Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZS) (“Aeterna” or the

“Company”), a specialty biopharmaceutical company commercializing

and developing therapeutics and diagnostic tests, today reported

its financial and operating results for the fourth quarter and year

ended December 31, 2020.

The Company also provided an update on the

recent expansion of its development pipeline and clinical program

of macimorelin for the diagnosis of childhood-onset growth hormone

deficiency (“CGHD”), an area of significant unmet medical need.

“As a company, one of our key objectives over

the past year was to advance our goal of maximizing the value of

macimorelin and to expand our pipeline with multiple development

programs. I am extremely pleased that we have been successful in

progressing our goals across multiple fronts,” commented Dr. Klaus

Paulini, Chief Executive Officer of Aeterna. “Not only are we

preparing to launch the pivotal Study P02 for the diagnosis of CGHD

but we are working with the University of Queensland to explore the

potential therapeutic use of macimorelin for the treatment of a

serious neurodegenerative disease. Additionally, we made

significant progress with our pipeline expansion efforts and

entered into a number of previously announced agreements with

university partners providing Aeterna with the right to develop a

number of potential therapeutics and vaccines. Lastly, we have

secured significant capital that we believe provides us with

optionality as we continue to pursue growth as well as to

accelerate our planned pipeline development opportunities in

potentially high-value indications.”

Recent Highlights:

- Regained compliance with minimum bid price requirement for

continued listing on Nasdaq;

- Closed bought deal offering of common shares for gross proceeds

of $34.2 million;

- Received $20.0 million in proceeds from exercise of warrants in

2021;

- Entered into a material transfer agreement with The University

of Queensland (“Queensland University”), for the advancement of

macimorelin as a therapeutic for the treatment of an undisclosed

neurodegenerative disease which provides Aeterna with an option to

negotiate a license to any intellectual property developed by

Queensland University using macimorelin as therapeutic for the

undisclosed neurodegenerative disease;

- Executed on building pipeline to expand assets in development

for potential high-value indications through multiple licensing

agreements with universities in Europe;

- Announced an exclusive European licensing agreement with

Consilient Health Ltd. for the commercialization of macimorelin;

and

- Amended its existing License Agreement with Novo Nordisk

Biopharm Limited (“Novo Nordisk”) for the development and

commercialization of Macrilen™ (macimorelin) in U.S. and

Canada.

Macimorelin Clinical and Preclinical

Program Update

Aeterna is currently developing macimorelin for

the diagnosis of CGHD, an area of significant unmet need, in

collaboration with Novo Nordisk. Preparations are underway to

initiate Study P02, an open-label, single dose, multicenter and

multinational pivotal study expected to enroll approximately 100

subjects worldwide. At least 40 pre-pubertal and 40 pubertal

subjects are expected to be enrolled and a minimum of 25 subjects

are expected to be enrolled in the USA. The study design is

expected to be suitable to support a claim for potential

stand-alone testing with macimorelin, if successful. The Company

expects to commence its CGHD safety and efficacy study, Study P02,

in the second quarter of 2021.

Additionally, Aeterna has begun exploring the

potential therapeutic use of macimorelin in other indications. The

Company entered into a Material Transfer Agreement with Queensland

University, one of Australia’s leading research and teaching

institutions, to conduct preclinical and clinical studies

evaluating macimorelin as a potential therapeutic for the treatment

of an undisclosed neurodegenerative disease. Queensland University

researchers aim to conduct preclinical studies in multiple models

to demonstrate the therapeutic reach of macimorelin on disease

progression and disease-specific pathology and, if supported by the

data from those studies, then plan a subsequent investigator

initiated clinical study.

Pipeline Expansion

Aeterna continues to strive to balance risks and

secure growth opportunities by re-establishing a diversified, yet

focused, development pipeline which we believe best leverages the

Company’s expertise and experience. The Company remains focused on

utilizing its network with researchers in Europe and the U.S. to

seek opportunities to access innovative development candidates,

with a focus on rare or orphan indications and potential for

pediatric use.

Targeted Immunosuppressive Therapeutics:

Targeted, highly specific AIM Biologicals for the potential

treatment of NMOSD

In January 2021, the Company entered into an

exclusive license agreement with Julius-Maximilians-University of

Wuerzburg, Germany for worldwide rights to develop, manufacture and

commercialize targeted, highly specific immunosuppressive

therapeutic proteins (“AIM Biologicals”) for the potential

treatment of neuromyelitis optica spectrum disorder (“NMOSD”)

currently in pre-clinical development.

Next Steps

- Conduct further preclinical research to identify and

characterize an AIM Biologicals based development candidate for the

treatment of NMOSD.

- Meet with regulatory authorities to confirm the further

preclinical data required to advance into human clinical

trials.

COVID-19 Vaccine: Potential orally active

COVID-19 (SARS-CoV-2) live-attenuated bacterial vaccine

In February 2021, Aeterna entered into an

exclusive option agreement with Julius-Maximilians-University to

evaluate a preclinical, potential COVID-19 vaccine developed at the

University. In March 2021, the Company exercised its option and

entered into a license agreement where the Company was granted an

exclusive, world-wide, license to certain patents and know-how

owned by the University to research and develop, manufacture, and

sell a potential COVID-19 vaccine. The University also granted

Aeterna an option for the exclusive use of certain patents and

know-how in an additional undisclosed field. The Company has six

(6) months from the date of the License Agreement to exercise that

option. Additionally, Aeterna entered into a Research Agreement

under which the Company has engaged the University on a

fee-for-service basis to conduct supplementary research activities

and preclinical development studies on the potential vaccine, the

results of which will be included within the scope of the license

agreement.

Next Steps

- Select from a set of vaccine candidates to perform further in

vitro and in vivo characterization before selecting the most active

and stable bacterial strain for further preclinical and potentially

clinical development.

- Initiate development work on an oral dosage form of such

COVID-19 vaccine which is also potentially active against mutated

virus variants.

Primary Hypoparathyroidism: Delayed clearance parathyroid

hormone fusion polypeptides (DC-PTH) for potential treatment of

primary hypoparathyroidism

In March 2021, Aeterna entered into an exclusive

license agreement with The University of Sheffield, United Kingdom,

for the intellectual property relating to DC-PTH fusion

polypeptides with delayed clearance covering the field of all human

use. Aeterna has also engaged the University of Sheffield under a

research contract to conduct certain research activities to be

funded by Aeterna, the results of which will be included within the

scope of the license agreement.

Next Steps

- Working with the University,

Aeterna will undertake certain additional confirmatory research

prior to initiating formal preclinical toxicology studies and GMP

development before finalizing plans for the potential initiation of

human clinical trials.

Financing and Warrant

Exercises

Between January 1, 2021 and March 24, 2021, the

Company has raised net proceeds of approximately $31.0 million from

a registered public offering and $20.0 million from warrant

exercises. On February 19, 2021, the Company closed a public

offering of 20,509,746 common shares at a price to the public of

$1.45 per common share, for gross proceeds of $29.7 million, before

deducting underwriting discounts, commissions and offering expenses

payable by the Company, in the amount of $2.8 million. Aeterna also

granted the underwriter a 30-day overallotment option (the

“Underwriter Option”) to purchase up to 3,076,461 additional common

shares at the public offering price, less underwriting discounts

and commissions, and 1,435,682 warrants with an exercise price of

$1.8125 and expiring on February 17, 2026. The net cash proceeds to

the Company from the offering totaled $26.9 million. On February

22, 2021, the underwriter exercised the Underwriter Option in full

and received 3,076,461 common shares for gross proceeds to the

Company of $4.5 million. In connection with the public offering and

the exercise of the Underwriter Option, the Company paid

commissions and other expenses of $0.4 million and issued 215,352

warrants priced at $1.8125 and expiring on February 17, 2026.

Summary of Fourth Quarter and Full Year

2020 Financial Results

All amounts are in U.S. dollars

Results of operations for the

three-month period ended December 31, 2020

For the three-month period ended December 31,

2020, we reported a consolidated net loss of $1.3 million, or $0.02

loss per common share (basic), as compared with a consolidated net

loss of $1.0 million, or $0.05 loss per common share for the

three-month period ended December 31, 2019. The $0.3 million

increase in net results is primarily from an increase in total

operating expenses of $1.8 million, an increase in net finance

costs of $0.2 million, a change of tax expenses of $0.6 million

partially offset by an increase in revenues of $2.3 million.

Revenues

- Our total revenue for the three-month period ended December 31,

2020 was $2.4 million as compared with $0.02 million for the same

period in 2019, representing an increase of $2.4 million. The 2020

revenue was comprised of $1.4 million in product sales (2019 -

$nil), $0.9 million in licensing revenue (2019 - $0.02 million),

$0.02 million in royalty revenue (2019 - $0.2 million) and $0.1

million in supply chain revenue (2019 – ($0.02) million).

- On November 16, 2020, the Company announced that it had entered

into the Amendment of its existing License Agreement with Novo

Nordisk and received an upfront payment of €5.0 million ($6.1

million) in December 2020. In accordance with its accounting policy

on contract amendments, the Company recognized $0.6 million to the

Adult Indication as in revenues and deferred $5.5 million to be

recognized over time on a straight-line basis until the expected

FDA approval date of June 2023.

Operating Expenses

- Our total operating expense for the three-month period ended

December 31, 2020 was $3.6 million as compared with $1.8 million

for the same period in 2019, representing an increase of $1.8

million. This increase arises primarily from a $1.1 million

increase in cost of sales, $0.4 million increase in research and

development costs, $0.4 million increase in selling expenses and

$0.5 million in costs incurred in the fourth quarter of 2019 and

not incurred in the fourth quarter of 2020 (comprised of $0.3

million in restructuring costs and approximately $0.2 million in

impairment of right of use asset), offset by a decline of $0.4

million in general and administrative expenses and a reversal of

$0.1 million of write off of other asset.

- In the fourth quarter of 2020, cost of sales increased from the

sale of a batch of macimorelin to Novo Nordisk. The increase in

research and development costs reflect the Company’s initial

pipeline expansion activities in 2020 as compared to close out

activities for Study P01 in 2019.

Net Finance Income

- Our net finance income for the three-month period ended

December 31, 2020 was $0.3 million as compared with $0.6 million

for the same period in 2019, representing a decrease of $0.3

million. This is primarily due to a $0.5 million lower gain in the

change in fair value of warrant liability offset by $0.3 million

from changes in currency exchange rates. By December 31, 2020, the

Company had registered all of the common shares underlying all of

its issued and outstanding warrants.

Results of operations for the year ended

December 31, 2020

For the twelve-month period ended December 31,

2020, we reported a consolidated net loss of $5.1 million, or $0.12

loss per common share, as compared with a consolidated net loss of

$6.0 million, or $0.35 loss per common share (basic), for the

twelve-month period ended December 31, 2019. The $0.9 million

improvement in net results is primarily from an increase in total

revenues of $3.1 million and a reduction of operating expenses of

$1.4 million partially offset by a $3.0 million decline in net

finance income and an increase in income tax expense of $0.6

million.

Revenues

- Our total revenue for the twelve-month period ended December

31, 2020 was $3.7 million as compared with $0.5 million for the

same period in 2019, representing an increase of $3.2 million. The

2020 revenue was comprised of $2.4 million in product sales (2019 –

$0.1 million), $0.9 million in licensing revenue (2019 - $0.07

million), $0.3 million in supply chain (2019 - $0.3 million) and

$0.0.07 million in royalty income (2019 - $0.05 million).

- On November 16, 2020, the Company announced that it had entered

into the Amendment of its existing License Agreement with Novo

Nordisk and received an upfront payment of €5.0 million ($6.1

million) in December 2020. In accordance with its accounting policy

on contract amendments, the Company recognized $0.6 million to the

Adult Indication as in revenues and deferred $5.5 million to be

recognized over time on a straight-line basis until the expected

FDA approval date of June 2023.

Operating Expenses

- Our total operating expense for the

twelve-month period ended December 31, 2020 was $9.4 million as

compared with $10.8 million for the same period in 2019,

representing a decrease of $1.4 million. This decline arises

primarily from a $1.9 million reduction in general and

administration expenses, a decrease of $0.5 million in

restructuring costs, a $0.3 million reduction in research and

development costs, a $0.3 million reversal in write off of other

asset, a $0.2 million gain on modification of building lease and

$0.1 million reduction in selling costs, offset by an increase of

$1.9 million in cost of sales. This decline in operating expenses

is in-line with the expected impact of our cost control initiatives

as previously implemented and the impact of the 2019 restructuring

at our German subsidiary.

Net Finance Income

- Our net finance income for the

twelve-month period ended December 31, 2020 was $1.0 million as

compared with $4.0 million for the same period in 2019,

representing a decrease of $3.0 million. This is primarily due to a

$3.4 million change in fair value of warrant liability, an increase

of $0.1 million in other finance costs and a $0.5 million increase

in gain due to foreign currency exchange rates. Throughout 2020 and

by December 31, 2020, the Company registered the common shares

underlying all of its issued and outstanding warrants which removed

the cashless exercise option from all warrants.

Consolidated Financial Statements and

Management’s Discussion and Analysis

For reference, the Management’s Discussion and

Analysis of Financial Condition and Results of Operations for the

fourth quarter and full year 2020, as well as the Company’s audited

consolidated financial statements as of December 31, 2020 and 2019,

will be available at www.zentaris.com in the Investors section or

at the Company’s profile at www.sedar.com and www.sec.gov.

About Aeterna Zentaris Inc.

Aeterna Zentaris Inc. is a specialty

biopharmaceutical company commercializing and developing

therapeutics and diagnostic tests. The Company’s lead product,

macimorelin, is the first and only U.S. FDA and European Commission

approved oral test indicated for the diagnosis of adult growth

hormone deficiency (AGHD). Macimorelin is currently marketed in the

United States under the tradename Macrilen™ through a license

agreement with Novo Nordisk where Aeterna receives royalties on net

sales. According to a commercialization and supply agreement,

MegaPharm Ltd. will seek regulatory approval and then commercialize

macimorelin in Israel and the Palestinian Authority. Additionally,

upon receipt of pricing and reimbursement approvals, Aeterna

expects that macimorelin will be marketed in Europe and the United

Kingdom through a recently established license agreement with

Consilient Health Ltd. and Aeterna will receive royalties on net

sales and other potential payments.

Aeterna is also leveraging the clinical success

and compelling safety profile of macimorelin to develop it for the

diagnosis of childhood-onset growth hormone deficiency (CGHD), an

area of significant unmet need.

Aeterna is actively pursuing business

development opportunities for the commercialization of macimorelin

in Asia and the rest of the world, in addition to other

non-strategic assets to monetize their value. For more information,

please visit www.zentaris.com and connect with the Company on

Twitter, LinkedIn and Facebook.

Forward-Looking Statements

This press release contains statements that may

constitute forward-looking statements within the meaning of U.S.

and Canadian securities legislation and regulations and such

statements are made pursuant to the safe-harbor provision of the

U.S. Securities Litigation Reform Act of 1995. Forward-looking

statements are frequently, but not always, identified by words such

as “expects,” “anticipates,” “believes,” “intends,” “potential,”

“possible,” and similar expressions. Such statements, based as they

are on current expectations of management, inherently involve

numerous risks, uncertainties and assumptions, known and unknown,

many of which are beyond our control. Forward-looking statements in

this press release include, but are not limited to, those relating

to: Aeterna’s expectation with respect to Study P02 (including the

ability to commence in the second quarter of 2021, to enroll

subjects in the USA or elsewhere in Study P02, and expectations

that Study P02 are suitable to support a claim (regulatory

approval) for potential stand-alone testing with macimorelin);

Aeterna’s expectation that, upon receipt of pricing and

reimbursement approvals, macimorelin will be marketed in Europe and

the United Kingdom; the aims and details of the pre-clinical and

potential clinical studies involving the potential use of

macimorelin to treat an undisclosed neurodegenerative disease being

conducted by Queensland University; the potential of the

coronavirus vaccine platform technology licensed from

Julius-Maximilians-University (and any vaccine candidates using

that technology) to be effective as a vaccine against COVID-19

(SARS-CoV-2) or any other coronavirus disease or to offer an

alternative to other approved vaccines against COVID-19; the

ability to obtain approval to commence any clinical trial or the

timeline to develop any potential vaccine and the characteristics

of any potential vaccine; plans regarding the DC-PTH fusion

polypeptides licensed from the University of Sheffield, plans

regarding AIM Biologicals in-licensed from

Julius-Maximilians-University and the potential to treat NMOSD; and

Aeterna’s intentions with respect to growth opportunities and its

business focus, including with respect to its cash position and

development pipeline (including the ability to accelerate its

development pipeline).

Forward-looking statements involve known and

unknown risks and uncertainties, and other factors which may cause

the actual results, performance or achievements stated herein to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

information. Such risks and uncertainties include, among others,

our reliance on the success of the pediatric clinical trial in the

European Union and U.S. for Macrilen™ (macimorelin); the

commencement of Study P02 may be delayed or we may not obtain

regulatory approval to initiate that study, we may be unable to

enroll the expected number of subjects in Study P02 and the result

of Study P02 may not support receipt of regulatory approval in

CGHD, we may be delayed or unsuccessful in obtaining pricing and

reimbursement approvals in Europe and the UK to market macimorelin;

the coronavirus vaccine platform technology (and any vaccine

candidates using that technology) licensed from

Julius-Maximilians-University has never been tested in humans and

so further pre-clinical or clinical studies of that technology and

any vaccine developed using that technology may not be effective as

a vaccine against COVID-19 (SARS-CoV-2) or any other coronavirus

disease; that the timeline to develop a vaccine may be longer than

expected; that such technology or vaccines may not be capable of

being used orally, may not have the same characteristics as

vaccines previously approved using the Salmonella Typhi Ty21a

carrier strain; results from ongoing or planned pre-clinical

studies of macimorelin by Queensland University or for our other

products under development may not be successful or may not support

advancing the product to human clinical trials; our ability to

raise capital and obtain financing to continue our currently

planned operations; our now heavy dependence on the success of

Macrilen™ (macimorelin) and related out-licensing arrangements and

the continued availability of funds and resources to successfully

commercialize the product, including our heavy reliance on the

success of the License Agreement with Novo Nordisk; the global

instability due to the global pandemic of COVID-19, and its unknown

potential effect on our planned operations; our ability to enter

into out-licensing, development, manufacturing, marketing and

distribution agreements with other pharmaceutical companies and

keep such agreements in effect. Investors should consult our

quarterly and annual filings with the Canadian and U.S. securities

commissions for additional information on risks and uncertainties,

including those risks discussed in our Annual Report on Form 40-F

and annual information form, under the caption "Risk Factors".

Given the uncertainties and risk factors, readers are cautioned not

to place undue reliance on these forward-looking statements. We

disclaim any obligation to update any such factors or to publicly

announce any revisions to any of the forward-looking statements

contained herein to reflect future results, events or developments,

unless required to do so by a governmental authority or applicable

law.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

Toronto Stock Exchange accepts no responsibility for the adequacy

or accuracy of this release.

Investor Contact:

Jenene Thomas JTC Team T (US): +1 (833) 475-8247 E:

aezs@jtcir.com

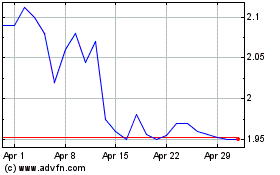

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Oct 2024 to Nov 2024

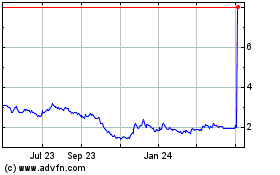

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Nov 2023 to Nov 2024