AppTech Payments Corp. Announces Closing of $5.0 Million Registered Direct Offering and Concurrent Private Placement

February 02 2023 - 1:00PM

AppTech Payments Corp. (Nasdaq: APCX) (the “Company” or “AppTech”),

an innovative Fintech company powering seamless, omni-channel

commerce between businesses and consumers, today announced the

closing of its previously announced $5.0 million registered direct

offering (the “Registered Direct Offering”) with a single

institutional investor to sell 1,666,667 shares of its common stock

(the “Shares”) and warrants to purchase up to 1,666,667 shares (the

“Warrants”) in a concurrent private placement (the “Private

Placement”). The combined purchase price for one Share and one

Warrant was $3.00. Each of the Warrants will have an exercise price

of $4.64 per share of common stock and are exercisable on and after

August 1, 2023. The Warrants will expire five years from the date

on which they become exercisable. The aggregate gross proceeds from

the Registered Direct Offering and the concurrent Private Placement

were approximately $5.0 million before deducting placement agent

fees and other estimated offering expenses.

AppTech intends to use the net proceeds from

this offering and its existing cash for general corporate purposes,

including integrating Commerse™ platform clients, acquisition

capital, retiring all loan forbearance agreements, and working

capital.

EF Hutton, division of Benchmark Investments,

LLC (“EF Hutton”) acted as the exclusive placement agent for the

offering.

Nelson Mullins Riley & Scarborough LLP acted

as legal counsel to AppTech and Carmel, Milazzo & Feil LLP

acted as legal counsel to EF Hutton.

The Shares are being offered pursuant to a shelf

registration statement on Form S-3, as amended (File No.

333-265526) previously filed on June 10, 2022 and declared

effective by the Securities and Exchange Commission (“SEC”) on July

15, 2022. The offering of the Shares was made only by means of a

prospectus supplement that forms a part of the registration

statement. The Warrants issued in the Private Placement and the

shares issuable upon exercise of such warrants were offered in a

private placement under Section 4(a)(2) of the Securities Act of

1933, as amended (the “Act”), and Regulation D promulgated

thereunder, have not been registered under the Act or applicable

state securities laws and may not be offered or sold in the United

States absent registration or an applicable exemption from

registration requirements.

A prospectus supplement describing the terms of

the Registered Direct Offering and a Form 8-K relating to the

Registered Direct Offering were filed by AppTech with the SEC and

are available on the SEC’s website at http://www.sec.gov. An

electronic copy of the prospectus supplement is available by

contacting EF Hutton, division of Benchmark Investments, LLC,

Attention: Syndicate Department, 590 Madison Avenue, 39th Floor,

New York, NY 10022, by email atsyndicate@efhuttongroup.com, or by

telephone at (212) 404-7002.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About AppTech Payments

Corp.

AppTech Payments Corp. (NASDAQ: APCX) is an

innovative Fintech company whose mission is to deliver a better way

for businesses to provide their customers with customizable,

immersive commerce experiences. Commerse™, its all-new,

patent-backed technology platform powering seamless omni-channel

Commerce Experiences-as-a-Service (CXS), drives highly secure,

scalable, cross-border digital banking, text-to-pay, and merchant

services altogether from a single, unified stack designed to

increase operational efficiencies and growth for businesses while

providing the economic convenience their customers demand from

today’s commerce experiences. For more information, visit

apptechcorp.com.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of U.S. federal securities laws.

Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue” and

similar expressions are intended to identify such forward-looking

statements. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to

differ materially from the expected results and, consequently, you

should not rely on these forward-looking statements as predictions

of future events. These forward-looking statements and factors that

may cause such differences include, without limitation, the risks

disclosed in the Company’s Annual Report on Form 10-K filed with

the SEC on March 31, 2022, and in the Company’s other filings with

the SEC. Readers are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Except as required by law, the Company disclaims any obligation to

update or publicly announce any revisions to any of the

forward-looking statements contained in this press release.

Investor Relations Contact

Ben ShamsianLytham Partners,

LLCshamsian@lythampartners.com646-829-9701

Media Contact

KCD PR for AppTech Payments

Corp.AppTech@kcdpr.com619-252-9111

AppTech Payments Corp.

info@apptechcorp.com760-707-5959

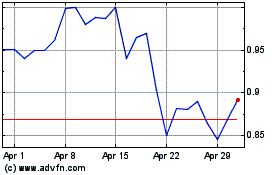

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

From Jun 2024 to Jul 2024

AppTech Payments (NASDAQ:APCX)

Historical Stock Chart

From Jul 2023 to Jul 2024