Form 8-K - Current report

October 08 2024 - 4:45PM

Edgar (US Regulatory)

false 0001808898 0001808898 2024-10-08 2024-10-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 8, 2024

BENITEC BIOPHARMA INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-39267 |

|

84-4620206 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 3940 Trust Way, Hayward, California |

|

94545 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (510) 780-0819

(Former Name or Former Address, if Changed Since Last Report): Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 |

|

BNTC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As previously disclosed, on August 29, 2024, the stockholders of Benitec Biopharma Inc. (the “Company”) approved the potential issuance of shares of the Company’s common stock, par value $0.0001 per share, issuable upon the exercise of certain of the Company’s outstanding warrants pursuant to Nasdaq Listing Rule 5635(b). Following stockholder approval, holders of the warrants are eligible to waive the 19.99% beneficial ownership limitations contained in the warrants. Following the stockholder approval, Suvretta Capital Management, LLC (“Suvretta Capital”) waived the 19.99% beneficial ownership limitation contained in the warrants held by funds managed by Suvretta Capital (the “Suvretta Funds”), and agreed with the Company that Suvretta Capital will not be permitted to complete an exercise of the warrants held by the Suvretta Funds to the extent the beneficial ownership by Suvretta Capital of the Company’s common stock would exceed 49.9% following such exercise. A copy of the letter agreement with Suvretta Capital is attached hereto as Exhibit 99.1.

In connection with the waiver of its 19.99% beneficial ownership limitation and the establishment of its new 49.9% beneficial ownership limitation, the Suvretta Funds exercised (i) 588,236 of the Company’s Series 2 warrants issued September 15, 2022 at an exercise price of $1.9299 per share, (ii) 5,181,347 of the Company’s warrants issued August 11, 2023 at an exercise price of $3.86 per share, and (iii) 1,368,180 pre-funded warrants with an exercise price of $0.0001 per share. Pursuant to these exercises, on October 4, 2024, the Company issued the Suvretta Funds an aggregate of 7,137,763 shares of common stock, for aggregate proceeds of approximately $21,135,373.

Following the completion of the above warrant exercises by the Suvretta Funds and warrant exercises by other holders, as of October 8, 2024, the Company has 17,893,765 outstanding shares of common stock.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

BENITEC BIOPHARMA INC. |

|

|

|

|

| Date: October 8, 2024 |

|

|

|

By: |

|

/s/ Jerel A. Banks |

|

|

|

|

Name: |

|

Jerel A. Banks |

|

|

|

|

Title: |

|

Chief Executive Officer |

Exhibit 99.1

BENITEC BIOPHARMA INC.

September 26, 2024

Suvretta Capital Management, LLC

540 Madison Ave., 7th Floor

New York, NY 10022

Attention: Andrew Nathanson, General Counsel &

Chief

Compliance Officer

Ladies and Gentlemen:

Reference is made to that certain confirmatory letter, dated May 23, 2024 (the “Confirmatory Letter”), between Benitec Biopharma Inc., a

Delaware corporation (the “Company”) and Suvretta Capital Management, LLC (including its affiliated funds holding the warrants referenced below, “Suvretta Capital”). Reference is further made to the following:

| |

(i) |

the pre-funded warrants issued to Averill Master Fund, Ltd. (the

“Averill Fund”) on September 15, 2022, with respect to an aggregate of 588,235 underlying shares of the Company’s common stock (“Common Stock”) (the “2022 Pre-funded

Warrant”) and Series 2 warrants issued to the Averill Fund on September 15, 2022, with respect to an aggregate of 588,236 underlying shares of Common Stock (the “2022 Coverage Warrant” and together with the 2022 Pre-funded Warrant,” the “2022 Warrants”) and the Warrant Agency Agreement (as defined in the 2022 Coverage Warrant); |

| |

(ii) |

the pre-funded warrants (the “2023

Pre-Funded Warrant”) issued to the Averill Fund and the Averill Madison Master Fund, Ltd. (the “Averill Madison Fund” and, together with the Averill Fund, the “Funds”) on

August 11, 2023, with respect to an aggregate of 5,181,347 underlying shares of the Company’s Common Stock and common warrants issued to the Averill Fund and the Averill Madison Fund on August 11, 2023, with respect to an

aggregate of 5,181,347 underlying shares of Common Stock (the “2023 Common Warrant” and together with the 2023 Pre-Funded Warrant, the “2023 Warrants”) and the Warrant Agency

Agreement (as defined in the 2023 Warrants); and |

| |

(iii) |

the pre-funded warrants issued to the Funds on April 22, 2024,

with respect to an aggregate of 2,002,556 underlying shares of Common Stock (the “2024 Warrants” and together with the 2023 Warrants and the 2022 Warrants, the “Warrants”). |

The purpose of this letter agreement is to memorialize the Company’s and Suvretta Capital’s understanding with respect to the Beneficial Ownership

Limitation set forth in each Warrant (as such term is defined in each Warrant) following stockholder approval on August 29, 2024 of a proposal to remove the 19.99% beneficial ownership limitation in the Warrants for purposes of complying with

Nasdaq Listing Rule 5635(b). To the extent the terms of this agreement conflict with the terms of the Confirmatory Letter, the parties agree that the terms of this letter agreement shall control. The Company and Suvretta Capital hereby agree as

follows:

| |

1. |

Suvretta Capital hereby waives the 19.99% beneficial ownership limitation as such right to waive is

contemplated under the Warrants and the Company hereby agrees to waive any time period that would not make such waiver by Suvretta Capital effective as of the date of this letter agreement. |

| |

2. |

Suvretta Capital and the Company agree that Suvretta Capital shall not be permitted to complete an exercise of

shares underlying any of the Warrants to the extent the beneficial ownership of Suvretta Capital (calculated as provided in the applicable Warrants) following such exercise would exceed 49.9% as of the date of such exercise. |

| |

3. |

Promptly following the date hereof, Suvretta Capital shall deliver a notice of exercise with respect to the

Warrants (or a portion thereof), such that immediately following such exercise and the receipt of the applicable shares of Common Stock underlying such Warrants so exercised, together with the Common Stock held by Suvretta Capital, Suvretta Capital

will beneficially own 49.9% of the outstanding shares of Common Stock, based on the Company’s representation that as of the date hereof, there are 10,555,728 shares of Common Stock outstanding. |

| |

4. |

Prior to the exercise of the Warrants as contemplated herein, the Board of Directors of the Company (the

“Board”) shall take all such actions as are reasonably necessary to approve any acquisition of any direct or indirect pecuniary interest of Common Stock (or any securities exercisable or exchangeable for Common Stock) in connection with

any purchase from the Company of the shares underlying the Warrants by Suvretta Capital (or its affiliates) to the extent deemed a director for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), as a so-called “director by deputization”, for the purpose of exempting, to the extent available under applicable law, any such acquisitions from Section 16(b) of the Exchange Act as

permitted by Rule 16b-3(d)(1) promulgated under the Exchange Act. |

| |

5. |

Consistent with the underlying transaction documents in connection with the original issuance of the Warrants,

the Board shall take all such actions as are reasonably necessary to approve any acquisition from the Company of the shares underlying the Warrants by Suvretta Capital (or its affiliates) for purposes of Section 203 of the Delaware General

Corporate Law and any other restrictive provision of any “business combination,” “fair price,” “moratorium,” “control share acquisition,” “takeover,” “interested shareholder” or other

similar anti-takeover statute or regulation that might apply to the exercise of the Warrants. |

Please confirm your agreement with the

foregoing by signing and returning one copy of this letter agreement to the undersigned, whereupon this letter agreement shall become a binding agreement among the Parties.

[Signature Page Follows]

2

|

|

|

| Benitec Biopharma Inc. |

|

|

| By: |

|

/s/ Megan Boston |

|

|

Name: Megan Boston |

|

|

Title: Executive Director |

Accepted and agreed as of the date first written above, by:

|

|

|

| Suvretta Capital Management, LLC, on behalf of itself and Averill Master Fund, Ltd. and Averill Madison Master Fund, Ltd. |

|

|

| By: |

|

/s/ Andrew Nathanson |

| Name: |

|

Andrew Nathanson |

| Title: |

|

GC/CCO |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

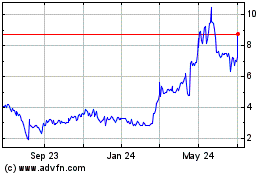

Benitec Biopharma (NASDAQ:BNTC)

Historical Stock Chart

From Nov 2024 to Dec 2024

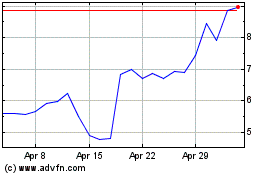

Benitec Biopharma (NASDAQ:BNTC)

Historical Stock Chart

From Dec 2023 to Dec 2024