Current Report Filing (8-k)

July 01 2015 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 1, 2015

AV Homes, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-07395 |

|

23-1739078 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 8601 N. Scottsdale Rd. Suite 225, Scottsdale, Arizona |

|

|

|

85253 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (480) 214-7400

Not Applicable

Former

name or former address, if changed since last report

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. |

As previously announced, on

June 10, 2015, AV Homes, Inc. (the “Company”) and Bel Air Acquisition Sub, LLC, a newly formed subsidiary of the Company (the “Acquisition Subsidiary”), entered into an Asset Purchase Agreement with Bonterra Builders, LLC

(“Bonterra”) and each of its owners (the “Bonterra Agreement”), pursuant to which the Company agreed to acquire, through its Acquisition Subsidiary, substantially all of the assets and certain liabilities of Bonterra, a

residential home builder based in Charlotte, North Carolina (the “Bonterra Acquisition”). A copy of the Bonterra Agreement was included with the Company’s Current Report on Form 8-K filed on June 10, 2015.

The Bonterra Acquisition was completed on July 1, 2015. The Company currently anticipates that the aggregate purchase price for the

Bonterra acquisition will be approximately $101.3 million in cash, subject to customary post-closing adjustments. Such aggregate purchase price includes the repayment of third party indebtedness and assumes achievement at the target level of certain

performance objectives for the acquired business through the end of 2016. The total earn-out payable by the Company is targeted at $6 million, but may be more or less based on the performance of the Bonterra business during the relevant earn-out

periods. A portion of the aggregate consideration equal to $750,000 was held back by the Company at closing as security for Bonterra’s indemnification and other obligations under the Bonterra Agreement.

The Bonterra Acquisition was funded with cash on hand, a portion of which may include proceeds from the Company’s recent private offering

of its 6.00% Senior Convertible Notes due 2020 (the “New Notes”). The New Notes were issued to certain qualified institutional buyers, including TPG Aviator, L.P. (“TPG Aviator”). TPG Aviator owns approximately 41% of the

Company’s outstanding common stock.

| Item 9.01 |

Financial Statements and Exhibits. |

| |

(a) |

Financial Statements of Businesses Acquired |

The financial statements required by

Item 9.01(a) of Form 8-K will be filed by amendment to this Form 8-K as soon as practicable, but not later than 71 calendar days after the date on which this Form 8-K was required to be filed.

| |

(b) |

Pro Forma Financial Information |

The pro forma financial information required by

Item 9.01(b) of Form 8-K will be filed by amendment to this Form 8-K as soon as practicable, but not later than 71 calendar days after the date on which this Form 8-K was required to be filed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AV Homes, Inc. |

|

|

|

| July 1, 2015 |

|

By: |

|

/s/ ROGER A. CREGG |

|

|

|

|

Name: |

|

Roger A. Cregg |

|

|

|

|

Title: |

|

Director, President, and Chief Executive Officer |

|

|

|

|

|

|

(Principal Executive Officer) |

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Oct 2024 to Nov 2024

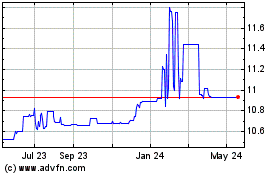

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Nov 2023 to Nov 2024