Avis Budget Group, Inc. (NASDAQ:CAR) today reported results for its

fourth quarter and year ended December 31, 2016. For the

quarter, the Company reported revenue of $1.9 billion and a net

loss of $31 million, or $0.35 per share. The Company reported

Adjusted EBITDA of $121 million and adjusted net income of $13

million, or $0.15 per diluted share, in the quarter.

For the year, the Company reported revenue of $8.7 billion, an

increase of 2% compared with 2015. Net income was $163

million, or $1.75 per diluted share. The Company reported

full-year Adjusted EBITDA of $838 million and adjusted net income

of $273 million, or $2.93 per diluted share. The Company

reported net cash provided by operating activities of $2.6 billion

and free cash flow of $472 million in 2016.

As discussed further below, the Company’s fourth quarter and

full-year Adjusted EBITDA exclude, among other adjustments, a

charge of $26 million ($16 million, net of tax) related to a recent

judgment against the Company in a personal-injury trial.

“While our fourth quarter results reflect softer-than-expected

volume and pricing, as well as currency movements having a $7

million adverse impact on Adjusted EBITDA compared to what we had

anticipated, we are enthusiastic about our prospects for 2017 and

beyond,” said Larry De Shon, Avis Budget Group Chief Executive

Officer. “Our strategic initiatives are already beginning to

deliver meaningful benefits, and we continue to expect that our

efforts will drive substantial long-term margin growth.”

Executive SummaryRevenue declined 1% in fourth

quarter 2016 primarily due to 1% decreases in rental days and

pricing in the Americas, as well as a 5% decrease in International

pricing. Our fourth quarter net loss was $31 million, and

Adjusted EBITDA was $121 million. Results were impacted by

lower pricing and higher per-unit fleet costs Company-wide,

partially offset by increased International volumes.

Full-year revenues totaled $8.7 billion, an increase of 2%

compared to the prior year. The increase was driven by a 3%

increase in rental days, partially offset by a 2% decline in

pricing (comprised of unchanged pricing in the Americas and a 5%

decrease in International). Full-year net income was $163

million, and Adjusted EBITDA was $838 million. Results were

impacted by higher per-unit fleet costs, lower International

pricing and a $28 million negative impact from currency movements,

partially offset by increased rental volumes.

Business Segment DiscussionThe following

discussion of fourth quarter operating results focuses on revenue

and Adjusted EBITDA for each of our segments. Revenue and Adjusted

EBITDA are expressed in millions.

Americas

|

|

2016 |

|

2015 |

% change |

|

Revenue |

$ |

1,343 |

|

|

$ |

1,362 |

|

(1 |

%) |

| Adjusted

EBITDA |

$ |

101 |

|

|

$ |

110 |

|

(8 |

%) |

Revenue declined 1% primarily due to a 1% decrease in rental

days and a 1% decrease in pricing. Per-unit fleet costs

increased 4%, to $308 per month. Adjusted EBITDA decreased to

$101 million primarily due to lower revenue and higher per-unit

fleet costs.

International

|

|

2016 |

|

2015 |

% change |

|

Revenue |

$ |

536 |

|

|

$ |

540 |

|

(1 |

%) |

| Adjusted

EBITDA |

$ |

36 |

|

|

$ |

32 |

|

13 |

% |

Revenue declined 1% due to 5% lower pricing, including a 2%

reduction due to currency movements, partially offset by a 3%

increase in volume. Per-unit fleet costs increased 4%, to

$236 per month. Adjusted EBITDA increased 13%, to $36

million, due to higher volumes and expense savings.

Other ItemsShare Repurchases

- The Company repurchased 2.8 million shares of

its common stock, or 3% of its shares outstanding, at a cost of

$100 million in the fourth quarter. For the full year, the

Company repurchased 12.3 million shares of its common stock, or 13%

of its shares outstanding, at a cost of $390 million.

Tuck-in Acquisition - In

December, the Company completed its previously announced

acquisition of France Cars, a privately-held vehicle rental company

based in France, to significantly expand its presence in the French

market.

Adverse Legal Judgment - The

Company recorded a $26 million charge in the fourth quarter related

to a recent judgment against it in a personal-injury trial and a

pending companion case. The judgment relates to a motor

vehicle accident allegedly caused by the employee of an independent

contractor of the Company who was acting outside the scope of

employment and in violation of the law. The Company does not

believe this judgment is supported by the law or the facts of the

case and intends to appeal. The Company has not reached

agreement with its insurance carriers regarding coverage related to

these cases. The Company determined to exclude the fourth

quarter charge related to this matter from its calculation of

Adjusted EBITDA in light of the unprecedented nature of the

judgment.

OutlookOur full-year 2017 outlook includes

non-GAAP financial measures. The Company believes that it is

impracticable to provide a reconciliation to the most comparable

GAAP measures due to the forward-looking nature of these forecasted

adjusted earnings metrics and the degree of uncertainty associated

with forecasting the reconciling items and amounts. The

Company further believes that providing estimates of the amounts

that would be required to reconcile the forecasted adjusted

measures to forecasted GAAP measures would imply a degree of

precision that would be confusing or misleading to investors.

The after-tax effect of reconciling items could be significant to

the Company’s future quarterly or annual results.

The Company today issued its estimates of its full-year 2017

results. The Company expects:

- Full-year 2017 revenue will increase 2% to 3%, to $8.8 to $8.95

billion. Movements in currency exchange rates are currently

expected to negatively impact revenue growth by approximately $130

million. In the Company’s Americas segment, rental days are

expected to increase 1% to 2%, and pricing is expected to increase

between 0% and 1%, with no significant impact from currency

exchange rates. In the Company’s International segment,

revenue is expected to grow 2% to 5%, including a 5% negative

impact from currency exchange rates.

- Total Company per-unit fleet costs are expected to be $280 to

$290 per month in 2017, compared to $285 in 2016. In the

Company’s Americas segment, per-unit fleet costs are expected to be

$311 to $321, a change of 0% to +3% compared to $311 in 2016.

In the Company’s International segment, per-unit fleet costs are

expected to be $210 to $220 per month, compared to $227 per month

in 2016, including a 5% decrease from currency exchange

rates.

- Adjusted EBITDA is expected to be $840 million to $920 million,

an increase of 0% to 10% compared to 2016, including an

approximately $10 million positive year-over-year impact from

movements in currency exchange rates.

- Interest expense related to corporate debt will be

approximately $205 million.

- Non-vehicle depreciation and amortization expense (excluding

the amortization of intangible assets) will be approximately $205

million.

- Adjusted pretax income will be $430 million to $510

million.

- The Company’s effective tax rate applicable to adjusted pretax

income will be 38% to 39%.

- The Company’s diluted share count will be 84 million to 86

million, compared to 93.3 million in 2016, including the effect of

repurchasing stock in 2017.

Based on these expectations, the Company estimates that its 2017

adjusted diluted earnings per share will be $3.05 to $3.75, an

increase of 16% at the midpoint. Such estimate includes a

positive impact from currency exchange rates of approximately 10

cents per share. The Company also expects that it will

generate $450 to $500 million of free cash flow in 2017, and that

it will repurchase $300 million or more of common stock this

year.

Investor Conference CallAvis Budget Group will

host a conference call to discuss fourth quarter results and its

outlook on February 16, 2017, at 8:30 a.m. (ET). Investors

may access the call and supporting presentation materials at

ir.avisbudgetgroup.com or by dialing (630) 395-0021 and providing

the participant passcode 2995545. Investors are encouraged to

dial in approximately 10 minutes prior to the call. A web

replay will be available at ir.avisbudgetgroup.com following the

call. A telephone replay will be available from 11:00 a.m.

(ET) on February 16 until 8:00 p.m. (ET) on March 2 at (203)

369-1520.

About Avis Budget GroupAvis Budget Group, Inc.

is a leading global provider of vehicle rental services, both

through its Avis and Budget brands, which have more than 11,000

rental locations in approximately 180 countries around the world,

and through its Zipcar brand, which is the world’s leading car

sharing network, with more than one million members. Avis

Budget Group operates most of its car rental offices in North

America, Europe and Australia directly, and operates primarily

through licensees in other parts of the world. Avis Budget

Group has approximately 30,000 employees and is headquartered in

Parsippany, N.J. More information is available at

www.avisbudgetgroup.com.

Forward-Looking StatementsCertain statements in

this press release constitute “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Statements preceded by, followed by or that otherwise

include the words “believes,” “expects,” “anticipates,” “intends,”

“projects,” “estimates,” “plans,” “may increase,” “forecast” and

similar expressions or future or conditional verbs such as “will,”

“should,” “would,” “may” and “could” are based upon then current

assumptions and expectations and are generally forward-looking in

nature and not historical facts. Any statements that refer to

outlook, expectations or other characterizations of future events,

circumstances or results, including all statements related to our

outlook, future results, future fleet costs, acquisition synergies,

cost-saving initiatives and future share repurchases are also

forward-looking statements.

Various risks that could cause future results to differ from

those expressed by the forward-looking statements included in this

press release include, but are not limited to, the Company’s

ability to promptly and effectively integrate acquired businesses,

any change in economic conditions generally, particularly during

our peak season or in key market segments, the high level of

competition in the vehicle rental industry, a change in our fleet

costs as a result of a change in the cost of new vehicles,

manufacturer recalls and/or the value of used vehicles, disruption

in the supply of new vehicles, disposition of vehicles not covered

by manufacturer repurchase programs, the financial condition of the

manufacturers that supply our rental vehicles, which could impact

their ability to perform their obligations under our repurchase

and/or guaranteed depreciation arrangements, any change in travel

demand, including changes in airline passenger traffic, any

occurrence or threat of terrorism, a significant increase in

interest rates or borrowing costs, our ability to obtain financing

for our global operations, including the funding of our vehicle

fleet via the asset-backed securities market, any changes to the

cost or supply of fuel, any fluctuations related to the

mark-to-market of derivatives which hedge our exposure to exchange

rates, interest rates and fuel costs, our ability to meet the

financial and other covenants contained in the agreements governing

our indebtedness, risks associated with litigation, governmental or

regulatory inquiries or investigations involving the Company,

changes in tax or other regulations, changes to our share

repurchase plans, risks related to acquisitions, and our ability to

accurately estimate our future results and implement our strategy

for cost savings and growth. Other unknown or unpredictable

factors could also have material adverse effects on the Company’s

performance or achievements. In light of these risks,

uncertainties, assumptions and factors, the forward-looking events

discussed in this press release may not occur. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date stated, or if no date

is stated, as of the date of this press release. Important

assumptions and other important factors that could cause actual

results to differ materially from those in the forward-looking

statements are specified in Avis Budget Group’s Annual Report on

Form 10-K for the year ended December 31, 2015, and its Quarterly

Report on Form 10-Q for the period ended September 30, 2016,

included under headings such as “Forward-Looking Statements,” “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” and in other filings and

furnishings made by the Company with the SEC from time to time.

Except for the Company’s ongoing obligations to disclose material

information under the federal securities laws, the Company

undertakes no obligation to release publicly any revisions to any

forward-looking statements, to report events or to report the

occurrence of unanticipated events unless required by law.

This release includes financial measures such as Adjusted EBITDA

and free cash flow, as well as metrics that exclude certain items

that are not considered generally accepted accounting principles

(“GAAP”) measures as defined under SEC rules. Important

information regarding such measures is contained on Table 1, Table

4 and Table 5 of this release. The Company believes that these

non-GAAP measures are useful in measuring the comparable results of

the Company period-over-period. The GAAP measures most directly

comparable to Adjusted EBITDA, free cash flow, adjusted pretax

income, adjusted net income and adjusted diluted earnings per share

are net income (loss), net cash provided by operating activities,

income (loss) before income taxes, net income (loss) and diluted

(loss) earnings per share, respectively. The Company

quantifies foreign currency translation impacts on the Company’s

results by translating the current period’s

non-U.S.-dollar-denominated results using the currency exchange

rates of the prior period of comparison plus any related gains and

losses on currency hedges.

| Table 1 |

| Avis Budget Group, Inc. |

| SUMMARY DATA SHEET |

| (In millions, except per share

data) |

| |

| |

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

2016 |

|

2015 |

|

% Change |

|

2016 |

|

2015 |

|

% Change |

|

Income Statement and Other Items |

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

$ |

1,879 |

|

|

$ |

1,902 |

|

|

(1 |

%) |

|

$ |

8,659 |

|

|

$ |

8,502 |

|

|

2 |

% |

| Income (loss) before income taxes |

(43 |

) |

|

4 |

|

|

* |

|

|

279 |

|

|

382 |

|

|

(27 |

%) |

| Net income (loss) |

(31 |

) |

|

(5 |

) |

|

* |

|

|

163 |

|

|

313 |

|

|

(48 |

%) |

| Earnings (loss) per share - Diluted |

(0.35 |

) |

|

(0.06 |

) |

|

* |

|

|

1.75 |

|

|

2.98 |

|

|

(41 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Earnings Metrics (non-GAAP)

(A) |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

121 |

|

|

128 |

|

|

(5 |

%) |

|

838 |

|

|

903 |

|

|

(7 |

%) |

| Adjusted pretax income |

25 |

|

|

37 |

|

|

(32 |

%) |

|

441 |

|

|

546 |

|

|

(19 |

%) |

| Adjusted net income |

13 |

|

|

18 |

|

|

(28 |

%) |

|

273 |

|

|

333 |

|

|

(18 |

%) |

| Adjusted earnings per share - Diluted |

0.15 |

|

|

0.18 |

|

|

(17 |

%) |

|

2.93 |

|

|

3.17 |

|

|

(8 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of |

|

|

|

|

|

|

|

|

| |

|

December 31, 2016 |

|

December 31, 2015 |

|

|

|

|

|

|

|

|

|

Balance Sheet Items |

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

490 |

|

|

$ |

452 |

|

|

|

|

|

|

|

|

|

| Vehicles, net |

10,464 |

|

|

10,658 |

|

|

|

|

|

|

|

|

|

| Debt under vehicle programs |

8,878 |

|

|

8,860 |

|

|

|

|

|

|

|

|

|

| Corporate debt |

3,523 |

|

|

3,461 |

|

|

|

|

|

|

|

|

|

| Stockholders’ equity |

221 |

|

|

439 |

|

|

|

|

|

|

|

|

|

|

Segment Results |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

2016 |

|

2015 |

|

% Change |

|

2016 |

|

2015 |

|

% Change |

| Net

Revenues |

|

|

|

|

|

|

|

|

|

|

|

| Americas |

$ |

1,343 |

|

|

$ |

1,362 |

|

|

(1 |

%) |

|

$ |

6,121 |

|

|

$ |

6,069 |

|

|

1 |

% |

| International |

536 |

|

|

540 |

|

|

(1 |

%) |

|

2,538 |

|

|

2,433 |

|

|

4 |

% |

| Corporate and Other |

— |

|

|

— |

|

|

* |

|

|

— |

|

|

— |

|

|

* |

|

| Total Company |

$ |

1,879 |

|

|

$ |

1,902 |

|

|

(1 |

%) |

|

$ |

8,659 |

|

|

$ |

8,502 |

|

|

2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (A) |

|

|

|

|

|

|

|

|

|

|

|

| Americas |

$ |

101 |

|

|

$ |

110 |

|

|

(8 |

%) |

|

$ |

633 |

|

|

$ |

682 |

|

|

(7 |

%) |

| International |

36 |

|

|

32 |

|

|

13 |

% |

|

273 |

|

|

277 |

|

|

(1 |

%) |

| Corporate and Other |

(16 |

) |

|

(14 |

) |

|

* |

|

|

(68 |

) |

|

(56 |

) |

|

* |

|

| Total Company |

$ |

121 |

|

|

$ |

128 |

|

|

(5 |

%) |

|

$ |

838 |

|

|

$ |

903 |

|

|

(7 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______ |

|

* |

Not meaningful. |

| (A)

|

See Table 5 for

definitions and reconciliations of non-GAAP measures. Adjusted

EBITDA includes stock-based compensation expense and deferred

financing fee amortization of $12 million and $14 |

| |

million in fourth

quarter 2016 and 2015, respectively, and $53 million and $56

million in the year ended December 31, 2016 and 2015,

respectively. |

| |

| Table 2 |

| Avis Budget Group, Inc. |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (In millions, except per share

data) |

| |

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

2016 |

|

2015 |

|

2016 |

|

2015 |

|

Revenues |

|

|

|

|

|

|

|

| |

Vehicle rental |

$ |

1,309 |

|

|

$ |

1,342 |

|

|

$ |

6,081 |

|

|

$ |

6,026 |

|

| |

Other |

570 |

|

|

560 |

|

|

2,578 |

|

|

2,476 |

|

| Net

revenues |

1,879 |

|

|

1,902 |

|

|

8,659 |

|

|

8,502 |

|

| |

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

| |

Operating |

1,001 |

|

|

1,005 |

|

|

4,382 |

|

|

4,284 |

|

| |

Vehicle depreciation

and lease charges, net |

476 |

|

|

448 |

|

|

2,047 |

|

|

1,933 |

|

| |

Selling, general and

administrative |

238 |

|

|

250 |

|

|

1,134 |

|

|

1,093 |

|

| |

Vehicle interest,

net |

69 |

|

|

71 |

|

|

284 |

|

|

289 |

|

| |

Non-vehicle related

depreciation and amortization |

64 |

|

|

57 |

|

|

253 |

|

|

218 |

|

| |

Interest expense

related to corporate debt, net: |

|

|

|

|

|

|

|

| |

Interest expense |

46 |

|

|

48 |

|

|

203 |

|

|

194 |

|

| |

Early extinguishment of debt |

17 |

|

|

— |

|

|

27 |

|

|

23 |

|

| |

Restructuring

expense |

3 |

|

|

8 |

|

|

29 |

|

|

18 |

|

| |

Transaction-related

costs, net |

8 |

|

|

11 |

|

|

21 |

|

|

68 |

|

| Total

expenses |

1,922 |

|

|

1,898 |

|

|

8,380 |

|

|

8,120 |

|

| |

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

(43 |

) |

|

4 |

|

|

279 |

|

|

382 |

|

| Provision

for (benefit from) income taxes |

(12 |

) |

|

9 |

|

|

116 |

|

|

69 |

|

| Net

income (loss) |

$ |

(31 |

) |

|

$ |

(5 |

) |

|

$ |

163 |

|

|

$ |

313 |

|

| |

|

|

|

|

|

|

|

|

|

Earnings (loss) per share |

|

|

|

|

|

|

|

| |

Basic |

$ |

(0.35 |

) |

|

$ |

(0.06 |

) |

|

$ |

1.78 |

|

|

$ |

3.02 |

|

| |

Diluted |

$ |

(0.35 |

) |

|

$ |

(0.06 |

) |

|

$ |

1.75 |

|

|

$ |

2.98 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

| |

Basic |

87.4 |

|

|

99.5 |

|

|

92.0 |

|

|

103.4 |

|

| |

Diluted |

87.4 |

|

|

99.5 |

|

|

93.3 |

|

|

105.0 |

|

| |

| Table 3 |

| Avis Budget Group, Inc. |

| SEGMENT REVENUE DRIVER ANALYSIS |

| |

| |

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

|

|

|

2016 |

|

2015 |

|

% Change |

|

2016 |

|

2015 |

|

% Change |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Americas |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Rental Days

(000’s) |

|

22,786 |

|

|

23,045 |

|

|

(1 |

%) |

|

100,793 |

|

|

99,548 |

|

|

1 |

% |

| |

|

Time and Mileage

Revenue per Day (A) |

|

$ |

38.32 |

|

|

$ |

38.60 |

|

|

(1 |

%) |

|

$ |

40.38 |

|

|

$ |

40.55 |

|

|

0 |

% |

| |

|

Average Rental

Fleet |

|

354,697 |

|

|

353,148 |

|

|

0 |

% |

|

384,914 |

|

|

383,301 |

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| International |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Rental Days

(000’s) |

|

10,288 |

|

|

9,943 |

|

|

3 |

% |

|

46,280 |

|

|

42,816 |

|

|

8 |

% |

| |

|

Time and Mileage

Revenue per Day (B) |

|

$ |

30.08 |

|

|

$ |

31.68 |

|

|

(5 |

%) |

|

$ |

32.01 |

|

|

$ |

33.57 |

|

|

(5 |

%) |

| |

|

Average Rental

Fleet |

|

163,034 |

|

|

156,342 |

|

|

4 |

% |

|

176,770 |

|

|

163,651 |

|

|

8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Rental Days

(000’s) |

|

33,074 |

|

|

32,988 |

|

|

0 |

% |

|

147,073 |

|

|

142,364 |

|

|

3 |

% |

| |

|

Time and Mileage

Revenue per Day |

|

$ |

35.76 |

|

|

$ |

36.52 |

|

|

(2 |

%) |

|

$ |

37.74 |

|

|

$ |

38.45 |

|

|

(2 |

%) |

| |

|

Average Rental

Fleet |

|

517,731 |

|

|

509,490 |

|

|

2 |

% |

|

561,684 |

|

|

546,952 |

|

|

3 |

% |

|

_______ |

|

|

|

|

|

|

| Rental

days and time and mileage revenue per day are calculated based on

the actual rental of the vehicle during a 24-hour |

| period.

Our calculation of rental days and time and mileage revenue per day

may not be comparable to the calculation of |

|

similarly-titled statistics by other companies. Amounts exclude

U.S. truck rental and Zipcar transactions. |

|

(A) |

Changes in

currency exchange rates had no impact in the three months and year

ended December 31, 2016. |

|

(B) |

Changes in

currency exchange rates had a 2% negative impact in the three

months and year ended December 31, 2016. |

| |

| Table 4 |

| Avis Budget Group, Inc. |

| CONSOLIDATED CONDENSED SCHEDULES OF CASH FLOWS

AND FREE CASH FLOWS |

| (In millions) |

| |

| CONSOLIDATED CONDENSED SCHEDULE OF CASH

FLOWS |

| |

| |

|

|

Year Ended December 31, 2016 |

|

Operating Activities |

|

| Net cash provided by operating activities |

$ |

2,629 |

|

| |

|

|

|

|

Investing Activities |

|

| Net cash used in investing activities exclusive of vehicle

programs |

(223 |

) |

| Net cash used in investing activities of vehicle programs |

(1,926 |

) |

| Net cash used in investing activities |

(2,149 |

) |

| |

|

|

|

|

Financing Activities |

|

| Net cash used in financing activities exclusive of vehicle

programs |

(356 |

) |

| Net cash used in financing activities of vehicle programs |

(82 |

) |

| Net cash used in financing activities |

(438 |

) |

| |

|

|

|

| Effect of

changes in exchange rates on cash and cash equivalents |

(4 |

) |

| Net change

in cash and cash equivalents |

38 |

|

|

Cash and cash equivalents, beginning of

period |

452 |

|

|

Cash and cash equivalents, end of period |

$ |

490 |

|

| CONSOLIDATED SCHEDULE OF FREE CASH FLOWS

(A) |

| |

| |

|

|

Year Ended December 31, 2016 |

| Income

before income taxes |

$ |

279 |

|

| Add-back of

non-vehicle related depreciation and amortization |

253 |

|

| Add-back of

debt extinguishment costs |

27 |

|

| Add-back of

transaction-related costs |

21 |

|

| Working

capital and other |

49 |

|

| Capital

expenditures |

(192 |

) |

| Tax

payments, net of refunds |

(60 |

) |

| Vehicle

programs and related (B) |

95 |

|

|

Free Cash Flow |

472 |

|

| |

|

|

|

| Acquisition

and related payments, net of acquired cash |

(55 |

) |

| Borrowings,

net of debt repayments |

51 |

|

|

Transaction-related payments |

(22 |

) |

| Repurchases

of common stock |

(387 |

) |

| Foreign

exchange effects, financing costs and other |

(21 |

) |

| Net

change in cash and cash equivalents (per above) |

$ |

38 |

|

| |

_______ |

| (A)

|

See Table 5 for a

description of Free Cash Flow. |

|

(B) |

Includes vehicle-backed

borrowings (repayments) that are incremental to amounts required to

fund incremental (reduced) vehicle and vehicle-related assets. |

| RECONCILIATION OF FREE CASH FLOW TO NET CASH

PROVIDED BY OPERATING ACTIVITIES |

| |

| |

|

|

Year Ended December 31, 2016 |

|

Free Cash Flow (per above) |

$ |

472 |

|

| Investing activities of vehicle programs |

1,926 |

|

| Financing activities of vehicle programs |

82 |

|

| Capital expenditures |

192 |

|

| Proceeds received on asset sales |

(19 |

) |

| Change in restricted cash |

(2 |

) |

| Transaction-related payments |

(22 |

) |

| Net

cash provided by operating activities (per above) |

$ |

2,629 |

|

Table 5

Avis Budget Group,

Inc.DEFINITIONS AND RECONCILIATIONS OF NON-GAAP

MEASURES(In millions, except per share

data)

The accompanying press release includes certain non-GAAP

(generally accepted accounting principles) financial measures as

defined under SEC rules. To the extent not provided in the press

release or accompanying tables, we have provided below the reasons

we present these non-GAAP financial measures, a description of what

they represent and a reconciliation to the most comparable

financial measure calculated and presented in accordance with

GAAP.

DEFINITIONS

Adjusted EBITDA

The accompanying press release presents Adjusted EBITDA, which

represents income from continuing operations before non-vehicle

related depreciation and amortization, any impairment charge,

restructuring expense, early extinguishment of debt costs,

non-vehicle related interest, transaction-related costs, charges

for an unprecedented personal-injury legal matter and income taxes.

The charges for the legal matter are recorded within operating

expenses in our statement of operations. We have revised our

definition of Adjusted EBITDA to exclude charges for an

unprecedented personal-injury legal matter which we do not view as

indicative of underlying business results due to the nature of this

legal matter. We did not revise prior years' Adjusted EBITDA

amounts because there were no charges similar in nature to this

legal matter. We believe that Adjusted EBITDA is useful as a

supplemental measure in evaluating the aggregate performance of our

operating businesses and in comparing our results from period to

period. Adjusted EBITDA is the measure that is used by our

management, including our chief operating decision maker, to

perform such evaluation. Adjusted EBITDA is also a component in the

determination of management's compensation. Adjusted EBITDA should

not be considered in isolation or as a substitute for net income or

other income statement data prepared in accordance with GAAP and

our presentation of Adjusted EBITDA may not be comparable to

similarly-titled measures used by other companies.

Adjusted Earnings MetricsThe accompanying press

release and tables present adjusted pretax income, adjusted net

income and adjusted diluted earnings per share for the three months

and year ended December 31, 2016 and 2015, which exclude

certain items. We believe that these measures referred to above are

useful as supplemental measures in evaluating the aggregate

performance of the Company. We exclude restructuring expense,

transaction-related costs, costs related to early extinguishment of

debt and other certain items as such items are not representative

of the results of operations of our business less a provision for

income taxes derived utilizing applicable statutory tax rates for

each item.

Reconciliations of Adjusted EBITDA and our adjusted earnings

metrics to income (loss) before income taxes, net income (loss) and

diluted earnings (loss) per share are as follows:

| |

|

|

Three Months Ended December 31, |

|

Reconciliation of Adjusted EBITDA to net

loss: |

2016 |

|

2015 |

| |

|

|

|

|

| |

Adjusted EBITDA |

$ |

121 |

|

|

$ |

128 |

|

| |

|

|

|

|

|

| |

Less: |

Non-vehicle related

depreciation and amortization (excluding acquisition-related

amortization expense) |

50 |

|

|

43 |

|

| |

|

Interest expense

related to corporate debt, net (excluding early extinguishment of

debt) |

46 |

|

|

48 |

|

| |

Adjusted

pretax income |

25 |

|

|

37 |

|

| |

|

|

|

|

|

| |

Less

certain items: |

|

|

|

| |

|

Acquisition-related

amortization expense |

14 |

|

|

14 |

|

| |

|

Restructuring

expense |

3 |

|

|

8 |

|

| |

|

Early extinguishment of

debt |

17 |

|

|

— |

|

| |

|

Transaction-related

costs, net |

8 |

|

|

11 |

|

| |

|

Charges for legal

matter |

26 |

|

|

— |

|

| |

Income

(loss) before income taxes |

(43 |

) |

|

4 |

|

| |

Provision

for (benefit from) income taxes |

(12 |

) |

|

9 |

|

| |

Net

loss |

$ |

(31 |

) |

|

$ |

(5 |

) |

| |

|

|

|

|

|

|

Reconciliation of adjusted net income to net

loss: |

|

| |

|

|

|

|

|

| |

Adjusted net income |

$ |

13 |

|

|

$ |

18 |

|

| |

Less

certain items, net of tax: |

|

|

|

| |

|

Acquisition-related

amortization expense |

10 |

|

|

9 |

|

| |

|

Restructuring

expense |

2 |

|

|

5 |

|

| |

|

Early extinguishment of

debt |

10 |

|

|

— |

|

| |

|

Transaction-related

costs, net |

6 |

|

|

9 |

|

| |

|

Charges for legal

matter |

16 |

|

|

— |

|

| |

Net

loss |

$ |

(31 |

) |

|

$ |

(5 |

) |

| |

|

|

|

|

|

| |

Adjusted diluted earnings per share |

$ |

0.15 |

|

|

$ |

0.18 |

|

| |

|

|

|

|

|

| |

Loss per share - Diluted |

$ |

(0.35 |

) |

|

$ |

(0.06 |

) |

| |

|

|

|

|

|

| |

Shares used to calculate adjusted diluted earnings per

share |

88.9 |

|

|

101.1 |

|

| |

|

|

Year Ended December 31, |

|

Reconciliation of Adjusted EBITDA to net

income: |

2016 |

|

2015 |

| |

|

|

|

|

|

| |

Adjusted EBITDA |

$ |

838 |

|

|

$ |

903 |

|

| |

|

|

|

|

|

| |

Less: |

Non-vehicle related

depreciation and amortization (excluding acquisition-related

amortization expense) |

194 |

|

|

163 |

|

| |

|

Interest expense

related to corporate debt, net (excluding early extinguishment of

debt) |

203 |

|

|

194 |

|

| |

Adjusted

pretax income |

441 |

|

|

546 |

|

| |

|

|

|

|

|

| |

Less

certain items: |

|

|

|

| |

|

Acquisition-related

amortization expense |

59 |

|

|

55 |

|

| |

|

Restructuring

expense |

29 |

|

|

18 |

|

| |

|

Early extinguishment of

debt |

27 |

|

|

23 |

|

| |

|

Transaction-related

costs, net |

21 |

|

|

68 |

|

| |

|

Charges for legal

matter |

26 |

|

|

— |

|

| |

Income

before income taxes |

279 |

|

|

382 |

|

| |

Provision

for income taxes |

116 |

|

|

69 |

|

| |

Net

income |

$ |

163 |

|

|

$ |

313 |

|

| |

|

|

|

|

|

|

Reconciliation of adjusted net income to net

income: |

|

|

| |

|

|

|

|

|

| |

Adjusted net income |

$ |

273 |

|

|

$ |

333 |

|

| |

Less

certain items, net of tax: |

|

|

|

| |

|

Acquisition-related

amortization expense |

40 |

|

|

36 |

|

| |

|

Restructuring

expense |

22 |

|

|

13 |

|

| |

|

Early extinguishment of

debt |

16 |

|

|

14 |

|

| |

|

Transaction-related

costs, net |

16 |

|

|

55 |

|

| |

|

Charges for legal

matter |

16 |

|

|

— |

|

| |

|

Resolution of a

prior-year income tax matter |

— |

|

|

(98 |

) |

| |

Net

income |

$ |

163 |

|

|

$ |

313 |

|

| |

|

|

|

|

|

| |

Adjusted diluted earnings per share |

$ |

2.93 |

|

|

$ |

3.17 |

|

| |

|

|

|

|

|

| |

Earnings per share - Diluted |

$ |

1.75 |

|

|

$ |

2.98 |

|

| |

|

|

|

|

|

| |

Shares used to calculate adjusted diluted earnings per

share |

93.3 |

|

|

105.0 |

|

Free Cash FlowRepresents Net Cash Provided by

Operating Activities adjusted to reflect the cash inflows and

outflows relating to capital expenditures and GPS navigational

units, the investing and financing activities of our vehicle

programs, asset sales, if any, and to exclude debt extinguishment

costs and transaction-related costs. We believe that Free Cash Flow

is useful to management and investors in measuring the cash

generated that is available to be used to repurchase stock, repay

debt obligations, pay dividends and invest in future growth through

new business development activities or acquisitions. Free Cash Flow

should not be construed as a substitute in measuring operating

results or liquidity, and our presentation of Free Cash Flow may

not be comparable to similarly-titled measures used by other

companies. A reconciliation of Free Cash Flow to the appropriate

measure recognized under GAAP is provided on Table 4.

Contacts

Media Contact:

Alice Pereira

(973) 496-3916

PR@avisbudget.com

Investor Contact:

Neal Goldner

(973) 496-5086

IR@avisbudget.com

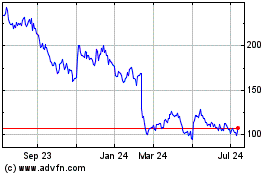

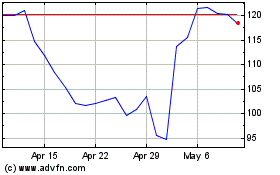

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Avis Budget (NASDAQ:CAR)

Historical Stock Chart

From Jul 2023 to Jul 2024