Current Report Filing (8-k)

June 18 2015 - 9:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 17, 2015

AV Homes, Inc.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-07395 |

|

23-1739078 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 8601 N. Scottsdale Rd. Suite 225,

Scottsdale, Arizona |

|

85253 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (480) 214-7400

Not Applicable

Former

name or former address, if changed since last report

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On June 17, 2015, AV Homes, Inc. (the “Company”) issued a press release

announcing that it had entered into a series of separate, privately negotiated purchase agreements in connection with a private offering to eligible purchasers of $80 million aggregate principal amount of 6.00% Senior Convertible Notes due 2020 (the

“Notes”). In accordance with Rule 135c under the Securities Act of 1933, as amended (the “Securities Act”), a copy of this press release is being filed as Exhibit 99.1 to this report. Accordingly, this notice is not intended to

and does not constitute an offer to sell nor a solicitation for an offer to purchase any securities of the Company.

The Notes and related guarantees have

not been registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and any applicable

state securities laws.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated June 17, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AV Homes, Inc. |

|

|

|

| June 18, 2015 |

|

By: |

|

/s/ Roger A. Cregg |

|

|

|

|

Name: |

|

Roger A. Cregg |

|

|

|

|

Title: |

|

Director, President, and Chief Executive Officer |

|

|

|

|

|

|

(Principal Executive Officer) |

Exhibit Index

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated June 17, 2015. |

Exhibit 99.1

AV HOMES, INC. ANNOUNCES FINANCING TRANSACTIONS

SCOTTSDALE, Ariz., June 17, 2015 (GLOBE NEWSWIRE) — AV Homes, Inc. (Nasdaq: AVHI) (“AV Homes” or the “Company”), a developer and

builder of active adult and conventional home communities in Florida, Arizona and the Carolinas, announced today that the Company has entered into a series of agreements under which it will issue $80 million in aggregate principal amount of new

6.00% Senior Convertible Notes due 2020 (“New Notes”).

The New Notes will mature on July 1, 2020 and will pay interest semiannually. The

New Notes will be convertible at the option of the holder at any time at an initial conversion rate of 50.2008 shares of Company common stock per $1,000 original principal amount of notes (equivalent to an initial conversion price of approximately

$19.92 per share), subject to adjustment in certain events. The initial conversion price represents a 20% premium over the closing sale price of the Company’s common stock on June 17, 2015.

The Company will use a portion of the proceeds from the New Notes to repurchase (either through exchange transactions involving the New Notes or separate cash

purchases) approximately $34 million aggregate principal amount of the Company’s outstanding 7.50% Senior Exchange Convertible Notes due 2016, issued on July 25, 2012 and approximately $10 million aggregate principal amount of the

Company’s outstanding 7.50% Senior Convertible Notes due 2016, issued on February 4, 2011.

The New Notes will not be redeemable or convertible

at the option of the Company. The New Notes will be senior unsecured obligations of the Company and will be guaranteed by certain of the Company’s wholly owned subsidiaries.

The Company expects to close on the sale of the New Notes on June 23, 2015, subject to the satisfaction of customary closing conditions.

No Solicitation

The New Notes and related guarantees are

being sold to qualified institutional buyers in reliance on private placement exemptions from registration under the Securities Act. The New Notes and the related guarantees, and the common stock issuable upon conversion of the New Notes, have not

been registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements.

This press release shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sales of the notes in

any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This press release is being issued pursuant to, and in accordance with, Rule 135c

under the Securities Act.

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the U.S. federal securities laws, which statements may include

information regarding the refinancing transactions and the plans, intentions, expectations, future financial performance, or future operating performance of the Company. These statements include, but are not limited to, the timing and likelihood of

the closing of the refinancing transaction. Forward-looking statements are based on the expectations, estimates, or projections of management as of the date of this news release. Although our management believes these expectations, estimates, or

projections to be reasonable as of the date of this news release, forward-looking statements are inherently subject to significant business risks, economic and competitive uncertainties, or other contingencies which could cause our actual results or

performance to differ materially from what may be expressed or implied in the forward-looking statements. Important factors that could cause our actual results or performance to differ materially from our forward-looking statements include those set

forth in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2014, and in our other filings with the Securities and Exchange Commission, which filings are available on www.sec.gov. AV Homes

disclaims any intention or obligation to update or revise any forward-looking statements to reflect subsequent events and circumstances, except to the extent required by applicable law.

Contact: Michael S. Burnett

m.burnett@avhomesinc.com

480.214.7408

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Jul 2024 to Aug 2024

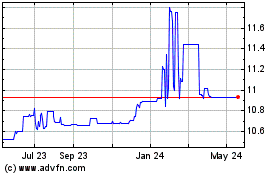

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Aug 2023 to Aug 2024