0001776661false0001776661adv:ClassCommonStock0.0001ParValuePerShareMember2024-08-072024-08-0700017766612024-08-072024-08-070001776661adv:WarrantsToPurchaseClassCommonStockMember2024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 7, 2024 |

Advantage Solutions Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38990 |

83-4629508 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

8001 Forsyth Blvd, Suite 1025 |

|

Clayton, Missouri |

|

63105 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (314) 655-9333 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

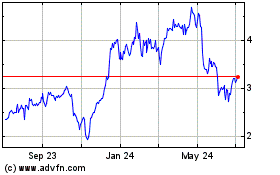

Class A common stock, $0.0001 par value per share |

|

ADV |

|

NASDAQ Global Select Market |

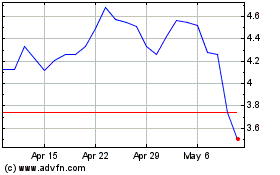

Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

ADVWW |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

Effective January 1, 2024, Advantage Solutions Inc. (the “Company”) revised its reportable segments to align with the Company's business strategy, and the manner in which the Chief Executive Officer, the Company’s chief operating decision maker, assesses performance and makes decisions regarding the allocation of resources for the Company. The Company’s revised reportable segments consist of Branded Services, Experiential Services, and Retailer Services.

•Branded Services offers capabilities in brokerage, branded merchandising and omni-commerce marketing services to consumer goods manufacturers.

•Experiential Services expands the reach of consumer brands and retailer products to convert shoppers into buyers through sampling and product demonstration programs executed in-store and online.

•Retailer Services provides retailers with end-to-end advisory, retailer merchandising, and agency expertise to drive sales.

For informational purposes and to assist investors in making comparisons of the Company’s historical financial information with financial information to be made available in the future that will reflect the revised reportable segments, the Company has furnished as Exhibit 99.1 to this Form 8-K certain unaudited historical information to recast supplemental financial information and historical data that is on a basis consistent with the Company’s revised reportable segments for the three months ended March 31 and June 30, 2024, 2023 and 2022, and the three months ended September 30, and December 31, 2023 and 2022. These changes only affect segment allocation of results and do not revise or restate the Company's previously reported consolidated financial statements or the Company's previously reported non-GAAP adjustments on a consolidated basis.

As of March 31, 2024, the Company determined that certain businesses that had been disposed of and businesses classified as held for sale as of March 31, 2024 met the criteria for discontinued operations presentation. In addition, as of June 30, 2024, certain additional businesses that had been disposed of and businesses classified as held for sale as of June 30, 2024 met the criteria for discontinued operations presentation. Accordingly, for all periods presented, the operating results associated with the businesses disposed of and classified as held for sale have been reclassified into discontinued operations. Refer to Note 2—Held for Sale, Divestitures and Discontinued Operations in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2024 to be filed with the Securities and Exchange Commission (the "SEC") on or about August 9, 2024 for additional information on the Company’s assets and liabilities classified as held for sale and the Company’s discontinued operations. The Company continues to evaluate opportunities to further simplify its operations so the Company can focus more resources on its core businesses.

The information contained in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ADVANTAGE SOLUTIONS INC. |

|

|

|

|

Date: |

August 7, 2024 |

By: |

/s/ Christopher Growe |

|

|

|

Christopher Growe

Chief Financial Officer |

ADVANTAGE SOLUTIONS INC.

SUMMARIZED QUARTERLY RESULTS

AS RECAST

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

(in thousands) |

|

June 30,

2024(a) |

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

|

June 30,

2023 |

|

|

March 31,

2023 |

|

|

December 31,

2022 |

|

|

September 30,

2022 |

|

|

June 30,

2022 |

|

|

March 31,

2022 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branded Services |

|

$ |

322,340 |

|

|

$ |

329,054 |

|

|

$ |

431,282 |

|

|

$ |

451,173 |

|

|

$ |

447,265 |

|

|

$ |

428,697 |

|

|

$ |

480,963 |

|

|

$ |

444,317 |

|

|

$ |

428,044 |

|

|

$ |

410,752 |

|

|

Experiential Services |

|

|

319,508 |

|

|

|

307,351 |

|

|

|

308,727 |

|

|

|

308,381 |

|

|

|

285,174 |

|

|

|

257,167 |

|

|

|

253,557 |

|

|

|

245,752 |

|

|

|

221,863 |

|

|

|

183,058 |

|

|

Retailer Services |

|

|

231,509 |

|

|

|

225,007 |

|

|

|

251,939 |

|

|

|

260,152 |

|

|

|

231,319 |

|

|

|

238,849 |

|

|

|

260,270 |

|

|

|

264,976 |

|

|

|

230,941 |

|

|

|

221,849 |

|

|

Total revenues from continuing operations |

|

$ |

873,357 |

|

|

$ |

861,412 |

|

|

$ |

991,948 |

|

|

$ |

1,019,706 |

|

|

$ |

963,758 |

|

|

$ |

924,713 |

|

|

$ |

994,790 |

|

|

$ |

955,045 |

|

|

$ |

880,848 |

|

|

$ |

815,659 |

|

|

Revenues from discontinued operations |

|

|

28,874 |

|

|

|

44,634 |

|

|

|

87,801 |

|

|

|

76,353 |

|

|

|

73,297 |

|

|

|

87,270 |

|

|

|

107,973 |

|

|

|

96,050 |

|

|

|

100,228 |

|

|

|

99,149 |

|

|

Previously reported revenues from continuing and discontinued operations(b) |

|

$ |

902,231 |

|

|

$ |

906,046 |

|

|

$ |

1,079,749 |

|

|

$ |

1,096,059 |

|

|

$ |

1,037,055 |

|

|

$ |

1,011,983 |

|

|

$ |

1,102,763 |

|

|

$ |

1,051,095 |

|

|

$ |

981,076 |

|

|

$ |

914,808 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (Loss) Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branded Services |

|

$ |

(107,280 |

) |

|

$ |

(22,118 |

) |

|

$ |

33,779 |

|

|

$ |

(599 |

) |

|

$ |

8,920 |

|

|

$ |

3,286 |

|

|

$ |

(800,471 |

) |

|

$ |

24,033 |

|

|

$ |

10,123 |

|

|

$ |

9,057 |

|

|

Experiential Services |

|

|

6,453 |

|

|

|

(3,642 |

) |

|

|

845 |

|

|

|

1,971 |

|

|

|

4,805 |

|

|

|

(4,326 |

) |

|

|

(358,628 |

) |

|

|

(1,390 |

) |

|

|

(5,379 |

) |

|

|

(6,503 |

) |

|

Retailer Services |

|

|

9,568 |

|

|

|

(4,190 |

) |

|

|

(13,962 |

) |

|

|

5,281 |

|

|

|

1,526 |

|

|

|

5,063 |

|

|

|

(392,537 |

) |

|

|

14,722 |

|

|

|

5,511 |

|

|

|

7,519 |

|

|

Total operating (loss) income from continuing operations |

|

$ |

(91,259 |

) |

|

$ |

(29,950 |

) |

|

$ |

20,662 |

|

|

$ |

6,653 |

|

|

$ |

15,251 |

|

|

$ |

4,023 |

|

|

$ |

(1,551,636 |

) |

|

$ |

37,365 |

|

|

$ |

10,255 |

|

|

$ |

10,073 |

|

|

Operating income (loss) from discontinued operations |

|

|

9,820 |

|

|

|

61,287 |

|

|

|

25,530 |

|

|

|

9,330 |

|

|

|

7,020 |

|

|

|

(12,279 |

) |

|

|

14,098 |

|

|

|

9,477 |

|

|

|

18,011 |

|

|

|

12,951 |

|

|

Previously reported operating (loss) income from continuing and discontinued operations(b) |

|

$ |

(81,439 |

) |

|

$ |

31,337 |

|

|

$ |

46,192 |

|

|

$ |

15,983 |

|

|

$ |

22,271 |

|

|

$ |

(8,256 |

) |

|

$ |

(1,537,538 |

) |

|

$ |

46,842 |

|

|

$ |

28,266 |

|

|

$ |

23,024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branded Services |

|

$ |

42,856 |

|

|

$ |

34,335 |

|

|

$ |

49,385 |

|

|

$ |

50,710 |

|

|

$ |

51,787 |

|

|

$ |

51,801 |

|

|

$ |

64,663 |

|

|

$ |

62,418 |

|

|

$ |

58,289 |

|

|

$ |

52,642 |

|

|

Experiential Services |

|

|

22,611 |

|

|

|

16,693 |

|

|

|

13,211 |

|

|

|

16,584 |

|

|

|

16,202 |

|

|

|

7,006 |

|

|

|

7,161 |

|

|

|

10,520 |

|

|

|

4,587 |

|

|

|

3,281 |

|

|

Retailer Services |

|

|

24,431 |

|

|

|

19,613 |

|

|

|

24,229 |

|

|

|

26,023 |

|

|

|

21,865 |

|

|

|

23,445 |

|

|

|

18,433 |

|

|

|

29,289 |

|

|

|

24,720 |

|

|

|

22,490 |

|

|

Total Adjusted EBITDA by segment from continuing operations |

|

$ |

89,898 |

|

|

$ |

70,641 |

|

|

$ |

86,825 |

|

|

$ |

93,317 |

|

|

$ |

89,854 |

|

|

$ |

82,252 |

|

|

$ |

90,257 |

|

|

$ |

102,227 |

|

|

$ |

87,596 |

|

|

$ |

78,413 |

|

|

Adjusted EBITDA from discontinued operations |

|

|

7,938 |

|

|

|

8,119 |

|

|

|

28,091 |

|

|

|

19,832 |

|

|

|

14,358 |

|

|

|

9,818 |

|

|

|

22,409 |

|

|

|

16,041 |

|

|

|

20,726 |

|

|

|

18,326 |

|

|

Previously reported Adjusted EBITDA from Continuing and Discontinued Operations(b) |

|

$ |

97,836 |

|

|

$ |

78,760 |

|

|

$ |

114,916 |

|

|

$ |

113,149 |

|

|

$ |

104,212 |

|

|

$ |

92,070 |

|

|

$ |

112,666 |

|

|

$ |

118,268 |

|

|

$ |

108,322 |

|

|

$ |

96,739 |

|

|

__________________

(a)Results for the three months ended June 30, 2024 have not been previously reported.

(b)For the three months ended March 31, 2024 and 2023 revenues related to discontinued operations as reported were $44.6 million and $87.3 million, respectively. For the three months ended March 31, 2024 operating income related to discontinued operations as reported was $61.3 million. For the three months ended March 31, 2023 operating loss related to discontinued operations as reported was $12.3 million. For the three months ended March 31, 2024 and 2023 Adjusted EBITDA from Discontinued Operations was not previously reported. During the three months ended June 30, 2024, additional businesses met the criteria as held for sale representing an additional $5.0 million and $3.6 million during the three months ended March 31, 2024 and 2023, respectively.

ADVANTAGE SOLUTIONS INC.

NON-GAAP ADJUSTED EBITDA RECONCILIATIONS

AS RECAST

(UNAUDITED)

This supplemental financial information includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”), including Adjusted EBITDA from Continuing Operations and Discontinued Operations, Adjusted EBITDA by segment, Adjusted EBITDA from Discontinued Operations, Revenues net of pass-through costs by segment and Revenues net of pass-through costs from discontinued operations. These are not measures of financial performance calculated in accordance with GAAP and may exclude items that are significant in understanding and assessing the financial results for Advantage Solutions Inc. (“Advantage”). Therefore, the measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP, and should not be considered in isolation or as an alternative to operating income, net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that Advantage’s presentation of these measures may not be comparable to similarly titled measures used by other companies. Reconciliations of historical non-GAAP measures to their most directly comparable GAAP counterparts are included below.

Advantage believes these non-GAAP measures provide useful information to management and investors regarding certain financial and business trends relating to Advantage’s financial condition and results of operations. Advantage believes that the use of Adjusted EBITDA from Continuing and Discontinued Operations, Adjusted EBITDA by segment, Adjusted EBITDA from Discontinued Operations, Revenues net of pass-through costs by segment and Revenues net of pass-through costs from discontinued operations each provide an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing Advantage’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Advantage believes that Adjusted EBITDA from Continued and Discontinued Operations will help management and investors reconcile to previously reported amounts. Non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. Additionally, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Advantage’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies.

Adjusted EBITDA from Continuing and Discontinued Operations are supplemental non-GAAP financial measures of our operating performance. Adjusted EBITDA from Continuing and Discontinued Operations, means net (loss) income before (i) interest expense, net, (ii) provision for (benefit from) income taxes, (iii) depreciation, (iv) amortization of intangible assets, (v) impairment of goodwill and indefinite-lived assets, (vi) gain on deconsolidation of subsidiaries, (vii) loss (gain) on divestitures, (viii) changes in fair value of warrant liability, (ix) stock based compensation expense, (x) equity-based compensation of Karman Topco L.P., (xi) fair value adjustments of contingent consideration related to acquisitions, (xii) acquisition and divestiture related expenses, (xiii) reorganization expenses, (xiv) litigation expenses (recoveries), (xv) costs associated with COVID-19, net of benefits received, (xvi) costs associated with the Take 5 Matter, net of (recoveries), (xvii) EBITDA for economic interests in investments and (xviii) other adjustments that management believes are helpful in evaluating our operating performance.

Adjusted EBITDA by segment and Adjusted EBITDA from Discontinued Operations means, with respect to such segment or discontinued operations, as applicable, operating income (loss) before (i) depreciation, (ii) impairment of goodwill and indefinite-lived assets, (iii) amortization of intangible assets, (iv) gain on deconsolidation of subsidiaries, (v) (gain) loss on divestitures, (vi) equity-based compensation of Karman Topco L.P., (vii) changes in fair value of warrant liability, (viii) stock-based compensation expense, (ix) fair value adjustments of contingent consideration related to acquisitions, (x) acquisition and divestiture related expenses, (xi) costs associated with COVID-19, net of benefits received, (xii) EBITDA for economic interests in investments, (xiii) reorganization expenses, (xiv) litigation expenses (recovery), (xv) costs associated with the Take 5 Matter, net of (recoveries) and (xvi) other adjustments that management believes are helpful in evaluating our operating performance.

Revenue net of pass-through costs by segment and Revenues net of pass-through costs from discontinued operations means revenues less pass-through costs that are paid by Advantage's clients, including media, sample, retailer fees and other marketing and production costs.

ADVANTAGE SOLUTIONS INC.

NON-GAAP ADJUSTED EBITDA RECONCILIATIONS

AS RECAST

(Unaudited)

Reconciliations of Adjusted EBITDA from Continuing and Discontinued Operations to Net (loss) income are provided in the following table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

(in thousands) |

|

June 30,

2024(a) |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

|

June 30,

2023 |

|

|

March 31,

2023 |

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

|

June 30,

2022 |

|

|

March 31,

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Previously reported revenues from continuing and discontinued operations |

|

$ |

902,231 |

|

|

$ |

906,046 |

|

|

$ |

1,079,749 |

|

|

$ |

1,096,059 |

|

|

$ |

1,037,055 |

|

|

$ |

1,011,983 |

|

|

$ |

1,102,763 |

|

|

$ |

1,051,095 |

|

|

$ |

981,076 |

|

|

$ |

914,808 |

|

Less: Pass-through costs(b) |

|

|

(124,391 |

) |

|

|

(134,592 |

) |

|

|

(134,132 |

) |

|

|

(131,926 |

) |

|

|

(123,217 |

) |

|

|

(110,068 |

) |

|

|

(127,040 |

) |

|

|

(109,480 |

) |

|

|

(94,951 |

) |

|

|

(73,138 |

) |

Total revenues net of pass-through costs from continuing and discontinued operations |

|

$ |

777,840 |

|

|

$ |

771,454 |

|

|

$ |

945,617 |

|

|

$ |

964,133 |

|

|

$ |

913,838 |

|

|

$ |

901,915 |

|

|

$ |

975,723 |

|

|

$ |

941,615 |

|

|

$ |

886,125 |

|

|

$ |

841,670 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(100,835 |

) |

|

$ |

(3,115 |

) |

|

$ |

17,788 |

|

|

$ |

(22,582 |

) |

|

$ |

(7,846 |

) |

|

$ |

(47,678 |

) |

|

$ |

(1,421,729 |

) |

|

$ |

23,227 |

|

|

$ |

3,676 |

|

|

$ |

17,534 |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

39,770 |

|

|

|

35,793 |

|

|

|

45,850 |

|

|

|

42,301 |

|

|

|

30,460 |

|

|

|

47,191 |

|

|

|

40,831 |

|

|

|

23,557 |

|

|

|

28,188 |

|

|

|

11,883 |

|

(Benefit from) provision for income taxes |

|

|

(19,688 |

) |

|

|

(1,628 |

) |

|

|

(16,573 |

) |

|

|

(4,323 |

) |

|

|

(416 |

) |

|

|

(7,696 |

) |

|

|

(156,860 |

) |

|

|

1,158 |

|

|

|

1,316 |

|

|

|

9,049 |

|

Depreciation and amortization |

|

|

53,200 |

|

|

|

52,356 |

|

|

|

54,390 |

|

|

|

56,465 |

|

|

|

56,738 |

|

|

|

57,104 |

|

|

|

59,078 |

|

|

|

57,785 |

|

|

|

58,444 |

|

|

|

57,768 |

|

Impairment of goodwill and indefinite-lived assets |

|

|

99,670 |

|

|

|

— |

|

|

|

43,500 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,572,523 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Gain on deconsolidation of subsidiaries |

|

|

— |

|

|

|

— |

|

|

|

(58,891 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

(Gain) loss on divestitures |

|

|

(13,179 |

) |

|

|

(57,016 |

) |

|

|

(1,140 |

) |

|

|

2,553 |

|

|

|

1,158 |

|

|

|

16,497 |

|

|

|

81 |

|

|

|

— |

|

|

|

— |

|

|

|

2,782 |

|

Changes in fair value of warrant liability |

|

|

(686 |

) |

|

|

287 |

|

|

|

(873 |

) |

|

|

587 |

|

|

|

73 |

|

|

|

(73 |

) |

|

|

220 |

|

|

|

(1,100 |

) |

|

|

(4,914 |

) |

|

|

(15,442 |

) |

Stock-based compensation expense(c) |

|

|

7,630 |

|

|

|

7,220 |

|

|

|

10,370 |

|

|

|

10,074 |

|

|

|

11,226 |

|

|

|

11,210 |

|

|

|

9,919 |

|

|

|

7,174 |

|

|

|

14,961 |

|

|

|

7,771 |

|

Equity-based compensation of Karman Topco L.P.(d) |

|

|

(872 |

) |

|

|

392 |

|

|

|

754 |

|

|

|

209 |

|

|

|

(1,218 |

) |

|

|

(2,269 |

) |

|

|

208 |

|

|

|

(828 |

) |

|

|

(3,519 |

) |

|

|

(2,795 |

) |

Fair value adjustments related to contingent consideration related to acquisitions(e) |

|

|

2,872 |

|

|

|

689 |

|

|

|

(1,229 |

) |

|

|

2,231 |

|

|

|

5,068 |

|

|

|

4,292 |

|

|

|

(674 |

) |

|

|

(340 |

) |

|

|

3,654 |

|

|

|

2,134 |

|

Acquisition and divestiture related expenses(f) |

|

|

450 |

|

|

|

1,319 |

|

|

|

2,503 |

|

|

|

1,591 |

|

|

|

498 |

|

|

|

2,432 |

|

|

|

3,978 |

|

|

|

4,260 |

|

|

|

5,998 |

|

|

|

6,803 |

|

Reorganization expenses(g) |

|

|

25,502 |

|

|

|

37,126 |

|

|

|

17,620 |

|

|

|

22,416 |

|

|

|

5,837 |

|

|

|

11,148 |

|

|

|

1,636 |

|

|

|

3,562 |

|

|

|

253 |

|

|

|

643 |

|

Litigation (recovery) expenses(h) |

|

|

(993 |

) |

|

|

284 |

|

|

|

855 |

|

|

|

4,314 |

|

|

|

4,350 |

|

|

|

— |

|

|

|

6,157 |

|

|

|

— |

|

|

|

(800 |

) |

|

|

— |

|

Costs associated with COVID-19, net of benefits received(i) |

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

(49 |

) |

|

|

2,317 |

|

|

|

1,017 |

|

|

|

2,263 |

|

|

|

2,009 |

|

|

|

1,362 |

|

|

|

1,574 |

|

Costs associated with the Take 5 Matter, net of (recoveries)(j) |

|

|

456 |

|

|

|

240 |

|

|

|

63 |

|

|

|

53 |

|

|

|

(1,576 |

) |

|

|

80 |

|

|

|

377 |

|

|

|

278 |

|

|

|

723 |

|

|

|

1,087 |

|

EBITDA for economic interests in investments(k) |

|

|

4,539 |

|

|

|

4,813 |

|

|

|

(69 |

) |

|

|

(2,691 |

) |

|

|

(2,457 |

) |

|

|

(1,185 |

) |

|

|

(5,342 |

) |

|

|

(2,474 |

) |

|

|

(1,020 |

) |

|

|

(4,052 |

) |

Previously reported Adjusted EBITDA from Continuing and Discontinued Operations |

|

$ |

97,836 |

|

|

$ |

78,760 |

|

|

$ |

114,916 |

|

|

$ |

113,149 |

|

|

$ |

104,212 |

|

|

$ |

92,070 |

|

|

$ |

112,666 |

|

|

$ |

118,268 |

|

|

$ |

108,322 |

|

|

$ |

96,739 |

|

ADVANTAGE SOLUTIONS INC.

NON-GAAP ADJUSTED EBITDA RECONCILIATIONS

AS RECAST

(Unaudited)

Financial information by segment, including reconciliations of Adjusted EBITDA by segment to Operating income (loss), the closest GAAP financial measure, is provided in the following tables:

Branded Services Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

(in thousands) |

|

June 30,

2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

|

June 30,

2023 |

|

|

March 31,

2023 |

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

|

June 30,

2022 |

|

|

March 31,

2022 |

|

Branded Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

322,340 |

|

|

$ |

329,054 |

|

|

$ |

431,282 |

|

|

$ |

451,173 |

|

|

$ |

447,265 |

|

|

$ |

428,697 |

|

|

$ |

480,963 |

|

|

$ |

444,317 |

|

|

$ |

428,044 |

|

|

$ |

410,752 |

|

Less: Pass-through costs(b) |

|

|

(38,206 |

) |

|

|

(46,629 |

) |

|

|

(48,497 |

) |

|

|

(46,227 |

) |

|

|

(45,052 |

) |

|

|

(39,252 |

) |

|

|

(61,739 |

) |

|

|

(48,383 |

) |

|

|

(38,459 |

) |

|

|

(29,893 |

) |

Total revenues net of pass-through costs |

|

$ |

284,134 |

|

|

$ |

282,425 |

|

|

$ |

382,785 |

|

|

$ |

404,946 |

|

|

$ |

402,213 |

|

|

$ |

389,445 |

|

|

$ |

419,224 |

|

|

$ |

395,934 |

|

|

$ |

389,585 |

|

|

$ |

380,859 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating (loss) income |

|

$ |

(107,280 |

) |

|

$ |

(22,118 |

) |

|

$ |

33,779 |

|

|

$ |

(599 |

) |

|

$ |

8,920 |

|

|

$ |

3,286 |

|

|

$ |

(800,471 |

) |

|

$ |

24,033 |

|

|

$ |

10,123 |

|

|

$ |

9,057 |

|

Depreciation and amortization |

|

|

32,327 |

|

|

|

31,987 |

|

|

|

34,382 |

|

|

|

35,369 |

|

|

|

35,609 |

|

|

|

35,572 |

|

|

|

35,720 |

|

|

|

35,718 |

|

|

|

36,206 |

|

|

|

36,710 |

|

Impairment of goodwill and indefinite-lived assets |

|

|

99,670 |

|

|

|

— |

|

|

|

43,500 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

831,008 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Gain on deconsolidation of subsidiaries |

|

|

— |

|

|

|

— |

|

|

|

(58,891 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Loss (gain) on divestitures |

|

|

— |

|

|

|

— |

|

|

|

(18,193 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

81 |

|

|

|

— |

|

|

|

— |

|

|

|

2,782 |

|

Stock based compensation expense(c) |

|

|

2,797 |

|

|

|

3,926 |

|

|

|

4,342 |

|

|

|

3,689 |

|

|

|

4,318 |

|

|

|

3,302 |

|

|

|

2,826 |

|

|

|

1,470 |

|

|

|

3,815 |

|

|

|

2,009 |

|

Equity-based compensation of Karman Topco L.P.(d) |

|

|

24 |

|

|

|

498 |

|

|

|

522 |

|

|

|

275 |

|

|

|

(463 |

) |

|

|

(1,021 |

) |

|

|

327 |

|

|

|

(164 |

) |

|

|

(1,558 |

) |

|

|

(1,255 |

) |

Fair value adjustments related to contingent consideration related to acquisitions(e) |

|

|

900 |

|

|

|

778 |

|

|

|

665 |

|

|

|

1,518 |

|

|

|

4,632 |

|

|

|

4,321 |

|

|

|

(1,606 |

) |

|

|

(985 |

) |

|

|

7,111 |

|

|

|

2,052 |

|

Acquisition and divestiture related expenses(f) |

|

|

30 |

|

|

|

74 |

|

|

|

293 |

|

|

|

159 |

|

|

|

258 |

|

|

|

1,067 |

|

|

|

(824 |

) |

|

|

2,307 |

|

|

|

2,905 |

|

|

|

3,779 |

|

Reorganization expenses(g) |

|

|

9,248 |

|

|

|

13,656 |

|

|

|

8,459 |

|

|

|

10,730 |

|

|

|

3,015 |

|

|

|

6,535 |

|

|

|

1,236 |

|

|

|

1,573 |

|

|

|

99 |

|

|

|

526 |

|

Litigation expenses(h) |

|

|

50 |

|

|

|

191 |

|

|

|

187 |

|

|

|

1,994 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Costs associated with COVID-19, net of benefits received(i) |

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

|

6 |

|

|

|

(361 |

) |

|

|

29 |

|

|

|

1,400 |

|

|

|

914 |

|

|

|

91 |

|

|

|

195 |

|

Costs associated with the Take 5 Matter, net of (recoveries)(j) |

|

|

456 |

|

|

|

240 |

|

|

|

63 |

|

|

|

53 |

|

|

|

(1,576 |

) |

|

|

80 |

|

|

|

377 |

|

|

|

278 |

|

|

|

723 |

|

|

|

1,087 |

|

EBITDA for economic interests in investments(k) |

|

|

4,634 |

|

|

|

5,103 |

|

|

|

274 |

|

|

|

(2,484 |

) |

|

|

(2,565 |

) |

|

|

(1,370 |

) |

|

|

(5,411 |

) |

|

|

(2,726 |

) |

|

|

(1,226 |

) |

|

|

(4,300 |

) |

Total Adjusted EBITDA |

|

$ |

42,856 |

|

|

$ |

34,335 |

|

|

$ |

49,385 |

|

|

$ |

50,710 |

|

|

$ |

51,787 |

|

|

$ |

51,801 |

|

|

$ |

64,663 |

|

|

$ |

62,418 |

|

|

$ |

58,289 |

|

|

$ |

52,642 |

|

ADVANTAGE SOLUTIONS INC.

NON-GAAP ADJUSTED EBITDA RECONCILIATIONS

AS RECAST

(Unaudited)

Experiential Services Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

(in thousands) |

|

June 30,

2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

|

June 30,

2023 |

|

|

March 31,

2023 |

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

|

June 30,

2022 |

|

|

March 31,

2022 |

|

|

Experiential Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

319,508 |

|

|

$ |

307,351 |

|

|

$ |

308,727 |

|

|

$ |

308,381 |

|

|

$ |

285,174 |

|

|

$ |

257,167 |

|

|

$ |

253,557 |

|

|

$ |

245,752 |

|

|

$ |

221,863 |

|

|

$ |

183,058 |

|

|

Less: Pass-through costs(b) |

|

|

(84,689 |

) |

|

|

(85,015 |

) |

|

|

(81,506 |

) |

|

|

(81,848 |

) |

|

|

(75,204 |

) |

|

|

(69,053 |

) |

|

|

(63,076 |

) |

|

|

(59,014 |

) |

|

|

(54,222 |

) |

|

|

(41,378 |

) |

|

Total revenues net of pass-through costs |

|

$ |

234,819 |

|

|

$ |

222,336 |

|

|

$ |

227,221 |

|

|

$ |

226,533 |

|

|

$ |

209,970 |

|

|

$ |

188,114 |

|

|

$ |

190,481 |

|

|

$ |

186,738 |

|

|

$ |

167,641 |

|

|

$ |

141,680 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

$ |

6,453 |

|

|

$ |

(3,642 |

) |

|

$ |

845 |

|

|

$ |

1,971 |

|

|

$ |

4,805 |

|

|

$ |

(4,326 |

) |

|

$ |

(358,628 |

) |

|

$ |

(1,390 |

) |

|

$ |

(5,379 |

) |

|

$ |

(6,503 |

) |

|

Depreciation and amortization |

|

|

11,015 |

|

|

|

9,920 |

|

|

|

9,298 |

|

|

|

9,221 |

|

|

|

9,002 |

|

|

|

9,063 |

|

|

|

10,465 |

|

|

|

9,485 |

|

|

|

9,466 |

|

|

|

8,491 |

|

|

Impairment of goodwill and indefinite-lived assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

354,452 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock based compensation expense(c) |

|

|

2,170 |

|

|

|

1,928 |

|

|

|

(1,560 |

) |

|

|

(778 |

) |

|

|

(646 |

) |

|

|

(436 |

) |

|

|

(456 |

) |

|

|

(19 |

) |

|

|

(424 |

) |

|

|

(443 |

) |

|

Equity-based compensation of Karman Topco L.P.(d) |

|

|

(458 |

) |

|

|

(44 |

) |

|

|

129 |

|

|

|

(29 |

) |

|

|

(358 |

) |

|

|

(547 |

) |

|

|

(45 |

) |

|

|

(267 |

) |

|

|

(792 |

) |

|

|

(594 |

) |

|

Fair value adjustments related to contingent consideration related to acquisitions(e) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Acquisition and divestiture related expenses(f) |

|

|

(101 |

) |

|

|

106 |

|

|

|

71 |

|

|

|

19 |

|

|

|

48 |

|

|

|

374 |

|

|

|

319 |

|

|

|

670 |

|

|

|

1,144 |

|

|

|

1,224 |

|

|

Reorganization expenses(g) |

|

|

3,472 |

|

|

|

8,252 |

|

|

|

3,869 |

|

|

|

4,960 |

|

|

|

1,304 |

|

|

|

1,966 |

|

|

|

299 |

|

|

|

1,079 |

|

|

|

98 |

|

|

|

29 |

|

|

Litigation expenses (recovery)(h) |

|

|

60 |

|

|

|

173 |

|

|

|

566 |

|

|

|

1,276 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(700 |

) |

|

|

— |

|

|

Costs associated with COVID-19, net of benefits received(i) |

|

|

— |

|

|

|

— |

|

|

|

(7 |

) |

|

|

(56 |

) |

|

|

2,040 |

|

|

|

912 |

|

|

|

755 |

|

|

|

962 |

|

|

|

1,174 |

|

|

|

1,077 |

|

|

Total Adjusted EBITDA |

|

$ |

22,611 |

|

|

$ |

16,693 |

|

|

$ |

13,211 |

|

|

$ |

16,584 |

|

|

$ |

16,202 |

|

|

$ |

7,006 |

|

|

$ |

7,161 |

|

|

$ |

10,520 |

|

|

$ |

4,587 |

|

|

$ |

3,281 |

|

|

ADVANTAGE SOLUTIONS INC.

NON-GAAP ADJUSTED EBITDA RECONCILIATIONS

AS RECAST

(Unaudited)

Retailer Services Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

(in thousands) |

|

June 30,

2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

|

June 30,

2023 |

|

|

March 31,

2023 |

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

|

June 30,

2022 |

|

|

March 31,

2022 |

|

|

Retailer Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

231,509 |

|

|

$ |

225,007 |

|

|

$ |

251,939 |

|

|

$ |

260,152 |

|

|

$ |

231,319 |

|

|

$ |

238,849 |

|

|

$ |

260,270 |

|

|

$ |

264,976 |

|

|

$ |

230,941 |

|

|

$ |

221,849 |

|

|

Less: Pass-through costs(b) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total revenues net of pass-through costs |

|

$ |

231,509 |

|

|

$ |

225,007 |

|

|

$ |

251,939 |

|

|

$ |

260,152 |

|

|

$ |

231,319 |

|

|

$ |

238,849 |

|

|

$ |

260,270 |

|

|

$ |

264,976 |

|

|

$ |

230,941 |

|

|

$ |

221,849 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

$ |

9,568 |

|

|

$ |

(4,190 |

) |

|

$ |

(13,962 |

) |

|

$ |

5,281 |

|

|

$ |

1,526 |

|

|

$ |

5,063 |

|

|

$ |

(392,537 |

) |

|

$ |

14,722 |

|

|

$ |

5,511 |

|

|

$ |

7,519 |

|

|

Depreciation and amortization |

|

|

7,975 |

|

|

|

7,841 |

|

|

|

7,740 |

|

|

|

7,825 |

|

|

|

7,866 |

|

|

|

7,909 |

|

|

|

8,322 |

|

|

|

8,485 |

|

|

|

8,493 |

|

|

|

8,486 |

|

|

Impairment of goodwill and indefinite-lived assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

387,063 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Loss on divestitures |

|

|

— |

|

|

|

— |

|

|

|

18,193 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock based compensation expense(c) |

|

|

2,561 |

|

|

|

2,700 |

|

|

|

6,751 |

|

|

|

6,072 |

|

|

|

6,340 |

|

|

|

7,539 |

|

|

|

6,265 |

|

|

|

4,515 |

|

|

|

10,037 |

|

|

|

5,506 |

|

|

Equity-based compensation of Karman Topco L.P.(d) |

|

|

(438 |

) |

|

|

(62 |

) |

|

|

103 |

|

|

|

(37 |

) |

|

|

(397 |

) |

|

|

(701 |

) |

|

|

(74 |

) |

|

|

(397 |

) |

|

|

(1,169 |

) |

|

|

(946 |

) |

|

Fair value adjustments related to contingent consideration related to acquisitions(e) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Acquisition and divestiture related expenses(f) |

|

|

(1,703 |

) |

|

|

260 |

|

|

|

(222 |

) |

|

|

154 |

|

|

|

89 |

|

|

|

896 |

|

|

|

3,102 |

|

|

|

983 |

|

|

|

1,765 |

|

|

|

1,576 |

|

|

Reorganization expenses(g) |

|

|

7,571 |

|

|

|

13,144 |

|

|

|

5,501 |

|

|

|

5,682 |

|

|

|

1,475 |

|

|

|

2,637 |

|

|

|

101 |

|

|

|

823 |

|

|

|

56 |

|

|

|

51 |

|

|

Litigation (recovery) expenses(h) |

|

|

(1,103 |

) |

|

|

(80 |

) |

|

|

102 |

|

|

|

1,044 |

|

|

|

4,350 |

|

|

|

— |

|

|

|

6,157 |

|

|

|

— |

|

|

|

(100 |

) |

|

|

— |

|

|

Costs associated with COVID-19, net of benefits received(i) |

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

1 |

|

|

|

638 |

|

|

|

76 |

|

|

|

108 |

|

|

|

133 |

|

|

|

97 |

|

|

|

302 |

|

|

EBITDA for economic interests in investments(k) |

|

|

— |

|

|

|

— |

|

|

|

21 |

|

|

|

1 |

|

|

|

(31 |

) |

|

|

26 |

|

|

|

(74 |

) |

|

|

25 |

|

|

|

30 |

|

|

|

(4 |

) |

|

Total Adjusted EBITDA |

|

$ |

24,431 |

|

|

$ |

19,613 |

|

|

$ |

24,229 |

|

|

$ |

26,023 |

|

|

$ |

21,865 |

|

|

$ |

23,445 |

|

|

$ |

18,433 |

|

|

$ |

29,289 |

|

|

$ |

24,720 |

|

|

$ |

22,490 |

|

|

ADVANTAGE SOLUTIONS INC.

NON-GAAP ADJUSTED EBITDA RECONCILIATIONS

AS RECAST

(Unaudited)

Discontinued Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

(in thousands) |

|

June 30,

2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

|

June 30,

2023 |

|

|

March 31,

2023 |

|

|

December 31, 2022 |

|

|

September 30, 2022 |

|

|

June 30,

2022 |

|

|

March 31,

2022 |

|

|

Discontinued Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

28,874 |

|

|

$ |

44,634 |

|

|

$ |

87,801 |

|

|

$ |

76,353 |

|

|

$ |

73,297 |

|

|

$ |

87,270 |

|

|

$ |

107,973 |

|

|

$ |

96,050 |

|

|

$ |

100,228 |

|

|

$ |

99,149 |

|

|

Less: Pass-through costs(b) |

|

|

(1,496 |

) |

|

|

(2,948 |

) |

|

|

(4,129 |

) |

|

|

(3,851 |

) |

|

|

(2,961 |

) |

|

|

(1,763 |

) |

|

|

(2,225 |

) |

|

|

(2,083 |

) |

|

|

(2,270 |

) |

|

|

(1,867 |

) |

|

Total revenues net of pass-through costs |

|

$ |

27,378 |

|

|

$ |

41,686 |

|

|

$ |

83,672 |

|

|

$ |

72,502 |

|

|

$ |

70,336 |

|

|

$ |

85,507 |

|

|

$ |

105,748 |

|

|

$ |

93,967 |

|

|

$ |

97,958 |

|

|

$ |

97,282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

$ |

9,820 |

|

|

$ |

61,287 |

|

|

$ |

25,530 |

|

|

$ |

9,330 |

|

|

$ |

7,020 |

|

|

$ |

(12,279 |

) |

|

$ |

14,098 |

|

|

$ |

9,477 |

|

|

$ |

18,011 |

|

|

$ |

12,951 |

|

|

Depreciation and amortization |

|

|

1,883 |

|

|

|

2,608 |

|

|

|

2,970 |

|

|

|

4,050 |

|

|

|

4,261 |

|

|

|

4,560 |

|

|

|

4,571 |

|

|

|

4,097 |

|

|

|

4,279 |

|

|

|

4,081 |

|

|

Loss on divestitures |

|

|

(13,179 |

) |

|

|

(57,016 |

) |

|

|

(1,140 |

) |

|

|

2,553 |

|

|

|

1,158 |

|

|

|

16,497 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock based compensation expense(c) |

|

|

102 |

|

|

|

(1,334 |

) |

|

|

837 |

|

|

|

1,091 |

|

|

|

1,214 |

|

|

|

805 |

|

|

|

1,284 |

|

|

|

1,208 |

|

|

|

1,533 |

|

|

|

699 |

|

|

Fair value adjustments related to contingent consideration related to acquisitions(e) |

|

|

1,972 |

|

|

|

(89 |

) |

|

|

(1,894 |

) |

|

|

713 |

|

|

|

420 |

|

|

|

(29 |

) |

|

|

932 |

|

|

|

645 |

|

|

|

(3,457 |

) |

|

|

82 |

|

|

Acquisition and divestiture related expenses(f) |

|

|

2,224 |

|

|

|

879 |

|

|

|

2,361 |

|

|

|

1,259 |

|

|

|

103 |

|

|

|

95 |

|

|

|

1,381 |

|

|

|

300 |

|

|

|

184 |

|

|

|

224 |

|

|

Reorganization expenses(g) |

|

|

5,211 |

|

|

|

2,074 |

|

|

|

(209 |

) |

|

|

1,044 |

|

|

|

43 |

|

|

|

10 |

|

|

|

— |

|

|

|

87 |

|

|

|

— |

|

|

|

37 |

|

|

EBITDA for economic interests in investments(k) |

|

|

(95 |

) |

|

|

(290 |

) |

|

|

(364 |

) |

|

|

(208 |

) |

|

|

139 |

|

|

|

159 |

|

|

|

143 |

|

|

|

227 |

|

|

|

176 |

|

|

|

252 |

|

|

Total Adjusted EBITDA from Discontinued Operations |

|

$ |

7,938 |

|

|

$ |

8,119 |

|

|

$ |

28,091 |

|

|

$ |

19,832 |

|

|

$ |

14,358 |

|

|

$ |

9,818 |

|

|

$ |

22,409 |

|

|

$ |

16,041 |

|

|

$ |

20,726 |

|

|

$ |

18,326 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________

(a)Results for the three months ended June 30, 2024 have not been previously reported.

(b)Pass-through costs are costs that are paid by our clients, including media, sample, retailer fees and other marketing and production costs.

(c)Represents non-cash compensation expense related to performance stock units, restricted stock units, and stock options under the 2020 Advantage Solutions Incentive Award Plan and the Advantage Solutions 2020 Employee Stock Purchase Plan.

(d)Represents expenses related to (i) equity-based compensation expense associated with grants of Common Series D Units of Topco made to one of the Advantage Sponsors, and (ii) equity-based compensation expense associated with the Common Series C Units of Topco.

(e)Represents adjustments to the estimated fair value of our contingent consideration liabilities related to our acquisitions, for the applicable periods.

(f)Represents fees and costs associated with activities related to our acquisitions, divestitures, and related reorganization activities, including professional fees, due diligence, and integration activities.

(g)Represents fees and costs associated with various internal reorganization activities, including professional fees, lease exit costs, severance, and nonrecurring compensation costs.

(h)Represents legal settlements, reserves, and expenses that are unusual or infrequent costs associated with our operating activities.

(i)Represents (i) costs related to implementation of strategies for workplace safety in response to COVID-19, including employee-relief fund, additional sick pay for front-line associates, medical benefit payments for furloughed associates, and personal protective equipment; and (ii) benefits received from government grants for COVID-19 relief.

(j)Represents cash receipts from an insurance policy for claims related to the Take 5 Matter and costs associated with investigation and remediation activities related to the Take 5 Matter, primarily, professional fees and other related costs.

(k)Represents additions to reflect our proportional share of Adjusted EBITDA related to our equity method investments and reductions to remove the Adjusted EBITDA related to the minority ownership percentage of the entities that we fully consolidate in our financial statements.

v3.24.2.u1

Cover

|

Aug. 07, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 07, 2024

|

| Securities Act File Number |

001-38990

|

| Entity Registrant Name |

Advantage Solutions Inc.

|

| Entity Central Index Key |

0001776661

|

| Entity Tax Identification Number |

83-4629508

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8001 Forsyth Blvd

|

| Entity Address, Address Line Two |

Suite 1025

|

| Entity Address, City or Town |

Clayton

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63105

|

| City Area Code |

314

|

| Local Phone Number |

655-9333

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Class A common stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

ADV

|

| Security Exchange Name |

NASDAQ

|

| Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Warrants exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

ADVWW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |