form prescribed by Nasdaq or in any other

form which our board of directors may approve. Our board of directors may, in its absolute discretion, refuse to register a transfer of

any common share that is not a fully paid up share to a person of whom it does not approve, or any common share issued under any share

incentive scheme for employees upon which a restriction on transfer imposed thereby still subsists, and it may also, without prejudice

to the foregoing generality, refuse to register a transfer of any common share to more than four joint holders or a transfer of any share

that is not a fully paid up share on which we have a lien. Our board of directors may also decline to register any transfer of any registered

common share unless: a fee of such maximum sum as Nasdaq may determine to be payable or such lesser sum as the board of directors may

from time to time require is paid to us in respect thereof; the instrument of transfer is in respect of only one class of shares; the

Ordinary Shares transferred are fully paid and free of any lien; the instrument of transfer is lodged at the registered office or such

other place (i.e., our transfer agent) at which the register of shareholders is kept, accompanied by any relevant share certificate(s)

and/or such other evidence as the board of directors may reasonably require to show the right of the transferor to make the transfer;

and if applicable, the instrument of transfer is duly and properly stamped.

If our board of directors refuses

to register a transfer, they are required, within one month after the date on which the instrument of transfer was lodged, to send to

each of the transferor and the transferee notice of such refusal.

Liquidation

Subject to any special rights,

privileges or restrictions as to the distribution of available surplus assets on liquidation applicable to any class or classes of shares

(1) if we are wound up and the assets available for distribution among our shareholders are more than sufficient to repay the whole of

the capital paid up at the commencement of the winding up, the excess shall be distributed pari passu among our shareholders in proportion

to the amount paid up at the commencement of the winding up on the shares held by them, respectively, and (2) if we are wound up and the

assets available for distribution among our shareholders as such are insufficient to repay the whole of the paid-up capital, those assets

shall be distributed so that, as nearly as may be, the losses shall be borne by our shareholders in proportion to the capital paid up,

or which ought to have been paid up, at the commencement of the winding up on the shares held by them, respectively.

If we are wound up, the liquidator

may with the sanction of a special resolution and any other sanction required by the Companies Act, divide among our shareholders in specie

the whole or any part of our assets and may, for such purpose, value any assets and determine how such division shall be carried out as

between the shareholders or different classes of shareholders. The liquidator may also, with the sanction of a special resolution, vest

any part of these assets in trustees upon such trusts for the benefit of our shareholders as the liquidator shall think fit, but so that

no shareholder will be compelled to accept any assets, shares or other securities upon which there is a liability.

Anti-Takeover Provisions

Some provisions of our Second

Amended and Restated Memorandum and Articles of Association may discourage, delay or prevent a change of control of our company or management

that shareholders may consider favorable, including provisions that authorize our board of directors to issue preferred shares in one

or more series and to designate the price, rights, preferences, privileges and restrictions of such preferred shares without any further

vote or action by our shareholders.

Inspection of Books and Records

Holders of Ordinary Shares will

have no general right under Cayman Islands law to inspect or obtain copies of our list of shareholders or our corporate records. However,

our board of directors may determine from time to time whether our accounting records and books shall be open to the inspection of our

shareholders not members of our board of directors. Notwithstanding the above, our Second Amended and Restated Memorandum and Articles

of Association provide our shareholders with the right to receive annual audited financial statements. Such right to receive annual audited

financial statements may be satisfied by filing such annual reports as we are required to file with the SEC.

Register of Shareholders

Under Cayman Islands law, we must

keep a register of shareholders that includes: the names and addresses of the shareholders, a statement of the shares held by each member,

and of the amount paid or agreed to be considered as paid, on the shares of each member; the date on which the name of any person was

entered on the register as a member; and the date on which any person ceased to be a member.

PLAN OF DISTRIBUTION

Maxim Group LLC, which we refer

to as the Placement Agent, has agreed to act as the exclusive Placement Agent in connection with this offering subject to the terms and

conditions of a placement agency agreement dated as of January 5, 2025. The Placement Agent is not purchasing or selling any securities

offered by this prospectus supplement, nor is it obligated to arrange the purchase or sale of any specific number or dollar amount of

securities, but it has agreed to use its reasonable efforts to arrange for the sale of all of the securities offered hereby.

We have entered into certain

Securities Purchase Agreements with certain accredited investors (the “Investors”) thereto on January 5, 2025 (collectively,

the “SPA”). Pursuant to the SPA, we will sell to the Investors an aggregate of 55,200,000 Ordinary Shares at a per share

price of $0.08. The SPA contains customary representations, warranties and covenants for transactions. We have also agreed to indemnify

the Investors against certain losses resulting from our breach of any of our representations, warranties, or covenants under agreements

with the Investors as well as under certain other circumstances described in the SPA.

We expect that delivery of the

Ordinary Shares being offered pursuant to this prospectus supplement and the accompanying prospectus will be made on or about January

7, 2025, subject to customary closing conditions.

Fees and Expenses

We have

agreed to pay the Placement Agent a total cash fee equal to seven percent (7.0%) of the aggregate gross proceeds raised in this offering.

In addition, we have agreed to reimburse the Placement Agent for certain out-of-pocket expenses up to $50,000.

The table below reflects the

total offering proceeds, before deducting the estimated offering expenses.

| | |

Per Share | |

Total |

| Offering price | |

$ | 0.08 | | |

$ | 4,416,000 | |

| Placement Agent’s fees | |

$ | 0.0056 | | |

$ | 309,120 | |

| Proceeds, before other expenses, to us(2) | |

$ | 0.0744 | | |

$ | 4,106,880 | |

We estimate expenses payable

by us in connection with this offering, other than the Placement Agent’s fees and expenses referred to above, will be approximately

$65,000.

After deducting certain fees

and expenses due to the Placement Agent and our estimated offering expenses, we expect the net proceeds from this offering to be approximately

$3,991,880.

Indemnification

We have agreed to indemnify the

Placement Agent against certain liabilities, including certain liabilities arising under the Securities Act, or to contribute to payments

that the Placement Agent may be required to make for these liabilities.

Lock-up Restrictions

Pursuant to the SPA, we have agreed

for a period of 60 days following the closing date of this offering not to issue, enter into an agreement to issue or announce the issuance

or proposed issuance of Ordinary Shares or any other securities convertible into, or exercisable or exchangeable for, Ordinary Shares

or file any registration statement or amendment or supplement thereto, subject to certain conditions and limited exceptions. We have also

agreed for a period of 60 days following the closing date of this offering not to (i) issue or agree to issue equity or debt securities

convertible into, or exercisable or exchangeable for, shares at a conversion price, exercise price or exchange price which floats with

the trading price of our shares or which may be adjusted after issuance upon the occurrence of certain events or (ii) enter into any agreement,

including an equity line of credit or at-the-market offering, whereby we may issue securities at a future-determined price.

Relationships

The Placement Agent and its affiliates

may provide from time to time in the future certain commercial banking, financial advisory, investment banking and other services for

us in the ordinary course of their business, for which they may receive customary fees and commissions. In addition, from time to time,

the Placement Agent and its affiliates may effect transactions for their own account or the account of customers, and hold on behalf of

themselves or their customers, long or short positions in our debt or equity securities or loans, and may do so in the future. However,

except as disclosed in this prospectus supplement, we have no present arrangements with the Placement Agent for any further services.

Right of First Refusal

For a

period of six (6) months from the closing of the offering, we have granted the Placement Agent the right of first refusal to act as to

act as sole managing underwriter and sole book runner, sole Placement Agent, or sole sales agent, for any and all such future public or

private equity, equity-linked or debt (excluding commercial bank debt) offerings for which the Company retains the service of an underwriter,

agent, advisor, finder or other person or entity in connection with such offering.

Listing

Our Ordinary Shares is listed

on the Nasdaq Capital Market under the symbol “BHAT.”

Regulation M

The Placement Agent may be deemed

to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized

on the resale of the securities sold by it while acting as principal might be deemed to be underwriting discounts or commissions under

the Securities Act. As an underwriter, the Placement Agent would be required to comply with the requirements of the Securities Act and

the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange

Act. These rules and regulations may limit the timing of purchases and sales of our securities by the Placement Agent acting as principal.

Under these rules and regulations, the Placement Agent:

| |

● |

may not engage in any stabilization activity in connection with our securities; and |

| |

|

|

| |

● |

may not bid for or purchase any of our securities

or attempt to induce any person to purchase any of our securities, other

than as permitted under the Exchange Act, until it

has completed its participation in the distribution. |

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following summary of the

material Cayman Islands, PRC and U.S. federal income tax consequences of an investment in our Ordinary Shares is based upon laws and relevant

interpretations thereof in effect as of the date of this prospectus supplement, all of which are subject to change. This summary does

not deal with all possible tax consequences relating to an investment in our Ordinary Shares, such as the tax consequences under U.S.

state and local tax laws or under the tax laws of jurisdictions other than the Cayman Islands, the People’s Republic of China and

the United States.

Material U.S. Federal Income Tax Considerations

for U.S. Holders

The following discussion describes

the material U.S. federal income tax consequences relating to the ownership and disposition of our Ordinary Shares by U.S. Holders (as

defined below). This discussion applies to U.S. Holders that purchase our Ordinary Shares and hold such Ordinary Shares as capital assets.

This discussion is based on the U.S. Internal Revenue Code of 1986, as amended, U.S. Treasury regulations promulgated thereunder and administrative

and judicial interpretations thereof, all as in effect on the date hereof and all of which are subject to change, possibly with retroactive

effect. This discussion does not address all of the U.S. federal income tax consequences that may be relevant to specific U.S. Holders

in light of their particular circumstances or to U.S. Holders subject to special treatment under U.S. federal income tax law (such as

certain financial institutions, insurance companies, dealers or traders in securities or other persons that generally mark their securities

to market for U.S. federal income tax purposes, tax-exempt entities or governmental organizations, retirement plans, regulated investment

companies, real estate investment trusts, grantor trusts, brokers, dealers or traders in securities, commodities, currencies or notional

principal contracts, certain former citizens or long-term residents of the United States, persons who hold our Ordinary Shares as part

of a “straddle,” “hedge,” “conversion transaction,” “synthetic security” or integrated

investment, persons that have a “functional currency” other than the U.S. dollar, persons that own directly, indirectly or

through attribution 10% or more of the voting power of our Ordinary Shares, corporations that accumulate earnings to avoid U.S. federal

income tax, partnerships and other pass-through entities, and investors in such pass-through entities). This discussion does not address

any U.S. state or local or non-U.S. tax consequences or any U.S. federal estate, gift or alternative minimum tax consequences.

As used in this discussion, the

term “U.S. Holder” means a beneficial owner of our Ordinary Shares who is, for U.S. federal income tax purposes, (1) an individual

who is a citizen or resident of the United States, (2) a corporation (or entity treated as a corporation for U.S. federal income tax purposes)

created or organized in or under the laws of the United States, any state thereof, or the District of Columbia, (3) an estate the income

of which is subject to U.S. federal income tax regardless of its source or (4) a trust (x) with respect to which a court within the United

States is able to exercise primary supervision over its administration and one or more United States persons have the authority to control

all of its substantial decisions or (y) that has elected under applicable U.S. Treasury regulations to be treated as a domestic trust

for U.S. federal income tax purposes.

If an entity treated as a partnership

for U.S. federal income tax purposes holds our Ordinary Shares, the U.S. federal income tax consequences relating to an investment in

such Ordinary Shares will depend in part upon the status and activities of such entity and the particular partner. Any such entity should

consult its own tax advisor regarding the U.S. federal income tax consequences applicable to it and its partners of the purchase, ownership

and disposition of our Ordinary Shares.

Persons considering an investment

in our Ordinary Shares should consult their own tax advisors as to the particular tax consequences applicable to them relating to the

purchase, ownership and disposition of our Ordinary Shares including the applicability of U.S. federal, state and local tax laws and non-U.S.

tax laws.

Passive Foreign Investment Company Consequences

In general, a corporation organized

outside the United States will be treated as a PFIC for any taxable year in which either (1) at least 75% of its gross income is “passive

income” (the “PFIC income test”), or (2) on average at least 50% of its assets, determined on a quarterly basis, are

assets that produce passive income or are held for the production of passive income (the “PFIC asset test”). Passive income

for this purpose generally includes, among other things, dividends, interest, royalties, rents, and gains from the sale or exchange of

property that gives rise to passive income. Assets that produce or are held for the production of passive income generally include cash,

even if held as working capital or raised in a public offering, marketable securities, and other assets that may produce passive income.

Generally, in determining whether a non-U.S. corporation is a PFIC, a proportionate share of the income and assets of each corporation

in which it owns, directly or indirectly, at least a 25% interest (by value) is taken into account.

Although PFIC status is determined

on an annual basis and generally cannot be determined until the end of a taxable year, based on the nature of our current and expected

income and the current and expected value and composition of our assets, we do not presently expect to be a PFIC for our current taxable

year or the foreseeable future. However, there can be no assurance given in this regard because the determination of whether we are or

will become a PFIC is a fact-intensive inquiry made on an annual basis that depends, in part, upon the composition of our income and assets.

In addition, there can be no assurance that the IRS will agree with our conclusion or that the IRS would not successfully challenge our

position.

If we are a PFIC in any taxable

year during which a U.S. Holder owns our Ordinary Shares, the U.S. Holder could be liable for additional taxes and interest charges under

the “PFIC excess distribution regime” upon (1) a distribution paid during a taxable year that is greater than 125% of the

average annual distributions paid in the three preceding taxable years, or, if shorter, the U.S. Holder’s holding period for our

Ordinary Shares , and (2) any gain recognized on a sale, exchange or other disposition, including a pledge, of our Ordinary Shares, whether

or not we continue to be a PFIC. Under the PFIC excess distribution regime, the tax on such distribution or gain would be determined by

allocating the distribution or gain ratably over the U.S. Holder’s holding period for our Ordinary Shares. The amount allocated

to the current taxable year (i.e., the year in which the distribution occurs or the gain is recognized) and any year prior to the first

taxable year in which we are a PFIC will be taxed as ordinary income earned in the current taxable year. The amount allocated to other

taxable years will be taxed at the highest marginal rates in effect for individuals or corporations, as applicable, to ordinary income

for each such taxable year, and an interest charge, generally applicable to underpayments of tax, will be added to the tax.

If we are a PFIC for any year

during which a U.S. Holder holds our Ordinary Shares, we must generally continue to be treated as a PFIC by that holder for all succeeding

years during which the U.S. Holder holds such Ordinary Shares, unless we cease to meet the requirements for PFIC status and the U.S. Holder

makes a “deemed sale” election with respect to our Ordinary Shares. If the election is made, the U.S. Holder will be deemed

to sell our Ordinary Shares it holds at their fair market value on the last day of the last taxable year in which we qualified as a PFIC,

and any gain recognized from such deemed sale would be taxed under the PFIC excess distribution regime. After the deemed sale election,

the U.S. Holder’s Ordinary Shares would not be treated as shares of a PFIC unless we subsequently become a PFIC.

If we are a PFIC for any taxable

year during which a U.S. Holder holds our Ordinary Shares and one of our non-United States subsidiaries is also a PFIC (i.e., a lower-tier

PFIC), such U.S. Holder would be treated as owning a proportionate amount (by value) of the shares of the lower-tier PFIC and would be

taxed under the PFIC excess distribution regime on distributions by the lower-tier PFIC and on gain from the disposition of shares of

the lower- tier PFIC even though such U.S. Holder would not receive the proceeds of those distributions or dispositions. Any of our non-United

States subsidiaries that have elected to be disregarded as entities separate from us or as partnerships for U.S. federal income tax purposes

would not be corporations under

U.S. federal income tax law and

accordingly, cannot be classified as lower-tier PFICs. However, non-United States subsidiaries that have not made the election may be

classified as a lower-tier PFIC if we are a PFIC during your holding period and the subsidiary meets the PFIC income test or PFIC asset

test. Each U.S. Holder is advised to consult its tax advisors regarding the application of the PFIC rules to any of our non-United States

subsidiaries.

If we are a PFIC, a U.S. Holder

will not be subject to tax under the PFIC excess distribution regime on distributions or gain recognized on our Ordinary Shares if a valid

“mark-to-market” election is made by the U.S. Holder for our Ordinary Shares. An electing U.S. Holder generally would take

into account as ordinary income each year, the excess of the fair market value of our Ordinary Shares held at the end of such taxable

year over the adjusted tax basis of such Ordinary Shares. The U.S. Holder would also take into account, as an ordinary loss each year,

the excess of the adjusted tax basis of such Ordinary Shares over their fair market value at the end of the taxable year, but only to

the extent of the excess of amounts previously included in income over ordinary losses deducted as a result of the mark-to-market election.

The U.S. Holder’s tax basis in our Ordinary Shares would be adjusted to reflect any income or loss recognized as a result of the

mark-to-market election. Any gain from a sale, exchange or other disposition of our Ordinary Shares in any taxable year in which we are

a PFIC would be treated as ordinary income and any loss from such sale, exchange or other disposition would be treated first as ordinary

loss (to the extent of any net mark-to-market gains previously included in income) and thereafter as capital loss. If, after having been

a PFIC for a taxable year, we cease to be classified as a PFIC because we no longer meet the PFIC income or PFIC asset test, the U.S.

Holder would not be required to take into account any latent gain or loss in the manner described above and any gain or loss recognized

on the sale or exchange of the Ordinary Shares would be classified as a capital gain or loss.

A mark-to-market election is available

to a U.S. Holder only for “marketable stock.” Generally, stock will be considered marketable stock if it is “regularly

traded” on a “qualified exchange” within the meaning of applicable U.S. Treasury regulations. A class of stock is regularly

traded during any calendar year during which such class of stock is traded, other than in de minimis quantities, on at least 15 days during

each calendar quarter.

Our Ordinary Shares are marketable

stock as long as they remain listed on the Nasdaq Capital Market and are regularly traded. A mark-to-market election will not apply to

the Ordinary Shares for any taxable year during which we are not a PFIC, but will remain in effect with respect to any subsequent taxable

year in which we become a PFIC. Such election will not apply to any of our non-U.S. subsidiaries. Accordingly, a U.S. Holder may continue

to be subject to tax under the PFIC excess distribution regime with respect to any lower-tier PFICs notwithstanding the U.S. Holder’s

mark-to-market election for the Ordinary Shares.

Except for stamp duties which

may be applicable on instruments executed in or brought within the jurisdiction of the Cayman Islands, no stamp duty, capital duty, registration

or other issue or documentary taxes are payable in the Cayman Islands on the creation, issuance or delivery of the Ordinary Shares. The

Cayman Islands currently have no form of income, corporate or capital gains tax and no estate duty, inheritance tax or gift tax. There

are currently no Cayman Islands’ taxes or duties of any nature on gains realized on a sale, exchange, conversion, transfer or redemption

of the Ordinary Shares. Payments of dividends and capital in respect of the Ordinary Shares will not be subject to taxation in the Cayman

Islands and no withholding will be required on the payment of interest and principal or a dividend or capital to any holder of the Ordinary

Shares, nor will gains derived from the disposal of the Ordinary Shares be subject to Cayman Islands income or corporation tax as the

Cayman Islands currently have no form of income or corporation taxes.

The tax consequences that would

apply if we are a PFIC would also be different from those described above if a U.S. Holder were able to make a valid qualified electing

fund, or “QEF”, election. As we do not expect to provide U.S. Holders with the information necessary for a U.S. Holder to

make a QEF election, prospective investors should assume that a QEF election will not be available.

The U.S. federal income tax rules

relating to PFICs are very complex. U.S. Holders and prospective U.S. investors are strongly urged to consult their own tax advisors with

respect to the impact of PFIC status on the purchase, ownership and disposition of our Ordinary Shares, the consequences to them of an

investment in a PFIC, any elections available with respect to the Ordinary Shares and the IRS information reporting obligations with respect

to the purchase, ownership and disposition of Ordinary Shares of a PFIC.

Distributions

Subject to the discussion above

under “Passive Foreign Investment Company Consequences,” a U.S. Holder that receives a distribution with respect to our Ordinary

Shares generally will be required to include the gross amount of such distribution in gross income as a dividend when actually or constructively

received to the extent of the U.S. Holder’s pro rata share of our current and/or accumulated earnings and profits (as determined

under U.S. federal income tax principles). To the extent a distribution received by a U.S. Holder is not a dividend because it exceeds

the U.S. Holder’s pro rata share of our current and accumulated earnings and profits, it will be treated first as a tax-free return

of capital and reduce (but not below zero) the adjusted tax basis of the U.S. Holder’s Ordinary Shares. To the extent the distribution

exceeds the adjusted tax basis of the U.S. Holder’s Ordinary Shares, the remainder will be taxed as capital gain. Because we may

not account for our earnings and profits in accordance with U.S. federal income tax principles, U.S. Holders should expect all distributions

to be reported to them as dividends.

Distributions on our Ordinary

Shares that are treated as dividends generally will constitute income from sources outside the United States for foreign tax credit purposes

and generally will constitute passive category income. Such dividends will not be eligible for the “dividends received’’

deduction generally allowed to corporate shareholders with respect to dividends received from U.S. corporations. Dividends paid by a “qualified

foreign corporation’’ to certain non-corporate U.S. Holders may be are eligible for taxation at a reduced capital gains rate

rather than the marginal tax rates generally applicable to ordinary income provided that a holding period requirement (more than 60 days

of ownership, without protection from the risk of loss, during the 121- day period beginning 60 days before the ex-dividend date) and

certain other requirements are met. Each U.S. Holder is advised to consult its tax advisors regarding the availability of the reduced

tax rate on dividends to its particular circumstances. However, if we are a PFIC for the taxable year in which the dividend is paid or

the preceding taxable year (see discussion above under “- Passive Foreign Investment Company Consequences’’), we will

not be treated as a qualified foreign corporation, and therefore the reduced capital gains tax rate described above will not apply.

Dividends will be included in

a U.S. Holder’s income on the date of the depositary’s receipt of the dividend. The amount of any dividend income paid in

Cayman Islands dollars will be the U.S. dollar amount calculated by reference to the exchange rate in effect on the date of receipt, regardless

of whether the payment is in fact converted into U.S. dollars. If the dividend is converted into U.S. dollars on the date of receipt,

a U.S. Holder should not be required to recognize foreign currency gain or loss in respect to the dividend income. A U.S. Holder may have

foreign currency gain or loss if the dividend is converted into U.S. dollars after the date of receipt.

A non-United States corporation

(other than a corporation that is classified as a PFIC for the taxable year in which the dividend is paid or the preceding taxable year)

generally will be considered to be a qualified foreign corporation with respect to any dividend it pays on Ordinary Shares that are readily

tradable on an established securities market in the United States.

Sale, Exchange or Other Disposition of Our

Ordinary Shares

Subject to the discussion above

under “- Passive Foreign Investment Company Consequences,’’ a U.S. Holder generally will recognize capital gain or loss

for U.S. federal income tax purposes upon the sale, exchange or other disposition of our Ordinary Shares in an amount equal to the difference,

if any, between the amount realized (i.e., the amount of cash plus the fair market value of any property received) on the sale, exchange

or other disposition and such U.S. Holder’s adjusted tax basis in the Ordinary Shares. Such capital gain or loss generally will

be long-term capital gain taxable at a reduced rate for non-corporate U.S. Holders or long-term capital loss if, on the date of sale,

exchange or other disposition, the Ordinary Shares were held by the U.S. Holder for more than one year. Any capital gain of a non-corporate

U.S. Holder that is not long-term capital gain is taxed at ordinary income rates. The deductibility of capital losses is subject to limitations.

Any gain or loss recognized from the sale or other disposition of our Ordinary Shares will generally be gain or loss from sources within

the United States for U.S. foreign tax credit purposes.

Medicare Tax

Certain U.S. Holders that are

individuals, estates or trusts and whose income exceeds certain thresholds generally are subject to a 3.8% tax on all or a portion of

their net investment income, which may include their gross dividend income and net gains from the disposition of our Ordinary Shares.

U.S. Holders that are individuals, estates or trusts are encouraged to consult their tax advisors regarding the applicability of this

Medicare tax to income and gains with respect to their investment in our Ordinary Shares.

Information Reporting and Backup Withholding

U.S. Holders may be required to