Arteris, Inc. (Nasdaq: AIP), a leading provider of system IP which

accelerates system-on-chip (SoC) creation, today announced

financial results for the fourth quarter and year ended

December 31, 2024 and provided first quarter and full year

2025 guidance.

“In the fourth quarter of 2024, we achieved a

record Annual Contract Value plus royalties of $65.1 million,

driven by strong demand for our commercial semiconductor System IP

products, particularly in AI-driven enterprise computing and

automotive SoCs,” said K. Charles Janac, President and CEO of

Arteris. “As AI adoption accelerates across data centers,

autonomous driving, and edge devices, the growing complexity of

both high performance and traditional technologies like MCUs is

fueling demand for the efficiency enabled by Arteris’

networks-on-chip IP technology, contributing to new customer wins,

and expanded partnerships. With a robust product pipeline and

deepening relationships with top-tier technology companies, we

believe we are well-positioned to capitalize on exciting

high-growth opportunities including Generative AI and Autonomous

Driving,” concluded Janac.

Fourth Quarter 2024 Financial

Highlights:

- Revenue of $15.5

million, up 24% year-over-year

- Annual Contract

Value (ACV) plus royalties of $65.1 million, up 16%

year-over-year, growing to the highest level we have ever

reported

- Remaining

performance obligation (RPO) of $88.4 million, up 22%

year-over-year, growing to the highest level we have ever

reported

- Operating loss of

$7.1 million, compared to an operating loss of

$9.2 million in the fourth quarter of 2023

- Non-GAAP operating

loss of $2.8 million, compared to a Non-GAAP operating loss of

$5.5 million in the fourth quarter of 2023

- Net loss of

$8.2 million or $0.20 per share

- Non-GAAP net loss

of $3.9 million or $0.10 per share

Full year 2024 Financial Highlights:

- Revenue of

$57.7 million, up 8% year-over-year

- Operating loss of

$31.6 million, compared to an operating loss of

$35.1 million for the year-ended 2023

- Non-GAAP operating

loss of $14.8 million, compared to a Non-GAAP operating loss

of $19.8 million for the year-ended 2023

- Net loss of

$33.6 million or $0.86 per share

- Non-GAAP net loss

of $16.9 million or $0.43 per share

Fourth Quarter 2024 Business Highlights:

- 2024 was a strong

year for Arteris, seeing accelerating demand for commercial system

IP. We signed on 14 new customers, including two major automotive

OEMs, and increased our footprint in key technology areas, such as

chiplets, microcontrollers (MCUs), and AI;

- Record high $65.1

million in ACV plus royalties, driven by the addition of new

customers as well as increased uptake by our current

customers;

- Large, established

customers are continuing to broaden their use of the Arteris

product portfolio, with a top 5 technology company licensing

Magillem and CSRCompiler, and a top 5 automotive semiconductor

company licensing several additional SoC designs;

- Delivered on last

quarter’s strategic expansion into the microcontroller space,

licensing Arteris interconnect to Infineon, the leading MCU

company, serving the world’s top automotive Tier 1 vendors and

OEMs;

- Announced design

wins with GigaDevice for automotive microcontrollers, and Menta for

edge AI and IoT chiplet designs; and

- Announced the

release of FlexGen smart NoC IP, which has the potential to deliver

up to 10x engineer productivity and lower power consumption,

through the automation of NoC design creation.

Non-GAAP gross profit, Non-GAAP gross margin,

Non-GAAP operating loss, Non-GAAP operating loss margin, Non-GAAP

net loss, Non-GAAP net loss per share, free cash flow and free cash

flow margin are Non-GAAP financial measures. Additional information

on Arteris’ historic reported results, including a reconciliation

of these Non-GAAP financial measures to their most comparable GAAP

measures, is included in the financial tables below.

First Quarter and Full Year 2025

Guidance:

|

|

Q1 2025 |

FY 2025 |

| |

(in millions) |

| ACV +

royalties |

$65.5 - $67.5 |

$73.0 - $77.0 |

| Revenue |

$15.7 - $16.1 |

$66.0 - $70.0 |

| Non-GAAP operating

loss |

$3.0 - $4.0 |

$8.5 - $12.5 |

| Free cash

flow |

$(2.0) - $2.0 |

$1.0 - $7.0 |

| |

|

|

The guidance provided above are forward-looking

statements and reflects Arteris' expectations as of today's date.

Actual results may differ materially. Refer to the section titled

"Forward-Looking Statements" below for information on the factors,

among others, that could cause our actual results to differ

materially from these forward-looking statements.

A reconciliation of Non-GAAP guidance measures

reported above to corresponding GAAP measures is not available on a

forward-looking basis without unreasonable effort due to the

uncertainty of expenses that may be incurred in the future,

although it is important to note that these factors could be

material to Arteris' results computed in accordance with GAAP.

Definitions of the other business metrics used

in this press release including ACV, active customers, confirmed

design starts and RPO are included below under the heading “Other

Business Metrics.”

Conference Call

Arteris will host a conference call today on

February 18, 2025 to review its fourth quarter and full year 2024

financial results and to discuss its financial outlook.

|

Time: |

4:30PM ET |

| United States/Canada Toll

Free: |

1-646-307-1865 |

|

International Toll: |

1-800-717-1738 |

|

|

|

A live webcast will also be available in the

Investor Relations section of Arteris’ website at:

https://ir.arteris.com/events-and-presentations

A replay of the webcast will be available in the

Investor Relations section of Arteris' website approximately two

hours after the conclusion of the call and remain available for

approximately 30 calendar days.

About Arteris

Arteris is a leading provider of system IP for

the acceleration of system-on-chip (SoC) development across today’s

electronic systems. Arteris network-on-chip (NoC) interconnect IP

and SoC integration automation technology enable higher product

performance with lower power consumption and faster time to market,

delivering better SoC economics so its customers can focus on

dreaming up what comes next. Learn more at arteris.com.

© 2004-2025 Arteris, Inc. All rights reserved

worldwide. Arteris, Arteris IP, the Arteris IP logo, and the other

Arteris marks found at https://www.arteris.com/trademarks are

trademarks or registered trademarks of Arteris, Inc. or its

subsidiaries. All other trademarks are the property of their

respective owners.

Investor Contacts:ArterisNick HawkinsChief

Financial OfficerIR@arteris.com

Sapphire Investor Relations, LLCErica Mannion and Michael

Funari+1 617 542 6180IR@arteris.com

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended, including but not limited to,

statements regarding our future financial and operating

performance, including our GAAP and Non-GAAP guidance for the

fourth quarter and full year 2024 and first quarter and full year

2025; our market opportunity and its potential growth; our ability

to execute on existing customer contracts and drive increased

customer adoption of our system IP; and our position within the

market and our ability to drive customer value. The words such as

"may," "will," "could," "expect," "approximately," "believe,"

"estimate," "future," "potential," "guidance," "outlook," and

similar words or expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Any forward-looking

statements contained herein are based on our historical performance

and our current plans, estimates and expectations and are not a

representation that such plans, estimates, or expectations will be

achieved. These forward-looking statements represent our

expectations as of the date of this press release. Subsequent

events may cause these expectations to change, and we disclaim any

obligation to update the forward-looking statements in the future,

except as required by law. These forward-looking statements are

subject to known and unknown risks and uncertainties that may cause

actual results to differ materially from our current expectations.

Important factors that could cause actual results to differ

materially from those anticipated in our forward-looking statements

include, but are not limited to, the significant competition we

face from larger companies and third-party providers; our history

of net losses; whether semiconductor companies in the automotive

market, enterprise computing market, communications market,

consumer electronics market, and industrial markets incorporate our

solutions into their end products and the growth and economic

stability of these end markets; our ability to attract new

customers and the extent to which our customers renew their

subscriptions for our solutions; the ability of our customers’ end

products achieving market acceptance or growth; our ability to

sustain or grow our licensing revenue; our ability, and the cost,

to successfully execute on research and development efforts; the

occurrence of product errors or defects in our solutions; if we

fail to offer high-quality support; the occurrence of

macro-economic conditions that adversely impact us, our customers

and their end product markets; the effects of geopolitical

conflicts, such as the military conflict between Russia and

Ukraine; the range of regulatory, operational, financial and

political risks we are exposed to as a result of our dependence on

international customers and operations; our ability to protect our

proprietary technology and inventions through patents and other IP

rights; whether we are subject to any liabilities or fines as a

result of government regulation, including import, export and

economic sanctions laws and regulations; the occurrence of a

disruption in our networks or a security breach; risks associated

with doing business in China, including as a result of changes to

trade relations between the U.S. and China; and the other factors

described under the heading “Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2024 to be filed with the

Securities and Exchange Commission (SEC) on or about February 18,

2025. All forward-looking statements reflect our beliefs and

assumptions only as of the date of this press release. We undertake

no obligation to update forward-looking statements to reflect

future events or circumstances. Our results for the quarter and

year ended December 31, 2024 are not necessarily indicative of our

operating results for any future periods.

|

Arteris, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(In thousands, except share and per share data) |

|

(Unaudited) |

| |

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenue |

|

|

|

|

|

|

|

|

Licensing, support and maintenance |

$ |

14,016 |

|

|

$ |

11,347 |

|

|

$ |

52,815 |

|

|

$ |

48,273 |

|

|

Variable royalties and other |

|

1,473 |

|

|

|

1,157 |

|

|

|

4,909 |

|

|

|

5,393 |

|

| Total revenue |

|

15,489 |

|

|

|

12,504 |

|

|

|

57,724 |

|

|

|

53,666 |

|

| Cost of revenue |

|

1,575 |

|

|

|

1,448 |

|

|

|

5,962 |

|

|

|

5,077 |

|

| Gross profit |

|

13,914 |

|

|

|

11,056 |

|

|

|

51,762 |

|

|

|

48,589 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

11,532 |

|

|

|

10,663 |

|

|

|

45,007 |

|

|

|

45,128 |

|

|

Sales and marketing |

|

5,365 |

|

|

|

5,029 |

|

|

|

20,796 |

|

|

|

20,659 |

|

|

General and administrative |

|

4,119 |

|

|

|

4,613 |

|

|

|

17,555 |

|

|

|

17,944 |

|

| Total operating expenses |

|

21,016 |

|

|

|

20,305 |

|

|

|

83,358 |

|

|

|

83,731 |

|

| Loss from operations |

|

(7,102 |

) |

|

|

(9,249 |

) |

|

|

(31,596 |

) |

|

|

(35,142 |

) |

| Interest expense |

|

(45 |

) |

|

|

(75 |

) |

|

|

(244 |

) |

|

|

(211 |

) |

| Other income (expense),

net |

|

824 |

|

|

|

917 |

|

|

|

3,400 |

|

|

|

3,558 |

|

| Loss before income taxes and

loss from equity method investment |

|

(6,323 |

) |

|

|

(8,407 |

) |

|

|

(28,440 |

) |

|

|

(31,795 |

) |

| Loss from equity method

investment, net of tax |

|

634 |

|

|

|

910 |

|

|

|

2,698 |

|

|

|

3,397 |

|

| Provision for income

taxes |

|

1,247 |

|

|

|

1,224 |

|

|

|

2,500 |

|

|

|

1,677 |

|

| Net loss |

$ |

(8,204 |

) |

|

$ |

(10,541 |

) |

|

$ |

(33,638 |

) |

|

$ |

(36,869 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders, basic and diluted |

$ |

(0.20 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.86 |

) |

|

$ |

(1.03 |

) |

| Weighted average shares used

in computing per share amounts, basic and diluted |

|

40,157,199 |

|

|

|

36,816,597 |

|

|

|

38,914,197 |

|

|

|

35,675,689 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arteris, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(In thousands, except share and per share data) |

| |

| |

As of December 31, |

| |

2024 |

|

2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

13,684 |

|

|

$ |

13,696 |

|

| Short-term investments |

|

30,157 |

|

|

|

27,477 |

|

| Accounts receivable, net

of allowance of $131 and $93 as of December 31, 2024, and

2023, respectively |

|

20,608 |

|

|

|

12,003 |

|

| Prepaid expenses and other

current assets |

|

4,634 |

|

|

|

5,254 |

|

|

Total current assets |

|

69,083 |

|

|

|

58,430 |

|

| Property and equipment,

net |

|

4,019 |

|

|

|

5,745 |

|

| Long-term investments |

|

8,504 |

|

|

|

11,802 |

|

| Equity method investment |

|

5,802 |

|

|

|

8,500 |

|

| Operating

lease right-of-use assets |

|

3,838 |

|

|

|

4,289 |

|

| Intangibles, net |

|

3,024 |

|

|

|

3,858 |

|

| Goodwill |

|

4,178 |

|

|

|

4,178 |

|

| Other assets |

|

7,687 |

|

|

|

5,999 |

|

| TOTAL ASSETS |

$ |

106,135 |

|

|

$ |

102,801 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

539 |

|

|

$ |

183 |

|

| Accrued expenses and other

current liabilities |

|

15,899 |

|

|

|

11,831 |

|

| Operating lease liabilities,

current |

|

917 |

|

|

|

781 |

|

| Deferred revenue, current |

|

40,445 |

|

|

|

31,537 |

|

| Vendor financing arrangements,

current |

|

1,482 |

|

|

|

2,070 |

|

|

Total current liabilities |

|

59,282 |

|

|

|

46,402 |

|

| Deferred revenue,

noncurrent |

|

35,177 |

|

|

|

25,172 |

|

| Operating lease liabilities,

noncurrent |

|

2,998 |

|

|

|

3,610 |

|

| Vendor financing arrangements,

noncurrent |

|

594 |

|

|

|

1,292 |

|

| Deferred income,

noncurrent |

|

7,631 |

|

|

|

8,810 |

|

| Other liabilities |

|

1,641 |

|

|

|

2,412 |

|

|

Total liabilities |

|

107,323 |

|

|

|

87,698 |

|

| Stockholders’ (deficit)

equity: |

|

|

|

|

Preferred stock, par value of $0.001—10,000,000 shares authorized

and no shares issued and outstanding as of both December 31,

2024, and 2023 |

|

— |

|

|

|

— |

|

|

Common stock, par value of $0.001—300,000,000 shares authorized at

December 31, 2024, and 2023; 40,724,936 and 37,518,583 shares

issued and outstanding at December 31, 2024, and 2023,

respectively |

|

40 |

|

|

|

37 |

|

|

Additional paid-in capital |

|

135,522 |

|

|

|

118,193 |

|

| Accumulated other

comprehensive income |

|

135 |

|

|

|

120 |

|

| Accumulated deficit |

|

(136,885 |

) |

|

|

(103,247 |

) |

|

Total stockholders’ (deficit) equity |

|

(1,188 |

) |

|

|

15,103 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

$ |

106,135 |

|

|

$ |

102,801 |

|

| |

|

|

|

|

|

|

|

|

Arteris, Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(In thousands) |

| |

| |

Twelve Months EndedDecember 31, |

| |

2024 |

|

2023 |

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

Net loss |

$ |

(33,638 |

) |

|

$ |

(36,869 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

|

3,362 |

|

|

|

3,069 |

|

|

Stock-based compensation |

|

15,938 |

|

|

|

14,535 |

|

|

Pension plan expenses |

|

163 |

|

|

|

134 |

|

|

Amortization of deferred income |

|

(1,182 |

) |

|

|

(1,179 |

) |

|

Loss from equity method investment |

|

2,698 |

|

|

|

3,397 |

|

|

Net accretion of discounts on available-for-sale securities |

|

(695 |

) |

|

|

(893 |

) |

|

Other, net |

|

(9 |

) |

|

|

128 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable, net |

|

(8,605 |

) |

|

|

(4,858 |

) |

|

Prepaid expenses and other assets |

|

(1,068 |

) |

|

|

(1,301 |

) |

|

Accounts payable |

|

324 |

|

|

|

(389 |

) |

|

Accrued expenses and other liabilities |

|

3,079 |

|

|

|

2,467 |

|

|

Deferred revenue |

|

18,913 |

|

|

|

6,030 |

|

|

Net cash used in operating activities |

|

(720 |

) |

|

|

(15,729 |

) |

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

| Purchases of property and

equipment |

|

(324 |

) |

|

|

(1,503 |

) |

| Purchases of

available-for-sale securities and other |

|

(37,175 |

) |

|

|

(47,788 |

) |

| Proceeds from maturities of

available-for-sale securities and other |

|

38,469 |

|

|

|

44,650 |

|

| Other investing

activities |

|

— |

|

|

|

(50 |

) |

|

Net cash provided by (used in) investing activities |

|

970 |

|

|

|

(4,691 |

) |

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

| Payments of contingent

consideration for business combination |

|

— |

|

|

|

(1,592 |

) |

| Principal payments under

vendor financing arrangements |

|

(1,749 |

) |

|

|

(1,289 |

) |

| Payments to tax authorities

for shares withheld from employees |

|

— |

|

|

|

(607 |

) |

| Proceeds from exercise of

stock options |

|

890 |

|

|

|

490 |

|

| Proceeds from employee stock

purchase plan |

|

538 |

|

|

|

— |

|

| Other financing

activities |

|

59 |

|

|

|

79 |

|

|

Net cash used in financing activities |

|

(262 |

) |

|

|

(2,919 |

) |

| NET DECREASE IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH |

|

(12 |

) |

|

|

(23,339 |

) |

| CASH, CASH EQUIVALENTS AND

RESTRICTED CASH, beginning of period |

|

14,084 |

|

|

|

37,423 |

|

| CASH, CASH EQUIVALENTS AND

RESTRICTED CASH, end of period |

$ |

14,072 |

|

|

$ |

14,084 |

|

| |

|

|

|

|

|

|

|

Non-GAAP Financial Measures

To supplement our financial results, which are

prepared and presented in accordance with GAAP, we use certain

non-GAAP financial measures, as described below, to understand and

evaluate our core performance. These non-GAAP measures, which may

be different than similarly-titled measures used by other

companies, are presented to enhance investors’ overall

understanding of our financial performance and should not be

considered a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP.

We define "Non-GAAP gross profit and Non-GAAP

gross margin" as GAAP gross profit and GAAP gross margin, adjusted

for stock-based compensation expense and amortization of intangible

assets included in cost of revenue. We define “Non-GAAP Loss from

Operations” as our income (loss) from operations adjusted to

exclude stock-based compensation, acquisition costs and

amortization of acquired intangible assets. We define “Non-GAAP Net

Loss” as our net income (loss) adjusted to exclude stock-based

compensation and amortization of acquired intangible assets.

We define “Non-GAAP EPS”, as our Non-GAAP Net

Income (Loss) divided by our GAAP weighted-average number of shares

outstanding for the period on a diluted basis. Management uses

Non-GAAP EPS to evaluate the performance of our business on a

comparable basis from period to period.

The above items are excluded from our Non-GAAP

Gross Profit, Non-GAAP Income (Loss) from Operations and Non-GAAP

Net Income (Loss) because these items are non-cash in nature, or

are not indicative of our core operating performance, and render

comparisons with prior periods and competitors less meaningful. We

believe Non-GAAP Gross Profit, Non-GAAP Income (Loss) from

Operations and Non-GAAP Net Income (Loss) provide useful

supplemental information to investors and others in understanding

and evaluating our results of operations, as well as provide a

useful measure for period-to-period comparisons of our business

performance.

We define free cash flow as net cash used in

operating activities less cash used for purchases of property and

equipment. We believe that free cash flow is a useful indicator of

liquidity that provides information to management and investors,

even if negative, about the amount of cash used in our operations

other than that used for investments in property and equipment.

Other Business Metrics

Active Customers – we define

Active Customers as customers who have entered into a license

agreement with us that remains in effect. The retention and

expansion of our relationships with existing customers are key

indicators of our revenue potential.

Annual Contract Value (ACV) –

we define Annual Contract Value for an individual customer

agreement as the total fixed fees under the agreement divided by

the number of years in the agreement term. Our total ACV is the

aggregate ACVs for all our customers as measured at a given point

in time. Total fixed fees includes licensing, support and

maintenance and other fixed fees under IP licensing or software

licensing agreements but excludes variable revenue derived from

licensing agreements with customers, particularly royalties. We

define ACV plus royalties as ACV plus the trailing-twelve-months

variable royalties and other revenue.

Confirmed Design Starts – we

define Confirmed Design Starts as when customers confirm their

commencement of new semiconductor designs using our interconnect IP

and notify us. Confirmed Design Starts is a metric management uses

to assess the activity level of our customers in terms of the

number of new semiconductor designs that are started using our

interconnect IP in a given period. We believe that the number of

Confirmed Design Starts is an important indicator of the growth of

our business and future royalty revenue trends.

Remaining Performance Obligations (RPO)

– we define Remaining Performance Obligations as the

amount of contracted future revenue that has not yet been

recognized, including deferred revenue, billed and unbilled

cancelable and non-cancelable contracted amounts.

| Arteris,

Inc. |

|

Reconciliation of GAAP Measures to Non-GAAP

Measures |

| (In thousands,

except share and per share data) |

| (Unaudited) |

| |

| |

Three Months Ended December

31, |

|

Twelve Months Ended December

31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Gross profit |

$ |

13,914 |

|

|

$ |

11,056 |

|

|

$ |

51,762 |

|

|

$ |

48,589 |

|

| Add: |

|

|

|

|

|

|

|

| Stock-based compensation

expense included in cost of revenue |

|

187 |

|

|

|

170 |

|

|

|

783 |

|

|

|

556 |

|

| Amortization of acquired

intangible assets (1) |

|

49 |

|

|

|

50 |

|

|

|

199 |

|

|

|

149 |

|

| Non-GAAP gross profit |

$ |

14,150 |

|

|

$ |

11,276 |

|

|

$ |

52,744 |

|

|

$ |

49,294 |

|

| Gross margin |

|

90 |

% |

|

|

88 |

% |

|

|

90 |

% |

|

|

91 |

% |

| Non-GAAP gross margin |

|

91 |

% |

|

|

90 |

% |

|

|

91 |

% |

|

|

92 |

% |

| |

|

|

|

|

|

|

|

| Research and development |

$ |

11,532 |

|

|

$ |

10,663 |

|

|

$ |

45,007 |

|

|

$ |

45,128 |

|

| Stock-based compensation

expense |

|

(1,959 |

) |

|

|

(1,668 |

) |

|

|

(7,509 |

) |

|

|

(7,324 |

) |

| Amortization of acquired

intangible assets (1) |

|

(109 |

) |

|

|

(85 |

) |

|

|

(389 |

) |

|

|

(390 |

) |

| Non-GAAP research and

development |

$ |

9,464 |

|

|

$ |

8,910 |

|

|

$ |

37,109 |

|

|

$ |

37,414 |

|

| |

|

|

|

|

|

|

|

| Sales and marketing |

$ |

5,365 |

|

|

$ |

5,029 |

|

|

$ |

20,796 |

|

|

$ |

20,659 |

|

| Stock-based compensation

expense |

|

(849 |

) |

|

|

(624 |

) |

|

|

(3,079 |

) |

|

|

(2,712 |

) |

| Amortization of acquired

intangible assets (1) |

|

(58 |

) |

|

|

(57 |

) |

|

|

(229 |

) |

|

|

(228 |

) |

| Non-GAAP sales and

marketing |

$ |

4,458 |

|

|

$ |

4,348 |

|

|

$ |

17,488 |

|

|

$ |

17,719 |

|

| |

|

|

|

|

|

|

|

| General and

administrative |

$ |

4,119 |

|

|

$ |

4,613 |

|

|

$ |

17,555 |

|

|

$ |

17,944 |

|

| Stock-based compensation

expense |

|

(1,136 |

) |

|

|

(1,092 |

) |

|

|

(4,567 |

) |

|

|

(3,943 |

) |

| Non-GAAP general and

administrative |

$ |

2,983 |

|

|

$ |

3,521 |

|

|

$ |

12,988 |

|

|

$ |

14,001 |

|

| |

|

|

|

|

|

|

|

| Loss from operations |

$ |

(7,102 |

) |

|

$ |

(9,249 |

) |

|

$ |

(31,596 |

) |

|

$ |

(35,142 |

) |

| Stock-based compensation

expense |

|

4,131 |

|

|

|

3,554 |

|

|

|

15,938 |

|

|

|

14,535 |

|

| Amortization of acquired

intangible assets (1) |

|

216 |

|

|

|

192 |

|

|

|

817 |

|

|

|

767 |

|

| Non-GAAP loss from

operations |

$ |

(2,755 |

) |

|

$ |

(5,503 |

) |

|

$ |

(14,841 |

) |

|

$ |

(19,840 |

) |

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(8,204 |

) |

|

$ |

(10,541 |

) |

|

$ |

(33,638 |

) |

|

$ |

(36,869 |

) |

| Stock-based compensation

expense |

|

4,131 |

|

|

|

3,554 |

|

|

|

15,938 |

|

|

|

14,535 |

|

| Amortization of acquired

intangible assets (1) |

|

216 |

|

|

|

192 |

|

|

|

817 |

|

|

|

767 |

|

| Non-GAAP net loss(2) |

$ |

(3,857 |

) |

|

$ |

(6,795 |

) |

|

$ |

(16,883 |

) |

|

$ |

(21,567 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders, basic and diluted |

$ |

(0.20 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.86 |

) |

|

$ |

(1.03 |

) |

| Per share impacts of

adjustments to net loss (3) |

$ |

0.10 |

|

|

$ |

0.11 |

|

|

$ |

0.43 |

|

|

$ |

0.43 |

|

| Non-GAAP net loss per share

attributable to common stockholders, basic and diluted |

$ |

(0.10 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.43 |

) |

|

$ |

(0.60 |

) |

| |

|

|

|

|

|

|

|

| Weighted average shares used

in computing per share amounts, basic and diluted |

|

40,157,199 |

|

|

|

36,816,597 |

|

|

|

38,914,197 |

|

|

|

35,675,689 |

|

| |

| (1) Represents the amortization expenses of our

intangible assets attributable to our acquisitions. |

| (2) Our GAAP tax provision is primarily related to

foreign withholding taxes and income tax in profitable foreign

jurisdictions. We maintain a full valuation allowance against our

deferred tax assets in the US. Accordingly, there is no significant

tax impact associated with these Non-GAAP adjustments. |

| (3) Reflects the aggregate adjustments made to

reconcile Non-GAAP net loss to our net loss as noted in the above

table, divided by the GAAP diluted weighted average number of

shares of the relevant period. |

| |

Free Cash Flow

| |

Twelve Months EndedDecember 31, |

| |

2024 |

|

2023 |

|

Net cash used in operating activities |

$ |

(720 |

) |

|

$ |

(15,729 |

) |

| Less: |

|

|

|

| Purchase of property and

equipment |

|

(324 |

) |

|

|

(1,503 |

) |

| Free cash flow |

$ |

(1,044 |

) |

|

$ |

(17,232 |

) |

| Net cash provided by (used in)

investing activities |

$ |

970 |

|

|

$ |

(4,691 |

) |

| Net cash used in financing

activities |

$ |

(262 |

) |

|

$ |

(2,919 |

) |

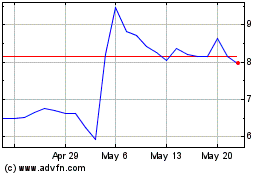

Arteris (NASDAQ:AIP)

Historical Stock Chart

From Feb 2025 to Mar 2025

Arteris (NASDAQ:AIP)

Historical Stock Chart

From Mar 2024 to Mar 2025