Avenue Therapeutics Announces Exercise of Warrants for $4.4 Million in Gross Proceeds

April 29 2024 - 8:00AM

Avenue Therapeutics, Inc. (Nasdaq: ATXI) (“Avenue” or the

“Company”), a specialty pharmaceutical company focused on the

development and commercialization of therapies for the treatment of

neurologic diseases, today announced the entry into definitive

agreements for the immediate exercise of certain outstanding

warrants to purchase an aggregate of 689,680 shares of the

Company’s common stock. The exercised warrants are comprised of

warrants to purchase shares of common stock originally issued by

Avenue on October 11, 2022, each having an exercise price of

$116.25 per share, Series A and Series B warrants to purchase

shares of common stock originally issued by Avenue on November 2,

2023, each having an exercise price of $22.545 per share, and

warrants to purchase shares of common stock originally issued by

Avenue on January 9, 2024, each having an exercise price of $22.545

per share. The warrant holders agreed to exercise these warrants

for cash at a reduced exercise price of $6.20 per share. The shares

of common stock issuable upon exercise of the warrants are

registered pursuant to effective registration statements on Form

S-1 (File Nos. 333-267206 and 333-274562) and Form S-3 (No.

333-276671). The gross proceeds to Avenue from the exercise of the

warrants are expected to be approximately $4.4 million, prior to

deducting placement agent fees and offering expenses. The closing

of the warrant exercise transaction is expected to occur on or

about May 1, 2024, subject to satisfaction of customary closing

conditions.

H.C. Wainwright & Co. is acting as the

exclusive placement agent for the offering.

In consideration for the immediate exercise of

the warrants for cash, the Company will issue new unregistered

Series C warrants to purchase up to 689,680 shares of common stock

and new unregistered Series D warrants to purchase up to 689,680

shares of common stock for a payment of $0.125 per new warrant. The

new Series C and Series D warrants will have an exercise price of

$6.20 per share. The new Series C warrants will be exercisable

immediately upon issuance for a period of five years from the date

of issuance and the Series D warrants will be exercisable

immediately upon issuance for a period of eighteen months from the

date of issuance.

The new warrants described above were offered in

a private placement pursuant to an applicable exemption from the

registration requirements of the Securities Act of 1933, as amended

(the “1933 Act”) and, along with the shares of common stock

issuable upon their exercise, have not been registered under the

1933 Act, and may not be offered or sold in the United States

absent registration with the SEC or an applicable exemption from

such registration requirements. Avenue has agreed to file a

registration statement with the Securities and Exchange Commission

(“SEC”) covering the resale of the shares of common stock issuable

upon exercise of the new warrants.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.

About Avenue Therapeutics

Avenue Therapeutics, Inc. (Nasdaq: ATXI) is a

specialty pharmaceutical company focused on the development and

commercialization of therapies for the treatment of neurologic

diseases. It is currently developing three assets including AJ201,

a first-in-class asset for spinal and bulbar muscular atrophy,

BAER-101, an oral small molecule selective GABAA α2, α3 receptor

positive allosteric modulator for CNS diseases, and IV tramadol,

which is in Phase 3 clinical development for the management of

acute postoperative pain in adults in a medically supervised

healthcare setting. Avenue is headquartered in Miami, FL and was

founded by Fortress Biotech, Inc. (Nasdaq: FBIO). For more

information, visit www.avenuetx.com.

Forward-Looking Statements

This press release contains predictive or

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements other than

statements of current or historical fact contained in this press

release, including statements that express our intentions, plans,

objectives, beliefs, expectations, strategies, predictions or any

other statements relating to our future activities or other future

events or conditions are forward-looking statements. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “predict,” “project,” “will,” “should,”

“would” and similar expressions are intended to identify

forward-looking statements. These statements are based on current

expectations, estimates and projections made by management about

our business, our industry and other conditions affecting our

financial condition, results of operations or business prospects.

These statements are not guarantees of future performance and

involve risks, uncertainties and assumptions that are difficult to

predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in, or implied by,

the forward-looking statements due to numerous risks and

uncertainties. Factors that could cause such outcomes and results

to differ include, but are not limited to, risks and uncertainties

arising from: the ability to satisfy the closing conditions related

to the warrant inducement transaction and the overall timing and

completion of such closing and the use of the net proceeds of the

warrant inducement transaction; the fact that we currently have no

drug products for sale and that our success is dependent on our

product candidates receiving regulatory approval and being

successfully commercialized; the possibility that serious adverse

or unacceptable side effects are identified during the development

of our current or future product candidates, such that we would

need to abandon or limit development of some of our product

candidates; our ability to successfully develop, partner, or

commercialize any of our current or future product candidates

including AJ201, IV tramadol, and BAER-101; the substantial doubt

raised about our ability to continue as a going concern, which may

hinder our ability to obtain future financing; the significant

losses we have incurred since inception and our expectation that we

will continue to incur losses for the foreseeable future; our need

for substantial additional funding, which may not be available to

us on acceptable terms, or at all, which unavailability of could

force us to delay, reduce or eliminate our product development

programs or commercialization efforts; our reliance on third

parties for several aspects of our operations; our reliance on

clinical data and results obtained by third parties that could

ultimately prove to be inaccurate, or unreliable, or unacceptable

to regulatory authorities; the possibility that we may not receive

regulatory approval for any or all of our product candidates, or

that such approval may be significantly delayed due to scientific

or regulatory reasons; the fact that even if one or more of our

product candidates receives regulatory approval, they will remain

subject to substantial regulatory scrutiny; the effects of current

and future laws and regulations relating to fraud and abuse, false

claims, transparency, health information privacy and security, and

other healthcare laws and regulations; the effects of competition

for our product candidates and the potential for new products to

emerge that provide different or better therapeutic alternatives

for our targeted indications; the possibility that the government

or third-party payors fail to provide adequate coverage and payment

rates for our product candidates or any future products; our

ability to establish sales and marketing capabilities or to enter

into agreements with third parties to market and sell our product

candidates; our exposure to potential product liability claims;

related to the protection of our intellectual property and our

potential inability to maintain sufficient patent protection for

our technology and products; our ability to maintain compliance

with the obligations under our intellectual property licenses and

funding arrangements with third parties, without which licenses and

arrangements we could lose rights that are important to our

business; the fact that Fortress Biotech, Inc. controls a majority

of the voting power of our outstanding capital stock and has rights

to receive significant share grants annually; and those risks

discussed in our filings which we make with the SEC. Any

forward-looking statements speak only as of the date on which they

are made, and we undertake no obligation to publicly update or

revise any forward-looking statements to reflect events or

circumstances that may arise after the date of this press release,

except as required by applicable law. Investors should evaluate any

statements made by us in light of these important factors.

Contact:

Jaclyn Jaffe Avenue Therapeutics, Inc. (781)

652-4500 ir@avenuetx.com

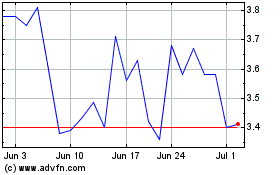

Avenue Therapeutics (NASDAQ:ATXI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Avenue Therapeutics (NASDAQ:ATXI)

Historical Stock Chart

From Dec 2023 to Dec 2024