Filed Pursuant to Rule 424(b)(5)

File Numbers 333-277855-01 and 333-277855

PROSPECTUS SUPPLEMENT

(To Prospectus dated March 27,

2024)

AIR T FUNDING

$8,000,000

320,000 Shares

of 8% Alpha Income Trust Preferred Securities

(Liquidation

amount $25.00 per Capital Security)

guaranteed by

Air T, Inc.

This

prospectus supplement and the accompanying prospectus relate to the offer and sale from time to time of up to 320,000 Shares of our Alpha

Income Preferred Securities, $25.00 liquidation value per share, (which we refer to in this prospectus supplement as “Capital Securities”),

having an aggregate offering price of up to $8,000,000. Sales of the Capital Securities will be made through Ascendiant Capital Markets,

LLC (the “sales agent”) as sales agent pursuant to the terms of the at the market offering agreement between us and the sales

agent. Sales of our Capital Securities, if any, may be made in transactions that are deemed to be “at-the-market offerings”

as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly

on the NASDAQ Capital Market (“NASDAQ”) or sales made to or through a market maker other than on an exchange, at market

prices prevailing at the time of sale or in negotiated transactions. In the event that any sales are made pursuant to the at the market

offering agreement which are not made directly on NASDAQ or on any other existing trading market for our Capital Securities at market

prices at the time of sale, including, without limitation, any sales to the sales agent acting as principal or sales in negotiated transactions,

we will file a prospectus supplement describing the terms of such transaction, the amount of shares sold, the price thereof, the applicable

compensation, and such other information as may be required pursuant to Rule 424 and Rule 430B of the Securities Act, as applicable,

within the time required by Rule 424 of the Securities Act. 17,058 Capital Securities have been sold during the previous twelve

(12) months.

The Capital Securities may

be redeemed, in whole or in part, at any time on or after June 7, 2024 at a redemption price equal to the total liquidation amount

plus accumulated and unpaid distributions to the date of redemption. In addition, the Capital Securities may be redeemed in whole if a

tax event (as defined herein) or investment company event (as defined herein) occur and are continuing.

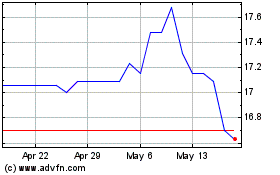

The Capital Securities are

listed on NASDAQ under the symbol “AIRTP.” The last reported sales price of our Capital Securities on NASDAQ on August 19,

2024 was $18.20 per share.

The sales agent will receive

a commission of 3.0% of the gross sales price per share for any shares sold through it as our sales agent under the at the market offering

agreement. We have also agreed to reimburse certain expenses of the sales agent in connection with the at the market offering agreement

as further described in the Plan of Distribution section. Subject to the terms and conditions of the at the market offering agreement,

the sales agent will use its commercially reasonable efforts to sell on our behalf any Capital Securities to be offered by us under the

at the market offering agreement. The offering of Capital Securities pursuant to the at the market offering agreement will terminate upon

the earlier of (1) the sale of $8,000,000 of Capital Securities subject to the at the market offering agreement, (2) March 27,

2027, and (3) the termination of the at the market offering agreement, pursuant to its terms, by either the sales agent or us.

Investing in the Capital Securities

involves a high degree of risk. Before buying any Capital Securities, you should carefully consider the risks that we have described in

“Supplemental Risk Factors” beginning on page S-4 of this prospectus supplement, as well as those described in our filings

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Capital Securities

are not deposits or other obligations of a depository institution and are not insured by the Federal Deposit Insurance Corporation, the

Bank Insurance Fund or any other governmental agency.

The Securities and Exchange

Commission and state securities regulators have not approved or disapproved these securities or determined if this prospectus supplement

or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

ASCENDIANT CAPITAL MARKETS, LLC

The date of this prospectus supplement is August 28,

2024.

TABLE OF CONTENTS

Prospectus Supplement

Page

Prospectus

We have not, and the sales

agent has not, authorized any dealer, salesperson or other person to give any information or to make any representation other than those

contained in or incorporated by reference into this prospectus supplement, the accompanying prospectus or any applicable free writing

prospectus. You must not rely upon any information or representation not contained in or incorporated by reference into this prospectus

supplement, the accompanying prospectus or any applicable free writing prospectus as if we had authorized it. This prospectus supplement,

the accompanying prospectus and any applicable free writing prospectus do not constitute an offer to sell or the solicitation of an offer

to buy any securities other than the registered securities to which they relate, nor does this prospectus supplement, the accompanying

prospectus or any applicable free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in

any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that

the information contained in this prospectus supplement, the accompanying prospectus, the documents incorporated herein and therein by

reference and any applicable free writing prospectus is correct on any date after their respective dates, even though this prospectus

supplement, the accompanying prospectus or an applicable free writing prospectus is delivered or securities are sold on a later date.

Our business, financial condition, results of operations and cash flows may have changed since those dates.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus are part of a shelf registration statement that we filed with the Securities and Exchange Commission (the

“SEC”). Our shelf registration statement allows us to offer from time to time a wide array of securities. In the accompanying

prospectus, we provide you with a general description of the securities we may offer from time to time under our shelf registration statement

and other general information that may apply to this offering. In this prospectus supplement, we provide you with specific information

about the Capital Securities that we are selling in this offering. Both this prospectus supplement and the accompanying prospectus include

important information about us, the Capital Securities and other information that you should know before investing. This prospectus supplement

also adds, updates and changes information contained in the accompanying prospectus. You should carefully read both this prospectus supplement

and the accompanying prospectus as well as additional information described under “Where You Can Find More Information” before

investing in the Capital Securities.

Generally, when we refer to

this “prospectus supplement,” we are referring to both this prospectus supplement and the accompanying prospectus, as well

as the documents incorporated by reference herein and therein. If information in this prospectus supplement is inconsistent with the accompanying

prospectus, you should rely on this prospectus supplement.

Air T, Inc. is a Delaware

corporation. Its principal executive office is located at 11020 David Taylor Drive, Suite 305, Charlotte, North Carolina 28262, and

its telephone number is (980) 595-2840. Air T, Inc. created Air T Funding by the execution of a Trust Agreement and a Certificate

of Trust that was filed with the Secretary of State of Delaware on September 28, 2018. The Trust Agreement was most recently amended

and restated by that certain Second Amended and Restated Trust Agreement dated June 23, 2021 and the First Amendment to the Second

Amended and Restated Trust Agreement dated January 28, 2022. The principal executive office of the Trust is located at the Delaware

Trust Company, 251 Little Falls Drive, New Castle, DE 19808, and the telephone number of the trust is (980) 595-2840. Air T, Inc’s

website is located at www.airt.net. The information contained on Air T’s website is not part of this prospectus supplement or the

accompanying prospectus.

WHERE

YOU CAN FIND MORE INFORMATION

Air T is required to file

annual, quarterly and current reports, proxy statements and other information with the SEC under the Exchange Act. Air T’s filings

with the SEC are available to the public through the SEC’s Internet site at http://www.sec.gov and through the NASDAQ Stock Market

at One Liberty Plaza, New York, New York 10006. Air T makes available free of charge on its website (https://www.airt.net) its Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as

soon as reasonably practicable after such material is electronically filed with the SEC. The information contained on or that may be accessed

through our website is not part of, and is not incorporated by reference into this Prospectus Supplement.

We have filed a registration

statement on Form S-3 with the SEC relating to the securities covered by this prospectus supplement. This prospectus supplement and

the accompanying prospectus are a part of the registration statement and do not contain all of the information in the registration statement.

Whenever a reference is made in this prospectus to a contract or other document of ours, please be aware that the reference is only a

summary and that you should refer to the exhibits that are part of the registration statement for a copy of the contract or other document.

You may review a copy of the registration statement through the SEC’s Internet site.

Additional copies of this

prospectus supplement and the accompanying prospectus may be obtained, without charge, by writing to us at Air T, Inc. or the Trust,

at 11020 David Taylor Drive, Suite 305, Charlotte, North Carolina 28262, telephone number is (980) 595-2840, Attention: Corporate

Secretary. You may also contact the Corporate Secretary at (980) 595-2840.

INCORPORATION

BY REFERENCE

The SEC’s rules allow

us to “incorporate by reference” information into this prospectus supplement. This means that we can disclose important information

to you by referring you to another document. Any information referred to in this way is considered part of this prospectus supplement

from the date we file that document. Any reports filed by us with the SEC after the date of this prospectus supplement and before the

date that the offerings of the securities by means of this prospectus supplement are terminated will automatically update and, where applicable,

supersede any information contained in this prospectus supplement or incorporated by reference in this prospectus supplement.

We incorporate by reference

into this prospectus supplement the following Air T and Trust documents or information filed with the SEC:

| (5) | the description of our Capital Stock contained in Exhibit 4.6 of the Company’s Annual Report

on Form 10-K/A for the fiscal year ended March 31, 2024, filed with the SEC on June 26, 2024 and; |

| (7) | All documents filed by us under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding

any information that is deemed to have been “furnished” and not “filed” with the SEC) on or after the date of

this prospectus supplement and before the termination of the offerings to which this prospectus supplement relates. |

We will provide without charge

to each person, including any beneficial owner, to whom this prospectus supplement is delivered, upon his or her written or oral request,

a copy of any or all documents referred to above which have been or may be incorporated by reference into this prospectus supplement,

excluding exhibits to those documents unless they are specifically incorporated by reference into those documents. You can request those

documents from the Corporate Secretary, Air T, Inc., at 11020 David Taylor Drive, Suite 305, Charlotte, North Carolina 28262.

You may also contact the Corporate Secretary at (980) 595-2840.

FORWARD-LOOKING

STATEMENTS

This prospectus supplement

contains or incorporates by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E

of the Exchange Act, which reflect our current views with respect to, among other things, our operations and financial performance. In

some cases, you can identify these forward-looking statements by the use of words such as “outlook”, “believes”,

“expects”, “potential”, “continues”, “may”, “will”, “should”,

“seeks”, “approximately”, “predicts”, “intends”, “plans”, “estimates”,

“anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject

to various risks and uncertainties. These forward-looking statements are not historical facts and are based on current expectations, estimates

and projections about Air T, Inc.’s industry, management’s beliefs and certain assumptions made by management, many of

which, by their nature, are inherently uncertain and beyond our control.

Accordingly, there are or

will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. All

statements other than statements of historical fact are forward-looking statements and are based on various underlying assumptions and

expectations and are subject to known and unknown risks, uncertainties and assumptions, and may include projections of our future financial

performance based on our growth strategies and anticipated trends in our business. We believe these factors include, but are not limited

to, those described under the “Supplemental Risk Factors” section of this prospectus supplement and under “Risk Factors”

in Item 1A of our most recent Annual Report on Form 10-K for the fiscal year ended March 31, 2024, filed with the SEC on June 26, 2024 (“2024 Annual Report”), and Item 1A of any subsequently filed Quarterly Reports on Form 10-Q, as such factors may

be updated from time to time in our periodic filings with the SEC (which documents are incorporated by reference herein), as well as the

other information contained or incorporated by reference in this prospectus supplement. These factors should not be construed as exhaustive

and should be read in conjunction with the other cautionary statements that are included or incorporated by reference in this prospectus

supplement. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information,

future developments or otherwise.

You should rely only on the

information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. Air T Funding and Air

T, Inc. have not authorized anyone to provide you with information other than that contained or incorporated by reference in this

prospectus supplement and the accompanying prospectus. The information in this prospectus supplement and the accompanying prospectus may

only be accurate as of their respective dates. In this prospectus supplement, references to the “Trust” mean Air T Funding

and references to “Air T” or “we” mean Air T, Inc. together with its subsidiaries, unless the context indicates

otherwise.

The Trust and Air T are offering

to sell the Capital Securities, and are seeking offers to buy the Capital Securities, only in jurisdictions where offers and sales are

permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the Capital Securities in

certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement

and accompanying prospectus must inform themselves about and observe any restrictions relating to the offering of the Capital Securities

and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement

and the accompanying prospectus do not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction

in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do

so or to any person to whom it is unlawful to make such offer or solicitation.

PROSPECTUS

SUPPLEMENT SUMMARY

The following information

concerning Air T, the Trust, the Capital Securities to be issued by the Trust, the Guarantee to be issued by Air T with respect to the

Capital Securities and the 8.0% Junior Subordinated Debentures to be issued by Air T supplements, and should be read in conjunction with,

the information contained in the accompanying prospectus. If the information set forth in this prospectus supplement differs in any way

from the information set forth in the accompanying prospectus, you should rely on the information set forth in this prospectus supplement.

Air T, Inc.

Air T is a holding company

with a portfolio of operating businesses and financial assets. Air T’s goal is to prudently and strategically diversify Air T’s

earnings power and compound its free cash flow per share over time.

Air T currently operates in

four industry segments:

| · | Overnight air cargo, which operates in the air express delivery services industry; |

| · | Ground equipment sales, which manufactures and provides mobile deicers and other specialized equipment

products to passenger and cargo airlines, airports, the military and industrial customers; |

| · | Commercial jet engines and parts, which manages and leases aviation assets; supplies surplus and aftermarket

commercial jet engine components; provides commercial aircraft disassembly/part-out services; sells commercial aircraft engines and parts;

and procures services and overhaul and repair services to aircraft companies; and |

| · | Corporate and other, which acts as the capital allocator and resource for other segments. Further, Corporate

and other also comprises insignificant businesses and business interests. |

Each business segment has

separate management teams and infrastructures that offer different products and services.

Air T Funding

The Trust is a Delaware statutory

business trust. The Trust exists solely to:

| · | issue and sell its common securities to Air T; |

| · | issue and sell its Capital Securities to the public; |

| · | use the proceeds from the sale of its common securities and Capital Securities to purchase Junior Subordinated

Debentures from Air T; and |

| · | engage in other activities that are necessary, convenient or incidental to these purposes. |

Delaware Trust Company, a

Delaware chartered trust company is the Delaware and Property Trustee of the Trust. Two officers of Air T act as administrative trustees

of the Trust. Delaware Trust Company is also the Indenture Trustee under the Subordinated Indenture dated as of June 10, 2019, as

amended and supplemented.

As of July 31, 2024,

there are $100,000,000 authorized amount of Capital Securities, par value $25.00, and 1,913,906 Capital Securities shares outstanding.

360,000 of these shares are held by wholly-owned subsidiaries of the Company. The Capital Securities are listed for trading on NASDAQ

and trade under the symbol “AIRTP.”

The rights of the holders

of Capital Securities are described in the applicable Trust Agreement and the Delaware Statutory Trust Act. The principal executive office

of the Trust is located at the Delaware Trust Company, 251 Little Falls Drive, New Castle, DE 19808, and the telephone number of the trust

is (980) 595-2840.

The Trust is a “finance

subsidiary” of Air T within the meaning of Rule 3-10 of Regulation S-X under the Securities Act of 1933, as amended, and as

a result the Trust does not file periodic reports with the SEC under the Securities Exchange Act of 1934, as amended.

The Offering

The Trust is offering its

Capital Securities in an at the market offering. The Trust will use all of the proceeds from the sale of its Capital Securities and its

common securities to purchase Junior Subordinated Debentures of Air T. The Junior Subordinated Debentures are and will be the Trust’s

only assets. Air T will fully and unconditionally guarantee the obligations of the Trust, based on its combined obligations under the

Guarantee, the trust agreement and the junior subordinated indenture.

The Capital Securities

If you purchase Capital Securities,

you will be entitled to receive cumulative cash distributions at an annual rate of $2.00 for each Capital Security, which represents 8.0%

of the liquidation amount of $25 for each Capital Security. If the Trust is terminated and its assets distributed, for each Capital Security

you own, you are entitled to receive a like amount of Junior Subordinated Debentures or the liquidation amount of $25 plus accumulated

but unpaid distributions from the assets of the Trust available for distribution, after it has paid liabilities owed to its creditors.

Accordingly, you may not receive the full liquidation amount and accumulated but unpaid distributions if the Trust does not have enough

funds.

Distributions will accumulate

from the date the Trust issues Capital Securities. The Trust will pay the distributions quarterly on February 15, May 15, August 15

and November 15 of each year. These distributions may be deferred for up to 20 consecutive quarters. The Trust will only pay distributions

when it has funds available for payment.

| Securities Offered |

The Capital Securities represent undivided beneficial interests in the Trust’s assets, which will consist solely of the Junior Subordinated Debentures and payments thereunder. |

| |

|

| Distributions |

The Distributions payable on each Capital Security will be fixed at a rate per annum of 8% of the Liquidation Amount of $25.00 per Capital Security, will be cumulative, will accrue from the date of issuance of the Capital Securities, and will be payable quarterly in arrears on the 15th day of February, May, August and November of each year (subject to possible deferral as described below). Additionally, from time to time the Board of Air T may in its sole discretion may declare Distributions in addition to the Distributions equal to the 8.0% per annum Liquidation Amount of the Capital Securities. |

| |

|

| Extension Periods |

So long as no Debenture event of default has occurred and is continuing, Air T will have the right, at any time on or after, June 7, 2024, to defer payments of interest on the Junior Subordinated Debentures by extending the interest payment period thereon for a period not exceeding 20 consecutive quarters with respect to each deferral period (each an “Extension Period”), provided that no Extension Period may extend beyond the Stated Maturity of the Junior Subordinated Debentures. If interest payments are so deferred, Distributions on the Capital Securities will also be deferred and Air T will not be permitted, subject to certain exceptions described herein, to declare or pay any cash distributions with respect to Air T’s capital stock or debt securities that rank pari passu with or junior to the Junior Subordinated Debentures. During an Extension Period, Distributions will continue to accrue with income thereon compounded quarterly. |

| Maturity |

The Junior Subordinated Debentures will mature on June 7, 2049, which date may be shortened (such date, as it may be shortened, the “Stated Maturity”) to a date not earlier than June 7, 2024. |

| |

|

| Redemption |

At any time on or after June 7, 2024, the Capital Securities are subject to mandatory redemption upon repayment of the Junior Subordinated Debentures at maturity or their earlier redemption in an amount equal to the amount of Junior Subordinated Debentures maturing on or being redeemed at a redemption price equal to the aggregate liquidation amount of the Capital Securities plus accumulated and unpaid distributions thereon to the date of redemption. The Junior Subordinated Debentures are redeemable prior to maturity at the option of Air T (i) on or after June 7, 2024, in whole at any time or in part from time to time, or (ii) at any time, in whole (but not in part), upon the occurrence and during the continuance of a tax event or an investment company event, in each case at a redemption price equal to 100% of the principal amount of the Junior Subordinated Debentures so redeemed, together with any accrued but unpaid interest to the date fixed for redemption. |

| |

|

| Distribution of Junior Subordinated Debentures |

Air T has the right at any time to terminate the Trust and cause the Junior Subordinated debentures to be distributed to holders of Capital Securities in liquidation of the Trust. |

| |

|

| Guarantee |

Taken together, Air T’s obligations under various documents described herein, including the Guarantee, provide a full guarantee of payments by the Trust of distributions and other amounts due on the Capital Securities. Under the Guarantee, Air T guarantees the payment of Distributions by the Trust and payments on liquidation of or redemption of the Capital Securities (subordinate to the right to payment of senior and subordinated debt of Air T, as defined herein) to the extent of funds held by the Trust. If the Trust has insufficient funds to pay distributions on the Capital Securities (i.e., if Air T has failed to make required payments under the Junior Subordinated Debentures), a holder of the Capital Securities would have the right to institute a legal proceeding directly against Air T to enforce payment of such distributions to such holder. |

| |

|

| Ranking |

Generally, the Capital Securities will rank pari passu, and payments thereon will be made pro rata, with the Common Securities of the Trust held by Air T. The obligations of Air T under the Guarantee, the Junior Subordinated Debentures and other documents described herein are unsecured and rank subordinate and junior in right of payment to all current and future Senior and Subordinated Debt, the amount of which is unlimited. At June 30, 2024, the aggregate outstanding Senior and Subordinated Debt of Air T was approximately $116,599,000 (which figure includes approximately $4,570,000 incurred in connection with the redemption of OCAS, Inc.’s interest in Contrail Aviation Support, LLC (“Contrail”)). In addition, because Air T is a holding company, all obligations of Air T relating to the securities described herein will be effectively subordinated to all existing and future liabilities of the Air T’s subsidiaries. Air T may cause additional Capital Securities to be issued by the Trust or trusts similar to the Trust in the future, and there is no limit on the amount of such securities that may be issued. In this event, Air T’s obligations under the Junior Subordinated Debentures to be issued to such other trusts and Air T’s guarantees of the payments will rank pari passu with Air T’s obligations under the Junior Subordinated Debentures and the Guarantee, respectively |

| Voting Rights |

The holders of the Capital Securities will generally have limited voting rights relating only to the modification of the Capital Securities, the dissolution, winding-up or termination of the Trust and certain other matters described herein. |

| |

|

| Use of Proceeds |

The Trust will invest all of the proceeds from the sale of the Capital Securities in the Junior Subordinated Debentures. Air T intends to use the net proceeds from the sale of the Junior Subordinated Debentures for general corporate purposes, which may include investments in or advances to its existing or future subsidiaries, repayment of its obligations that have matured and reduction of other debt. |

| |

|

| Manner of Offering |

“At the market offering” that may be made from time to time through our sales agent, Ascendiant Capital Markets, LLC. See “Plan of Distribution.” |

| |

|

| |

Under the terms of the “at the market offering” agreement, we also may sell Capital Securities to the sales agent, as principal for its own account, at a price per share to be agreed upon at the time of sale. If we sell Capital Securities to the sales agent, acting as principal, we will enter into a separate terms agreement with that sales agent, setting forth the terms of such transaction, and we will describe the terms agreement in a separate prospectus supplement or pricing supplement. |

| |

|

| |

The proceeds from this offering, if any, will vary depending on the number of Capital Securities that we offer and the offering price per Capital Security. We may choose to raise less than the maximum $8,000,000 in gross offering proceeds permitted by this prospectus supplement. |

| |

|

| Risk Factors |

Before deciding to invest in the Capital Securities, you should read carefully the risks set forth under the heading “Supplemental Risk Factors” beginning on page S-5 of this prospectus supplement, and the risk factors set forth under the heading “Risk Factors” in the Prospectus and under the heading “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended March 31, 2024, as well as any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K for certain considerations relevant to an investment in our securities. |

| NASDAQ Symbol |

AIRTP |

| |

|

| Transfer Agent and Registrar |

Equiniti Trust Company, LLC |

| |

|

| Form of Capital Securities |

The Capital Securities will be represented by one or more global securities that will be deposited with, or on behalf of, and registered in the name of The Depository Trust Company (“DTC”) or its nominee. This means that you will not receive a certificate for your Capital Securities and the Capital Securities will not be registered in your name. Rather, your broker or other direct or indirect participant of DTC will maintain your position in the Capital Securities. |

SUPPLEMENTAL

RISK FACTORS

Investing in the Capital

Securities involves risks. In deciding whether to invest in the Capital Securities, you should carefully consider the following risk factors

and the risk factors included in our Annual Report as well as any subsequent Quarterly Reports on Form 10-Q or Current Reports on

Form 8-K in addition to the other information contained in this prospectus supplement and the accompanying prospectus and the information

incorporated by reference herein and therein. The risks and uncertainties described below and in our other filings with the SEC are not

the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently deem immaterial, also may become

important factors that affect us. If any of these risks occur, our business, financial condition or results of operations could be materially

and adversely affected. In that case, the value of the Capital Securities and your investment could decline. See “Forward-Looking

Statements.”

Because the Trust will

rely on the payments it receives on the Junior Subordinated Debentures to fund all payments on the Capital Securities, and because the

Trust may distribute the Junior Subordinated Debentures in exchange for the Capital Securities, you are making an investment decision

with regard to the Junior Subordinated Debentures as well as the Capital Securities. You should carefully review the information in this

prospectus supplement and the accompanying prospectus about both of these securities and the Guarantee.

The ranking of Air T’s obligations under the

Junior Subordinated Debentures and the Guarantee creates a risk that the Trust may not be able to pay amounts due to holders of the Capital

Securities.

The ability of the Trust to

pay amounts due to holders of the Capital Securities is solely dependent upon Air T making payments on the Junior Subordinated Debentures

as and when required. All obligations of Air T under the Guarantee, the Junior Subordinated Debentures and other documents described herein

are unsecured and rank subordinate and junior in right of payment to all current and future Senior and Subordinated Debt, the amount of

which is unlimited. At June 30, 2024, the aggregate outstanding Senior and Subordinated Debt of Air T was approximately $116,599,000

(which figure includes approximately $4,570,000 incurred in connection with the redemption of OCAS, Inc.’s interest in Contrail).

None of the Indenture, the Guarantee or the Trust Agreement places any limitation on the amount of secured or unsecured debt, including

Senior and Subordinated Debt, that may be incurred by Air T or its subsidiaries. Further, there is no limitation on Air T’s ability

to issue additional Junior Subordinated Debentures in connection with any further offerings of Capital Securities, and such additional

debentures would rank pari passu with the Junior Subordinated Debentures.

Air T has the option to extend the interest payment

period; tax consequences of a deferral of interest payments.

So long as no Debenture Event

of Default (as defined) has occurred and is continuing, at any time on or after, June 7, 2024, Air T has the right under the Indenture

to defer the payment of interest on the Junior Subordinated Debentures at any time or from time to time for a period not exceeding 20

consecutive quarters with respect to each Extension Period, provided that no Extension Period may extend beyond the Stated Maturity of

the Junior Subordinated Debentures. As a consequence of any such deferral, quarterly Distributions on the Capital Securities by the Trust

will be deferred (and the amount of Distributions to which holders of the Capital Securities are entitled will accumulate additional amounts

thereon at the rate of 8% per annum, compounded quarterly, from the relevant payment date for such Distributions, to the extent permitted

by applicable law) during any such Extension Period. During any such Extension Period, Air T will be prohibited from making certain payments

or distributions with respect to Air T’s capital stock (including dividends on or redemptions of common or preferred stock) and

from making certain payments with respect to any debt securities of Air T that rank pari passu with or junior in interest to the

Junior Subordinated Debentures; however, Air T will NOT be restricted from (a) paying dividends or distributions in common stock

of Air T, (b) redeeming rights or taking certain other actions under a stockholders’ rights plan, (c) making payments

under the Guarantee or (d) making purchases of common stock generally or related to the issuance of common stock or rights under

any of Air T’s benefit plans for its directors, officers or employees. Further, during an Extension Period, Air T would have the

ability to continue to make payments on Senior and Subordinated Debt. At June 30, 2024, the aggregate outstanding Senior and Subordinated

Debt of Air T was approximately $116,599,000 (which figure includes approximately $4,570,000 incurred in connection with the redemption

of OCAS, Inc.’s interest in Contrail). Prior to the termination of any Extension Period, Air T may further extend such Extension

Period provided that such extension does not cause such Extension Period to exceed 20 consecutive quarters or to extend beyond the Stated

Maturity. Upon the termination of any Extension Period and the payment of all interest then accrued and unpaid (together with interest

thereon at the annual rate of 8%, compounded quarterly, to the extent permitted by applicable law), Air T may elect to begin a new Extension

Period subject to the above requirements. There is no limitation on the number of times that Air T may elect to begin an Extension Period.

Because Air T believes the

likelihood of it exercising its option to defer payments of interest is remote, the Junior Subordinated Debentures will be treated as

issued without “original issue discount” for United States federal income tax purposes. As a result, holders of Capital Securities

will include interest in taxable income under their own methods of accounting (i.e., cash or accrual). Air T has no current intention

of exercising its right to defer payments of interest by extending the interest payment period on the Junior Subordinated Debentures.

However, should Air T elect to exercise its right to defer payments of interest in the future (which shall be possible at any time

on or after, June 7, 2024), the market price of the Capital Securities is likely to be adversely affected. A holder that disposes

of such holder’s Capital Securities during an Extension Period, therefore, might not receive the same return on such holder’s

investment as a holder that continues to hold the Capital Securities.

Tax event redemption or investment company act redemption.

Upon the occurrence and during

the continuation of a Tax Event or an Investment Company Event, Air T has the right to redeem the Junior Subordinated Debentures in whole

(but not in part) at 100% of the principal amount together with accrued but unpaid interest to the date fixed for redemption within 90

days following the occurrence of such Tax Event or Investment Company Event and therefore cause a mandatory redemption of the Trust Securities.

A “Tax Event”

means the receipt by Air T and the Trust of an opinion of counsel experienced in such matters to the effect that, as a result of any amendment

to, or change (including any announced prospective change) in, the laws (or any regulations thereunder) of the United States or any political

subdivision or taxing authority thereof or therein, or as a result of any official administrative pronouncement or judicial decision interpreting

or applying such laws or regulations, which amendment or change is effective or such pronouncement or decision is announced on or after

the original issuance of the Capital Securities, there is more than an insubstantial risk that (i) the Trust is, or will be within

90 days of the date of such opinion, subject to United States federal income tax with respect to income received or accrued on the Junior

Subordinated Debentures, (ii) interest payable by Air T on the Junior Subordinated Debentures is not, or within 90 days of such opinion,

will not be, deductible by Air T, in whole or in part, for United States federal income tax purposes, or (iii) the Trust is, or will

be within 90 days of the date of the opinion, subject to more than a de minimis amount of other taxes, duties or other governmental charges.

An “Investment Company

Event” means the receipt by Air T and the Trust of an opinion of counsel experienced in such matters to the effect that, as a result

of any change in law or regulation or a change in interpretation or application of law or regulation by any legislative body, court, governmental

agency or regulatory authority, the Trust is or will be considered an “investment company” that is required to be registered

under the Investment Company Act, which change becomes effective on or after the original issuance of the Capital Securities.

Air T may cause the Junior Subordinated Debentures

to be distributed to the holders of the Capital Securities.

Air T will have the right

at any time to terminate the Trust and cause the Junior Subordinated Debentures to be distributed to the holders of the Capital Securities

in liquidation of the Trust. Because holders of the Capital Securities may receive Junior Subordinated Debentures in liquidation of the

Trust and because Distributions are otherwise limited to payments on the Junior Subordinated Debentures, prospective purchasers of the

Capital Securities are also making an investment decision with regard to the Junior Subordinated Debentures and should carefully review

all the information regarding the Junior Subordinated Debentures contained herein.

There are limitations on direct actions against Air

T and on rights under the Guarantee.

Under the Guarantee, Air T

guarantees the payment of Distributions by the Trust and payments on liquidation of or redemption of the Capital Securities (subordinate

to the right to payment of Senior and Subordinated Debt of the Company) to the extent of funds held by the Trust. If the Trust has insufficient

funds to pay Distributions on the Capital Securities (i.e., if Air T has failed to make required payments under the Junior Subordinated

Debentures), a holder of the Capital Securities would have the right to institute a legal proceeding directly against Air T for enforcement

of payment to such holder of the principal of or interest on such Junior Subordinated Debentures having a principal amount equal to the

aggregate Liquidation Amount of the Capital Securities of such holder (a “Direct Action”). Except as described herein, holders

of the Capital Securities will not be able to exercise directly any other remedy available to the holders of the Junior Subordinated Debentures

or assert directly any other rights in respect of the Junior Subordinated Debentures.

Under the Guarantee, Delaware

Trust Company is the indenture trustee (the “Guarantee Trustee”). The holders of not less than a majority in aggregate Liquidation

Amount of the Capital Securities have the right to direct the time, method and place of conducting any proceeding for any remedy available

to the Guarantee Trustee in respect of the Guarantee or to direct the exercise of any trust power conferred upon the Guarantee Trustee

under the Guarantee Agreement. Any holder of the Capital Securities may institute a legal proceeding directly against Air T to enforce

its rights under the Guarantee without first instituting a legal proceeding against the Trust, the Guarantee Trustee or any other person

or entity. The Trust Agreement provides that each holder of the Capital Securities by acceptance thereof agrees to the provisions of the

Guarantee Agreement and the Indenture.

The covenants in the Indenture are limited.

The covenants in the Indenture

are limited, and there are no covenants relating to Air T in the Trust Agreement. As a result, neither the Indenture nor the Trust Agreement

protects holders of Junior Subordinated Debentures, or Capital Securities, respectively, in the event of a material adverse change in

Air T’s financial condition or results of operations or limits the ability of Air T or any subsidiary to incur additional indebtedness.

Therefore, the provisions of these governing instruments should not be considered a significant factor in evaluating whether Air T

will be able to comply with its obligations under the Junior Subordinated Debentures or the Guarantee.

Holders of the Capital Securities will generally have

limited voting rights.

Holders of the Capital Securities

will generally have limited voting rights relating only to the modification of the Capital Securities and certain other matters. In the

event that (i) there is a Debenture Event of Default (as defined herein) with respect to the Junior Subordinated Debentures, (ii) the

Property Trustee fails to pay any distribution on the Capital Securities for 30 days (subject to deferral of distributions), (iii) the

Property Trustee fails to pay the redemption price on the Capital Securities when due upon redemption, (iv) the Property Trustee

fails to observe a covenant in the Trust Agreement for the Capital Securities for 60 days after receiving a Notice of Default, or (v) the

Property Trustee is declared bankrupt or insolvent and not replaced by the Company within 60 days, the holders of a majority of the outstanding

Capital Securities will be able to remove the Property Trustee and the Indenture Trustee (but not the Administrative Trustees who may

only be removed by Air T as holder of the Common Securities).

The public market for the Capital Securities is limited;

Market prices for the Capital Securities may fluctuate based on numerous factors and there is no assurance of an active and liquid trading

market.

The Capital Securities are

currently listed on the NASDAQ and trade under the symbol “AIRTP.” There can be no assurance that an active and liquid trading

market for the Capital Securities will continue or that a continued listing of the Capital Securities will be available on NASDAQ. Future

trading prices of the Capital Securities will depend on many factors including, among other things, prevailing interest rates, the operating

results and financial condition of Air T, and the market for similar securities. There can be no assurance as to the market prices for

the Capital Securities or the Junior Subordinated Debentures that may be distributed in exchange for the Capital Securities if Air T exercises

its right to terminate the Trust. Accordingly, the Capital Securities that an investor may purchase, or the Junior Subordinated Debentures

that a holder of the Capital Securities may receive in liquidation of the Trust, may trade at a discount from the price that the investor

paid to purchase the Capital Securities offered hereby.

PLAN

OF DISTRIBUTION

We have entered into an at

the market offering agreement with Ascendiant Capital Markets, LLC, the sales agent, under which we may issue and sell over a period of

time, and from time to time, Capital Securities having an aggregate offering price of up to $8,000,000 through the sales agent. This prospectus

supplement relates to our ability to issue and sell over a period of time, and from time to time, up to $8,000,000 of our Capital Securities

through the sales agent. Sales of the Capital Securities to which this prospectus supplement and the accompanying prospectus relate, if

any, will be made by means of ordinary brokers’ transactions on NASDAQ, or otherwise at market prices prevailing at the time of

sale or negotiated transactions, or as otherwise agreed with the sales agent. In the event that any sales are made pursuant to the at

the market offering agreement which are not made directly on NASDAQ or on any other existing trading market for the Capital Securities

at market prices at the time of sale, including, without limitation, any sales to the sales agent acting as principal or sales in negotiated

transactions, we will file a prospectus supplement describing the terms of such transaction, the amount of shares sold, the price thereof,

the applicable compensation, and such other information as may be required pursuant to Rule 424 and Rule 430B under the Securities

Act, as applicable, within the time required by Rule 424 under the Securities Act. To the extent required by Regulation M, as our

sales agent, the sales agent will not engage in any transactions that stabilize our Capital Securities while the offering is ongoing under

this prospectus supplement.

Upon written instructions

from us, the sales agent will offer the shares of Capital Securities, subject to the terms and conditions of the at the market offering

agreement, on a daily basis or as otherwise agreed upon by us and the sales agent. We will designate the maximum amount of shares of Capital

Securities to be sold through the sales agent on a daily basis or otherwise determine such maximum amount together with the sales agent,

subject to certain limitations set forth by the SEC. Subject to the terms and conditions of the at the market offering agreement, the

sales agent will use its commercially reasonable efforts to sell on our behalf all of the shares of Capital Securities so designated or

determined. We may instruct the sales agent not to sell shares of Capital Securities if the sales cannot be effected at or above the price

designated by us in any such instruction. We or the sales agent may suspend the offering of shares of Capital Securities being made through

the sales agent under the at the market offering agreement upon proper notice to the other party.

For its service as sales agent

in connection with the sale of shares of our Capital Securities that may be offered hereby, we will pay the sales agent an aggregate fee

of 3.0% of the gross sales price per share for any shares sold through it acting as our sales agent. The remaining sales proceeds, after

deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory or self-regulatory organization

in connection with the sales, will equal our net proceeds for the sale of such shares. We have agreed to reimburse the sales agent for

certain of its expenses in an amount not to exceed $30,000 (excluding reimbursement to the sales agent of any periodic due diligence fees),

subject to compliance with FINRA Rule 5110(f)(2)(D)(i).

The sales agent will provide

written confirmation to us following the close of trading on NASDAQ on each day in which shares of Capital Securities are sold by it on

our behalf under the at the market offering agreement. Each confirmation will include the number of shares sold on that day, the gross

sales price per share, the compensation payable by us to the sales agent and the proceeds to us net of such compensation.

Settlement for sales of Capital

Securities will occur, unless the parties agree otherwise, on the third business day following the date on which any sales were made in

return for payment of the proceeds to us net of compensation paid by us to the sales agent. There is no arrangement for funds to be received

in an escrow, trust or similar arrangement.

We will deliver to NASDAQ

copies of this prospectus supplement and the accompanying prospectus pursuant to the rules of NASDAQ. Unless otherwise required,

we will report at least quarterly the number of shares of Capital Securities sold through the sales agent under the at the market offering

agreement, the net proceeds to us and the compensation paid by us to the sales agent in connection with the sales of Capital Securities.

In connection with the sale

of Capital Securities on our behalf, the sales agent may be deemed to be an “underwriter” within the meaning of the Securities

Act, and the compensation paid to the sales agent may be deemed to be underwriting commissions or discounts. We have agreed, under the

at the market offering agreement, to provide indemnification and contribution to the sales agent against certain civil liabilities, including

liabilities under the Securities Act.

In the ordinary course of

their business, the sales agent and/or its affiliates may perform investment banking, broker-dealer, financial advisory or other services

for us for which they may receive separate fees.

We estimate that the total

expenses from this offering payable by us, excluding compensation payable to the sales agent under the at the market offering agreement,

will be approximately $60,000.

The offering of Capital Securities

pursuant to the at the market offering agreement will terminate upon the earlier of (1) the sale of $8,000,000 of shares of our Capital

Securities subject to the at the market offering agreement, (2) March 27, 2027, and (3) the termination of the at the market

offering agreement, pursuant to its terms, by either the sales agent or us.

VALIDITY

OF SECURITIES

Certain legal matters in connection

with the Capital Securities will be passed upon for us by Winthrop & Weinstine, P.A., Minneapolis, Minnesota. Certain legal matters

relating to the securities will be passed upon for the sales agent by Clyde Snow & Sessions, PC, Salt Lake City, Utah.

EXPERTS

The financial statements of

Air T, Inc. incorporated by reference in this Prospectus Supplement have been audited by Deloitte & Touche LLP, an independent

registered public accounting firm, as stated in their report. Such financial statements are incorporated by reference in reliance upon

the report of such firm, given their authority as experts in accounting and auditing.

Air T, Inc.

$25,000,000

Common Stock

Preferred Stock

Warrants

Depositary Shares

Units

Debt Securities

Air T Funding

Alpha Income Trust Preferred Securities, par

value $25.00

( the “Capital Securities”)

(fully and unconditionally guaranteed as described herein by Air T, Inc.)

We and/or the Issuer Trust

may offer and sell any combination of the securities listed above, in one or more offerings, up to a total dollar amount of $25,000,000.

We may offer these securities separately or together, in separate series or classes and in amounts, at prices and on terms described in

one or more prospectus supplements. The Debt Securities, Preferred Stock and Warrants may be convertible or exercisable or exchangeable

for debt or equity securities of the Company or of one or more entities.

We encourage you to carefully

read this prospectus and any applicable prospectus supplement before you invest in our securities. We also encourage you to read the documents

we have referred you to in the “Where You Can Find More Information” section of this prospectus for information on us and

for our financial statements. This prospectus may not be used to consummate sales of our securities unless accompanied by a prospectus

supplement.

We are subject to General

Instruction I.B.6 of Form S-3, which limits the amounts that we may sell under the registration statement of which this prospectus

forms a part. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities registered on the registration

statement of which this prospectus is a part in a public primary offering with a value exceeding more than one-third of our public float

in any 12-month period if our public float, measured in accordance with such instruction, remains below $75.0 million. As of February 12,

2024, the aggregate market value of our Common Stock held by non-affiliates, or the public float, was approximately $17.7 million, which

was calculated based on 976,468 shares of our outstanding Common Stock held by non-affiliates as of February 12, 2024, at a price

of $18.09 per share, which was the closing price of our Common Stock on the NASDAQ Global Market on February 12, 2024. As of January 19,

2024, the Issuer Trust sold 14,354 shares of Capital Securities for $259,010.68 pursuant to General Instruction I.B.6 of Form S-3

during the 12 calendar months prior to and including the date of this prospectus. These sales were the only sales of securities pursuant

to the registration statement during the prior 12 calendar months.

Our Common Stock is listed

on the NASDAQ Global Market, under the symbol “AIRT.” On March 6, 2024, the last quoted sale price of our Common Stock

was $17.38 per share. The Capital Securities are also listed on the NASDAQ Global Market under the symbols “AIRTP.” On March 6,

2024, the last quoted sale price of the Capital Securities was $17.38. You are urged to obtain current market quotations.

The securities may be offered

and sold on a continuous or delayed basis, through agents, dealers or underwriters, or directly to purchasers. The prospectus supplement

for each offering of securities will describe in detail the plan of distribution for that offering. If agents or any dealers or underwriters

are involved in the sale of the securities, the applicable prospectus supplement will set forth the names of the agents, dealers or underwriters

and any applicable commissions or discounts. Net proceeds from the sale of securities will be set forth in the applicable prospectus supplement.

For general information about the distribution of securities offered, please see “Plan of Distribution” in this prospectus.

Investing in our securities

involves risks. You should carefully consider the Risk Factors beginning on page 6 of this prospectus and set forth in the applicable

prospectus supplement and in the documents incorporated or deemed incorporated by reference herein before making any decision to invest

in the securities.

These securities are not

savings accounts, deposits or other obligations of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation

or any other government agency.

Neither the Securities

and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities

or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus is dated March 27, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the Securities and Exchange Commission (“SEC”) using a “shelf” registration

process. Under this shelf registration process, we may, from time to time, offer and sell any combination of the securities described

in this prospectus in one or more offerings.

This prospectus provides you

with a general description of the securities we and the Issuer Trust may offer. Each time we sell securities, we will provide a prospectus

supplement that will contain specific information about the terms of that offering. We may also provide a prospectus supplement that will

contain specific information about the terms of any offering by the selling securityholders. That prospectus supplement may include a

discussion of any risk factors or other special considerations that apply to those securities. The prospectus supplement may also add,

update or change the information in this prospectus. If there is any inconsistency between the information in this prospectus or any information

incorporated by reference herein and in a prospectus supplement, you should rely on the information in that prospectus supplement. You

should carefully read both this prospectus, any prospectus supplement, any free writing prospectus that we authorize to be distributed

to you and any information incorporated by reference into the foregoing, together with additional information described under the headings

“Incorporation of Certain Information by Reference” and “Where You Can Find More Information,” before buying any

of the securities offered under this prospectus

As used in this prospectus,

the terms “Company,” “we,” “our,” “ours” “Air T” and “us” refer

Air T, Inc., a Delaware corporation and its subsidiaries (unless the context indicates another meaning). Air T Funding is referred

to as the “Issuer Trust” or “Air T Funding”, and is a Delaware statutory trust which may offer from time to time

Capital Securities representing preferred undivided beneficial interests in the assets of the Issuer Trust (unless the context indicates

another meaning).

You should rely only on the

information contained in this prospectus and in any relevant prospectus supplement or free writing prospectus, including any information

incorporated herein or therein by reference. We have not authorized any other person to provide you with different information. If anyone

provides you with different or inconsistent information, you should not rely on it. You should not assume that the information in this

prospectus, any accompanying prospectus supplement, any free writing prospectus or any document incorporated by reference is accurate

as of any date other than the date on its front cover. Our business, financial condition, results of operations and prospects may have

changed since the date indicated on the front cover of such documents. Neither this prospectus nor any prospectus supplement or free writing

prospectus constitutes an offer to sell or the solicitation of an offer to buy any securities other than the securities to which they

relate, nor does this prospectus or a prospectus supplement or free writing prospectus constitute an offer to sell or the solicitation

of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

ABOUT AIR T, INC. AND THE ISSUER TRUST

The items in the following summary are described

in more detail later in this prospectus. This summary does not contain all of the information you should consider. Before investing in

our securities, you should read the entire prospectus carefully, including the “Risk Factors” beginning

on page 6 and the financial statements and notes thereto incorporated by reference.

Air T, Inc.

Air T, Inc. (the “Company,”

“Air T,” “we” or “us” or “our”) is a holding company with a portfolio of operating businesses

and financial assets. Our goal is to prudently and strategically diversify Air T’s earnings power and compound its free cash flow

per share over time.

We currently operate in four

industry segments:

| |

· |

Overnight air cargo, which operates in the air express delivery services industry; |

| |

· |

Ground equipment sales, which manufactures and provides mobile deicers and other specialized equipment

products to passenger and cargo airlines, airports, the military and industrial customers; |

| |

· |

Commercial aircraft engines and parts, which manages and leases aviation assets; supplies surplus

and aftermarket commercial jet engine components; provides commercial aircraft disassembly/part-out services, commercial aircraft

parts sales, procurement services and overhaul and repair services to airlines; and |

| |

· |

Corporate and other, which acts as the capital allocator and resource for other consolidated businesses.

Further, Corporate and other also comprises insignificant businesses and business interests. |

Each business segment has

separate management teams and infrastructures that offer different products and services. We evaluate the performance of our business

segments based on operating income.

Corporate Information

Our principal executive office

is located at 11020 David Taylor Drive, Suite 305, Charlotte, North Carolina 28262, and our telephone number is (980) 595-2840. Our

website address is http://www.airt.net. No information found on our website is part of this prospectus. Also, this prospectus may include

the names of various government agencies or the trade names of other companies. Unless specifically stated otherwise, the use or display

by us of such other parties’ names and trade names in this prospectus is not intended to and does not imply a relationship with,

or endorsement or sponsorship of us by, any of these other parties.

The Issuer Trust

We created Air T Funding by

the execution of a Trust Agreement and a Certificate of Trust for the Issuer Trust that we filed with the Secretary of State of Delaware

on September 28, 2018. The Trust Agreement was most recently amended on March 4, 2021 and January 28, 2022. As of the date

of this prospectus, there are $100,000,000 authorized amount of Alpha Income Trust Preferred Securities, par value $25.00, 1,913,906 Capital

Securities shares outstanding.

The purchasers of the Capital

Securities that the Issuer Trust may issue will collectively own a portion of the Issuer Trust’s Capital Securities, and we will

continue to own all of the Issuer Trust’s common securities (the “Common Securities”). The Common Securities generally

will rank equally, and payments will be made ratably, with the Capital Securities. However, upon the occurrence and during the continuance

of an event of default under the Trust Agreement resulting from an event of default under the Indenture, and any supplemental indenture

which contain the terms of the debt securities held by the Issuer Trust, our rights as the holder of the Common Securities of that Issuer

Trust to distributions, liquidation, redemption and other payments from the Issuer Trust will be subordinated to the rights to those payments

of the holders of the Capital Securities. The Issuer Trust will use the proceeds from the sale of the Capital Securities to invest in

a series of our debt securities (each, a “Junior Subordinated Debenture” and, collectively, the “Junior Subordinated

Debentures”) that we will issue to the Issuer Trust. As of the date hereof, the sole debt securities of the Company purchased by

the Issuer Trust are the Junior Subordinated Debentures.

The debt securities will be

the Issuer Trust’s only assets, and the interest we pay on such debt securities and the Agreement as to Expenses and Liabilities

entered into by the Company under the Trust Agreement (the “Expense Agreement”) will be the only revenue of the Issuer Trust.

Unless stated otherwise in the applicable prospectus supplement, the Trust Agreement does not permit the Issuer Trust to acquire any assets

other than the specified debt securities or to issue any securities other than the trust securities (or warrants to acquire trust securities)

or to incur any other indebtedness. The Issuer Trust will not carry on any active business operations.

The Issuer Trust’s business

and affairs are conducted by the trustees. The Issuer Trust has a Delaware Trustee (the “Delaware Trustee”), two administrative

trustees (each, an “Administrative Trustee” and, collectively, the “Administrative Trustees”) and a Property Trustee

(the “Property Trustee” and together with the Delaware Trustee and the Administrative Trustees, collectively, the “Trustees”).

The Delaware Trustee and the Property Trustee are unaffiliated with us while the Administrative Trustees are employees, officers or affiliates

of ours. The Delaware Trustee has its principal place of business in the State of Delaware. Air T, the holder of the Common Securities

of the Issuer Trust, is entitled generally to appoint, remove or replace any of the trustees and to increase or decrease the number of

trustees; provided that the number of trustees is at least three and that at least one trustee is a Property Trustee, one trustee is a

Delaware Trustee and one trustee is an Administrative Trustee. If a Debenture Event of Default has occurred and is continuing, the Property

Trustee and the Delaware Trustee may be removed at such time by the holders of a majority in Liquidation Amount of the outstanding Capital

Securities. In no event, however, will the holders of the Capital Securities have the right to vote to appoint, remove or replace the

Administrative Trustees, which voting rights are vested exclusively in the Company as the holder of the Common Securities.

The rights of holders of Capital

Securities, including economic rights, rights to information and voting rights, are set forth in the Trust Agreement, Delaware law and

the Trust Indenture Act. The Trust Agreement also incorporates by reference the Trust Indenture Act. The principal executive office of

the Issuer Trust is located at the Delaware Trust Company, 251 Little Falls Drive, Wilmington, DE 19808, and the telephone number of the

trust is (980) 595-2840.

The Issuer Trust is not subject

to reporting requirements under the Exchange Act.

RISK FACTORS

SUMMARY

General Business Risks

| |

· |

Market fluctuations may affect the Company’s operations. |

| |

· |

Rising inflation may result in increased costs of operations and negatively impact the credit and securities markets generally, which could have a material adverse effect on our results of operations and the market price of our Securities. |

| |

· |

We could experience significant increases in operating costs and reduced profitability due to competition for skilled management and staff employees in our operating businesses. |

| |

· |

Legacy technology systems require a unique technical skillset which is becoming scarcer. |

| |

· |

Security threats and other sophisticated computer intrusions could harm our information systems, which in turn could harm our business and financial results. |

| |

· |

We may not be able to insure certain risks adequately or economically. |

| |

· |

Legal liability may harm our business. |

| |

· |

Our business might suffer if we were to lose the services of certain key employees. |

Risks Related to Our Segment Operations

| |

· |

The operating results of our four segments may fluctuate, particularly our commercial jet engine

and parts segment. |

| |

· |

Our Air Cargo Segment is dependent on a significant customer. |

| |

· |

Our dry-lease agreements with FedEx subject us to operating risks. |

| |

· |

Because of our dependence on FedEx, we are subject to the risks that may affect FedEx’s operations. |

| |

· |

A material reduction in the aircraft we fly for FedEx could materially adversely affect our business

and results of operations. |

| |

· |

Sales of deicing equipment can be affected by weather conditions. |

| |

· |

We are affected by the risks faced by commercial aircraft operators and MRO companies because they

are our customers. |

| |

· |

Our engine values and lease rates, which are dependent on the status of the types of aircraft on

which engines are installed, and other factors, could decline. |

| |

· |

Upon termination of a lease, we may be unable to enter into new leases or sell the airframe, engine

or its parts on acceptable terms. |

| |

· |

Failures by lessees to meet their maintenance and recordkeeping obligations under our leases could

adversely affect the value of our leased engines and aircraft which could affect our ability to re-lease the engines and aircraft

in a timely manner following termination of the leases. |

| |

· |

We may experience losses and delays in connection with repossession of engines or aircraft when a

lessee defaults. |

| |

· |

Our commercial jet engine and parts segment and its customers operate in a highly regulated industry

and changes in laws or regulations may adversely affect our ability to lease or sell our engines or aircraft. |

| |

· |

Our aircraft, engines and parts could cause damage resulting in liability claims. |

| |

· |

We have risks in managing our portfolio of aircraft and engines to meet customer needs. |

| |

· |

Liens on our engines or aircraft could exceed the value of such assets, which could negatively affect our ability to repossess, lease or sell a particular engine or aircraft. |

| |

· |

In certain countries, an engine affixed to an aircraft may become an addition to the aircraft and we may not be able to exercise our ownership rights over the engine. |

| |

· |

Higher or volatile fuel prices could affect the profitability of the aviation industry and our lessees’ ability to meet their lease payment obligations to us. |

| |

· |

Interruptions in the capital markets could impair our lessees’ ability to finance their operations, which could prevent the lessees from complying with payment obligations to us. |

| |

· |

Our lessees may fail to adequately insure our aircraft or engines which could subject us to additional costs. |

| |

· |

If our lessees fail to cooperate in returning our aircraft or engines following lease terminations, we may encounter obstacles and are likely to incur significant costs and expenses conducting repossessions. |

| |

· |

If our lessees fail to discharge aircraft liens for which they are responsible, we may be obligated to pay to discharge the liens. |

| |

· |

If our lessees encounter financial difficulties and we restructure or terminate our leases, we are likely to obtain less favorable lease terms. |

| |

· |

Withdrawal, suspension or revocation of governmental authorizations or approvals could negatively affect our business. |

Risks Related to Our Structure and Financing/Liquidity

Risks

| |

· |

The Company could experience liquidity issues if the Company’s revolving line of credit with MBT is not extended or replaced. |

| |

· |

Our holding company structure may increase risks related to our operations. |

| |

· |

A small number of stockholders has the ability to control the Company. |

| |

· |

Although we do not expect to rely on the “controlled company” exemption, we may soon become a “controlled company” within the meaning of the Nasdaq listing standards, and we would qualify for exemptions from certain corporate governance requirements. |

| |

· |

An increase in interest rates or in our borrowing margin would increase the cost of servicing our debt and could reduce our cash flow and negatively affect the results of our business operations. |

| |

· |

Our inability to maintain sufficient liquidity could limit our operational flexibility and also impact our ability to make payments on our obligations as they come due. |

| |

· |

Future cash flows from operations or through financings may not be sufficient to enable the Company to meet its obligations. |

| |

· |

A large proportion of our capital is invested in physical assets and securities that can be hard to sell, especially if market conditions are poor. |

| |

· |

To service our debt and meet our other cash needs, we will require a significant amount of cash, which may not be available. |

| |

· |

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to seek alternatives. |

| |

· |

Despite our substantial indebtedness, we may incur significantly more debt, and cash may not be available to meet our financial obligations when due or enable us to capitalize on investment opportunities when they arise. |

| |

· |

Our current financing arrangements require compliance with financial and other covenants and a failure to comply with such covenants could adversely affect our ability to operate. |

| |

· |

Future acquisitions and dispositions of businesses and investments are possible, changing the components of our assets and liabilities, and if unsuccessful or unfavorable, could reduce the value of the Company and its securities. |

| |

· |

We face numerous risks and uncertainties as we expand our business. |

| |

· |

Our business strategy includes acquisitions, and acquisitions entail numerous risks, including the risk of management diversion and increased costs and expenses, all of which could negatively affect the Company’s ability to operate profitably. |

| |

· |

Strategic ventures may increase risks applicable to our operations. |

| |

· |

Rapid business expansions or new business initiatives may increase risk. |

| |

· |

Our policies and procedures may not be effective in ensuring compliance with applicable law. |

| |

· |

Compliance with the regulatory requirements imposed on us as a public company results in significant costs that may have an adverse effect on our results. |

| |

· |

Deficiencies in our public company financial reporting and disclosures could adversely impact our reputation. |

Risks Related to Air T Funding

| |

· |

The ranking of the Company’s obligations under the Junior Subordinated Debentures and the Guarantee creates a risk that Air T Funding may not be able to pay amounts due to holders of the Capital Securities. |

| |

· |

The Company has the option to extend the interest payment period; tax consequences of a deferral of interest payments. |

| |

· |

Tax event redemption or investment company act redemption |

| |

· |