0000799850 False 0000799850 2024-09-04 2024-09-04 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 4, 2024

_______________________________

America's Car-Mart Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Texas | 0-14939 | 63-0851141 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1805 North 2nd Street, Suite 401

Rogers, Arkansas 72756

(Address of Principal Executive Offices) (Zip Code)

(479) 464-9944

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CRMT | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On September 4, 2024, America’s Car-Mart, Inc. (the “Company”) issued a press release announcing its operating results for the first quarter ended July 31, 2024. The press release contains certain financial, operating and other information for the period ended July 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

In accordance with General Instruction B.2., the information contained in Item 2.02 of this Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act. The Company undertakes no obligation to update or revise this information.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | America's Car-Mart Inc. |

| | | |

| | | |

| Date: September 4, 2024 | By: | /s/ Vickie D. Judy |

| | | Vickie D. Judy |

| | | Chief Financial Officer (Principal Financial Officer) |

| | | |

EXHIBIT 99.1

America’s Car-Mart Reports First Quarter Fiscal Year 2025

Results

ROGERS, Ark., Sept. 04, 2024 (GLOBE NEWSWIRE) -- America’s Car-Mart, Inc. (NASDAQ: CRMT) (“we,” “Car-Mart”

or the “Company”), today reported financial results for the first quarter ended July 31, 2024.

First Quarter Key Highlights (FY'25 vs. FY'24 Q1, unless otherwise noted)

- Revenue was $347.8 million, down 5.2%

- Interest income increased $4.1 million, up 7.2%

- Total collections increased 4.3% to $172.9 million

- Favorable adjustment to allowance for credit loss to 25.0%, down from 25.32%

- Net charge-offs as a % of average finance receivables were 6.4% vs. 5.8%

- Interest expense increased $4.0 million, or 28.3%

- Loss per share of $0.15 vs. diluted earnings per share of $0.63

President and CEO Doug Campbell commentary:

“I’m encouraged with our rebound in sales volume from two quarters ago, despite the ongoing economic challenges

facing the customer today. During the quarter, our new loan origination system (“LOS”) contributed to higher down payments

and improved deal structures. I’d like to recognize our operations team for improvements on several credit metrics. Affordability

remains Car-Mart’s number one focus in putting and keeping customers on the road. We believe that our strategic priorities, including

acquisitions like Texas Auto Center completed in June, will strengthen our competitive position and along with cost control initiatives,

can drive better results for the remainder of the fiscal year.”

| First

Quarter Fiscal Year 2025 Key Operating Metrics |

| |

Dollars in thousands, except per share data. Dollar and percentage changes may not recalculate due to rounding. Charts may not

be to scale.

Note: Discussions in each section provide information for the first quarter of fiscal year 2025 compared to the first quarter

of fiscal year 2024, unless otherwise noted.

| First

Quarter Business Review |

| |

TOTAL REVENUE – A 5.2% drop in revenue was primarily driven by the decrease in retail units

sold. A portion of the decline in revenue was offset by increases in interest income and average retail sales price. We had a sequential

reduction in the average retail sales price, excluding ancillary products, of approximately $100. Our initiatives in place should allow

us to see this favorability continue throughout the balance of the calendar year.

SALES – Sales for the quarter were 14,391 units vs. 15,912 units, down 9.6%. This is the second

quarter of sequential improvement in unit sales on a year-on-year basis.

GROSS PROFIT – Gross profit margin as a percentage of sales was 35%, or $6,996 per unit, an

improvement of 30 basis points, or $228 per unit. This 3.4% increase resulted from continued execution and focus on gross margin.

NET CHARGE-OFFS – Net charge-offs as a percentage of average finance receivables were 6.4% compared

to 5.8%. On a relative basis, we experienced continued increases in both the frequency and severity of losses, primarily from FY 22 and

FY 23 originations. This is evident when looking at our cash-on-cash returns table contained here. As a reference, the quarterly performance

of net charge-offs for the five-year period preceding the pandemic period ranged from 5.9% - 8.7%, signaling a return to more normal pre-pandemic

levels.

ALLOWANCE FOR CREDIT LOSSES – The allowance for credit loss as a percentage of finance receivables,

net of deferred revenue and pending accident protection plan claims, decreased from 25.32% at April 30, 2024, to 25.0% at July 31, 2024

providing a 32 basis points benefit to the provision for credit losses. The primary driver of this favorability are originations from

our new LOS and their favorable performance when compared to originations from the legacy underwriting system. As of July 31, 2024, approximately

40% of the outstanding portfolio balance originated from LOS. Delinquencies (accounts over 30 days past due) improved by 90 basis points

to 3.5% of finance receivables as of July 31, 2024, but increased sequentially by 40 basis points from 3.1% of finance receivables as

of April 30, 2024. This put us ending the quarter with recency, the average percentage of receivables current, at 82.3%. This is higher

than any quarter within the last two fiscal years.

UNDERWRITING – Average down payments improved to 5.2%, 20 basis points over the prior year first

quarter. The average originating term was 44.3 months, down from the prior year’s 44.7 months, despite a 2.4% higher average sales

price. These improved deal structures are expected to strengthen the performance of the portfolio going forward. The projected cash-on-cash

returns for the quarter improved to 72.4%, a 290-basis points improvement over originations in the prior quarter. Please see the table

and supplemental material for Cash-on-Cash returns.

SG&A EXPENSE – SG&A expense was $46.7 million compared to $46.5 million. Although we

had favorable declines in payroll and payroll-related costs from prior expense management actions, expenses supporting recently implemented

technology offset this favorability. When looking at SG&A per customer, it was $453 compared to $444 the prior year. This 2% increase

is also driven by our most recent acquisitions who are currently building a book of customers. We expect this dynamic to improve in subsequent

quarters and ultimately provide SG&A leverage.

LEVERAGE & LIQUIDITY – Debt to finance receivables and debt, net of cash, to finance receivables

(non-GAAP)1 were 53.4% and 46.7%, compared to 49.3% and 42.9%, respectively, at the end of the prior year’s first quarter (sequentially

52.6% and 46.0%, respectively). During the first quarter, we grew finance receivables by $29.9 million, increased inventory by $7.1 million,

invested $13.6 million in dealership acquisitions, and purchased fixed assets of $986,000, with a $23.7 million increase in debt, net

of cash.

ANNUAL CASH-ON-CASH RETURNS – We continue to generate solid cash-on-cash returns. During the

quarter, the frequency of losses on originations in fiscal years 2021 through 2023 were higher than prior projections; however, these

contracts represent a smaller balance of our total portfolio. In contrast, the originations generated during fiscal year 2024 improved

cash-on-cash returns by 140 basis points, mainly due to lower than projected loss rates. Fiscal year 2025 is off to a solid start with

projected returns of 72.4% due to the improved underwriting.

The following table sets forth the actual and projected cash-on-cash returns as of July 31, 2024, for the Company’s

finance receivables by origination year. The return percentages provided for contracts originated in fiscal years 2017 through 2020 reflect

the Company’s actual cash-on-cash returns.

| Cash-on-Cash

Returns2 |

| Loan Origination Year |

Prior Quarter Projected |

Current Quarter Actual/Projected |

Variance |

% of A/R Remaining |

| FY2017 |

* |

61.1% |

* |

0.0% |

| FY2018 |

* |

67.6% |

* |

0.0% |

| FY2019 |

* |

70.0% |

* |

0.1% |

| FY2020 |

* |

73.6% |

* |

0.2% |

| FY2021 |

72.8% |

72.5% |

-0.3% |

2.2% |

| FY2022 |

56.6% |

54.9% |

-1.7% |

11.7% |

| FY2023 |

52.5% |

49.1% |

-3.4% |

28.9% |

| FY2024 |

62.9% |

64.4% |

1.4% |

62.8% |

| FY2025 |

* |

72.4% |

* |

96.8% |

| * 2017 - 2020 Pools' Current Projection reflects actual cash-on-cash returns |

|

| |

|

1 Calculation of this non-GAAP financial measure and a reconciliation to the most directly comparable

GAAP measure are included in the tables accompanying this release

2“Cash-on-cash returns” represent the return on cash invested by the Company in the vehicle finance loans

the Company originates and is calculated with respect to a pool of loans (or finance receivables) by dividing total “cash in”

less “cash out” by total “cash out” with respect to such pool. “Cash in” represents the total cash

the Company expects to collect on the pool of finance receivables, including credit losses. This includes down-payments, principal and

interest collected (including special and seasonal payments) and the fair market value of repossessed vehicles, if applicable. “Cash

out” includes purchase price paid by the Company to acquire the vehicle (including reconditioning and transportation costs), and

all other post-sale expenses as well as expenses related to our ancillary products. The calculation assumes estimates on expected credit

losses net of fair market value of repossessed vehicles and the related timing of such losses as well as post sales repair expenses and

special payments. The Company evaluates and updates expected credit losses quarterly. The credit quality of each pool is monitored and

compared to prior and initial forecasts and is reflected in our on-going internal cash-on-cash projections.

| |

|

|

Three Months Ended |

|

| |

|

|

July 31, |

|

|

| |

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

| Operating Data: |

|

|

|

|

|

| |

Retail units sold |

|

14,391 |

|

|

|

15,912 |

|

|

(9.6 |

)% |

| |

Average number of stores in operation |

|

155 |

|

|

|

155 |

|

|

- |

|

| |

Average retail units sold per store per month |

|

30.9 |

|

|

|

34.2 |

|

|

(9.6 |

) |

| |

Average retail sales price |

$ |

19,250 |

|

|

$ |

18,799 |

|

|

2.4 |

|

| |

Total gross profit per retail unit sold |

$ |

6,996 |

|

|

$ |

6,768 |

|

|

3.4 |

|

| |

Total gross profit percentage |

|

35.0 |

% |

|

|

34.7 |

% |

|

|

| |

Same store revenue growth |

|

(8.6 |

)% |

|

|

8.2 |

% |

|

|

| |

Net charge-offs as a percent of average finance receivables |

|

6.4 |

% |

|

|

5.8 |

% |

|

|

| |

Total collected (principal, interest and late fees) |

$ |

172,872 |

|

|

$ |

165,747 |

|

|

4.3 |

|

| |

Average total collected per active customer per month |

$ |

562 |

|

|

$ |

535 |

|

|

5.0 |

|

| |

Average percentage of finance receivables-current (excl. 1-2 day) |

|

82.3 |

% |

|

|

80.5 |

% |

|

|

| |

Average down-payment percentage |

|

5.2 |

% |

|

|

5.0 |

% |

|

|

| |

|

|

|

|

|

|

| Period End Data: |

|

|

|

|

|

| |

Stores open |

|

156 |

|

|

|

154 |

|

|

1.3 |

% |

| |

Accounts over 30 days past due |

|

3.5 |

% |

|

|

4.4 |

% |

|

|

| |

Active customer count |

|

103,231 |

|

|

|

104,734 |

|

|

(1.4 |

) |

| |

Principal balance of finance receivables |

$ |

1,465,259 |

|

|

$ |

1,440,707 |

|

|

1.7 |

|

| |

Weighted average total contract term |

|

48.1 |

|

|

|

46.9 |

|

|

2.5 |

|

| |

|

|

|

|

|

|

| Conference

Call and Webcast |

| |

The Company will hold a conference call to discuss its quarterly results on Wednesday, September 4, 2024, at 9 am ET.

Participants may access the conference call via webcast using this link: Webcast Link. To participate via telephone,

please register in advance using this Registration Link. Upon registration, all telephone participants will receive a

one-time confirmation email detailing how to join the conference call, including the dial-in number along with a unique PIN that can be

used to access the call. All participants are encouraged to dial in 10 minutes prior to the start time. A replay and transcript of the

conference call and webcast will be available on-demand for 12 months.

| About

America's Car-Mart, Inc. |

| |

America’s Car-Mart, Inc. (the “Company”) operates automotive dealerships in 12 states and

is one of the largest publicly held automotive retailers in the United States focused exclusively on the “Integrated Auto

Sales and Finance” segment of the used car market. The Company emphasizes superior customer service and the building of strong

personal relationships with its customers. The Company operates its dealerships primarily in smaller cities throughout the South-Central

United States, selling quality used vehicles and providing financing for substantially all of its customers. For more information about

America’s Car-Mart, including investor presentations, please visit our website at www.car-mart.com.

| Non-GAAP Financial Measures |

| |

This news release contains financial information determined by methods other than in accordance with generally accepted

accounting principles (GAAP). We present total debt, net of total cash, to finance receivables, a non-GAAP measure, as a supplemental

measure of our performance. We believe total debt, net of total cash, to finance receivables is a useful measure to monitor leverage and

evaluate balance sheet risk. This measure should not be considered in isolation or as a substitute for reported GAAP results because it

may include or exclude certain items as compared to similar GAAP-based measures, and such measures may not be comparable to similarly-titled

measures reported by other companies. We strongly encourage investors to review our consolidated financial statements included in publicly

filed reports in their entirety and not rely solely on any one, single financial measure or communication. The most directly comparable

GAAP financial measure, as well as a reconciliation to the comparable GAAP financial measure, for non-GAAP financial measures are presented

in the tables of this release.

| Forward-Looking

Statements |

| |

This news release contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements address the Company’s future objectives, plans and goals, as well as the Company’s

intent, beliefs and current expectations and projections regarding future operating performance and can generally be identified by words

such as “may,” “will,” “should,” “could,” “expect,” “anticipate,”

“intend,” “plan,” “project,” “foresee,” and other similar words or phrases. Specific events

addressed by these forward-looking statements may include, but are not limited to:

- operational infrastructure investments;

- same dealership sales and revenue growth;

- customer growth and engagement;

- gross profit percentages;

- gross profit per retail unit sold;

- business acquisitions;

- inventory acquisition, reconditioning, transportation, and remarketing;

- technological investments and initiatives;

- future revenue growth;

- receivables growth as related to revenue growth;

- new dealership openings;

- performance of new dealerships;

- interest rates;

- future credit losses;

- the Company’s collection results, including but not limited to

collections during income tax refund periods;

- cash-on-cash returns from the collection of contracts originated by

the Company

- seasonality; and

- the Company’s business, operating and growth strategies and expectations.

These forward-looking statements are based on the Company’s current estimates and assumptions and involve various

risks and uncertainties. As a result, you are cautioned that these forward-looking statements are not guarantees of future performance,

and that actual results could differ materially from those projected in these forward-looking statements. Factors that may cause actual

results to differ materially from the Company’s projections include, but are not limited to:

- general economic conditions in the markets in which the Company operates,

including but not limited to fluctuations in gas prices, grocery prices and employment levels and inflationary pressure on operating costs;

- the availability of quality used vehicles at prices that will be affordable

to our customers, including the impacts of changes in new vehicle production and sales;

- the ability to leverage the Cox Automotive services agreement to perform

reconditioning and improve vehicle quality to reduce the average vehicle cost, improve gross margins, reduce credit loss, and enhance

cash flow;

- the availability of credit facilities and access to capital through

securitization financings or other sources on terms acceptable to us, and any increase in the cost of capital, to support the Company’s

business;

- the Company’s ability to underwrite and collect its contracts

effectively, including whether anticipated benefits from the Company’s recently implemented loan origination system are achieved

as expected or at all;

- competition;

- dependence on existing management;

- ability to attract, develop, and retain qualified general managers;

- changes in consumer finance laws or regulations, including but not

limited to rules and regulations that have recently been enacted or could be enacted by federal and state governments;

- the ability to keep pace with technological advances and changes in

consumer behavior affecting our business;

- security breaches, cyber-attacks, or fraudulent activity;

- the ability to identify and obtain favorable locations for new or relocated

dealerships at reasonable cost;

- the ability to successfully identify, complete and integrate new acquisitions;

- the occurrence and impact of any adverse weather events or other natural

disasters affecting the Company’s dealerships or customers; and

- potential business and economic disruptions and uncertainty that may result from any future public health

crises and any efforts to mitigate the financial impact and health risks associated with such developments.

Additionally, risks and uncertainties that may affect future results include those described from time to time in the Company’s SEC filings.

The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the

dates on which they are made.

Vickie Judy, CFO

479-464-9944

Investor_relations@car-mart.com

America’s Car-Mart

Consolidated Results of Operations

(Amounts in thousands, except per share data)

| |

|

|

|

|

|

|

|

|

|

|

|

|

As a % of Sales |

| |

|

|

|

|

|

|

Three Months Ended |

|

|

Three Months Ended |

| |

|

|

|

|

|

|

July 31, |

|

|

|

July 31, |

| |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

2024 |

|

2023 |

|

| Statements of Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Sales(1) |

|

$ |

287,248 |

|

|

$ |

310,337 |

|

|

(7.4 |

)% |

|

|

100.0 |

|

% |

|

100.0 |

% |

| |

|

Interest income |

|

|

60,515 |

|

|

|

56,456 |

|

|

7.2 |

|

|

|

21.1 |

|

|

|

18.2 |

|

| |

|

|

|

Total(1) |

|

|

347,763 |

|

|

|

366,793 |

|

|

(5.2 |

) |

|

|

121.1 |

|

|

|

118.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Cost of sales(1) |

|

|

186,570 |

|

|

|

202,647 |

|

|

(7.9 |

) |

|

|

65.0 |

|

|

|

65.3 |

|

| |

|

Selling, general and administrative |

|

46,711 |

|

|

|

46,470 |

|

|

0.5 |

|

|

|

16.3 |

|

|

|

15.0 |

|

| |

|

Provision for credit losses |

|

|

95,423 |

|

|

|

96,323 |

|

|

(0.9 |

) |

|

|

33.2 |

|

|

|

31.0 |

|

| |

|

Interest expense |

|

|

18,312 |

|

|

|

14,274 |

|

|

28.3 |

|

|

|

6.4 |

|

|

|

4.6 |

|

| |

|

Depreciation and amortization |

|

1,884 |

|

|

|

1,693 |

|

|

11.3 |

|

|

|

0.7 |

|

|

|

0.5 |

|

| |

|

Loss on disposal of property and equipment |

|

46 |

|

|

|

166 |

|

|

(72.4 |

) |

|

|

- |

|

|

|

- |

|

| |

|

|

|

Total(1) |

|

|

348,946 |

|

|

|

361,573 |

|

|

(3.5 |

) |

|

|

121.5 |

|

|

|

116.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

(Loss) income before taxes |

|

(1,183 |

) |

|

|

5,220 |

|

|

|

|

|

(0.4 |

) |

|

|

1.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(Benefit) provision for income taxes |

|

(219 |

) |

|

|

1,034 |

|

|

|

|

|

(0.1 |

) |

|

|

0.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Net (loss) income |

|

$ |

(964 |

) |

|

$ |

4,186 |

|

|

|

|

|

(0.3 |

) |

|

|

1.3 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Dividends on subsidiary preferred stock |

$ |

(10 |

) |

|

$ |

(10 |

) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Net (loss) income attributable to common shareholders |

$ |

(974 |

) |

|

$ |

4,176 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Basic |

|

$ |

(0.15 |

) |

|

$ |

0.65 |

|

|

|

|

|

|

|

|

|

|

| |

|

Diluted |

|

$ |

- |

|

|

$ |

0.63 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average number of shares used in calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Basic |

|

|

6,396,757 |

|

|

|

6,381,704 |

|

|

|

|

|

|

|

|

|

|

| |

|

Diluted |

|

|

6,396,757 |

|

|

|

6,635,002 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Some items in the prior year financial statements

were reclassified to conform to the current presentation. Reclassification had no effect on the prior year net income or shareholders

equity. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

America’s Car-Mart

Condensed Consolidated Balance Sheet and Other Data

(Amounts in thousands, except per share data)

| |

|

|

|

July 31, |

|

April 30, |

|

July 31, |

| |

|

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

| |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

4,748 |

|

|

$ |

5,522 |

|

|

$ |

6,314 |

|

|

| Restricted cash from collections on auto finance receivables |

$ |

93,873 |

|

|

$ |

88,925 |

|

|

$ |

85,887 |

|

|

| Finance receivables, net(1) |

$ |

1,126,271 |

|

|

$ |

1,098,591 |

|

|

$ |

1,115,246 |

|

(1) |

| Inventory |

|

$ |

114,548 |

|

|

$ |

107,470 |

|

|

$ |

117,186 |

|

|

| Total assets(1) |

|

$ |

1,531,270 |

|

|

$ |

1,477,644 |

|

|

$ |

1,498,906 |

|

(1) |

| Revolving lines of credit, net |

$ |

184,846 |

|

|

$ |

200,819 |

|

|

$ |

(1,035 |

) |

|

| Notes payable, net |

|

$ |

597,494 |

|

|

$ |

553,629 |

|

|

$ |

711,789 |

|

|

| Treasury stock |

|

$ |

297,810 |

|

|

$ |

297,786 |

|

|

$ |

297,489 |

|

|

| Total equity |

|

$ |

471,153 |

|

|

$ |

470,750 |

|

|

$ |

504,729 |

|

|

| Shares outstanding |

|

|

6,396,757 |

|

|

|

6,394,675 |

|

|

|

6,381,954 |

|

|

| Book value per outstanding share |

$ |

73.72 |

|

|

$ |

73.68 |

|

|

$ |

79.15 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Allowance as % of principal balance net of deferred revenue |

|

25.00 |

% |

|

|

25.32 |

% |

|

|

23.91 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Changes in allowance for credit losses: |

|

|

|

|

|

|

| |

|

|

|

Three months ended

|

|

|

|

| |

|

|

|

July 31, |

|

|

|

| |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

| |

Balance at beginning of period |

$ |

331,260 |

|

|

$ |

299,608 |

|

|

|

|

| |

Provision for credit losses |

|

95,423 |

|

|

|

96,323 |

|

|

|

|

| |

Charge-offs, net of collateral recovered |

|

(92,259 |

) |

|

|

(81,489 |

) |

|

|

|

| |

|

Balance at end of period |

$ |

334,424 |

|

|

$ |

314,442 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| (1) |

Some items in the prior year financial statements

were reclassified to conform to the current presentation. Reclassification had no effect on the prior year net income or shareholders

equity. |

| |

|

America’s Car-Mart

Condensed Consolidated Statements of Cash Flows

(Amounts in thousands)

| |

|

|

Years Ended |

|

| |

|

|

July 31, |

|

| |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

| Operating activities: |

|

|

|

|

|

| |

Net income |

$ |

(964 |

) |

|

$ |

4,186 |

|

| |

Provision for credit losses |

95,423 |

|

|

96,323 |

|

| |

Losses on claims for accident protection plan |

9,321 |

|

|

7,769 |

|

| |

Depreciation and amortization |

1,884 |

|

|

1,693 |

|

| |

Finance receivable originations |

(271,756 |

) |

|

(297,732 |

) |

| |

Finance receivable collections |

112,358 |

|

|

109,291 |

|

| |

Inventory |

25,603 |

|

|

23,953 |

|

| |

Deferred accident protection plan revenue |

205 |

|

|

1,651 |

|

| |

Deferred service contract revenue |

707 |

|

|

3,479 |

|

| |

Income taxes, net |

1,078 |

|

|

900 |

|

| |

Other |

11,169 |

|

|

3,088 |

|

| |

|

Net cash used in operating activities |

(14,972 |

) |

|

(45,399 |

) |

| |

|

|

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

| |

Purchase of investments |

(7,527 |

) |

|

(1,379 |

) |

| |

Purchase of property and equipment and other |

(986) |

|

|

529 |

|

| |

|

Net cash used in investing activities |

(8,513 |

) |

|

(850 |

) |

| |

|

|

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

| |

Change in revolving credit facility, net |

(15,798 |

) |

|

(168,516 |

) |

| |

Payments on notes payable |

(106,076 |

) |

|

(116,862 |

) |

| |

Change in cash overdrafts |

989 |

|

|

- |

|

| |

Issuances of notes payable |

149,889 |

|

|

360,340 |

|

| |

Debt issuance costs |

(1,387 |

) |

|

(4,091 |

) |

| |

Purchase of common stock |

(24 |

) |

|

(68 |

) |

| |

Dividend payments |

(10 |

) |

|

(10 |

) |

| |

Exercise of stock options and issuance of common stock |

76 |

|

|

(377 |

) |

| |

|

Net cash provided by financing activities |

27,659 |

|

|

70,416 |

|

| |

|

|

|

|

|

|

|

| Increase in cash, cash equivalents, and restricted cash |

$ |

4,174 |

|

|

$ |

24,167 |

|

| |

|

|

|

|

|

|

|

America’s Car-Mart

Reconciliation of Non-GAAP Financial Measures

(Amounts in thousands)

| Calculation of Debt, Net of Total Cash, to Finance Receivables: |

|

|

|

| |

|

|

July 31, 2024 |

|

April 30, 2024 |

| |

Debt: |

|

|

|

| |

|

Revolving lines of credit, net |

$ |

184,846 |

|

|

$ |

200,819 |

|

| |

|

Notes payable, net |

|

597,494 |

|

|

|

553,629 |

|

| |

Total debt |

$ |

782,340 |

|

|

$ |

754,448 |

|

| |

|

|

|

|

|

| |

Cash: |

|

|

|

| |

|

Cash and cash equivalents |

$ |

4,748 |

|

|

$ |

5,522 |

|

| |

|

Restricted cash from collections on auto finance receivables |

|

93,873 |

|

|

|

88,925 |

|

| |

Total cash, cash equivalents, and restricted cash |

$ |

98,621 |

|

|

$ |

94,447 |

|

| |

|

|

|

|

|

| |

Debt, net of total cash |

$ |

683,719 |

|

|

$ |

660,001 |

|

| |

|

|

|

|

|

| |

Principal balance of finance receivables |

$ |

1,465,259 |

|

|

$ |

1,435,388 |

|

| |

|

|

|

|

|

| |

Ratio of debt to finance receivables |

|

53.4 |

% |

|

|

52.6 |

% |

| |

Ratio of debt, net of total cash, to finance receivables |

|

46.7 |

% |

|

|

46.0 |

% |

| |

|

|

|

|

|

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b9f4d0eb-3e21-478d-9b3b-c117d6f81833

https://www.globenewswire.com/NewsRoom/AttachmentNg/29a93946-aa70-408b-a499-cd78853dff71

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

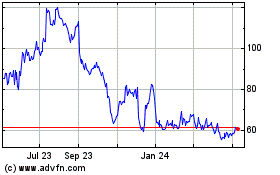

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Jan 2025 to Feb 2025

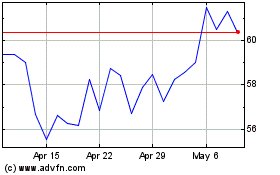

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Feb 2024 to Feb 2025