false

0001086745

0001086745

2024-08-21

2024-08-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 21, 2024

AYRO,

Inc.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

001-34643 |

|

98-0204758 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

AYRO,

Inc.

900

E. Old Settlers Boulevard, Suite 100

Round

Rock, Texas 78664

(Address

of principal executive offices and zip code)

Registrant’s

telephone number, including area code: 512-994-4917

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

AYRO |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers

Appointment

of Joseph Ramelli

On

August 21, 2024, Ayro, Inc. (the “Company”) appointed Joseph Ramelli to the position of Chief Financial Officer of the Company,

effective as August 21, 2024.

Mr.

Ramelli, age 56, has nearly 30 years of experience in the Biotechnology, Biopharmaceutical and Financial Services industries. He is a

seasoned investor and consultant who specializes in business strategic planning and development, capital raising, talent acquisition,

and corporate governance. Mr. Ramelli is currently an investor and strategic advisor with Ramelli Asset Management. Since 2023, Mr. Ramelli

has also served as the Vice President of Business Development at Origin Agritech Ltd. Previously, Mr. Ramelli served as Interim Chief

Financial Officer from 2020 to 2021 and was a founding member of ValenzaBio, a privately held biopharmaceutical company, where he established

and grew all the finance functions of the company. He also served as Chief Executive Officer of Marina Biotech from 2016 to 2018 where

he helped close a business development deal to keep the company afloat and negotiated and closed merger to navigate the company out of

bankruptcy and forge a successful path forward. Mr. Ramelli also has over 15 years of experience in varied roles at investment firms.

Mr. Ramelli graduated from the University of California, Santa Barbara with a B.A. in Business Economics.

There

is no arrangement or understanding between Mr. Ramelli and any other person pursuant to which he was appointed as Chief Financial Officer.

There is no family relationship between Mr. Ramelli and any director or executive officer of the Company. There are no transactions between

Mr. Ramelli and the Company that would be required to be reported under Item 404(a) of Regulation S-K of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”).

Appointment

of Gilbert Villarreal

On

August 21, 2024, Gilbert Villarreal was appointed to the position of President of the Company’s subsidiary, DropCar Operating Company,

Inc. (“Operating Subsidiary”), effective as August 21, 2024.

Mr.

Villarreal, 59, has over 32 years of wide manufacturing experience that spreads from Aerospace, Automotive, and Marine industries. As

an industrialist with a diverse portfolio, Mr. Villarreal has successfully restructured companies in both the automotive and marine yacht

building industries. Mr. Villarreal is the co-founder and chief executive officer of VLF Automotive LLC. Mr. Villarreal is also the founder

of GLV Ventures, a leader in the design and production of a variety of vehicles including electric vehicles. The Company is known for

its advanced manufacturing in a timely, cost-effective manner. Founded by Mr. Villarreal, GLV Ventures has operated in the space for

25 years. GLV and its affiliate, EVESSA, are Tier 1 consulting and manufacturing companies that have produced electric vehicles and non-electric

vehicles for several of the leading OEMs and Fortune 100 companies. Mr. Villarreal is a former United States Marine and holds a B.A.

in Business Administration. After serving active duty in the Marine Air Wing as an Aircraft Aviation Specialist on numerous Naval aircraft,

Mr. Villarreal continued his career in aerospace with the Boeing Aircraft Company on the 767 and 747 aircraft production lines in Everett,

Washington. After 10 years in Aerospace manufacturing, Mr. Villarreal transitioned into the automotive and marine industries with UTA

“United Technologies Automotive” with The Becker Group, and as the chief executive officer with Acord Incorporated, a leader

in automotive interior trim systems and chief executive officer of Concorde Marine, a luxury yacht manufacturer in Washington State.

There

is no arrangement or understanding between Mr. Villarreal and any other person pursuant to which he was appointed as President. There

is no family relationship between Mr. Villarreal and any director or executive officer of the Company or Operating Subsidiary. There

are no transactions between Mr. Villarreal and the Company or Operating Subsidiary that would be required to be reported under Item 404(a)

of Regulation S-K of the Exchange Act.

Item

8.01 Other Events.

On

August 21, 2024, the Company issued a press release announcing the appointment of Mr. Ramelli and Mr. Villarreal. A copy of the press

release is attached as Exhibit 99.1 hereto.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AYRO,

INC. |

| |

|

|

| Date:

August 27, 2024 |

By:

|

/s/

Joshua Silverman |

| |

|

Joshua

Silverman |

| |

|

Executive

Chairman |

Exhibit

99.1

AYRO

Appoints New Management Team to Re-Engineer and Revamp a Lower Cost Low-Speed Electric Vehicle

Appoints

new President of operating division and new CFO

ROUND

ROCK, TX (August 21, 2024) – AYRO, Inc. (NASDAQ: AYRO) (“AYRO” or the “Company”), a designer and manufacturer

of electric, purpose-built delivery vehicles and solutions for micro distribution, micro-mobility, and last-mile delivery, today announced

that it has appointed Joseph Ramelli as AYRO’s new Chief Financial Officer and Gilbert Villarreal as President of AYRO’s

operating subsidiary.

Joseph

Ramelli has vast experience in various management roles, including chief executive officer, chief financial officer and president. Mr.

Ramelli also has over 15 years of experience in varied roles at investment firms. AYRO believes that Mr. Ramelli’s management and

capital markets experience will be instrumental in managing AYRO’s strong cash position and employing prudent financial rigor as

AYRO continues to work towards bringing its innovative electrical vehicles to market, while also managing costs and maximizing profits.

Gilbert

Villarreal is the founder of GLV Ventures, a leader in the design and production of a variety of vehicles including electric vehicles.

GLV Ventures is known for its advanced manufacturing in a timely, cost-effective manner. Founded by Mr. Villarreal, GLV Ventures has

operated in the manufacturing and design space for 25 years. GLV and its affiliate, EVESSA, are Tier 1 consulting and manufacturing companies

that have produced electric vehicles and non-electric vehicles for several of the leading OEMs and Fortune 100 companies.

Josh

Silverman, AYRO’s Executive Chairman, commented, “These high value additions to our management team are exactly what we need

to move the Company forward. Gilbert, through his extensive experience in designing and developing electric vehicles in a cost-effective

manner, will enable AYRO to offer Vanish at a significantly reduced cost. We believe this minimal lower risk investment in re-engineering

our vehicles is an appropriate next step for AYRO. With a strong balance sheet, including $37 million in cash and cash equivalents as

of the quarter ended June 30, 2024, we are well positioned to move the Company forward and maximize stockholder value. Redesigning the

Vanish to be produced in a more cost-effective manner is the first step towards this goal. We also continue to evaluate other alternatives

to maximize stockholder value, including M&A and/or capital investment opportunities.”

About

AYRO

AYRO

designs and produces zero emission vehicles and systems that redefine the very nature of sustainability. Our goal is to craft solutions

in a way that leaves minimal impact on not only carbon emissions, but the space itself. From tire tread, fuel cells, sound, and even

discordant visuals, we apply engineering and artistry to every element of our product mix. The AYRO Vanish is the first in this new product

roadmap. For more information, visit www.ayro.com.

Forward-Looking

Statements

This

press release may contain forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties

and other factors which may cause actual results, performance or achievements to be materially different from any expected future results,

performance, or achievements. Words such as “anticipate,” “believe,” “could,” “estimate,”

“intend,” “expect,” “may,” “plan,” “will,” “would” and their

opposites and similar expressions are intended to identify forward-looking statements and include the development and launch of the AYRO

Vanish. Such forward-looking statements are based on the beliefs of management as well as assumptions made by and information currently

available to management. Important factors that could cause actual results to differ materially from those indicated by such forward-looking

statements include, without limitation: AYRO’s success depends on its ability to complete the development of and successfully introduce

new products; AYRO may experience delays in the development and introduction of new products; the ability of AYRO’s suppliers to

deliver parts and assemble vehicles; the ability of the purchaser to terminate or reduce purchase orders; AYRO has a history of losses

and has never been profitable, and AYRO expects to incur additional losses in the future and may never be profitable; AYRO faces risks

associated with litigation and claims; AYRO may be unable to replace lost manufacturing capacity on a timely and cost-effective basis,

which could adversely impact its operations and ability to meet delivery timelines; the market for AYRO’s products is developing

and may not develop as expected and AYRO, accordingly, may never meet its targeted production and sales goals; AYRO’s limited operating

history makes evaluating its business and future prospects difficult and may increase the risk of any investment in its securities; AYRO

may experience lower-than-anticipated market acceptance of its vehicles; developments in alternative technologies or improvements in

the internal combustion engine may have a materially adverse effect on the demand for AYRO’s electric vehicles; the markets in

which AYRO operates are highly competitive, and AYRO may not be successful in competing in these industries; AYRO may become subject

to product liability claims, which could harm AYRO’s financial condition and liquidity if AYRO is not able to successfully defend

or insure against such claims; increases in costs, disruption of supply or shortage of raw materials, in particular lithium-ion cells,

chipsets and displays, could harm AYRO’s business; AYRO may be required to raise additional capital to fund its operations, and

such capital raising may be costly or difficult to obtain and could dilute AYRO stockholders’ ownership interests, and AYRO’s

long term capital requirements are subject to numerous risks; AYRO may fail to comply with evolving environmental and safety laws and

regulations; and AYRO is subject to governmental export and import controls that could impair AYRO’s ability to compete in international

market due to licensing requirements and subject AYRO to liability if AYRO is not in compliance with applicable laws. A discussion of

these and other factors with respect to AYRO is set forth in our most recent Annual Report on Form 10-K and subsequent reports on Form

10-Q. Forward-looking statements speak only as of the date they are made and AYRO disclaims any intention or obligation to revise any

forward-looking statements, whether as a result of new information, future events or otherwise.

| For

investor inquiries: |

|

| |

|

| CORE

IR |

|

| investors@ayro.com

|

|

| 516-222-2560 |

|

v3.24.2.u1

Cover

|

Aug. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 21, 2024

|

| Entity File Number |

001-34643

|

| Entity Registrant Name |

AYRO,

Inc.

|

| Entity Central Index Key |

0001086745

|

| Entity Tax Identification Number |

98-0204758

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

AYRO,

Inc.

|

| Entity Address, Address Line Two |

900

E. Old Settlers Boulevard

|

| Entity Address, Address Line Three |

Suite 100

|

| Entity Address, City or Town |

Round

Rock

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78664

|

| City Area Code |

512

|

| Local Phone Number |

994-4917

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.0001 per share

|

| Trading Symbol |

AYRO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

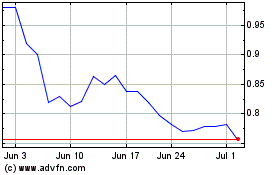

AYRO (NASDAQ:AYRO)

Historical Stock Chart

From Feb 2025 to Mar 2025

AYRO (NASDAQ:AYRO)

Historical Stock Chart

From Mar 2024 to Mar 2025