Better.com Announces Launch of FHA Streamline Refinance Product

September 09 2024 - 9:00AM

Business Wire

Better Mortgage offers FHA Streamline

Refinancing with no income verification or appraisal requirements

for faster processing

Better Home & Finance Holding Company (NASDAQ: BETR)

(“Better.com”), the leading digital homeownership company, today

announced the launch of its FHA Streamline Refinance program. This

fully digital refinance option is designed to streamline the

process for qualified borrowers with an existing Federal Housing

Administration (FHA) loan interested in lowering their monthly

mortgage payment, reducing their interest rate, shortening their

loan term, or getting out of an adjustable-rate mortgage.

FHA loans, backed by the Federal Housing Administration, are

specifically designed to assist borrowers who may not qualify for

conventional loans due to lower credit scores, limited credit

history, or higher debt-to-income and loan-to-value ratios. With

potential interest rate reductions on the horizon, the FHA

Streamline program empowers FHA borrowers to refinance their

mortgage and take advantage of more favorable interest rate terms

with ease by reducing underwriting requirements for income

verifications and appraisals.

“As we look ahead with optimism to a more favorable interest

rate environment, we are enabling hardworking homeowners – each

with their own unique path to upward financial mobility – to

capitalize on advantageous loan terms with greater ease and

convenience,” said Vishal Garg, CEO & Founder of Better.com.

“With this launch, we are reducing the traditional barriers that

exist for FHA borrowers and delivering flexible financing solutions

at a timely moment for consumers across the country.”

With several fully digital mortgage products announced in 2024

including Better Mortgage’s One Day HELOC ™, Home Equity Loans, and

VA Loans, today’s launch strengthens the company’s growing suite of

homeownership solutions and its continued commitment to building

consumer-oriented products across market cycles. To apply, please

visit Better.com.

*Eligibility for the FHA Streamline Refinance program requires

that the existing FHA loan is current, and insured, and the

property is a primary residence that is not listed for sale. All

qualifications will adhere to HUD’s guidelines.

About Better Home & Finance Holding Company

Since 2017, Better Home & Finance Holding Company (NASDAQ:

BETR; BETRW) has leveraged its industry-leading technology

platform, Tinman™, to fund more than $100 billion in mortgage

volume. Tinman™ allows customers to see their rate options in

seconds, get pre-approved in minutes, lock in rates and close their

loan in as little as three weeks. Better’s mortgage offerings

include GSE-conforming mortgage loans, FHA and VA loans, and jumbo

mortgage loans. Better launched its "One Day Mortgage" program in

January 2023, which allows eligible customers to go from click to

Commitment Letter within 24 hours. Better was named Best Online

Mortgage Lender by Forbes and Best Mortgage Lender for

Affordability by WSJ in 2023, ranked #1 on LinkedIn’s Top Startups

List for 2021 and 2020, #1 on Fortune’s Best Small and Medium

Workplaces in New York, #15 on CNBC’s Disruptor 50 2020 list, and

was listed on Forbes FinTech 50 for 2020. Better serves customers

in all 50 US states and the United Kingdom.

For more information, follow @betterdotcom.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909402844/en/

Nneka Etoniru better@avenuez.com

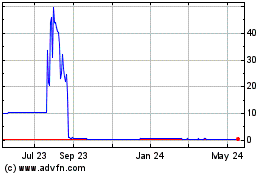

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Jan 2025 to Feb 2025

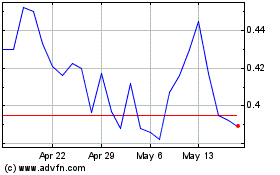

Better Home and Finance (NASDAQ:BETR)

Historical Stock Chart

From Feb 2024 to Feb 2025