Operational Highlights

- Signed a term sheet with Airbus to launch a Joint Project for

the potential use of HT-PEM fuel cells in aviation.

- Signed new supply contract with the U.S. Department of Defense

of $2.2 million for portable power systems.

- Received order from a prominent fuel cell integrator in the

Asian market with initial value of $1.3 million.

- Unveiled Advent’s range of Serene Power Systems at the 2023

Monaco Yacht Show.

- Continued discussions with the Greek State to finalize its

procedures for state aid funding of Advent’s Green HiPo project,

following official ratification from the European Commission under

the Important Projects of Common European Interest (“IPCEI”)

Hy2Tech Program.

Advent Technologies Holdings, Inc. (NASDAQ: ADN) (“Advent” or

the “Company”), an innovation-driven leader in the fuel cell and

hydrogen technology space, today announced consolidated financial

results for the three months ended September 30, 2023. All amounts

are in U.S. dollars unless otherwise noted and have been prepared

in accordance with U.S. generally accepted accounting principles

(“GAAP”).

Q3 2023 Financial Highlights

(All comparisons are to Q3 2022, unless otherwise stated)

- Revenue of $1.3 million and income from grants of $0.5 million,

for a total of $1.8 million.

- Operating expenses of $11.0 million, a year-over-year increase

of $0.3 million, primarily related to an increase in expenses for

our new Hood Park facility in Charlestown, Massachusetts.

- Net loss in Q3 of $(11.8) million or $(0.20) per share.

- Unrestricted cash reserves were $3.7 million as of September

30, 2023, a decrease of $6.4 million from June 30, 2023, which

includes $2.1 million of cash raised from the Company’s equity line

of credit with Lincoln Park Capital and a final payment of $0.7

million for the build-out of the Hood Park facility.

“The consolidation of our global operations continued during Q3

2023, which has driven efficiencies and contributed to the

reduction of our cash burn. We will continue to consolidate the

business as we commercialize our portfolio and expand our

production pipeline,” said Dr. Vasilis Gregoriou, Chairman and CEO

of Advent Technologies. “Our HT-PEM technology is very attractive

to the transportation sector, and this is reflected across

applications for maritime, aviation, and automotive. Our goal is to

forge partnerships like the ones announced with Hyundai and Airbus

which will provide financial support and help us accelerate the

development of the technology. These partnerships will actively

support our R&D and investment efforts and provide a clear path

to commercialization. Furthermore, we are actively developing our

pipeline for the stationary power (diesel generator replacement)

market, where we see increased commercial interest for deployments

in 2024. We shall remain focused on successfully developing

innovative fuel cell systems and expanding our collaboration

agreements with world-class partners.”

Business Updates

Airbus Term Sheet to launch a Joint Benchmarking Project:

On November 6, 2023, Advent announced the signing of a term sheet

with Airbus, a global leader in aeronautics, space, and related

services, for a joint benchmarking project regarding an optimized

Ion Pair™ Membrane Electrode Assembly (“MEA”) for hydrogen fuel

cells. Airbus will provide financial support to the project and its

extensive knowledge of the aviation industry. Advent will invest in

people, materials, hardware, and 3rd party research centers to

contribute to the goals of the project. The multi-million dollar

collaboration will take place over two years. A contract based on

the signed term sheet is expected to be signed by the end of 2023,

and the project will commence immediately thereafter in 2024.

The goal of the project is to accelerate the development of

Advent’s MEA and benchmark the Ion Pair MEA against aviation

requirements and current/expected technological limits. HT-PEM MEAs

operating at temperatures higher than 180°C (360°F) aim to solve

one of the largest challenges in aviation fuel cell use: thermal

management. High temperature fuel cells allow increased

performance, increased passenger carrying capability, and increased

range compared to low temperature fuel cell stack technology.

Advent believes that HT-PEM is a superior option not only for

aviation, but also for heavy-duty trucks, the automotive industry

and marine use.

New Contract with the U.S. Department of Defense: Advent

secured a new $2.2 million contract with the U.S. Department of

Defense (“DoD”). This milestone achievement comes under the General

Technical Services prime contract and will play a crucial role in

supporting the demanding mission requirements of the U.S. Army.

This contract is the continuation of a series of past contracts

with the U.S. DoD, and its primary objective is to further optimize

Advent’s proprietary Honey Badger 50™ (“HB50”) portable fuel cell

system by integrating the Company’s innovative Ion Pair MEA

technology. Upon the completion of this new 12-month contract,

Advent and the U.S. DoD aim to reinforce their long-term

collaboration by focusing on the manufacturing process of the

enhanced HB50 fuel cell system that will enable high-volume

production manufacturing capacity. Advent’s Ion Pair MEA technology

is anticipated to significantly enhance HB50’s performance,

resulting in higher power density in an improved, more compact

package, making it an ideal solution for off-grid field

applications, including military and rescue operations. Since 2020,

Advent has been actively improving its HB50 fuel cell system to

create a highly portable and efficient power supply suitable for

on-the-move battery charging and direct power supply for various

U.S. Army applications. Through rigorous development efforts, the

size and weight of the original 50W fuel cell system have been

significantly reduced, culminating in successful field tests in

2022 and 2023, with the final technical report reinforcing its

operational suitability. The HB50 power system can be fueled by

biodegradable methanol, providing near-silent power generation with

clean emissions. Its compact design allows it to seamlessly power

radio and satellite communications apparatus, remote surveillance

systems, laptops, and other battery charging needs, making it an

ideal choice for covert operations. The system’s unique thermal

features enable it to operate within a wide ambient temperature

range from considerably below freezing to at least 40°C (104°F),

therefore ensuring reliability in challenging conditions and

climates. HB50’s adaptability to run on methanol as a hydrogen

carrier allows it to operate at a fraction of the weight of

traditional military-grade batteries. This factor is aligned with

the U.S. DoD’s pursuit of lightweight and highly portable power

solutions for their electronic needs, especially in conjunction

with Integrated Visual Augmentation System and dismounted leader

situational awareness systems for use during combat operations,

like Nett Warrior.

Significant Expansion Order Contract with a Prominent Fuel

Cell Integrator: Advent secured a significant expansion order

contract with a prominent fuel cell integrator operating in the

Asian market. Under the terms of the agreement, Advent will provide

its innovative eFuel-powered (“Serene”) fuel cell stacks to be

incorporated in power applications within the leisure sector in the

region. The contract has a total initial value of $1.3 million. The

supply chain is projected to remain active throughout 2024 in

accord with the customer’s specified timeline. The primary

application of Advent’s fuel cell stacks is to serve as sustainable

prime and back-up power sources in small cabins, working in

conjunction with batteries. The market for portable fuel cells,

especially in the context of the leisure industry, is currently

niche. However, because of the requirement to reduce carbon and

other particulate emissions, this upswing in demand can be

attributed to the increasing need for compact and portable fuel

cell systems that are tailored to various leisure-related

applications. The utilization of Advent’s Serene fuel cell stacks

using liquid methanol as a hydrogen carrier fuel offers advantages

in terms of transportation, logistics, and storage efficiency

compared to gaseous hydrogen, thus enhancing operational safety.

Advent’s Serene fuel cells stand out with their small footprint,

occupying only about a third of the space required by a typical

comparable diesel generator. Beyond their environmental advantage

in terms of reduced emissions, Serene fuel cells provide an

uninterrupted power supply across diverse environmental conditions

and geographical locations. Serene fuel cells operate seamlessly

within ambient temperatures ranging from -20°C to +50°C (-4°F to

122°F) and are designed to function efficiently even in humid and

polluted air, showcasing exceptional adaptability.

Advent Unveils its Range of Serene Power Systems at the

Monaco Yacht Show: On September 27, 2023, Advent unveiled its

range of Serene Power Systems, resulting from the synergy of the

Company’s High-Temperature Proton Exchange Membrane (“HT-PEM”) fuel

cells with a compact battery unit, designed to fulfil both primary

and auxiliary power requirements for vessels. Serene Power Systems

integrate a compact battery, significantly smaller than traditional

battery-only solutions, with a small fuel cell configuration

operating on methanol, biomethanol or eMethanol. This combination

not only can serve as the primary power source for smaller vessels,

including leisure boats, sailboats, ferries, and inland river

vessels, but also replace conventional diesel generators, providing

a clean and efficient power alternative for a wide range of

maritime applications. Furthermore, Serene Power Systems offer

robust power capacity for supporting auxiliary loads on larger

vessels and supply convenient shore power solutions for vessels at

ports. Leveraging Advent’s patented HT-PEM technology, Serene Power

Systems are purpose-built for optimal performance with various

fuels. Operating at high temperatures, they efficiently generate

electricity while producing heat, significantly boosting overall

efficiency, reaching up to 85%. Methanol, a standout energy

delivery and storage medium, excels as a superior hydrogen carrier,

releasing hydrogen catalytically through a fuel reformer. Moreover,

methanol offers the advantage of efficient storage and wide

availability through existing infrastructure, with a distribution

network akin to conventional fuels, establishing it as a safe and

cost-effective maritime fuel option. Serene Power Systems offer

several key advantages:

- Customized for Every Vessel: Meticulously designed with modular

flexibility, Serene Power Systems adapt to each vessel’s unique

specifications, ensuring durability and simplicity while allowing

for effortless customization.

- Near Silent Operation: Serene Power Systems preserve the

tranquility of the vessel experience by eliminating disruptive

noise and vibration.

- Minimal Maintenance, Cost-Efficiency: Advent’s innovative

design significantly reduces the need for maintenance, repair, and

operations, sparing vessel owners from mid-journey engine servicing

inconveniences and providing more uninterrupted time on the open

waters.

- Competitive Pricing: Efficiency extends to cost-effectiveness.

Advent’s low-maintenance fuel cell solutions offer a competitive

total cost of ownership, benefiting both the environment and the

financial bottom line.

- Effortless Refueling: Advent’s Serene Power Systems recharge

themselves by converting liquid green methanol fuel into electric

power. Advent is planning to introduce 100% green eMethanol,

derived from green hydrogen and sustainable power sources, enabling

vessels to harness the energy of the sun and wind.

Clean Transition Dialogue on Hydrogen Organized by the

European Commission: On October 10, 2023, Advent actively

participated in the inaugural Clean Transition Dialogue on Hydrogen

organized by the European Commission in Brussels. This very

significant event, which addressed the vital hydrogen sector’s role

in ensuring Europe’s energy independence, brought together key

figures from the EU and top executives from companies and

organizations engaged in the European hydrogen value chain. The

event opened with an address by European Commission President

Ursula von der Leyen and featured a keynote speech by Executive

Vice President Maroš Šefčovič. Specialized thematic sessions

followed, during which participants explored ideas and best

practices to strengthen the industrial dimension of the European

Green Deal and expedite the growth of the hydrogen sector

throughout Europe. Dr. Vasilis Gregoriou, the Chairman and CEO of

Advent Technologies, who also chairs the Coordination Group for the

Important Projects of Common European Interest (“IPCEI”) in

hydrogen technology (“Hy2Tech”), had the opportunity to brief

President von der Leyen on the progress of projects endorsed by the

EU under IPCEI Hy2Tech. Dr. Gregoriou also addressed the length of

time that it is taking to secure funding for Advent Technologies’

EU-ratified Green HiPo project in Greece, reiterating the Company’s

resolute commitment to executing the project efficiently.

Update on Green HiPo Project: The Green HiPo project is

among the 41 initiatives under IPCEI Hy2Tech, collectively prepared

and reported by fifteen Member States. Its implementation is a

pivotal step towards fulfilling the EU’s goal of producing 10

million tons of renewable hydrogen in Europe by 2030. In July 2022,

the European Commission officially ratified Advent’s Green HiPo

project following a notification by the Greek State in June 2022,

securing total state aid funding of up to EUR 782.1 million. The

Green HiPo project focuses on the development, design, and

production of HT-PEM fuel cell systems and electrolyser systems for

the production of power and green hydrogen, respectively. Located

in Kozani, Greece, this project is expected to play a crucial role

in transitioning the Western Macedonia region from a coal-based

economy to a more sustainable economic model. A state-of-the-art

facility in Kozani is intended to serve as the production hub for

fuel cells and electrolysers, contributing significantly to the

region’s economic development. Advent has already installed over

1,200 HT-PEM fuel cell systems worldwide, replacing environmentally

harmful diesel generators and providing clean energy to sectors

such as telecommunications and critical communication

infrastructure. Moreover, Advent is expected to lead the way in

electrifying commercial ships, trucks, and aircraft, with these

fuel cell systems being produced in the Kozani region as part of

the Green HiPo project.

Advent is working closely with the Greek State to help it

finalize its internal processes and procedures so that the funding

of Green HiPo will commence.

Dr. Gregoriou concluded, “Advent continues to make significant

progress across the portable, stationary and transportation power

sectors. We will continue to consolidate our business with a view

to maximizing efficiency and effectiveness throughout our global

operations, and to focus on core markets and significant projects.

As an update to Green HiPo, we have been working actively with the

Greek State to finalize their procedures that will result in the

release of state aid funding. I am confident in the potential of

Advent and our technology, and I am very optimistic that we will

continue to increase market share as economies embrace clean energy

and decarbonization.”

Conference Call

The Company will host a conference call on Tuesday, November 14,

2023, at 9:00 AM ET to discuss its results.

To access the call please dial (888) 660-6182 from the United

States, or (929) 203-0891 from outside the U.S. The conference call

I.D. number is 3273042. Participants should dial in 5 to 10 minutes

before the scheduled time.

A replay of the call can also be accessed via phone through

November 28, 2023, by dialing (800) 770-2030 from the U.S., or

(647) 362-9199 from outside the U.S. The conference I.D. number is

3273042.

About Advent Technologies Holdings, Inc.

Advent Technologies Holdings, Inc. is a U.S. corporation that

develops, manufactures, and assembles complete fuel cell systems,

and the critical components for fuel cells in the renewable energy

sector. Advent is headquartered in Boston, Massachusetts, with

offices in California, Greece, Denmark, Germany and the

Philippines. With more than 150 patents issued, pending, or

licensed worldwide for fuel cell technology, Advent holds the IP

for next-generation HT-PEM that enable various fuels to function at

high temperatures and under extreme conditions – offering a

flexible option for the automotive, aviation, defense, oil and gas,

maritime, and power generation sectors. For more information,

please visit www.advent.energy.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements. These

forward-looking statements generally can be identified by the use

of words such as “anticipate,” “expect,” “plan,” “could,” “may,”

“will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and

other words of similar meaning. Each forward-looking statement

contained in this press release is subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statement. Applicable risks

and uncertainties include, among others, the Company’s ability to

maintain the listing of the Company’s common stock on Nasdaq;

future financial performance; public securities’ potential

liquidity and trading; impact from the outcome of any known and

unknown litigation; ability to forecast and maintain an adequate

rate of revenue growth and appropriately plan its expenses;

expectations regarding future expenditures; future mix of revenue

and effect on gross margins; attraction and retention of qualified

directors, officers, employees, and key personnel; ability to

compete effectively in a competitive industry; ability to protect

and enhance our corporate reputation and brand; expectations

concerning our relationships and actions with our technology

partners and other third parties; impact from future regulatory,

judicial and legislative changes to the industry; ability to locate

and acquire complementary technologies or services and integrate

those into the Company’s business; future arrangements with, or

investments in, other entities or associations; and intense

competition and competitive pressure from other companies worldwide

in the industries in which the Company will operate; and the risks

identified under the heading “Risk Factors” in our Annual Report on

Form 10-K filed with the Securities and Exchange Commission on

March 31, 2023, as well as the other information we file with the

SEC. We caution investors not to place considerable reliance on the

forward-looking statements contained in this press release. You are

encouraged to read our filings with the SEC, available at

www.sec.gov, for a discussion of these and other risks and

uncertainties. The forward-looking statements in this press release

speak only as of the date of this document, and we undertake no

obligation to update or revise any of these statements. Our

business is subject to substantial risks and uncertainties,

including those referenced above. Investors, potential investors,

and others should give careful consideration to these risks and

uncertainties.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S. GAAP

throughout this press release, the Company has provided non-GAAP

financial measures - Adjusted Net Income / (Loss) and Adjusted

EBITDA - which present results on a basis adjusted for certain

items. The Company uses these non-GAAP financial measures for

business planning purposes and in measuring its performance

relative to that of its competitors. The Company believes that

these non-GAAP financial measures are useful financial metrics to

assess its operating performance from period-to-period by excluding

certain items that the Company believes are not representative of

its core business. These non-GAAP financial measures are not

intended to replace, and should not be considered superior to, the

presentation of the Company’s financial results in accordance with

GAAP. The use of the terms Adjusted Net Income / (Loss) and

Adjusted EBITDA may differ from similar measures reported by other

companies and may not be comparable to other similarly titled

measures. These measures are reconciled from the respective

measures under GAAP in the appendix below.

ADVENT TECHNOLOGIES HOLDINGS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Amounts in USD thousands,

except share and per share amounts)

As of

ASSETS

September 30,

2023

(Unaudited)

December 31,

2022

Current assets:

Cash and cash equivalents

$

3,661

$

32,869

Restricted cash, current

2,018

-

Accounts receivable, net

833

979

Contract assets

63

52

Inventories

13,913

12,620

Prepaid expenses and Other current

assets

3,030

2,980

Total current assets

23,518

49,500

Non-current assets:

Goodwill

-

5,742

Intangibles, net

1,789

6,062

Property and equipment, net

24,260

17,938

Right-of-use assets

3,741

4,055

Restricted cash, non-current

750

750

Other non-current assets

1,023

5,221

Available for sale financial asset

316

320

Total non-current assets

31,879

40,088

Total assets

$

55,397

$

89,588

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Trade and other payables

$

6,134

$

4,680

Deferred income from grants, current

780

801

Contract liabilities

712

1,019

Other current liabilities

2,668

4,703

Operating lease liabilities

2,340

2,280

Income tax payable

181

183

Total current liabilities

12,815

13,666

Non-current liabilities:

Warrant liability

99

998

Long-term operating lease liabilities

8,774

9,802

Defined benefit obligation

89

72

Deferred income from grants,

non-current

338

50

Other long-term liabilities

700

852

Total non-current liabilities

10,000

11,774

Total liabilities

22,815

25,440

Commitments and contingent

liabilities

Stockholders’ equity

Common stock ($0.0001 par value per share;

Shares authorized: 500,000,000 and

110,000,000 at September 30, 2023 and

December 31, 2022, respectively; Issued

and outstanding: 62,108,317 and 51,717,720

at September 30, 2023 and

December 31, 2022, respectively)

6

5

Preferred stock ($0.0001 par value per

share; Shares authorized: 1,000,000 at

September 30, 2023 and December 31, 2022;

nil issued and outstanding at

September 30, 2023 and December 31,

2022)

-

-

Additional paid-in capital

188,850

174,509

Accumulated other comprehensive loss

(2,847)

(2,604)

Accumulated deficit

(153,427)

(107,762)

Total stockholders’ equity

32,582

64,148

Total liabilities and stockholders’

equity

$

55,397

$

89,588

ADVENT TECHNOLOGIES HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Amounts in USD thousands,

except share and per share amounts)

Three months ended September

30,

(Unaudited)

Nine months ended September

30,

(Unaudited)

2023

2022

2023

2022

Revenue

$

1,264

$

2,399

$

3,353

$

5,880

Cost of revenues

(2,456)

(2,339)

(5,845)

(6,126)

Gross loss

(1,192)

60

(2,492)

(246)

Income from grants

496

294

1,690

1,011

Research and development

expenses

(2,131)

(2,547)

(8,155)

(7,338)

Administrative and selling

expenses

(8,916)

(8,203)

(25,736)

(26,657)

Sublease income

139

-

404

-

Amortization of intangibles

(117)

(696)

(526)

(2,113)

Credit loss – customer contracts

64

-

(63)

-

Impairment losses

-

-

(9,763)

-

Operating loss

(11,657)

(11,092)

(44,641)

(35,343)

Fair value change of warrant

liability

(134)

(911)

355

7,248

Finance income / (expenses),

net

-

-

118

(9)

Foreign exchange gains /

(losses), net

(12)

(33)

106

(51)

Other income / (expenses), net

(123)

1

(883)

(220)

Loss before income tax

(11,926)

(12,035)

(44,945)

(28,375)

Income taxes

80

567

(720)

1,663

Net loss

$

(11,846)

$

(11,468)

$

(45,665)

$

(26,712)

Net loss per share

Basic loss per share

(0.20)

(0.22)

(0.83)

(0.52)

Basic weighted average

number of shares

60,371,473

51,660,133

55,294,610

51,465,004

Diluted loss per share

(0.20)

(0.22)

(0.83)

(0.52)

Diluted weighted average

number of shares

60,371,473

51,660,133

55,294,610

51,465,004

ADVENT TECHNOLOGIES HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Amounts in USD

thousands)

Nine months ended September

30,

(Unaudited)

2023

2022

Net Cash used in Operating

Activities

$

(26,338)

$

(32,166)

Cash Flows from Investing

Activities:

Purchases of property and equipment

(3,226)

(3,549)

Purchases of intangible assets

-

(117)

Advances for the acquisition of property

and equipment

(1,255)

-

Acquisition of available for sale

financial assets

-

(319)

Acquisition of subsidiaries

(1,864)

-

Net Cash used in Investing

Activities

$

(6,345)

$

(3,985)

Cash Flows from Financing

Activities:

Issue of common stock and paid-in

capital

5,488

State refundable deposit repayment

-

(41)

Net Cash (used in) provided by

Financing Activities

$

5,488

$

(41)

Net decrease in cash, cash equivalents,

restricted cash and restricted cash equivalents

$

(27,195)

$

(36,192)

Effect of exchange rate changes on cash,

cash equivalent, restricted cash and restricted

cash equivalents

5

(1,126)

Cash, cash equivalents, restricted cash

and restricted cash equivalents at the beginning of

the period

33,619

79,764

Cash, cash equivalents, restricted cash

and restricted cash equivalents at the end of the

period

$

6,429

$

42,446

Reconciliation to Condensed

Consolidated Balance Sheets:

Cash and cash equivalents

$

3,661

$

41,696

Restricted cash, current

2,018

-

Restricted cash, non-current

750

750

Cash, cash equivalents, restricted cash

and restricted cash equivalents

$

6,429

$

42,446

Supplemental Cash Flow

Information

Cash activities

Interest paid

$

16

$

16

Non-cash Investing and Financing

Activities:

Assets acquired under operating leases

$

-

$

1,594

Issuance of common stock and paid-in

capital

$

769

$

-

Supplemental Non-GAAP Measures and Reconciliations

In addition to providing measures prepared in accordance with

GAAP, we present certain supplemental non-GAAP measures. These

measures are EBITDA, Adjusted EBITDA and Adjusted Net Income /

(Loss), which we use to evaluate our operating performance, for

business planning purposes and to measure our performance relative

to that of our peers. These non-GAAP measures do not have any

standardized meaning prescribed by GAAP and therefore may differ

from similar measures presented by other companies and may not be

comparable to other similarly titled measures. We believe these

measures are useful in evaluating the operating performance of

Advent’s ongoing business. These measures should be considered in

addition to, and not as a substitute for net income, operating

expense and income, cash flows and other measures of financial

performance and liquidity reported in accordance with GAAP. The

calculation of these non-GAAP measures has been made on a

consistent basis for all periods presented.

EBITDA and Adjusted EBITDA

These supplemental non-GAAP measures are provided to assist

readers in determining our operating performance. We believe this

measure is useful in assessing performance and highlighting trends

on an overall basis. We also believe EBITDA and Adjusted EBITDA are

frequently used by securities analysts and investors when comparing

our results with those of other companies. EBITDA differs from the

most comparable GAAP measure, net income / (loss), primarily

because it does not include interest, income taxes, depreciation of

property, plant and equipment, and amortization of intangible

assets. Adjusted EBITDA adjusts EBITDA for items such as one-time

transaction costs, asset impairment charges, and fair value changes

in the warrant liability.

The following tables show a reconciliation of net loss to EBITDA

and Adjusted EBITDA for the three and nine months ended September

30, 2023 and 2022.

EBITDA and Adjusted EBITDA

Three months ended September

30,

(Unaudited)

Nine months ended September

30,

(Unaudited)

(in Millions of US dollars)

2023

2022

$ change

2023

2022

$ change

Net loss

$

(11.85)

$

(11.47)

(0.38)

$

(45.67)

$

(26.71)

(18.96)

Depreciation of property and equipment

$

0.89

$

0.35

0.54

$

2.10

$

1.13

0.97

Amortization of intangibles

$

0.12

$

0.69

(0.57)

$

0.53

$

2.11

(1.58)

Finance income / (expenses), net

$

-

$

-

-

$

(0.12)

$

0.01

(0.13)

Other income / (expenses), net

$

0.12

$

-

0.12

$

0.88

$

0.22

0.66

Foreign exchange differences, net

$

0.01

$

0.03

(0.02)

$

(0.11)

$

0.05

(0.16)

Income taxes

$

(0.08)

$

(0.56)

0.48

$

0.72

$

(1.66)

2.38

EBITDA

$

(10.79)

$

(10.96)

0.17

$

(41.67)

$

(24.85)

(16.82)

Net change in warrant liability

$

0.13

$

0.91

(0.78)

$

(0.36)

$

(7.25)

6.89

Impairment losses

$

-

$

-

-

$

9.76

$

-

9.76

Adjusted EBITDA

$

(10.66)

$

(10.05)

(0.61)

$

(32.27)

$

(32.10)

(0.17)

Adjusted Net Loss

This supplemental non-GAAP measure is provided to assist readers

in determining our financial performance. We believe this measure

is useful in assessing performance and highlighting trends on an

overall basis. Adjusted Net Loss differs from the most comparable

GAAP measure, net loss, primarily because it does not include

one-time transaction costs, asset impairment charges and warrant

liability changes. The following table shows a reconciliation of

net loss to Adjusted Net Loss for the three and nine months ended

September 30, 2023 and 2022.

Adjusted Net Loss

Three months ended September

30,

(Unaudited)

Nine months ended September

30,

(Unaudited)

(in Millions of US dollars)

2023

2022

$ change

2023

2022

$ change

Net loss

$

(11.85)

$

(11.47)

(0.38)

$

(45.67)

$

(26.71)

(18.96)

Net change in warrant liability

$

0.13

$

0.91

(0.78)

$

(0.36)

$

(7.25)

6.89

Impairment losses

$

-

$

-

-

$

9.76

$

-

9.76

Adjusted Net Loss

$

(11.72)

$

(10.56)

(1.16)

$

(36.27)

$

(33.96)

(2.31)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114489099/en/

Advent Technologies Holdings, Inc.

Naiem Hussain nhussain@advent.energy

Chris Kaskavelis press@advent.energy

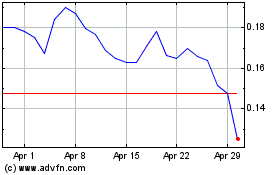

Advent Technologies (NASDAQ:ADN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Advent Technologies (NASDAQ:ADN)

Historical Stock Chart

From Nov 2023 to Nov 2024