Form 425 - Prospectuses and communications, business combinations

March 04 2024 - 5:29PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 28, 2024

Aetherium

Acquisition Corp.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41189 |

|

86-3449713 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

79B

Pemberwick Rd.

Greenwich,

CT |

|

06831 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (650) 450-6836

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ |

Written

communications pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Units,

each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

GMFIU |

|

The

Nasdaq Stock Market LLC |

| Class

A Common Stock, par value $0.0001 per share |

|

GMFI |

|

The

Nasdaq Stock Market LLC |

| Warrants

|

|

GMFIW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On March 4, 2024, Aetherium Acquisition Corp. issued a press release announcing that it is postponing its special meeting of shareholders

(“Meeting”) from its scheduled time of 8:30 a.m. Eastern Time on March 5, 2024 to 8:30 a.m. Eastern Time on March 12, 2024.

The record date for the Meeting remains February 9, 2024. To exercise redemption rights, holders must tender their share certificates

to Continental Stock Transfer & Trust Company, Aetherium Acquisition’s transfer agent, no later than two (2) business days prior

to the Meeting, which deadline is now March 10, 2024. The record date for the Meeting remains February 9, 2024. To exercise redemption

rights, holders must tender. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial

Statements and Exhibits.

| Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release dated March 4, 2024 |

| 104 |

|

Cover Page Interactive Data File (Embedded within the Inline XBRL document and included in Exhibit). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

March 4, 2024 |

|

|

| |

|

|

| |

AETHERIUM

ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/

Jonathan Chan |

| |

Name: |

Jonathan

Chan |

| |

Title: |

Chief

Executive Officer and Chairman |

Exhibit

99.1

Aetherium

Acquisition Corp Announces Postponement of Special Meeting of Stockholders

~

Stockholders of Record as of February 9, 2024, are Eligible to Vote at Meeting ~

New

York, March 4, 2024 - Aetherium Acquisition Corp (“Aetherium”) (NASDAQ:GMFI), a special purpose acquisition

company, today announced that its extraordinary general meeting of stockholders (“Meeting”) will be postponed from its scheduled

time of 8:30 a.m. Eastern Time on March 5, 2024 to 8:30 a.m. Eastern Time on March 12, 2024. The Meeting can still be accessed virtually

by visiting the following website: https://www.cstproxy.com/aetherium/2024 (Conference ID: 2629892#). You will need the 12-digit meeting

control number that is printed on your proxy card to enter the Meeting.

The

record date for the Meeting remains February 9 2024. To exercise redemption rights, holders must tender their share certificates to Continental

Stock Transfer & Trust Company, Aetherium Acquisition’s transfer agent, no later than two (2) business days prior to the Meeting,

which deadline is now February 26, 2024.

Stockholders

who have previously submitted their proxies or otherwise voted and who do not want to change their vote need not take any action. Shareholders

as of the record date can vote, even if they have subsequently sold their shares. Any stockholders who wish to change their vote and

need assistance should contact Continental Share Transfer & Trust Company at 917-262-2373, or email proxy@continentalshare.com.

Stockholders who wish to withdraw their previously submitted redemption requests may do so prior to the rescheduled meeting by requesting

that the transfer agent return such public shares prior to 8:30 a.m. Eastern Time on March 10, 2024.

About

Aetherium Acquisition Corp

Aetherium

Acquisition Corp is a blank check company whose business purpose is to effect a merger, capital stock exchange, asset acquisition, stock

purchase, reorganization or similar business combination with one or more businesses or entities. In January 2022, Aetherium consummated

an initial public offering of its units, with each unit consisting of one share of Class A Common Stock and one redeemable warrant. Each

warrant entitles its holder to purchase one share of Class A Common Stock at a price of $11.50 per share.

Participants

in the Solicitation

The

Company and its directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from

the Company’s stockholders in respect of the Special Meeting and the Proposals and related matters. Information regarding the Company’s

directors and executive officers is available in Company’s Definitive Proxy Statement on Schedule 14A filed by the Company with

the U.S. Securities and Exchange Commission (the “SEC”) on February 23, 2024 (the “Proxy Statement”). Additional

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests are contained

in the Proxy Statement.

Non-Solicitation

This

press release is for informational purposes and is not intended and does not constitute a proxy statement or solicitation of a proxy,

consent or authorization with respect to any securities or in respect of the potential transaction and shall not constitute an offer

to sell or a solicitation of an offer or invitation for the sale or purchase of the securities, assets or the business of Aetherium Acquisition

Corp, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would

be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall

be deemed to be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Contact:

Aetherium

Aetherium

Acquisition Corp.

79B

Pemberwick Rd.

Greenwich,

CT

Attention:

Jonathan Chen, CEO

Email:

jonathan.chan@aetheriumcapital.com

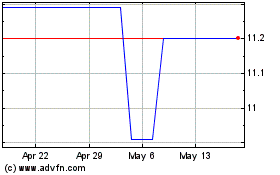

Aetherium Acquisition (NASDAQ:GMFIU)

Historical Stock Chart

From Oct 2024 to Nov 2024

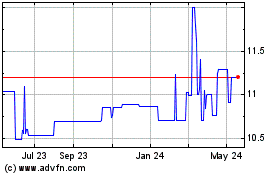

Aetherium Acquisition (NASDAQ:GMFIU)

Historical Stock Chart

From Nov 2023 to Nov 2024