false

0001086745

0001086745

2024-10-29

2024-10-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 29, 2024

AYRO,

Inc.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

001-34643 |

|

98-0204758 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

AYRO,

Inc.

900

E. Old Settlers Boulevard, Suite 100

Round

Rock, Texas 78664

(Address

of principal executive offices and zip code)

Registrant’s

telephone number, including area code: 512-994-4917

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

AYRO |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

On

October 29, 2024, AYRO, Inc. (the “Company”) entered into a stock repurchase agreement (the “Agreement”) with

a certain beneficial owner (the “Seller”) of 418,478 shares of the Company’s common stock, US$0.0001 par value per

share (the “Common Stock”). Pursuant to the Agreement, the Company agreed to repurchase from the Seller 418,478 shares of

Common Stock beneficially owned by the Seller, constituting all of the Seller’s ownership interest in the Company, for an aggregate

cash purchase price of US$376,630.20 (equal to US$0.90 per share). The Agreement contains customary representations and warranties and

releases by the Seller.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AYRO,

INC. |

| |

|

|

| Date:

October 29, 2024 |

By:

|

/s/

Joshua Silverman |

| |

|

Joshua

Silverman |

| |

|

Executive

Chairman |

Exhibit

10.1

STOCK

REPURCHASE AGREEMENT

THIS

STOCK REPURCHASE AGREEMENT is dated effective as of October 29, 2024 (the “Effective Date”), by and between

AYRO, Inc., a Delaware corporation (the “Company”), and Natale Rea (“Rea”). Rea and

the Company are together referred to herein as the “Parties” or singly as a “Party.”

This Stock Repurchase Agreement and all documents and instruments delivered pursuant to the terms hereof, are collectively referred to

herein as the “Agreement.”

RECITALS

WHEREAS,

Rea is the record and beneficial owner of 418,478 shares of the Company’s common stock, US$0.0001 par value per share (“Common

Stock”); and

WHEREAS,

the Company desires to repurchase from Rea, and Rea desires to sell to the Company, a total of 418,478 shares of Common Stock (the “Shares”),

constituting all of Rea’s ownership interest in the Company, for certain consideration and on the terms and conditions set forth

herein.

NOW,

THEREFORE, in consideration of the premises and the mutual promises herein made, and in consideration of the representations, warranties,

agreements and covenants herein, the Parties hereto hereby agree as follows:

1.

Sale and Purchase.

(a)

Upon the basis of the representations and warranties and on the terms and subject to the conditions set forth in this Agreement, and

for the consideration set forth below, Rea hereby sells, assigns and transfers to the Company the Shares free and clear of all security

interests, pledges, mortgages, liens, charges, encumbrances, adverse claims, restrictions or other burdens or encumbrances of any kind

(collectively, “Encumbrances”).

(b)

Upon the execution of this Agreement, as consideration for the repurchase and redemption of the Shares, the Company shall pay to Rea

an aggregate cash purchase price of US$376,630.20 (equal to US$0.90 per share) payable by check or wire transfer in immediately available

funds as directed by Rea (the “Payment”), as the purchase price of the Shares. The Payment shall be made promptly

but in any event within one (1) business day of the Parties’ execution and delivery of this Agreement.

2.

Representations and Warranties of Rea. Rea represents and warrants to the Company that:

(a)

The Shares are in book-entry form and are not certificated and Rea is not in possession of any stock certificates evidencing the Shares.

Rea is the sole record owner and is the beneficial owner of the Shares; other than Rea, no person has a right to acquire or direct the

disposition, or holds a proxy or other right to vote or direct the vote, of the Shares; and Rea has good and valid title to the Shares,

free and clear of any Encumbrances. Except for this Agreement, there is no option, warrant, right, call, proxy, agreement, commitment

or understanding of any nature whatsoever, fixed or contingent, that directly or indirectly (i) calls for the sale, pledge or other transfer

or disposition of any of the Shares, any interest therein or any rights with respect thereto, or relates to the voting, disposition,

exercise, conversion or control of the Shares, or (ii) obligates Rea to grant, offer or enter into any of the foregoing.

(b)

The sale by Rea of the Shares and the delivery of the certificate representing the Shares to the Company, upon receipt of payment therefor,

pursuant hereto will transfer to the Company good and valid title to the Shares, free and clear of all Encumbrances.

(c)

Rea (i) is an “accredited investor” as defined in Rule 501 under the Securities Act of 1933, as amended, and (ii) has consulted

with his own legal, tax, business, investment, financial and accounting advisors to the extent he has deemed necessary. Rea is entering

into this Agreement with a full understanding of all of the terms, conditions and risks hereof (economic and otherwise), is capable of

independently evaluating and understanding (on his own behalf or through independent professional advice) and of assuming, understanding

and accepting such terms, conditions and risks.

(d)

Rea hereby expressly acknowledges and agrees that (i) the consideration given in exchange for the Shares as represented in this Agreement

is fair, equitable and valid, (ii) the price of the Company’s Common Stock is subject to market forces, which may result in variances

in the value thereof, which variances may be significant and (iii) the Company has access to material non-public information about the

Company that is not available to Rea.

(e)

This Agreement has been duly executed and delivered by Rea and constitutes the legal, valid and binding obligation of Rea enforceable

against him in accordance with its terms.

(f)

The execution and delivery of this Agreement or any other agreement or instrument executed and delivered pursuant hereto by Rea does

not, or when executed will not, and the consummation of the transactions contemplated hereby or thereby and the performance by Rea of

the obligations that he is obligated to perform hereunder or thereunder do not:

| | i. | create

any lien on any of the Shares under any indenture, mortgage, lien, agreement, contract, commitment

or instrument to which Rea is a party; |

| | | |

| | ii. | conflict

with any law applicable to Rea; or |

| | | |

| | iii. | conflict

with, result in a breach of, constitute a default under (whether with notice or the lapse

of time or both) or accelerate or permit the acceleration of the performance required by,

or require any consent, authorization or approval under, any indenture, mortgage, lien or

agreement, contract, commitment or instrument to which Rea is a party or otherwise bound; |

except

as would not be reasonably likely to have, individually or in the aggregate, a material adverse effect and would not prevent, materially

delay or materially impede the performance by Rea of his obligations under this Agreement.

3.

Rea Release. Rea hereby waives and releases and promises never to assert any claims or causes of action, whether or not now known,

against the Company, or its respective predecessors, successors or past or present subsidiaries, officers, directors, agents, partners,

members, managers, employees, present and future stockholders, assigns and affiliates thereof (the “Company Released Parties”)

from any and all actions, suits, claims, demands, debts, sums of money, accounts, reckonings, bonds, bills, covenants, contracts, controversies,

promises, judgments, liabilities or obligations of any kind whatsoever in law or equity and causes of action of every kind and nature,

or otherwise (including, without limitation, claims for damages, costs, expenses and attorneys’, brokers’ and accountants’

fees and expenses) arising out of or related to events, facts, conditions or circumstances existing or arising on or prior to the closing

of the transactions contemplated hereby, which Rea can, shall or may have against the Company Released Parties, whether known or unknown,

suspected or unsuspected, unanticipated as well as anticipated and that now exist or may hereafter accrue (other than with respect to

a breach of a covenant by such parties under this Agreement).

4.

Public Disclosure. Rea will not make any public disclosures or filings in connection with the transactions contemplated by this

Agreement, whether voluntary or required pursuant to the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated

thereunder, unless he has furnished a copy thereof to the Company for its review prior to such disclosure or filing and the Company approves

such disclosure or filing, which approval shall not be unreasonably withheld, conditioned or delayed.

5.

Legal and Equitable Remedies. The Company has the right to enforce this Agreement and any of its provisions by injunction, specific

performance or other equitable relief without prejudice to any other rights or remedies the Company may have at law or in equity for

breach of this Agreement.

6.

Validity and Severability. If any provision of this Agreement shall be held to be illegal, invalid or unenforceable under any

applicable law, then such contravention or invalidity shall not invalidate the entire Agreement. Such provision shall be deemed to be

modified to the extent necessary to render it legal, valid and enforceable, and if no such modification shall render it legal, valid

and enforceable, then this Agreement shall be construed as if not containing the provision held to be illegal, invalid or unenforceable

and the rights and obligations of the Parties hereto shall be construed and enforced accordingly.

7.

Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of New York applicable

to contracts executed in and to be performed in that state and without regard to any applicable conflict of laws principles.

8.

Expenses. Whether or not the transactions contemplated by this Agreement are consummated, each of the Parties hereto shall pay

their respective fees and expenses incurred in connection herewith.

9.

Entire Agreement. This Agreement contains the sole and entire agreement and understanding of each of the Parties with respect

to the subject matter hereof, and any and all other discussions, negotiations, representations, commitments, understandings, promises,

and agreements relating to the entire subject matter of this Agreement are merged into this Agreement. Each Party to this Agreement further

acknowledges and agrees that no other agreement or representation, whether written, oral, or implied, other than those expressly contained

or referred to in this Agreement, shall be deemed to exist or bind the Parties with respect to the entire subject matter of this Agreement.

Each Party represents and acknowledges that in executing this Agreement, such Party does not rely on, has not relied on, and specifically

disavows any reliance on any communications, promises, statements, inducements, or representation(s), oral or written, by any other Party

or its agents except as expressly contained in this Agreement.

10.

Survival. All representations, warranties, and agreements made hereunder or pursuant hereto or in connection with the transactions

contemplated hereby shall survive the Effective Date and shall continue in full force and effect thereafter according to their terms

without limit as to duration.

11.

Amendment. This Agreement may not be amended or modified except by an instrument in writing signed by each of the Parties.

12.

Assignment; Binding Effect. No Party has or shall assign any of its respective rights, interests or obligations hereunder without

the prior written consent of the other Party, which consent may be granted or withheld in such other Party’s sole discretion. Subject

to the preceding sentence, this Agreement shall be binding upon and inure to the benefit of the Parties hereto and their respective successors

and permitted assigns. Nothing in this Agreement, express or implied, is intended to confer on any person other than the Parties hereto

or their respective successors and permitted assigns any rights, remedies, obligations or liabilities under or by reason of this Agreement.

13.

Counterparts. This Agreement may be executed and delivered (including by electronic or facsimile transmission) in one or more

counterparts, and by the Parties hereto in separate counterparts, each of which when executed and delivered shall be deemed to be an

original, but all of which taken together shall constitute one and the same agreement.

14.

Headings. The headings of the sections of this Agreement are inserted for convenience only and shall not be deemed to constitute

part of this Agreement or to affect the construction hereof.

15.

Construction. As used in this Agreement, the words “herein,” “hereof” and “hereunder” and

other words of similar import refer to this Agreement as a whole and not to any particular article, section, paragraph or other subdivision.

16.

Facsimile and Electronic Signatures. A facsimile copy of a signature or a signature transmitted electronically (e.g., by

..pdf) shall be deemed an original signature for purposes of enforcing this Agreement.

[End

of Agreement; Remainder of Page Intentionally Left Blank; Signature Pages Follow]

IN

WITNESS WHEREOF, the Parties hereto have caused this Agreement to be executed as of the date first set forth above.

| |

AYRO, Inc. |

| |

|

|

| |

By:

|

/s/

Joshua Silverman |

| |

Name:

|

Joshua

Silverman |

| |

Title:

|

Executive

Chairman |

| |

/s/

Natale Rea |

| |

Natale

Rea |

SIGNATURE

PAGE TO STOCK REPURCHASE AGREEMENT

v3.24.3

Cover

|

Oct. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 29, 2024

|

| Entity File Number |

001-34643

|

| Entity Registrant Name |

AYRO,

Inc.

|

| Entity Central Index Key |

0001086745

|

| Entity Tax Identification Number |

98-0204758

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

AYRO,

Inc.

|

| Entity Address, Address Line Two |

900

E. Old Settlers Boulevard

|

| Entity Address, Address Line Three |

Suite 100

|

| Entity Address, City or Town |

Round

Rock

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78664

|

| City Area Code |

512

|

| Local Phone Number |

994-4917

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.0001 per share

|

| Trading Symbol |

AYRO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

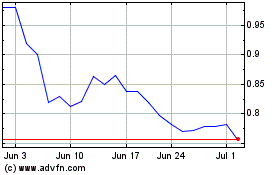

AYRO (NASDAQ:AYRO)

Historical Stock Chart

From Dec 2024 to Jan 2025

AYRO (NASDAQ:AYRO)

Historical Stock Chart

From Jan 2024 to Jan 2025