0001845942

false

0001845942

2023-08-07

2023-08-07

0001845942

BNIX:CommonStockParValue0.01PerShareMember

2023-08-07

2023-08-07

0001845942

BNIX:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member

2023-08-07

2023-08-07

0001845942

BNIX:OneRightToReceive110thOfOneShareOfCommonStockMember

2023-08-07

2023-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 7, 2023

Bannix

Acquisition Corp.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

1-40790 |

|

86-1626016 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

8265

West Sunset Blvd., Suite # 107

West Hollywood, CA |

|

90046 |

| (Address of Principal

Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (323) 682-8949

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.01 per share |

|

BNIX |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

|

BNIXW |

|

The Nasdaq Stock Market LLC |

| One Right to receive 1/10th of one share of Common Stock |

|

BNIXR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive

Agreement.

On June

23, 2023, Bannix Acquisition Corp., a Delaware corporation (“Bannix”), EVIE Autonomous Group Ltd, a private

company formed under the Laws of England and Wales (the “Company”), and the shareholder of the Company (the

“Company Shareholder”), entered into a Business Combination Agreement (the “Business Combination Agreement”),

pursuant to which, subject to the satisfaction or waiver of certain conditions precedent in the Business Combination Agreement,

the following transactions will occur: the acquisition by Bannix of all of the issued and outstanding share capital of the Company

from the Company Shareholder in exchange for the issuance of eighty-five million new shares of common stock of Bannix, $0.01 par

value per share (the “Common Stock”), pursuant to which the Company will become a direct wholly owned subsidiary

of Bannix (the “Share Acquisition”) and (b) the other transactions contemplated by the Business Combination

Agreement and the Ancillary Documents referred to therein (collectively, the “Transactions”). Pursuant to the

Business Combination Agreement, Bannix, Instant Fame LLC, a Nevada limited liability company (the “Bannix Sponsor”),

and the Company shall enter into the sponsor letter agreement (the “Sponsor Letter Agreement”), pursuant to

which the Bannix Sponsor will agree to, among other things, support and vote in favor of the Business Combination Agreement and

use its reasonable best efforts to take all other actions necessary to consummate the transactions contemplated thereby, on the

terms and subject to the conditions set forth in the Sponsor Letter Agreement. Further, the Company also agreed to enter

into, execute and deliver to Bannix a transaction support agreement (collectively, the “Transaction Support Agreement”),

pursuant to which the Company Shareholder will agree to, among other things, support and provide any necessary votes in favor of

the Business Combination Agreement and ancillary agreements. On August 7, 2023, the Bannix Sponsor and the Company entered into

the Sponsor Letter Agreement and the Company Shareholder and Bannix entered into the Transaction Support Agreement.

The foregoing description of the Sponsor Letter

Agreement and the Transaction Support Agreement does not purport to be complete and is qualified in its entirety by the terms and

conditions of each of the agreements copies of which are filed as Exhibits 10.1 and 10.2 and are incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits. The following exhibits are filed with this Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: August 9, 2023 |

|

| |

|

| BANNIX ACQUISITION CORP. |

|

| |

|

| By: |

/s/ Douglas Davis |

|

| Name: |

Douglas Davis |

|

| Title: |

Chief Executive Officer |

|

EXHIBIT 10.1

SPONSOR LETTER AGREEMENT

This SPONSOR

LETTER AGREEMENT (this “Agreement”), dated as of August 7, 2023, is made by and among Instant Fame, LLC,

a Nevada limited liability company (the “Sponsor”), Bannix Acquisition Corp., a Delaware company (“BNIX”),

and EVIE Autonomous Group Ltd, a corporation existing under the laws of England and Wales (the

“Company”). The Sponsor, BNIX and the Company shall be referred to herein from time to time collectively

as the “Parties”. Capitalized terms used but not otherwise defined herein shall have the meanings ascribed

to such terms in the Business Combination Agreement (as defined below).

WHEREAS, BNIX,

the Company and the shareholder of the Company entered into that certain Business Combination Agreement, dated June 20, 2023 (as

it may be amended, restated or otherwise modified from time to time in accordance with its terms, the “Business Combination

Agreement”); and

WHEREAS, the

Business Combination Agreement contemplates that the Parties will enter into this Agreement pursuant to which, among other things,

the Sponsor agrees that it will support and vote in favor of the Business Combination Agreement and

use its reasonable best efforts to take all other actions necessary to consummate the transactions contemplated thereby.

NOW, THEREFORE,

in consideration of the premises and the mutual promises contained herein and for other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the Parties, each intending to be legally bound, hereby agree as follows:

1. Agreement

to Vote. The Sponsor hereby irrevocably agrees, at any meeting of the shareholders of BNIX duly called and convened in accordance

with the Governing Documents of BNIX, whether or not adjourned and however called, including at the Bannix Stockholders Meeting

or otherwise, and in any action by written consent of the shareholders of BNIX, (i) to vote, or cause to be voted, or execute

and return, or cause to be executed and returned, an action by written consent with respect to, as applicable, all of Sponsor’s

Bannix Shares held of record or beneficially by the Sponsor as of the date of this Agreement, or to which the Sponsor acquires

record or beneficial ownership after the date hereof and prior to the Closing (collectively, the “Subject BNIX Equity

Securities”) in favor of each of the Bannix Transaction Proposals, in each case, to the extent Subject BNIX Equity

Securities are entitled to vote thereon or consent thereto, (ii) when such meeting is held, appear at such meeting or otherwise

cause the Subject BNIX Equity Securities to be counted as present thereat for the purpose of establishing a quorum, and (iii) to

vote, or cause to be voted against, against or withhold written consent, or cause written consent to be withheld, with respect

to, as applicable, (A) any Bannix Acquisition Proposal or (B) any other matter, action or proposal that would reasonably

be expected to result in a breach of any of the BNIX Parties’ covenants, agreements or obligations under the Business Combination

Agreement or any of the conditions to the Closing set forth in the Business Combination Agreement not being satisfied.

2. Transfer

of Shares. Except as expressly contemplated by the Business Combination Agreement or with the prior written consent of the

Company (such consent to be given or withheld in its sole discretion), from and after the date hereof, the Sponsor hereby agrees

that he, she or it shall not (i) Transfer any of his, her or its Subject BNIX Equity Securities or any right, title or interest

therein, (ii) enter into (A) any option, warrant, purchase right, or other contract that could (either alone or in connection

with one or more events, developments or events (including the satisfaction or waiver of any conditions precedent)) require such

Sponsor to Transfer his, her or its Subject BNIX Equity Securities, or any right, title or interest therein or (B) any voting

trust, proxy or other contract with respect to the voting or Transfer of the Subject BNIX Equity Securities, or any right, title

or interest therein, in a manner inconsistent with the covenants and obligations of this Agreement, or (iii) enter into any

contract to take, or cause to be taken, any of the actions set forth in clauses (i) or (ii); provided,

however, that the foregoing shall not apply to any Transfer (1) to BNIX’s officers or directors, any members

or partners of the Sponsor, any affiliates of the Sponsor, or any employees of such affiliate; (2) in the case of an individual,

by gift to a member of one of the individual’s immediate family, to a trust, the beneficiary of which is a member of the

individual’s immediate family or an Affiliate of such individual; (3) in the case of an individual, by virtue of laws

of descent and distribution upon death of the individual; (4) in the case of an individual, pursuant to a qualified domestic

relations order; or (5) by virtue of the Sponsor’s organizational documents upon liquidation or dissolution of the Sponsor

(any transferee of the type set forth in clauses (1) through (5) a “Permitted Transferee”);

provided, that the transferring Sponsor shall, and shall cause any Permitted Transferee, to enter into a written agreement

in form and substance reasonably satisfactory to the Company, agreeing to be bound by this Agreement (which will include, for the

avoidance of doubt, all of the covenants, agreements and obligations of the transferring Sponsor hereunder and the making of all

applicable representations and warranties of the transferring Sponsor set forth in this Agreement with respect to such transferee

and his, her or its Subject BNIX Equity Securities, or any right, title or interest therein received upon such Transfer, as applicable)

prior and as a condition to the occurrence of such Transfer. For purposes of this Agreement, “Transfer”

means any, direct or indirect, sale, transfer, assignment, pledge, mortgage, exchange, hypothecation, grant of a security interest

or encumbrance in or disposition of an interest (whether with or without consideration, whether voluntarily or involuntarily or

by operation of law or otherwise).

3. Other

Agreements.

a. The Sponsor

hereby agrees that he, she or it shall (i) be bound by and subject to Sections 5.3(a) (Confidentiality and Access to

Information) and 5.4(a) (Public Announcements) of the Business Combination Agreement to the same extent as such provisions apply

to the parties to the Business Combination Agreement, as if the Sponsor is directly a party thereto, and (ii) not, directly

or indirectly, take any action that BNIX is prohibited from taking pursuant to Section 5.6(a) (Exclusive Dealing) of the Business

Combination Agreement.

b. The Sponsor

acknowledges and agrees that the Company entered into the Business Combination Agreement in reliance upon the expectation that

the Sponsor entering into this Agreement and agreeing to be bound by, and perform, or otherwise comply with, as applicable, the

agreements, covenants and obligations contained in this Agreement and but for each such Sponsor entering into this Agreement and

agreeing to be bound by, and perform, or otherwise comply with, as applicable, the agreements, covenants and obligations contained

in this Agreement, the Company would not have entered into or agreed to consummate the transactions contemplated by the Business

Combination Agreement or the Ancillary Documents.

c. The Sponsor

hereby agrees that it shall not exercise or submit a request to exercise the Bannix Stockholder Redemption with respect to any

Bannix Shares held by him, her or it.

4. Termination.

This Agreement shall automatically terminate, without any notice or other action by any Party, and be void ab initio upon

the earlier of (a) the Effective Time and (b) the termination of the Business Combination Agreement in accordance with

its terms. Upon termination of this Agreement as provided in the immediately preceding sentence, none of the Parties shall have

any further obligations or Liabilities under, or with respect to, this Agreement.

5. No Third-Party

Beneficiaries. This Agreement shall be for the sole benefit of the Parties and their respective successors and permitted assigns

and is not intended, nor shall be construed, to give any Person, other than the Parties and their respective successors and assigns,

any legal or equitable right, benefit or remedy of any nature whatsoever by reason this Agreement. Nothing in this Agreement, expressed

or implied, is intended to or shall constitute the Parties, partners or participants in a joint venture.

6. Notices.

All notices, requests, claims, demands and other communications hereunder shall be in writing and shall be given (and shall be

deemed to have been duly given) by delivery in person, by e-mail (having obtained electronic delivery confirmation thereof (i.e.,

an electronic record of the sender that the email was sent to the intended recipient thereof without an “error” or

similar message that such email was not received by such intended recipient)), or by registered or certified mail (postage prepaid,

return receipt requested) (upon receipt thereof) to the other Parties as follows:

If to Sponsor,

to:

8265 W Sunset, Suit 107,

West Hollywood, CA 90046

If to the

Company, to:

Unit 8 Riverside

Campbell Road

Stoke-On-Trent

Staffordshire ST4 4RJ

T: +44 01782 640650

Attn: CEO

Email: sl@evieautonomous.com

with a copy (which shall not constitute

notice) to

Beswicks Legal

West Court, Campbell Road

Stoke-on-Trent ST4 4FB

or to such other address as the

Party to whom notice is given may have previously furnished to the others in writing in the manner set forth above.

7. Incorporation

by Reference. Sections 8.1 (Non-Survival), 8.2 (Entire Agreement; Assignment). 8.3 (Amendment), 8.5 (Governing Law), 8.7

(Constructions; Interpretation), 8.10 (Severability), 8.11 (Counterparts; Electronic Signatures), 8.15 (Waiver of Jury Trial),

8.16 (Submission to Jurisdiction) and 8.17 (Remedies) of the Business Combination Agreement are incorporated herein and shall apply

to this Agreement mutatis mutandis.

[Signature Page Follows]

IN WITNESS WHEREOF, each

of the Parties has caused this Agreement to be duly executed on its behalf as of the day and year first above written.

| |

INSTANT FAME, LLC |

| |

|

| |

By: |

/s/ Doug Davis |

| |

Name: |

Doug Davis |

| |

Title: |

Manager |

| |

EVIE AUTONOMOUS GROUP LTD. |

| |

|

| |

By: |

/s/ Steven Lake |

| |

Name: |

Steven Lake |

| |

Title: |

Director |

| |

BANNIX ACQUISITION CORP. |

| |

|

| |

By: |

/s/ Doug Davis |

| |

Name: |

Doug Davis |

| |

Title: |

Chief Executive Officer |

4

EXHIBIT 10.2

TRANSACTION SUPPORT AGREEMENT

THIS AGREEMENT is made as of August 7,

2023

BETWEEN:

The person executing this Agreement as “Shareholder”

on the signature page hereof (the “Shareholder”);

- and -

Bannix Acquisition Corp., a Delaware corporation

(“BNIX”).

RECITALS:

WHEREAS, BNIX, EVIE Autonomous Group Ltd

(the “Company”) and the Shareholder, entered into a business combination agreement (the “Business Combination

Agreement”), a copy of which has been provided to the Shareholder, pursuant to which, among other things, (i) BNIX will acquire

all of the issued and outstanding Company Ordinary Shares from the shareholder(s) of the Company (the “Company Shareholder”)

in exchange for Bannix Shares, and (ii) the Company will become a wholly-owned Subsidiary of BNIX;

WHEREAS, the Shareholder is the holder

of record and beneficial owner of the Company Ordinary Shares of the Company on the Shareholder’s signature page hereto;

WHEREAS, the Shareholder acknowledges

that BNIX would not have entered into the Business Combination Agreement but for the expectation of the execution and delivery of this

Agreement by the Shareholder;

WHEREAS, the Company Board has unanimously

(a) determined that the transactions contemplated by the Business Combination Agreement and the Ancillary Documents are in the best

interests of the Company and fair to the Company Shareholders, (b) approved the Business Combination Agreement, the Ancillary Documents

to which the Company is or will be a party and the transactions contemplated hereby and thereby and (c) recommended, among other

things, that the Company Shareholders vote in favor of the transactions contemplated therein; and

WHEREAS, this Agreement sets out the terms

and conditions of the agreement of the Shareholder to abide by the covenants in respect of the Company Ordinary Shares and the other restrictions

and covenants set forth herein.

NOW THEREFORE, in consideration of the

premises and the covenants and agreements herein contained, the Parties agree as follows:

ARTICLE 1

INTERPRETATION

1.1 Definitions

Capitalized terms used, and not otherwise defined,

herein have the meanings ascribed to them in the Business Combination Agreement. In this Agreement:

“Agreement” means this transaction

support agreement;

“Business Combination Agreement”

has the meaning set forth in the recitals of this Agreement;

“Company” has the meaning

set forth in the recitals of this Agreement;

“Parties” means the Shareholder

and BNIX, collectively, and “Party” means any one of them, as the context requires;

“Permitted Transferee” has

the meaning set forth in section 4.1(a)(iii) of this Agreement;

“Shareholder” has the meaning

set forth in the introductory paragraph to this Agreement;

“BNIX” has the meaning set

forth in the introductory paragraph to this Agreement; and

“Transfer” has the meaning

set forth in section 4.1(a)(iii) of this Agreement.

1.2 Incorporation of Schedule

The Shareholder’s signature page to this

Agreement forms an integral part of this Agreement for all purposes of it.

ARTICLE 2

REPRESENTATIONS AND WARRANTIES

2.1 Representations and Warranties of the

Shareholder

The Shareholder represents and warrants to and

in favor of BNIX as follows and acknowledges that BNIX is relying upon such representations and warranties in entering into this Agreement

and the Business Combination Agreement:

(a) The Shareholder, if not an individual, is

a corporation, limited liability company or other applicable business entity duly organized, incorporated or formed, as applicable, validly

existing and in good standing (or the equivalent thereof, if applicable, in each case, with respect to the jurisdictions that recognize

the concept of good standing or any equivalent thereof) under the Laws of its jurisdiction of formation or organization (as applicable).

The Shareholder, if an individual, has the legal capacity to enter into and perform his or her obligations under this Agreement.

(b) The Shareholder, if not an individual, has

the requisite corporate power and authority to execute and deliver this Agreement, to perform its obligations hereunder and to consummate

the transactions contemplated by this Agreement. This Agreement has been duly authorized by all necessary corporate action on the part

of the Shareholder. This Agreement has been duly and validly executed and delivered by the Shareholder and constitutes a legal, valid

and binding agreement of the Shareholder (assuming that this Agreement has been duly authorized, executed and delivered by BNIX) enforceable

against the Shareholder in accordance with its terms (subject to applicable bankruptcy, insolvency, reorganization, moratorium or other

Laws affecting generally the enforcement of creditors’ rights and subject to general principles of equity).

(c) The Shareholder is the sole holder of, record

and beneficial owner of, or exercises control or direction over, and at the Effective Time and at all times between the date hereof and

the Effective Time, the Shareholder will be the sole holder of, record and beneficial owner of, or exercise control or direction over,

all the Company Ordinary Shares set forth on the Shareholder’s signature page hereto, with good title thereto, free and clear of

all Liens (other than transfer restrictions under this Agreement, the Governing Documents of the Shareholder and applicable Securities

Laws). Other than the Company Ordinary Shares set forth on the Shareholder’s signature page hereto, the Shareholder does not own,

beneficially or of record, and is not a party to or bound by any agreement or option, or right or privilege (whether by law, pre-emptive

or contractual) capable of becoming an agreement or option, for the purchase or acquisition by the Shareholder of, any additional securities,

or any securities convertible or exchangeable into any additional securities, of the Company, except as may be required under the Governing

Documents of the Shareholder.

(d) Except as contemplated by the Business Combination

Agreement or the Governing Documents of the Shareholder, no Person has any contractual right or privilege for the purchase or acquisition

from the Shareholder of any of the Company Ordinary Shares of the Shareholder or for the right to vote any of the Company Ordinary Shares

of the Shareholder.

(e) There are no legal proceedings in progress

or pending before any Governmental Entity or, to the knowledge of the Shareholder, threatened against the Shareholder that would adversely

affect in any manner the ability of the Shareholder to enter into this Agreement and to perform its obligations hereunder in any material

respect.

(f) No consent, approval, order or authorization

of, or designation, declaration or filing with, any Person is required on the part of the Shareholder with respect to the execution, delivery

or performance of its obligations under this Agreement by the Shareholder, the performance by the Shareholder of its obligations under

this Agreement and the completion of the transactions contemplated by this Agreement, other than those which are contemplated by the Business

Combination Agreement, except for any consents, approvals, authorizations, designations, declarations, waivers or filings, the absence

of which would not adversely affect the ability of the Shareholder to perform, or otherwise comply with, any of its covenants, agreements

or obligations hereunder in any material respect, or which have already been obtained in advance of the Shareholder’s entry into

this Agreement.

(g) None of the execution or delivery by the

Shareholder of this Agreement, the performance by the Shareholder of its obligations hereunder or the consummation of the transactions

contemplated hereby or pursuant to the Business Combination Agreement will, directly or indirectly (with or without due notice or lapse

of time or both), (i) result in a violation or breach of any provision of the Governing Documents of the Shareholder, (ii) result

in a violation or breach of, or constitute a default or give rise to any right of termination, Consent, cancellation, amendment, modification,

suspension, revocation or acceleration under, any of the terms, conditions or provisions of any Contract to which the Shareholder is a

party, (iii) violate, or constitute a breach under, any Order or applicable Law to which the Shareholder or any of its properties

or assets are subject or bound or (iv) result in the creation of any Lien upon the Company Ordinary Shares of the Shareholder, except,

in the case of any of clauses (ii) through (iv) above, as would not adversely affect the ability of the Shareholder

to perform, or otherwise comply with, any of its covenants, agreements or obligations hereunder in any material respect.

2.2 Representations and Company Warranties

of BNIX

BNIX represents and warrants to and in favor

of the Shareholder as follows and acknowledges that the Shareholder is relying upon such representations and warranties in entering into

this Agreement:

(a) BNIX is corporation duly organized, incorporated

or formed, as applicable, validly existing and in good standing (or the equivalent thereof, if applicable, in each case, with respect

to the jurisdictions that recognize the concept of good standing or any equivalent thereof) under the Laws of its jurisdiction of organization,

incorporation or formation (as applicable).

(b) BNIX has the requisite exempted corporate

power and authority to execute and deliver each of this Agreement and the Business Combination Agreement, to perform its obligations hereunder

and thereunder, and to consummate the transactions contemplated hereby and thereby. Each of this Agreement and the Business Combination

Agreement has been duly authorized by all necessary corporate or other similar action on the part of BNIX. Each of this Agreement and

the Business Combination Agreement has been duly and validly executed and delivered by BNIX and constitutes a legal, valid and binding

agreement of BNIX (assuming that this Agreement or the Business Combination Agreement, as applicable, has been duly authorized, executed

and delivered by the other Persons party thereto), enforceable against BNIX in accordance with its terms (subject to applicable bankruptcy,

insolvency, reorganization, moratorium or other Laws affecting generally the enforcement of creditors’ rights and subject to general

principles of equity).

(c) None of the execution and delivery by BNIX

of this Agreement or the Business Combination Agreement, the performance of BNIX of its obligations hereunder and thereunder, or the consummation

by BNIX of the transactions contemplated hereby and thereby will, directly or indirectly (with or without due notice or lapse of time

or both), (i) result in a violation or breach of any provision of the Governing Documents of BNIX, (ii) result in a violation

or breach of, or constitute a default or give rise to any right of termination, consent, cancellation, amendment, modification, suspension,

revocation or acceleration under, any of the terms, conditions or provisions of any contract to which BNIX is a party, (iii) violate,

or constitute a breach under, any Order or applicable Law to which BNIX or any of its properties or assets are subject or bound or (iv) result

in the creation of any Lien upon any of the assets or properties (other than any Permitted Liens) of BNIX, except in the case of any of

clauses (ii) through (iv) above, as would not have a BNIX Material Adverse Effect.

ARTICLE 3

SHAREHOLDER ACKNOWLEDGMENT AND CONSENT

3.1 Acknowledgment and Consent of the Shareholder

Until the termination of this Agreement in accordance

with its terms, the Shareholder:

(a) irrevocably and unconditionally consents

to and approves the entering into and execution by the Company of the Business Combination Agreement and all Ancillary Documents to which

the Company is or will be a party and the consummation of the transactions contemplated by the Business Combination Agreement; and

(b) irrevocably and unconditionally consents

to the details of this Agreement being set out in the Proxy Statement and for the form of this Agreement to be filed with the SEC and

any other Governmental Entity, in connection with the Agreement, the Ancillary Documents to which the Company is or will be a party and

the transactions contemplated hereby and thereby.

ARTICLE 4

COVENANTS

4.1 Covenants of the Shareholder

(a) The Shareholder hereby irrevocably and unconditionally

covenants, undertakes and agrees, from time to time, until the earlier of (i) the Effective Time, and (ii) the termination of

this Agreement in accordance with Section 5.1 hereof:

(i) to cause to be counted as present for purposes

of establishing quorum all the Company Ordinary Shares of the Shareholder, at any meeting of any of the securityholders of the Company

at which the Shareholder is entitled to vote, including the Company Shareholder Resolution, or at any adjournment thereof or in any other

circumstances upon which a vote, consent or other approval with respect to the Transactions contemplated by the Business Combination Agreement

is sought, or in any action by written consent of the securityholders of the Company, and to vote or cause to be voted (in person, by

proxy, by action by written consent, as applicable, or as otherwise may be required under the articles of the Company) all the Company

Ordinary Shares of the Shareholder, in favor of the approval, consent, ratification and adoption of the Transactions contemplated by the

Business Combination Agreement.

(ii) to cause to be counted as present for purposes

of establishing quorum all the Company Ordinary Shares of the Shareholder, at any meeting of any of the securityholders of the Company

at which the Shareholder is entitled to vote, or at any adjournment thereof or in any other circumstances upon which a vote, consent or

other approval, with respect to matters contemplated by clause (A) or clause (B) of this Section 4.1(a)(ii),

is sought, or in any action by written consent of the securityholders of the Company, and to vote or cause to be voted (in person, by

proxy or by action by written consent, as applicable, or as otherwise may be required under the articles of the Company) all the Company

Ordinary Shares of the Shareholder, in opposition to: (A) any Company Acquisition Proposal; and (B) any other matter, action

or proposal which would reasonably be expected to result in a breach of any representation, warranty, covenant or other obligation of

the Company under the Business Combination Agreement if such breach requires securityholder approval and is communicated as being such

a breach in a notice in writing delivered by BNIX to the Shareholder;

(iii) except pursuant to the Business Combination

Agreement or with the prior written consent of BNIX (such consent to be given or withheld in its sole discretion), not to (A) Transfer

any Company Ordinary Shares of the Shareholder, or any right or interest therein, (B) enter into (1) any option, warrant, purchase

right, or other Contract that could (either alone or in connection with one or more events, developments or events (including the satisfaction

or waiver of any conditions precedent)) require such Shareholder to Transfer any Company Ordinary Shares of the Shareholder, or any right

or interest therein, or (2) any voting trust, proxy or other Contract with respect to the voting or Transfer of any Company Ordinary

Shares of the Shareholder, or any right or interest therein, in a manner inconsistent with the covenants and obligations of this Agreement,

or (C) enter into any Contract to take, or cause to be taken, any of the actions set forth in clauses (A) or (B);

provided, however, that the foregoing shall not apply to any Transfer (1) to any Affiliate of such Shareholder; (2) in the case

of an individual, by gift to a member of one of the individual’s immediate family, to a trust, the beneficiary of which is a member

of the individual’s immediate family or an Affiliate of such individual; (3) in the case of an individual, by virtue of laws

of descent and distribution upon death of the individual; (4) in the case of an individual, pursuant to a qualified domestic relations

order; or (5) by virtue of the Shareholder’s organizational documents upon liquidation or dissolution of the Shareholder (any

transferee of the type set forth in clauses (1) through (5) a “Permitted Transferee”); provided, that the

transferring Shareholder shall, and shall cause any Permitted Transferee, to enter into a written agreement in form and substance reasonably

satisfactory to BNIX, agreeing to be bound by this Agreement (which will include, for the avoidance of doubt, all of the covenants, agreements

and obligations of the transferring Shareholder hereunder and the making of all applicable representations and warranties of the transferring

Shareholder set forth in Article 2 with respect to such transferee and his, her or its Company Ordinary Shares, or any right or

interest therein, received upon such Transfer, as applicable) prior and as a condition to the occurrence of such Transfer. For purposes

of this Agreement, “Transfer” means any, direct or indirect, sale, transfer, assignment, pledge, mortgage, exchange,

hypothecation, grant of a security interest or encumbrance in or disposition of an interest (whether with or without consideration, whether

voluntarily or involuntarily or by operation of law or otherwise).

(iv) not to exercise any dissent rights in respect

of any transaction contemplated by the Business Combination Agreement;

(v) to execute and deliver all related documentation

and take such other actions in support of the transactions contemplated by the Business Combination Agreement as shall reasonably be requested

by the Company or BNIX to consummate the Transactions;

(vi) the Shareholder hereby revokes any and all

previous proxies granted or voting instruction forms or other voting documents delivered that conflict, or are inconsistent, with the

matters set forth in this Agreement;

(vii) not take any other action of any kind,

directly or indirectly, which would make any representation or warranty of the Shareholder set forth in this Agreement untrue or incorrect

in any material respect or might reasonably be regarded, individually or in the aggregate, as likely to reduce the success of, or delay

or interfere with, the completion of the Transactions contemplated by the Business Combination Agreement;

(viii) the Shareholder shall be bound by

and subject to Sections 5.3(a) (Confidentiality and Access to Information), 5.4(a) (Public Announcements)

and 5.6(a) (Exclusive Dealing) of the Business Combination Agreement to the same extent that Sections 5.3(a)

(Confidentiality and Access to Information), 5.4(a) (Public Announcements) and 5.6(a) (Exclusive Dealing)

of the Business Combination Agreement apply to the Company, mutatis mutandis, as if the Shareholder is directly party thereto;

provided that, notwithstanding anything in this Agreement to the contrary, any breach by the Company of its obligations under the Business

Combination Agreement shall not be considered a breach of this Section 4.1(a)(viii); and

(ix) the Shareholder hereby grants an irrevocable

power of attorney and hereby irrevocably constitutes and appoints BNIX, or any individual designated by BNIX, as attorney in fact (which

appointment is coupled with an interest), with full power of substitution in favor of BNIX, to take all such actions and execute and deliver

such documents, instruments or agreements as are necessary to give effect to the covenants set forth in this Article 4.

(b) If the Shareholder acquires or is issued

any additional Company Ordinary Shares following the date hereof, the Shareholder acknowledges that such additional Company Ordinary Shares

shall be deemed to be Company Ordinary Shares for the purposes of this Agreement.

ARTICLE 5

GENERAL

5.1 Termination

This Agreement shall automatically terminate,

without any notice or other action on the part of any Party, upon the earliest to occur of the following:

(a) the Effective Time;

(b) the date upon which the Parties agree in

writing to terminate this Agreement;

(c) the date of earlier termination of the Business

Combination Agreement in accordance with its terms; and

(d) the amendment or modification of the Business

Combination Agreement without the Shareholder’s written consent to decrease, or change the form of, the consideration payable to

Company Shareholders.

5.2 Fiduciary Duties

Notwithstanding anything in this Agreement to

the contrary, (a) the Shareholder makes no agreement or understanding herein in any capacity other than in the Shareholder’s

capacity as a record holder and/or beneficial owner of the Company Ordinary Shares of the Shareholder and not in such Shareholder’s

capacity as a director, officer or employee of the Company and (b) nothing herein will be construed to limit or affect any action

or inaction by the Shareholder or any representative of the Shareholder serving as a member of any Group Company Board or as an officer,

employee or fiduciary of any Group Company, in each case, acting in such person’s capacity as a director, officer, employee or fiduciary

of such Group Company.

5.3 Effect of Termination

If this Agreement is terminated pursuant to Section 5.1,

this Agreement shall become void and of no force and effect and no Party will have any liability or further obligation to the other Party

hereunder. Notwithstanding the foregoing or anything to the contrary in this Agreement, (i) the termination of this Agreement pursuant

to Section 5.1(c) shall not affect any Liability on the part of any Party for a Willful Breach of any covenant or agreement

set forth in this Agreement prior to such termination or Fraud, (ii) Section 4.1(a)(viii) (solely to the extent that

it relates to Section 5.3(a) (Confidentiality and Access to Information) of the Business Combination Agreement) and

this Article 5 (to the extent related to any of the provisions that survive the termination of this Agreement and excluding Section 5.10

(solely to the extent that it relates to Section 8.1 (Non Survival) of the Business Combination Agreement)) shall survive

the termination of this Agreement and (iii) Section 4.1(a)(viii) (solely to the extent that it relates to Section 5.4(a)

(Public Announcements) of the Business Combination Agreement) and Section 5.10 (solely to the extent that it relates

to Section 8.1 (Non Survival) of the Business Combination Agreement) shall each survive the termination of this Agreement

pursuant to Section 5.1(a). For purposes of this Section 5, (x) “Willful Breach” means

a material breach of this Agreement by a Party that is a consequence of an act undertaken or a failure to act by the breaching Party with

the knowledge that the taking of such act or such failure to act would, or would reasonably be expected to, constitute or result in a

breach of this Agreement and (y) “Fraud” means an act or omission by a Party, and requires: (a) a false

or incorrect representation or warranty expressly set forth in this Agreement, (b) with actual knowledge (as opposed to constructive,

imputed or implied knowledge) by the Party making such representation or warranty that such representation or warranty expressly set forth

in this Agreement is false or incorrect, (c) an intention to deceive another Party, to induce him, her or it to enter into this Agreement,

(d) another Party, in justifiable or reasonable reliance upon such false or incorrect representation or warranty expressly set forth

in this Agreement, causing such Party to enter into this Agreement, and (e) another Party to suffer damage by reason of such reliance.

For the avoidance of doubt, “Fraud” does not include any claim for equitable fraud, promissory fraud, unfair dealings fraud

or any torts (including a claim for fraud or alleged fraud) based on negligence or recklessness.

5.4 Notices

All notices, requests, claims, demands and other

communications hereunder shall be in writing and shall be given (and shall be deemed to have been duly given) by delivery in person, by

e-mail (having obtained electronic delivery confirmation thereof), or by registered or certified mail (postage prepaid, return receipt

requested) (upon receipt thereof) to the other Parties as follows:

(a) if to BNIX:

Bannix Acquisition Corp.

8265 West Sunset Blvd., Suite 107, West Hollywood, CA 90046

Attention: Douglas Davis

Email: doug.davis@bannixacquisition.com

(b) if to the Shareholder, at the address set

forth on the Shareholder’s signature page hereto.

or to such other address as the Party to whom

notice is given may have previously furnished to the others in writing in the manner set forth above. Any demand, notice or other communication

given by personal delivery will be conclusively deemed to have been given on the day of actual delivery thereof and, if given by electronic

communication, on the day of transmittal thereof if given during the normal business hours of the recipient and on the Business Day during

which such normal business hours next occur if not given during such hours on any day.

5.5 Benefit of Agreement

This Agreement shall be for the sole benefit

of the Parties and their respective successors and permitted assigns and is not intended, nor shall be construed, to give any Person,

other than the Parties and their respective successors and assigns, any legal or equitable right, benefit or remedy of any nature whatsoever

by reason this Agreement. Nothing in this Agreement, expressed or implied, is intended to or shall constitute the Parties, partners or

participants in a joint venture.

5.6 Non-Recourse

Except for claims pursuant to the Business Combination

Agreement or any other Ancillary Document by any party(ies) thereto against any other party(ies) thereto on the terms and subject to the

conditions therein, each Party agrees that (a) this Agreement may only be enforced against, and any action for breach of this Agreement

may only be made against, the Parties, and no claims of any nature whatsoever (whether in tort, contract or otherwise) arising under or

relating to this Agreement, the negotiation hereof or its subject matter, or the transactions contemplated hereby shall be asserted against

any Company Non-Party Affiliate or any BNIX Non-Party Affiliate (other than the Shareholders named as parties hereto), and (b) no

Company Non-Party Affiliate or BNIX Non-Party Affiliate (other than the Shareholders named as parties hereto), shall have any Liability

arising out of or relating to this Agreement, the negotiation hereof or its subject matter, or the transactions contemplated hereby, including

with respect to any claim (whether in tort, contract or otherwise) for breach of this Agreement or in respect of any written or oral representations

made or alleged to be made in connection herewith, or for any actual or alleged inaccuracies, misstatements or omissions with respect

to any information or materials of any kind furnished in connection with this Agreement, the negotiation hereof or the transactions contemplated

hereby.

5.7 Time

Time is of the essence of this Agreement. The

mere lapse of time in the performance of the terms of this Agreement by any Party will have the effect of putting such Party in default.

5.8 Further Assurances

Subject to the provisions of this Agreement,

the Parties will, from time to time, do all acts and things and execute and deliver all such further documents and instruments, as the

other Parties may, reasonably require to effectively carry out or better evidence or perfect the full intent and meaning of this Agreement.

5.9 Governing Law

This Agreement shall be governed by, construed

and enforced in accordance with, the laws of the State of Delaware.

5.10 Incorporation by Reference

Sections 8.1 (Non-Survival),

8.2 (Entire Agreement; Assignment), 8.3 (Amendment), 8.7 (Constructions; Interpretation), 8.10

(Severability), 8.11 (Counterparts; Electronic Signatures), Section 8.14 (Extension; Waiver),

8.15 (Waiver of Jury Trial), 8.16 (Submission to Jurisdiction) and 8.17 (Remedies) of the Business

Combination Agreement are incorporated herein and shall apply to this Agreement mutatis mutandis.

[The remainder of this page has been intentionally

left blank.]

IN WITNESS OF WHICH the Parties have executed

this Agreement.

BNIX:

| Bannix Acquisition Corp. |

|

| |

|

| By: |

/s/ Doug Davis |

|

| Name: |

Doug Davis |

|

| Title: |

Chief Executive Officer |

|

[Signature Page — Transaction Support

Agreement]

IN WITNESS OF WHICH the Parties have executed

this Agreement.

SHAREHOLDER:

| Name: |

Steven Lake |

|

| |

|

|

| By: |

/s/ Steven Lake |

|

| Name: |

Steven Lake |

|

| Title: |

N/A |

|

Company Ordinary Shares: 100

Address for Notice:

Address:

| Telephone: |

|

|

| Email: |

|

|

| Facsimile: |

|

|

[Signature Page — Transaction Support

Agreement]

10

v3.23.2

Cover

|

Aug. 07, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 07, 2023

|

| Entity File Number |

1-40790

|

| Entity Registrant Name |

Bannix

Acquisition Corp.

|

| Entity Central Index Key |

0001845942

|

| Entity Tax Identification Number |

86-1626016

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8265

West Sunset Blvd.

|

| Entity Address, Address Line Two |

Suite # 107

|

| Entity Address, City or Town |

West Hollywood

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90046

|

| City Area Code |

(323)

|

| Local Phone Number |

682-8949

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.01 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

BNIX

|

| Security Exchange Name |

NASDAQ

|

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50

|

| Trading Symbol |

BNIXW

|

| Security Exchange Name |

NASDAQ

|

| One Right to receive 1/10th of one share of Common Stock |

|

| Title of 12(b) Security |

One Right to receive 1/10th of one share of Common Stock

|

| Trading Symbol |

BNIXR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BNIX_CommonStockParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BNIX_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BNIX_OneRightToReceive110thOfOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

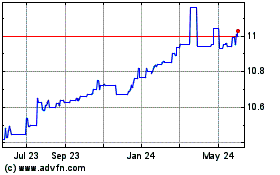

Bannix Acquisition (NASDAQ:BNIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

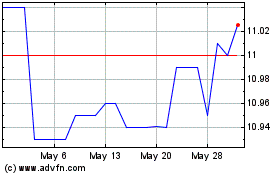

Bannix Acquisition (NASDAQ:BNIX)

Historical Stock Chart

From Nov 2023 to Nov 2024