Alpha Star Acquisition Corporation (NASDAQ: ALSA) (“Alpha Star” or

“ALSA”), a special purpose acquisition company, today announced the

execution of a business combination agreement on September 12, 2024

(the “Business Combination Agreement”), pursuant to which Alpha

Star will undergo a business combination with OU XDATA GROUP

(“XDATA”), an Estonia-based financial technology solutions company.

The transaction has been approved by the boards of directors of

Alpha Star and XDATA and is expected to be consummated in late

2024. The closing of the transaction is subject to regulatory

approval, approval by the shareholders of Alpha Star and XDATA and

the satisfaction of certain other customary closing conditions.

Transaction Details

The Business Combination Agreement provides for

(i) SPAC will incorporate a Cayman Islands exempted company

(“PubCo”) in accordance with the Companies Act (Revised) of the

Cayman Islands, (ii) the merger of Alpha Star with and into PubCo

(the “Reincorporation Merger”), with PubCo surviving the

Reincorporation Merger, and (iii) the share exchange between PubCo

and the shareholders of XDATA (the “Share Exchange”, together with

Reincorporation Merger, the “Proposed Transaction”), resulting in

XDATA being a wholly owned subsidiary of PubCo. Following the

closing of the Proposed Transaction, XDATA will operate through

PubCo, and PubCo will be a publicly traded company listed on the

Nasdaq Stock Market.

The board of directors of both XDATA and ALSA

have unanimously approved the Proposed Transaction, which is

expected to be completed later this year, subject to, among other

things, the approval of the shareholders of XDATA and ALSA and

other customary closing conditions, including but not limited to a

registration statement on Form F-4 (the “Registration Statement”)

to be filed by PubCo being declared effective by the SEC, and the

listing application of XDATA being approved by the Nasdaq Stock

Market LLC.

The description of the Proposed Transaction

contained herein is only a summary and is qualified in its entirety

by reference to the Business Combination Agreement, a copy of which

will be filed by ALSA with the Securities and Exchange Commission

(the “SEC”) as an exhibit to a Current Report on Form 8-K, which

will be available at http://www.sec.gov.

Han Kun Law Offices LLP and Ogier (Cayman) LLP

are acting as legal advisors to ALSA. Loeb & Loeb LLP is acting

as U.S. securities legal advisor to XDATA.

About XDATA

XDATA is an innovative software development

company based in Estonia, known for its expertise in financial

technology solutions. The company provides a range of specialized

products, including an Internet Banking Suite, Mobile Banking Apps

for banks and EMIs, the AI-enhanced transaction monitoring solution

ComplyControl, and a comprehensive CRM solution.

About Alpha Star Acquisition

Corporation

Alpha Star Acquisition Corporation is a blank

check exempted company incorporated in the Cayman Islands for the

purpose of effecting a merger, share exchange, asset acquisition,

stock purchase, reorganization, or similar business combination

with one or more businesses.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995

that involve risks and uncertainties that could cause actual

results to differ materially from what is expected. Words such as

“expects”, “believes”, “anticipates”, “intends”, “estimates”,

“seeks”, “may”, “might”, “plan”, “possible”, “should” and

variations and similar words and expressions are intended to

identify such forward-looking statements, but the absence of these

words does not mean that a statement is not forward-looking. These

forward-looking statements include, but are not limited to,

statements regarding projections, estimates and forecasts of

revenue and other financial and performance metrics, projections of

market opportunity and expectations, the estimated enterprise value

of the PubCo, XDATA’s ability to scale and grow its business, the

advantages and expected growth of the PubCo, the cash position of

the PubCo following closing of the Proposed Transaction, the

parties’ ability to consummate the Proposed Transaction, and

expectations related to the terms and timing of the Proposed

Transaction, as applicable. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of ALSA’s and XDATA’s management and

are not predictions of actual performance. A number of factors

could cause actual events or results to differ materially from the

events and results discussed in the forward-looking statements.

Such factors include, among other things: the possibility that the

business combination will not close or that the closing may be

delayed because conditions to the closing may not be satisfied,

including shareholder and other approvals; the performance of ALSA

and XDATA; the ability of the PubCo to meet the Nasdaq Stock

Market’s listing standards; changes in the market for XDATA’s

products and services; XDATA’s inability to maintain sufficient

levels of liquidity and working capital; the amount of redemption

requests made by ALSA’s public shareholders; the reaction of XDATA

customers to the business combination; XDATA’s inability to develop

and maintain effective internal controls; the exposure to any

liability, protracted and costly litigation or reputational damage

relating to XDATA’s data security; unexpected costs, liabilities or

delays in the Proposed Transaction; the outcome of any legal,

governmental or regulatory proceedings related to the Proposed

Transaction; the occurrence of any event, change or other

circumstances that could give rise to the termination of the

transaction agreement; and general economic conditions. In

addition, please refer to the Risk Factors section in the proxy

statement/prospectus included in the Registration Statement

relating to the Proposed Transaction to be filed by PubCo and in

ALSA’s prospectus and its periodic reports filed or to be filed

with the SEC, including its quarterly reports on Form 10-Q and 10-K

for additional information identifying important factors that could

cause actual results to differ materially from those anticipated in

the forward-looking statements. In light of the significant

uncertainties in these forward-looking statements, nothing in this

press release should be regarded as a representation by any person

that the forward-looking statements set forth herein will be

achieved and neither ALSA nor XDATA can assure you that the

forward-looking statements in this press release will prove to be

accurate. The forward-looking statements in this press release

represent the views of ALSA and XDATA as of the date of this press

release. Except as expressly required by applicable securities law,

ALSA and XDATA disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events or otherwise.

Additional Information and Where to Find

It

In connection with the Proposed Transaction,

XDATA and ALSA intend to cause a registration statement on Form F-4

to be filed with the SEC, which will include a proxy statement to

be distributed to ALSA’s shareholders in connection with ALSA’s

solicitation for proxies for the vote by ALSA’s shareholders in

connection with the Proposed Transaction and other matters as

described in the registration statement, as well as a prospectus

relating to PubCo’s securities to be issued in connection with the

Proposed Transaction. ALSA’s shareholders and other interested

persons are advised to read, once available, the preliminary proxy

statement/prospectus and any amendments thereto and, once

available, the definitive proxy statement/prospectus, in connection

with ALSA’s solicitation of proxies for its extraordinary general

meeting of shareholders to be held to approve, among other things,

the Proposed Transaction, because these documents will contain

important information about ALSA, XDATA, PubCo and the Proposed

Transaction. After the registration statement is filed and declared

effective, ALSA will mail a definitive proxy statement and other

relevant documents to its shareholders as of the record date to be

established for voting on the Proposed Transaction. Shareholders

may also obtain a copy of the preliminary and definitive proxy

statement/prospectus to be included in the registration statement,

once available, as well as other documents filed with the SEC

regarding the Proposed Transaction and other documents filed with

the SEC, without charge, at the SEC’s website located at

www.sec.gov.

Participants in the

Solicitation

ALSA, XDATA and PubCo and certain of their

respective directors, executive officers and other members of

management and employees may, under SEC rules, be deemed to be

participants in the solicitations of proxies from ALSA’s

shareholders in connection with the Proposed Transactions.

Information regarding the persons who may, under SEC rules, be

deemed participants in the solicitation of ALSA’s shareholders in

connection with the Proposed Transactions will be set forth in the

proxy statement/prospectus included in a registration statement on

Form F-4 to be filed by PubCo with the SEC. You can find more

information about ALSA’s directors and executive officers in ALSA’s

annual report on Form 10-K for the fiscal year ended December 31,

2023 filed with the SEC on July 3, 2024. Additional information

regarding the participants in the proxy solicitation and a

description of their direct and indirect interests will be included

in the proxy statement/prospectus when it becomes available.

Shareholders, potential investors and other interested persons

should read the proxy statement/prospectus carefully when it

becomes available before making any voting or investment decisions.

You may obtain free copies of these documents , once available, at

the SEC’s website at www.sec.gov, or by directing a request to

Alpha Star Acquisition Corporation, 100 Church Street, 8th Floor,

New York, NY 10007.

No Offer or Solicitation

This press release is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to

any securities or in respect of the proposed transaction described

above and shall not constitute an offer to sell or a solicitation

of an offer to buy any securities of Alpha Star or PubCo, nor shall

there be any sale of any such securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such state or jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act.

Contact Information

For inquiries regarding

ALSA

Zhe ZhangChief Executive OfficerEmail:

zhangzhe@siftcap.cn

For inquiries regarding

XDATA

Roman EloshviliChief Executive

Officerroman@xdatagroup.io

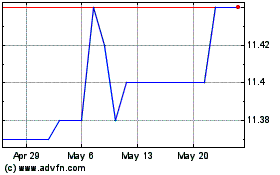

Alpha Star Acquisition (NASDAQ:ALSA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Alpha Star Acquisition (NASDAQ:ALSA)

Historical Stock Chart

From Nov 2023 to Nov 2024