UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: June 14, 2023

BioPlus

Acquisition Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Cayman Islands |

|

001-41116 |

|

98-1583272 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

260 Madison Avenue

Suite 800

New York, New

York 10016

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (212) 287-4092

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A Ordinary Share and one-half of one Redeemable Warrant |

|

BIOSU |

|

The Nasdaq Stock Market LLC |

| Class A Ordinary Share, par value $0.0001 per share |

|

BIOS |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one Class A Ordinary Share for $11.50 per share |

|

BIOSW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

On June 14, 2023, BioPlus Acquisition Corp (“BIOS”) and Avertix Medical, Inc. (f/k/a Angel Medical Systems, Inc.), a Delaware corporation

(“Avertix”) will make available a joint investor presentation concerning their previously announced proposed business combination. A copy of the investor presentation is furnished herewith as Exhibit 99.1.

The information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of BIOS under the Securities Act of 1933, as

amended, or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K will not be deemed an admission as to the materiality of any information

contained in this Item 7.01, including Exhibit 99.1.

Important Information About the Transactions and Where to Find It

This Current Report on Form 8-K may contain information relating to a proposed business combination between BIOS and

Avertix. In connection with the proposed transaction, BIOS has filed a registration statement on Form S-4 (as amended or supplemented, the “Registration Statement”) with the Securities and Exchange

Commission (the “SEC”), which includes a preliminary proxy statement/prospectus of BIOS, which will be both the proxy statement to be distributed to holders of BIOS’ ordinary shares in connection with the solicitation of proxies for

the vote by BIOS’ shareholders with respect to the proposed business combination and related matters as may be described in the Registration Statement, as well as the prospectus relating to the offer and sale of the securities to be issued in

the business combination. After the Registration Statement is declared effective, BIOS will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders. BIOS shareholders and other interested persons are advised to

read, when available, the preliminary proxy statement/prospectus, and amendments thereto, and the definitive proxy statement/prospectus in connection with BIOS’ solicitation of proxies for its shareholders’ meeting to be held to approve

the proposed business combination and related matters because the proxy statement/prospectus will contain important information about BIOS and Avertix and the proposed business combination.

The definitive proxy statement/prospectus will be mailed to shareholders of BIOS as of a record date to be established for voting on the proposed business

combination and related matters. Shareholders may obtain copies of the proxy statement/prospectus, when available, without charge, at the SEC’s website at www.sec.gov or by directing a request to: BioPlus Acquisition Corp., 260 Madison Avenue,

Suite 800, New York, NY 10026 or by emailing info@Biosspac.com

Participants in the Solicitation

BIOS and Avertix and their respective directors, officers and other members of their management and employees may be deemed to be participants in the

solicitation of proxies from BIOS’ shareholders with respect to the proposed business combination and related matters. Investors and securityholders may obtain more detailed information regarding the names, affiliations and interests of the

directors and officers of BIOS and Avertix in the proxy statement/prospectus relating to the proposed business combination filed with the SEC. These documents may be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This Current Report on Form 8-K is for informational purposes only and is not intended to and shall not constitute a proxy statement or the solicitation of a proxy, consent or authorization with respect to any securities or in respect of the

proposed transaction and is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote of approval, nor shall

there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are not historical facts, and involve risks and uncertainties that could cause actual results of BIOS and Avertix to differ materially from those expected

and projected. These statements, other than statements of present or historical fact included in this document, regarding BIOS’ proposed business combination with Avertix, BIOS’ ability to consummate the proposed transactions, the benefits

of the proposed transactions and the combined company’s future financial performance, including financial projections, as well as the combined company’s strategy, demand for products and services, use cases for products and services,

anticipated business model and future operations, estimated financial position, estimated revenue growth, prospects expectations, estimated market growth, size and opportunity, plans and objectives of management, among others, are forward-looking

statements. These statements are based on various assumptions, whether or not identified in this document, and on the current expectations of Avertix’s management and are not predictions of actual performance, and, as a result, are subject to

risks and uncertainties. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many factors could cause actual future events to differ materially from the forward-looking statements in this document,

including but not limited to: the inability of the parties to successfully or timely consummate the proposed business combination; the risk that the proposed business combination may not be completed by BIOS’ business combination deadline and

the potential failure to obtain an extension of the business combination deadline by BIOS; failure to realize the anticipated benefits of the proposed business combination; the occurrence of any event, change or other circumstance that could give

rise to the termination of the definitive transaction agreement; Avertix’s history of operating losses; Avertix’s ability to engage physicians to utilize and prescribe its solution; changes in reimbursement practices; technological changes

in Avertix’s market; Avertix’s ability to protect its intellectual property; Avertix‘s material weaknesses in financial reporting; and the Avertix’s ability to navigate complex regulatory requirements. The foregoing list of

factors is not exhaustive. Please carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the final prospectus to BIOS’ registration statement on Form S-1, as amended (File No. 333-249676), the Registration Statement filed with the SEC by BIOS and other documents filed or that may be filed by BIOS from time to time with

the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those obtained in the forward-looking statements.

There may be additional risks that neither BIOS nor Avertix presently know or that BIOS and Avertix currently believe are immaterial that could also cause

actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect BIOS’ and Avertix’s expectations, plans or forecasts of future events and views as of the date of this

document. BIOS and Avertix anticipate that subsequent events and developments will cause BIOS’ and Avertix’s assessments to change. However, while BIOS and Avertix may elect to update these forward-looking statements at some point in the

future, BIOS and Avertix specifically assume no obligation and do not intend to do so, nor do they intend to revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by

applicable law. These forward-looking statements should not be relied upon as representing BIOS’ and Avertix’s assessments as of any date subsequent to the date of this document. Neither BIOS nor Avertix gives any assurance that either

BIOS or Avertix, or the combined company, will achieve its expectations. Accordingly, undue reliance should not be placed upon the forward-looking statements as predictions of future events.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Investor Presentation, dated June 14, 2023. |

|

|

| 104.1 |

|

Cover page interactive data file (embedded within the Inline XBRL document). |

| * |

Certain exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). BIOS agrees to supplementally furnish a copy of any omitted exhibit or schedule to the SEC upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| BioPlus Acquisition Corp. |

|

|

| By: |

|

/s/ Ross Haghighat |

| Name: |

|

Ross Haghighat |

| Title: |

|

Chief Executive Officer and Chief Financial Officer |

Dated: June 14, 2023

Exhibit 99.1

! #$%&’()) * + ,! -( * - +* ++ -.(/ 0 123#)4,4.! 0 5

123#$!&$.(/&’6% *.7*83#$6295&$5%.8&’ #$% 6*8 +&’)*36( -!!%1* - + (!+ !*+ -3 :*/ -)62951%) - +#’*# - ’1#’ 1#’*)* *( *)!#(’(1/* ( -, - -()) )) 3%* (* - *+ - !*+; )3 % -%*)) 1 )))+*1

*1*;*1 )(1( ;* -% 6*8 + 1 + 1*))*;* -1 - 1*))1 + * -)* * -)* ;*3%*( !!*3.)) * - + **)(*+! - + / ) !* 5*.)<=>>1 1))) )*( (*+ ))!36295!(! - - )))!;*+! )3 *) %+ -?)+*1*+1;* -*+** -* + -!* 3 @ -1/ !(1)1%32* , *%(++) A**+ * - ) ) *3@6295! ()+)

***)B* 3*+;!3C)%*1 *+7* *) -62951!((( 1 ! /(321%*+ A *( )) +7* ,)* )! % 6*8 +3C)%* , -( *)!) (7*)) * ,*(! 3 DEF GHFIJEEKLMNOPHPQ RQMPS 8 *% )+*) -A ,! )*))+(*T5%(5*U!C) .)<==V3W -A ,! ! + -*$+ (1&$ 1&$ - 1&$

1&$*1&$1&$1&$/1&$* 1&$ -* 1&$ 1&$1&$ 1&$ 1&$,1&$)**1&$* ,1& /)**( ) 1+*+) - ) -A ,!3. 1 ) ) *%1!!6295B7*)!16295B+ * 1+)) + B)**) ) 1 *!) ;1 - + B!1 )*(1*)* (1+* )**1 ) 1 (*! -1/1 ,! -1X*1 +;()

! 1 !1) -A ,! 3 +(** 1 -)%1*/)!B ! )* ) 11* 1*+;,*3) -A ,! () *(* (1 *+ +(1!*1*1)( ))++ 3.* (* ))* + - ))) * 3 0)* ** )**()) ) ) -A ,! %1 *!+* Y+ )*)* * % 6*8 +?,% 6*8 + + +6295B+* + ) *+/)+* + +6295?) * X+) )% 6*8 +?, !*);) ) -!?+ %2%Z)!?*)(1!* *

!( ) )(! ?!B)! ?!B) *+* ! -?!B+ !!* X+ *?! +* ? ! !!B ,?!B+ * ?![ -,) !?!B+ (! /!* 7* 3)! ! )) /*(3% )* )!!)1,)!V)%,*+$C,W&)) *6295B! W 5A<1 #W @3 >>>A]=^_^’1! W 5A+) -5Z8+6295* ) +) +6295) -5Z83) !) ,** ** ( * )) ) ) -A ,!

3 2)), X** (1* * * )) ) * +) -A ,! 3 + ,6295! , -6295!* + ( * ** * ))) ) -A ,! 321) -A ,! ) 6295B!B/1 )))**(( -)) %36295!*+7*(( - *6295B!B !3‘ -(1 - 6295! *) -A ,! )**16295! ) * + !1() -A ,! 1 -* ) -) 1)**(1 -1/ +7*+ + -3) -A ,! * + *!6295B!B

)*+7*)%3@6295!!(*6295!1 + 1 - (/3.! 1** * + *) -A ,! ))**(3

! !# ! $# %&# ’%# ($ !#!)!*#!)$ (#$+, #-#$! ! $ ’$ #$

!.)!$$ &$$( ’- !$ ’ / ! #(#0 # ’-)!$$ &!0-# 1 !$ # ’ ) !2 #!0 # !& # ’ ! ! !# !+3!0 !-$-#& # ’! # ’ ) !2 ! !# ! $! ! ! !$ &((#-#& # ’!+4567!#2$$( ’! .) 2 ! (- !& #

’ ! ! $-#$! !+8(##9& !! )$ ! !# ! /#-#-#.0#2 ! #! / -# % ’-!035:;3$!#$+#2 $(##!)0 !-# $$ &(-) & !2 $& !! )$ ’-)0 / -(.) ’-!0!7< :#=( #’!$+ >?@ A?B 4567!#2 /! #%# 2$ %# ($# ’#C$9$#%

’#C$!#! ’$0($ ! !! ! / -# ! & ##$- %.($ !$$$+ $-#$! ! ’0)$ ! !# ’#C$9$#% ’#C$9#! ’$! -0# 2$ & #-# $9 / #-# -#0 & ##$- % /!#$+($ # $-)0 & #-# $D# ’#C$9$#% ’#C$9#! ’$ #-# ($ ! $-#$!

! $! !! 9! $! ’-)09#) !$ -/ 4567 ##29 #!! #$’! #$- !$ #$ -.0 # &4567 ##2+7 ))0& # !%! !9# ’#C$9$#% ’#C$9#! ’$! -0# 2$#&## ! $-#$! ! ’0--# / ( E97 E9F #G$0 ’. )$9.($(#&#!$#! !! ! 9 !!0 /094567

##2 / ))! $$#9 &())$*!(!#--) .))/9 ## 2$ ## 2 &--) .)) !$ # $# ’#C$9$#% ’#C$9#! ’$! -0# 2$+ H?IJKL -# 1 !$9$ ’$!#2$ ! $;#$! !#& # /#M) C !2$ ’!$#.$ !$$( ’- !$# !#!)0$(.1 $ 2! & !(!# ! $! ! !2! $9

’!0 & / #.0 !4567D!#2D$ !# )+ N )))-# 1 !$9 $ ’$!#2$#!$$# )0$-() %94567!#2.) %-#-# ! &-# $- %& !! ) !& # ’ ! !% )%$ !#$ !2)0 2#)%)$ &(!# !0&(## (-# 1 !9$ ’ ##2*!$&# ’ &-#-# !+ $$(

’- !$!$ ’$(!#)0 !2-# 19*- ##2#$()$# !#!)0(!# !!#$(.1 / %# 0 &$ 2! & !.($ !$$9 ! ’ 9#2() #0! ’- %# $C$!(!# ! $ ()($()#$()$ O# ’# ))0&# ’ $ ! ! !$(-# 1 !$9$ ’$!#2$+ !)($ ! &-# 1 !$9$

’$!#2$ ! $-#$! !$ ()! .#2#$! ! !4567!#29 # ##-#$! %$9 !$ # # !$ #& !! )-# 1 !$9$ ’$! #2$ .#) .)-# ! &&((#%!$+ PKLLJKQRL? AKL & !! ) !& # ’ !! ! ! ! $;#$! ! $(!( ! $! !& # ’ S2() !7MT+3 # !2)09$( !&

# ’ !! ’0! . !)( !9 ’0.1($ ! # ’0.-#$! &&#!)0 !9!0-# *0$ ’! ##2 $# ! $ ’! .& ).04567 ##2 / 7<:+ R AU?LRL?AKL?RLV?L@WJBXQ@? 4567!#2! ##$- % # #$!*( % && #$9(!#7<:#()$9 ’0. ’

.-# -!$ !$ ) ! &-# * $ &4567D$# )#$ ! !! ! / ; ! )4($ !$$: ’. ! !+5!%$ #$!$(# 0 )#$ ’0 . ! ’ # ) !& # ’ !#2# !2! ’$! !#$$ !; ! )4($ !$$: ’. ! ! &4567D # #$! && #$ !4567D& ) !2$ /

7<:9 !)( !24567D#2 $# !$ ’! !8 # ’7MY9 / /$ # 2 !))0& ) / 7<: !Z()0[9[[Y+ *! ) !2$ &4567D$(# $%!2&# ’ ’ (!$#- # !4567D#2 $# !$ ’! !8 # ’7MY9$(!2$%.! # / )).#&) !7 ’!$ &:!2 !6 /!#$

- !8 # ’]& ) / 7<:+5!& # ’ !#2# !2-#$ !$ / ’09(!# 7<:#()$9. ’-# -!$ !$ ) ! &-# * $ 4567D$# )#$ ! !! ! / ; ! )4($ !$$: ’. ! ! $$& # !#2 $# !$ ’!& ).04567 !8 # ’7M]^$ ’! #$(--)

’!9_S2 $# !7 ’!‘a9 / !)($-#) ’ !#0-# *0$ ’!b-# $-($ &45679 / / )).. -# *0$ ’! . $# .( )#$ &4567D # !#0$#$ ! !! ! / $ ) ! &-# * $& #% .04567c$# )#$ / #$- -# - $.($ !$$ ’. ! !!#) ’#$$

’0.$# . !S2 $# !7 ’!9$ /))$-# $-($#) !2 &&#!$) &$(# $ . $$( !;# - $4($ !$$: ’. ! !+3&#S2 $# !7 ’! $)#&& %94567/ )) ’ ) & ! %-# *0$ ’!b-# $-($! ##)%! ( ’!$ $$# )#$+4567$# )#$! #

!#$-#$ !$#% $ #9 /!% ).)9-#) ’ !#0-# *0$ ’!b-# $-($9! ’! ’!$# 9!& ! %-# *0 $ ’!b-# $-($ ! !! ! / 4567D$ ) ! &-# * $& # $$# )#$D ’ !2 .) --# %;# - $4($ !$$: ’. ! !!#) ’#$.($-# *0$

’!b-# $-($ / )) ! ! ’- #! !& # ’ !. (4567!3%# * !;# - $4($ !$$: ’. ! !+ $;#$! ! $! $(.$ (& ##2 $# !$ ’! #& #!0 # ( ’!4567 ’0& )/ 7<: ! !! ! / ; ! )4($ !$$: ’. !

!+5,d<76S73,e7<:fS5gh6ie<S73S<fSj<e6S<3eh<e6:f E<,785i<eN5hh<7<: :3S<8fiig3,e5,h<5S<,5S<g Nh<,h<g4<:6 E<3d35i34i<4<:3f7<h<g N5ii:6,35,5 E;6S3,5,86S E356,+5!%$ #$!$(# 0 )#$ ’0

. !&# - $ & # ( ’!$& ) / 7<:.04567# (2 /.$ ’ ! !.07<: -kbb ///+$+2 %+

5,d<7E<,5,3,g7<:fS55<7e<7:S54<eh<S<5,h37,64<<,3;;S6d<e6Se573;;S6d<e4gh<7<:6S3,g6h<SS<jfi36Sg3fh6S5g,6Sh373,g3fh6S5g;377<ef;6,6S<,e6S7<eh<

E<S5768h<688<S5,j6Sh<3::fS3:g6S3e<lf3:g 68h<5,86S E356,:6,35,<eh<S<5,+3,gS<;S<7<,356,6h<:6,S3Sg573:S5 E5,3i688<,7<+

! #$%&’ ()*+,-./01210.2-3,43536+,1-.789322+217:

;1473-1<0.+*+3,2=2-1.76,35.-1>.9.-4.7-0+5=-=,+? @++/6+<--3.7<=,9322+253,-0+53,+2++1>9+5=-=,+A17:3=,1>.9.-4-31<0.+*+17: ;1.7-1.76,35.-1>.9.-4:+6+7:237-0+<3 ;;+,<.192=<<+2235-0+B=1,:.17C42-+ ;?

()*+,-./,+D=.,+21::.-.3719<16.-19-32=663,-.-26,+2+7->=2.7+22691717:17-.<.61-+:>=2.7+228,3 E-0A17:2=<0<16.-19 ;1473->+1*1.91>9+371<<+6-1>9+-+, ;2A3,1-199A E0.<0 E3=9:1:*+,2+94155+<-.-21>.9.-4-336+,1-+?

()*+,-./F2>=2.7+22.2:+6+7:+7-=6376042.<.172=-.9.G.7817:6,+2<,.>.78.-2239=-.37H.5)*+,-./51.92-3+7818+6042.<.172-3=-.9.G+.-2239=-.37A.-2,+*+7=+2 ;147+*+, ;1-+,.19.G+3, ;1473- ;++-.-26,3I+<-.372? J3,+3*+,A.5

E+1,+=71>9+-3+:=<1-+<9.7.<.17237-0+215+A +55+<-.*+17:166,36,.1-+=2+353=,6,3:=<-17::+2.87+:2=,8+,4A E+ ;14+/6+,.+7<+.7<,+12+:<91. ;2356,3:=<-9.1>.9.-417: ;14>+=71>9+-31<0.+*+3=,+/6+<-+:8,3 E-0?

()*+,-./F253,+<12-217:6,3I+<-.3721,+>12+:=637122= ;6-.372A171942+217:+2-. ;1-+2:+*+936+:>4.-2 ;1718+ ;+7-?K5-0+2+122= ;6-.372A171942+23,+2-. ;1-+26,3*+-3>+.7<3,,+<-3,.71<<=,1-+A)*+,-./F21<-=19,+2=9-2 ;14:.55+,

;1-+,.19945,3 ;-032+53,+<12-+:3, 6,3I+<-+:? ()*+,-./F2,+*+7=+,+9.+237-0+B=1,:.17C42-+ ;A E0.<0.2<=,,+7-94.-23794355+,.78?K5-0+B=1,:.17C42-+ ;3,5=-=,+355+,.78251.9- 381.7A3,932+A ;1,L+-1<<+6-17<+A)*+,-./F2>=2.7+22 E.992=55+,?

()*+,-./F22=<<+22:+6+7:237.-21>.9.-4-3+55+<-.*+94 ;1,L+-.-2B=1,:.17C42-+ ;181.72--032+35+/.2-.783,7+ E-+<073938.+2.7-0+ ;1,L+-? (K5)*+,-./.2=71>9+-3L++6=6E.-0:+ ;17:53,-0+B=1,:.17C42-+ ;A.-2,+*+7=+<3=9:>+. ;61.,+:A

;1,L+-1<<+6-17<+53,-0+B=1,:.17C42-+ ;<3=9:>+01, ;+:A17:6042.<.172 ;14.72-+1:3,:+,19-+,71-.*+-,+1- ;+7-2? (K5)*+,-./.273-1>9+-3 ;1.7-1.71:+D=1-+9+*+9235-0.,:M61,-4,+. ;>=,2+ ;+7-53,.-2B=1,:.17C42-+ ;A.- E3=9:01*+1

;1-+,.191:*+,2++55+<-37.-2>=2.7+22? (N0178+2.7,+. ;>=,2+ ;+7-6,1<-.<+235-0.,:M61,-46143,2<3=9:155+<--0+:+ ;17:53,-0+B=1,:.17C42-+ ;17:)*+,-./F2,+*+7=+9+*+92? (O+. ;>=,2+ ;+7->4

J+:.<1,+.20.8094,+8=91-+:17:2=>I+<--3<0178+H17451.9=,+-3<3 ;694 E.-01669.<1>9+,+8=91-.372<3=9::+<,+12+)*+,-./F2+/6+<-+:,+*+7=+17: ;142=>I+<-.--36+719-.+23,01*+171:*+,2+. ;61<-37.-2>=2.7+22? (K5,+.

;>=,2+;+7-3,3-0+,614 ;+7-53,-0+B=1,:.17C42-+ ;.2,+:=<+:3, ;3:.5.+:.7-0+P7.-+:C-1-+2A.7<9=:.78-0,3=80<32-<37-1.7 ;+7- ;+12=,+23,<0178+2-3639.<.+2 E.-0,+26+<--36,.<.78A)*+,-./F2>=2.7+22<3=9:2=55+,?

()*+,-./.2.7<,+12.7894:+6+7:+7-372360.2-.<1-+:.753, ;1-.37-+<073938417:.5.-51.92-3+55+<-.*+94 ;1.7-1.73,6,3-+<-.-2.753, ;1-.37242-+ ;23,:1-1A.7<9=:.785,3 ;:1-1>,+1<0+2A.-2>=2.7+22<3=9:>+1:*+,2+94155+<-+:?

()*+,-./<3=9:>++/632+:-32.87.5.<17-9.1>.9.-4<91. ;2.5.-.2=71>9+-33>-1.7.72=,17<+1-1<<+6-1>9+<32-217:1:+D=1-+9+*+923,3-0+, E.2+6,3-+<-181.72-63-+7-.196,3:=<-9.1>.9.-4<91. ;2?

(K5)*+,-./51.92-3,+-1.7<+,-1.735.-2L+46+,2377+917:1--,1<-17:,+-1.71::.-.3719D=19.5.+:6+,2377+9A.- ;.80-73->+1>9+-36=,2=+.-28,3 E-02-,1-+84? (K7-+,71-.3719+/6172.3735)*+,-./F2>=2.7+22.2+/6+<-+:-39+1:-3.7<,+12+:+/632=,+-3

;1,L+-A,+8=91-3,4A639.-.<19A36+,1-.3719A5.717<.1917:+<373 ;.<,.2L21223<.1-+:E.-0:3.78>=2.7+223=-2.:+35-0+P7.-+:C-1-+2? (Q0+.7:=2-,4.7 E0.<0)*+,-./36+,1-+2.20.8094<3

;6+-.-.*+17:2=>I+<--3,16.:-+<073938.<19<0178+?K5<3 ;6+-.-3,21,+>+--+,1>9+-3:+*+93617: ;1,L+-6,3:=<-2-01-1,+215+,A ;3,++55+<-.*+A9+22<32-94A+12.+,-3=2+A3,1,+3-0+, E.2+ ;3,+1--,1<-.*+A E0.<0E3=9:81.7

8,+1-+,1<<+6-17<+.7-0+ ;1,L+-691<+A)*+,-./ ;14>+=71>9+-3<3 ;6+-++55+<-.*+94 E.-03-0+,<3 ;617.+2? (Q0+NRSKTMUV617:+ ;.<3,3-0+,5=-=,+893>190+19-0+ ;+,8+7<.+2 ;14 ;1-+,.199417:1:*+,2+94.

;61<-3=,>=2.7+22A36+,1-.78,+2=9-2A5.717<.19<37:.-.3717:9.D=.:.-4?K5-0+. ;61<-25,3 ;-0+NRSKTMUV617:+ ;.<+/-+7:>+437:3=,122= ;+:-. ;+9.7+23,7+ E893>190+19-0 + ;+,8+7<.+2+ ;+,8+A3=,1<-=19,+2=9-2 ;14*1,42.87.5.<17-945,3

;3=,+/6+<-1-.372? (P751*3,1>9+893>19+<373 ;.<<37:.-.372A.7<9=:.78293 E+,8,3 E-03,,+<+22.37A.7591-.373,:+<,+12+2.7<372= ;+,26+7:.7863

E+,3,<375.:+7<+A<3=9:1:*+,2+94155+<-3=,>=2.7+22A5.717<.19<37:.-.373,,+2=9-23536+,1-.372? W’X&Y Z [ (K7-+99+<-=196,36+,-49.-.81-.3717:.75,.78+ ;+7-<91.

;2<3=9:<1=2+)*+,-./-3.7<=,2.87.5.<17-+/6+72+23,6,+*+7-.-5,3 ;2+99.78-0+B=1,:.17C42-+ ;17:5=-=,+.-+,1-.372? (K5)*+,-./.2=71>9+-36,3-+<-.-26,36,.+-1,4,.80-2A3,.5.-.75,.78+237-0+6,36,.+-1,4,.80-2353-0+,2A.-2<3

;6+-.-.*+7+2217:>=2.7+226,326+<-2 ;14>+ ;1-+,.1994:1 ;18+:? (T+6+7:+7<+376,36,.+-1,4,.80-217:51.9.78-36,3-+<-2=<0,.80-23,-3>+2=<<+225=9.79.-.81-.37,+91-+:-32=<0,.80-2 ;14,+2=9-.7614 ;+7-352.87.5.<17- ;37+-1,4:1

;18+23,. ;61<-)*+,-./F21>.9.-4-32+99.-26,3:=<-2? ’&]X& ’^’_&ZZ[‘a’ ’^b’ (K7-+,,=6-.3735

;17=51<-=,.7836+,1-.372<3=9:1:*+,2+94155+<-)*+,-./F2>=2.7+22A5.717<.19<37:.-.3717:,+2=9-23536+,1-.372? (T.2,=6-.372.7-0+2=669435-0+ ;1-+,.19217:<3 ;637+7-2=2+:.7

;17=51<-=,.78)*+,-./F26,3:=<-23,-0+2-+,.9.G1-.3735.-26,3:=<-2>4-0.,:M61,-42=669.+,2<3=9:1:*+,2+94155+<-.-2>=2.7+22A5.717<.19<37:.-.3717:,+2=9-23536+,1-.372? ()*+,-./:+6+7:237-0.,:M61,-4*+7:3,253,-0+2=669417:

;17=51<-=,+35<+,-1.7<3 ;637+7-235-0+B=1,:.17C42-+ ;A12 E+991253,3-0+,126+<-235.-236+,1-.372? ()*+,-./F2:+6+7:+7<+3719. ;.-+:7= ;>+,352=669.+,2-36+,53, ;-12L2=7.D=+-3.-2>=2.7+22A2=<012<9+17.7817:61<L18.7835.

;6917-:+*.<+253,2-+,.9.G1-.37A ;146,+*+7-)*+,-./5,3 ;:+9.*+,.78.-2:+*.<+2371-. ;+94>12.2? ^& [cd^’e&[ ()*+,-./.22=>I+<--3+/-+72.*+<3 ;69.17<+,+D=.,+ ;+7-253,-0+D=19.-435-0+B=1,:.17C42-+ ;.-

;17=51<-=,+217:53,*.8.917<+37<3 ;691.7-M017:9.78A+2<191-.37A122+22 ;+7-A17:,+63,-.78351:*+,2++*+7-217: ;195=7<-.372?)E.:+,178+35D=19.-4A,+8=91-3,4A3,215+-4 ;1--+,2<3=9:-,.88+,-0+7++:53,1,+<1993,<3,,+<-.37-3

;1,L+-+:6,3:=<-2? (K5)*+,-./51.92-3<3 ;694 E.-0 ;+:.<19:+*.<+A0+19-0<1,+17:3-0+,83*+,7

;+7-19,+8=91-.372A.-<3=9:51<+2=>2-17-.196+719-.+217:.-2>=2.7+22A,+2=9-23536+,1-.372A17:5.717<.19<37:.-.37<3=9:>+1:*+,2+94155+<-+:? ()*+,-./F2<3; ;=7.<1-.372 E.-00+19-0<1,+2-1L+039:+,2

f6042.<.17217:3-0+,0+19-0<1,+6,35+22.37192A6143,217:2. ;.91,+7-.-.+2A12 E+991261-.+7-2 f1,+2=>I+<--310.80:+8,++352<,=-.7453,<3 ;69.17<+ E.-01E.:+,178+3591 E217:,+8=91-.372?N37-.7=.783,.7<,+12.78 .-2219+217:

;1,L+-.7817:3-0+,+/-+,719<3 ;;=7.<1-.37+553,-2 ;14+/632+)*+,-./-31::.-.3719,.2L35>+.78199+8+:3,:++ ;+:-3>+737M<3 ;69.17->4,+8=91-3,4A+753,<+ ;+7-1=-03,.-.+2A3,<3 ;6+-.-3,2?

! ! # $ %$&%’ ( )%(& %% % ( ’ !( *’%+, -) %

.% % !%%& % / *’%+% )-0 &%’ (! # 1 $’1!!%.) .% ! ) &%1 !12! 1& !% %1 %!! . % %!) &!( #%11)! )-0% )- % !!% -%!%% .%!)%$&%’ !%%$ % 3 ’ &)-!%%( )!$ %’!( % & %$ )! -) % / *’%+ (-

)-0 ! ! ! % ! # #1%1% & )- % !& !% / 4 5) !%(% ) % #%1*’%+, &) )! ’ !( 1 )! % & % / 6$ %’&)-!%%(%$)&)) &% ,&) .%!)%$)&) ( )!%$!%%$ %.)!1 )&) % ) 1 7 # %$ ( .%1 #1%1)! ’ !(% & )- % %

! )! / 8*’%+% )&&!% %! &!( #%119 4)$* %% %, :1;94*<=$ ) )%$& %$)! % % %! % % !$)! % .1% )!% & %% -%!%( 7% &) % 2%’ %!( / 8194* % %! $)! ( )1%( &&’)))&) 5)% %% !!%% !% ! - ( &&’

!% ( &&’ !)&) %!) %% ! %% 1! -!.5)% 1 %> %)&) 1 % ) 31$)! ( )1%% .)-) % .% % !%%. )! & % $ #1& & )! - % !!( ’ !( / ?@ABA?CDEFCGFHI JK@KLFMCNH OP@KCGNH OQEKRSATFHUB *’%+1 %%% % ! # 7 %)% !!’% %

!&%$ #1%1.%.)! 1!% -%!%(1 -% & (V % % ! . 1 ’1 ’ 5) / 9!!#%$1! %$1&% !-) % -% %. %’ %$ 71 -% & (, 7 (- ’ %! -! % - % &’% 1 1! #%1 5) !%5)%%(/W1 1 &% (-+!(’! %! 1 1! )!! %$%% &

1%%’ / X ! )- % !) - 1 1 -% & (, 7%1&)-!% 7-(+% %$ 1 1! )! ) 1 -% & (, 1 &%!%/ W1 -% & (, 7 ( %!1%%% !%)!% %$ 16 5X7 Y 7ZZ[:;6 5<=. %% ! 7 (- &&’!% %$6 5.!!#%$1! %$1&% !-) % -% % +1 $. #1%1)!!%

%%’ , -%!%( 7 % %1[ & (, )%% )-01[ & ( %% ! %$ %% / ) *’%+1 )&! & ( 1%’% 1 -!)).() (%’ ()%’ )! () !!() 1 &%$ 1 #1%1()& %1/ 8.!!#%$1&% !-) % -% %. )%% %) ( !( &)-!% 1 &)-!% 1%$&

-)1 -% & (.% -) % .% 7.%1(1 $1% % $ %$1 -% & (, )%% ’ !(. 1&% %$’!)1 -% & (, )%% )!!%/ ?@ABA?CDEFCGFHFMC]^HQHACG_‘A@KCAANH OP@KEF@HK W1-% 1&% !-) % -% % (- !%>1+)!( %%& -(8aX *’%+. !!/W1

-%!%($%> ( )1-% (- -(. $11%$ . &%%.1 -%!%(1 -%& ( $ # $$ #1&% -!(. % %! % 1%& #%1) )&&!% %% $ 7( &!( / W1 ! 1&% !-) % -% %)!- %$%% !(1%$11 )!( %%& (+1 ) &% ! % %% #%11&% !-) % -% %/ 88aX ) %%% !-) % -%

%-(b)c.dedf:)! +)&4 -c.dedf )!1 &%1+ % && ! 1)& %$+ %%$=.% &)-!% 1 1! (- # %)%! 1 - &%1W) *)/ W1 ) %1&% !-) % -% %% +&- )-0 ) -%% .%1 %% % % # %’. (%%%’ $! %$1&% !-) % -% % (- % % #%1% 1&% !-)

% -% % (- &!/ 8aX% % (1 ’% %1&% !-) % -% %%1% 8aX.*’%+1% &%’ )%(1! / W1&% !-) % -% % #%!! )!%1 $ 1- % *’%+1 ( 1 $(1 -% & (/ ) 1 -% & ( #%!!- &)-!%!( & (-(’%)$ %% #%11&% !-) % -% %

&& ) #%%%% !&)-!%%$.1 ) #% %’!’%1& . #1% 1)! )!%! %!%$-%$)1W $1 % ) #%%%% !&)-!%%$/ W1 -%!%(8aX, 1 1! +% &%%$1 #%1 &)& !!1) %$8aX[! *% ( 1 )!% 1&- -%!%(1 1&% !-) % -% % #)!).%% ).!% %1&% !-%

1 &% !-) % -% %.1 1-) % % % !%%1 -% & (!!#%$1&% !-) % -% % 1%$11% 7 %$1 -% & (// W1X[1 !(% )&& )! Y 1fe.dedd:1;Xg*[h)!g& ! <=! %$ % %’%% &% !&)& 5)% %% & % /[ %1&) 1 8aX. &% !-) % -% % $1

( %) 7 %% #%1 )1&& ! (% 8aX, 1% &!% %%% !-) % -% % ( %1%) ) #1%18aX)! &! %%% !-) % -% %/W1 &!% #% 11Xg*[h)! g& ! ( ) 8aX!%5)% 1) %1W) *)!%5)% 8aX !%%1 8aX %$11 #% 1 / 88aX% - %’ & ()18’ [ & (*.8aX

(-5)%% %)-) &!% 5)% % %’%% (- %. #1%1 ( 7%%%)!8aX &!% %%% !-) % -% %/ W %%$ 1% 7-%$- %’ & (&)& 18’ [ & (*.8aX (% )) 1W) *)!%5)% 1 )%% 1!%1W) *) % 1! !!) %1W) *)% - 7& % )/

GH I JKLMN^HWH_GK I^S‘SLaWHM 1&# - 301 #b( % 34,%(+, ,)+,+,

3+- /%&;97)# &5<&#=> /+:6 1 ,*)-34*)5)1.* &6 ! #$%& && 1&# - (:,5?3>:36 +-7%#& /8’()* +,-.,%%& /#,) ;)@)01A; /-(# B /# , 9 (& : -9 & 1 & 01-$ 2 5<C3> /’:6

OMPHQRSSNMNVKWWX YHNQWSLZM[M]KN^O :, ) !01;)@), , +, /2 +, TEF!& U.(4 #()* # 01- % , &-?%,7) DEF!&4* , &&,)B) , #*)! :;%# !& 01- /2 A % , &-&&&& @) ,)& )& ’,- .,%%& /#,) ) ,) &)

,%& 3 -.:A:B$))?@& $ #A1#%,/2 -$ 2- !&)

?@AAT@UCGECU?@UC]^ H BCDEFDECG?FDVW_CAG ‘CU #$%& ’$(,

K+ O%:3 #$%& ’$( *+, 5+ ! #$%& ’$() *+,-&%./(012.3 ’2 ! *+,I3J/>/K%/.#3&$=36.%:2 !03(%/&X7J%2/&,* YZ3$>.#:$&3L$&.(3&2 ! /45/6(73&, /&3-389(:; !5/&

’3&L&32%73(.,M(%.37-#3&$=36.%:2 !5/& ’3& *+,[3&/ ( /&=/&$.%/( !<%&3:./&, #%(//8-#3&$=36.%:2 !5/& ’3& *+,0.3$71 N3 7-#3&$=36.%:2 !5/& ’3&

*+,I%($.36&/2:%3(:3 !<%&3:./&,5>63(:3 /&=/&$.%/( ! /45/6(73&)5/& ’3&0OL/PK<,Q/R3(%S !<%&3:./&,06(3J $N37%:$> bGcdEcUk@lkCUDcg p]cUbEC fU bEce fFUg hiji hijigmEiji pF@qCUUcGGFte@AA

<%&3:./&<%&3:./&<%&3:./& <%&3:./& !5/& ’3& #$%& ’$() *+, 3>>[3(3212 !5/6(73&)5/& ’3&<%&3:./&, $&7%/[3( !5/&

’3&[>/a$>K%/.3:#,n%P30:%3(:3 !L&32%73(.) ++,X==;N/>3:6>$& !5/& ’3& #$%& ’$() /45/6(73&,0:%3(:32n3$73&,*o-&$(2=/&. 3&3R3(3 !5/&

’3&*OL)0&;X7J%2/&,[%>3$7 !<%&3:./&,I3J/>/K%/.#3&$=36.%:2 !5/& ’3& #$%& ’$(r *+,[-K%/=#$& ’$ !5/& ’3& #$%& ’$() /45/6(73&,XaR3(%S !5/&

’3& #$%& ’$() *+, O-#3&$=36.%:2 !<%&3:./&,-3/ (-#3&$=36.%:2 !5/& ’3& N<, /4Z3$7Z3$>.#:$&39K,s NL uvI/22Z$R#%R#$.wK9+0 *+$(7 5+,$(7XJ3&.%Sx2*S3:6.%J3 #$%&v#$2&3:6237#%

’23>PP&/ ’73:%2%/(4 ’$8%(R/(.#3.&$(2$:.%/(/(K9+02%73R%J3(#%2&/>3$2*S3:6.%J3 #$%&’$(/P .#3K/$&7/PXJ3&.%S;5/&$77%.%/($>%(P/&

’$.%/(&3R$&7%(R.#3%(.3&32.2/PK9+0$(7XJ3&.%Sy27%&3:./&2$(7/PP%:3&2%(.#3=&/=/237a62%(322:/ ’a%($.%/(,=>3$23&3P3&./.#3z9 ’=/&.$(. 9(P/&

’$.%/(P/&9(J32./&2$(70./:8#/>73&2z23:.%/(/P.#3<%2:>$% ’3&/(2>%73{;

HIJKILJMQRSTUVKWXSWYTLRXH MXJKSZL[ N1$7$ ,$ 3$$ j:i21$ p6 3 62!

9>G& 4’-G/*O’0. 3$ <-’8 NP 44 90(6:6. ./4+3 / 2! ! N./ !!’(’% 6:6.:3 %G-’8 %-?8 N./4+3 /2! ! 4((8! /4@$7 j:i26$, G 2! ! %0->8 ]XTJK[KLSJ^W_‘Jab ccdeR‘KYJSWXfgSJSab ccd

]XTJK[KLSJ^W_‘JhW_Y‘_WTLRXeR‘KYJS 2! i$4A%G-<j:i2*!P $9%k ’ 6:6.6 A/2! 6 9(-((0( % ./4*!j2! .@$7C$9%G< < .@$73 ABl*!AGk%’ . C$9>GP2$ 9%’ VKWXSWYTLRX m‘_TL[_JSgSJS 0 *!j2! .

C$n’(’<.3$G-(/9Gk G . C$n’(’0.3$’-G/P *’ < .@$73 %’ Po9%’ ! #$%&’(’%)$*+! ! !!,$ ,-./$-01$ 2! ! ,$34$,5!!3 34-6 47$ ((8$ $4-’+$90( 46:6. & !!!3,! $,$! -%+3 /;/4!,!

#$%&’(’%-<=$’->? $! /4+3 /@$7! ! $,534,4!3A0(8’(B7C D+69’-0(0(8 ’(B7C D+690-((&7?7 4,$ ,4-0+$*+! !! ,$ ,&E90( 6:6. &E9’ B / &!/4+3 /F! ((8! @$7! 7-G 7-

ijklkmnlkonpqrplsjk tspukrkolrvwx N:NG P635QA*40A-R S !

#!##!$%&’ ()( &+1yY 9)H ! #!##!$% ! #!##!$%& &’ ()( & f=-0z:{ G)H’# & 8 *+,,-./-0+-12-31456-0 30-A+,-15 36-305355327AK0=+=40 8 6-305355327 9 |} ) H$ &!& $HF ( H# C9 9:; ~ ! & %)H< I

0-3A41>40DE!F G)&&)HJ !(<:’ & 54300+=->40 ?-@+23,3,564KL6MNO()&)#&! kokprq B +15-0=-15+4135364A/+53, H ’& ST655/AUVV ***WAK0=+=40A63=-6-305W24 ?VA535+A5+2AX31@X0+A7W65 ?, 8T655/AUVV

***W2@2WL4=V6-305@+A-3A-V>325AW65? BT655/AUVV ***WA2+-12-@+0-25W24 ?VA2+-12-V305+2,-V/++VYZ[BSZ][S]B[B[^[_=+3‘Ba+6Kb ^T655/AUVV62K/XKAW360cWL4=V0-/405AVA535b0+->AVAb8deXfaXg0-cK-15Xh41@+5+41AX8ZSdW/@> T655/AUVV ***WA2+-12-@+0-25W24

?VA2+-12-V305+2,-V/++VYZ[BSZ][S]BZ8B[8_=+3‘Ba+6Kb

B0CDEFGHIJKILMNOPQHRREKSTJD URLHIGHVLTWHEJDHW UKIDGKEDIX)(: ]^

HLTEGDIX!&) >-*3:0 ’,(0:>-* 0THELMJTGTWGDKIKCYTHEGHGGHWZF[ _‘) 0( 0:)(:!*-!*’0 )*8)&,-*’ 31 ’(, 3)%’(0 &0)*(’(,a )’&-*0: - 0’(:’.’:1)&!) ’0(

_/b$c$def%-( ’(1-1 %)*:’)% 3-(’ -*’(,;)&0* _=:0( ’%)&!*-%0:1*0 - ’(,&0%) 3g0*!)%0 3)h0* _ij5)!!*-.0:;7 k9*0’ 3g1* 0: _l0 0*j0%’ ’-( ai) 0*+ ! #$$%&’(’%)&

*’)& +,-.$% /$*0 1& 2 0* 345%1 067-*-()*8698(:*- 306:0.’%0;),0<.4;,(:*4; 8!04=( *;* & 4;90)*%45!!&8 /= 3),0->:0.’%0 - ?(’ )%- 3!1 0*@,0(0*) 0:’ 3),0 ) :-0 (- *0!*0 0( 0)% 1)& ’A0->

0:0.’%0+

WXYZ[]^_[‘]Xabcde^b[‘]fg c‘]hi . !

#$%&!%!!%’( )&**+& ,- /%’$0%&12232224567868869:;3+< =$’$1>223222675 AP ?5@3% BCD2E+<!$ F%! ! %&5GHIHJG5KL7MN67OH6? kj j Q$RS&F& ! %CTUJHGGHL?6OO75;;6JG5 V67:58 l,-)F!+mnop!$ r

q+<,-lFF+&!) !0 .s$!!F tuu ===o )&**+& $%*$%&!o’+v As$!!F tuu ===o’B’o#+*u$%&!B % u<%’! o$!v wsx% B+ v% %#v !’%y’)y%!+ !$%!%FF&+ v%!y0.z{+< B*B)%y =$+

)<<&%$%&!%!!%’(&’*% vFy% !B|}~ rsl,- v%&(! qB%!%% +<Az.$!!F tuu*q$)o$%y!$B%!%o+&#u#B& )y!

! #$% &’()*&+,#(* t( uv ww#*xt( uu yz#+w {vv(y,)*#,|

-./001123456789::;;;79<=>9?@AB>?A -ED2S506625OODFG5 ]D2f5Q -C23D6EDF5G;H=>?9I>JH -gJUh:I‘DG5O‘Q2DQ5SXd<JiA?I>Hjklm ]K54LPnm -K5LMFN2O5 M5PQR3452DS5 -o5DGQWXp23OO ]D2SLPO -T9BJ<9U8 AVWXOLYLDPZY3P3 MLYO

-q8JU98K545PN5‘Q2DQ5SX -C23D6[VV23Q5YQL3P -d89IeJ< aZr1DPOL3PK3D6 MD1 -I9U8A ]DPN^DYQN2LPS_‘N11GX -V2345PE5D652OWL1s5DM -; ab8A aAHI9I>JH> a>89<IJ7J aaJH8c dA<eJ< aA=V23Y56N25 }~d<JiA?I>JH:9::h

aAh8c?8J:A

! #$ % &’ 6 ()*)+, -,*./012,3.41*5 789:8;<=>?>@A9

B<>@CDE {|}~| || 7F;<=>?9>E@GE?89:8=@A9HIJCCK 9==@>8LM BN:9>@AOAHAOP>A89? Q@8<E>9:8RIE=A98EH9?@<>E@S <A@?=>EE>O 7TA@U=>E@8988BE B<:9>A@V AE BNA89N:WI@:O 7TA@U=>?89:8@V9<<A@;E

B9>:OJDNO E=:?E H@: O=@>A9=>??E8>AEN>E@ 9HA B>8EXFYM9?M8E9T9=L;ZP[E9R 7]^_‘abcdeff D^dghifj:?NOkTk AE BNA8B>9?>[@H[>V: B9V9=>AEH <:9 z 7>A@H<F ;VVE=E=E89?A@N8>HA@88 B9AHE F FF

9A;<=>?>@?AE>@lmnopqrefh‘hs]hiJCJ 7M>E=E<9>tCDE=9<E>9:A9E8?AuEA?>@ A9=[v^faw_e xrefh‘hs]ybJCJ WRTA@U=>E@8988B:O=:@8Z

Q KgH>BJ>hHC V !% # GNODIPQ =N ‘ $ $#’#

!’#’( !% # ’% 2’ # !’ O RS ‘_ # #$ ’%* #* : # !’ 7’ #)# ( #)]#(LNPN RPQ TU W $ %’#$ XYZ[0 NbJCEB>HGC?CAcCE =>?@ABCDC>EBABF ‘)!’(# #( !a* #$#$ ’% :)#’!7 ^6

! # #$%! &#’( #)& ’$# ’ ’%!)!’ ’!$ !* ( 7$#’# !’ ’#]+ ‘.’#:$# ’! $’)#$# ’ #)# ( #) !’ ! ’%!+,-%’ _)! #$_!)< fEMFE> KKCE GC>HIJA

KCLCJC?JAMB ‘ W $$)!’ )# d && $#’ .* /0)!’(123456748# ,-%’#’()!# !## ’9 +! # # ’%#’((## *#$ :#$ ’ ;’! + ’%&# ’ ’ #$- !< %’)( )#$#’

!’ ‘6 $#a#’#$e! ((##

! # $%&’() #*+,!&#- 0123454676338338396:487:;3 $ ./,/-

7<7=>?@87:5<7A4:4<7 PQRSTURVWSXYZV[ ]R^_ PQRSTURVeTTZTfZVZgU_h a B‘988A<MA46@7<343 G BC63:8?:4 D8:<EF a B‘988A<M?8K635>I6?4b6:4<7 J BH32 D9:< D6:456I8?:3 a Bc8A>58A47M6?5:34b8 J

B0<34:4K89?8A45:4K8K6I>8 a Bd8::8?I<7@4:>A476I<>:5< D83 O BL>6I4:2<MI4M8N98658<M D47A a BH??12:1 D46A8:85:4<7 Gi1::93jNN kkkl3548758A4?85:l5< DN3548758N6?:45I8N944N‘mnOoGmpnGpOnOnanqK46rOF41>s Ji1::93jNN

kkkl3548758A4?85:l5< DN3548758N6?:45I8N944N‘mnOoGmpnGpOmJOnJqK46rOF41>s OiHtEcu‘L>6I4:2=vM=t4M8wHLvti‘>s=3:>A2wx< D9672‘:>A2iy1::93jNN kkkl655833A6:6lMA6l@<KN5A?1zA<53N9AMGoN0Gommmpxl9AM

aiL>6::?<{>6?A467{?< k:1v99<?:>74:2 |6?}8:‘:>A2wx< D9672‘:>A2i

0 123456789 1:;56;<66=>6=?:3=5@5534AB '5“:=

«‹97943‹›97fi97flB S- †‡&( †w+x+, † +* Ovw–L S’x )& yz{*# & %& # †(, ‡, #’%&’/ &N+)! #$%&’()’) *-

†‡&( †*+x() ~(, |}v (~&(&+x$)) % **+,-.!/’*’&* , +x·RS / )& !.PQR.S ” ¶•3‹95‚6>„9>:0 12345 TUV WXYZTUV WX[Tfghij WX[ ]^ _‘a _bc^ _^d‘ec]^

_klk]_ Uf mhnouqj pqrstfriUf mhno pqrstfri CGK EKJEHKJFCFCFFFGI DGK EKJEHKJFCFCDFDGI L I¡¢¢£¡IKI£⁄HI¥GK EKKE¢EƒHJG§HK¢C¤C⁄E¢ C CDE FGHIJK C LMN($,* C LMON($,*

VWXYZ[YW ]^Y_W‘abcWXdYWeY_Zfa^VWXYZ[YW

tbb‘^_ac‘ucebvwxww ghJRSSJQ #$%& ’(&))+, O6<0=4(2+&15%;(:06/, #7&(80%9/424(.:(&/50;&%4(/.1$%G5%44%H i(65=%4%j0(/,).2(==( O(:06.4 !! kU0/1&061@.4(/ O.=.j(&lro #$%&

’(&)*+,-.&/0123(.4156.&( k)40=06.4lso #7&(80%9/424(.:(&/50;&%4(/.1<90:.=1>?%/1%=@60(=10A06, @1BC9:(>DEE%11,?0%1&%=0F,.=:$%G5%44%H I JK L!MJ VWXYZ[YW tbb‘^_ac‘uy^Yz‘Ye{|ucebv #$%&

’(&-7,N@@.4(/,D6919/ O(:06.4 #$%& ’(&-7,?0%1&%=0F }~wxw~ P QRST #$%& ’(&-7?9/0=(//.=: O.&F(1U(8(4%; ’(=1, D6919/ O(:06.4.=:-%46.=%)%&;%&.10%= kU0/1&061@.4(/ O.=.j(&lmno

k)40=06.4lmno kp=:(;(=:(=1/lmqo

tuZTSTU^XOtuZTSTU^aQbQRRUV [O]TXUVU^_‘WNaQbQRRUV

c9C:C@>L98=C:de D;?89=C<f+1g!+J($h+!-&’#)0J%1#+#.1%& /0#0(% !i)!’&1%!1$H(-! (g!’%j3 )+($&(*+!k(’,1(- !l1*’1++(&#’%F3k %Gj !&-m1$&0!)’(-&1-!m NO PPQRSTUVWXRUXQYZ !

#$%&’(&!’!)!(&(*+!($,%-(+(*+!.’# /&0/1&0)’!,1-&(*+!’!%2+&% 3 )+! !$&456789:;8<=>8?@;ABC DA:C?EF-#$&’#++!,+(2$-0G /1&0nCKC<<C<@opqr01.0s#+Hk3I3k%

/0#*!+1!s!($,’!l!’ )+($&!’ H’!-1%1#$I-#$&’#+())’#(-0&0(&J1!+,%498=6<8?<CKC<<>9LCM;89@>A9@E

! #$% %& &#’ () % ) * +,-./061780 +,-./01231

452+,-780129:;<52 =>?@?A>BCDEKLB MFNDE?OPDCQFO?BGOR SLDBTQBE?BGUBFGVIWFO?BGO?R MDEB FGHIJAXOFEBRBGOLD MB S?OLGDDE>? M?OBYOEBFO MBGOROFA?>?]BYAXO K[ UFGGD SABDCCBEBYFZXFEY?FGRO?>>FOE?R^ _‘a bcdeffgehiejkj

A ; 9: *H4. 7I5,64748>J18+ 7.36 ’()

*+,-.(/(012,(34-5,4624,)(, 74-.89: *6 Vfgf]MN#_#NVhghO^ MTRijKjSROUklmll nMW#NMo__&MRV S[TR%kmp qrstuvuwx yrzs{|}~ jPOT&#R#STOUhO&&%jaPS[XahO^ MTRRSVWMPR# ‘ig Kkm &R# ORM$ ]UOTRMPYM# Z[P&M MTRk %km ! #$%& <,(

=>?;@ABC>?,(50? 7.-D;@;@6;F’ G’ <,( =>?;@AED;@ABC K LM$#NOPMQOR#STOUVWMPOXMYM# Z[P&M MTRYM# Z[P&M MTR&[]]SPR]PSW#$M$Z^P$]OPR^O$W#&SP^_#P OT$_[T$M$Z^VWMPR#‘ KaRR]&bcc dddZO#TNS c#T

R&cO

Z[UORSP^%&[PXMP^%NMTRMP%XPS dRa%ONNMUMPORM&%#&% M$RMNa%PMO$^ce

6 &’()$ 1!) 2-#(! !%$34% )5( ! #$%!#&’()$ (

*+!#!,-#.)% )(/#’0!. [EOQ<D>GQ:=<S<=H]^]>R L:FD_A‘@‘a8aED>Gb7AcB@d e:I<=:fSSO:DH LENFDYbgc@hi jklmnonpq rksltuvw a?>FO<D<EF>G]>OOYaU?ENJU]>R L:FDDEHI:?D< T_^7gBB8b7Ac@‘A xOD<

L>D:;y LQG>FD:?K:< LMN?O: L:FDbgAAYb7c@AA 78 9:;<=>?:@A@BC>D<EF>GHI:?>J:K:< LMN?O: L:FDPK:< LMN?O: L:FDONQQE?DQ?EI<;:;MRB?;Q>?DR>;I<OE?RS<? L>F;SNF;:;MRHI:?D<TP @8UDDQOVWW XXXPM><FP=E

LW<FO<JUDOW> LMNG>DE?RYON?J:?RY=:FD:?YJ?E XDUY>==:G:?>D:OY<OY L:;D:=UY?:>;RWZ

! # $%& # $% ’() %*++%) %, l^‘iv[a[ f[] VWPNMKNLQ

WXPQRNQSFGH IJKL IMKNO FGH IJKL IMKNOJMKNPQKG WUXPGULR JMKNPQKG RNMSQLGPRTNKU x E94 E. <{ RNMSQLGPR qMXRNMQFXXHKU INM TNKUVW [w[c^m^b]s[ m^ivmt^]^ecs]b fijj KXPQRNQSY ^e[c^m^‘[c][a[ew[g oMKNPQK _‘cs[ectu Z[]^_^‘

MMKNLQ^][^ f[c^ pq rG v[we^ebc abcde] f[g x y@;<:z?{ | -./012 3456 |} he^‘ijk 728.9:.;< 612<=.</ l[mebccg >.?:;/19 @9<= n^e[c^hm A;112?B;<=.</ CDE GKPQKPR ~j bwec s~ws ~j ~j ec m^ivmt^]^ecs]b fj

¡_bcga^[gam[m^ge[m][ab fncdcg[g [gec tuv[we^ebcVW e c[gec t uv[we^ebc PNMKNLQ t uv[we^ebc

B8796857<C85DE76579FA 4567896:;<=>?7<@<7A

GHHIJKLMNOLOPQRSN ! #$% & ’( )$*+*+ !% .#$ GHHMTULOTJVQ , - % & ./0 GHHIJKWX ^(# *+*1 0 ’_# /#$- ’( /23( ‘ % % GHHMTULOTJVQ ) %a % SVXWIYWKWMJHZWVO # ! GHHMTULOTJV 2/ [MLVVWXTV] /2

! ( )$*+,+- ./0123245621271 #! 89 :;79.472957 <;527;=25>

#$%!&’ ?474@4A7B=945C <;5972D472;5 ‘aA45C9CbC;A74c2d270 EFGHIHJIKLMYZXIL Q[HSI QHMI]USMXSMT ^ _ GKSWMLXIKJX NOP QRIL QSIKJSMTOKUHMIVYL QRUKSMJH

!%& ! #$ , #-( ./0/1 0+2$*3*4*$* $ ’ % #% 0 * 5%* %*)

’()%* +# 6 7- 5% *8 *% ST-’%- *% 9:;<=<>=?@AMNL=@ EOP<G= E<A=QIGALGAH R$7$$;?GKA@L=?>L BCD EF=@ EG=?>GAHC?I<A=JM@ EFI?GA><

! # $ $%&’’()** +*,-’;)3)/2=’.;A +71173, @

./0*123)4*%56/,173,8 %B$=9.;A +71173, @ 9*:*,;*9/ +6 &*5-<%&’;)3)/=*17(,2)**>* %B$=9’66)3:/0 @ $%&’9*(;0/-3)?’66)3:/0&*5-<%&’;)3)/2=’’66)3:/0 @

! #$ % &’ 6 ()*)+, -,*./012,3.41*5 789:8;<=>?>@A9

B<>@CDE {|}~| || 7F;<=>?9>E@GE?89:8=@A9HIJCCK 9==@>8LMN89?O@8<E>9:8PIE=A98EH 9?@<>E@Q<A@?=>EE>R 7SA@T=>E@8988BE B<:9>A@U AE BVA89V:WI@:R 7SA@T=>?89:8@U9<<A@;E B9>:RJDVR E=:?E H@:

R=@>A9=>??E8>AEV>E@9HA B>8E XFYM9?M8E9S9=L;ZN[E9P 7]^_‘abcdeff D^dghifj:?VRkSkAE BVA8B> 9?>[@H[>U: B9U9=>AEH<:9 7>A@H<F ;UUE=E=E89?A@V8>HA@88 B9AHE9A z ;<=>?>@?AE>@lmnopqrefh‘hs]hiJCJ F

FF 7M>E=E<9>tCDE=9<E>9:A9E8?AuEA?>@A9=[ v^faw_e xrefh‘hs]ybJCJ WPSA@T=>E@8988B:R=:@8Z

! #$%&’(’ !# ’*! 0 $*. )’&’

&+,-&(.’ ’/! 1#1(/2*9* / * ’*! 9* / * ’*! R 6.*/. ’!:6 /!’ /.’!:; /!’ /.’!:G’ $ ! % ’(& </,!2($*(=64>2 %(,& / ’H -* !2?6@647A /! $!/ ’I’(

’/!& ($*(=A,&B *. A2.’C*!+,-&(.’ ’/! 4 /’! *! &JF *; 3KKD L/M@N* .& 3456785*.#$%&’(’ !DEC*. ’FO3PQ*. ’*! /IS,’2/. . !*. ! .*C*!,*&$ .*.*(,..’!:.*C*!,*/2*

/C*.’I*/I’ ! TUVWXYWZW[Z ]^[^_W ]W[WZ‘ ]^Wa

! #$%&’()%*+ ’) u’ vwxx )yu’ vvz{ *x

|ww’z+() +} ,-.//001234567899:::68;<=8>?@A=>@ ,DC1R4/5514NNCEF4 C1e4P o ,B12C5DCE4F:G<=>8H=IG ,fITg9H_CF4N_P1CP4RWc;Ih@>H=Gijkl J43KOmnl ,J4KLEM1N4 L4OPQ2341CR4 ,p4CFPVWq12NN C1RKON ,S8AI;8T7 @UVWNKXKCOYX2O2 LKXN

,r7IT87J434OM4_P1CP4RW ,B12C5ZUU12P4XPK2O ,c78HdI; ‘Ys0CONK2OJ2C5 LC0 ,[H8T7@ COM]CXPM1KOR^_M00FW ,U1234OD4C541NVK0t4CL ,: ‘a7@ ‘@GH8H=IG[= ‘=78;HI6I ‘‘IG7b c@;dI; ‘@<U12X45M14 ~c;Ih@>H=IG9899g

‘@g7b>7I9@

@A B CDEAF@DGD =b LMNMOPQ RMST<) =; ( )*+ ( )*+ ]I^^ H-./

012345678&,-./ 012345678& _:‘a ULVVQQWPNVOX >’ 9> YP RRMWYZVOZ[VTZPS ::;IJ; ! !#$%& =K cde3f&%$4gh&.57i 0343j& 0&45&f57 035&fk >?

MNOPQRST

UPVSWXYZ[W]^_NOPQRST‘aXVbScdYefNWgeSfSRSchcQi]Z^_b[jk‘a^ lNkmN nob[jkaRcWc pqSPRcWQPXR PXieqYSWYrYSfRPV ^wa Wc piX rsSR tXeiRcuvwxy ppPRPQiQSf POXYeP MdcfRzWYcfS {PRSR rPTiPWRP VRcq PYSfRP VclNkmN neVPQPsRSW|PQZN}~ZXVpXSRXS

RtPNOPQRSTX pP MtPRQXfXWRScSfPTiPWRP VRcWYcfPSRtPfPWcVtXYc ^a M[ piYSPVPRPQiQSfPOXYePc]yTQPOPeP ^a MTSfRS{NOPQRSTPgeSRrtcYVPQfsSYYqPSffePVXiiQcTS pXRPYrw] ppftXQPfSPsNOPQRSTftXQPfcQNOPQRSTciRScf ^a MQXfXWRScRcqPeVPVqrXWc

pqSXRScceiRcXiiQcTS pXRPYrvw ppb[ jkWXftSRQefRXVv ppcPTiPWRPVd[d iQcWPPVfQXSfPVicfRzXceWP pPRQc pSfRSReRScXYSOPfRcQfXVfRQXRP{SWf ^a MNffe pS{cQPVP piRScfZNOPQRSTSfPTiPWRPVRctXOPvwy ppSWXftcSRfqXYXWPftPPRiQccQ pXcQRtPRQXfXWRScZc

stSWtuv ppSfPTiPWRPVRceYYreVRtPWc piXreRSYiQcPWRPViQcSRXqSYSRrS Mb[ jkh j~cffX{tS{tXRSfPTiPWRPVRcqPNOPQRSTfhtXSQ pXcYYcsS{RtPWYcfS{cRtPiQcicfPVqefSPffWc pqSXRSc MbScdYefkicfcQhRcc pSXRPRscmSQPWRcQfRcNOPQRSTbcXQVcmSQPWRcQf

MTiPWRPVbcXQVcmSQPWRcQfo pP pqPQfZcstSWt pXcQSRrXQPSVPiPVPRf ! # $% &’( )$*+#$$, ) -,(,$.,!/$,0,, 12,$%3(& 45 )) (,! ,+$,$*’6 ,$+7($,8!3 ,!, (9:%,,6,$* )$3,9$*%!$6;<=,&>8? @’A.& <<=,&>8?

@’A.< B8,$ )$58 .33C$*,!%3$*.,!9($%)9$,$ D ’.E(1B&&1 F,GH. ,, %,$( )) 8#*. .( ,! ,$3 <’( )$,$3I3’! )#,$$%%,$ C$,!,!#,,$39($%)9$,$B J<)).AKAL# % $BJ&))., %,$> 3,+#B,!,+$,$*’6 ,$+,%-!3 33=.,!$

7($,8$,,!# . ),$,8

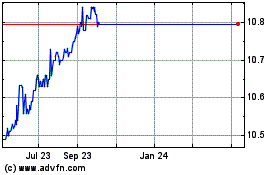

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Nov 2024 to Dec 2024

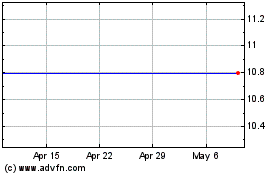

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Dec 2023 to Dec 2024