UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

Atour Lifestyle

Holdings Limited

(Name of Issuer)

Class A Ordinary

Shares, par value US$0.0001 per share

(Title of Class of Securities)

**

(CUSIP Number)

September

30, 2024

(Date of Event Which Requires Filing of This Statement)

Check the appropriate box to designate the rule pursuant to which this

Schedule is filed:

☐

Rule 13d-l(b)

☐

Rule 13d-l(c)

☒

Rule 13d-l(d)

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter the disclosures provided in a prior cover page.

** There is no CUSIP number assigned to the Class A Ordinary Shares.

CUSIP number 04965M 106 has been assigned to the American Depositary Shares (“ADSs”) of the Issuer, which are quoted on the

Nasdaq Global Select Market under the symbol “ATAT.” Each ADS represents three Class A Ordinary Shares. The information required

in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| 1 |

Names of Reporting Persons.

Shanghai Yi Nan Enterprise Management Partnership

|

| 2 |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☐ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

The People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

5 |

Sole Voting Power

17,321,3251 |

| 6 |

Shared Voting Power

None |

| 7 |

Sole Dispositive Power

17,321,3251 |

| 8 |

Shared Dispositive Power

None |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting

Person

17,321,325 |

| 10 |

Check if the Aggregate Amount in Row (9) Excludes

Certain Shares (See Instructions)

☐ |

| 11 |

Percent of Class Represented by Amount in Row (9)

4.2% of total outstanding Class A ordinary

shares2 |

| 12 |

Type of Reporting Person (See Instructions)

CO |

1 Represents (i) 11,655,462 Class A

ordinary shares held of record by Shanghai Yi Nan Enterprise Management Partnership, and (ii) 5,665,863 Class A ordinary shares represented

by ADSs that are beneficially owned by Shanghai Yi Nan Enterprise Management Partnership as of October 31, 2024. Each Class A ordinary

share is entitled to one vote.

2 See Item 4. As shown from the percentage

of class, each of Shanghai Yi Nan Enterprise Management Partnership, Legend Capital Management Co., Ltd., Beijing Juncheng Hezhong Investment

Management Partnership and Beijing Junqi Jiarui Business Management Limited has ceased to be the beneficial owner of more than five percent

of the referenced class of securities. The filing of this Amendment No.2 constitutes an exit filing for each of Shanghai Yi Nan Enterprise

Management Partnership, Legend Capital Management Co., Ltd., Beijing Juncheng Hezhong Investment Management Partnership and Beijing Junqi

Jiarui Business Management Limited.

| 1 |

Names of Reporting Persons.

Legend Capital Management Co., Ltd.

|

| 2 |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☐ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

The People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

5 |

Sole Voting Power

19,995,8723 |

| 6 |

Shared Voting Power

None |

| 7 |

Sole Dispositive Power

19,995,8723 |

| 8 |

Shared Dispositive Power

None |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting

Person

19,995,872 |

| 10 |

Check if the Aggregate Amount in Row (9) Excludes

Certain Shares (See Instructions)

☐ |

| 11 |

Percent of Class Represented by Amount in Row (9)

4.8% of total outstanding Class A ordinary

shares2 |

| 12 |

Type of Reporting Person (See Instructions)

CO |

3 Represents (i) 11,655,462 Class A ordinary

shares held of record by Shanghai Yi Nan Enterprise Management Partnership, a limited liability partnership incorporated under the laws

of PRC, (ii) 5,665,863 Class A ordinary shares represented by ADSs that are beneficially owned by Shanghai Yi Nan Enterprise Management

Partnership, (iii) 1,821,956 Class A ordinary shares held of record by Shanghai Yin Nai Enterprise Management Partnership, a limited liability

partnership incorporated under the laws of PRC, and (iv) 852,591 Class A ordinary shares represented by ADSs that are beneficially owned

by Shanghai Yin Nai Enterprise Management Partnership as of October 31, 2024. Both of Shanghai Yi Nan Enterprise Management Partnership

and Shanghai Yin Nai Enterprise Management Partnership are ultimately controlled by Legend Capital Management Co., Ltd., a PRC limited

company. Legend Capital Management Co., Ltd. is majority-owned by Beijing Juncheng Hezhong Investment Management Partnership (Limited

Partnership), which is controlled by Beijing Junqi Jiarui Business Management Limited, its general partner. Each Class A ordinary share

is entitled to one vote.

| 1 |

Names of Reporting Persons.

Beijing Juncheng Hezhong Investment Management Partnership

|

| 2 |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☐ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

The People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

5 |

Sole Voting Power

19,995,8723 |

| 6 |

Shared Voting Power

None |

| 7 |

Sole Dispositive Power

19,995,8723 |

| 8 |

Shared Dispositive Power

None |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting

Person

19,995,872 |

| 10 |

Check if the Aggregate Amount in Row (9) Excludes

Certain Shares (See Instructions)

☐ |

| 11 |

Percent of Class Represented by Amount in Row (9)

4.8% of total outstanding Class A ordinary shares2 |

| 12 |

Type of Reporting Person (See Instructions)

CO |

| 1 |

Names of Reporting Persons.

Beijing Junqi Jiarui Business Management Limited |

| 2 |

Check the Appropriate Box if a Member of a Group

(See Instructions)

(a) ☐

(b) ☐ |

| 3 |

SEC Use Only

|

| 4 |

Citizenship or Place of Organization

The People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

5 |

Sole Voting Power

19,995,8723 |

| 6 |

Shared Voting Power

None |

| 7 |

Sole Dispositive Power

19,995,8723 |

| 8 |

Shared Dispositive Power

None |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting

Person

19,995,872 |

| 10 |

Check if the Aggregate Amount in Row (9) Excludes

Certain Shares (See Instructions)

☐ |

| 11 |

Percent of Class Represented by Amount in Row (9)

4.8% of total outstanding Class A ordinary

shares2 |

| 12 |

Type of Reporting Person (See Instructions)

CO |

| Item l(a). | Name of Issuer: |

Atour Lifestyle Holdings Limited

| Item l(b). | Address of Issuer’s Principal Executive Offices: |

1st Floor, Wuzhong Building

618 Wuzhong Road, Minhang District

Shanghai, People’s Republic of China

| Item 2(a). | Name of Person Filing: |

Shanghai Yi Nan Enterprise Management

Partnership

Legend Capital Management Co., Ltd.

Beijing Juncheng Hezhong Investment Management

Partnership

Beijing Junqi Jiarui Business Management

Limited

| Item 2(b). | Address of Principal Business Office, or if None, Residence: |

For all reporting persons:

16th Floor, Block B, Rongke

Information Center, No. 2 South Road of Zhongguancun Academy of Sciences, Haidian District, Beijing, China.

Shanghai Yi Nan Enterprise Management

Partnership: The People’s Republic of China

Legend Capital Management Co., Ltd.: The

People’s Republic of China

Beijing Juncheng Hezhong Investment Management

Partnership: The People’s Republic of China

Beijing Junqi Jiarui Business Management

Limited: The People’s Republic of China

| Item 2(d). | Title of Class of Securities: |

Class A Ordinary Shares, par value US$0.0001

per share (each American Depositary Share (“ADS”), representing three Class A Ordinary Shares).

There is no CUSIP number assigned to the

Class A Ordinary Shares. CUSIP number 04965M 106 has been assigned to the ADSs of the Issuer, which are quoted on the Nasdaq Global Select

Market under the symbol “ATAT.” Each ADS represents three Class A Ordinary Shares.

| Item 3. | If this Statement is Filed Pursuant to Rule 13d-l(b), or 13d-2(b) or (c), Check Whether the Person Filing is a: |

| (a) | ☐

Broker or dealer registered under section 15 of the Act (15 U.S.C. 780); |

| (b) | ☐

Bank as defined in section 3(a)(6) of the Act (15 U.S.C. 78c); |

| (c) | ☐

Insurance company as defined in section 3(a)(19) of the Act (15 U.S.C. 78c); |

| (d) | ☐

Investment company registered under Section 8 of the Investment Company Act of 1940 (15 U.S.C. 80a-8); |

| (e) | ☐

An investment adviser in accordance with Rule 13d-l(b)(l)(I(E); |

| (f) | ☐

An employee benefit plan or endowment fund in accordance with Rule 13d-l(b)(l)(ii)(F); |

| (g) | ☐

A parent holding company or control person in accordance with Rule 13d-l(b)(l)(ii)(G); |

| (h) | ☐

A savings associations as defined in Section 3(b) of the Federal Deposit Insurance Act (12 U.S.C. 1813); |

| (i) | ☐ A church plan that is excluded from the definition of an investment

company under section 3(c)(14) of the Investment Company Act of 1940 (15 U.S.C. 80a-3); |

| (j) | ☐ A non-U.S. institution in accordance with Rule 240.13d-l(b)(l)(ii)(J); |

| (k) | ☐ Group, in accordance with Rule 13d-l(b)(l)(ii)(K). If filing

as a non-U.S. institution in accordance with Rule 13d-1 (b)(1)(ii)(J), please specify the type of institution: ___ . |

Provide the following information regarding

the aggregate number and percentage of the class of securities of issuer identified in Item 1.

| (a) | The information required by Items 4(a) is set forth in Row 9 of the cover page for each Reporting Person and is incorporated herein

by reference. |

| (b) | The total number of outstanding Class A ordinary shares used to calculate the percentage of class represented by the Class A ordinary

Shares is the sum of (i) 339,104,792 Class A ordinary shares (excluding 1,211,514 Class A ordinary shares issued by the Issuer to the

depositary bank for bulk issuance of ADSs reserved for future share issuances upon the exercise or vesting of equity awards under the

Issuer’s Public Company Plan) and (ii) 73,680,917 Class B ordinary shares outstanding as of December 31, 2023, all of which can

be converted into an equal number of Class A ordinary shares at any time by the holder thereof, as disclosed in the annual report on Form

20-F for the fiscal year ended December 31, 2023 filed by the Issuer with the SEC on April 26, 2024. |

| (c) | The information required by Items 4(c) is set forth in Rows 5-8 of the cover page for each Reporting Person and is incorporated herein

by reference. |

| Item 5. | Ownership of Five Percent or Less of a Class. |

If this statement is being filed to report

the fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than 5 percent of the class of

securities, check the following ☒.

As shown from the percentage of class

calculated herein, each of Shanghai Yi Nan Enterprise Management Partnership, Legend Capital Management Co., Ltd., Beijing Juncheng Hezhong

Investment Management Partnership and Beijing Junqi Jiarui Business Management Limited has ceased to be the beneficial owner of more than

five percent of the referenced class of securities. The filing of this Amendment No.2 constitutes an exit filing for each of Shanghai

Yi Nan Enterprise Management Partnership, Legend Capital Management Co., Ltd., Beijing Juncheng Hezhong Investment Management Partnership

and Beijing Junqi Jiarui Business Management Limited.

| Item 6. | Ownership of More than Five Percent on Behalf of Another Person. |

Not applicable.

| Item 7. | Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on by the Parent Holding Company. |

Not applicable.

| Item 8. | Identification and Classification of Members of the Group. |

Not applicable.

| Item 9. | Notice of Dissolution of Group. |

Not applicable.

Not applicable.

LIST OF EXHIBITS

| Exhibit No. |

Description |

| A |

Joint Filing Agreement |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: November 1, 2024

| |

Shanghai Yi Nan Enterprise Management Partnership |

| |

|

| |

|

| |

By: |

/s/ Hongbin Zhou |

| |

|

Name: Hongbin Zhou |

| |

|

Title: Authorized Signatory |

| |

Legend Capital Management Co., Ltd. |

| |

|

| |

|

| |

By: |

/s/ Hongbin Zhou |

| |

|

Name: Hongbin Zhou |

| |

|

Title: Authorized Signatory |

| |

Beijing Juncheng Hezhong Investment Management Partnership |

| |

|

| |

|

| |

By: |

/s/ Hongbin Zhou |

| |

|

Name: Hongbin Zhou |

| |

|

Title: Authorized Signatory |

| |

Beijing Junqi Jiarui Business Management Limited |

| |

|

| |

|

| |

By: |

/s/ Hongbin Zhou |

| |

|

Name: Hongbin Zhou |

| |

|

Title: Authorized Signatory |

[Signature page to 13G (Atour)]

Exhibit A

JOINT FILING AGREEMENT

The undersigned hereby agree that the foregoing

statement on Schedule 13G is filed on behalf of each of the undersigned in accordance with the provisions of Rule 13d-l(k) under the Securities

Exchange Act of 1934, as amended, and that all subsequent amendments to this statement on Schedule 13G may be filed on behalf of each

of the undersigned without the necessity of filing additional joint filing agreements.

Date: February 13, 2023

| |

Shanghai Yi Nan Enterprise Management Partnership |

| |

|

| |

|

| |

By: |

/s/ Hongbin Zhou |

| |

|

Name: Hongbin Zhou |

| |

|

Title: Authorized Signatory |

| |

Legend Capital Management Co., Ltd. |

| |

|

| |

|

| |

By: |

/s/ Hongbin Zhou |

| |

|

Name: Hongbin Zhou |

| |

|

Title: Authorized Signatory |

| |

Beijing Juncheng Hezhong Investment Management Partnership |

| |

|

| |

|

| |

By: |

/s/ Hongbin Zhou |

| |

|

Name: Hongbin Zhou |

| |

|

Title: Authorized Signatory |

| |

Beijing Junqi Jiarui Business Management Limited |

| |

|

| |

|

| |

By: |

/s/ Hongbin Zhou |

| |

|

Name: Hongbin Zhou |

| |

|

Title: Authorized Signatory |

[Signature page to joint filing agreement (Atour

13G)]

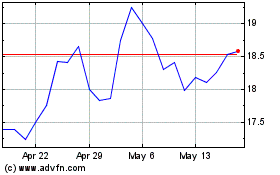

Atour Lifestyle (NASDAQ:ATAT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Atour Lifestyle (NASDAQ:ATAT)

Historical Stock Chart

From Dec 2023 to Dec 2024