false

0001178879

0001178879

2024-02-28

2024-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT PURSUANT TO

SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported): February 28, 2024

AMICUS THERAPEUTICS, INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

001-33497 |

|

71-0869350 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

47 Hulfish Street,

Princeton, NJ 08542

(Address of Principal

Executive Offices, and Zip Code)

609-662-2000

Registrant’s

Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since

Last Report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock Par Value $0.01 |

|

FOLD |

|

Nasdaq |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2). Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 – Results of Operations and Financial

Condition

On February 28, 2024, Amicus Therapeutics, Inc.

(the “Company”) issued a press release announcing its financial results for the fiscal year ended December 31, 2023.

A copy of this press release is attached hereto as Exhibit 99.1. The Company will host a conference call and webcast on February 28,

2024 to discuss its full year results of operations. A copy of the conference call presentation materials is attached hereto as Exhibit 99.2.

Both exhibits are incorporated herein by reference.

In accordance with General Instruction B.2. of

Form 8-K, the information in this Current Report on Form 8-K and the Exhibits shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

Signature Page

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

AMICUS THERAPEUTICS, INC. |

| |

|

| Date: February 28, 2024 |

By: |

/s/

Ellen S. Rosenberg |

| |

Name: |

Ellen S. Rosenberg |

| |

Title: |

Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

Amicus Therapeutics

Announces Full-Year 2023 Financial Results and Corporate Updates

2023 Total

Revenue of $399.4M, a 21% Increase Year-over-Year

Strong Patient

Demand Continues for Pombiliti™ + Opfolda™ in the U.S., U.K., and Germany

Projecting

2024 Galafold® Revenue Growth of 11-16% at CER

Anticipating

Full-Year Non-GAAP Profitability in 2024

Conference

Call and Webcast Today at 8:30 a.m. ET

PRINCETON, NJ,

Feb. 28, 2024 – Amicus Therapeutics (Nasdaq: FOLD), a patient-dedicated global biotechnology company focused on developing

and commercializing novel medicines for rare diseases, today announced financial results for the full-year ended December 31, 2023.

“In

2023, Amicus made tremendous progress across all our strategic priorities,” said Bradley Campbell, President and Chief

Executive Officer of Amicus Therapeutics, Inc. “We strengthened our leadership position in Fabry and Pompe disease globally

and achieved our goal of non-GAAP profitability in the fourth quarter. Patient demand for Galafold exceeded our expectations and

grew at the highest rate seen in the last four years, and we continue to be excited by the long-term growth potential of this

important medicine. We also successfully launched our second commercial therapy, Pombiliti + Opfolda, in the three largest Pompe

disease markets. In 2024, we will continue to drive significant top line revenue growth supported by sustained double-digit Galafold

performance and the successful ongoing global commercial launch of Pombiliti + Opfolda, putting us on track for our first full year

of non-GAAP profitability. Amicus is at a major inflection point and strongly positioned to continue to advance our mission of

delivering groundbreaking new medicines to thousands of people living with rare diseases and creating value for our

shareholders.”

Corporate Highlights:

| · | Total

revenues for the full-year 2023 were $399.4 million, up 21%, reflecting operational growth

measured at constant exchange rates (CER)1 of 20% and favorable currency impact

of $2.7 million or 1%. Fourth quarter total revenues were $115.1 million, up 31%, or 27%

at CER. |

| (in thousands) | |

Three Months Ended

December 31, | | |

Year over Year %

Growth | | |

Twelve Months Ended December 31, | | |

Year over Year % Growth | |

| | |

2023 | | |

2022 | | |

Reported | | |

at CER1 | | |

2023 | | |

2022 | | |

Reported | | |

at CER1 | |

| Galafold® | |

| 106,600 | | |

| 87,989 | | |

| 21 | % | |

| 18 | % | |

| 387,777 | | |

| 329,046 | | |

| 18 | % | |

| 17 | % |

| Pombiliti™ + Opfolda™ | |

| 8,482 | | |

| 107 | | |

| n/a | | |

| n/a | | |

| 11,579 | | |

| 187 | | |

| n/a | | |

| n/a | |

| Net Product Revenues | |

$ | 115,082 | | |

$ | 88,096 | | |

| 31 | % | |

| 27 | % | |

$ | 399,356 | | |

$ | 329,233 | | |

| 21 | % | |

| 20 | % |

| · | Galafold

(migalastat) net product sales for the full-year 2023 were $387.8 million, representing

a year-over-year increase of 18%, or 17% at CER. Fourth quarter net product sales were $106.6

million. At the end of 2023, there were >2,400 people living with Fabry disease on Galafold

following a year of increased demand. |

| · | Pombiliti

(cipaglucosidase alfa-atga) + Opfolda (miglustat) net product sales for the full-year 2023

were $11.6 million. Fourth quarter net product sales were $8.5 million. The commercial

launch of Pombiliti + Opfolda is underway in the three largest markets with 120 patients

on treatment with commercial product or scheduled to be treated as of early January and continued strong patient demand. |

| · | Eleven

posters and an oral presentation highlighting Amicus’ development programs in Fabry

disease and Pompe disease presented at the 20th Annual WORLDSymposium™.

Pombiliti (cipaglucosidase alfa-atga) + Opfolda (miglustat) honored with the 2024 New Treatment

Award, which recognizes important achievements in advancing new treatments approved for lysosomal

diseases. |

| · | On

a GAAP basis, net loss in the fourth quarter of 2023 was $33.8 million. The Company achieved

non-GAAP profitability3 in the fourth quarter of 2023 of $2.6 million. |

Full-Year 2023 Financial Results

| · | Total

revenue in the full-year 2023 was $399.4 million, a year-over-year increase of 21% from total

revenue of $329.2 million in the full-year 2022. On a constant currency basis, full-year

2023 total revenue growth was 20%. Reported revenue had a favorable currency impact of approximately

$2.7 million, or 1%. |

| · | Total

GAAP operating expenses of $439.2 million for the full-year 2023 decreased by 13% as compared

to $502.8 million for the full-year 2022. |

| · | Total

non-GAAP operating expenses of $341.6 million for the full-year 2023 decreased by 17% as

compared to $413.2 million for the full-year 2022. |

| · | GAAP

net loss was $151.6 million, or $0.51 per share, for the full-year 2023, and was reduced

compared to a net loss of $236.6 million, or $0.82 per share, for the full-year 2022. |

| · | Non-GAAP

net loss was $38.5 million, or $0.13 per share, for the full-year 2023, and was reduced compared

to a net loss of $152.5 million, or $0.53 per share, for the full-year 2022. |

| · | Cash,

cash equivalents, and marketable securities totaled $286.2 million at December 31, 2023,

compared to $293.6 million at December 31, 2022. |

2024 Financial

Guidance

| · | For

the full-year 2024, the Company anticipates total Galafold revenue growth between 11% and

16% at CER1 driven by continued underlying demand from both switch and treatment-naïve

patients, geographic expansion, label extensions, the continued diagnosis of new Fabry patients,

and commercial execution across all major markets, including the U.S., EU, U.K., and Japan.

|

| · | Non-GAAP

operating expense guidance for the full-year 2024 is $345 million to $365 million, driven

by disciplined expense management offset by continued investment in Galafold, Pombiliti +

Opfolda clinical studies, as well as global launch activities4. |

Amicus

is focused on the following key strategic priorities in 2024:

| · | Delivering

double-digit Galafold revenue growth (11-16% at CER) |

| · | Executing

multiple successful launches of Pombiliti + Opfolda |

| · | Advancing

ongoing studies to support medical and scientific leadership in Fabry and Pompe diseases |

| · | Achieving

full year non-GAAP profitability2 |

1 In

order to illustrate underlying performance, Amicus discusses its results in terms of constant exchange rate (CER) growth. This represents

growth calculated as if the exchange rates had remained unchanged from those used in the comparative period. Full-year 2024 Galafold

revenue guidance utilizes actual exchange rate as of December 31, 2023.

2 Based

on projections of Amicus’ non-GAAP Net (Loss) Income under current operating plans, which includes successful Pombiliti + Opfolda

launches and continued Galafold growth. Amicus defines non-GAAP Net (Loss) Income as GAAP Net (Loss) Income excluding the impact of share-based

compensation expense, changes in fair value of contingent consideration, loss on impairment of assets, depreciation and amortization,

acquisition related income (expense), loss on extinguishment of debt, restructuring charges and income taxes.

3 Full

reconciliation of GAAP results to the Company’s non-GAAP adjusted measures for all reporting periods appear in the tables to this

press release.

4 A

reconciliation of the differences between the non-GAAP expectation and the corresponding GAAP measure is not available without unreasonable

effort due to high variability, complexity, and low visibility as to the items that would be excluded from the GAAP measure.

Conference

Call and Webcast

Amicus

Therapeutics will host a conference call and audio webcast today, February 28, 2024, at 8:30 a.m. ET to discuss the full-year 2023 financial

results and corporate updates. Participants and investors interested in accessing the call by phone will need to register using the online

registration form. After registering, all phone participants will receive a dial-in number along

with a personal PIN number to access the event.

A

live audio webcast and related presentation materials can also be accessed via the Investors section of the Amicus Therapeutics corporate

website at ir.amicusrx.com. Web participants are encouraged

to register on the website 15 minutes prior to the start of the call. An archived webcast and accompanying slides will be available on

the Company's website shortly after the conclusion of the live event.

About

Galafold

Galafold® (migalastat)

123 mg capsules is an oral pharmacological chaperone of alpha-Galactosidase A (alpha-Gal A) for the treatment of Fabry disease in adults

who have amenable galactosidase alpha gene (GLA) variants. In these patients, Galafold works by stabilizing the body’s

own dysfunctional enzyme so that it can clear the accumulation of disease substrate. Globally, Amicus Therapeutics estimates that approximately

35 to 50 percent of people living with Fabry disease may have amenable GLA variants, though amenability rates within

this range vary by geography. Galafold is approved in more than 40 countries around the world, including the U.S., EU, U.K., and Japan.

U.S. INDICATIONS

AND USAGE

Galafold is indicated for the treatment of adults with a confirmed diagnosis of Fabry disease and an amenable galactosidase alpha gene

(GLA) variant based on in vitro assay data.

This indication

is approved under accelerated approval based on reduction in kidney interstitial capillary cell globotriaosylceramide (KIC GL-3) substrate.

Continued approval for this indication may be contingent upon verification and description of clinical benefit in confirmatory trials.

U.S. IMPORTANT

SAFETY INFORMATION

ADVERSE

REACTIONS

The most common adverse reactions reported with Galafold (≥10%) were headache, nasopharyngitis, urinary tract infection, nausea and

pyrexia.

USE IN SPECIFIC

POPULATIONS

There is insufficient clinical data on Galafold use in pregnant women to inform a drug-associated risk for major birth defects and miscarriage.

Advise women of the potential risk to a fetus.

It is not known

if Galafold is present in human milk. Therefore, the developmental and health benefits of breastfeeding should be considered along with

the mother’s clinical need for Galafold and any potential adverse effects on the breastfed child from Galafold or from the underlying

maternal condition.

Galafold is

not recommended for use in patients with severe renal impairment or end-stage renal disease requiring dialysis.

The safety

and effectiveness of Galafold have not been established in pediatric patients.

To report Suspected

Adverse Reactions, contact Amicus Therapeutics at 1-877-4AMICUS or FDA at 1-800-FDA-1088 or www.fda.gov/medwatch.

For additional

information about Galafold, including the full U.S. Prescribing Information, please visit https://www.amicusrx.com/pi/Galafold.pdf.

About Pombiliti

+ Opfolda

Pombiliti + Opfolda,

is a two-component therapy that consists of cipaglucosidase alfa-atga, a bis-M6P-enriched rhGAA that facilitates high-affinity uptake

through the M6P receptor while retaining its capacity for processing into the most active form of the enzyme, and the oral enzyme stabilizer,

miglustat, that’s designed to reduce loss of enzyme activity in the blood.

U.S. INDICATIONS

AND USAGE

POMBILITI in combination

with OPFOLDA is indicated for the treatment of adult patients with late-onset Pompe disease (lysosomal acid alpha-glucosidase [GAA] deficiency)

weighing ≥40 kg and who are not improving on their current enzyme replacement therapy (ERT).

SAFETY INFORMATION

HYPERSENSITIVITY

REACTIONS INCLUDING ANAPHYLAXIS: Appropriate medical support measures, including cardiopulmonary resuscitation equipment, should be readily

available. If a severe hypersensitivity reaction occurs, POMBILITI should be discontinued immediately and appropriate medical treatment

should be initiated. INFUSION-ASSOCIATED REACTIONS (IARs): If severe IARs occur, immediately discontinue POMBILITI and initiate appropriate

medical treatment. RISK OF ACUTE CARDIORESPIRATORY FAILURE IN SUSCEPTIBLE PATIENTS: Patients susceptible to fluid volume overload, or

those with acute underlying respiratory illness or compromised cardiac or respiratory function, may be at risk of serious exacerbation

of their cardiac or respiratory status during POMBILITI infusion. See PI for complete Boxed Warning. CONTRAINDICATION: POMBILITI

in combination with Opfolda is contraindicated in pregnancy. EMBRYO-FETAL TOXICITY: May cause

embryo-fetal harm. Advise females of reproductive potential of the potential risk to a fetus and to use effective contraception during

treatment and for at least 60 days after the last dose. Adverse Reactions: Most common adverse

reactions ≥ 5% are headache, diarrhea, fatigue, nausea, abdominal pain, and pyrexia. Please see full PRESCRIBING INFORMATION,

including BOXED WARNING, for POMBILITI (cipaglucosidase alfa-atga) LINK and full PRESCRIBING INFORMATION for OPFOLDA (miglustat)

LINK.

About Amicus

Therapeutics

Amicus Therapeutics

(Nasdaq: FOLD) is a global, patient-dedicated biotechnology company focused on discovering, developing and delivering novel high-quality

medicines for people living with rare diseases. With extraordinary patient focus, Amicus Therapeutics is committed to advancing and expanding

a pipeline of cutting-edge, first- or best-in-class medicines for rare diseases. For more information please visit the company’s

website at www.amicusrx.com, and follow on X and LinkedIn.

Non-GAAP

Financial Measures

In addition to

financial information prepared in accordance with U.S. GAAP, this press release also contains adjusted financial measures that we believe

provide investors and management with supplemental information relating to operating performance and trends that facilitate comparisons

between periods and with respect to projected information. These adjusted financial measures are non-GAAP measures and should be considered

in addition to, but not as a substitute for, the information prepared in accordance with U.S. GAAP. We use these non-GAAP measures as

key performance measures for the purpose of evaluating operational performance and cash requirements internally. We typically exclude

certain GAAP items that management does not believe affect our basic operations and that do not meet the GAAP definition of unusual or

non-recurring items. Other companies may define these measures in different ways. When we provide our expectation for non-GAAP operating

expenses and profitability on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectation and the corresponding

GAAP measure generally is not available without unreasonable effort due to potentially high variability, complexity and low visibility

as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains or losses. The variability

of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results.

Forward Looking Statement

This press release

contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 relating to

preclinical and clinical development of our product candidates, the timing and reporting of results from preclinical studies and clinical

trials, the prospects and timing of the potential regulatory approval of our product candidates, commercialization plans, manufacturing

and supply plans, financing plans, and the projected revenues and cash position for the Company. The inclusion of forward-looking statements

should not be regarded as a representation by us that any of our plans will be achieved. Any or all of the forward-looking statements

in this press release may turn out to be wrong and can be affected by inaccurate assumptions we might make or by known or unknown risks

and uncertainties. For example, with respect to statements regarding the goals, progress, timing, and outcomes of discussions with regulatory

authorities and pricing and reimbursement authorities, are based on current information. Actual results may differ materially from those

set forth in this release due to the risks and uncertainties inherent in our business, including, without limitation: the potential that

results of clinical or preclinical studies indicate that the product candidates are unsafe or ineffective; the potential that it may

be difficult to enroll patients in our clinical trials; the potential that regulatory authorities may not grant or may delay approval

for our product candidates; the potential that required regulatory inspections may be delayed or not be successful and delay or prevent

product approval; the potential that we may not be successful in negotiations with pricing and reimbursement authorities; the potential

that we may not be successful in commercializing Galafold and/or Pombiliti and Opfolda in Europe, the UK, the US and other geographies;

the potential that preclinical and clinical studies could be delayed because we identify serious side effects or other safety issues;

the potential that we may not be able to manufacture or supply sufficient clinical or commercial products; and the potential that we

will need additional funding to complete all of our studies, the manufacturing, and commercialization of our products. With respect to

statements regarding corporate financial guidance and financial goals and the expected attainment of such goals and projections of the

Company's revenue, non-GAAP profitability and cash position, actual results may differ based on market factors and the Company's ability

to execute its operational and budget plans. In addition, all forward-looking statements are subject to other risks detailed in our Annual

Report on Form 10-K for the year ended December 31, 2023 to be filed today. You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary

statement, and we undertake no obligation to revise or update this news release to reflect events or circumstances after the date hereof.

CONTACT:

Investors:

Amicus Therapeutics

Andrew Faughnan

Vice

President, Investor Relations

afaughnan@amicusrx.com

(609)

662-3809

Media:

Amicus Therapeutics

Diana Moore

Head of Global

Corporate Affairs and Communications

dmoore@amicusrx.com

(609) 662-5079

FOLD-G

TABLE 1

Amicus Therapeutics, Inc.

Consolidated

Statements of Operations

(in thousands,

except share and per share amounts)

| | |

Years Ended December 31, | |

| | |

2023 | | |

2022 | | |

2021 | |

| Net product sales | |

$ | 399,356 | | |

$ | 329,233 | | |

$ | 305,514 | |

| Cost of goods sold | |

| 37,326 | | |

| 38,599 | | |

| 34,466 | |

| Gross profit | |

| 362,030 | | |

| 290,634 | | |

| 271,048 | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Research and development | |

| 152,381 | | |

| 276,677 | | |

| 272,049 | |

| Selling, general, and administrative | |

| 275,270 | | |

| 213,041 | | |

| 192,710 | |

| Changes in fair value of contingent consideration payable | |

| 2,583 | | |

| 1,078 | | |

| 6,514 | |

| Loss on impairment of assets | |

| 1,134 | | |

| 6,616 | | |

| — | |

| Depreciation and amortization | |

| 7,873 | | |

| 5,342 | | |

| 6,209 | |

| Total operating expenses | |

| 439,241 | | |

| 502,754 | | |

| 477,482 | |

| Loss from operations | |

| (77,211 | ) | |

| (212,120 | ) | |

| (206,434 | ) |

| Other (expense) income: | |

| | | |

| | | |

| | |

| Interest income | |

| 7,078 | | |

| 3,024 | | |

| 509 | |

| Interest expense | |

| (50,149 | ) | |

| (37,119 | ) | |

| (32,471 | ) |

| Loss on extinguishment of debt | |

| (13,933 | ) | |

| — | | |

| (257 | ) |

| Other (expense) income | |

| (15,886 | ) | |

| 4,176 | | |

| (2,901 | ) |

| Loss before income tax | |

| (150,101 | ) | |

| (242,039 | ) | |

| (241,554 | ) |

| Income tax (expense) benefit | |

| (1,483 | ) | |

| 5,471 | | |

| (8,906 | ) |

| Net loss attributable to common stockholders | |

$ | (151,584 | ) | |

$ | (236,568 | ) | |

$ | (250,460 | ) |

| Net loss attributable to common stockholders per common share — basic and diluted | |

$ | (0.51 | ) | |

$ | (0.82 | ) | |

$ | (0.92 | ) |

| Weighted-average common shares outstanding — basic and diluted | |

| 295,164,515 | | |

| 289,057,198 | | |

| 271,421,986 | |

TABLE 2

Amicus Therapeutics, Inc.

Consolidated

Balance Sheets

(in thousands,

except share and per share amounts)

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 246,994 | | |

$ | 148,813 | |

| Investments in marketable securities | |

| 39,206 | | |

| 144,782 | |

| Accounts receivable | |

| 87,632 | | |

| 66,196 | |

| Inventories | |

| 59,696 | | |

| 23,816 | |

| Prepaid expenses and other current assets | |

| 49,533 | | |

| 40,209 | |

| Total current assets | |

| 483,061 | | |

| 423,816 | |

| Operating lease right-of-use assets, net | |

| 26,312 | | |

| 29,534 | |

| Property and equipment, less accumulated depreciation of $25,429 and $22,281 at December 31, 2023 and 2022, respectively | |

| 31,667 | | |

| 30,778 | |

| Intangible assets, less accumulated amortization of $2,510 and $0 at December 31, 2023 and December 31, 2022, respectively | |

| 20,490 | | |

| 23,000 | |

| Goodwill | |

| 197,797 | | |

| 197,797 | |

| Other non-current assets | |

| 18,553 | | |

| 19,242 | |

| Total Assets | |

$ | 777,880 | | |

$ | 724,167 | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 15,120 | | |

$ | 15,413 | |

| Accrued expenses and other current liabilities | |

| 144,245 | | |

| 93,636 | |

| Contingent consideration payable | |

| — | | |

| 21,417 | |

| Operating lease liabilities | |

| 8,324 | | |

| 8,552 | |

| Total current liabilities | |

| 167,689 | | |

| 139,018 | |

| Long-term debt | |

| 387,858 | | |

| 391,990 | |

| Operating lease liabilities | |

| 48,877 | | |

| 51,578 | |

| Other non-current liabilities | |

| 13,282 | | |

| 18,534 | |

| Total liabilities | |

| 617,706 | | |

| 601,120 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Common stock, $0.01 par value, 500,000,000 shares authorized, 293,594,209 and 281,108,273 shares issued and outstanding at December 31, 2023 and 2022, respectively | |

| 2,918 | | |

| 2,815 | |

| Additional paid-in capital | |

| 2,836,018 | | |

| 2,664,744 | |

| Accumulated other comprehensive gain (loss): | |

| | | |

| | |

| Foreign currency translation adjustment | |

| 5,429 | | |

| (11,989 | ) |

| Unrealized loss on available-for-sale securities | |

| (188 | ) | |

| (116 | ) |

| Warrants | |

| 71 | | |

| 83 | |

| Accumulated deficit | |

| (2,684,074 | ) | |

| (2,532,490 | ) |

| Total stockholders' equity | |

| 160,174 | | |

| 123,047 | |

| Total Liabilities and Stockholders' Equity | |

$ | 777,880 | | |

$ | 724,167 | |

TABLE 3

Amicus Therapeutics, Inc.

Reconciliation

of Non-GAAP Financial Measures

(in thousands)

(Unaudited)

| | |

Years Ended December 31, | |

| | |

2023 | | |

2022 | | |

2021 | |

| Total GAAP operating expenses | |

$ | 439,241 | | |

$ | 502,754 | | |

$ | 477,482 | |

| Research and development: | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 21,469 | | |

| 25,089 | | |

| 17,340 | |

| Selling, general and administrative: | |

| | | |

| | | |

| | |

| Share-based compensation | |

| 64,608 | | |

| 51,423 | | |

| 40,498 | |

| Loss on impairment of assets | |

| 1,134 | | |

| 6,616 | | |

| — | |

| Changes in fair value of contingent consideration payable | |

| 2,583 | | |

| 1,078 | | |

| 6,514 | |

| Depreciation and amortization | |

| 7,873 | | |

| 5,342 | | |

| 6,209 | |

| Total Non-GAAP operating expense adjustments | |

| 97,667 | | |

| 89,548 | | |

| 70,561 | |

| Total Non-GAAP operating expenses | |

$ | 341,574 | | |

$ | 413,206 | | |

$ | 406,921 | |

TABLE 4

Amicus Therapeutics, Inc.

Reconciliation

of Non-GAAP Financial Measures

(in thousands,

except share and per share amounts)

(Unaudited)

| | |

Three Months Ended December 31, | | |

Years Ended December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| GAAP net loss | |

$ | (33,843 | ) | |

$ | (55,865 | ) | |

$ | (151,584 | ) | |

$ | (236,568 | ) |

| Share-based compensation | |

| 18,095 | | |

| 18,626 | | |

| 86,077 | | |

| 76,512 | |

| Loss on impairment of assets | |

| — | | |

| — | | |

| 1,134 | | |

| 6,616 | |

| Changes in fair value of contingent consideration payable | |

| — | | |

| 1,584 | | |

| 2,583 | | |

| 1,078 | |

| Depreciation and amortization | |

| 2,182 | | |

| 1,311 | | |

| 7,873 | | |

| 5,342 | |

| Loss on extinguishment of debt | |

| 13,933 | | |

| — | | |

| 13,933 | | |

| — | |

| Income tax expense (benefit) | |

| 2,183 | | |

| (14,214 | ) | |

| 1,483 | | |

| (5,471 | ) |

| Non-GAAP net income (loss) | |

$ | 2,550 | | |

$ | (48,558 | ) | |

$ | (38,501 | ) | |

$ | (152,491 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP net income (loss) attributable to common stockholders per common share — basic and diluted | |

$ | 0.01 | | |

$ | (0.17 | ) | |

$ | (0.13 | ) | |

$ | (0.53 | ) |

| Weighted-average common shares outstanding — basic and diluted | |

| 300,648,503 | | |

| 289,602,648 | | |

| 295,164,515 | | |

| 289,057,198 | |

Exhibit 99.2

| AT THE FOREFRONT OF

THERAPIES FOR RARE DISEASES

FY23 Results

Conference Call

& Webcast

February 28, 2024 |

| 2

Forward-Looking Statements

This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 relating to preclinical and clinical development of our

product candidates, the timing and reporting of results from preclinical studies and clinical trials, the prospects and timing of the potential regulatory approval of our product candidates,

commercialization plans, manufacturing and supply plans, financing plans, and the projected revenues and cash position for the Company. The inclusion of forward-looking statements

should not be regarded as a representation by us that any of our plans will be achieved. Any or all of the forward-looking statements in this press release may turn out to be wrong and

can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. For example, with respect to statements regarding the goals, progress,

timing, and outcomes of discussions with regulatory authorities and pricing and reimbursement authorities, are based on current information. Actual results may differ materially from

those set forth in this release due to the risks and uncertainties inherent in our business, including, without limitation: the potential that results of clinical or preclinical studies indicate

that the product candidates are unsafe or ineffective; the potential that it may be difficult to enroll patients in our clinical trials; the potential that regulatory authorities may not grant or

may delay approval for our product candidates; the potential that required regulatory inspections may be delayed or not be successful and delay or prevent product approval; the

potential that we may not be successful in negotiations with pricing and reimbursement authorities; the potential that we may not be successful in commercializing Galafold and/or

Pombiliti and Opfolda in Europe, the UK, the US and other geographies; the potential that preclinical and clinical studies could be delayed because we identify serious side effects or

other safety issues; the potential that we may not be able to manufacture or supply sufficient clinical or commercial products; and the potential that we will need additional funding to

complete all of our studies, the manufacturing, and commercialization of our products. With respect to statements regarding corporate financial guidance and financial goals and the

expected attainment of such goals and projections of the Company's revenue, non-GAAP profitability and cash position, actual results may differ based on market factors and the

Company's ability to execute its operational and budget plans. In addition, all forward-looking statements are subject to other risks detailed in our Annual Report on Form 10-K for the

year ended December 31, 2023 to be filed today. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All

forward-looking statements are qualified in their entirety by this cautionary statement, and we undertake no obligation to revise or update this news release to reflect events or

circumstances after the date hereof.

Non-GAAP Financial Measures

In addition to financial information prepared in accordance with U.S. GAAP, this presentation also contains adjusted financial measures that we believe provide investors and

management with supplemental information relating to operating performance and trends that facilitate comparisons between periods and with respect to projected information. These

adjusted financial measures are non-GAAP measures and should be considered in addition to, but not as a substitute for, the information prepared in accordance with U.S. GAAP. We

typically exclude certain GAAP items that management does not believe affect our basic operations and that do not meet the GAAP definition of unusual or non-recurring items. Other

companies may define these measures in different ways. When we provide our expectation for non-GAAP operating expenses on a forward-looking basis, a reconciliation of the

differences between the non-GAAP expectation and the corresponding GAAP measure generally is not available without unreasonable effort due to potentially high variability,

complexity and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains or losses. The variability of the excluded

items may have a significant, and potentially unpredictable, impact on our future GAAP results. |

| 3

A leading biotech company with >$500M of sales projected in 2024

A Rare Company

LEVERAGEABLE

GLOBAL

COMMERCIAL

ORGANIZATION

>500 EMPLOYEES

in 20+ Countries

First Two-Component Therapy

for Pompe Disease

2

APPROVED

THERAPIES

Combined Peak

Revenue Potential

$1.5B – $2B

Non-GAAP

PROFITABILITY

Q4 2023

ACHIEVED

World Class

Clinical

Development

Capabilities

$399M

in 2023 Revenue

21%

Increase Year-Over-Year

Expect Full Year

2024

Non-GAAP

Profitability |

| 1

2

3

4

A Transformative

Year Ahead for

Amicus

1CER: Constant Exchange Rates; 2024 Galafold revenue guidance utilizes actual exchange rate as of December 31, 2023

2024

Strategic

Priorities

4

Drive double-digit Galafold® revenue growth of 11-16% at CER1

Execute multiple successful launches of Pombiliti + Opfolda

Advance ongoing studies to support medical and scientific

leadership in Fabry and Pompe diseases

Achieve non-GAAP profitability for the full year |

| 5

Galafold® (migalastat)

Continued Growth

Building a leadership position in the

treatment of Fabry disease |

| 6

Galafold is the only approved oral treatment option in Fabry disease

2023 Galafold Success (as of December 31, 2023)

Galafold is indicated for adults with a confirmed diagnosis of Fabry disease and an amenable variant. The most common adverse reactions reported with Galafold (≥10%)

were headache, nasopharyngitis, urinary tract infection, nausea, and pyrexia. For additional information about Galafold, including the full U.S. Prescribing Information, please

visit https://www.amicusrx.com/pi/Galafold.pdf. For further important safety information for Galafold, including posology and method of administration, special warnings,

drug interactions, and adverse drug reactions, please see the European SmPC for Galafold available from the EMA website at www.ema.europa.eu.

A unique mechanism of action for

Fabry patients with amenable variants

35-50%

Fabry Patients

Amenable to

Galafold 40+

Countries with

Regulatory

Approvals

2,400+

Individuals

Treated

$388M

2023 Galafold

Revenue

17%

YoY Growth at CER1

60-65%

Share of Treated

Amenable Patients

1CER: Constant Exchange Rates |

| 7

Galafold YTD reported revenue growth of +18% to $388M

FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24

$5M

$37M

$91M

$182M

$261M

$306M

$329M

Galafold Performance

Global mix of switch (~43%) and previously

untreated patients (~57%)2

Expect non-linear quarterly growth to continue

due to uneven ordering patterns

and FX fluctuations

FY24 revenue growth guidance to 11% to 16% at CER

1 At constant exchange rate (CER)

2 Data on file

Q1

$86M

Q2

$94M

Q3

$101M

Q4

$107M

$388M

$430M-450M1

Distribution of Galafold revenue

by quarter over previous 5 years:

Q1 Q2 Q3 Q4

5 Year Avg. 22% 24% 26% 28% |

| 8

Key Growth Drivers for 2024

Building off a strong year with highest patient demand seen in last four years to lay the

groundwork for continued double-digit Galafold growth in 2024

Increasing patient identification through ongoing medical

education, screening, and improved diagnostics

Driving market share of treated amenable patients

through excellent execution

Expanding market through uptake in naïve population

as well as geographic and label expansion

Maintaining >90% adherence and compliance through HCP

and patient education and support

8 |

| 9

Pombiliti (cipaglucosidase alfa-atga)

Opfolda (miglustat)

Potential to establish a new standard of care

for people living with late-onset Pompe disease

+ |

| 10

Successful Global Launch of Pombiliti + Opfolda Underway

FY 2023 revenue of $11.6M ($8.5M in Q4 2023) provides strong foundation for 2024

Access and

Reimbursement

Positive interactions

with US, UK, and EU payors

Focus on broad patient

access

Country-by-country

reimbursement process

underway

Multiple launches expected

in 2H 2024

~120 patients treated with

commercial product or

scheduled to be treated

~105 patients from clinical

trials and early access

~15 new patients from

competitor ERTs or naïve

Very positive early feedback

from real-world experience

KOL Outreach

Successfully engaged with

top prescribers in each

approved country

Existing relationships with

HCPs at key treatment

centers

Ongoing disease education

Patient Demand

As of early January 2024

10

Focus in 2024 is on maximizing the number of patients on therapy by year end |

| 11

Regulatory and Clinical Updates

Continuing to build the body of evidence and expand commercial access

>10 reimbursement dossiers and multiple

regulatory submissions throughout 2024

Ongoing clinical studies in children with late-onset

Pompe disease (LOPD) and infantile-onset Pompe

disease (IOPD)

Amicus registry for Pompe disease to continue

generating evidence on differentiated MOA and

long-term effect

Significant presence at WORLDSymposium 2024

with 11 posters and an oral presentation

highlighting work in Fabry and Pompe |

| 12

Corporate Outlook

Delivering on our mission for patients

and shareholders |

| 13

FY 2023 Select Financial Results

2023 revenue of $399.4M, up 20% at CER, and net loss significantly reduced

(in thousands, except per share data) Dec. 31, 2023

Dec. 31, 2022

Product Revenue $399,356 $329,233

Cost of Goods Sold 37,326 38,599

R&D Expense 152,381 276,677

SG&A Expense 275,270 213,041

Changes in Fair Value of Contingent Consideration 2,583 1,078

Loss on Impairment of Assets 1,134 6,616

Depreciation and Amortization 7,873 5,342

Loss from Operations (77,211) (212,120)

Interest Income 7,078 3,024

Interest Expense (50,149) (37,119)

Loss on Extinguishment of Debt (13,933) ―

Other (Expense) Income (15,886) 4,176

Income Tax (Expense) Benefit (1,483) 5,471

Net Loss (151,584) (236,568)

Net Loss Per Share (0.51) (0.82)

2023 weighted-average common shares outstanding: 295,164,515

2022 weighted-average common shares outstanding: 289,057,198 |

| Financial Outlook and Path to Profitability

Clear strategy to build our business, advance our portfolio, and achieve profitability

14

Sustain Revenue

Growth

Deliver on

Financial Goals

Successfully Launch

Pombiliti + Opfolda

$399M FY23 revenue,

+21% YoY growth

>$500M in total

revenue in FY24

Galafold and

Pombiliti + Opfolda

expected to drive

strong double-digit

growth long term

Focused on disciplined

expense management

Achieve FY24

non-GAAP profitability1

1 Based on projections of Amicus non-GAAP Net (Loss) Income under current operating plans. We define non-GAAP Net (Loss) Income as GAAP Net (Loss) Income excluding the impact of share-based compensation expense, changes in fair value of contingent

consideration, depreciation and amortization, acquisition related income (expense), loss on extinguishment of debt, loss on impairment of assets, restructuring charges, and income taxes.

FY24 non-GAAP operating

expense guidance of

$345M-$365M |

| 15

Accelerating

total revenue

growth

Positioned for Significant Value Creation in 2024

Unlocking the value of two unique commercial therapies in sizeable and growing markets

1 Non-GAAP Net (Loss) Income defined as GAAP Net (Loss) Income excluding the impact of stock-based compensation expense, changes in fair value of contingent consideration, loss on impairment of

assets, depreciation and amortization, acquisition related income (expense), loss on extinguishment of debt, restructuring charges and income taxes.

Clear line of

sight to

generating

positive

cashflow

Delivering

full-year

non-GAAP1

profitability |

| Appendix |

| 17

Appendix I |

| 18

Appendix II |

| 19

Environmental, Social, & Governance (ESG) Snapshot

Board of Directors

Committed to ongoing Board refreshment and diversity of

background, gender, skills, and experience:

80% Board

Independence

60% Overall Board

Diversity

Address a rare genetic disease

First-in-class or best-in-class

Impart meaningful benefit for patients

517

Global Employees

58%

% Female Employees

Who We Serve Our mission is to drive

sustainability with

our partners by

incorporating

environmental and

sustainability principles

into all our commercial

relationships

Pledge for a Cure

Designate a portion of product revenue back into

R&D for that specific disease until there is a cure.

Programs we

invest in

have 3 key

characteristics

3 Female

2 Veteran Status

1 African American

Director Diversity

Leverage employee capabilities and expertise to provide a

culture that drives performance and ultimately attracts,

energizes, and retains critical talent.

Employee Recruitment,

Engagement, & Retention

Pulse surveys reveal employees feel high personal

satisfaction in their job, are proud of their work

and what they contribute to the community

Career Development

Reimagined performance management process to

measure the what and the how, rewarding those who

role-model our Mission-focused Behaviors.

Committed to producing

transformative medicines for

people living with rare diseases

while practicing environmental

responsibility and adhering to

sustainability best practices in our

operations.

Environmental

Management

0% Amicus-owned Direct Manufacturing

and Related GHG Emissions

Diversity, Equity, &

Inclusion (DEI)

580

Volunteer

hours (U.S.):

22

Amicus-supported

community programs:

32 patients /24countries

Expanded Access through Jan 2024:

Pricing PROMISE

Contributions allocated:

$2,288,998 U.S.

$954,349 Intl.

Charitable Giving

Committed to never raising the annual price of

our products more than consumer inflation.

Pledge to support a more inclusive culture to impact

our employees, our communities, and society.

Goal of maintaining gender diversity and

increasing overall diversity throughout

our global workforce. |

| 20

FX Sensitivity and Galafold Distribution of Quarterly Sales

Impact from Foreign Currency Q4 2023:

Currency Variances:

USD/

Q4 2022 Q4 2023 YoY Variance

EUR 1.021 1.076 5.4%

GBP 1.174 1.241 5.7%

JPY 0.007 0.007 (4.4%)

Full-year 2024 Revenue Sensitivity

Given the high proportion of Amicus revenue Ex-US (~60%), a change in exchange rates of

+/- 5% compared to year-end 2023 rates could lead to a $15M move in global reported

revenues in 2024.

Distribution of Galafold Revenue

by Quarter over Past 5 Years:

Q1 Q2 Q3 Q4

5 Year Avg. 22% 24% 26% 28% |

| 21

Streamlined Rare Disease Pipeline with Focus on Fabry Disease and

Pompe Disease Franchises

INDICATION DISCOVERY PRECLINICAL PHASE 1/2 PHASE 3 REGULATORY COMMERCIAL

FABRY FRANCHISE

Galafold® (migalastat)

Fabry Genetic Medicines

Next-Generation Chaperone

POMPE FRANCHISE

Pombiliti (cipaglucosidase alfa-atga) + Opfolda (miglustat)

Pompe Genetic Medicines

OTHER

Discovery Programs |

| Thank you |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

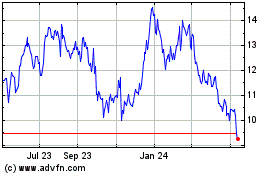

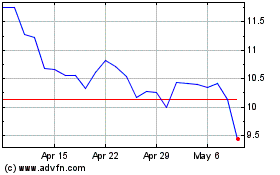

Amicus Therapeutics (NASDAQ:FOLD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amicus Therapeutics (NASDAQ:FOLD)

Historical Stock Chart

From Nov 2023 to Nov 2024